|

시장보고서

상품코드

1687977

위성 자세 궤도 제어 시스템(AOCS) 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Satellite Attitude and Orbit Control System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

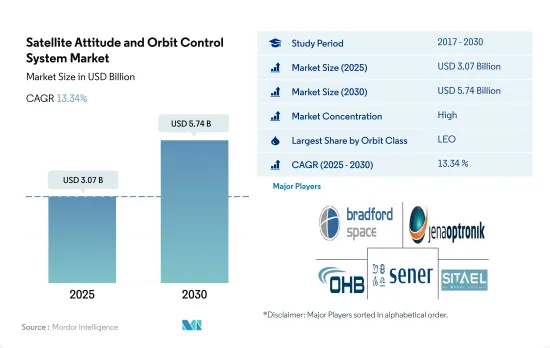

위성 자세 궤도 제어 시스템 시장 규모는 2025년 30억 7,000만 달러로 추정되고, 2030년에는 57억 4,000만 달러에 이를 것으로 예측되며, 예측 기간 2025년부터 2030년까지 CAGR 13.34%로 성장할 전망입니다.

LEO 위성의 급속한 배치 확대가 AOCS 채용률을 끌어올립니다.

- 위성 AOCS 시장은 커뮤니케이션, 네비게이션, 지구관측, 군사 모니터링, 과학 미션에 사용되는 LEO 위성 수요 증가에 견인되어 강력한 성장을 이루고 있습니다. LEO 부문은 세 가지 궤도 클래스 중에서 가장 크고 가장 널리 사용됩니다. 다른 두 궤도 클래스와 비교하면 점유율의 대부분을 차지합니다. 2017년부터 2022년 사이에 전 지역에서 4,100대 이상의 LEO 위성이 주로 통신 목적으로 제조 및 발사되었습니다. 또한, 특히 지역 및 원격지에서 고속 인터넷 접속을 위해 통신 위성의 채용이 증가하고 있기 때문에 AOCS 수요가 증가하고 있습니다. 이를 위해 SpaceX, OneWeb, Amazon 등 주요 기업들은 LEO에 수천 개의 위성 발사를 계획하고 있습니다.

- MEO 위성은 두 번째로 큰 점유율을 차지합니다. MEO 위성은 신호 강도의 향상, 통신 및 데이터 전송 능력의 향상, 커버 영역의 확대 등의 이점이 있기 때문에 군사 분야에서의 이용이 증가하고 있습니다.

- 게다가 GEO 위성에 대한 AOCS의 필요성은 낮은 것, 위성의 자세를 제어하고, 위치를 안정시키고, 태양풍, 자기장, 중력과 같은 외적 요인에 의해 야기되는 모든 외란을 수정하는 등 다양한 작업을 수행함으로써 GEO 위성을 정상적으로 기능시키는 데 중요한 역할을 하고 있습니다. AOCS 시스템 제조업체는 혁신적인 스타 트래커, 반응 휠, 자이로스코프, 자기 토크 등 GEO 위성 플랫폼을 위한 고급 제품을 제공합니다.

다수의 위성 개발과 발사가 시장 개척의 원동력

- 위성 AOCS는 우주 공간에서 위성의 정확한 위치, 안정성 및 자세를 유지하는 데 중요한 역할을 합니다. 이러한 시스템은 위성 미션의 성공을 보장하고 정확한 데이터 수집, 통신 및 지구관측을 가능하게 하기 위해 매우 중요합니다. 세계의 AOCS 시장은 현저한 성장을 이루고 있으며, 북미, 유럽, 아시아태평양이 이 산업의 발전을 견인하는 주요 지역이 되고 있습니다.

- 북미는 세계의 AOCS 시장을 선도하고 있으며 미국이 기술 진보의 최전선에 있습니다. 이 지역은 확립된 항공우주 기업, 연구 기관 및 정부 기관으로 구성된 견고한 우주 산업을 자랑합니다. 북미의 AOCS 시장은 위성 기반 통신, 방위, 과학 미션에 대한 강한 수요를 견인하고 있습니다.

- 유럽의 AOCS 시장은 ESA 회원국과 유럽 연합의 강력한 협력 관계로부터 혜택을 누리고 있습니다. 프랑스, 독일, 영국 등 유럽의 주요 국가는 위성 제조에 강한 존재감을 나타내고 있으며, AOCS 시장의 성장에 공헌하고 있습니다. 이 지역은 스타 트래커, 반응 휠 및 추진기 시스템을 포함한 고급 AOCS 기술 개발에 중점을 둡니다.

