|

시장보고서

상품코드

1687463

전기자동차용 파워 인버터 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Electric Vehicle Power Inverter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

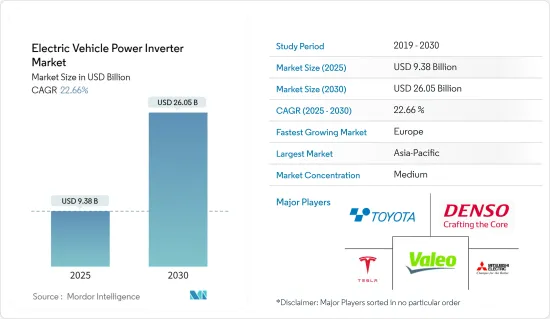

세계의 전기자동차용 파워 인버터 시장 규모는 2025년 93억 8,000만 달러로 추정되며, 예측기간 중(2025-2030년) CAGR 22.66%로, 2030년에는 260억 5,000만 달러에 달할 것으로 예측됩니다.

각국 정부는 전동 이동성 프로젝트에 많은 예산을 투자하고 있습니다. 정부는 전기자동차용 파워 인버터 제조업체에 기회를 제공하려고 합니다. 정부는 또한 자동차 제조업체와 고객에게 전기자동차의 생산과 채택을 장려합니다. 전기자동차 수요 증가는 파워 인버터 등 전기자동차에 사용되는 부품의 매출을 증가시킬 것으로 예상됩니다.

세계적으로 배기가스 규제가 엄격해짐에 따라 자동차 제조업체는 기존 엔진 차량에서 하이브리드 자동차 및 전기자동차로 점차 생산을 이동하고 있습니다. 또한 각국 정부는 전기차 판매 성장을 지원하기 위해 전기자동차 구매자에 대한 자동차세 감세, 보너스 지급, 보험료 지불 등의 인센티브를 시작했습니다. 특히 유럽, 북미, 아시아태평양, 특히 일본과 중국에서 충전소 시설 증가가 전기자동차 판매의 성장을 더욱 뒷받침했습니다.

일부 제조업체들은 2025년 이후의 전망을 세워 전기차와 관련된 발표를 넘어서는 장애물을 끌어올렸습니다. 주요 OEM 중 10개 이상이 2030년 이후 전동화 목표를 선언했습니다. 중요한 것은 일부 OEM이 전기자동차만을 생산하기 위해 제품 라인 재구성을 계획하고 있다는 것입니다. 예를 들어, General Motors는 1분기에 전기차와 자율주행차에 대한 지출을 2025년까지 200억 달러로 끌어올릴 계획을 발표했습니다. 이 회사는 2023년 말까지 20개의 신형 전기자동차를 출시해 예측기간 동안 미국과 중국에서 연간 100만대 이상의 전기자동차를 판매하는 것을 목표로 했습니다.

전기자동차용 파워 인버터 시장 동향

전기차 판매 확대

전기자동차는 자동차산업에 필수적인 존재로 오염물질 및 기타 온실가스의 배출감소와 함께 에너지효율 달성을 위한 길을 제시하고 있습니다. 환경 문제에 대한 관심과 정부의 적극적인 노력이 시장 성장을 가속하는 주요 요인이되었습니다.

2023년 배터리 전기자동차(BEV)와 플러그인 하이브리드차(PHEV)의 세계 판매 대수는 35% 급증해 1,400만대에 달했습니다. 그 중 1,000만대가 순수한 전기차인 BEV로, 400만대가 PHEV였습니다. 소형 승용차용 전기자동차(EV)의 보급을 가속화해 기존의 내연기관을 탑재한 자동차를 단계적으로 폐지해 나가려는 움직임은 세계에서 활발해지고 있습니다. 평균 연료 가격 상승은 유럽의 전기자동차 신규 등록 대수가 다른 지역보다 높은 비율을 차지하고 있음을 반영합니다. 그러므로 연료 가격 상승으로 인한 전기자동차의 대량 도입은 전 세계적으로 사업을 확대할 것으로 예상됩니다.

충전 인프라 정비에 대한 정부 투자가 세계적으로 증가하고 있다는 것은 전기자동차 판매를 촉진하는 것으로 보입니다. 예를 들어,

- 영국 정부는 전기자동차 수요 증가에 맞추어 공공 전기자동차 충전소의 수를 100배 이상으로 확대해 2030년까지 30만 곳에 이르는 것을 목표로 하고 있습니다.

- BP는 2023년 2월 미국 전역 전기차(EV) 충전 포인트에 2030년까지 10억 달러를 투입할 의향을 밝혔습니다. 이것은 BP가 종합 에너지 기업으로 진화함에 있어서 큰 전진이 되었습니다.

게다가 배터리와 관련된 높은 비용으로 인해 자동차 성능 향상과 함께 인버터 및 기타 파워 일렉트로닉스의 개선이 필요했습니다.

예를 들어, 고객의 선호가 전기자동차로 이동하는 것은 미래의 탈탄소화의 명백한 징후이며 동시에 충전소에 결정적입니다. 그러나 전기자동차의 보급은 소비자 행동, 인프라, 특정 지역 클러스터와 같은 다양한 속성에 달려 있습니다. 전기차 판매량 증가는 비례하여 충전소 수요에 박차를 가할 것으로 예상됩니다. 시장의 유력 기업은 소비자 심리를 정확하게 파악하고 있으며, 전국에서 급속 충전 기술을 제공함으로써 소비자 심리에 부응하는 데 주력하고 있습니다.

이 변화는 IC 엔진 차량의 판매 부진으로 이어지지 않은 것, 현재와 미래에 전기자동차의 유망한 시장을 만들었습니다. 이러한 추세에 따라 일부 자동차 제조업체는 전기자동차 및 파워 인버터와 같은 관련 부품의 연구 개발 비용을 증가 시켰습니다. 한편 시장 점유율을 얻기 위해 신제품 투입에 힘을 쏟기 시작한 자동차 제조업체도 있어 궁극적으로 시장 수요를 밀어 올렸습니다.

아시아태평양이 전기자동차용 파워 인버터 시장을 견인

아시아태평양의 전기자동차 시장은 환경 의식, 정부 이니셔티브, 전기자동차(EV) 기술의 진보와 함께 최근 몇 년간 상당한 성장을 이루고 있습니다. 대기질에 대한 관심이 높아지고, 온실가스 배출감축에 대한 헌신이 높아지고 있는 가운데, 이 지역의 국가들은 전기차의 채용을 촉진하기 위한 지원 정책과 인센티브를 실시했습니다.

- 2023년 4월에는 인도네시아의 ION Mobility사와 베트남의 VinFast사 등 동남아시아의 신흥기업 몇사가 다액의 자금을 조달해, 전기차의 신모델을 발매했습니다.

아시아태평양의 주요 기업인 중국은 전기자동차의 최대 시장으로 부상했습니다. 두꺼운 보조금, 인센티브, 종합적인 충전 인프라 정비 등 중국 정부의 강력한 지원이 일본에서 전기자동차의 급성장을 추진하고 있습니다. 또한 전기 이동성의 세계 리더를 목표로 한 중국의 움직임은 전기자동차 제조의 기술 혁신과 투자에 박차를 가하고 있습니다.

- 2023년 7월에는 중국의 EV 대기업 BYD가 2023년 상반기 전기차 판매 대수로 Tesla를 제치고 세계 선두가 되어, 세계의 EV 시장에서 중국이 힘을 쏟고 있는 것이 부각되었습니다.

일본과 한국 등의 국가도 아시아태평양의 전기자동차 시장에서 매우 중요한 역할을 하고 있습니다. 유명 자동차 제조업체의 본거지인 일본은 기술의 진보와 지속가능한 운송에 대한 강한 헌신으로 전기차 도입이 꾸준히 증가하고 있습니다. 한국에서는 정부의 장려책과 연구개발에 대한 투자가 전기자동차 시장의 성장에 기여하고 있으며, 배터리 기술의 강화와 충전 인프라의 확대에 중점을 두고 있습니다.

- 일본 정부는 2023년 3월에 전기자동차 보조금 제도를 개정해, 대상이 되는 전기자동차에 대한 보조금을 연장·증액해 전기자동차의 보급을 더욱 촉진했습니다.

- 2023년 2월 LG Energy Solution과 Honda는 미국에 배터리셀 생산공장을 설립하는 합작사업을 발표하고 북미에서 높아지는 EV 수요에 대응함과 동시에 아시아태평양시장에도 공급할 가능성이 있습니다.

전동화의 야심찬 계획을 가진 인도는 아시아태평양 전기자동차 사정에서 점차 중요한 국가가 되고 있습니다. FAME(Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) 계획 등 인도 정부의 이니셔티브는 전기차 도입에 인센티브를 주고 충전 인프라 개발을 지원하기 위한 것입니다. 이는 소비자의 의식이 높아짐에 따라 전기자동차용 전원 인버터 시장에 바람직한 환경을 조성하고 있습니다.

2023년 5월 인도의 EV 시장은 판매 급증에 휩싸여 단년도 전기차 판매 대수로 최다를 기록했습니다.

전기자동차용 파워 인버터 산업 개요

전기자동차용 파워 인버터 시장은 Continental AG, Robert Bosch GmbH, DENSO Corporation, Mitsubishi Electric Corporation 등 여러 회사가 독점하고 있습니다. 각 회사는 경쟁사보다 우위를 차지하도록 새로운 생산 공장의 개설과 합작 사업에 의해 사업을 확대하고 있습니다. 예를 들면

- 2024년 6월 NXP Semiconductors NV와 ZF Friedrichshafen AG는 NXP의 GD316x HV 절연 게이트 드라이버를 활용한 첨단 SiC 기반 전기자동차용 트랙션 인버터 솔루션으로 협업했습니다. 이러한 솔루션은 800V 및 SiC 파워 디바이스의 채택을 촉진하고, EV의 항속 거리를 늘리고, 충전 정지 시간을 줄이고, OEM 비용을 절감하는 것을 목표로 합니다.

- 2024년 1월 BorgWarner는 Shaanxi Fast Auto Drive Group과 제휴하여 중국의 전기상용차용 고전압 인버터 솔루션에 주력했습니다.

- 2023년 11월 Diamond Foundry Inc.가 다이아몬드 웨이퍼 기술을 사용한 전기자동차용 인버터를 개발하여 테슬라 3의 유닛보다 대폭 소형화하여 보다 효율적인 전력을 공급할 수 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 전기자동차 수요 증가가 예상된다

- 시장 성장 억제요인

- 인프라 정비의 과제, 운용면에서의 과제

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자/소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 추진력 유형별

- 하이브리드 전기자동차

- 플러그인 하이브리드 전기자동차

- 배터리 전기자동차

- 연료전지 전기자동차

- 차량 유형별

- 승용차

- 상용차

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 세계 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Vitesco Technologies

- Robert Bosch GmbH

- DENSO Corporation

- Toyota Industries Corporation

- Hitachi Astemo Ltd

- Meidensha Corporation

- Aptiv PLC(Borgwarner Inc.)

- Mitsubishi Electric Corporation

- Marelli Corporation

- Valeo Group

- Lear Corporation

- Infineon Technologies AG

- Eaton Corporation

제7장 시장 기회와 앞으로의 동향

- 양방향 충전 통합

The Electric Vehicle Power Inverter Market size is estimated at USD 9.38 billion in 2025, and is expected to reach USD 26.05 billion by 2030, at a CAGR of 22.66% during the forecast period (2025-2030).

Governments in various countries are spending heavily on electric mobility projects. They are trying to provide opportunities for electric vehicle power inverter manufacturers. The governments are also encouraging automobile manufacturers and customers to produce and adopt electric vehicles. The rise in the demand for electric vehicles is also expected to increase the sales of the components used in electric vehicles, such as power inverters.

With growing stringent emission standards globally, automakers are gradually shifting their production from conventional engine vehicles to hybrid and electric vehicles. In addition, governments initiated incentives, such as a cut down in vehicle tax, bonus payments, and premiums, for buyers of electric vehicles in the respective countries to support electric vehicle sales growth. The increasing charging station facilities in the regions, especially in Europe, North America, and Asia-Pacific, particularly in Japan and China, further supported the growing electric vehicle sales.

Several manufacturers raised the bar to go beyond the announcements related to electric vehicles with an outlook beyond 2025. More than ten of the largest OEMs declared electrification targets for 2030 and beyond. Significantly, some OEMs plan to reconfigure their product lines to produce only electric vehicles. For instance, in the first trimester, General Motors announced its plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company launched 20 new electric models by the end of 2023 and aimed to sell more than 1 million electric cars a year in the United States and China over the forecast period.

EV Power Inverter Market Trends

Growing Sales of Electric Vehicles

Electric vehicles have become an integral part of the automotive industry, and they represent a pathway toward achieving energy efficiency, along with reduced emissions of pollutants and other greenhouse gases. The increasing environmental concerns, coupled with favorable government initiatives, are some of the major factors driving the market's growth.

In 2023, global sales of battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) surged by 35%, reaching 14 million units. Among these, 10 million were pure electric BEVs, while 4 million were PHEVs. The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe holds a higher share of new electric car registrations than other parts of the world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to increase business globally.

Rising government investment in the development of charging infrastructure worldwide is likely to promote the sale of electric vehicles. For instance,

- The UK government aims to expand the quantity of public electric vehicle charging stations by over a hundredfold, reaching 300,000 by 2030, to match the rising demand for electric vehicles.

- In February 2023, BP revealed intentions to inject USD 1 billion by 2030 into electric vehicle (EV) charge points across the United States. It marked a significant stride in the company's evolution toward becoming an integrated energy company.

Moreover, the high cost associated with batteries necessitated the improvement of inverters and other power electronics, along with improving the performance of vehicles.

For instance, shifting customer preference toward electric vehicles is an evident sign of future decarbonization and is simultaneously decisive for charging stations. However, the penetration of EVs is subjected to various attributes, including consumer behavior, infrastructure, and certain regional clusters. The increase in electric vehicle sales is anticipated to proportionally fuel the demand for charging stations. Prominent players in the market have pinpointed consumer sentiment and thus are focusing on catering to it by offering fast-charging technologies across the country.

Though the change did not result in a slump in IC engine vehicle sales, it created a promising market for electric vehicles in the present and future. The above trend propelled some of the automakers to increase their expenditure on R&D in electric vehicles and associated components, like power inverters. While others, on the other hand, started focusing on launching new products to capture the market share, eventually pushing the demand in the market.

Asia-Pacific is leading the Electric Vehicle Power Inverter Market

The Asia-Pacific electric vehicle market has witnessed substantial growth in recent years, driven by a combination of environmental awareness, government initiatives, and advancements in electric vehicle (EV) technology. With a rising concern for air quality and a commitment to reducing greenhouse gas emissions, countries in the region have implemented supportive policies and incentives to promote the adoption of electric vehicles.

- In April 2023, several startups in Southeast Asia, like Indonesia's ION Mobility and Vietnam's VinFast, raised significant funding and launched new electric vehicle models, indicating a growing interest in regional EV production.

China, as a major player in the Asia-Pacific region, has emerged as the largest market for electric vehicles. The Chinese government's robust support, including generous subsidies, incentives, and the establishment of a comprehensive charging infrastructure, has propelled the rapid growth of electric vehicles in the country. Additionally, China's push toward becoming a global leader in electric mobility has spurred innovation and investment in electric vehicle manufacturing.

- In July 2023, Chinese EV giant BYD overtook Tesla as the world's leading electric vehicle seller in the first half of 2023, highlighting the growing strength of Chinese players in the global EV market.

Countries like Japan and South Korea have also played pivotal roles in the Asia-Pacific electric vehicle market. Japan, home to renowned automakers, has seen a steady increase in electric vehicle adoption, driven by technological advancements and a strong commitment to sustainable transportation. In South Korea, government incentives and investments in research and development have contributed to the growth of the electric vehicle market, with a focus on enhancing battery technology and expanding charging infrastructure.

- In March 2023, the Japanese government revised its EV subsidy program, extending it and increasing benefits for eligible electric vehicles to further promote EV adoption.

- In February 2023, LG Energy Solution and Honda announced a joint venture to establish a battery cell production plant in the United States, catering to the growing demand for EVs in North America and potentially supplying the Asia-Pacific market as well.

India, with its ambitious plans for electrification, is gradually becoming a significant player in the Asia-Pacific electric vehicle landscape. The Indian government's initiatives, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, aim to incentivize electric vehicle adoption and support the development of charging infrastructure. This, coupled with increasing consumer awareness, is fostering a positive environment for the electric vehicle power inverter market.

In May 2023, the Indian EV market experienced a surge in sales, registering the highest number of electric vehicles sold in a single year, driven by rising fuel prices and increasing awareness of environmental benefits.

EV Power Inverter Industry Overview

A few players, such as Continental AG, Robert Bosch GmbH, DENSO Corporation, and Mitsubishi Electric Corporation, dominate the electric vehicle power inverter market. Companies are expanding their business by opening new production plants and making joint ventures so that they can gain an edge over their competitors. For instance,

- June 2024: NXP Semiconductors NV and ZF Friedrichshafen AG collaborated on advanced SiC-based traction inverter solutions for EVs, utilizing NXP's GD316x HV isolated gate drivers. These solutions aim to expedite the adoption of 800-V and SiC power devices, enhancing EV range, reducing charging stops, and lowering costs for OEMs.

- January 2024: BorgWarner, in partnership with Shaanxi Fast Auto Drive Group, is focusing on high-voltage inverter solutions for electric commercial vehicles in China.

- November 2023: Diamond Foundry Inc. developed an electric car inverter using diamond wafer technology, which was significantly smaller than Tesla 3's unit and delivered more efficient power.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Demand for Electric Vehicles Is Expected to Increase the Demand

- 4.2 Market Restraints

- 4.2.1 Infrastructure Challenges May Possess Operational Challenges

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Propulsion Type

- 5.1.1 Hybrid Electric Vehicles

- 5.1.2 Plug-in Hybrid Electric Vehicle

- 5.1.3 Battery Electric Vehicle

- 5.1.4 Fuel Cell Electric Vehicle

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Vitesco Technologies

- 6.2.2 Robert Bosch GmbH

- 6.2.3 DENSO Corporation

- 6.2.4 Toyota Industries Corporation

- 6.2.5 Hitachi Astemo Ltd

- 6.2.6 Meidensha Corporation

- 6.2.7 Aptiv PLC (Borgwarner Inc.)

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.9 Marelli Corporation

- 6.2.10 Valeo Group

- 6.2.11 Lear Corporation

- 6.2.12 Infineon Technologies AG

- 6.2.13 Eaton Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Bidirectional Charging