|

시장보고서

상품코드

1687917

유럽의 항공우주 및 방위 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

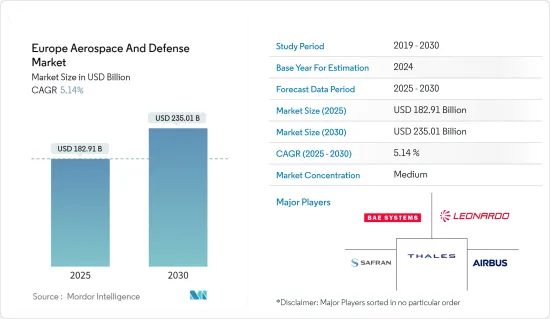

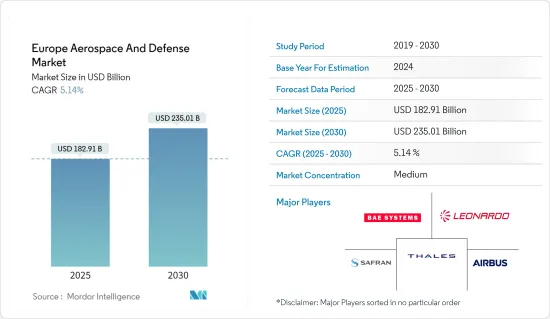

유럽의 항공우주 및 방위 시장 규모는 2025년에 1,829억 1,000만 달러로 추정되고, 예측 기간 2025년부터 2030년까지 CAGR 5.14%로 성장할 전망이며, 2030년에는 2,350억 1,000만 달러에 도달할 것으로 예측됩니다.

유럽 시장은 주로 새로운 위협에 대항하기 위한 군의 조달과 업그레이드 활동에 의해 성장할 것으로 예상됩니다. 유럽 국가의 군는 공군기와 해군기 등 여러 항공기를 사용합니다. 러시아, 우크라이나 및 중동에서 국제 분쟁이 증가하고 있기 때문에 유럽 각국은 이러한 분쟁으로 인한 잠재적 문제를 해결할 준비를 진행하고 있습니다. 그 결과 기존 항공기 업그레이드와 효율적인 기술을 탑재한 새로운 항공기 구입에 많은 투자가 이루어지고 있습니다.

유럽 항공우주 및 방위 시장은 기술의 급속한 진보로 혁명적인 변화를 이루고 있습니다. 인공지능(AI), 첨단 소재, 3D 프린팅, 자율형 무인 시스템 등 최첨단 기술 혁신이 업계를 재구축하고 있습니다. BAE Systems PLC, Dassault Aviation SA, Fincantieri SpA, GKN Aerospace, Leonardo SpA 등 기업이 최전선에 서서 차세대 항공기의 선구자가 되는 연구개발에 많은 투자를 하고 있습니다. AI와 첨단 소재를 도입함으로써 유인 플랫폼의 성능이 향상되고 무인 시스템 수요가 높아집니다.

항공우주 및 방위 산업은 큰 성장을 이루려고 하는 반면 공급망의 취약성이라는 어려운 과제에 직면하고 있습니다. COVID-19 팬데믹이 생산과 물류에 미치는 영향에서도 분명히 알 수 있듯이 업계 공급망은 세계에서 복잡하기 때문에 혼란에 민감합니다. 이러한 공급망의 탄력성을 확보하는 것은 일관된 운영을 유지하고 방위 계획의 요구를 충족시키는 데 매우 중요합니다. 마찬가지로 적어도 유럽 시장에서의 반도체 선박 부족은 2024년까지 지속되었습니다. 그러나 유럽에서는 기술 변화, 노동력 부족, 공장 화재, 사이버 공격 등에 대처하면서 독자적인 공장을 건설하고 대만에서 생산 시프트를 진행하고 있습니다. 이러한 요인은 예측 기간 동안 유럽 시장 수요를 촉진할 것으로 예상됩니다.

유럽의 항공우주 및 방위 시장 동향

상용 및 일반 항공기 분야가 예측 기간 중 가장 높은 시장 성장을 이룰 전망

COVID-19 팬데믹 이후 유럽 전역에서 항공 여객 수가 크게 증가하고 대부분의 국가에서 팬데믹 전 항공 여객 수에 도달하여 이를 초과합니다. 2023년 1-9월의 유럽연합(EU) 전체의 여객 수송량은 약 7억 4,900만 명으로, 2022년 대비 21% 증가했습니다. 동기간에 있어서 EU역 외로의 국제수송은 EU전체 여객수의 48.5%를 차지했고, EU역내의 국제수송 및 국내수송의 점유율은 각각 약 36.2%와 15.3%였습니다.

그 후, 유럽 각국의 항공사는 새로운 민간 항공기를 주문하고 있으며, 일부 항공사는 증가하는 승객 수에 대응하기 위해 기존 항공기를 업그레이드하고 있습니다. 이 지역 전체에서는 2023년의 민간 항공기 납입수는 약 324기로 2022년의 납품수에 비해 17% 증가했습니다. 2023년 10월에 발표된 국제 에어라인 그룹(IAG)의 20대 와이드 바디 제트기 주문 계획에는 영국에서 브리티시 에어웨이즈가 운항하는 B777형기의 일부를 대체하는 것이 포함됩니다. 또한 루프트한자는 2023년 12월 B737-8 MAX 40대와 A220-300 40대를 포함한 고효율의 중단거리 노선용 항공기 80대를 새로 주문했습니다. 이들은 2026년부터 2032년까지 납품될 예정입니다.

2023년 비즈니스 항공 회복은 2020년과 2021년에 비해 지속적이었습니다. HNWI의 급증은 지역 시장에서 비즈니스 제트 부문을 뒷받침할 것으로 예상되며 2024년부터 2030년까지 약 1,120대가 납품될 전망입니다. 2023년 유럽의 UHNWI 수는 2022년 대비 1.8% 증가했습니다. 이는 유로존의 유틸리티, 하이테크 주식, 고급품업계가 호조를 보이고 견조한 성장세를 기록했기 때문입니다. 납품 실적에서는 2017년부터 2023년에 걸쳐 대형 제트기 부문이 52%의 점유율로 유럽 시장을 석권한 다음 소형 제트기가 35%, 중형 제트기가 13%의 점유율을 차지했습니다.

그 일환으로 여러 헬리콥터가 여러 지역에서 취항합니다. 보다 깨끗한 에너지로의 전환이 진행되는 가운데, 풍력에너지는 에너지 위기를 타개하는 유력한 선택이 되고 있습니다. 이와 같이 유럽 각국에서 헬리콥터 서비스 수요가 높아지고 있기 때문에 민간 헬리콥터 수요가 높아지고 있습니다. 에어버스 헬리콥터스는 2022년 3월에 H160의 증산을 발표하고 있으며, 러시아의 헬리콥터 서비스 회사가 수요 리스트의 톱이 될 것으로 예상되고 있습니다. 그러나 러시아와 우크라이나 전쟁으로 인해 러시아는 세계 기타 지역으로부터 큰 경제 제재를 받고 있으며, 러시아는 에어 버스의 생산 정지를 강요할 가능성이 높을 것으로 예상됩니다. 이러한 조달 및 개발 요인은 예측 기간 중 시장 수요를 촉진할 것으로 예상됩니다.

예측기간 중 시장 성장이 기대되는 독일

상업 부문에서는 독일의 항공우주 및 방위 시장에 대한 수요가 주로 항공 교통량 증가에 의해 부추겨지고, 이에 비례하여 새로운 항공기의 납품 수요가 창출됩니다. 예를 들어, 2023년에 독일의 모든 공항에서 처리된 여객수는 1억 5,200만 명으로, 1억 2,700만 명이었던 2022년에 비해 19%의 성장이었습니다. 이 데이터는 항공 여객 수 증가를 돋보이게 합니다. 이러한 증가 추세에 대응하기 위해 많은 항공사가 항공 여객 운송량 증가에 대응하기 위해 새로운 항공기를 주문하고 있습니다. 예를 들어 루프트한자 독일 항공은 2023년 12월 에어버스와 보잉에 대해 2026년부터 2032년까지 80대의 신조항공기를 납품하는 계약을 맺었습니다. 이 계약에서 보잉은 B737 MAX 8을 40기, 에어 버스는 A220-300을 40기 납품합니다. 이 계약에는 B737 MAX 8 60대, A220 20대, 에어 버스 A320 40대 옵션도 포함되어 있습니다.

제너럴 에비에이션 부문에서는 슈퍼 부유층(UHNWI) 증가가 시장 수요에 큰 영향을 미칩니다. 이러한 부유층은 개인 여행 요구를 위해 비즈니스 제트를 선호하며 종종 구입합니다. 그들의 부와 여행 요구가 증가함에 따라 비즈니스 제트 및 기타 개인 항공 서비스에 대한 수요가 증가하고 있습니다. 예를 들어 2023년에는 성장률 1.1%로 UHNWI 인구는 29,021명에 달했고, 전년 28,711명을 웃돌았습니다.

또한 2019년부터 2023년 사이에 82대의 비즈니스 제트가 납품되었습니다. 항공 응급 서비스, 수색 구조 임무, 정부 목적으로 사용되는 헬리콥터의 독일 시장에서 에어버스의 이점은 업계를 선도하는 공급자로서의 지위를 확고하게 하고 있습니다. 2023년 12월 현재, 에어버스 시장 점유율은 61%에 달하여 이러한 중요한 산업의 다양한 요구에 대응하는 능력을 보여주고 있습니다. 에어버스에 이어 유로콥터는 37%의 2위 시장 점유율을 차지합니다. 동기간 중, 이 나라의 헬리콥터 보유수는 255기로, 그 중 121기가 항공 구급 서비스용, 109기가 정부용, 22기가 수색 구조 활동용, 1기가 소방용으로서 배치되고 있었습니다.

군사부문에서는 독일의 군사력을 강화하고 테러리즘 등의 지정학적 위협에 대응하기 위한 국방비 증가가 이 시장의 확대를 뒷받침하고 있습니다. 2023년 국방예산은 668억 달러로, 이 나라는 이 지역에서 3위, 세계에서도 7위의 국방지출국입니다. 러시아와 우크라이나 전쟁으로 독일 정부는 군사력을 위한 특별 기금의 일부로 1,070억 달러를 할당하고 국방비를 국내총생산(GDP)의 2% 이상으로 끌어올릴 계획을 발표했습니다.

독일은 안보 위협이 증가하고 있음을 고려하여 국방 능력에 대한 투자를 크게 확대했습니다. 이 자원 배분 증가는 국가 안보 체제를 강화하기 위해 국가의 행정 부대를 업그레이드하고 강화하는 것을 목표로 합니다. 예를 들어, 2024년 4월 독일은 라인메탈 디펜스 호주에 독일 육군용으로 복서 중전차 123량을 27억 달러로 발주해 2025년부터 납품을 개시했습니다. 마찬가지로 2024년 6월 라인메탈은 독일에서 유탄포탄 20만발(9억 5,700만 달러)공급계약을 획득했습니다. 독일은 우크라이나의 러시아군에 대한 대항을 지원하기 위해 새로 획득한 이 포탄은 독일군의 비축을 보충하게 됩니다.

독일은 또한 위성 제조에 대한 민간 투자를 유치하는 새로운 법을 초안하고 있습니다. 독일은 기술적 이점으로 세계적으로 유명합니다. 따라서, 정비한 법적 틀은 지역 시장 기업이 운영 능력을 강화하고 신흥 우주 경제를 수용할 수 있을지도 모릅니다. 예를 들어, 2019년부터 2023년까지 23개의 위성이 제조되었으며 국내 다양한 사업자들에 의해 발사되었습니다. 가장 많은 위성을 발사한 로켓은 Soyuz-2.1b로 7대 근처의 위성을 탑재한 다음 Falcon 9가 5대의 위성을 발사했습니다. 이러한 개발은 예측 기간 동안 이러한 분야 시장 수요가 긍정적으로 일할 것으로 예상됩니다.

유럽의 항공우주 및 방위 산업 개요

이 시장은 Airbus SE, BAE Systems PLC, Leonardo SpA, Safran SA, THALES 등 세계적 기업이 큰 점유율을 차지하고 반고체화하고 있습니다. 이 지역의 여러 나라에서 지정학적 불안이 높아지고 있는 것은 안보 환경의 신흥화에 기여하고 있으며, 선진적인 항공기, UAV, 위성에 대한 수요가 높아지고 있습니다. 장기 계약을 확보하고 시장 점유율을 향상시키기 위해 기업은 정교한 제품의 연구 개발에 많은 투자를 하고 있습니다. 지속적인 연구 개발은 유럽 항공우주 및 방위 시장에서 플랫폼 및 관련 제품 및 솔루션의 기술적 진보를 촉진하고 있습니다. 예를 들어, 2023년 9월, 에어프랑스는 에어버스와 A350을 50대, 40대의 옵션으로 계약했습니다. 이 주문은 50대의 A350-900 및 A350-1000과 40대의 추가 구매권을 다루는 것으로, 최초 배송은 2026년부터 2030년까지 완료될 예정입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 세분화

- 민간항공 및 일반항공

- 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 시장 동향

- 상용 항공기

- 항공교통

- 훈련 및 비행 시뮬레이터

- 공항 서비스(지상 지원 설비 및 물류)

- 구조물

- 기체

- 재료(복합재료, 금속 및 금속 합금, 기타 재료)

- 접착제 및 코팅

- 엔진 및 엔진 시스템

- 객실내장

- 착륙장치

- 어비오닉스 및 제어 시스템

- 통신 시스템

- 네비게이션 시스템

- 비행 제어 시스템

- 건강 모니터링 시스템

- 전기 시스템

- 환경 제어 시스템

- 연료 및 연료 시스템

- MRO

- 연구개발

- 공급망 분석(설계, 원재료, 제조, 조립, 시험, 인증)

- 경쟁 분석

- 일반항공

- 항공교통

- 훈련 및 비행 시뮬레이터

- 공항 서비스(지상 지원 설비 및 물류)

- 구조물

- 기체

- 재료(복합재료, 금속 및 금속 합금, 기타 재료)

- 접착제와 코팅

- 엔진 및 엔진 시스템

- 객실내장

- 착륙장치

- 어비오닉스 및 제어 시스템

- 통신 시스템

- 네비게이션 시스템

- 비행 제어 시스템

- 건강 모니터링 시스템

- 전기 시스템

- 환경 제어 시스템

- 연료 및 연료 시스템

- MRO

- 연구개발

- 공급망 분석

- 경쟁 분석

- 군용기 및 시스템

- 시장 개요

- 국방 지출 및 예산 배분의 상세

- 육군

- 해군 및 해병대

- 공군

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 시장 동향

- MRO

- 연구개발

- 훈련 및 비행 시뮬레이터

- 경쟁 분석

- 공급망 분석

- 고객 및 대리점 정보

- 전투기

- 구조

- 기체

- 재료(복합재, 금속 및 금속 합금, 기타 재료)

- 접착제 및 코팅

- 엔진 및 엔진 시스템

- 착륙장치

- 어비오닉스 및 제어 시스템

- 일반 아비오닉스

- 미션 전용 아비오닉스

- 미사일 및 무기

- 비전투기

- 구조

- 기체

- 재료(복합재료, 금속 및 금속 합금, 기타 재료)

- 접착제 및 코팅

- 엔진 및 엔진 시스템

- 착륙장치

- 어비오닉스 및 제어 시스템

- 일반 아비오닉스

- 미션 전용 아비오닉스

- 미사일 및 무기

- 무인 항공기 시스템

- 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 시장 동향

- 연구개발

- 경쟁 분석

- 규제 상황 및 향후 정책 변화

- 세분화

- 상업

- 군사

- 우주 시스템 및 기기

- 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 시장 동향

- 연구개발

- 경쟁 분석

- 규제 상황 및 향후 정책 변경

- 고객정보

- 세분화 우주 로켓, 우주선, 지상 시스템

- 세분화 위성

- 서브시스템별

- 커맨드 및 컨트롤 시스템

- 텔레메트리, 트래킹, 커맨드 링, 모니터링(TTCM)

- 안테나 시스템

- 트랜스폰더

- 전력 시스템

- 용도별

- 군사

- 상용

- 지역별

- 영국

- 프랑스

- 독일

- 이탈리아

- 스페인

- 기타 유럽

제5장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Airbus SE

- BAE Systems PLC

- Dassault Aviation SA

- Fincantieri SpA

- GKN Aerospace

- Leonardo SpA

- Naval Group

- QinetiQ Group PLC

- Rheinmetall AG

- Rolls-Royce PLC

- Rostec

- Safran SA

- THALES

- Lockheed Martin Corporation

제6장 시장 기회 및 향후 동향

AJY 25.04.07The Europe Aerospace And Defense Market size is estimated at USD 182.91 billion in 2025, and is expected to reach USD 235.01 billion by 2030, at a CAGR of 5.14% during the forecast period (2025-2030).

The European market is expected to grow primarily due to the armed forces' procurement and upgradation activities to counter emerging threats. Military forces in European countries use multiple aircraft across their Air Force and naval aircraft. Owing to the increasing international conflicts in Russia, Ukraine, and the Middle East, countries in Europe are gearing up to tackle any potential issues arising from such conflicts. As a result, significant investments in upgrading the existing fleet and purchasing a new fleet equipped with efficient technologies have been witnessed over the past year.

The European aerospace and defense market is undergoing a revolutionary shift driven by rapid advancements in technologies. Cutting-edge innovations in artificial intelligence (AI), advanced materials, 3D printing, and autonomous and unmanned systems are reshaping the industry. Companies like BAE Systems PLC, Dassault Aviation SA, Fincantieri SpA, GKN Aerospace, and Leonardo SpA are at the forefront, investing substantially in research and development to usher in the next generation of aircraft. Incorporating AI and advanced materials enhances the performance of manned platforms and promotes high demand for unmanned systems.

While the aerospace and defense industry stands on the cusp of significant growth, it faces formidable challenges in supply chain vulnerabilities. The industry's supply chains, often global and intricate, are susceptible to disruptions, as evidenced by the impact of the COVID-19 pandemic on production and logistics. Ensuring the resilience of these supply chains is crucial for maintaining consistent operations and meeting the demands of defense programs. Similarly, at least semiconductor ship shortages in the European market will continue till 2024. However, Europe is building its own factories and shifting production away from Taiwan while dealing with changing technology, labor shortages, factory fires, and cyber attacks. Such factors are expected to drive demand in the European market during the forecast period.

Europe Aerospace and Defense Market Trends

The Commercial and General Aviation Aircraft Segment is Expected to Witness the Highest Market Growth During the Forecast Period

There has been a tremendous increase in air passenger traffic across Europe after the COVID-19 pandemic, and most countries have reached and exceeded their pre-pandemic air passenger numbers. In the first nine months of 2023, passenger traffic across the European Union was around 749 million, a 21% growth compared to 2022. International extra-EU transport accounted for 48.5% of all passengers across the European Union in the same period, while international intra-EU and national transport shares were around 36.2% and 15.3%, respectively.

Subsequently, airlines across European countries are ordering new commercial aircraft, and some are upgrading their existing fleet to serve the increasing number of passengers. Across the region, the number of commercial aircraft deliveries in 2023 was around 324, a 17% increase compared to the deliveries in 2022. Some ongoing and future commercial aircraft orders include the plans of International Airlines Group (IAG), announced in October 2023, to order 20 widebody jets to replace some of the B777s operated by British Airways in the United Kingdom. Additionally, in December 2023, Lufthansa ordered 80 new highly efficient short-and medium-haul aircraft, including 40 B737-8 MAX and 40 A220-300s, with an option of 120 aircraft. These will be delivered from 2026 to 2032.

The recovery of business aviation in 2023 was more sustained compared to 2020 and 2021. The surge in HNWI individuals is expected to aid the business jet segment in the regional market, and around 1,120 aircraft are expected to be delivered between 2024 and 2030. In 2023, the number of UHNWIs in Europe increased by 1.8% compared to 2022. This was because the Eurozone utilities, tech stocks, and luxury goods industries performed well, registering solid gains. In terms of deliveries, during 2017-2023, the large jet segment dominated the European market with a 52% share, followed by light and mid-size jets accounting for shares of 35% and 13%, respectively.

As part of this, several helicopters have been introduced into service in different geographical places. With the increasing transition toward cleaner energy, wind energy has become a viable alternative to the energy crisis, owing to which several countries have been investing in developing offshore wind farms to harvest electricity from winds. This increasing demand for helicopter services across European countries prompts the requirement for civil helicopters. Some of the procurements include Airbus Helicopters, which, in March 2022, announced the ramp-up of H160 production, with Russian helicopter service companies expected to top the demand list. However, the Russia-Ukraine war has led to significant economic sanctions on Russia from the rest of the world, and it is expected that Russia would likely force Airbus to halt production. Such procurement and development factors are expected to drive the demand in the market during the forecast period.

Germany Expected to Witness Market Growth During the Forecast Period

In the commercial segment, the demand in the aerospace and defense market in Germany is primarily fueled by increasing air traffic, which proportionally creates demand for new aircraft deliveries. For instance, in 2023, the passengers processed across all German airports accounted for 152 million, with a growth of 19% compared to 2022, which was recorded at 127 million. The data highlights a rise in air passenger traffic. In response to this growing trend, numerous airlines are placing orders for new aircraft to accommodate the increasing air passenger traffic. For instance, in December 2023, Lufthansa awarded contracts to Airbus and Boeing for 80 new aircraft deliveries between 2026 and 2032. Under the contract, Boeing will deliver 40 B737 MAX 8s, and Airbus will deliver 40 A220-300s. The agreement also covers options for 60 B737 MAX 8, 20 A220, and 40 Airbus A320s.

In the general aviation segment, the market demand is significantly influenced by the increasing number of ultra high net worth individuals (UHNWIs). These individuals prefer and often acquire business jets for their private travel needs. As their wealth and travel requirements grow, the demand for business jets and other private aviation services continues to rise. For instance, in 2023, with a growth rate of 1.1%, the UHNWI population reached 29,021 individuals, surpassing the previous year's count of 28,711.

Moreover, during 2019-2023, 82 business jets were delivered. The dominance of Airbus in the German market for helicopters used in air ambulance services, search and rescue missions, and government purposes has solidified its position as the leading provider in the industry. As of December 2023, Airbus commanded an impressive 61% market share, showcasing its ability to meet the diverse needs of these critical industries. Followed by Airbus, Eurocopter held the second-largest market share, amounting to 37%. During the same period, the country's helicopter fleet consisted of 255 helicopters, of which 121 were deployed for air ambulance services, 109 were used by the government, 22 were designated for search and rescue operations, and one for fire service.

In the military segment, the expansion of this market is being propelled by the rising defense expenditures aimed at enhancing Germany's military capabilities and adapting to emerging geopolitical threats such as terrorism. The country was the third-largest defense spender in the region and the seventh-largest globally, with a defense budget of USD 66.8 billion in 2023. Due to the Russia-Ukraine war, the German government announced plans to allocate USD 107 billion as part of a special fund for its military forces and raise its defense spending to over 2% of its gross domestic product (GDP).

Germany has substantially ramped up its defense capability investments, considering growing security threats. This increased allocation of resources is geared toward upgrading and fortifying the nation's administrative forces to bolster the country's security framework. For instance, in April 2024, Germany awarded Rheinmetall Defence Australia a contract to deliver 123 Boxer Heavy Weapon Carrier vehicles for the German Army for USD 2.7 billion, with deliveries starting in 2025. Similarly, in June 2024, Rheinmetall was granted a contract by Germany to supply 200,000 howitzer shells valued at USD 957 million. These newly acquired shells will replenish the German army's stockpiles as Germany supports Ukraine in countering the Russian military forces.

Germany is also drafting new laws to attract private investments in satellite manufacturing. The country is renowned globally for its technical superiority. Thus, a well-formulated legal framework may enable localized market players to enhance their operational capabilities and cater to an emerging space economy. For instance, during 2019-2023, 23 satellites were manufactured and launched by various operators across the country. The launch vehicle that launched the most satellites was Soyuz-2.1b, which carried nearly seven satellites, followed by Falcon 9, which launched five satellites. These developments are anticipated to positively drive market demand in these segments throughout the forecast period.

Europe Aerospace and Defense Industry Overview

The market is semi-consolidated, with several global players, including Airbus SE, BAE Systems PLC, Leonardo SpA, Safran SA, and THALES, occupying a significant market share. The growing geopolitical unrest across several countries in the region contributes to an emerging security environment, with increasing demand for advanced aircraft, UAVs, and satellites. To secure long-term contracts and improve their market share, players are investing significantly in the R&D of sophisticated product offerings. Continuous R&D has fostered technological advancements in platforms and associated products and solutions in the European aerospace and defense market. For instance, in September 2023, Air France sealed a deal with Airbus for 50 A350s, with an option for 40 more. This order will cover 50 A350-900 and A350-1000 aircraft, along with purchase rights for 40 additional aircraft, with the first deliveries expected to be completed in 2026 through 2030.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET SEGMENTATION

- 4.1 Commercial and General Aviation

- 4.1.1 Market Overview

- 4.1.2 Market Dynamics

- 4.1.2.1 Drivers

- 4.1.2.2 Restraints

- 4.1.2.3 Opportunities

- 4.1.3 Market Trends

- 4.1.4 Commercial Aircraft

- 4.1.4.1 Air Traffic

- 4.1.4.2 Training and Flight Simulators

- 4.1.4.3 Airport Services (Ground Support Equipment and Logistics)

- 4.1.4.4 Structures

- 4.1.4.4.1 Airframe

- 4.1.4.4.1.1 Materials (Composite, Metal and Metal Alloys, Other Materials)

- 4.1.4.4.1.2 Adhesives and Coatings

- 4.1.4.4.2 Engine and Engine Systems

- 4.1.4.4.3 Cabin Interiors

- 4.1.4.4.4 Landing Gear

- 4.1.4.4.5 Avionics and Control Systems

- 4.1.4.4.5.1 Communication System

- 4.1.4.4.5.2 Navigation System

- 4.1.4.4.5.3 Flight Control System

- 4.1.4.4.5.4 Health Monitoring System

- 4.1.4.4.6 Electrical Systems

- 4.1.4.4.7 Environmental Control Systems

- 4.1.4.4.8 Fuel and Fuel Systems

- 4.1.4.4.9 MRO

- 4.1.4.4.10 Research and Development

- 4.1.4.4.11 Supply Chain Analysis (Design, Raw Materials, Manufacturing, Assembly, Testing, and Certification)

- 4.1.4.4.12 Competitor Analysis

- 4.1.5 General Aviation (Includes Business Jets, Helicopter, and Personal Aircraft)

- 4.1.5.1 Air Traffic

- 4.1.5.2 Training and Flight Simulators

- 4.1.5.3 Airport Services (Ground Support Equipment and Logistics)

- 4.1.5.4 Structures

- 4.1.5.4.1 Airframe

- 4.1.5.4.1.1 Materials (Composite, Metal and Metal Alloys, Other Materials)

- 4.1.5.4.1.2 Adhesives and Coatings

- 4.1.5.4.2 Engine and Engine Systems

- 4.1.5.4.3 Cabin Interiors

- 4.1.5.4.4 Landing Gear

- 4.1.5.4.5 Avionics and Control Systems

- 4.1.5.4.5.1 Communication System

- 4.1.5.4.5.2 Navigation System

- 4.1.5.4.5.3 Flight Control System

- 4.1.5.4.5.4 Health Monitoring System

- 4.1.5.4.6 Electrical Systems

- 4.1.5.4.7 Environmental Control Systems

- 4.1.5.4.8 Fuel and Fuel Systems

- 4.1.5.4.9 MRO

- 4.1.5.4.10 Research and Development

- 4.1.5.4.11 Supply Chain Analysis

- 4.1.5.4.12 Competitor Analysis

- 4.2 Military Aircraft and Systems

- 4.2.1 Market Overview

- 4.2.2 Defense Spending and Budget Allocation Details

- 4.2.2.1 Army

- 4.2.2.2 Navy and Marine Corps

- 4.2.2.3 Air Force

- 4.2.3 Market Dynamics

- 4.2.3.1 Drivers

- 4.2.3.2 Restraints

- 4.2.3.3 Opportunities

- 4.2.4 Market Trends

- 4.2.5 MRO

- 4.2.6 Research and Development

- 4.2.7 Training and Flight Simulators

- 4.2.8 Competitor Analysis

- 4.2.9 Supply Chain Analysis

- 4.2.10 Customer/Distributor Information

- 4.2.11 Combat Aircraft

- 4.2.11.1 Structures

- 4.2.11.1.1 Airframe

- 4.2.11.1.1.1 Materials (Composite, Metal and Metal Alloys, Other Materials)

- 4.2.11.1.1.2 Adhesives and Coatings

- 4.2.11.1.2 Engine and Engine Systems

- 4.2.11.1.3 Landing Gear

- 4.2.11.2 Avionics and Control Systems

- 4.2.11.2.1 General Avionics

- 4.2.11.2.2 Mission Specific Avionics

- 4.2.11.3 Missiles and Weapons

- 4.2.12 Non-combat Aircraft

- 4.2.12.1 Structures

- 4.2.12.1.1 Airframe

- 4.2.12.1.1.1 Materials (Composite, Metal and Metal Alloys, Other Materials)

- 4.2.12.1.1.2 Adhesives and Coatings

- 4.2.12.1.2 Engine and Engine Systems

- 4.2.12.1.3 Landing Gear

- 4.2.12.2 Avionics and Control Systems

- 4.2.12.2.1 General Avionics

- 4.2.12.2.2 Mission-specific Avionics

- 4.2.12.3 Missiles and Weapons

- 4.3 Unmanned Aerial Systems

- 4.3.1 Market Overview

- 4.3.2 Market Dynamics

- 4.3.2.1 Drivers

- 4.3.2.2 Restraints

- 4.3.2.3 Opportunities

- 4.3.3 Market Trends

- 4.3.4 Research and Development

- 4.3.5 Competitor Analysis

- 4.3.6 Regulatory Landscape and Future Policy Changes

- 4.3.7 Segmentation

- 4.3.7.1 Commercial

- 4.3.7.2 Military

- 4.4 Space Systems and Equipment

- 4.4.1 Market Overview

- 4.4.2 Market Dynamics

- 4.4.2.1 Drivers

- 4.4.2.2 Restraints

- 4.4.2.3 Opportunities

- 4.4.3 Market Trends

- 4.4.4 Research and Development

- 4.4.5 Competitor Analysis

- 4.4.6 Regulatory Landscape and Future Policy Changes

- 4.4.7 Customer Information

- 4.4.8 Segmentation: Space Launch Vehicle, Spacecraft, and Ground Systems

- 4.4.9 Segmentation: Satellites

- 4.4.9.1 By Subsystem

- 4.4.9.1.1 Command and Control System

- 4.4.9.1.2 Telemetry, Tracking, Commanding, and Monitoring (TTCM)

- 4.4.9.1.3 Antenna System

- 4.4.9.1.4 Transponders

- 4.4.9.1.5 Power System

- 4.4.9.2 By Application

- 4.4.9.2.1 Military

- 4.4.9.2.2 Commercial

- 4.5 Geography

- 4.5.1 United Kingdom

- 4.5.2 France

- 4.5.3 Germany

- 4.5.4 Italy

- 4.5.5 Spain

- 4.5.6 Rest of Europe

5 COMPETITIVE LANDSCAPE

- 5.1 Vendor Market Share

- 5.2 Company Profiles

- 5.2.1 Airbus SE

- 5.2.2 BAE Systems PLC

- 5.2.3 Dassault Aviation SA

- 5.2.4 Fincantieri SpA

- 5.2.5 GKN Aerospace

- 5.2.6 Leonardo SpA

- 5.2.7 Naval Group

- 5.2.8 QinetiQ Group PLC

- 5.2.9 Rheinmetall AG

- 5.2.10 Rolls-Royce PLC

- 5.2.11 Rostec

- 5.2.12 Safran SA

- 5.2.13 THALES

- 5.2.14 Lockheed Martin Corporation