- 아시아태평양은 우주 산업의 급속한 확대로 세계 AOCS 시장의 주요 기업으로 부상하고 있습니다. 중국, 인도, 일본 등의 국가들은 우주 탐사, 위성 기술, 국산 제조 능력에 많은 투자를 하고 있습니다. 통신, 원격 감지 및 네비게이션 서비스에 대한 수요가 증가함에 따라 AOCS 시스템 채택을 뒷받침하고 있습니다.

세계의 위성 자세 궤도 제어 시스템 시장 동향

소형 위성이 시장 수요를 창출할 태세

- 우주선의 질량별 분류는 위성을 궤도에 발사하기 위한 로켓의 크기와 비용을 결정하는 주요 지표 중 하나입니다. 북미에서는 2017-2022년 사이에 45기 이상의 대형 위성(북미의 조직이 소유), 80기 이상의 중형 위성(북미의 조직이 운용), 2,900기 이상의 소형 위성(동지역에서 제조)이 발사되었습니다.

- 유럽은 최근 몇 년간 현저한 성장을 이루고 있으며, 주요 요인은 다른 질량의 위성에 대한 수요가 증가하는 것입니다. 위성 질량은 유럽의 위성 제조 시장에 영향을 미치는 가장 중요한 요소 중 하나입니다. 이것은 위성의 유형에 따라 다른 질량이 필요하기 때문에 로켓 시장에 영향을 미칩니다. 2017년부터 2022년까지 총 569대의 위성이 궤도에 투입되었습니다. 그 중 소위성이 451대와 가장 큰 점유율을 차지한 다음 초소형 위성(44대), 대형 위성(37대), 중형 위성(16대), 초소형 위성(7대)으로 이어집니다.

- 최근 아시아태평양에서는 높은 위성 능력에 대한 수요 증가에 대응할 필요성 때문에 위성 제조가 점점 중요한 산업이 되고 있습니다. 아시아태평양에서 생산되는 위성의 질량 범위는 크게 다르며 이는 시장 성장에 영향을 미칩니다. 2017년부터 2022년 사이에 이 지역에서는 130대의 초소형 위성, 75대의 대형 위성, 63대의 초소형 위성, 60대의 중형 위성, 42대의 소형 위성을 포함한 총 370대의 위성이 발사되었습니다.

시장 성장을 가속하는 투자 기회

- 북미에서는 우주 계획을 위한 정부 지출이 2021년에 약 1,030억 달러로 사상 최고를 기록했습니다. 이 지역은 세계 최대의 우주 기관인 NASA의 존재로 인해 우주 혁신과 연구의 진원지가 되고 있습니다. 2022년 미국 정부는 그 우주 프로그램에 약 620억 달러를 지출하여 세계에서 가장 우주 프로그램에 예산을 투입하는 나라가 되었습니다. 예를 들어, 2023년 2월까지 NASA는 연구 보조금으로 3억 3,300만 달러를 분배했습니다. 2022년 미국 정부는 우주 프로그램에 약 620억 달러를 지출하여 우주 산업에 대한 지출액이 세계 제일이 되었습니다.

- 유럽 국가들은 우주 분야에 대한 투자의 중요성을 인식하고 있으며, 세계 우주 산업에서 경쟁력을 유지하기 위해 우주 활동과 혁신에 대한 지출을 늘리고 있습니다. 2022년 11월 ESA는 지구관측에서 유럽의 리드를 유지하고 항법 서비스를 확대하고 미국과의 탐사에서 파트너가 되기 위해 향후 3년간 우주 예산을 25% 증가할 것을 제안했다고 발표했습니다. ESA는 22개국에 2023년부터 2025년까지 약 185억 유로의 예산을 지원하도록 요청했습니다. 독일, 프랑스, 이탈리아가 주요 기여국입니다.

- 아시아태평양에서 우주 관련 활동이 증가하고 있습니다. 2022년 일본 예산안에 따르면 우주 예산은 14억 달러를 넘는데, 이는 H3 로켓, 기술 시험 위성 9호, 정보 수집 위성(IGS) 계획의 개발을 포함합니다. 2022년도 인도의 우주개발 예산안은 18억 3,000만 달러였습니다. 2022년 한국의 과학정보통신부는 인공위성, 로켓 및 기타 주요 우주 장비 제조를 위해 6억 1,900만 달러의 우주 예산을 발표했습니다.

위성 자세 궤도 제어 시스템 산업 개요

위성 자세 궤도 제어 시스템 시장은 상당히 통합되어 있으며 상위 5개사에서 98.09%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Bradford Engineering BV, Jena-Optronik, OHB SE, SENER Group and Sitael SpA(sorted alphabetically).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 위성의 소형화

- 위성 질량

- 우주 개발에 대한 지출

- 규제 프레임워크

- 세계

- 호주

- 브라질

- 캐나다

- 중국

- 프랑스

- 독일

- 인도

- 이란

- 일본

- 뉴질랜드

- 러시아

- 싱가포르

- 한국

- 아랍에미리트(UAE)

- 영국

- 미국

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 용도별

- 통신

- 지구관측

- 네비게이션

- 우주 관측

- 기타

- 위성 질량별

- 10-100kg

- 100-500kg

- 500-1000kg

- 10kg 미만

- 1000kg 이상

- 궤도 클래스별

- GEO

- LEO

- MEO

- 최종 사용자별

- 상업

- 군사 및 정부

- 기타

- 지역별

- 아시아태평양

- 유럽

- 북미

- 세계 기타 지역

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- AAC Clyde Space

- Bradford Engineering BV

- Innovative Solutions in Space BV

- Jena-Optronik

- NewSpace Systems

- OHB SE

- SENER Group

- Sitael SpA

- Thales

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Satellite Attitude and Orbit Control System Market size is estimated at 3.07 billion USD in 2025, and is expected to reach 5.74 billion USD by 2030, growing at a CAGR of 13.34% during the forecast period (2025-2030).

Rapid or increased deployment of LEO satellites driving the adoption rate of AOCS

- The satellite AOCS market is experiencing strong growth, driven by the increasing demand for LEO satellites, which are used for communication, navigation, Earth observation, military surveillance, and scientific missions. The LEO segment is the largest and most widely used among the three orbit classes. It occupies the majority of the share when compared to the other two orbit classes. Between 2017 and 2022, more than 4,100 LEO satellites were manufactured and launched across all the regions, primarily for communication purposes. In addition, the demand for AOCS is increasing because of the increasing adoption of communication satellites for high-speed internet access, particularly in rural and remote areas. This has led companies such as SpaceX, OneWeb, and Amazon to plan the launch of thousands of satellites into LEO.

- MEO satellites constitute the second largest share. The usage of these satellites in the military has increased because of their added advantages, such as increased signal strength, improved communications and data transfer capabilities, and greater coverage area.

- In addition, though the requirement of AOCS for GEO satellites is less, it plays an important role in ensuring the proper functioning of GEO satellites by performing a range of tasks, including controlling the satellite's orientation, stabilizing its position, and correcting any disturbances caused by external factors like solar wind, magnetic fields, and gravity. AOCS system manufacturers provide advanced products for GEO satellite platforms, including innovative star trackers, reaction wheels, gyroscopes, and magnetic torques.

Development and launch of large number of satellites drives the growth of the market

- Satellite AOCS play a vital role in maintaining satellites' precise positioning, stability, and orientation in space. These systems are crucial for ensuring the success of satellite missions, enabling accurate data collection, communication, and Earth observation. The global AOCS market is witnessing significant growth, with North America, Europe, and Asia-Pacific emerging as key regions driving advancements in this industry.

- North America is a leading player in the global AOCS market, with the United States at the forefront of technological advancements. The region boasts a robust space industry comprising established aerospace companies, research institutions, and government agencies. The North American AOCS market is driven by strong demand for satellite-based communication, defense, and scientific missions.

- The European AOCS market benefits from strong collaborations between ESA member states and the European Union. Leading European countries such as France, Germany, and the United Kingdom have a strong presence in satellite manufacturing, contributing to the growth of the AOCS market. The region emphasizes the development of advanced AOCS technologies, including star trackers, reaction wheels, and thruster systems.

- The Asia-Pacific region has emerged as a key player in the global AOCS market, driven by the rapid expansion of its space industry. Countries like China, India, and Japan have invested substantially in space exploration, satellite technology, and indigenous manufacturing capabilities. The growing demand for communication, remote sensing, and navigation services fuels the adoption of AOCS systems.

Global Satellite Attitude and Orbit Control System Market Trends

Small satellites are poised to create demand in the market

- The classification of spacecraft by mass is one of the main metrics for determining the launch vehicle size and cost of launching satellites into orbit. In North America, during 2017-2022, over 45 large satellites (owned by North American organizations), more than 80 medium-sized satellites (operated by North American organizations), and over 2,900 small satellites (manufactured in the region) were launched.

- Europe has witnessed significant growth in recent years, primarily driven by the increasing demand for different satellite masses. Satellite mass is one of the most critical factors influencing the European satellite manufacturing market. This is because different types of satellites require different masses, which, in turn, affects the launch vehicle market. During 2017-2022, a total of 569 satellites were deployed in orbit. Of that, minisatellites accounted for the largest share, with 451, followed by nanosatellites (44), large satellites (37), medium-sized satellites (16), and microsatellites (7).

- Satellite manufacturing has become an increasingly important industry in the Asia-Pacific region in recent years, driven by the need to meet the growing demand for advanced satellite capabilities. The range of satellite mass manufactured in the Asia-Pacific region varies significantly, which affects the growth of the market. During 2017-2022, a total of 370 satellites were launched in the region, including 130 microsatellites, 75 large satellites, 63 nanosatellites, 60 medium-sized satellites, and 42 minisatellites.

Investment opportunities in the market driving growth

- In North America, government expenditure for space programs hit a record of approximately USD 103 billion in 2021. The region is the epicenter of space innovation and research, with the presence of the world's biggest space agency, NASA. In 2022, the US government spent nearly USD 62 billion on its space programs, making it the highest spender on space programs in the world. For instance, till February 2023, NASA distributed USD 333 million as research grants. In 2022, the US government spent nearly USD 62 billion on its space programs, making it the highest spender in the space industry in the world.

- European countries are recognizing the importance of investments in the space domain and are increasing their spending on space activities and innovation to stay competitive in the global space industry. In November 2022, ESA announced that it had proposed a 25% boost in space funding over the next three years to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in exploration with the United States. ESA asked its 22 nations to back a budget of around EUR 18.5 billion for the period of 2023-2025. Germany, France, and Italy are the major contributors.

- There has been an increase in space-related activities in the Asia-Pacific region. In 2022, according to the draft budget for Japan, the space budget amounted to over USD 1.4 billion, which included the development of the H3 rocket, Engineering Test Satellite-9, and the nation's Information Gathering Satellite (IGS) program. The proposed budget for India's space programs in FY22 was USD 1.83 billion. In 2022, South Korea's Ministry of Science and ICT announced a space budget of USD 619 million for manufacturing satellites, rockets, and other key space equipment.

Satellite Attitude and Orbit Control System Industry Overview

The Satellite Attitude and Orbit Control System Market is fairly consolidated, with the top five companies occupying 98.09%. The major players in this market are Bradford Engineering BV, Jena-Optronik, OHB SE, SENER Group and Sitael S.p.A. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Miniaturization

- 4.2 Satellite Mass

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 Global

- 4.4.2 Australia

- 4.4.3 Brazil

- 4.4.4 Canada

- 4.4.5 China

- 4.4.6 France

- 4.4.7 Germany

- 4.4.8 India

- 4.4.9 Iran

- 4.4.10 Japan

- 4.4.11 New Zealand

- 4.4.12 Russia

- 4.4.13 Singapore

- 4.4.14 South Korea

- 4.4.15 United Arab Emirates

- 4.4.16 United Kingdom

- 4.4.17 United States

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application

- 5.1.1 Communication

- 5.1.2 Earth Observation

- 5.1.3 Navigation

- 5.1.4 Space Observation

- 5.1.5 Others

- 5.2 Satellite Mass

- 5.2.1 10-100kg

- 5.2.2 100-500kg

- 5.2.3 500-1000kg

- 5.2.4 Below 10 Kg

- 5.2.5 above 1000kg

- 5.3 Orbit Class

- 5.3.1 GEO

- 5.3.2 LEO

- 5.3.3 MEO

- 5.4 End User

- 5.4.1 Commercial

- 5.4.2 Military & Government

- 5.4.3 Other

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 AAC Clyde Space

- 6.4.2 Bradford Engineering BV

- 6.4.3 Innovative Solutions in Space BV

- 6.4.4 Jena-Optronik

- 6.4.5 NewSpace Systems

- 6.4.6 OHB SE

- 6.4.7 SENER Group

- 6.4.8 Sitael S.p.A.

- 6.4.9 Thales

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms