|

시장보고서

상품코드

1687449

커넥티드 의료기기 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Connected Medical Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

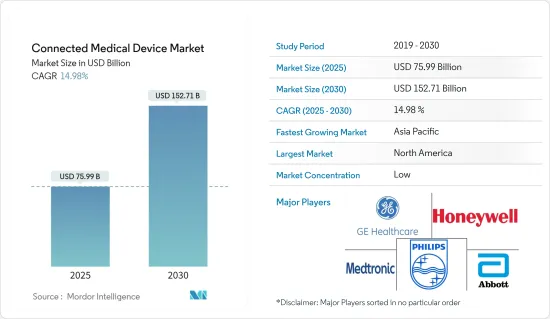

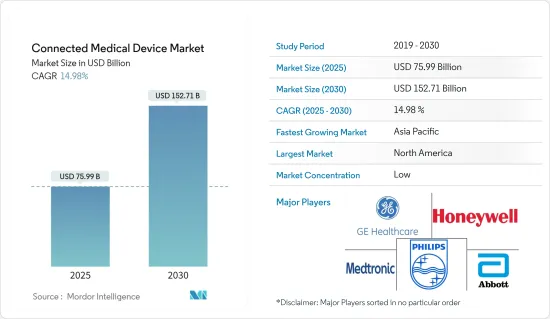

세계의 커넥티드 의료기기 시장 규모는 2025년 759억 9,000만 달러로 추정되며, 예측기간 중(2025-2030년) CAGR 14.98%로, 2030년에는 1,527억 1,000만 달러에 달할 것으로 예측됩니다.

의료 시설 및 의료 연구 분야에서는 사물 인터넷(IoT)과 컴퓨팅 능력, 무선 기술, 빅 데이터와 같은 데이터 분석 기술의 진보가 이용되고 있습니다. 의료 시설 및 의료 연구 분야에서는 IoT와 컴퓨팅 능력, 무선 기술, 빅 데이터와 같은 데이터 분석 기술의 진보를 이용하여 유전체학, 단백질체학, 약리 유전체학를 포함한 대량의 복잡한 이종 의료 데이터의 분석을 실시했습니다.

주요 하이라이트

- 커넥티드 의료기기 시장은 IoT 기술에 의존하기 때문에 지난 10년간 지속적으로 성장해온 새로운 의료 산업 중 하나입니다. 커넥티드 의료기기의 세계에서는 제조·보수로부터 사용까지, 기기의 라이프 사이클 전체를 통해 기술 통합의 기회가 존재합니다. 20년 이상 동안 소비자를 위한 건강 관리는 업계를 파괴해 온 혁신의 물결에 단호하게 저항해 왔습니다. 인공지능(AI) 및 머신러닝(ML)과 같은 기술은 커넥티드 헬스케어의 잠재력을 더욱 넓히는 데 필수적입니다.

- 메디케어 메디케이드 서비스 센터에 따르면 지난해 국민건강지출은 9.7% 증가한 4조 1,000억 달러, 2020년에는 1인당 1만 2,530달러에 이릅니다. 미국 국내총생산(GDP)의 19.7%를 차지합니다. 국민의료비 총액은 2019년부터 2028년까지 연평균 5.4%로 확대되어 2028년에는 6조 2,000억 달러에 달할 것으로 추정되고 있습니다. 건강 관리에 대한 이러한 상당한 지출은 연결 장치의 요구 사항이 전반적으로 점진적으로 증가 할 수 있음을 의미합니다.

- 또한 미국 질병예방센터의 보고에 따르면 출생시 평균 수명은 꾸준히 성장하고 있으며 2017년 73.3년부터 올해까지 74.4년을 목표로 하고 있습니다. 증가의 대부분은 유아 사망률의 감소 때문입니다. 그러나 이 조사에 따르면 미국의 평균 수명은 78.6세와 3년 연속 감소했습니다. 사람들은 주로 건강한 라이프 스타일을 목표로, 건강을 유지하고, 식생활에 신경 쓰고 있습니다. 이러한 사람들의 행동 변화는 연결 의료기기에 대한 수요를 크게 증가시킬 것으로 보입니다.

- 다양한 의료기기의 연결성과 상호 운용성 솔루션의 총 비용은 엄청나게 높습니다. 의료기기에 대한 인터넷 액세스는 보안 설정으로 여러 네트워크를 구축하기가 어려우므로 소규모 의료 조직에서는 배포가 어렵습니다. 무선 연결 옵션은 거의 없으며 데이터 유출을 방지하기 위해 많은 보안 계층을 추가해야 합니다. 이 문제는 건강 관리 제공업체의 총 소유 비용을 더욱 증가시킵니다.

- COVID-19 팬데믹은 환자와 의료 종사자를 서로 안전하게 유지하면서 환자의 원격 모니터링을 수행하는 의료 연결 장치의 사용을 크게 증가 시켰습니다. 이 유행학에서 의료 종사자와 의료 시스템은 통신과 원격 환자 모니터링 프로그램을 통해 환자 집에서 필요한 치료를 제공하기 위해 기술에 크게 의존하고 있습니다. 마찬가지로 정부의 보건당국은 스마트폰을 이용한 접촉자 추적, 적극적인 건강상태 모니터링 및 원격컨설팅을 이용하여 바이러스의 확산을 억제하기 위해 기술을 활용하고 있습니다. COVID-19의 대유행으로 사람들의 관심은 집에서의 셀프케어 시설로 옮겨가고 있습니다.

커넥티드 의료기기 시장 동향

웨어러블 디바이스가 큰 점유율을 차지할 전망

- 헬스케어에서 웨어러블 디바이스는 다양한 생리학적 파라미터를 모니터링하는 실용적인 방법을 제공합니다. 의료 솔루션은 고객에게 이익만을 가져다주는 것이 아닙니다. 의사가 멀리 떨어진 곳에서 환자를 진단하기 위한 최신 정보도 제공합니다. 헬스케어 업계에서는 Apple Watch의 심전도 기능에서 포도당 모니터링 시스템에 이르기까지 웨어러블 의료기기의 폭넓은 용도가 있습니다.

- 또한 올해 Apple은 인도에서 애플 워치 시리즈 8을 발표했으며 심전도 앱과 여성 건강에 관한 몇 가지 기능을 제공했습니다. 이 시계는 두 센서로 온도 감지 기술을 활용하여 배란 예측을 제공했습니다. 또한 새로운 충돌 감지 기능은 충돌이 감지될 때 긴급 연락처 및 이웃 시설을 검색하는 데 도움이 됩니다. 이러한 장치는 기존 및 향후 개발될 의료용 웨어러블 및 일상 생활용 웨어러블에 혁신적이고 사려깊은 기능을 추가하기 위한 생태계를 개발합니다.

- 실용적인 것 외에도 웨어러블 기술은 경제적입니다. 웨어러블 기술이 생성하는 데이터에 의해 의사가 떨어진 곳에서 판단할 수 있게 되어 환자가 정기 검진을 위해 병원을 방문하는 횟수가 줄어들 가능성이 있기 때문입니다. 또한 건강 관련 웨어러블은 피트니스 밴드에 머물지 않습니다. 광대하고 확장되는 건강 관리 웨어러블 시장에는 스마트 워치, 스마트 글라스, 스마트 양말, 스마트 웨어, 자세 모니터, 통증 관리 장치, 작동 센서, 목록 장치, 하트 스트랩, 헤드 밴드, 웨어러블 패치, 약물 전달 포드 등 다양한 제품이 포함됩니다.

- 모바일 기술의 진보로 질병 진단과 환자의 치료 모니터링은 혁명을 일으키려고합니다. 웨어러블은 중요한 지표를 지속적으로 모니터링하는 개인 가젯이므로 특정 질병의 패턴을 파악하고 질병에 대한 이해를 높이고 사용자의 건강을 지속적으로 모니터링하는 임상 도구로 사용할 수 있습니다. 예를 들어, 핏 비트와 스마트 워치는 웨어러블 피트니스 기술이 사회에 침투하여 운동에 특화된 모드와 커스터마이즈 가능한 기능을 도입함으로써 인기를 얻고 있습니다. 예측 기간 동안 웨어러블 기술은 계속 확대될 것으로 보입니다.

- Cisco Systems에 따르면 세계에 연결된 웨어러블 디바이스의 수는 2016년 3억 2,500만대에서 2019년에는 7억 2,200만대로 증가했으며 3년 만에 두배로 증가했습니다. 올해에는 전 세계에서 10억대 이상의 가젯이 등장할 가능성이 높습니다.

북미가 가장 높은 시장 점유율을 차지

- 전통 의료기기 제조업체의 존재, 첨단 의료 인프라, 사업 확장, 엄청난 건강 관리 지출은 미국 연결 의료기기 업계를 특징으로합니다. 예를 들어 RAYUS Radiology는 지난해 12월 Auburn에 외래 기반의 고도화상진단센터를 신설하여 메인주 주변의 영상클리닉 사업을 확대하였습니다. 고자장 MRI, CT, 엑스레이는 오번 센터가 제공하는 영상 진단 서비스의 일부입니다.

- 게다가 FDA는 지난해 Epitel의 최초 장비인 무선 웨어러블 EEG(뇌파 모니터) 센서를 병원 응급실 및 중증 치료실에서의 사용을 허가했습니다. Epitel이 FDA에 인가한 최초의 제품에는 간호사나 병원 기사가 쉽고 빠르게 장착할 수 있는 웨어러블 무선 센서가 포함되어 있었습니다. 신경과 의사는 뇌파 데이터를 클라우드 기반 소프트웨어 플랫폼에 연결하여 언제 어디서나 액세스할 수 있도록 하여 발작을 평가하고 모니터링할 수 있습니다. 또한 이 회사는 올해 2월 웨어러블 발작 감지 시스템 시리즈 A 자금 조달 라운드에서 1,250만 달러를 조달했습니다.

- 다른 스마트 웨어러블 제조업체들은 커넥티드 앱 기능을 통해 데이터 수집을 용이하게 하는 혁신적인 솔루션을 도입하여 국내 의료용 웨어러블 분야를 개척하고 있습니다. Garmin은 올해 9월 스마트 혈압계 'Index BPM'을 150달러로 출시해 사용자가 어디서나 이완기 혈압과 수축기 혈압을 측정할 수 있도록 했습니다. FDA(미국 식품의약국)의 인가를 받은 이 상완식 BPM은 최대 16명의 사용자의 개인 기록을 유지하고 데이터를 개인의 Garmin Connect 앱에 동기화할 수 있습니다.

- 의료기기는 다른 컴퓨터 시스템과 마찬가지로 보안 결함의 영향을 받기 쉽고 장비의 효율성과 안전성을 위험에 빠뜨릴 수 있습니다. 환자와 개인의 이익이 위험을 초과한다는 합리적인 보증이 있다면 FDA는 장비 판매를 허용합니다.

- 컴퓨터 통합 시스템을 설계한 기업인 요약에 따르면 미국 병원에서는 침대 1대당 평균 접속 의료기기 수는 10-15대입니다. 커넥티드 디바이스 시장 출시를 목표로 하는 기업에 있어서, 무선 디바이스의 인증 절차는 매우 중요합니다. 모든 무선 장비는 북미 FDA가 실시하는 시험과는 별도로 이 시험을 받아야 합니다. 따라서 미국에서 연결된 의료기기의 총 수가 증가하면 예측기간 동안 시장에 큰 성장 기회를 가져올 것으로 보입니다.

커넥티드 의료기기 산업 개요

커넥티드 의료기기 시장은 세분화된 첨단 경쟁 환경에서 주로 국내외 여러 기업로 구성되어 있습니다. 시장의 기술 강화는 기업에 광범위한 지속 가능한 경쟁 우위를 제공합니다. 또한 서비스 제공업체의 여러 제휴, 합병 및 기타 전략적 움직임을 볼 수 있습니다.

