|

시장보고서

상품코드

1907269

페인트 및 코팅 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

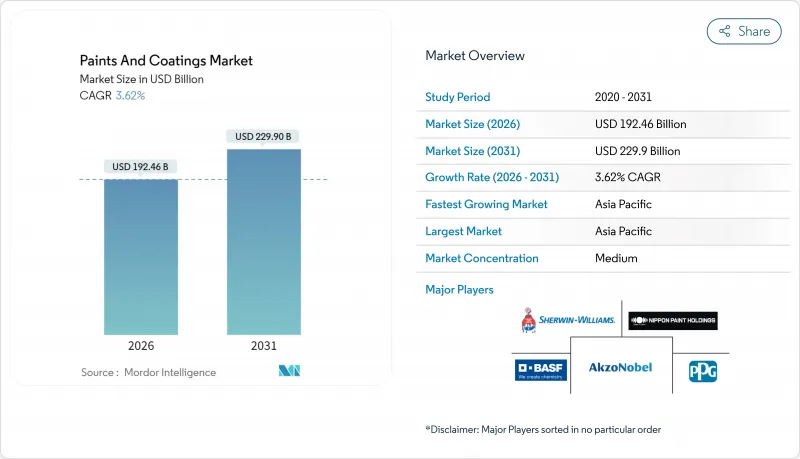

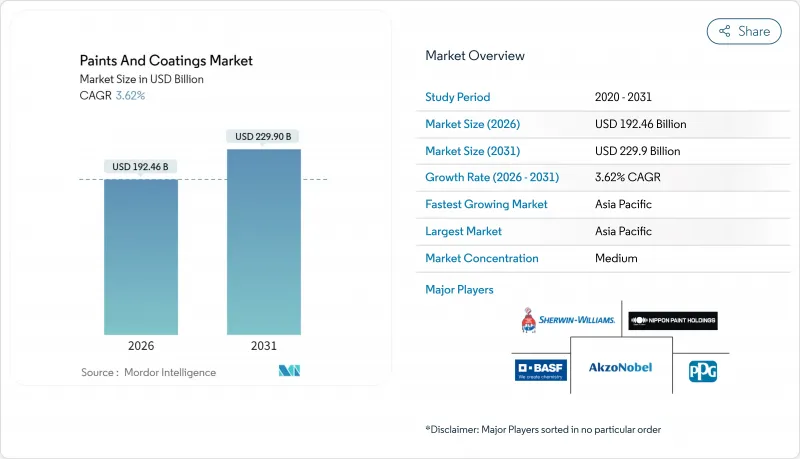

페인트 및 코팅 시장 규모는 2026년에 1,924억 6,000만 달러로 예측되며, 2025년 1,857억 4,000만 달러에서 성장을 이룰 것입니다.

2031년까지 2,299억 달러에 이를 것으로 예상되며, 2026-2031년에 걸쳐 CAGR 3.62%로 성장할 전망입니다.

원자재 비용의 급격한 변동과 환경 규제 강화 속에서도 주거용 건설, 인프라 업그레이드, 지속 가능한 제품 혁신에 따른 꾸준한 수요가 이러한 완만한 성장을 뒷받침하고 있습니다. 아시아태평양 지역은 구조적 이점, 급속한 도시 이주, 대규모 자본 프로젝트, 확대되는 산업 생산량 등을 보유하여 성숙한 경제권보다 현저히 빠른 속도로 지역 소비를 촉진하고 있습니다. 모든 기술 분야에서 저휘발성 유기화합물(VOC) 수성 화학 물질로의 전환이 가장 영향력 있는 단일 트렌드로 남아 있으며, 정부의 배출량 제한과 친환경 사양에 대한 고객 선호로 더욱 강화되고 있습니다. 동시에 생산자들은 인력 부족 완화 및 시장 출시 기간 단축을 위해 색상 매칭, 공장 스케줄링, 품질 관리 워크플로우를 디지털화하고 있습니다. 글로벌 페인트 및 코팅 산업에서 상위 12개 공급업체들이 효율적인 포트폴리오 구축과 규모의 경제 실현을 위한 표적 인수·매각을 추진하면서 경쟁 강도가 높아지고 있습니다.

세계의 페인트 및 코팅 시장의 동향 및 인사이트

전 세계 주거용 건설 활동 급증

인프라 투자 및 일자리 법안(IIJA)과 같은 북미 법안은 도로, 교량, 공공시설에 자본을 집중시켜 신규 및 리모델링 자산 모두에 대한 보호 및 장식용 코팅 수요를 끌어올리고 있습니다. 이와 동시에 아시아태평양 지역 정부들은 저렴한 주택 프로그램을 지속적으로 우선시하여 신규 주거용 건설 시작과 실내 재도장 주기를 촉진하고 있습니다. 여러 경제권에서 사상 최저 수준의 모기지 금리가 리모델링 예산을 부활시켜, 친환경 건축 크레딧을 획득할 수 있는 프리미엄 무VOC(휘발성 유기화합물) 벽 마감재로 추가 수요를 유도하고 있습니다. 공급업체들은 적용 속도를 저하시키지 않으면서도 엄격한 실내 공기 기준을 충족하는 속건성 수성 제품 라인으로 대응하고 있습니다. 이러한 요소들이 결합되어 예측 기간 동안 페인트 및 코팅 산업의 안정적인 판매량 기반을 강화할 것입니다.

자동차 생산 대수 확대

경차 생산량은 2024년 반등했으며, 2026년까지 팬데믹 이전 성장 궤도를 회복할 것으로 전망됩니다. 중국, 인도 및 동남아시아가 증설된 생산 능력의 대부분을 차지할 것입니다. 현대식 차체 공장은 사이클 시간과 VOC 배출을 줄이기 위해 수성 베이스코트와 저온 경화형 클리어코트를 점점 더 많이 지정하고 있어, OEM과 리피니시 라인 간의 기술 융합이 강화되고 있습니다. 수지 제조사, 스프레이 부스 제조사 및 자동차 제조사 간의 전략적 파트너십은 단위 도포당 에너지 사용량을 낮추는 통합 코팅 플랫폼의 채택을 가속화하고 있습니다. 이러한 지속적인 생산 확대는 산업용 소비를 의미 있게 증가시켜 페인트 및 코팅 시장 동향을 부양합니다.

엄격한 세계의 VOC 규정

캘리포니아 남부 해안 대기질 관리구는 규칙 1113을 주기적으로 강화하여 비준수 제품의 재제형화 또는 철수를 강제하고 중소 공급업체의 연구개발 비용을 증가시키고 있습니다. 유럽의 다가오는 CLP 개정안은 내분비 교란 물질 표시를 추가하여 생산자가 원자재 포트폴리오를 검토하고 안전 데이터 시트를 업데이트하도록 의무화합니다. 중국이 제안한 통일 건축 기준은 프라이머 및 실러와 같은 보조 재료까지 VOC 제한을 확대하여 준수 복잡성을 가중시킬 것입니다. 이러한 규제들은 종합적으로 페인트 및 코팅 산업의 마진을 압박하며, 민첩한 제품 개발 파이프라인의 중요성을 높이고 있습니다.

부문 분석

아크릴 화학 물질은 2025년 페인트 및 코팅 산업에서 35.78%의 점유율을 차지했으며, 입증된 내후성, 색상 유지력 및 건축 및 경공업 수요를 충족하는 저 VOC 특성에 힘입어 2031년까지 연평균 3.98%의 성장률을 기록할 것으로 예상됩니다. 제조업체들은 스크럽 저항성과 얼룩 차단 기능을 강화하는 가교 구조를 지속적으로 개선하여 DIY 및 전문 도장 작업자에게 더 긴 서비스 주기를 제공하고 있습니다. 성장 동력은 신흥 시장의 도시화에서 비롯되며, 아크릴 에멀션 페인트가 신축 주택 내장재 시장을 주도하고 있습니다. 생산업체들은 리드 타임을 단축하고 색상 구성을 현지화하기 위해 지역별 반응기 설비 용량을 확대하고 있으며, 이는 용제형 경쟁사 대비 경쟁력을 강화하는 전략입니다.

다국적 기업들이 고마진 아크릴 분산 플랫폼으로 포트폴리오를 간소화함에 따라 수지 시장은 점차 통합되고 있습니다. 알키드 수지는 금속 및 목재 마감재 분야에서 틈새 시장을 유지하고 있으나, 대두유 가격 변동으로 인한 마진 압박에 직면해 있습니다. 에폭시 수요는 중장비 유지보수 분야에서 안정적이지만, 2025년 달성된 가격 안정성은 구조적 상승세보다는 균형 잡힌 생산 능력의 반영입니다. 폴리우레탄 및 폴리에스터 시스템은 각각 내마모성 바닥재와 분체 도장이라는 특수 성능 니치 시장을 점유하고 있으나, 아크릴계처럼 광범위한 물량 기반을 갖추지는 못합니다. 전반적으로 아크릴계는 페인트 및 코팅 시장 전반에 걸쳐 제형 개발업체들의 성장 전략을 계속해서 주도할 것입니다.

