|

시장보고서

상품코드

1687852

셋톱 박스 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Set-Top Box - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

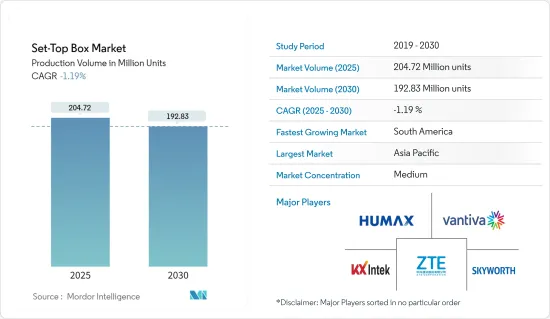

생산량 기반 셋톱 박스 시장 규모는 2025년 2억 472만 대에서 2030년 1억 9,283만 대로 감소할 것으로 예상됩니다.

인터넷과 광대역의 보급, HD채널에 대한 선호도 고조 및 온디맨드 비디오 서비스의 등장으로 셋톱박스 시장 진출 기업은 서비스 확대 기회를 얻을 수 있습니다.

디지털 텔레비전 산업의 진화는 온라인과 텔레비전 모두에서 소비자의 미디어 참여 방식을 크게 바꿨습니다. 가처분 소득이 증가하고 중산층이 급증하는 가운데 미디어가 풍부한 홈 엔터테인먼트에 대한 수요가 높아지고 있습니다. 그 결과 특히 인터넷 기반 서비스와 주문형비디오(VoD), 기존 TV 방송에 대응하는 차세대 셋톱박스(STB) 수요가 급증하면서 시장 업체들이 기회를 잡고 있습니다.

셋톱 박스(STB)는 텔레비전 컨텐츠의 소비에 혁명을 가져왔습니다. 그 선진적 기능과 매끄러운 통합에 의해, 가정에 없어서는 안 될 존재가 되고 있습니다. STB는 스트리밍과 온디맨드 서비스부터 인터랙티브 기능까지 다양하고 몰입감 있는 엔터테인먼트 경험을 담고 있습니다. AI 통합 및 모션 센서 등의 혁신을 통해 STB는 사용자 친화적인 인터페이스와 일류 영상 및 음질을 제공하여 즐거운 시청 경험을 보장합니다.

신흥 시장에는 인도, 중국, 브라질이 포함되어 있습니다. 신흥 시장에서의 인터넷과 광대역 확산은 인터넷 기반 셋톱 박스의 성장에 영향을 미치는 요인입니다. 중국 인터넷 네트워크 정보센터(CNNIC)에 따르면 2024년 상반기 중국은 10억 명이라는 방대한 인터넷 인구에 740만 명의 신규 사용자를 추가했다고 보고했습니다. 게다가 중국 국가통계국에 따르면 2022년에는 허베이(河北)성에서 약 100만 가구가 유료 TV를 이용했습니다.

보다 많은 개인이 정액제의 OTT 스트리밍 서비스를 이용하게 됨에 따라, 정액제의 피로가 우려되게 되어 있습니다. 이에 대응하기 위해 OTT 플랫폼은 기존 구독 번들과 모델에서 벗어나 페이퍼뷰와 같은 수익 전략을 선택하고 있습니다. 페이퍼 뷰는 시청자가 특정 콘텐츠에 대해 프라이빗 방영을 통해 요금을 지불하는 것을 가능하게 합니다.

거시경제 요인은 셋톱박스(STB) 시장에 큰 영향을 미칩니다. 예를 들어 GDP 성장률이 높아지면 셋톱박스를 포함한 필수품 이외의 전자기기에 대한 소비지출이 증가할 수 있습니다. 게다가 GDP가 성장함에 따라 기업은 수익과 이익률이 상승하는 경향이 있어 기술, 특히 전자기기에 대한 투자의 증가를 촉진합니다. 이러한 재무 건전성의 고조는 종종 기업의 능력 강화와 고객 경험 향상을 우선시하고 있습니다. IMF에 따르면 2023년 몬테네그로는 GDP가 4.5% 확대되면서 유럽에서 가장 급성장하는 경제국으로 떠올랐습니다. 이 성장률은 4% 증가한 터키와 3.8% 증가한 몰타를 앞질렀습니다.

셋톱 박스 시장 동향

큰 성장을 이루는 IPTV

- IPTV(Internet Protocol Television) 셋톱박스는 기존의 케이블이나 위성 신호 대신 인터넷을 통해 텔레비전 컨텐츠를 전달하는 장치입니다. 인터넷을 통해 전송되는 디지털 비디오 스트림을 디코딩하여 처리하기 위해 사용자는 TV의 라이브 채널과 주문형 비디오 및 기타 멀티미디어 콘텐츠를 TV로 직접 시청할 수 있습니다.

- IPTV의 유연성을 통해 OTT(Over-the-Top) 플랫폼과 같은 다른 디지털 서비스와 원활하게 통합할 수 있어 현대 시청자들에게 호소하는 하이브리드 모델을 만들 수 있습니다. IPTV와 OTT 서비스를 결합한 이들 하이브리드 셋톱박스는 라이브 TV와 스트리밍 콘텐츠 모두에 통일된 인터페이스를 제공해 온디맨드 시청을 선호하는 소비자 증가에 대응하기 위해 인기를 끌고 있습니다.

- 공업정보화부(중국)에 따르면 2023년 중국 IPTV 유저는 4억 100만 명으로 2022년부터 약 2,000만 명 증가했습니다.

- 이 외에도 TiVo의 IPTV 플랫폼은 첨단 영상 혁신으로 눈에 띄는 시각적으로 매력적이고 고도로 개인화된 비디오 솔루션을 제공합니다. 이 플랫폼은 쉬운 통합, 적응성 있는 전개, 확대성을 보장합니다. FAST, AVOD, SVOD, OTT, 라이브TV 콘텐츠를 매끄럽게 통합하여 엔터테인먼트 여행 전체를 강화합니다. 이는 모두 TiVo의 정평이 나 있는 유니버설 검색과 추천 인터페이스에 의해 실현되고 있습니다. 또한 이 플랫폼은 스타트오버, 캐치업, OnePass 등의 기능을 자랑합니다.

아시아태평양이 큰 성장을 이룰 전망

- 아시아태평양에서는 소비자가 기존의 케이블 및 위성 기술에서 IPTV 및 OTT 서비스로 이동함에 따라 셋톱 박스 사용이 점차 감소하고 있습니다. 고속 인터넷의 등장 및 스마트폰과 스마트 TV의 보급이 이러한 변화를 촉진하여 컨텐츠에 대한 액세스가 더욱 쉽고 유연해졌습니다.

- 넷플릭스나 아마존 프라임과 같은 OTT 플랫폼과 현지 진출기업들이 온디맨드 시청 옵션을 제공하기 때문에 소비자들은 코드를 끊는 데 점점 매력을 느끼고 있습니다. 이 때문에 DTT(지상 디지털 TV)의 이용도 서서히 감소하고 있습니다. 한때 DTT는 가입 없이 디지털 신호를 제공함으로써 인기를 얻었지만, 현재는 OTT 서비스가 제공하는 방대한 컨텐츠 라이브러리에 비해 제한적인 것으로 간주되고 있습니다.

- 이러한 변화에도 불구하고 IPTV와 OTT의 기능을 지원하는 첨단 셋톱 박스를 도입함으로써 시장의 일부 기업은 여전히 관련성을 유지하려고 합니다. 이 하이브리드 박스는 기존 TV와 최신 스트리밍 갭을 채우기 위한 목적으로 음성 제어, 통합 앱, 4K 컨텐츠 지원 등의 기능을 제공합니다.

- 인도의 Tata Sky와 말레이시아의 Astro와 같은 기업들은 이 하이브리드 방식을 채택하여 보다 광범위한 시청자를 수용하고 고객 기반을 유지할 수 있습니다.

- 2024년 6월, 통합정보통신기술 솔루션의 주요 제공업체인 ZTE Corporation은 파키스탄의 통신사업자인 PTCL을 지원하고 SHOQ TV Box라는 브랜드명으로 Android TV를 탑재한 B866V2F 셋톱 박스(STB)를 도입하여 TV 시청 체험을 변화시켜 뉴스와 엔터테인먼트 제공을 업그레이드했습니다. 이 장치는 HD 60개 채널을 포함한 200개의 라이브 TV 채널과 15,000시간의 주문형 콘텐츠를 제공하여 풍부한 시청 경험을 기재하고 있습니다. B866 V2F powered by Android TV는 고성능 쿼드코어 64비트 칩 솔루션을 탑재한 신세대 4K IPTV/OTT STB로 효율적인 비디오 스트림 디코딩과 빠른 명령 처리를 실현합니다.

셋톱 박스 산업 세분화

셋톱 박스 산업은 반고체화되어 있으며, 다양한 기업 간의 경쟁은 가격, 제품, 시장 점유율, 시장 경쟁의 치열에 따라 달라집니다. 시장 진출 기업으로는 Vantiva SA, KX INTEK INC., HUMAX Co. Ltd (HUMAX HOLDINGS Co. Ltd), ZTE CORPORATION, and Shenzhen Skyworth Digital Technology Co. Ltd 등이 있습니다.

인터넷과 광대역의 보급률이 높아지고 HD 채널에 대한 선호도가 높아지고 온디맨드 비디오 서비스의 상승으로 셋톱박스 시장 진출 기업은 서비스 확대 기회를 얻을 수 있습니다. 디지털 TV 산업의 진화는 온라인과 TV 모두에서 소비자의 미디어 참여 방식을 크게 바꾸었습니다. 가처분 소득이 증가하고 중산층이 급증하는 가운데 미디어가 풍부한 홈 엔터테인먼트에 대한 수요가 높아지고 있습니다. 그 결과 특히 인터넷 기반 서비스와 주문형비디오(VoD), 기존 TV 방송에 대응하는 차세대 셋톱박스(STB) 수요가 급증하고 있어 시장 업체들이 기회를 잡고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력-Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 이해관계자 분석

- 시장의 거시 경제 동향의 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 첨단 기술 혁신

- 신흥 시장에서의 보급 확대

- OS 기반 디바이스 배포

- 시장의 과제

- 온라인 OTT 서비스 및 플랫폼 성장

- 시장 기회

제6장 기술 스냅샷

제7장 시장 세분화

- 기술별

- 위성 및 DTH

- IPTV

- 케이블

- 기타 유형(DTT)

- 해상도별

- SD

- HD

- 울트라 HD 이상

- 지역별

- 북미

- 유럽

- 아시아

- 인도

- 호주 및 뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

제8장 벤더의 시장 점유율 분석

제9장 경쟁 구도

- 기업 프로파일

- Vantiva SA

- KX INTEK INC.

- HUMAX Co. Ltd(HUMAX HOLDINGS Co. Ltd)

- ZTE CORPORATION

- Shenzhen Skyworth Digital Technology Co. Ltd

- Sagemcom SAS

- Gospell Digital Technology Co. Limited

- Kaonmedia Co. Ltd

- Shenzhen Coship Electronics Co. Ltd

- Evolution Digital LLC

- Shenzhen SDMC Technology Co. Ltd

- Laxmi Remote(India) Private Limited

제10장 투자 분석

제11장 투자 분석 시장의 미래

AJY 25.05.07The Set-Top Box Market size in terms of production volume is expected to decline from 204.72 million units in 2025 to 192.83 million units by 2030.

Due to the increasing internet and broadband penetration, a growing preference for HD channels, and the rise of on-demand video services, the players in the set-top box market may have an opportunity to expand their services.

The digital TV industry's evolution has significantly shifted how consumers engage with media, both online and on television. With rising disposable incomes and a burgeoning middle class, there is a heightened demand for media-rich home entertainment. Consequently, market players are seizing opportunities, especially with the surging demand for next-generation set-top boxes (STBs) that cater to internet-based services, video-on-demand (VoD), and traditional television broadcasts.

Set-top boxes (STBs) have revolutionized TV content consumption. Their advanced features and seamless integration have made them indispensable in households. STBs deliver a versatile and immersive entertainment experience from streaming and on-demand services to interactive features. With innovations like AI integration and motion sensors, STBs provide a user-friendly interface and top-notch video and audio quality, guaranteeing an enjoyable viewing experience.

The emerging markets include India, China, and Brazil. The rising adoption of the internet and broadband in emerging markets is a factor influencing the growth of internet-based set-top boxes. According to the China Internet Network Information Center (CNNIC), in the first half of 2024, China reported adding 7.4 million new users to its massive one billion internet population. Furthermore, according to the National Bureau of Statistics China, in 2022, approximately one million households in the Hebei province used pay TV.

As more individuals turn to subscription-based OTT streaming services, Subscription Fatigue is becoming an increasing concern. In response, OTT platforms are moving away from traditional subscription bundles and models, opting for revenue strategies like pay-per-view. Pay-per-view allows viewers to pay for specific content via private telecast.

Macroeconomic factors wield considerable influence over the set-top box (STBs) market. For instance, higher GDP growth can increase consumer spending on nonessential electronics, including set-top boxes. Furthermore, as GDP grows, businesses tend to see a rise in revenue and profitability, prompting increased investments in technology, notably in electronic devices. This surge in financial health often directs companies to prioritize bolstering their capabilities and elevating customer experiences. According to the IMF, in 2023, Montenegro emerged as Europe's fastest-growing economy, with its GDP expanding by 4.5%. This growth outpaced Turkey, which saw a 4% increase, and Malta, which experienced a 3.8% rise.

Set-Top Box Market Trends

IPTV to Witness Major Growth

- An IPTV (Internet Protocol Television) set-top box is a device that delivers television content via the Internet instead of traditional cable or satellite signals. It decodes and processes the digital video streams transmitted over the Internet, allowing users to watch live TV channels, on-demand videos, and other multimedia content directly on their TV sets.

- The flexibility of IPTV enables it to integrate seamlessly with other digital services, such as OTT (Over-the-Top) platforms, creating hybrid models that appeal to modern viewers. These hybrid set-top boxes, which combine IPTV and OTT services, are gaining traction as they provide a unified interface for both live TV and streaming content, catering to the growing consumer preference for on-demand viewing.

- According to the Ministry of Industry and Information Technology (China), in 2023, China boasted 401 million IPTV users, marking an increase of approximately 20 million from 2022.

- In addition to this, TiVo's IPTV Platform stands out with its advanced video innovations. It provides a visually captivating and highly personalized video solution. The platform ensures easy integration, adaptable deployments, and scalability. It enhances the entire entertainment journey, seamlessly aggregating content across FAST, AVOD, SVOD, OTT, and live TV. This is all powered by TiVo's renowned universal search and recommendation interface. In addition, the platform boasts features like Start Over, Catch-up, and OnePass.

Asia-Pacific Expected to Witness Major Growth

- In the Asia-Pacific region, the use of set-top boxes is slowly declining as consumers shift away from traditional cable and satellite technologies, favoring IPTV and OTT services. The advent of high-speed internet and the widespread adoption of smartphones and smart TVs have driven this change, providing easier and more flexible access to content.

- With OTT platforms like Netflix, Amazon Prime, and local players offering on-demand viewing options, consumers find it increasingly appealing to cut the cord. This has led to a gradual reduction in the usage of DTT (Digital Terrestrial Television) as well, which, although once popular for offering digital signals without a subscription, is now seen as limited compared to the vast libraries of content provided by OTT services.

- Despite this shift, some players in the market are still trying to stay relevant by introducing advanced set-top boxes that support IPTV and OTT functionalities. These hybrid boxes aim to bridge the gap between traditional TV and modern streaming, offering features like voice control, integrated apps, and support for 4K content.

- Companies like Tata Sky in India and Astro in Malaysia have embraced this hybrid approach, allowing them to cater to a broader audience and maintain their customer base.

- In June 2024, ZTE Corporation, a key provider of integrated information and communication technology solutions, assisted the Pakistani operator PTCL in introducing the B866V2F Set Top Box (STB) powered by Android TV under the brand name SHOQ TV Box to transform the TV viewing experience and upgrade the news and entertainment offerings. The device offers 200 live television channels, including 60 channels in HD and 15,000 hours of on-demand content to deliver an enriched viewing experience. The B866V2F powered by Android TV is a new-generation 4K IPTV/OTT STB featuring a high-performance quad-core 64-bit chip solution to ensure efficient video stream decoding and speedy instruction processing.

Set-Top Box Industry Segmentation

The Set-top Box industry is semi-consolidated and has witnessed the moderate competitive rivalry between various firms is dependent on price, product, or market share, along with the intensity of competition in the market. Some of the players include Vantiva SA, KX INTEK INC., HUMAX Co. Ltd (HUMAX HOLDINGS Co. Ltd), ZTE CORPORATION, and Shenzhen Skyworth Digital Technology Co. Ltd.

Due to the increasing internet and broadband penetration, a growing preference for HD channels, and the rise of on-demand video services, the players in the set-top box market may have an opportunity to expand their services. The digital TV industry's evolution has significantly shifted how consumers engage with media, both online and on television. With rising disposable incomes and a burgeoning middle class, there is a heightened demand for media-rich home entertainment. Consequently, market players are seizing opportunities, especially with the surging demand for next-generation set-top boxes (STBs) that cater to internet-based services, video-on-demand (VoD), and traditional television broadcasts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 An Assessment of the Macroeconomics Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Levels of Technological Innovations

- 5.1.2 Increasing Adoption in the Emerging Markets

- 5.1.3 Deployment of OS-based Devices

- 5.2 Market Challenges

- 5.2.1 Growing Online OTT Services/Platform

- 5.3 Market Opportunities

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Technology

- 7.1.1 Satellite/DTH

- 7.1.2 IPTV

- 7.1.3 Cable

- 7.1.4 Other Types (DTT)

- 7.2 By Resolution

- 7.2.1 SD

- 7.2.2 HD

- 7.2.3 Ultra-HD and Higher

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.3.1 India

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 VENDOR MARKET SHARE ANALYSIS

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Vantiva SA

- 9.1.2 KX INTEK INC.

- 9.1.3 HUMAX Co. Ltd (HUMAX HOLDINGS Co. Ltd)

- 9.1.4 ZTE CORPORATION

- 9.1.5 Shenzhen Skyworth Digital Technology Co. Ltd

- 9.1.6 Sagemcom SAS

- 9.1.7 Gospell Digital Technology Co. Limited

- 9.1.8 Kaonmedia Co. Ltd

- 9.1.9 Shenzhen Coship Electronics Co. Ltd

- 9.1.10 Evolution Digital LLC

- 9.1.11 Shenzhen SDMC Technology Co. Ltd

- 9.1.12 Laxmi Remote (India) Private Limited