|

시장보고서

상품코드

1907335

유럽의 혈당 모니터링 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Europe Blood Glucose Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

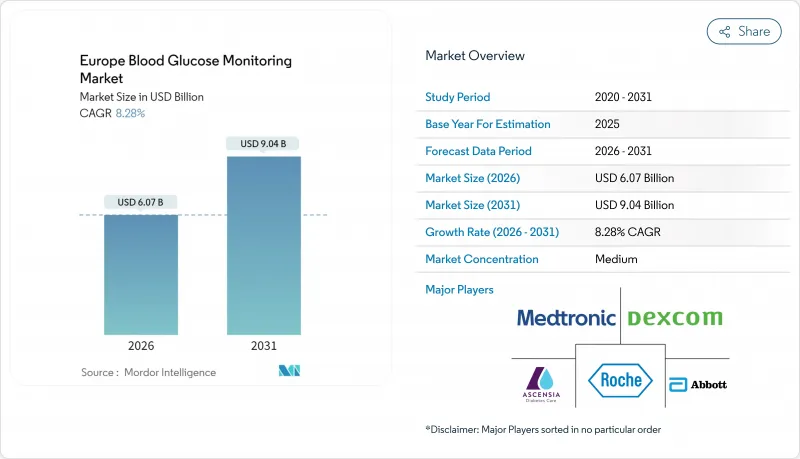

유럽의 혈당 모니터링 시장은 2025년 56억 1,000만 달러에서 2026년에는 60억 7,000만 달러로 성장할 것으로 보입니다. 2026-2031년에 걸쳐 CAGR 8.28%로 성장할 것으로 예상되며, 2031년까지 90억 4,000만 달러에 달한다고 예측했습니다.

해당 지역은 법정 보험사들의 보장 범위 확대와 기기 정확도 향상으로 단발성 손가락 채혈 검사에서 통합형 지속 혈당 모니터링으로 전환되고 있습니다. 센서, 클라우드 플랫폼, 자동 인슐린 투여 기기의 융합은 임상 결과를 강화하는 동시에 수백만 당뇨병 환자의 일상 관리를 간소화합니다. 독일의 법정 건강보험 계약과 영국의 인공 췌장 도입은 확장 가능한 보험 적용 모델을 입증하는 반면, 북유럽 프로그램들은 원격 의료를 가속화하는 데이터 공유 프레임워크를 선보입니다. 애보트와 덱스콤 간의 10년간 특허 휴전 협정으로 강화된 경쟁 심화는 예측 분석, 센서 수명 연장, 비침습적 폼 팩터 등 차세대 기능 개발을 촉진하고 있습니다. 특히 유럽 위원회의 새로운 공지 규정 하에서 공급망 리스크 관리가 이제 순수한 혁신만큼이나 조달 전략을 형성하고 있습니다.

유럽의 혈당 모니터링 시장 동향 및 인사이트

고령화 인구로 인해 유럽 전역에서 전례 없는 당뇨병 부담 증가

고령화 인구는 유럽 혈당 모니터링 시장 기기의 잠재적 사용자 기반을 확대합니다. Scientific Reports에 따르면 20-79세 유럽인 6,100만 명이 당뇨병을 앓고 있으며, 2045년까지 6,900만 명으로 증가할 것으로 전망됩니다. 동부 및 남부 경제권은 가장 가파른 동반 질환 지수를 보이며, 재정 역량이 제한된 의료 시스템에 수요가 집중되고 있습니다. NHS 잉글랜드 데이터에 따르면 1년간 50만 명의 신규 제2형 당뇨병 고위험군이 확인되어 예방적 검진의 중요성이 부각되고 있습니다. 인구학적 변화는 조기 발견, 원격 추적 및 코칭을 위한 다부문 협력을 촉진합니다. 장기적으로 위험도 계층화 프로그램이 유럽 전역에서 안정적인 기기 활용과 반복적 센서 수익을 견인할 것으로 예상됩니다.

정밀도 혁신을 통한 기술 융합으로 기존 CGM-SMBG 경계 해소

유럽의 의료진은 센서 MARD(평균 상대적 변동계수)가 9% 미만으로 하락함에 따라 연속 모니터링과 모세관 모니터링을 동등한 분석 기준으로 비교합니다. 덱스콤 G7은 15.5일 착용 기간 동안 8.0% MARD를 기록합니다. 애보트 프리스타일 리브레 3는 14일 동안 매분마다 혈당을 스트리밍하며, 메드트로닉 미니메드 780G는 5분마다 인슐린을 자동 조정해 일상적인 손가락 채혈 확인을 없앤다. 로슈는 2024년 7월 AI 기반 저혈당 예측 기능을 탑재한 Accu-Chek SmartGuide CGM에 대해 CE 인증을 획득했습니다. FDA의 iCGM 규정은 이제 인구 집단 전반에 걸친 정확도를 기준으로 삼아 증거 요건을 더욱 조화롭게 합니다. 이러한 이정표들은 SMBG와 CGM 기기 분류 간 역사적인 장벽을 허물고 교체 주기를 단축시킵니다.

임상적 혜택 입증에도 높은 CGM 기기 비용이 접근 장벽으로 작용

동유럽 및 남유럽의 예산 제약 시스템에서는 단위 경제성이 여전히 걸림돌입니다. 프랑스의 2025년 사회보장재정법은 건강보험 지출이 3.4% 증가한 2,659억 유로에 달함에도 이미 220억 유로의 적자를 예상하고 있습니다. 프랑스의 비용-효용 연구에 따르면 CGM은 기기 비용으로 460만 유로를 추가하지만 장기 입원률을 낮춰 예측 기간 동안 순절감 효과를 창출합니다. 그럼에도 덱스콤의 2025년 유럽 의료진 설문조사에서는 제한된 자금 지원과 엄격한 적용 기준이 주요 도입 장벽으로 지적되었습니다. 독일 보험사는 CGM 승인 전 집중적 인슐린 사용을 검증하기 위해 독립적 의료 검토를 요구해 행정적 마찰을 가중시킵니다. 이러한 비용 우려는 본래 강한 수요 증가세를 억제합니다.

부문 분석

자가 혈당 모니터링은 낮은 초기 비용과 확립된 임상 관행으로 인해 2025년 유럽 혈당 모니터링 시장 점유율의 59.85%를 유지할 전망입니다. 일회용 테스트 스트립은 특히 체중 관리 및 경구 약물을 복용하는 제2형 당뇨병 환자의 일차 진료 분야에서 가장 높은 소비량을 기록하는 소모품으로 남아 있습니다. 그럼에도 지속형 혈당 모니터링 부문은 2031년까지 연평균 14.80% 성장률을 기록하며 현재 대부분의 전략적 투자를 주도하고 있습니다. 유럽 혈당 모니터링 시장 규모 중 CGM 센서 부문만 2026년부터 2031년 사이 13억 6,000만 달러가 증가할 것으로 전망되며, 이는 초기 도입자 단계에서 주류 처방 단계로의 전환을 반영합니다. 획기적인 정확도 향상 - 덱스콤 G7의 8.0% MARD(평균 상대적 변화율) 및 애보트 리브레 3의 1분 전송 속도 - 는 임상적 신뢰도를 높이고 보험 청구 서류를 간소화합니다. 옴니팟 5의 리브레 2 플러스 연동과 같은 인슐린 펌프와의 통합은 하드웨어 경계를 더욱 모호하게 만듭니다.

송신기 및 수신기와 같은 내구성 부품은 반복적인 센서 수익을 뒷받침하는 반면, 알고리즘 라이선스는 신생 가치 풀로 부상하고 있습니다. DiaMonTech와 EU 지원 Talisman 프로토타입이 주도하는 비침습적 광학 기술은 정밀도 기준을 충족할 경우 획기적인 편의성을 약속합니다. FDA의 iCGM 규제는 이제 성능 시험을 표준화하여 로슈와 같은 자가혈당측정(SMBG) 기존 업체들이 AI 기반 플랫폼으로 재진입하도록 장려합니다. 이러한 변화들은 종합적으로 연구개발 예산을 스트립 화학에서 센서 펌웨어, 실시간 분석 및 클라우드 연결성으로 전환시켜 공급망과 유통업체 교육 커리큘럼을 재편하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 고령화 및 당뇨병 유병률 급증