페인트 및 코팅 시장 보고서는 수지별(아크릴, 알키드, 폴리우레탄, 에폭시 등), 기술별(수성, 용제계, 분체 도장, UV 경화 도장), 최종 사용자 산업(건축, 자동차, 목재, 보호 코팅 등), 지역(아시아태평양, 북미, 유럽, 남미, 중동, 아프리카)별로 분석되고 있습니다. 시장 예측은 금액 기준(달러)으로 제공됩니다.

지역별 분석

아시아태평양 지역은 2025년 전 세계 매출의 46.21%를 차지했으며, 2031년까지 연평균 4.91%의 견고한 성장률을 기록할 것으로 전망됩니다. 이 지역의 페인트 및 코팅 시장 규모는 지속적인 메가시티 개발, 산업 리쇼어링, 지속적인 공공 인프라 지출로 인해 보호 및 장식용 마감재 수요가 지속적으로 증가함에 따라 혜택을 받고 있습니다.

북미는 연방 자금 지원 교통 회랑과 안정적인 모기지 금리로 가속화된 주거용 리모델링 사이클에 힘입어 성장세를 보이고 있습니다. ESG(환경·사회·지배구조) 기준에 부합하는 자산에 대한 수요 증가로 인증된 저배출 실내 페인트 채택이 가속화되며, 수성 페인트 공급업체들이 페인트 및 코팅 산업에서 점유율을 점진적으로 확대할 수 있는 기회를 얻고 있습니다. 유럽은 주요 경제국들이 EU 그린딜과 연계된 주택 부족 및 에너지 효율 개선 사업 파이프라인을 해결해 나가며 점진적인 회복세를 보이고 있으나, 개정된 CLP 규정 하의 강화된 라벨링 체계가 공급망 전반에 걸쳐 비용을 증가시키고 있습니다.

남미는 브라질을 중심으로 선별적 상승 여력을 제공하는데, 셔윈-윌리엄스의 바스프 장식용 사업부 인수로 즉시 매장 네트워크가 확대되고 계약업체들이 브랜드 제품에 더 쉽게 접근할 수 있게 되었습니다. 중동 및 아프리카는 초대형 프로젝트와 자원 기반 인프라를 전제로 한 초기 성장 단계를 보이지만, 정치적 위험과 자금 조달 제약으로 아시아태평양 지역에 비해 물량이 제한됩니다. 혹독한 사막 및 해안 기후는 자본 자산을 보호하는 고성능 폴리실록산 및 불소수지 탑코트 사양을 뒷받침합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 세계의 주거용 건설 활동 급증

- 확대하는 자동차 생산 대수

- 아시아태평양 도시 인구의 급격한 증가

- 그린빌딩(저VOC)에 대한 정부 우대조치

- AI 기반 컬러 매칭 플랫폼의 등장

- 시장 성장 억제요인

- 세계의 엄격한 VOC 규제

- 이산화 티타늄 원료 가격 변동성

- 수성 시스템의 긴 건조, 경화 시간

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 수지

- 아크릴

- 알키드

- 폴리우레탄

- 에폭시

- 폴리에스터

- 기타 수지 유형

- 기술

- 수성

- 용제계

- 분체 도장

- UV 경화형 코팅

- 최종 사용자 산업

- 건축

- 자동차

- 목재

- 보호 코팅

- 일반산업

- 운송

- 포장

- 지역

- 아시아태평양

- 중국(대만 포함)

- 인도

- 일본

- 인도네시아

- 호주 및 뉴질랜드

- 한국

- 태국

- 말레이시아

- 필리핀

- 방글라데시

- 베트남

- 싱가포르

- 스리랑카

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 베네룩스

- 러시아

- 튀르키예

- 스위스

- 스칸디나비아 국가

- 폴란드

- 포르투갈

- 스페인

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 칠레

- 기타 남미

- 중동

- 사우디아라비아

- 카타르

- 아랍에미리트(UAE)

- 쿠웨이트

- 이집트

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 알제리

- 모로코

- 기타 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/순위 분석

- 기업 프로파일

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems Ltd.

- BASF

- Beckers Group

- Benjamin Moore & Co.

- Berger Paints India

- Chugoku Marine Paints, Ltd.

- DAW SE

- Hempel A/S

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd

- Masco Corporation

- NATIONAL PAINTS FACTORIES CO. LTD.

- Nippon Paint Holdings Co., Ltd.

- NOROO Paint & Coatings co.,Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Russian Paints Company

- SK Kaken Co. Ltd

- The Sherwin-Williams Company

제7장 시장 기회와 장래의 전망

HBR 26.02.04Paints And Coatings Market size in 2026 is estimated at USD 192.46 billion, growing from 2025 value of USD 185.74 billion with 2031 projections showing USD 229.9 billion, growing at 3.62% CAGR over 2026-2031.

Steady demand from residential construction, infrastructure upgrades and sustainable product innovation underpins this moderate expansion even as raw-material costs swing sharply and environmental regulations tighten. Asia-Pacific holds structural advantages, rapid urban migration, large-scale capital projects and expanding industrial output, that collectively fuel regional consumption at a noticeably faster rate than mature economies. Across technologies, the migration to low-VOC water-borne chemistries remains the single most influential trend, reinforced by government emission caps and customer preference for greener specifications. Simultaneously, producers are digitizing color-matching, plant scheduling and quality-control workflows to mitigate labor shortages and compress time-to-market. Competitive intensity is rising as the top dozen suppliers pursue targeted acquisitions and divestitures that create leaner portfolios and unlock scale efficiencies in the global paints and coatings industry.

Global Paints And Coatings Market Trends and Insights

Surge in Global Residential Construction Activity

North American legislation such as the Infrastructure Investment and Jobs Act is funneling capital toward roads, bridges and utilities, lifting demand for protective and decorative coatings on both new and renovated assets. In parallel, Asia-Pacific governments continue to prioritize affordable housing programs that stimulate fresh residential starts and interior repaint cycles. Historically low mortgage rates in several economies have revived remodeling budgets, channeling incremental gallons into premium zero-VOC wall finishes that qualify for green-building credits. Suppliers are responding with fast-dry water-borne lines that meet stringent indoor-air benchmarks without sacrificing application speed. Combined, these factors reinforce a stable base of volume for the paints and coatings industry during the forecast window.

Expanding Automotive Production Volumes

Light-vehicle output rebounded in 2024 and is projected to regain its pre-pandemic trajectory by 2026, with China, India and Southeast Asia capturing the lion's share of incremental capacity additions. Modern body shops increasingly specify water-borne basecoats and low-temperature bake clearcoats to cut cycle times and VOC emissions, strengthening technology convergence between OEM and refinish lines. Strategic partnerships among resin formulators, spray-booth makers and carmakers are accelerating the adoption of integrated coating platforms that lower energy use per unit sprayed. This ongoing production expansion delivers a meaningful uplift to industrial consumption boosts the paints and coatings market trends.

Stringent Global VOC Regulations

California's South Coast Air Quality Management District periodically tightens Rule 1113, forcing reformulation or withdrawal of non-compliant products and raising research and development costs for smaller suppliers. Europe's upcoming CLP amendments add endocrine-disruptor labeling, obliging producers to review raw-material portfolios and update safety data sheets. China's proposed unified architectural standard will extend VOC limits to auxiliary materials such as primers and sealers, broadening compliance complexity. Collectively, these regulations compress margins in the paints and coatings industry and elevate the importance of agile product-development pipelines.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Urban Population Growth in APAC

- Government Incentives for Green Building (Low-VOC)

- Longer Drying/Curing Times for Water-Borne Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic chemistries delivered 35.78% paints and coatings industry share in 2025 and are projected to post a 3.98% CAGR through 2031, underpinned by proven weatherability, color retention and low-VOC credentials that meet architectural and light-industrial demands. Formulators continue to refine cross-linked structures that boost scrub resistance and stain blocking, giving do-it-yourself and professional painters longer service intervals. Growth momentum stems from emerging market urbanization where acrylic emulsion paints dominate new housing interiors. Producers are scaling regional reactor capacity to shorten lead times and localize color assortments, a strategy that enhances competitiveness against solvent-borne rivals.

The resin landscape is gradually consolidating as multinationals streamline portfolios toward high-margin acrylic dispersion platforms. Alkyds maintain niche relevance in metal and wood finishes but face margin pressure from soybean-oil price fluctuations. Epoxy demand remains steady in heavy-duty maintenance; however, price stability achieved in 2025 reflects balanced capacity rather than a structural upswing. Polyurethane and polyester systems occupy specialized performance niches, abrasion-resistant floors and powder coatings respectively, yet lack the broad-based volume of acrylics. Overall, acrylics will continue to anchor formulators' growth strategies across the paints and coatings market.

The Paints and Coatings Report is Segmented by Resin (Acrylic, Alkyd, Polyurethane, Epoxy, and More), Technology (Water-Borne, Solvent-Borne, Powder Coating, and UV-Cured Coating), End-User Industry (Architectural, Automotive, Wood, Protective Coating, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 46.21% of worldwide sales in 2025 and is tracking a robust 4.91% CAGR to 2031. The region's paints and coatings market size benefits from ongoing megacity development, industrial reshoring and sustained public infrastructure outlays that collectively require ever larger volumes of protective and decorative finishes.

North America is buoyed by federally funded transport corridors and an accelerating residential remodeling cycle boosted by stable mortgage rates. The push for ESG-aligned assets cats up adoption of certified low-emission interior paints, positioning water-borne suppliers for incremental share gains in the paints and coatings industry. Europe shows a measured recovery as major economies work through housing shortages and energy-retrofit pipelines tied to the EU's Green Deal; however, tightening labeling frameworks under the updated CLP regulation add costs across supply chains.

South America provides selective upside, headlined by Brazil where Sherwin-Williams' purchase of BASF's decorative unit instantly enlarges store footprints and gives contractors easier access to branded formulations. The Middle-East and Africa offer early-stage growth premised on mega-projects and resource-driven infrastructure, yet political risk and financing limitations restrain volume relative to Asia-Pacific. Harsh desert and coastal climates underpin specification of high-performance polysiloxane and fluoropolymer topcoats that protect capital assets.

- Akzo Nobel N.V.

- Asian Paints

- Axalta Coating Systems Ltd.

- BASF

- Beckers Group

- Benjamin Moore & Co.

- Berger Paints India

- Chugoku Marine Paints, Ltd.

- DAW SE

- Hempel A/S

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd

- Masco Corporation

- NATIONAL PAINTS FACTORIES CO. LTD.

- Nippon Paint Holdings Co., Ltd.

- NOROO Paint & Coatings co.,Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Russian Paints Company

- SK Kaken Co. Ltd

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Global Residential Construction Activity

- 4.2.2 Expanding Automotive Production Volumes

- 4.2.3 Rapid Urban Population Growth in APAC

- 4.2.4 Government Incentives for Green Building (Low-VOC)

- 4.2.5 Emergence of AI-Driven Colour-Matching Platforms

- 4.3 Market Restraints

- 4.3.1 Stringent Global VOC Regulations

- 4.3.2 Volatility in Titanium-Dioxide Feedstock Prices

- 4.3.3 Longer Drying/Curing Times for Water-Borne Systems

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured Coating

- 5.3 End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coating

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China (Including Taiwan)

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 Indonesia

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 South Korea

- 5.4.1.7 Thailand

- 5.4.1.8 Malaysia

- 5.4.1.9 Philippines

- 5.4.1.10 Bangladesh

- 5.4.1.11 Vietnam

- 5.4.1.12 Singapore

- 5.4.1.13 Sri Lanka

- 5.4.1.14 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Benelux

- 5.4.3.6 Russia

- 5.4.3.7 Turkey

- 5.4.3.8 Switzerland

- 5.4.3.9 Scandinavian Countries

- 5.4.3.10 Poland

- 5.4.3.11 Portugal

- 5.4.3.12 Spain

- 5.4.3.13 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Rest of South America

- 5.4.5 Middle-East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Kuwait

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Algeria

- 5.4.6.4 Morocco

- 5.4.6.5 Rest of Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems Ltd.

- 6.4.4 BASF

- 6.4.5 Beckers Group

- 6.4.6 Benjamin Moore & Co.

- 6.4.7 Berger Paints India

- 6.4.8 Chugoku Marine Paints, Ltd.

- 6.4.9 DAW SE

- 6.4.10 Hempel A/S

- 6.4.11 Jazeera Paints

- 6.4.12 Jotun

- 6.4.13 Kansai Paint Co. Ltd

- 6.4.14 Masco Corporation

- 6.4.15 NATIONAL PAINTS FACTORIES CO. LTD.

- 6.4.16 Nippon Paint Holdings Co., Ltd.

- 6.4.17 NOROO Paint & Coatings co.,Ltd.

- 6.4.18 PPG Industries, Inc.

- 6.4.19 RPM International Inc.

- 6.4.20 Russian Paints Company

- 6.4.21 SK Kaken Co. Ltd

- 6.4.22 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment