|

시장보고서

상품코드

1851005

접착 테이프 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Adhesive Tapes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

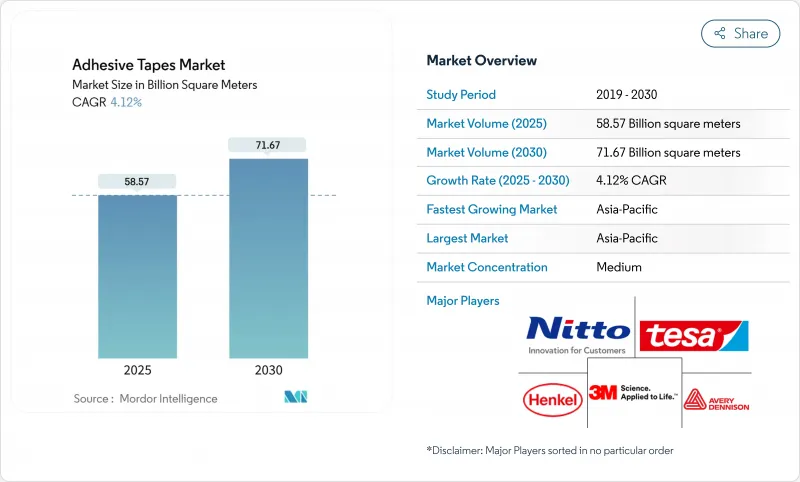

접착 테이프 시장의 규모는 2025년에 585억 7,000만 평방미터로 추계되고, 2030년에는 716억 7,000만 평방미터에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 4.12%로 예상됩니다.

포장, 전자기기, 자동차 제조로부터의 안정적인 수요는 원재료 비용 변동과 휘발성 유기 화합물(VOC) 배출 규제 강화를 상쇄하고 있습니다. 수성 기술은 컨버터가 낮은 VOC 화학물질로 전환하면서 급속히 확대되고 있지만, 감압식은 순간 접착성과 자동화된 도포 라인에 적합하기 때문에 양적 리더십을 유지하고 있습니다. 아시아태평양은 고밀도 전자 공급망과 대규모 인프라 지출에 힘입어 소비와 성장을 이끌고 있습니다. 헬스케어는 피부 친화적인 실리콘 접착제가 의료기기의 긴 수명화를 가능하게 하고, 이익률이 높은 특수 등급으로 가치를 이동시키기 때문에 가장 급성장하는 아울렛으로 부상하고 있습니다. 주요 제조업체는 수직 통합, 지역별 생산 능력 증대, 지속 가능한 솔루션을 위한 포트폴리오 재구성을 통해 비용 압력에 대응하고 있습니다.

세계의 접착 테이프 시장의 동향과 인사이트

전자상거래 및 포장업계 수요 증가

디지털 소매업은 물류 사업자를 보다 빠르고 안전하며 지속가능한 포장으로 계속 이끌고 있습니다. 브랜드 소유자는 현재 긴 유통 사이클을 견디면서 재활용 가능한 목표를 충족하는 섬유 기반 개봉 테이프 및 무용제 상자 포장 시스템을 도입합니다. HB 풀러의 Earthic 포트폴리오는 전단 강도를 희생하지 않고 인증된 바이오 컨텐츠를 제공하는 이 시프트를 보여줍니다. 적절한 크기의 판지 수요는 자동화 라인에서 다양한 골판지 등급에 접착하는 판지 포장 테이프의 맞춤화도 가속화하고 있습니다. 성장이 가장 두드러진 지역은 아시아태평양이며, 국경을 넘어서는 소포의 양이 증가하고, 플루필먼트 센터는 플라스틱 사용량을 줄이기 위해서 수활성 테이프를 표준으로 사용하고 있습니다. 이러한 동력은 고성능 포장 등급의 평방미터 당 평균 가격을 향상시키고 접착 테이프 시장을 성장시킵니다.

OEM이 경량 철사 하네스 테이프로 이동

tesa SuperSleeve 51026 PV6은 PET 크로스와 무용제 아크릴계 접착제를 결합한 차세대 랩의 대표적인 제품으로 고열 영역에서의 내마모성이 우수합니다. 전기자동차 플랫폼에서는 하네스가 오랫동안 사용되고 있으며 배터리 팩을 점검하기 위해 유연성을 유지해야 하므로 시장 기회가 증가하고 있습니다. 하네스의 경량화는 항속 거리의 연장에 도움이 되고 OEM의 채용 곡선을 강화합니다. 이러한 동향은 컨버터가 자동 직기 포장용 폭과 다이 컷을 조정할 때 접착 테이프 시장에 직접적으로 반영됩니다.

원재료 가격 변동

타키파이어 수지나 스페셜티 카본 등의 원료는 원유 비용이나 운송 비용에 따라 변동하여 컨버터의 마진을 압박하고 있습니다. 캐봇은 인플레이션 압력 때문에 2024년 12월부터 카본블랙 가격 인상을 발표했습니다. 생산자는 여러 공급업체의 조달과 지수화된 계약에 의해 급등을 완화하고 있지만, 아직도 중소 컨버터의 확장 계획을 정체시키는 운전자본의 부담에 직면하고 있어, 접착 테이프 시장의 당면 과제가 되고 있습니다.

부문 분석

아크릴 제제는 2024년 판매량의 41.12%를 차지하였으며 접착 테이프 시장 규모에 가장 기여하고 있습니다. 뛰어난 내자외선성과 경시 안정성에 의해 옥외용 전자기기나 태양전지 어셈블리에의 채용이 진행되고 있습니다. 고무계는 내구성이 떨어지지만 자동차 제조업체가 와이어 룸의 결속이나 차내의 NVH 대책에 높은 초기 접착력을 선호하기 때문에 CAGR 4.24%로 확대하고 있습니다. 실리콘 PSA는 수량적으로는 틈새이지만, 생체 적합성과 200°C의 사용 온도에 의해 의료용 웨어러블이나 고열 전자 기기에 프리미엄 가격이 설정되어 있습니다. 에폭시와 폴리우레탄의 화학제품은 전단 강도가 재위치 가능성을 초과하는 구조 접착 틈새에 해당합니다. Lohmann과 같은 공급업체는 현재 전기자동차 배터리 팩에서 2W/mK의 방열성을 가진 열전도성 아크릴과 실리콘 하이브리드를 제공합니다.

수지 포트폴리오의 다양화는 아크릴 점유율을 빼앗지 않고 특수한 최종 용도의 요구를 지원합니다. 고무 업그레이드는 125°C 엔진 베이의 피크를 견디는 합성 고무에 중점을 두고 아크릴과의 격차를 메우고 있습니다. 실리콘 개발은 유럽 의료 규정을 충족하는 저환형 실록산 등급을 중심으로 하고 있으며, 에폭시 테이프에서는 상온 경화의 잠재성 촉매가 추가되어 항공우주용 복합재료의 수리 능력을 확대하고 있습니다. 이러한 혁신은 진화하는 기능 요구에 수지의 화학적 성질을 맞추고 시장 경쟁력을 유지하고 있습니다.

수성 시스템은 2024년 매출의 45.19%를 차지하였으며, 이 분야가 저VOC 처리에 초점을 두고 있음을 반영합니다. 3M과 같은 제조업체는 솔벤트 캐리어를 중단하여 1990년 이후 VOC를 99% 줄였습니다. 이 분야는 컨버터가 용매로 인해 발생하는 전단을 극복하는 고고형분 아크릴 에멀젼을 취급하기 위해 코팅키를 개조함에 따라 CAGR 4.47%로 성장합니다. 솔벤트 기반 라인은 저표면 에너지 기판에서 뛰어난 습윤성으로 인해 여전히 고온 전자를 지배하고 있지만 규제에 따른 설비 투자 압박에 직면하고 있습니다. 핫멜트 PSA는 순간 접착 속도가 처리량을 극대화하는 전자상거래 포장으로 점유율을 늘리고 있습니다. 주변의 수분으로 가교하는 폴리우레탄 폼을 포함한 반응성 화학제품은 자동차의 구조용 조인트에서 틈새 채용을 확보하고 있습니다.

트윈 시스템 코팅기는 현재 물과 용매의 하이브리드 기능을 제공하여 신속한 전환과 에너지 절약을 가능하게 합니다. 기술 혁신은 테르펜과 전분을 원료로 하는 바이오 재료의 확산에도 미치고 있으며, 수성 접착제를 차세대 순환형 경제 지표로 자리매김하고 있습니다. 이러한 기술의 이질성은 컨버터가 환경 목표와 고성능 요구를 매칭함에 따라 접착 테이프 시장을 확대합니다.

