|

시장보고서

상품코드

1687875

APAC의 계약 물류 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)APAC Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

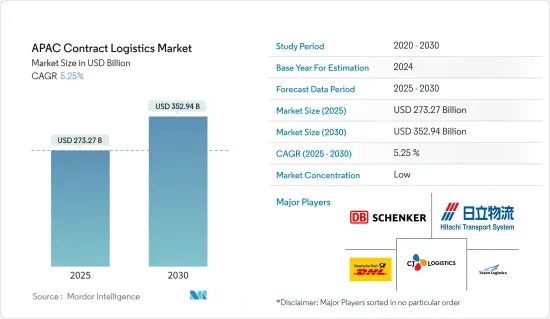

아시아태평양의 계약 물류 시장 규모는 2025년에 2,732억 7,000만 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 5.25%로 성장할 전망이며, 2030년에는 3,529억 4,000만 달러에 달할 것으로 예측됩니다.

이 지역이 경제 불안의 폭풍을 극복하는 능력을 갖추고 있다는 것은 보다 안정을 요구하는 투자자나 기업에게 바람직한 목적지로서의 지위를 강화하고 있습니다. 지역경제 통합을 강화하고 더 큰 시장 접근을 제공하는 아세안 주도의 지역포괄적 경제동반자 협정은 2022년 1월 발효돼 경제성장에 박차를 가하는 동시에 아세안 국가들이 최근의 역병에서 회복하는 데 도움이 될 것으로 보입니다.

아시아태평양은 그 신속한 경제 개발과 활발한 비즈니스 환경에 의해 이 시장에서 가장 급속하게 지반을 굳히고 있는 지역입니다. 아시아태평양은 유럽을 제치고 계약 물류 세계 시장 1위에 올랐습니다. 이 지역 성장의 원동력이 되고 있는 것은 견조한 경기 확대, 소매업 제정률 상승, 가처분 소득 증가입니다.

2022년 중국은 7년 연속 세계 최대의 물류 시장 자리를 차지했으며, 이 나라 물류 산업으로부터 12조 7,000억 위안(약 1조 8,300억 달러)의 수익을 올렸습니다. 이 나라의 인프라는 중국 정부로부터 고액의 자금에 의해 개발되고 있습니다. 중국은 '일대일로' 구상의 실행으로 가까운 미래에 물류 및 운송 부문의 세계적 리더가 될 전망입니다. : 2022년, 2023년 아시아 신흥국의 GDP 성장률은 각각 5.2%, 5.3%에 달했습니다.

그러나 회복 속도는 하위 지역에 따라 다릅니다. 또한 경제 내수는 특히 남아시아에서는 팬데믹 이전의 동향을 아직 따라잡고 있으며, 이것이 지역의 성장을 뒷받침하고 있습니다. 남아시아의 성장률은 2022년에도 7.0%로 견조하였으며, 2023년에는 7.4%로 급상승했습니다. 동아시아의 성장률은 2023년에는 4.5%로 정상화되었습니다.

아시아태평양의 계약 물류 시장 동향

제조업과 자동차 부문 수요가 계약 물류 서비스 견인

아시아태평양은 세계 제조업의 중심지 중 하나이며 세계 제조업 생산량의 약 48.5%를 차지하고 있습니다. 오늘날 세계 여러 나라가 인더스트리 4.0의 성장을 뒷받침하기 위해 선진적 제조 능력을 구축하고 있습니다. 인더스트리 4.0은 세계 제조업체들이 제품을 생산하고 유통시키는 방식에 혁명을 가져오고 있습니다. AI, 클라우드 컴퓨팅, 분석, AI, 기계 학습은 사업에 도입하려는 주요 기업의 기술 중 일부에 불과합니다.

2022년 중국은 약 9조 8,800억 달러 상당의 화물 수송용 자동차를 수출해, 약 50.57%의 성장을 나타냈습니다. 베트남은 또한 지역의 중심성, 높은 시장 통합성, 낮은 생산 비용으로 인해 제조업체에 점점 더 매력적인 시장이 되고 있습니다. Samsung, Apple, Nintendo, LG, 파나소닉, Intel은 모두 베트남에 거점을 두고 있습니다. 베트남은 또, 전자 분야를 옹립하는 것으로부터, 자국을 중견 기업에 있어서 매력적인 시장으로서 자리매김해 밸류 체인의 진전을 도모하고 있습니다.

NBS에 따르면 2023년 3월 중국의 공업생산고는 전년 동기 대비 3.9% 증가했으며 COVID-19 유통기간 이후의 국가 경제 회복의 소폭 개선을 나타냈습니다. 부가 가치 공업 생산고는 전년 동기 대비 3% 증가해, 전기대비로 0.3 포인트 증가했습니다. 2022년의 중국 자동차 제조업체의 생산 대수는 전년 동기 대비 3.4% 증가한 2,702만 대, 판매 대수는 전년 동기 대비 2.1% 증가의 2,686만 대가 되었습니다. 중국은 세계에서 가장 매력적인 제조 거점으로서의 지위를 굳히고 있고, 태국은 비용 프로파일 개선의 혜택을 받고 있습니다.

중국이 계약 물류 시장 견인

중국의 고객 수요가 증가함에 따라 기업은보다 선진적인 물류 채널을 구축해야 합니다. 그것은 더 나은 보안과 핸들링을 포함한 로지스틱스 관리를 필요로 하는 높은 가격의 소비재와 신선 식품에 대한 수요 증가에 의한 것입니다. 이는 향후 몇 년간 중국과 신흥 경제국의 하이엔드 서비스 수요가 크게 증가하는 것을 가리키는 이러한 경제의 보다 중대한 변화 중 하나에 불과합니다.

중국은 아시아태평양의 계약 물류 시장을 선도할 것으로 예상됩니다. 중국의 계약 물류 시장은 꾸준히 성장하고 있습니다. 따라서 제품 및 서비스 제공 확대, 보다 효율적인 네트워크 필요성, 변동 비용 억제 필요성 등 이 부문에 새로운 과제가 생겨나고 있습니다.

중국의 계약 물류 시장은 주로 소비자 소매, 자동차, 의약품, 전자기기 등의 산업에 집중하고 있으며, 소비자 소매 산업이 약 50%를 차지하고 있습니다.

2023년 2월 전자상거래 선도인 Alibaba Group Holding의 물류 부문인 Cainiao Network는 독일의 주요 택배 회사인 Deutschlandpost DHL 그룹과 폴란드에서 가장 광범위한 소포 로커 네트워크를 구축하기 위한 새로운 합의를 발표했습니다. 독일 포스트 전자상거래 그룹의 일부인 Deutsche Post ECommerce Solutions와의 합의는 중국의 선도적인 기술 기업들에게 유럽에서 가장 빠르게 성장하는 전자상거래 시장에 대한 발판이 될 것입니다. 이 계약에 따르면 Deutsche Post ECommerce Group(DHL)과 Cainiao Network(Alibaba Group Holding의 물류 부문)는 폴란드 전역에서 소포 로커 건설에 6,000만 유로(6,475만 달러)를 공동으로 투자합니다. 양사는 기존 네트워크를 결합하여 소비자가 택배 사물함을 더 편리하게 사용할 수 있도록 현대적이고 사용하기 쉬운 인터페이스를 갖춘 택배 사물함을 중요한 장소에 설치합니다. 폴란드의 DHL 택배 숍 네트워크는 이미 1,200곳에 이르고 있으며, DHL 택배 사물함은 지난 3년간 품질과 속도가 3배 향상되었습니다.

아시아태평양의 계약 물류 산업 개요

아시아태평양의 계약 물류 시장은 세분화되어 있으며, 대형 국제 기업과 현지 기업이 혼재하고 있습니다. 인도네시아와 필리핀처럼 이 지역의 일부 국가는 완만하게 성장하고 있으며, 많은 현지 기업과 몇몇 대형 국제 기업이 존재합니다. 그러나 싱가포르, 베트남, 태국은 국제적인 참가 기업이 다수 존재하는 경쟁이 치열한 시장입니다. 기업은 항상 비용의 최소화와 경영 효율의 최적화를 강요받고 있습니다. 투자의 시프트 및 세계 공급망의 다양화에 수반해, 국제적인 투자가는 아시아태평양 물류 시장에 있어서 M&A에 대한 관심을 높이고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 역학 및 인사이트

- 시장 개요

- 시장 역학

- 성장 촉진요인

- 전자상거래 성장

- 세계 무역 및 공급망 회복력

- 성장 억제요인

- 높은 초기 투자

- 기회

- 국경을 넘은 전자상거래

- 성장 촉진요인

- 산업의 매력-Porter's Five Forces 분석

- 신규 참가업체의 위협

- 대체품의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 경쟁 기업간 경쟁 관계의 강도

- 밸류체인 및 공급망 분석

- 정부 규제 및 대처

- 기술 동향

- 역내의 전자상거래 산업(국내 및 국외)에 대한 인사이트

- 애프터 판매 및 역물류의 계약 물류 인사이트

- 계약 물류 참가 기업이 제공하는 각종 서비스(종합 창고 및 수송, 공급망 서비스, 기타 부가가치 서비스) 개요

- 주요 루트의 화물 운송 비용 및 운임에 관한 스포트라이트

- 화물 수송 코리도 개요

- 주요 경제특구(SEZ) 및 제조 거점에 대한 인사이트

- COVID-19가 시장에 미치는 영향

제5장 시장 세분화

- 유형별

- 인소싱

- 아웃소싱

- 최종 사용자별

- 제조 및 자동차

- 소비재 및 소매

- 하이테크

- 의료 의약품

- 기타

- 국가별

- 중국

- 인도

- 일본

- 한국

- 호주

- 싱가포르

- 말레이시아

- 인도네시아

- 태국

- 기타 아시아태평양

제6장 경쟁 구도

- 기업 프로파일

- Deutsche Post DHL Group

- DB Schenker

- Ceva Logistics

- United Parcel Services Inc.

- Logisteed Ltd

- CJ Logistics

- Nippon Express Co. Ltd

- Toll Group

- Nippon Express Co. Ltd

- Yusen Logistics Co. Ltd*

- 기타 기업(주요정보 및 개요)

- Hellmann Worldwide Logistics, SFHolding Co. Ltd, Kerry Logistics Network Limited, Yamato holdings Co. Ltd, Leschaco Japan KK, Agility Logistics Ltd, Rhenus Logistics, GAC, Geodis, Linc Group, BCR Australia Pty Ltd, Silk Contract Logistics, DSV A/S*

제7장 시장 기회 및 향후 동향

제8장 부록

- GDP 분포, 활동별, 지역별

- 자본 이동에 관한 인사이트

- 대외무역 통계-주요국 수출입(품목별)

- 주요국의 주요 수출처에 대한 인사이트

- 주요국의 주요 수입 원산지에 관한 인사이트

The APAC Contract Logistics Market size is estimated at USD 273.27 billion in 2025, and is expected to reach USD 352.94 billion by 2030, at a CAGR of 5.25% during the forecast period (2025-2030).

The region's ability to weather the storm of economic instability strengthens its position as a preferred destination for investors and companies looking for more stability. Enhancing regional economic integration and providing access to a larger market, the ASEAN-led Regional Comprehensive Economic Partnership Agreement, taking effect in January 2022, would help the ASEAN countries recover from the recent epidemic while spurring economic growth.

Asia-Pacific is the area that is gaining ground the fastest in this market due to its quick economic development and thriving business climate. Asia-Pacific has eclipsed Europe to take the top spot in the global market for contract logistics. The region's growth is fueled by robust economic expansion, rising retail enactment, and increasing disposable income.

For the seventh year in a row, China held the title of largest logistics market in the world in 2022, generating a revenue of CNY 12.7 trillion (about USD 1.83 trillion) from the country's logistics industry. The country's infrastructure is being developed with significant funding from the Chinese government. China will soon become the global leader in the logistics and transportation sectors thanks to the Belt and Road Initiative's execution: 5.2% and 5.3% of the region's GDP growth in emerging Asia in 2022 and 2023, respectively.

However, the rate of recovery differs amongst subregions. However, domestic demand in economies is still catching up to their pre-pandemic trend, particularly in South Asia, which supports regional growth. Growth in South Asia remained robust in 2022 at 7.0% before soaring to 7.4% in 2023. The growth rates in East Asia are normalized at 4.5% in 2023.

APAC Contract Logistics Market Trends

Demand From The Manufacturing And Automotive Sector Is Driving The Contract Logistics Services

Asia-Pacific is one of the world's manufacturing hubs, accounting for almost 48.5% of global manufacturing output. Today, more countries worldwide are building advanced manufacturing capabilities to support Industry 4.0 growth. Industry 4.0 is revolutionizing the way global manufacturers produce and distribute their products. AI, cloud computing, analytics, AI, and machine learning are just a few technologies leading businesses looking to incorporate into their operations.

In 2022, China exported around USD 9.88 trillion worth of motor vehicles for transporting goods, representing a growth of about 50.57%. Vietnam has also become an increasingly attractive market for manufacturers due to the country's regional centrality, high market integration, and low production costs. Samsung, Apple, Nintendo, LG, Panasonic, and Intel are all based in Vietnam. Vietnam is also making progress in the value chain by positioning itself as an attractive market for mid-tech due to its electronic sector.

In March 2023, China's industrial output increased by 3.9% YoY in the first quarter of 2023, according to the NBS, indicating a slight improvement in the country's economic recovery in the wake of the COVID-19 pandemic. Value-added industrial output grew by 3% Y-o-Y, representing a YoY increase of 0.3 percentage points compared to the previous quarter. In 2022, Chinese car manufacturers produced 27.02 million units, an increase of 3.4% YoY, while sales rose 2.1% Y-o-Y to 26.86 million. China is consolidating its position as the world's most attractive manufacturing hub, while Thailand benefits from cost profile improvements.

China Is Leading The Way In The Contract Logistics Market

Companies are pressed to create more advanced distribution channels as customer demand in China grows. It is due to the increased demand for higher-priced consumer goods and perishable foods that require logistics management, including better security and handling. It is only one of the more profound changes in these economies that point to a significant growth in the demand for high-end services in China and developing countries over the next few years.

China is expected to lead the Asia-Pacific contract logistics market. The contract logistics market in China is growing steadily. This has created new challenges for the sector, such as the need to expand product and service offerings, the need for more efficient networks, and the need to control variable costs.

The Chinese contract logistics market is mainly concentrated in consumer retail, automotive, medicine, electronics, and other industries, with the consumer retail industry making up about 50%.

In February 2023, Cainiao Network, a logistics arm of e-commerce giant Alibaba Group Holding, announced a new agreement to build Poland's most extensive parcel locker network with German courier giant Deutschlandpost DHL Group. The agreement with Deutsche Post ECommerce Solutions, a Deutsche Post E-commerce Group division, provides a foothold for the Chinese technology giant into one of Europe's fastest-growing e-commerce markets. According to the agreement, Deutsche Post ECommerce Group (DHL) and Cainiao Network (the logistics arm of Alibaba Group Holding) will jointly invest EUR 60 million (USD 64.75 million) in the construction of parcel lockers throughout Poland. The two companies will combine their existing networks to provide consumers with more convenient access to parcel lockers, which will be installed at critical locations with modern, easy-to-use interfaces. DHL's parcel shop network in Poland has already reached 1,200 locations, and DHL's parcel lockers have tripled in quality and speed in the past three years.

APAC Contract Logistics Industry Overview

The Asia-Pacific Contract logistics market is fragmented, with a mix of major international and local companies. Some of the countries in the region, like Indonesia and the Philippines, are moderately growing, with many local players and some major international players. However, Singapore, Vietnam, and Thailand are highly competitive markets, with the presence of a large number of international players. Companies are constantly under pressure to minimize costs and optimize operational efficiency. In the wake of investment shifts and diversification of global supply chains, international investors are increasingly interested in mergers and acquisitions in the APAC logistics market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 E-commerce Growth

- 4.2.1.2 Global Trade and Supply Chain Resilience

- 4.2.2 Restraints

- 4.2.2.1 High Initial Investment

- 4.2.3 Opportunities

- 4.2.3.1 Cross-Border E-commerce

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Threat of Substitute Products

- 4.3.3 Bargaining Power of Buyers/Consumers

- 4.3.4 Bargaining Power of Suppliers

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Technological Trends

- 4.7 Insights into E-Commerce Industry in the Region (Domestic and Cross-Border)

- 4.8 Insights into Contract Logistics in the Context of After-Sales/Reverse Logistics

- 4.9 Brief on Different Services Provided by Contract Logistics Players (Integrated Warehousing and Transportation, Supply Chain Services, and Other Value-added Services)

- 4.10 Spotlight on Freight Transportation Costs/Freight Rates for Key Routes

- 4.11 Brief on Freight Transport Corridors

- 4.12 Insights into Key Special Economic Zones (SEZs) and Manufacturing Hubs

- 4.13 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Insourced

- 5.1.2 Outsourced

- 5.2 By End User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Consumer Goods and Retail

- 5.2.3 High-Tech

- 5.2.4 Healthcare and Pharmaceuticals

- 5.2.5 Other End Users

- 5.3 By Country

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Australia

- 5.3.6 Singapore

- 5.3.7 Malaysia

- 5.3.8 Indonesia

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration, Major Players)

- 6.2 Company Profiles

- 6.2.1 Deutsche Post DHL Group

- 6.2.2 DB Schenker

- 6.2.3 Ceva Logistics

- 6.2.4 United Parcel Services Inc.

- 6.2.5 Logisteed Ltd

- 6.2.6 CJ Logistics

- 6.2.7 Nippon Express Co. Ltd

- 6.2.8 Toll Group

- 6.2.9 Nippon Express Co. Ltd

- 6.2.10 Yusen Logistics Co. Ltd*

- 6.3 Other companies (Key Information/Overview)

- 6.3.1 Hellmann Worldwide Logistics, S.F.Holding Co. Ltd, Kerry Logistics Network Limited, Yamato holdings Co. Ltd, Leschaco Japan K.K., Agility Logistics Ltd, Rhenus Logistics, GAC, Geodis, Linc Group, BCR Australia Pty Ltd, Silk Contract Logistics, DSV A/S*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 GDP Distribution, By Activity and By Region

- 8.2 Insights on Capital Flows

- 8.3 External Trade Statistics - Export and Import, By Product For Key Countries

- 8.4 Insights on Key Export Destinations of Key Countries

- 8.5 Insight on Key Import Origins of Key Countries