2022년 10월 Royal Philips는 증강현실(AR) 수술 네비게이션 솔루션 'ClarifEye'의 일본 도입 확대를 발표했습니다. 이는 IUHW(국제의료복지대학) 미타병원(도쿄도 미타시)에서 혁신적인 3D AR 솔루션을 활용하여 치료를 받은 초기 환자에서 얻은 좋은 결과를 바탕으로 합니다. ClarifEye는 이 병원의 정형외과 의사인 이시이 건의사를 지원하여 저침습의 영상 유도 수술에 의해 척추측만증(척추 옆으로의 만곡)이나 척주관협착증(척추 틈의 협착) 환자의 치료에 성공했습니다.

2022년 6월 - GE Healthcare는 환자의 생체 감시를 위해 널리 퍼져 있는 수작업으로 인한 "탈취 검사"를 생략하고 환자 입원 기간 동안 지속적인 감시를 가능하게 하는 무선 환자 감시 시스템 "인물 모바일 3"을 발표했습니다. 이 시스템은 임상의가 환자의 악화를 감지하는 데 도움이 됩니다. 환자의 악화를 조기에 발견하면 집중 치료실(ICU)로의 입실 및 입원 기간을 줄이고 환자의 결과를 개선할 수 있습니다. 이 솔루션에는 모바일 모니터와 통신하는 환자 장착형 무선 센서가 포함되었습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자/소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- COVID-19의 업계에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 헬스케어 분야에서의 데이터 분석의 채용 증가

- 센싱 디바이스의 총 비용 절감

- 시장의 과제

- 레거시 인프라가 디지털 성장의 과제

제6장 접속 기술

- Wi-Fi

- 블루투스 저에너지(BLE)

- 근거리 무선 통신(NFC)

- Zigbee

- 셀룰러

제7장 시장 세분화

- 용도

- 소비자(환자) 모니터링

- 웨어러블 디바이스

- 내장형 디바이스

- 거치형 디바이스

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 북미

제8장 경쟁 구도

- 기업 프로파일

- Medtronic Inc.

- Koninklijke Philips NV

- Boston Scientific Corporation

- Abbott Laboratories

- Garmin Ltd

- Biotronik Se & Co. Kg

- Honeywell International Inc.

- Stanley Healthcare

- NXP Semiconductors NV

- GE Healthcare

제9장 투자 분석

제10장 시장 기회와 앞으로의 동향

JHS 25.04.01The Connected Medical Device Market size is estimated at USD 75.99 billion in 2025, and is expected to reach USD 152.71 billion by 2030, at a CAGR of 14.98% during the forecast period (2025-2030).

The medical facilities and the medical research sector use the Internet of Things (IoT) and advancements in computing power, wireless technology, and data analytics techniques, like Big Data. They use it to analyze a large amount of complex heterogeneous medical data involving genomics, proteomics, and pharmacogenomics, which have significantly transformed the healthcare industry over the last few years.

Key Highlights

- The market for connected medical devices is one of those new medical industries that has consistently grown over the last decade, given its dependency on IoT technologies. In the world of connected medical devices, opportunities for technological integration exist throughout the device's lifecycle, from manufacturing and maintenance to use. For over two decades, consumer-facing healthcare has steadfastly resisted the wave of innovations that have been disrupting industries. It signifies that the industry is ripe for disruption, and technologies like Artificial Intelligence (AI) and Machine Learning (ML) will be vital to unlocking greater connected healthcare possibilities.

- As per the Center for Medicare and Medicaid Services, last year, the National Healthcare Expenditure grew 9.7% to USD 4.1 trillion in 2020 or USD 12,530 per person. It accounted for 19.7% of the Gross Domestic Product (GDP) in the United States. The total National health expenditure is estimated to expand at an average annual rate of 5.4% for 2019-28 and will reach a landmark of USD 6.2 trillion by 2028. Such drastic expenditure on healthcare signifies a possible gradual overall increment in the requirement for connected devices.

- Also, according to the US Center for Disease and Prevention report, the overall life expectancy at birth is steadily rising, with the aim of 74.4 years by the current year, up from 73.3 years in 2017. Most of the increase is because of the lower infant mortality. However, according to the same survey, life expectancy in the U. S. has dropped for the third year consecutively to 78.6 years. People mainly strive toward a healthy lifestyle to keep fit and monitor their eating habits. Such changes in people's behavior would significantly increase the demand for connected medical devices.

- The total cost of connectivity and interoperability solutions for various medical equipment is incredibly high. Internet access to medical equipment is difficult to adopt in smaller healthcare organizations because creating multiple networks with secure configurations is challenging. There are few wireless connectivity alternatives, and they must add numerous security layers to prevent data breaches. This challenge raises the overall cost of ownership for healthcare providers even more.

- The COVID-19 pandemic has highly increased the use of healthcare-connected devices for remote patient monitoring while keeping patients and medical personnel safe from one another. In this pandemic, healthcare personnel and systems have highly relied on technology to deliver the required care to patients at their homes through telecommunication and remote patient monitoring programs. Similarly, government health officials have utilized technology to restrict the spread of the virus, using smartphone-based contact tracking and proactive wellness monitoring or tele-consultancies. People's emphasis has shifted to self-care facilities in their homes due to the COVID-19 pandemic.

Connected Medical Devices Market Trends

Wearable Device is Expected to Hold a Major Share

- In healthcare, wearable devices offer practical ways to monitor various physiological parameters. Medical solutions do not just benefit customers. They also give doctors up-to-date information to examine patients from a distance. The healthcare industry has a wide range of uses for wearable medical devices, starting from the Apple Watch's EKG capabilities to its glucose monitoring systems.

- Also this year, Apple Inc introduced Apple Watch Series 8 in India, offering the ECG app and several features related to women's health. The watch provided ovulation estimates leveraging a two-sensor temperature sensing technology. The new crash detection was also helpful in forming emergency contacts or nearby facilities in case a crash was detected, which could be highly crucial during fatal encounters. Such devices develop the ecosystem for innovative and thoughtful additions to existing and upcoming medical and everyday wearables.

- In addition to being practical, wearable technology is also economical since the data it produces may allow doctors to make choices from a distance, reducing the number of hospital visits by patients for routine checkups. Moreover, health-related wearables go beyond fitness bands. The vast and expanding healthcare wearable market includes various products, including smartwatches, smart glasses, smart footwear, smart clothes, posture monitors, pain management devices, movement sensors, wrist devices, heart straps, headbands, wearable patches, and medicine delivery pods.

- Disease diagnostics and patient treatment monitoring are about to revolutionize due to mobile technology advancements. You can use wearables as a clinical tool to identify the patterns of a particular disease, provide a better understanding of the disease, and continuously monitor users' health since they are personal gadgets that continuously monitor critical indicators. For instance, FitBit and smartwatches are popular due to how wearable fitness technology has risen into society, introducing exercise-specific modes and customizable features. Over the forecasted period, wearable technology will continue to expand.

- Per Cisco Systems, globally, the number of connected wearable devices has increased from 325 million in 2016 to 722 million in 2019, doubling in only three years. More than one billion gadgets will likely be worldwide by the current year.

North America Holds the Highest Market Share

- The presence of well-established medical device manufacturers, an advanced healthcare infrastructure, expansions, and considerable healthcare spending characterize the US-connected medical device industry. For instance, in December last year, RAYUS Radiology opened a new outpatient-based advanced diagnostic imaging center in Auburn, expanding its operations of imaging clinics around Maine. High-field MRI, CT, and X-ray are just a few diagnostic imaging services the center in Auburn provides.

- Additionally, the FDA authorized the use of Epitel's initial device, a wireless and wearable EEG (brain wave monitor) sensor, in hospital emergency rooms and critical care units last year. Epitel's first FDA-approved product included wearable, wireless sensors, which a nurse or hospital technician could easily and quickly apply. Neurologists could also evaluate and keep an eye out for seizures by connecting the EEG data to a cloud-based software platform they could access from anywhere at any time. Also, in February this year, the company raised USD 12.5 million in a Series A funding round for its wearable seizure detection system.

- Other smart wearable manufacturers are exploring the medical wearables space in the country by introducing innovative solutions which ease data collection through connected app features. In September year, Garmin launched a smart blood pressure monitor, 'Index BPM,' for USD 150, allowing users to measure diastolic and systolic blood pressure anywhere. The FDA-approved upper arm BPM could keep the individual records of up to 16 users and sync the data to their own Garmin Connect app.

- Medical devices, like other computer systems, are susceptible to security flaws, which could jeopardize the device's effectiveness and safety. When there is a reasonable assurance that the benefits to patients and individuals outweigh the dangers, the FDA permits the marketing of devices.

- According to Synopsys, a company that designed computer-integrated systems, the average number of connected medical devices per bed in US hospitals is 10-15. The certification procedure for wireless devices is crucial for businesses looking to bring connected devices to the market. All wireless devices must undergo this testing, separate from that conducted by the FDA in North America. Hence the rise in the total count of connected medical devices in the US would bring immense growth opportunities to the market throughout the forecasted period.

Connected Medical Devices Industry Overview

The Connected Medical Device Market mainly comprises multiple domestic and international players in a fragmented and highly competitive environment. Technological enhancements in the market also bring companies a wide range of sustainable competitive advantages. The market is also witnessing multiple partnerships, mergers, and other strategic moves by the service providers.

October 2022 - Royal Philips announced the expanded introduction of its augmented reality (AR) surgical navigation solution, ClarifEye, in Japan. It is based on the positive results in the initial patients treated at the IUHW (International University of Health and Welfare), Mita Hospital (in Tokyo, Japan) leveraging the innovative 3D AR solution. ClarifEye assisted the hospital's orthopedic surgeon, Dr. Ken Ishii, in successfully treating patients with scoliosis (sideways curvature of the spine) and spinal stenosis (narrowing of the spaces in the spine) through minimally-invasive image-guided procedures.

June 2022 - GE Healthcare unveiled Portrait Mobile3, a wireless patient monitoring system that enabled continuous monitoring throughout a patient's stay, omitting broadly popular manual 'spot-checks' to monitor patient vitals. The system helped clinicians detect patient deterioration. The early detection of patient deterioration might help reduce Intensive Care Unit (ICU) admissions and length of stay, improving patient outcomes. The solution included patient-worn wireless sensors which communicated with a mobile monitor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Adoption of Data Analytics in the Healthcare Sector

- 5.1.2 Reduction of the Total Cost of Sensing Devices

- 5.2 Market Challenges

- 5.2.1 Legacy Infrastructure Challenging the Digital Growth

6 CONNECTIVITY TECHNOLOGIES

- 6.1 Wi-Fi

- 6.2 Bluetooth Low Energy (BLE)

- 6.3 Near-field Communication (NFC)

- 6.4 Zigbee

- 6.5 Cellular

7 MARKET SEGMENTATION

- 7.1 Application

- 7.1.1 Consumer (Patient) Monitoring

- 7.1.2 Wearable Device

- 7.1.3 Internally Embedded Device

- 7.1.4 Stationary Device

- 7.2 Geography

- 7.2.1 North America

- 7.2.1.1 United States

- 7.2.1.2 Canada

- 7.2.2 Europe

- 7.2.2.1 Germany

- 7.2.2.2 United Kingdom

- 7.2.2.3 France

- 7.2.2.4 Rest of Europe

- 7.2.3 Asia-Pacific

- 7.2.3.1 China

- 7.2.3.2 Japan

- 7.2.3.3 South Korea

- 7.2.3.4 Rest of Asia-Pacific

- 7.2.4 Latin America

- 7.2.5 Middle East and Africa

- 7.2.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Medtronic Inc.

- 8.1.2 Koninklijke Philips NV

- 8.1.3 Boston Scientific Corporation

- 8.1.4 Abbott Laboratories

- 8.1.5 Garmin Ltd

- 8.1.6 Biotronik Se & Co. Kg

- 8.1.7 Honeywell International Inc.

- 8.1.8 Stanley Healthcare

- 8.1.9 NXP Semiconductors NV

- 8.1.10 GE Healthcare