- CGM-SMBG 기술의 융합과 정밀도 향상

- CGM 센서에 대한 공적 보험 적용 범위 확대

- 디지털 헬스 플랫폼 통합과 원격 모니터링

- 저혈당 모니터링의 필요성 증가

- 시장 성장 억제요인

- CGM 기기 및 소모품의 높은 비용

- 반도체 MEMS공급망 제약

- GDPR 데이터 개인정보 보호 규정 준수 부담

- 규제 상황

- Porter's Five Forces

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 기기 유형별

- 자가 혈당 측정 기기

- 혈당 측정기

- 테스트 스트립

- 란셋

- 연속 혈당 모니터링 기기

- 센서

- 내구성 부품

- 자가 혈당 측정 기기

- 최종 사용자별

- 재택 헬스케어

- 병원 및 진료소

- 약국 및 기타

- 지역

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타 유럽

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Abbott Laboratories

- F. Hoffmann-La Roche

- Dexcom Inc.

- Medtronic plc

- Ascensia Diabetes Care

- LifeScan Inc.

- Senseonics, Inc.

- Ypsomed AG

- Nova Biomedical

- Nipro

- i-Sens

- Arkray

- Agamatrix

- Bionime

- Acon Labs

- Rossmax

- Terumo

- Trividia Health

- Medisana

제7장 시장 기회와 장래의 전망

HBR 26.02.04The Europe blood glucose monitoring market is expected to grow from USD 5.61 billion in 2025 to USD 6.07 billion in 2026 and is forecast to reach USD 9.04 billion by 2031 at 8.28% CAGR over 2026-2031.

The region is shifting from episodic finger-stick testing toward integrated continuous glucose monitoring as statutory payers expand coverage and device accuracy improves. Convergence of sensors, cloud platforms and automated insulin delivery strengthens clinical outcomes while streamlining daily management for millions living with diabetes. Germany's statutory health insurance contracts and the United Kingdom's artificial-pancreas rollout validate scalable reimbursement blueprints, whereas Nordic programs showcase data-sharing frameworks that accelerate remote care. Intensifying competition, reinforced by a 10-year patent truce between Abbott and Dexcom, is spurring next-generation features such as predictive analytics, longer sensor life and non-invasive form factors. Supply-chain risk management, notably under new European Commission notice rules, now shapes procurement strategy as much as raw innovation.

Europe Blood Glucose Monitoring Market Trends and Insights

Ageing Population Drives Unprecedented Diabetes Burden Across European Demographics

An ageing population enlarges the addressable base of users for Europe blood glucose monitoring market devices. Scientific Reports confirms that 61 million Europeans aged 20-79 live with diabetes, with projections indicating 69 million by 2045. Eastern and Southern economies exhibit the steepest comorbidity indices, concentrating demand into health systems with limited fiscal capacity. NHS England data registers half a million newly identified people at high risk of type 2 diabetes in 1 year, underscoring preventive screening momentum. The demographic wave supports multisector collaboration on earlier detection, remote follow-up and coaching. Over the long term, risk-stratified programs are expected to anchor stable device utilisation and recurring sensor revenues across the continent.

Technology Convergence Eliminates Traditional CGM-SMBG Boundaries Through Accuracy Innovations

European clinicians now compare continuous and capillary monitoring on equal analytical footing as sensor MARD falls below 9%. Dexcom G7 records an 8.0% MARD with a 15.5-day wear period. Abbott FreeStyle Libre 3 streams glucose every minute over 14 days, while Medtronic's MiniMed 780G auto-adjusts insulin every 5 minutes, eliminating routine finger-stick confirmation. Roche gained CE Mark for its Accu-Chek SmartGuide CGM with AI-driven hypoglycaemia prediction in July 2024. FDA iCGM rules now benchmark accuracy across populations, further harmonising evidence requirements. Together, these milestones dissolve historical silos between SMBG and CGM device classes and lift replacement cycles.

High CGM Device Costs Create Access Barriers Despite Proven Clinical Benefits

Unit economics remain a hurdle for budget-constrained systems in Eastern and Southern Europe. France's 2025 Social Security Financing Law already projects a EUR 22 billion deficit even as health insurance outlays rise 3.4% to EUR 265.9 billion. A French cost-utility study finds CGM adds EUR 4.6 million in device costs yet lowers long-run admissions, yielding net savings over the forecast horizon. Still, Dexcom identifies limited funding and restrictive inclusion rules as top adoption barriers in its 2025 European clinician survey. German insurers require independent medical reviews to validate intensive insulin use before approving CGM, adding administrative friction. These cost concerns temper otherwise strong demand trajectories.

Other drivers and restraints analyzed in the detailed report include:

- European Reimbursement Revolution Unlocks CGM Access for Type 2 Diabetes Populations

- Digital Health Platform Integration Transforms Diabetes Management Through Remote Monitoring Capabilities

- Semiconductor MEMS Supply Chain Constraints Threaten Medical Device Production Continuity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Self-monitoring blood glucose preserved 59.85% Europe blood glucose monitoring market share in 2025 due to low upfront cost and entrenched clinical routines. Single-use test strips remain the highest-volume consumable, especially across primary care for type 2 patients managing weight and oral medication. Nonetheless, the continuous glucose monitoring segment increases at a 14.80% CAGR to 2031 and now anchors most strategic investment. Europe blood glucose monitoring market size for CGM sensors alone is projected to add USD 1.36 billion between 2026 and 2031, reflecting transitions from early adopters to mainstream prescriptions. Breakthrough accuracy gains - Dexcom G7's 8.0% MARD and Abbott Libre 3's one-minute transmission - elevate clinical confidence and simplify reimbursement dossiers. Integration with insulin pumps, as in Omnipod 5's linkage to Libre 2 Plus, further blurs hardware boundaries.

Durable components such as transmitters and receivers underpin recurring sensor revenue, while algorithm licences emerge as a nascent value pool. Non-invasive optics, led by DiaMonTech and EU-funded Talisman prototypes, promise step-change convenience if precision thresholds are met. FDA iCGM regulation now harmonises performance trials, encouraging SMBG incumbents like Roche to re-enter with AI-enabled platforms. Collectively, these shifts redirect R&D budgets from strip chemistry to sensor firmware, real-time analytics and cloud connectivity, reshaping supply chains and distributor training curricula.

The Europe Blood Glucose Monitoring Market Report is Segmented by Device Type (Self-Monitoring Blood Glucose Devices [Glucometer Devices, Test Strips, and Lancets] and Continuous Glucose Monitoring Devices [Sensors and Durables]), End User (Home Healthcare, Hospitals & Clinics, and Pharmacies & Others), and Geography (Germany, France, United Kingdom, Italy, Spain and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbott Laboratories

- Roche

- Dexcom

- Medtronic

- Ascensia

- Lifescan

- Senseonics, Inc.

- Ypsomed

- Nova Biomedical

- Nipro

- I-Sens

- Arkray

- AgaMatrix

- Bionime

- Acon Labs

- Rossmax

- Terumo

- Trividia Health

- Medisana

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing & Diabetes Prevalence Surge

- 4.2.2 CGM-SMBG Technology Convergence & Accuracy Gains

- 4.2.3 Expanded Public Reimbursement For CGM Sensors

- 4.2.4 Digital-Health Platform Integration & Remote Monitoring

- 4.2.5 Raising Need Of Hypoglycaemia Monitoring

- 4.3 Market Restraints

- 4.3.1 High Cost Of CGM Devices & Consumables

- 4.3.2 Semiconductor MEMS Supply-Chain Constraints

- 4.3.3 GDPR Data-Privacy Compliance Burden

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (value, USD)

- 5.1 By Device Type

- 5.1.1 Self-Monitoring Blood Glucose Devices

- 5.1.1.1 Glucometer Devices

- 5.1.1.2 Test Strips

- 5.1.1.3 Lancets

- 5.1.2 Continuous Glucose Monitoring Devices

- 5.1.2.1 Sensors

- 5.1.2.2 Durables

- 5.1.1 Self-Monitoring Blood Glucose Devices

- 5.2 By End User

- 5.2.1 Home Healthcare

- 5.2.2 Hospitals & Clinics

- 5.2.3 Pharmacies & Others

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche

- 6.3.3 Dexcom Inc.

- 6.3.4 Medtronic plc

- 6.3.5 Ascensia Diabetes Care

- 6.3.6 LifeScan Inc.

- 6.3.7 Senseonics, Inc.

- 6.3.8 Ypsomed AG

- 6.3.9 Nova Biomedical

- 6.3.10 Nipro

- 6.3.11 i-Sens

- 6.3.12 Arkray

- 6.3.13 Agamatrix

- 6.3.14 Bionime

- 6.3.15 Acon Labs

- 6.3.16 Rossmax

- 6.3.17 Terumo

- 6.3.18 Trividia Health

- 6.3.19 Medisana

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment