|

시장보고서

상품코드

1687871

유럽의 계약 물류 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

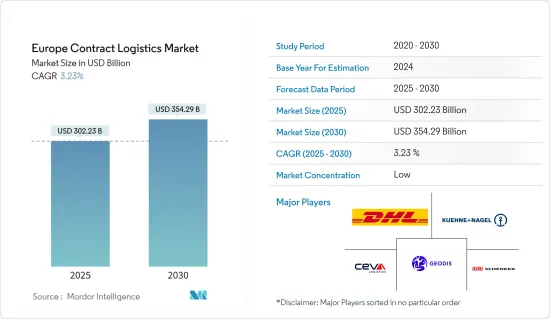

유럽의 계약 물류 시장 규모는 2025년 3,022억 3,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 3.23%로, 2030년에는 3,542억 9,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 2024년 유럽 전망은 완만한 회복입니다. 물가 하락과 임금 상승에 따라 유럽 소비자들은 구매력을 되찾기 시작했고, 이는 내수를 밀어올릴 것으로 보입니다. 이 회복의 힘은 국가마다 다릅니다. 제조업과 에너지 집약형 경제는 기타 국가보다 완만하게 회복될 것으로 보입니다. 유럽 선진국에서는 올해 성장률이 0.7%로 떨어졌으며, 이후 2024년과 2025년에 약간 회복될 것으로 예측됩니다. 유럽 신흥국(러시아, 우크라, 터키, 벨로루시 제외)에서는 2021년 4.5% 감소에서 2025년 1.1% 감소로 회복하고 2024년 2.9%로 회복될 것으로 예상됩니다.

- 인플레이션 비율은 에너지 가격 하락과 공급망의 제약 완화에 의해 하락할 것으로 예측됩니다. 올해 유럽 선진국 경제의 인플레이션률은 평균 5.8%로, 2025년에는 11.9%까지 떨어질 것으로 예측됩니다. 대부분의 국가는 2025년까지 인플레이션 목표보다 낮을 것으로 보입니다. 유럽의 물류 비용은 유럽 경제의 GDP의 11-12%를 차지합니다.

- 유럽의 중앙에 위치한 독일의 중심 위치와 고도로 숙련된 물류 서비스는 국제 화주들이 유럽 시장에서 성공할 수 있는 이상적인 조건을 제공합니다. 독일은 EU의 5억 소비자에게 쉽게 접근할 수 있습니다. 독일의 숙련된 노동력은 독일의 물류 부문에 투자하고 현지 지점을 설립하는 것을 고려하고자 하는 국제 기업에 매력적입니다. 독일의 대외 무역 및 관련 상품 및 화물 운송의 약 70%는 유럽 내에서 이루어지고 있습니다. 유럽의 주요 무역 상대국으로는 프랑스(수출입액 1,700억 유로(1,859억 달러)), 네덜란드(수출액 1,670억 달러(1,826억 2,000만 달러)) 등이 있습니다. 유럽 밖에서 물류의 가장 큰 목적지는 아시아이며, 그 다음 미국입니다. 많은 기업들이 독일 사업 확장을 위해 창고를 개설하고 있습니다.

- 예를 들어, 2023년 6월, GXO는 독일의 존재를 '심화'시킬 계획을 발표했습니다. 그 첫걸음으로 GXO는 Dormagen 지역에 587,000 평방 피트의 창고를 신설하여 최첨단 창고 솔루션을 전시합니다. GXO의 창고는 유럽과 영국에 700곳, 북미에 300곳 있는 반면 독일에는 6개밖에 없습니다.

- 예를 들어 2023년 7월 Geopost와 JD Logistics는 세계 물류 능력을 강화하기 위한 전략적 제휴를 발표했습니다. JDL의 강력한 창고 네트워크와 Geopost의 물류 배송 능력을 결합하여 이 제휴는 중국에서 유럽으로의 국제 익스프레스 서비스를 확장하여 소비자와 기업에 고품질 익스프레스 물류 솔루션을 제공합니다. JDL과 Geoopost는 중국에서 유럽으로의 양방향 원활한 C2C(소비자 직송) 및 B2C(기업 대 소비자) 운송 솔루션을 구축합니다. 이 새로운 파트너십은 종합적인 엔드 투 엔드 화물 추적 및 배송을 제공하여 도어 스텝 배송 및 전담 고객 지원을 포함한 편리한 "원스톱" 익스프레스 배송 서비스 및 물류 프로세스 전반에 걸쳐 최첨단 디지털 추적을 실현합니다.

유럽의 계약 물류 시장 동향

계약 물류 아웃소싱 시장은 상당한 성장을 기록합니다.

계약 물류의 아웃소싱 점유율은 낮고 명확한 성장 가능성을 보여줍니다. 세계적으로 보면 시장 전체에서 차지하는 계약 물류의 점유율은 불과 10-15%입니다. 유럽에서는 이 비율이 약 20%로 추정됩니다. 아웃소싱의 정도는 국가에 따라 크게 다릅니다. 일반적으로 운송 및 보관 서비스는 크게 아웃소싱됩니다.

전자상거래는 아웃소싱 성장의 큰 원동력이 될 것으로 예상됩니다. 전자상거래 시장이 급성장함에 따라 보다 신속하고 확실한 배송에 대한 소비자의 기대도 높아지고 있습니다. 그 결과, 창고 관리 및 주문 처리 아웃소싱이 증가할 것으로 예상됩니다. 계약 물류는 모든 규모의 전자상거래 기업에게 다음과 같은 이점을 제공합니다.

계약 물류 회사는 온라인 비즈니스에 서비스를 제공하고 세계 및 네트워크를 성공적으로 활용하여 새로운 시장 진출을 지원합니다. 또한 배송 옵션 옵션을 제공하거나 통관 및 부가가치세(VAT) 서비스를 맡아 고객과의 거리를 줄일 수 있습니다.

계약 물류 회사는 가전제품, 통신 장비, 컴퓨터 장비 및 기타 하이테크 제품을 제조하는 기업에 특화된 서비스를 제공합니다. 이러한 기업들이 재고를 줄이고 유통 비용을 낮추고 신제품을 출시할 수 있도록 지원합니다.

영국이 이 지역을 석권

영국은 중국, 미국에 이어 세계 3위의 전자상거래 시장입니다.

온라인 쇼핑과 온라인 결제가 급증함에 따라 영국은 디지털 경제로 전환하고 있습니다. 영국의 전자상거래 시장은 유럽 최대급의 급성장을 이루고 있습니다. 2023년 영국 가구는 전자상거래에 약 1,200억 파운드(1,525억 4,000만 달러)를 소비했으며 연간 8.8%로 성장할 것으로 예상됩니다.

소매 전자상거래는 세계에서 가장 빠르게 성장하는 소매 동향 중 하나입니다. 지난 10년간 온라인 쇼핑은 영국에서 가장 인기 있는 소매 채널이 되었습니다. 전자상거래 사이트는 수십년전부터 존재했지만, 보급되기 시작한 것은 매우 최근의 것입니다. 영국에서의 온라인 쇼핑의 성장은 세계의 동향에 맞추어 경이로워지고 있습니다. 결과적으로 계약 물류 서비스에 대한 수요가 매우 높아지고 있습니다.

2023년 11월 EV Cargo는 기술을 활용한 공급망에 투자하여 세계 최고의 관제탑 시스템을 갖춘 물류 네트워크를 구축했습니다. 세계 화물 운송 회사이며 세계 공급망 및 서비스 제공 업체인 EV Cargo는 도로화물, 창고 및 계약 물류에서 3개 고객과 영국에서 새로운 계약을 획득했습니다. EV 카고는 지난 3년간 영국의 물류업계에 영향을 미치는 보다 광범위한 시장 환경에 대응하기 위해 영국에서 보유한 차량의 전략적 자원 검토를 완료했습니다. 이 회사는 효율성을 높이고 민첩성을 향상시키는 기술을 도입했습니다.

유럽의 계약 물류 산업 개요

이 시장의 주요 기업으로는 Deutsche Post DHL Group, Schenker AG (DB Schenker), Ceva Logistics, DSV AS, SNCF Logistics/Geodis 등이 있습니다. 유럽에 본사를 둔 이러한 기업들은 전 세계적으로 큰 존재감을 보여줍니다. 이러한 대기업이 이 지역에 강력한 발자취를 남기고 큰 시장 점유율을 차지하고 있지만, 시장은 아직 어느 정도 단편화되고 있으며, 많은 기업들이 다양한 수준에서 계약 물류 서비스를 제공합니다.

기업은 업계 동향에 맞추어 항상 진화해야 합니다. 그렇게 함으로써 새로운 고객을 획득하고 발판을 굳힐 수 있다고 생각됩니다.

대부분의 대기업은 서유럽에 본사를 두고 있습니다. CEE 지역에서는 현지의 계약 물류 공급자 수가 비교적 적습니다. 이것은 CEE 지역의 기존 현지 물류 공급자가 계약 물류 시장에 진입하여 큰 시장 점유율을 얻는 기회입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 역학과 인사이트

- 현재의 시장 시나리오

- 시장 역학

- 성장 촉진요인

- 아웃소싱 서비스 증가

- 이탈리아, 프랑스, 폴란드의 계약 물류 수요 증가

- 억제요인

- 유럽의 계약 물류 시장에서의 경쟁의 격화

- 규제 준수

- 기회

- 풀형 창고

- 성장 촉진요인

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 밸류체인/서플라이체인 분석

- 정부의 규제와 대처

- 기술 동향

- 지역의 전자상거래 산업(국내 및 월경)에 대한 통찰

- 애프터 판매/역물류의 계약 물류에 대한 통찰

- 계약 물류 기업이 제공하는 각종 서비스(종합 창고 및 수송, 공급 체인 서비스, 기타 부가 가치 서비스)의 개요

- 화물 수송 비용/운임에 관한 고찰

- 브렉짓의 유럽 물류 산업에 미치는 영향에 대한 통찰

- COVID-19가 시장에 미치는 영향

제5장 시장 세분화

- 최종 사용자별

- 산업기계 및 자동차

- 식음료

- 건설

- 화학제품

- 기타 소비재

- 기타 최종 사용자

- 국가별

- 독일

- 영국

- 네덜란드

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 벨기에

- 스웨덴

- 기타 유럽

제6장 경쟁 구도

- 기업 프로파일(M&A, 합작사업, 제휴, 계약 포함)

- Deutsche Post DHL Group

- XPO Logistics

- Schenker AG(DB Schenker)

- CEVA Logistics

- SNCF Logistics/Geodis

- DSV AS

- Neovia Logistics Services

- GEFCO SA

- United Parcel Service Inc.(UPS Supply Chain Solutions)

- Rhenus SE & Co. KG

- Bertelsmann SE & Co. KGaA(Arvato)

- FIEGE Logistik Stiftung & Co. KG*

- 기타 기업(주요정보/개요)

- Expeditors International, United Parcel Service Inc., Bollore Logistics, Hellmann Worldwide Logistics GmbH & Co. KG, Agility Logistics Pvt. Ltd, H. Essers NV, Wincanton PLC*

제7장 시장 기회와 앞으로의 동향

제8장 부록

- 주요국의 활동별 GDP 분포

- 자본 흐름의 통찰

- 대외무역 통계-제품별 수출입

- 유럽의 주요 수출처에 대한 통찰

- 유럽의 주요 수입 원산지에 관한 통찰

The Europe Contract Logistics Market size is estimated at USD 302.23 billion in 2025, and is expected to reach USD 354.29 billion by 2030, at a CAGR of 3.23% during the forecast period (2025-2030).

Key Highlights

- Europe's outlook for 2024 is of gradual recovery. As prices fall and wages rise, European consumers are beginning to regain purchasing power, which will boost domestic demand. The strength of this recovery will vary across countries. Manufacturing and energy-intensive economies will recover more slowly than others. In advanced European economies, growth is projected to decline to 0.7% this year before some pickup in 2024 and 2025. In emerging European economies (except Russia, Ukraine, and Turkey, and Belarus), it is expected to recover from a decline of 4.5% in 2021 to 1.1% in 2025 and to recover to 2.9% in 2024.

- Inflation is projected to fall, driven by lower energy prices and loosening supply chain constraints. It is projected to average 5.8% in advanced European economies this year and to fall to 11.9% by 2025. Most countries will fall short of their inflation targets by 2025. The cost of logistics in Europe accounts for 11 to 12% of the European economy's GDP.

- Germany's central location in the middle of Europe and highly skilled logistics services provide ideal conditions for international shippers to succeed in European markets. Germany provides easy access to the EU's 500 million consumers. Germany's skilled workforce is attractive for international companies wanting to invest in the German logistics sector or consider setting up a local branch. About 70% of Germany's foreign trade and related goods and freight traffic takes place within Europe. The major European trading partners include France (with imports and exports of €170 billion (USD 185.90 bn) and the Netherlands (with exports of USD 167 billion (USD 182.62 billion)). The biggest destination for logistics outside Europe is Asia, followed by America. Many companies are opening warehouses to expand their business in Germany.

- For instance, in June 2023, GXO announced its plans to "deepen" its presence in Germany. As a first step, GXO will construct a new 587,000-square-foot warehouse in the Dormagen area to showcase its cutting-edge warehousing solutions. GXO has only six warehouses in Germany, compared with 700 in Europe and the United Kingdom and 300 in North America.

- For instance, In July 2023, Geopost and JD Logistics announced a strategic partnership to strengthen global logistics capabilities. By combining JDL's strong warehousing network with Geopost's logistics delivery capabilities, this partnership will expand international express services from China to Europe, providing consumers and businesses with high-quality express logistics solutions. JDL and Geoopost will create seamless C2C (direct-to-consumer) and B2C (business-to-consumer) shipping solutions from China to Europe in both directions. This new partnership will provide comprehensive end-to-end shipment tracking and delivery, with a convenient 'one-stop' express delivery service that includes doorstep delivery and dedicated customer support, as well as state-of-the-art digital tracking throughout the logistics process.

Europe Contract Logistics Market Trends

Outsourced Contract Logistics Market to Register Significant Growth

The outsourcing share of contract logistics is low, showing clear growth potential. Globally, the share of contract logistics in the total market is only 10-15%. In Europe, this proportion is estimated at around 20%. The extent of outsourcing varies greatly from country to country. Transportation and storage services are generally outsourced to a large extent.

E-commerce is expected to be a major driver of outsourcing growth. As the e-commerce market grows rapidly, so do consumer expectations for faster and more reliable delivery. As a result, outsourcing of warehousing and order processing is expected to increase. Contract logistics offers e-commerce companies of all sizes the following benefits: Business manageability, advanced technology solutions, risk mitigation, and scalability.

Contract logistics companies provide services to online businesses and help enter new markets by making good use of global networks. They also help move closer to customers by offering a choice of delivery options, taking care of customs and value-added tax (VAT) services, and more.

Contract logistics companies offer specialized services for businesses that manufacture consumer electronics, telecommunications devices, computer equipment, or other high-tech products. They help these businesses reduce inventory, lower distribution costs, and launch new products.

United Kingdom is dominating the region

The United Kingdom is the third biggest e-commerce market globally after China and the United States.

The United Kingdom is on track to become a digital economy as online shopping and online payments soar. The UK E-commerce market is one of Europe's largest and fastest-growing. In 2023, UK households are expected to spend approximately GBP 120 billion (USD 152.54 billion) on e-commerce, growing at an annual rate of 8.8%.

Retail e-commerce is one of the fastest-growing retail trends in the world. Over the past decade, online shopping has become the UK's most popular retail channel. While e-commerce sites have existed for decades, they've only recently started to gain traction. The growth of online shopping in the UK has been staggering to keep up with global trends. As a result, there's a huge demand for contract logistics services.

In November 2023, EV Cargo invested in technology-driven supply chains and built a distribution network with a world-leading control tower system. EV Cargo, a global freight forwarding company and global supply chain services provider, has won new UK contracts for three new customers in road freight and warehousing, as well as contract logistics. EV Cargo has completed a strategic resource review of its UK fleet in response to wider market conditions that have affected the UK logistics industry over the past three years. The company has incorporated technology to drive efficiencies and improve agility.

Europe Contract Logistics Industry Overview

The prominent players in the market include Deutsche Post DHL Group, Schenker AG (DB Schenker), Ceva Logistics, DSV AS, and SNCF Logistics/Geodis. These players based in Europe have a significant presence across the world. Even though these major players have a strong footprint across the region and account for significant market share, the market is still fragmented to some extent, with many players providing contract logistics services at different levels.

It is necessary for companies to make sure they are constantly evolving to match the industry trends. This is likely to help them gain a stronger foothold by attracting new customers.

Most major companies are based out of the Western European region. The number of local contract logistics providers in the CEE region is comparatively lower. This is an opportunity for the existing local logistics players in the CEE region to enter the contract logistics market and gain significant market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increased Outsourcing of Services

- 4.2.1.2 Increasing Demand For Contract Logistics In Italy, France, And Poland

- 4.2.2 Restraints

- 4.2.2.1 Increasing Competition In The European Contract Logistics Market

- 4.2.2.2 Regulatory Compliance

- 4.2.3 Opportunities

- 4.2.3.1 Pooled Warehousing

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Technological Trends

- 4.7 Insights into the E-commerce Industry in the Region (Domestic and Cross-border)

- 4.8 Insights into Contract Logistics in the Context of After-sales/Reverse Logistics

- 4.9 Brief on Different Services Provided by Contract Logistics Players (Integrated Warehousing and Transportation, Supply Chain Services, and Other Value-added Services)

- 4.10 Spotlight on Freight Transportation Costs/Freight Rates

- 4.11 Insights into Effects of Brexit on the European Logistics Industry

- 4.12 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Industrial Machinery and Automotive

- 5.1.2 Food and Beverage

- 5.1.3 Construction

- 5.1.4 Chemicals

- 5.1.5 Other Consumer Goods

- 5.1.6 Other End Users

- 5.2 By Country

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 Netherlands

- 5.2.4 France

- 5.2.5 Italy

- 5.2.6 Spain

- 5.2.7 Poland

- 5.2.8 Belgium

- 5.2.9 Sweden

- 5.2.10 Rest of the Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles (including Merger and Acquisition, Joint Ventures, Collaborations, and Agreements)

- 6.2.1 Deutsche Post DHL Group

- 6.2.2 XPO Logistics

- 6.2.3 Schenker AG (DB Schenker)

- 6.2.4 CEVA Logistics

- 6.2.5 SNCF Logistics/Geodis

- 6.2.6 DSV AS

- 6.2.7 Neovia Logistics Services

- 6.2.8 GEFCO SA

- 6.2.9 United Parcel Service Inc. (UPS Supply Chain Solutions)

- 6.2.10 Rhenus SE & Co. KG

- 6.2.11 Bertelsmann SE & Co. KGaA (Arvato)

- 6.2.12 FIEGE Logistik Stiftung & Co. KG*

- 6.3 Other Companies (Key Information/Overview)

- 6.3.1 Expeditors International, United Parcel Service Inc., Bollore Logistics, Hellmann Worldwide Logistics GmbH & Co. KG, Agility Logistics Pvt. Ltd, H. Essers NV, Wincanton PLC*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 GDP Distribution by Activity for Key Countries

- 8.2 Insights into Capital Flows

- 8.3 External Trade Statistics - Export and Import by Product

- 8.4 Insights into Key Export Destinations of Europe

- 8.5 Insights into Key Import Origins of Europe