|

시장보고서

상품코드

1907342

사기 탐지 및 방지(FDP) : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Fraud Detection And Prevention (FDP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

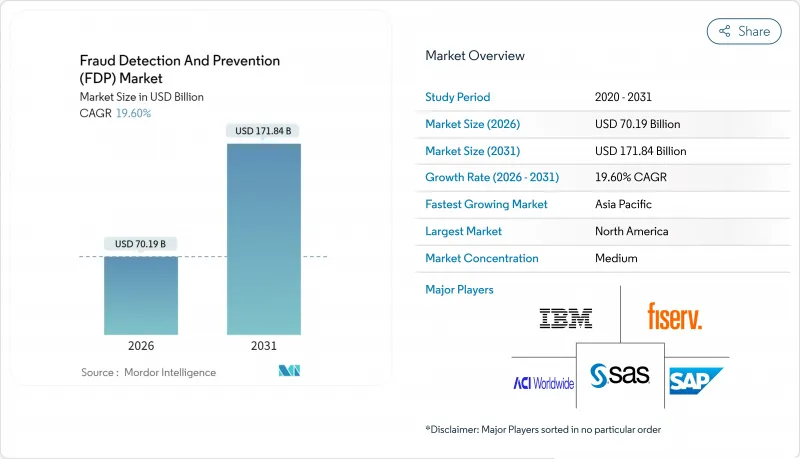

2026년 사기 탐지 및 방지(FDP) 시장 규모는 701억 9,000만 달러로 평가되었고, 2025년 586억 9,000만 달러에서 성장했으며, 2031년에는 1,718억 4,000만 달러에 이를 것으로 예측됩니다.

2026-2031년에 걸쳐 연평균 복합 성장률(CAGR)은 19.6%가 될 전망입니다.

이 급성장은 기존의 룰 기반 엔진으로는 대응할 수 없는 딥 페이크 사기나 합성 신분 증명, 기타 AI를 활용한 위협의 급증을 반영하고 있어 적응형 머신러닝 방어 기술에 대한 수요를 높이고 있습니다. 특히 유럽의 PSD3(제3차 결제 서비스 지령)이나 PSR(지불 서비스 규칙) 패키지에 의한 2026년부터의 견고한 고객 인증(SCA) 강화 등의 규제의 움직임은 은행이 보안, 규정 준수, 고객 경험을 실시간으로 정합시키기 위해 기술 갱신 사이클을 가속화하고 있습니다. 각국의 사기 탐지 및 방지(FDP) 시장의 성장은 모바일 퍼스트 결제 습관과 자동화된 실시간 감시를 의무화하는 필리핀의 '금융계좌 사기 방지법' 등의 법규제에 의해 촉진되고 있습니다. 위조 부품 사기가 3자리 급증을 보이는 등 공급망 사기의 심각화는 조직이 보안을 단순한 규정 준수 비용이 아닌 수익 보호 수단으로 파악할 수 있음을 더욱 뒷받침합니다.

세계의 사기 탐지 및 방지(FDP) 시장 동향 및 인사이트

디지털 결제 및 전자상거래 거래량 증가

모바일 지갑, QR 코드, 비접촉식 카드가 결제 흐름을 주도하면서 기존 시스템이 효과적으로 처리할 수 없는 공격 표면이 확대되고 있습니다. 따라서 합법적 고객과 봇 또는 스크립트화된 카드 테스트 공격을 구분하기 위해 기기 지문 인식 및 행동 생체 인식의 실시간 분석이 필수적입니다. 2023년 전자상거래 사기 손실액은 480억 달러에 달했으며, 카드 미소지(CNP) 거래가 주범으로 지목되면서 상인들은 거래를 밀리초 단위로 평가하는 클라우드 기반 위험 엔진으로 전환하고 있습니다. 소매 플랫폼들은 결제 속도를 유지하면서 지불 거절 위험을 줄이기 위해 이러한 엔진을 결제 게이트웨이에 직접 내장하는 경우가 늘고 있습니다. 디지털 우선 소비자들이 오프라인 매장 방문객을 계속 대체함에 따라, ‘지금 구매 후 나중에 결제(BNPL)’ 및 즉시 신용 한도 같은 새로운 결제 형식에 적응하는 확장 가능한 탐지 기술에 대한 수요가 모든 주요 지역에서 더욱 강해지고 있습니다.

엄격한 규제 규정 준수 압력

유럽의 PSD3(제3차 지불서비스지침) 및 PSR(지불서비스규정) 개편으로 SCA(강화된 고객 인증)가 2단계 인증을 넘어 수취인 이름 필수 확인 및 금융기관 간 실시간 사기 데이터 공유로 확대됩니다. 인증, 분석, 보고를 아우르는 단일 플랫폼을 제공하는 벤더들은 은행들이 규정 준수 부담을 줄이기 위해 개별 제품을 통합함에 따라 경쟁 우위를 점하고 있습니다. 국경을 넘는 상거래의 글로벌 특성으로 인해 미국 은행 및 PSP(지급서비스제공자)들은 EU 고객에게 서비스를 제공할 때 유럽의 SCA 기준을 충족해야 하며, 이는 사실상 전 세계적으로 더 엄격한 기준을 수출하는 효과를 가져옵니다. 아시아태평양 지역에서도 유사한 추세가 나타나고 있습니다. 싱가포르와 호주의 규제 당국은 운영 라이선스를 사기 모니터링 기준치와 연계하고 있습니다. 이에 따라 규정 준수는 전개 일정을 압박하여, 심지어 위험 회피 성향의 기관들조차도 긴 변경 관리 주기 없이 신속한 규칙 및 모델 업데이트를 제공하는 클라우드 인프라로 전환하도록 유도하고 있습니다.

높은 오탐률(False-Positive Rate)이 고객 경험에 악영향을 미침

지나치게 민감한 규칙 세트는 정상적인 지출을 의심스러운 거래로 분류하여 수동 검토를 유발함으로써 즉시 결제 기대를 저해할 수 있습니다. 고객 설문조사에 따르면, 연속으로 거절된 정상 거래가 두 건 발생할 경우 1년 내 은행을 변경할 가능성이 세 배로 증가합니다. 현대적인 AI 엔진은 개인별 지출 패턴, 계절별 여행 습관, 기기 선호도 등을 프로파일링하여 잡음을 줄이고, 적발률을 저하시키지 않으면서 오탐률을 최대 절반까지 감소시킵니다. 그러나 실시간 결제로의 전환은 의사결정 시간을 단 몇 초로 압축하여 인적 개입의 여지를 남기지 않습니다. 따라서 금융기관들은 위험 임계값을 더욱 신중하게 조정하여, 전체 전환율과 만족도 지표를 보호하기 위해 소액 거래에서 사기 손실을 약간 더 감수하는 방식을 채택하고 있습니다.

부문 분석

솔루션은 사기 탐지 및 방지 시장 규모의 63.25%를 차지하며, 분석 엔진, 인증 모듈, 조사자 대시보드의 핵심적 역할을 강조합니다. 공급업체들은 적응형 머신러닝으로 규칙 라이브러리를 정교화하여 금융 기관이 매일 테라바이트 단위의 행동 데이터를 수집하고 새로운 공격 시그니처에 거의 실시간으로 대응할 수 있도록 합니다. 솔루션 매출은 탐지 데이터를 감사 준비 완료 형식으로 변환하는 규제 보고 모듈도 반영하여, 리스크 담당자가 별도 도구 없이도 PSD3, GDPR 또는 OCC 검사를 충족할 수 있게 합니다.

서비스 부문은 규모는 작지만 이사회가 24시간 모니터링을 관리형 보안 전문가에게 위임함에 따라 20.95% CAGR로 성장 중입니다. 해당 전문가들은 보정된 모델, 선별된 글로벌 위협 피드, 사고 후 포렌식 서비스를 제공합니다. 데이터 사이언스 및 사이버 운영 분야의 인재 부족은 탐지율 SLA를 보장하는 성과 기반 계약의 매력을 높입니다. 동시에 컨설팅은 솔루션 전개를 포괄하여 KYC(고객 확인) 흐름을 재설계하고, 경보 분류를 최적화하며, 분쟁 해결을 간소화합니다. 이러한 기술과 전문성의 융합은 2031년 서비스 매출을 전체의 약 3분의 1 수준으로 끌어올려, 광범위한 사기 탐지 및 방지 시장 내 전략적 위치를 강화할 것으로 예상됩니다.

2025년 매출의 55.35%는 온프레미스 설치가 차지했습니다. 1급 은행들은 기존 인프라를 활용하고 자체 데이터 센터에서 개인 식별 정보(PII)를 처리함으로써 데이터 거주 규정을 준수했기 때문입니다. 이들 기업은 모델 훈련을 클라우드로 이전하면서도 지연 시간을 최소화하기 위해 생산 스코어링 노드를 사설 클러스터에 유지하는 하이브리드 패턴을 선호합니다. 이러한 아키텍처 하에서는 휴일 성수기 트래픽이 급증해도 사기 방지 지연 시간이 10밀리초 미만으로 유지됩니다.

그러나 클라우드 네이티브 플랫폼은 22.05%의 연평균 성장률(CAGR)로 다른 모든 방식을 앞지르며 시장 점유율 격차를 빠르게 좁힐 전망입니다. 구독형 가격 정책은 라이선스 비용을 거래량 증가에 연동시켜 중견 금융기관과 핀테크 기업이 자본 지출을 피할 수 있게 합니다. 주요 벤더들은 이제 주당 여러 차례 탐지 모델을 갱신하는 지속적 전개 툴체인을 사전 패키징하여 신종 사기에 대한 노출 기간을 단축하고 있습니다. 고급 암호화 및 기밀 컴퓨팅 영역은 지속되는 주권 문제를 해결하며, ISO 27001 및 SOC 2와 같은 인증은 감사관의 신뢰를 확보합니다. 이러한 장점들이 종합적으로 클라우드 기반을 사기 탐지 및 방지 시장의 미래 표준으로 자리매김하게 합니다.

사기 감지 및 방지(FDP) 시장은 구성요소(솔루션, 서비스), 전개 모드(클라우드, 온프레미스), 조직 규모(중소기업, 대기업), 최종 사용자 업계(은행, 금융서비스 및 보험(BFSI), 소매, 전자상거래, 의료 등) 및 지역별로 분류됩니다. 시장 예측은 금액(달러) 기준으로 제공됩니다.

지역별 분석

북미는 2025년 매출의 27.10%로 가장 큰 지역 점유율을 기록했으며, 이는 조기 클라우드 도입, 정교한 위협 인텔리전스 공유, 상당한 기술 예산에 힘입은 결과입니다. 미국 재무부 등 연방 기관들은 AI 기반 이상 탐지 시스템을 도입한 후 2024 회계연도에 수표 사기로 인한 10억 달러를 회수했으며, 이는 공공 부문의 검증 사례로 민간 부문의 도입을 더욱 촉진하고 있습니다. 미국 카드 네트워크 역시 CNP(카드 비접촉) 차지를 억제하기 위해 AI 기반 사전 승인 점수를 주창하며, 사기 논리를 결제 레일에 직접 내장하고 있습니다. 캐나다 은행들은 신종 실시간 레일 사기 대응을 위한 공동 컨소시엄을 구성하여 신호 교환에 대한 지역적 협력을 보여주고 있습니다.

유럽은 PSD3(제3차 지불서비스지침) 및 PSR(지불서비스규정)이 수취인 이름 일치 및 실시간 위험 피드 의무화를 도입함에 따라 규제 확장이 빠르게 진행되고 있습니다. GDPR 제약은 프라이버시 보호 연방 학습 혁신을 촉진하여 은행들이 원시 데이터 전송 없이도 은행 간 모델을 훈련할 수 있게 합니다. 통신 사업자들은 새로운 eIDAS 업데이트에 따라 스푸핑 전화 및 악성 SMS를 필터링해야 하며, 이는 사기 탐지 및 방지 시장을 통신 인프라로 확대합니다. 스페인과 같은 국가들은 이러한 조치를 이행하지 못한 통신사에 200만 유로(235만 달러)의 벌금을 부과하며, 운영 라이선스에 보안 요구사항을 깊이 내재화합니다.