지역 분석

아시아태평양은 2024년 생산량의 58.91%를 차지하였고 중국, 인도, 동남아시아가 전자, 자동차, 건설 생산을 확대함에 따라 CAGR 5.01%로 성장할 전망입니다. 각 지역의 제조업체는 현지 코팅 및 슬리터 가공 능력을 추가하고 리드 타임을 단축하고 국내 요구 사항에 맞는 SKU를 공급합니다. 중국과 인도의 반도체 공장에 대한 정부의 우대 조치가 초청정 다이싱 테이프와 마스킹 테이프 수요를 확대하고 있습니다. 동시에 첸나이와 쑤저우의 태양광 발전 접착제 공장은 지속가능성에 대한 노력을 강화하고 접착 테이프 시장공급 회복력을 강화하고 있습니다.

북미는 헬스케어와 항공우주 분야의 선진적인 연구개발을 활용하여 기술면에서 리더십을 유지하고 있습니다. 3M 무용제 플랫폼과 에이버리 데니슨의 UL-94 표준 EV 배터리 테이프는 혁신 중심의 특수 용도로의 이동을 보여줍니다. 노동 시장의 불황은 자동화 투자를 자극하고 조립을 가속화하는 다이컷 PSA 부품이 지지되고 있습니다. 미국, 멕시코, 캐나다 간의 협정도 자동차용 하네스 테이프 생산의 니어 쇼어링을 지원해, 환율 변동을 완화하고 있습니다.

유럽은 에코 디자인과 VOC 컴플라이언스를 중시하고 수성 PSA의 채택을 가속화하고 있습니다. 자동차 경량화와 전동화 정책은 리벳과 용접을 대체하는 고성능 본딩 테이프 수요를 지원합니다. 한편 중동 및 아프리카 시장에서는 인프라의 대규모 프로젝트에서 고온 외벽용 테이프를 채용하고 있습니다. 남미의 접착 테이프 시장은 브라질의 농업 관련 포장 부문과 지역화된 유연한 포장 플랜트를 통해 점차 확대되고 있습니다. 신흥국 시장의 확대와 선진국 지역의 산업 리쇼어링의 복합 효과는 세계 성장 전망을 유지하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 전자상거래 및 포장업계 수요 증가

- OEM이 경량 와이어 하네스 테이프로 이행

- 웨어러블 의료기기에의 저외상성 실리콘 테이프의 채용

- ASEAN 및 중동의 건설 붐에 의해 접착 테이프의 사용이 증가

- 일렉트로닉스 업계로부터의 접착 테이프 수요 증가

- 시장 성장 억제요인

- 원재료 가격 변동

- 극한 조건 하에서의 제품 성능의 한계

- VOC 배출에 대한 우려

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체 제품 및 서비스의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 수지별

- 아크릴

- 고무

- 실리콘

- 에폭시

- 폴리우레탄

- 기술별

- 수성

- 용제계

- 핫멜트

- 반응형

- 제품 유형별

- 감압 테이프

- 수분 활성화 테이프

- 감열 테이프

- 특수 테이프

- 최종 이용 산업별

- 포장

- 자동차

- 전기 및 전자공학

- 헬스케어

- 소비자/DIY

- 기타(건축 및 건설 등)

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/랭킹 분석

- 기업 프로파일

- 3M

- Avery Dennison Corporation

- Berry Global Inc.

- CCT(Coating & Converting Technologies, LLC)

- DuPont

- HB Fuller Company

- Henkel AG & Co. KGaA

- IPG

- LINTEC Corporation

- Lohmann

- Mativ

- Nitto Denko Corporation

- Oji Holdings Corporation

- Scapa Group Ltd

- Sekisui Chemical Co., Ltd.

- Shurtape Technologies, LLC

- Sika AG

- tesa SE-A Beiersdorf Company

제7장 시장 기회와 미래 전망

CSM 25.11.20The Adhesive Tapes Market size is estimated at 58.57 billion square meters in 2025, and is expected to reach 71.67 billion square meters by 2030, at a CAGR of 4.12% during the forecast period (2025-2030).

Consistent demand from packaging, electronics, and automotive manufacturing is offsetting raw-material cost swings and stricter limits on volatile organic compound (VOC) emissions. Water-based technologies are scaling quickly as converters pivot toward low-VOC chemistries, while pressure-sensitive formats retain volume leadership because they bond instantly and suit automated application lines. Asia-Pacific leads consumption and growth, propelled by a dense electronics supply chain and large-scale infrastructure spending. Healthcare is emerging as the fastest-growing outlet as skin-friendly silicone adhesives enable longer-wear medical devices and shift value toward high-margin specialty grades. Major producers are countering cost pressures through vertical integration, regional capacity additions, and portfolio realignment toward sustainable solutions.

Global Adhesive Tapes Market Trends and Insights

Rising Demand from E-Commerce and the Packaging Industry

Digital retail continues to push logistics operators toward faster, safer, and more sustainable packaging. Brand owners now specify fiber-based tear tapes and solvent-free box-closing systems that meet recyclability targets while surviving long distribution cycles. H.B. Fuller's Earthic portfolio exemplifies this shift, delivering certified bio-based content without sacrificing shear strength. Demand for right-sized cartons is also accelerating the customization of carton-sealing tapes that adhere to diverse corrugate grades in automated lines. Growth is most pronounced in Asia-Pacific, where cross-border parcel volumes are rising and fulfillment centers standardize on water-activated tapes to cut plastic use. These forces collectively lift the adhesive tapes market by improving the average price per square meter for high-performance packaging grades.

OEM Shift to Lightweight Wire-Harness Tapes

Automakers are replacing bulky PVC tubing with specialty cloth and PET adhesive tapes that save up to 50% harness weight while absorbing vibration and withstanding 150 °C engine-bay temperatures. tesa SuperSleeve 51026 PV6 typifies next-generation wraps that combine PET cloth with a solvent-free acrylic adhesive to resist abrasion in high-heat zones. Electric-vehicle platforms amplify the opportunity because harnesses run longer and must remain flexible for battery-pack servicing. Lighter harness assemblies help extend driving range, reinforcing OEM adoption curves. These trends feed directly into the adhesive tapes market as converters qualify tailored widths and die-cuts for automated loom wrapping.

Volatility in Prices of Raw Materials

Feedstocks such as tackifier resins and specialty carbons swing with crude oil and freight costs, compressing converter margins. Cabot announced carbon-black price increases effective December 2024, citing inflationary pressures. Producers mitigate spikes through multi-supplier sourcing and indexed contracts, but still face working-capital strain that can stall smaller converters' expansion plans, placing a near-term drag on the adhesive tapes market.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Low-Trauma Silicone Tapes for Wearable Medical Devices

- Construction Boom in ASEAN and Middle East Region

- Limitations in Product Performance Under Extreme Conditions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic formulations secured 41.12% of 2024 volume, making them the largest contributor to adhesive tapes market size because they bond metals, plastics, and glass without extensive surface treatment. Their excellent UV resistance and aging stability drive uptake in outdoor electronics and solar assemblies. Rubber systems, despite lower durability, are scaling at 4.24% CAGR as automakers favor their high initial tack for wire-loom bundling and interior NVH control. Silicone PSAs, though niche in volume, command premium pricing in medical wearables and high-heat electronics thanks to biocompatibility and 200 °C service temperatures. Epoxy and polyurethane chemistries cater to structural bonding niches where shear strength outweighs repositionability. Suppliers such as Lohmann now offer thermally conductive acrylic-silicone hybrids that dissipate 2 W/mK in electric-vehicle battery packs.

Diversification within resin portfolios supports specialized end-use needs without cannibalizing acrylic share. Rubber upgrades focus on synthetic variants that withstand 125 °C engine-bay peaks, closing the historical gap with acrylics. Silicone development centers on low-cyclic-siloxane grades to satisfy European medical regulations, while epoxy tapes add latent catalysts for room-temperature cure, expanding repair capabilities in aerospace composites. These innovations collectively keep the adhesive tapes market competitive as formulators match resin chemistries to evolving functional demands.

Water-based systems represented 45.19% of 2024 sales, reflecting the sector's pivot to low-VOC processing. Producers such as 3M have slashed VOCs by 99% since 1990 by phasing out solvent carriers. The segment grows at 4.47% CAGR as converters retrofit coaters to handle high-solids acrylic emulsions that rival solvent-borne shear. Solvent-based lines still dominate high-temperature electronics because of superior wet-out on low-surface-energy substrates, but they face tightening regulatory capex. Hot-melt PSAs gain share in e-commerce packaging, where instant bond speeds maximize throughput. Reactive chemistries, including polyurethane foams that crosslink with ambient moisture, secure niche adoption in structural automotive joints.

Twin-system coaters now deliver hybrid water/solvent capability, allowing rapid changeovers and energy savings. Innovation extends to bio-based dispersions from terpene or starch feedstocks, positioning water-based adhesives for next-generation circular-economy metrics. This technology heterogeneity broadens the adhesive tapes market as converters align environmental targets with high-performance demands.

The Adhesive Tapes Market Report Segments the Industry by Resin (Acrylic, Rubber-Based, and More), Technology (Water-Based, Solvent-Based, and More), Product Type (Pressure-Sensitive Tapes, Water-Activated Tapes, and More), End-User Industry (Packaging, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific held 58.91% of the 2024 volume and is set to grow at a 5.01% CAGR as China, India, and Southeast Asia expand electronics, automotive, and construction output. Regional producers add local coating and slitting capacity, reducing lead times and tailoring SKUs to domestic requirements. Government incentives for semiconductor fabs in China and India amplify demand for ultra-clean dicing and masking tapes. Concurrently, solar-powered adhesive plants in Chennai and Suzhou demonstrate growing sustainability commitments, reinforcing supply resilience in the adhesive tapes market.

North America retains technology leadership, leveraging advanced R&D in healthcare and aerospace. 3M's solvent-free platforms and Avery Dennison's UL-94-rated EV battery tapes illustrate an innovation-driven shift toward specialized applications. Tight labor markets stimulate automation investments, favoring die-cut PSA components that accelerate assembly. The United States-Mexico-Canada Agreement also supports near-shoring of automotive harness tape production, buffering currency volatility.

Europe emphasizes eco-design and VOC compliance, accelerating water-based PSA adoption. Automotive lightweighting and electrification policies sustain demand for high-performance bonding tapes that replace rivets and welds. Meanwhile, Middle East and Africa markets benefit from infrastructure megaprojects that specify high-temperature exterior facade tapes. South America's adhesive tapes market gains incrementally through Brazil's agriculture-linked packaging sector and localized flexible-packaging plants. The combined effect of emerging-market expansion and industrial re-shoring in developed regions sustains the global growth outlook.

- 3M

- Avery Dennison Corporation

- Berry Global Inc.

- CCT (Coating & Converting Technologies, LLC)

- DuPont

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- IPG

- LINTEC Corporation

- Lohmann

- Mativ

- Nitto Denko Corporation

- Oji Holdings Corporation

- Scapa Group Ltd

- Sekisui Chemical Co., Ltd.

- Shurtape Technologies, LLC

- Sika AG

- tesa SE - A Beiersdorf Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from the E-Commerce and Packaging Industry

- 4.2.2 OEM shift to lightweight wire-harness tapes

- 4.2.3 Adoption of low-trauma silicone tapes for wearable medical devices

- 4.2.4 Construction boom in ASEAN and Middle-East region boosting adhesive tape usage

- 4.2.5 Growing Demand for Adhesive Tapes from Electronics Industry

- 4.3 Market Restraints

- 4.3.1 Volatility in Prices of Raw Materials

- 4.3.2 Limitations in Product Performance Under Extreme Conditions

- 4.3.3 Concerns of VOC Emissions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Resin

- 5.1.1 Acrylic

- 5.1.2 Rubber-based

- 5.1.3 Silicone

- 5.1.4 Epoxy

- 5.1.5 Polyurethane

- 5.2 By Technology

- 5.2.1 Water-based

- 5.2.2 Solvent-based

- 5.2.3 Hot-melt

- 5.2.4 Reactive

- 5.3 By Product Type

- 5.3.1 Pressure-Sensitive Tapes

- 5.3.2 Water-Activated Tapes

- 5.3.3 Heat-Sensitive Tapes

- 5.3.4 Specialty Tapes

- 5.4 By End-use Industry

- 5.4.1 Packaging

- 5.4.2 Automotive

- 5.4.3 Electrical and Electronics

- 5.4.4 Healthcare

- 5.4.5 Consumer/DIY

- 5.4.6 Others (Building and Construction, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Berry Global Inc.

- 6.4.4 CCT (Coating & Converting Technologies, LLC)

- 6.4.5 DuPont

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 IPG

- 6.4.9 LINTEC Corporation

- 6.4.10 Lohmann

- 6.4.11 Mativ

- 6.4.12 Nitto Denko Corporation

- 6.4.13 Oji Holdings Corporation

- 6.4.14 Scapa Group Ltd

- 6.4.15 Sekisui Chemical Co., Ltd.

- 6.4.16 Shurtape Technologies, LLC

- 6.4.17 Sika AG

- 6.4.18 tesa SE - A Beiersdorf Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment