|

시장보고서

상품코드

1851847

영국의 시설 관리 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)United Kingdom (UK) Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

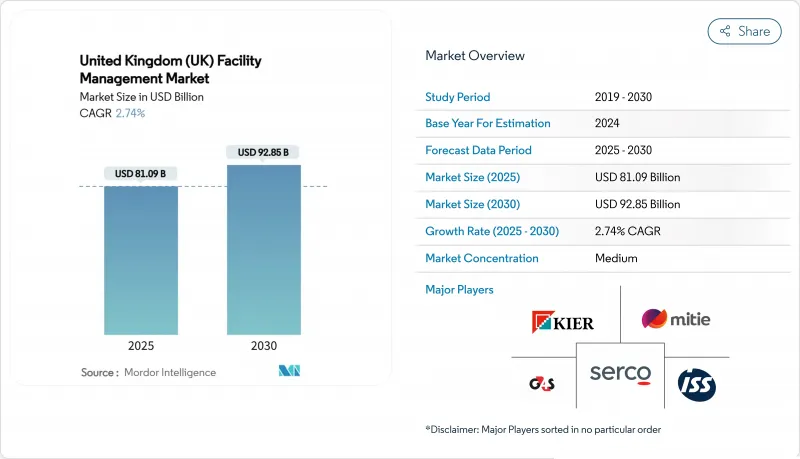

영국의 시설 관리 시장 규모는 2025년에 810억 9,000만 달러, 2030년에는 928억 5,000만 달러에 이를 것으로 예측되며, 기간 중 CAGR은 2.74%로 예상됩니다.

이 시장 규모는 에너지 효율 향상, 디지털 변환 및 아웃소싱 서비스 모델의 지속적인 선호에 따라 성숙한 섹터로 발전하고 있음을 보여줍니다. 하드 서비스는 노후화된 건물 스톡이 최저 에너지 효율 기준을 충족하기 위해 엄격한 기계, 전기 및 배관 유지관리를 요구하기 때문에 가장 중요합니다. IoT 센서 그리드에서 AI를 활용한 분석에 이르기까지 기술 통합은 응답 시간을 단축하고, 에너지 소비를 줄이고, 인력 증가에 비례하지 않고 수익을 확대하는 성과 기반 계약을 가능하게 합니다. 아웃소싱의 기세는 계속되고 있으며, 공공기관과 민간 고객은 투입 가격이 변동하는 동안 컴플라이언스를 보장하고 비용 확실성을 가져오는 전문 지식을 요구하고 있습니다. 브렉시트와 관련된 노동력 부족과 비용 인플레이션은 금리를 줄이지만 공공 부문의 리모델링 자금 증가와 유연한 작업 공간의 보급은 신속한 혁신을 제공하는 공급자에게 사업 확장의 길을 제공합니다.

영국의 시설 관리 시장 동향과 통찰

기술 통합(IoT, AI, 자동화)

AI를 활용한 빌딩 관리 플랫폼은 서비스 제공을 재정의하고 있으며, 지적재산청은 디지털 작업 지시 포털을 시작한 후 유지보수 대응 시간을 14일에서 몇 초로 단축했습니다. 스마트 센서가 가동 상황, 온도, 공기 품질 데이터를 실시간으로 중계함으로써 공급자는 에너지 사용량을 줄이고 직원의 쾌적성을 향상시키면서 사후 대응형에서 예지보전형으로 이동할 수 있습니다. CBRE의 하이퍼스케일 데이터센터 시설 관리 진입은 24시간 분석 모니터링이 필요한 부문에서 높은 수익 가능성을 강조합니다. 헬스케어와 교육기관의 고객은 컴플라이언스 체제에 의해 지속적인 환경 모니터링이 의무화되고 있기 때문에 도입을 선도하고 있습니다. 디지털 대시보드가 소프트와 하드 서비스를 통합함에 따라 공급업체는 청소, 보안, 사무실 지원, 자산 유지보수를 데이터 풍부한 계약으로 패키징하고 가격 프리미엄을 요구하고 있습니다.

상업용 부동산의 급속한 확대

영국 왕립 칙허 측량사 협회의 데이터에 따르면 2025년 1분기에 입주자 수요가 긍정적으로 바뀌고 런던 중심부의 프라임 오피스 임대료는 연내에 5% 가까이 상승할 것으로 예측됩니다. 투자 의욕이 가장 왕성한 것은 산업용 자산으로 전자상거래와 니어 쇼어링에 힘입어 투자자 수요는 18% 순 증가했습니다. 신규 개발은 시운전, 라이프사이클 자산 관리, 지속적인 컴플라이언스 감사에 대한 수요를 높입니다. 개발업체와 조기에 제휴한 퍼실리티 매니저는 첫날부터 ESG 대시보드를 통합한 스마트 대응 빌딩으로 여러 해에 걸친 수익원을 확보합니다. 물류의 성장도 마찬가지로 재고 추적 기술, 도크 관리, 고처리량 창고를 위한 첨단 방화 유지 보수 등을 결합한 맞춤형 FM 패키지를 뒷받침하고 있습니다.

노동력 부족과 기술 격차

접객, 청소 및 케이터링 부서는 브렉시트 후 13만 2,000명의 결원에 직면해 FM 인원을 압박하고 있습니다. 2025년 이민백서는 숙련 근로자 비자의 역치를 RQF 레벨 6으로 끌어올려 엔트리 레벨 FM 업무에 종사하는 외국인 직원에 대한 접근을 억제하고 있습니다. 고용주의 교육투자는 2005년 이후 28% 감소해 건물이 고급 디지털 시스템을 채택하는 것처럼 기술 부족을 낳고 있습니다. 기업은 JPC by Samsic의 리더십과 기술 향상에 중점을 둔 12개 모듈로 구성된 차세대 프로그램과 같은 감독자 아카데미에서 경쟁하고 있습니다. 그럼에도 불구하고, 높은 이직률과 노동력의 노령화는 이 섹터의 능력을 계속 제한하고 있습니다.

부문 분석

2024년 영국의 시설 관리 시장 점유율은 하드 서비스가 60.54%를 차지하며 NHS의 116억 파운드(31억 9,000만 달러)의 유지보수 백로그와 엄격한 EPC 업그레이드 타임라인이 그 요인이 되고 있습니다. 상업시설의 28%가 여전히 EPC 평가에서 D랭크 이하이며, 기계, 전기, 배관의 오버홀의 가속화를 강요하고 있기 때문에 하드 서비스 계약의 영국의 시설 관리 시장 규모는 확대될 전망입니다. MEP와 HVAC 부서는 2035년까지 47% - 62%의 배출 감소를 의무화하는 넷 제로 규제 경로에서 혜택을 누리고 있습니다. 자산의 디지털화는 예측 보전 분석에 대한 수요를 더욱 높여주고 공급자는 규정 준수 보고 요구를 충족시키면서 자산 고장 이전에 개입할 수 있습니다.

소프트 서비스는 현재는 소규모이지만, 병원 수준의 청소 기준이나 직장 체험의 혁신에 힘입어 2030년까지 연평균 복합 성장률(CAGR) 2.89%의 성장이 예측됩니다. 감염 관리 규칙의 강화로 로봇 소독 시스템이나 센서로 검증된 위생 프로토콜의 프리미엄이 높아집니다. 코워킹 사업자는 스마트한 입퇴실 관리를 필요로 하고 보안서비스의 현대화를 추진하고 있습니다. Grenfell 사건 이후 법규와 관련된 방화 안전성 업그레이드는 통합된 경보 테스트 및 대피 계획 서비스에 대한 수요를 증가시키고 있습니다. 이와 같이 공급자가 제공하는 서비스는 탁월한 소프트 서비스와 데이터에 뒷받침된 컴플라이언스를 융합시킨 종합적인 패키지로 이동하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 현재 가동률

- 주요 FM 기업의 수익률

- 노동력 지표 - 노동참가

- 시설 관리 시장 점유율(%) : 서비스 유형별

- 시설 관리 시장 점유율(%) : 하드 서비스별

- 시설 관리 시장 점유율(%) : 소프트 서비스별

- 주요 도시의 도시화와 인구 증가

- 영국 인프라 파이프라인에서 섹터 투자 우선순위

- 노동 및 안전 기준에 특유의 규제 요인

- 시장 성장 촉진요인

- 상업용 부동산의 급속한 확대

- 기술 통합(IoT, AI, 자동화)

- 높아지는 아웃소싱 동향

- 직장 경험과 직원의 웰빙에 대한 주목 증가

- 엄격한 에너지 절약 및 넷 제로 규제

- 기동적인 FM 계약이 요구되는 유연한 작업 공간의 대두

- 시장 성장 억제요인

- 일손 부족과 스킬 격차

- 운영비용 상승에 따른 마진압박

- 서비스의 표준화를 막는 단편적인 공급자 및 에코시스템

- 스마트 빌딩 시스템의 데이터 보안에 대한 우려

- 밸류체인 분석

- PESTEL 분석

- 시장 진입을 위한 규제 및 법적 틀

- 거시경제지표가 FM 수요에 미치는 영향

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 투자 및 자금조달 분석

제5장 시장 규모와 성장 예측

- 서비스 유형별

- 하드 서비스

- 자산 관리

- MEP 및 HVAC 서비스

- 소방 시스템 및 안전

- 기타 하드 FM 서비스

- 소프트 서비스

- 사무실 지원 및 보안

- 청소 서비스

- 케이터링 서비스

- 기타 소프트 FM 서비스

- 하드 서비스

- 제공 유형별

- 인하우스

- 아웃소싱

- 싱글 FM

- 번들 FM

- 통합 FM

- 최종 사용자 업계별

- 상업(IT 및 통신, 소매, 창고 등)

- 호스피탈리티(호텔, 음식점, 대규모 레스토랑)

- 시설 및 공공 인프라(정부, 교육, 수송 기관)

- 헬스케어(공공 및 민간 시설)

- 산업 및 공정(제조, 에너지, 광업)

- 기타 최종 사용자 산업(집합 주택, 엔터테인먼트, 스포츠, 레저)

제6장 경쟁 구도

- 시장 집중도

- 전략적 이전과 파트너십

- 시장 점유율 분석

- 기업 프로파일

- ISS UK

- Mitie Group PLC

- Serco Group PLC

- Kier Group PLC

- G4S Facilities Management UK Limited

- Sodexo Facilities Management Services

- Compass Group

- Equans

- VINCI Facilities Limited

- Aramark Facilities Services

- Andron Facilities Management

- CSM Facilities Management Group

- Orton Group

- Global Facilities.

- BGIS

제7장 시장 기회와 장래의 전망

JHS 25.11.25The United Kingdom facility management market size stands at USD 81.09 billion in 2025 and is forecast to reach USD 92.85 billion by 2030, reflecting a 2.74% CAGR over the period.

The measured trajectory signals a mature sector advancing under energy-efficiency mandates, digital transformation, and a sustained preference for outsourced service models. Hard services hold prime importance because ageing building stock demands strict mechanical, electrical, and plumbing upkeep to meet Minimum Energy Efficiency Standards, while soft services evolve quickly to address workplace well-being and stringent hygiene rules. Technology integration from IoT sensor grids to AI-powered analytics-cuts response times, trims energy consumption, and enables outcome-based contracts that grow revenue without proportionate head-count expansion. Outsourcing momentum continues as public and private clients seek specialist expertise that guarantees compliance and delivers cost certainty amid volatile input prices. Although Brexit-linked labour shortages and cost inflation compress margins, rising public-sector refurbishment funding and the spread of flexible workspaces offer expansion lanes for providers that innovate fast.

United Kingdom (UK) Facility Management Market Trends and Insights

Technology Integration (IoT, AI, Automation)

AI-driven building-management platforms are redefining service delivery, with the Intellectual Property Office cutting maintenance response times from 14 days to seconds after launching a digital work-order portal. Smart sensors relay live occupancy, temperature, and air-quality data, letting providers shift from reactive to predictive maintenance while lowering energy use and elevating employee comfort. CBRE's entry into hyperscale data-center facilities management underscores the high-margin potential in segments that demand 24-hour analytical monitoring. Healthcare and education clients lead adoption because compliance regimes mandate continuous environmental monitoring. As digital dashboards merge soft and hard services, providers package cleaning, security, office support, and asset maintenance into data-rich contracts that command price premiums.

Rapid Commercial Real Estate Expansion

Royal Institution of Chartered Surveyors data show occupier demand turned positive in Q1 2025, and prime office rents in Central London are projected to rise nearly 5% in the year. Industrial assets register the strongest investment appetite, with an +18% net balance in investor demand, propelled by e-commerce and near-shoring. New developments increase demand for commissioning, lifecycle asset management, and ongoing compliance auditing. Facility managers partnering early with developers secure multi-year revenue streams in smart-ready buildings that integrate ESG dashboards from day one. Logistics growth similarly drives tailored FM packages that combine inventory tracking technologies, dock management, and advanced fire-suppression maintenance for high-throughput warehouses.

Labor Shortages and Skill Gaps

Hospitality, cleaning, and catering units face 132,000 job vacancies post-Brexit, straining FM rosters. The 2025 Immigration White Paper raises the Skilled Worker visa threshold to RQF Level 6, curtailing access to international staff for entry-level FM roles. Employer training investment has fallen 28% since 2005, creating a skills deficit just as buildings adopt sophisticated digital systems. Firms counteract with supervisor academies such as JPC by Samsic's 12-module Next Gen programme focusing on leadership and technical upskilling. Nonetheless, high turnover and an aging workforce continue to limit sector capacity.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Outsourcing Trend

- Rising Focus on Workplace Experience and Employee Well-being

- Margin Pressure from Rising Operational Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard services held 60.54% of United Kingdom facility management market share in 2024, anchored by the NHS's GBP 11.6 billion (USD 3.19 billion) maintenance backlog and stringent EPC upgrade timelines. The United Kingdom facility management market size for hard-service contracts is poised to expand as 28% of commercial properties still rate D or lower on EPC scale, forcing accelerated mechanical, electrical, and plumbing overhauls. MEP and HVAC segments benefit from regulatory pathways to net-zero that mandate 47%-62% emissions cuts by 2035. Asset digitization further lifts demand for predictive-maintenance analytics, letting providers intervene before asset failure while meeting compliance reporting needs.

Soft services, while smaller today, are forecast to grow 2.89% CAGR through 2030, propelled by hospital-grade cleaning standards and workplace-experience innovations. Heightened infection-control rules elevate the premium for robotic disinfection systems and sensor-verified hygiene protocols. Co-working operators require smart access control, driving security-service modernization. Fire-safety upgrades tied to post-Grenfell legislation amplify demand for integrated alarm testing and evacuation-planning services. Together, these forces shift provider offerings toward comprehensive packages that merge soft-service excellence with data-backed compliance.

The United Kingdom Facility Management Market Report is Segmented by Service Type (Hard Services, Soft Services), Offering Type (In-House, Outsourced), End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, Industrial and Process, Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ISS UK

- Mitie Group PLC

- Serco Group PLC

- Kier Group PLC

- G4S Facilities Management UK Limited

- Sodexo Facilities Management Services

- Compass Group

- Equans

- VINCI Facilities Limited

- Aramark Facilities Services

- Andron Facilities Management

- CSM Facilities Management Group

- Orton Group

- Global Facilities.

- BGIS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%), by Service Type

- 4.1.5 Facility Management Market Share (%), by Hard Services

- 4.1.6 Facility Management Market Share (%), by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in United Kingdom's Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Rapid Commercial Real Estate Expansion

- 4.2.2 Technology Integration (IoT, AI, Automation)

- 4.2.3 Increasing Outsourcing Trend

- 4.2.4 Rising Focus on Workplace Experience and Employee Well-being

- 4.2.5 Stringent Energy-Efficiency and Net-Zero Regulations

- 4.2.6 Rise of Flexible Workspaces Requiring Agile FM Contracts

- 4.3 Market Restraints

- 4.3.1 Labor Shortages and Skill Gaps

- 4.3.2 Margin Pressure from Rising Operational Costs

- 4.3.3 Fragmented Supplier Ecosystem Hindering Service Standardization

- 4.3.4 Data-Security Concerns in Smart Building Systems

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ISS UK

- 6.4.2 Mitie Group PLC

- 6.4.3 Serco Group PLC

- 6.4.4 Kier Group PLC

- 6.4.5 G4S Facilities Management UK Limited

- 6.4.6 Sodexo Facilities Management Services

- 6.4.7 Compass Group

- 6.4.8 Equans

- 6.4.9 VINCI Facilities Limited

- 6.4.10 Aramark Facilities Services

- 6.4.11 Andron Facilities Management

- 6.4.12 CSM Facilities Management Group

- 6.4.13 Orton Group

- 6.4.14 Global Facilities.

- 6.4.15 BGIS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)