아시아태평양은 19.95%라는 가장 빠른 CAGR을 기록하고 있으며, 높은 모바일 결제 보급률과 벤더에게 설정 가능한 정책 엔진의 제공을 강요하는 복잡한 규정 준수 환경이 주도하고 있습니다. 필리핀의 '금융계좌 사기 방지법'은 기관 규모에 맞춰 확장된 사기 방지 시스템을 의무화하는 반면, 인도의 RBI는 UPI 즉시 결제를 위한 AI 기반 거래 모니터링을 요구합니다. 중국 본토는 복지 배분 분야에 AI 부패 분석을 시범 운영하며 핀테크를 넘어 공공 자금 감독 분야로의 적용 가능성을 입증하고 있습니다. 이러한 역학은 유연하고 실시간 솔루션에 대한 지역적 수요를 증폭시켜 글로벌 사기 탐지 및 방지 시장에서 아시아태평양 지역의 비중을 높이고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 디지털 결제 및 전자상거래의 거래량 증가

- 엄격한 규제 준수의 압력

- AI/ML 기반 분석 기술로 향상된 탐지 정확도

- 토큰화 및 3-D Secure 2.3 도입 촉진

- 오픈 뱅킹/즉시 결제 인프라 - 새로운 사기 위험 요인

- 생성형 AI 딥페이크 사기 증가

- 시장 성장 억제요인

- 높은 오탐률로 인한 고객 경험(CX) 저하

- 레거시 시스템과의 통합 복잡성

- AI 모델 훈련용 라벨이 붙은 데이터 세트 부족

- 개인정보 보호 규정 하의 데이터 공유 제한

- 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장의 거시 경제적 요인의 평가

제5장 시장 규모와 성장 예측

- 컴포넌트별

- 솔루션

- 사기 분석

- 인증

- 보고

- 시각화

- 기타

- 서비스

- 솔루션

- 전개 모드별

- 클라우드

- 온프레미스

- 조직 규모별

- 중소기업

- 대기업

- 최종 사용자 업계별

- BFSI

- 소매 및 전자상거래

- IT 및 통신

- 헬스케어

- 에너지, 유틸리티

- 제조업

- 정부 및 공공 부문

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 이집트

- 기타 아프리카

- 중동

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- SAP SE

- IBM Corporation

- SAS Institute Inc.

- ACI Worldwide Inc.

- Fiserv Inc.

- Experian PLC

- DXC Technology Company

- BAE Systems PLC

- RSA Security LLC(Dell Technologies)

- Oracle Corporation

- NICE Ltd

- Equifax Inc.

- LexisNexis Risk Solutions

- Fair Isaac Corporation(FICO)

- Cybersource Corporation(Visa)

- Global Payments Inc.

- Feedzai SA

- Signifyd Inc.

- Riskified Ltd.

- Kount Inc.

제7장 시장 기회와 장래의 전망

HBR 26.02.04Fraud detection and prevention market size in 2026 is estimated at USD 70.19 billion, growing from 2025 value of USD 58.69 billion with 2031 projections showing USD 171.84 billion, growing at 19.6% CAGR over 2026-2031.

This steep trajectory mirrors the surge in deepfake scams, synthetic identities, and other AI-enabled threats that overwhelm legacy rule engines and elevate demand for adaptive machine-learning defenses. Regulatory momentum, notably the European PSD3 and PSR package that tightens Strong Customer Authentication (SCA) from 2026, accelerates technology refresh cycles as banks look to align security, compliance, and customer experience in real time. Fraud detection and prevention market in various countries is fueled by mobile-first payment habits and laws such as the Philippines' Anti-Financial Account Scamming Act that mandates automated, real-time monitoring. Intensifying supply-chain fraud, evidenced by triple-digit spikes in counterfeit component scams, further underscores because organizations now treat security as a revenue-protection lever, not merely a compliance cost.

Global Fraud Detection And Prevention (FDP) Market Trends and Insights

Rising Digital Payments and E-commerce Volumes

Mobile wallets, QR codes, and contactless cards now dominate checkout flows, expanding attack surfaces that legacy systems cannot parse effectively. Real-time analysis of device fingerprinting and behavioral biometrics has therefore become mandatory to distinguish legitimate customers from bots or scripted card-testing attacks.E-commerce fraud losses reached USD 48 billion in 2023, with card-not-present (CNP) transactions as the chief culprit, pushing merchants toward cloud-based risk engines that score transactions in milliseconds. Retail platforms increasingly embed these engines directly in payment gateways to preserve checkout speed while reducing chargeback exposure. As digital-first consumers continue to displace in-store traffic, demand for scalable detection that adapts to novel payment formats-such as buy-now-pay-later and instant-credit lines-intensifies across every major geography.

Stringent Regulatory Compliance Pressures

Europe's PSD3 and PSR overhaul expands SCA beyond two-factor credentials to include mandatory payee name verification and real-time fraud data sharing among financial institutions. Vendors that deliver single platforms covering authentication, analytics, and reporting gain an edge as banks consolidate point products to rein in compliance overhead. The global nature of cross-border commerce compels US banks and PSPs to meet European SCA benchmarks when serving EU clients, effectively exporting stricter standards worldwide. Similar momentum appears in Asia-Pacific, where regulators in Singapore and Australia link operating licences to monitored fraud thresholds. Compliance thus compresses deployment timelines, pushing even risk-averse institutions toward cloud infrastructures that offer rapid rule and model updates without lengthy change-control cycles.

High False-Positive Rates Hurting Customer Experience

Overly sensitive rule sets can tag legitimate spend as suspicious, triggering manual reviews that stall instant-payment expectations. Customer surveys show that two consecutively declined genuine transactions triple the likelihood of switching banks within a year. Modern AI engines reduce noise by profiling individual spending rhythms, seasonal travel patterns, and device preferences, cutting false-positive counts by up to half without sacrificing catch rates. Yet the shift to real-time settlement compresses decision windows to mere seconds, leaving no room for human intervention. Institutions therefore calibrate risk thresholds more carefully, accepting marginally higher fraud loss on low-ticket items to protect overall conversion and satisfaction metrics.

Other drivers and restraints analyzed in the detailed report include:

- AI/ML-Enabled Analytics Improving Detection Accuracy

- Generative-AI Deepfake Fraud Escalation

- Integration Complexity with Legacy Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions hold 63.25% of the fraud detection and prevention market size, underscoring the foundational role of analytics engines, authentication modules, and investigator dashboards. Vendors refine rule libraries with adaptive machine learning, letting financial institutions ingest terabytes of behavioral data per day and respond to fresh attack signatures in near real time. Solutions revenue also reflects regulatory reporting modules that convert detection data into audit-ready formats, allowing risk officers to satisfy PSD3, GDPR, or OCC exams without separate tooling.

Services, although smaller, are expanding at 20.95% CAGR as boards delegate 24/7 monitoring to managed-security specialists that provide calibrated models, curated global threat feeds, and post-incident forensics. Talent shortages in data science and cyber-ops elevate the appeal of outcome-based contracts that guarantee detection-rate SLAs. In parallel, consulting wraps around solution deployments to re-engineer KYC flows, optimize alert triage, and streamline dispute resolution. This convergence of technology and expertise is expected to lift services to almost one-third of 2031 revenue, reinforcing their strategic position within the broader fraud detection and prevention market.

On-premises installations retained 55.35% of 2025 revenue as tier-one banks leveraged sunk infrastructure and met data-residency statutes by processing PII in their own data centers. These firms favor hybrid patterns that shift model training to the cloud yet keep production scoring nodes in private clusters to minimize latency. Under such architectures, anti-fraud latency remains below 10 milliseconds even at holiday peak volumes.

Cloud-native platforms, however, outpace all others at a 22.05% CAGR and will narrow the share gap rapidly. Subscription pricing aligns license fees with transaction growth, letting mid-tier lenders and fintechs avoid capital outlays. Leading vendors now pre-package continuous deployment toolchains that refresh detection models multiple times per week, shortening exposure windows to novel frauds. Advanced encryption and confidential-compute zones address lingering sovereignty worries, while certifications like ISO 27001 and SOC 2 reassure auditors. These advantages collectively establish cloud as the future default for the fraud detection and prevention market.

Fraud Detection and Prevention Market is Segmented by Component (Solutions, Services), Deployment Mode (Cloud, On-Premises), Organization Size (SMEs, Large Enterprises), End-User Industry (BFSI, Retail and E-Commerce, Healthcare, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest regional slice at 27.10% of 2025 revenue, supported by early cloud adoption, sophisticated threat intelligence sharing, and sizeable technology budgets. Federal agencies such as the US Treasury recovered USD 1 billion in check fraud during fiscal 2024 after deploying AI-driven anomaly detection, signaling public-sector validation that further stimulates private-sector uptake. US card networks likewise advocate AI-based pre-authorization scoring to curb CNP chargebacks, embedding fraud logic directly in payment rails. Canadian banks collaborate in a joint consortium to combat emerging real-time rail fraud, demonstrating regional co-operation on signals exchange.

Europe follows with rapid regulatory expansion as PSD3 and PSR introduce mandatory payee-name matching and real-time risk feeds. GDPR constraints drive innovation in privacy-preserving federated learning, allowing banks to train cross-bank models without raw-data transfers. Telecom operators must filter spoofed calls and malware SMS under new eIDAS updates, broadening the fraud detection and prevention market into telco infrastructure. Nations such as Spain impose EUR 2 million (USD 2.35 million) fines on carriers that fail to implement these measures, embedding security requirements deep in operational licences.

Asia-Pacific records the fastest 19.95% CAGR, led by high mobile payment penetration and fragmented compliance terrain that forces vendors to offer configurable policy engines. The Philippines' Anti-Financial Account Scamming Act compels fraud systems scaled to institution size, while India's RBI mandates AI-powered transaction monitoring for UPI instant payments. Mainland China pilots AI corruption analytics on welfare distributions, proving applicability beyond fintech into public-fund oversight. Together, these dynamics amplify regional demand for flexible, real-time solutions, elevating APAC's weighting in the global fraud detection and prevention market.

- SAP SE

- IBM Corporation

- SAS Institute Inc.

- ACI Worldwide Inc.

- Fiserv Inc.

- Experian PLC

- DXC Technology Company

- BAE Systems PLC

- RSA Security LLC (Dell Technologies)

- Oracle Corporation

- NICE Ltd

- Equifax Inc.

- LexisNexis Risk Solutions

- Fair Isaac Corporation (FICO)

- Cybersource Corporation (Visa)

- Global Payments Inc.

- Feedzai SA

- Signifyd Inc.

- Riskified Ltd.

- Kount Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising digital payments and e-commerce volumes

- 4.2.2 Stringent regulatory compliance pressures

- 4.2.3 AI/ML-enabled analytics improving detection accuracy

- 4.2.4 Tokenization and 3-D Secure 2.3 boosting adoption

- 4.2.5 Open Banking/instant-payment rails - new fraud vectors

- 4.2.6 Generative-AI deepfake fraud escalation

- 4.3 Market Restraints

- 4.3.1 High false-positive rates hurting CX

- 4.3.2 Integration complexity with legacy systems

- 4.3.3 Lack of labelled data sets for AI model training

- 4.3.4 Data-sharing limits under privacy regulations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Fraud Analytics

- 5.1.1.2 Authentication

- 5.1.1.3 Reporting

- 5.1.1.4 Visualization

- 5.1.1.5 Others

- 5.1.2 Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premises

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Retail and E-commerce

- 5.4.3 IT and Telecom

- 5.4.4 Healthcare

- 5.4.5 Energy and Utilities

- 5.4.6 Manufacturing

- 5.4.7 Government and Public Sector

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAP SE

- 6.4.2 IBM Corporation

- 6.4.3 SAS Institute Inc.

- 6.4.4 ACI Worldwide Inc.

- 6.4.5 Fiserv Inc.

- 6.4.6 Experian PLC

- 6.4.7 DXC Technology Company

- 6.4.8 BAE Systems PLC

- 6.4.9 RSA Security LLC (Dell Technologies)

- 6.4.10 Oracle Corporation

- 6.4.11 NICE Ltd

- 6.4.12 Equifax Inc.

- 6.4.13 LexisNexis Risk Solutions

- 6.4.14 Fair Isaac Corporation (FICO)

- 6.4.15 Cybersource Corporation (Visa)

- 6.4.16 Global Payments Inc.

- 6.4.17 Feedzai SA

- 6.4.18 Signifyd Inc.

- 6.4.19 Riskified Ltd.

- 6.4.20 Kount Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment