|

시장보고서

상품코드

1692118

싱가포르의 시설 관리 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Singapore Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

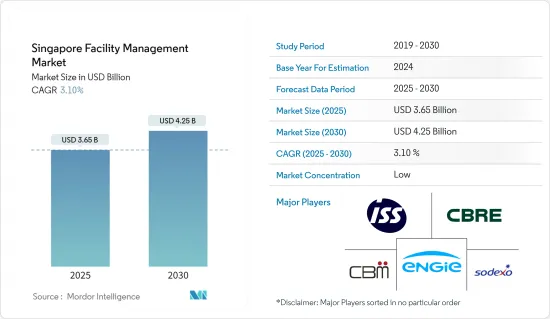

싱가포르의 시설 관리 시장 규모는 2025년에 36억 5,000만 달러로 추정되고, 시장 추계 및 예측 기간인 2025-2030년 CAGR 3.1%로 성장할 전망이며, 2030년에는 42억 5,000만 달러에 달할 것으로 예측됩니다.

세계 운송 및 물류의 허브로서 싱가포르의 지위는 일류 인프라와 시설 관리에 대한 노력을 강조하고 있습니다. 동남아시아에 대한 매우 중요한 게이트웨이로서 싱가포르는 시설의 업그레이드와 유지에 고액의 투자를 실시해 왔습니다. 싱가포르 정부는 건축건설청(BCA)이나 주택개발청(HDB) 같은 기관을 통해 시설 관리의 한계를 넓히는 데 주력해 왔습니다. 그들은 지속 가능하고 효율적인 관행을 지지하기 위해 엄격한 규제를 전개하고 가이던스를 제공하고 있습니다.

주요 하이라이트

- 스마트 빌딩은 기술과 부동산의 융합을 상징하는 것으로, 인간의 경험을 최우선으로 하고 있습니다. 이러한 건축물은 디지털 시스템을 활용하여 효율성, 지속 가능성, 이용자의 만족도를 높이고 있습니다. 스마트 빌딩에서는 관리 시스템이 단일 디지털 플랫폼으로 통합됩니다. 이 통일된 접근 방식을 통해 자산 소유자는 건물의 성능을 감독하고 건물의 수명을 연장하며 세입자 간의 교류를 촉진할 수 있습니다. 번영하는 스마트 빌딩의 중심에 있는 것은 인공지능에 의한 예측 능력입니다.

- 싱가포르에서 사업을 전개하는 많은 서비스 제공업체들은 시설 관리 요구 증가로 이익을 얻기 위해, 특히 비중핵 업무의 아웃소싱이 선호되는 기존의 동향을 배경으로 지난 10년간 프레즌스를 확대하는 것을 우선해 왔습니다.

- 싱가포르의 시설 관리 시장은 다수의 중소규모 현지 공급업체의 존재를 특징으로 하는 단편적 특성으로 인해 큰 과제에 직면하고 있습니다. 이러한 공급업체는 종종 청소, 보안, 유지보수 등 특정 분야와 서비스를 전문으로 하며 통합된 정통 솔루션을 제공하기에는 한계가 있습니다. 다국적 대기업과는 달리, 이러한 현지 벤더는 현대적인 시설 관리 실천에 필수적인 자원이나 전문 지식이 없습니다. 그 결과, 업무 효율이나 서비스 내용은 여전히 최적이라고는 할 수 없고, 확장성에 한계가 있습니다.

- 이에 더해 기회를 고려하면 국내에서는 시설 관리 및 기업 부동산을 혁신적인 방법으로 활용할 가능성이 급증하고 있습니다. 또한 IFM에 대한 수요 증가와 신흥 업종의 비중핵 업무 아웃소싱, 워크플레이스 최적화 및 생산성 재중시가 시장 성장을 더욱 강화하고 있습니다.

- 인프라 개발 투자의 급증은 싱가포르의 시설 관리 서비스 시장에 긍정적인 영향을 미칠 수 있습니다. 새로운 인프라 프로젝트가 건설됨에 따라 이러한 시설을 효율적으로 유지, 처리 및 운영하는 효과적인 시설 관리에 대한 수요가 증가하고 있습니다. 이로 인해 자산의 적절한 유지 관리와 기능성을 확보하기 위해 시설 관리 서비스를 요구하는 조직과 정부 기관이 늘어나 시설 관리 서비스의 성장으로 이어질 수 있습니다.

싱가포르의 시설 관리 시장 동향

자산 관리가 급성장할 전망

- 이 시장에서의 자산관리란 건물의 구조, 전기시스템, 배관 등의 물리적 자산을 체계적으로 유지, 운용, 최적화하고, 라이프사이클을 통해 기능성, 안전성, 효율성을 확보하는 것입니다. 예방 보전, 점검, 적시 수리를 통해 자산의 수명을 늘리고 운용 효율을 확보하며 생애주기를 관리하는 데 중점을 두고 있습니다.

- 자산 관리는 싱가포르의 시설 관리 시장의 성장을 견인하고 있으며, 이것은 건물 개발 증가와 고급 인프라 관리 수요에 지지되고 있습니다.

- 싱가포르는 스마트시티화를 추진하고 있으며 지속가능성과 에너지 효율에 중점을 두고 있기 때문에 하드시설 서비스, 특히 자산관리의 기회가 탄생하고 있습니다. World Population Review에 따르면 싱가포르는 2024년 79.52의 모션 인덱스 점수를 획득하여 최고의 스마트 시티 중 하나로 랭크되었습니다.

- 2024년 8월 엔지니어링 서비스 및 원자력 회사인 AtkinsRealis Group Inc.는 Singapore GP Pte.Ltd.(SGP)에서 국제 자동차 연맹(FIA)의 포뮬러 원 세계 챔피언십 시리즈의 일환인 중요한 모터 레이스 이벤트, 포뮬러 원 싱가포르 그랑프리의 프로젝트 관리 서비스를 수주했습니다. AtkinsRealis는 2년간의 계약의 일환으로 시설의 건설, 운영, 해체를 지원하기 위해 50개 이상의 계약과 4,000명 이상의 인원을 포함한 비용 관리 및 건설 관리 서비스를 제공합니다. 또한 프로젝트가 최고의 품질과 효율 기준으로 시행될 수 있도록 안전 위생, 지속 가능성에 대한 자문, 디지털 및 설비 관리 지원도 포함됩니다.

- 싱가포르에서는 대규모 건설 프로젝트가 증가하고 있으며 시설 관리 서비스에 대한 수요가 증가하고 있습니다. 예를 들어, 풍골 디지털 디스트릭트 개발은 스마트하고 지속 가능한 주요 이니셔티브입니다. 동지구에는 싱가포르 공과대학의 캠퍼스가 건설되어 사이버 보안 및 그 외의 디지털 산업의 거점이 됩니다. 또 하나의 중요한 프로젝트는 창이공항의 확장으로 2030년대 중반까지 터미널 5가 완성될 예정이며 2024-2025년 건설이 가속화될 것입니다.

상업, 소매 및 외식 부문이 주요 점유율을 차지합니다.

- 세계의 비즈니스 중심지인 싱가포르에는 다국적 기업이 모여 상업 공간에서 전문적인 시설 관리 서비스에 대한 수요가 높아지고 있습니다. 기업이 직장의 효율화를 중시하는 가운데, 시설 관리 프로바이더는 통합 서비스를 제공하고 있습니다. 이러한 서비스는, 스페이스의 최적화나 에너지 관리로부터 선진적인 스마트 빌딩 기술까지 다방면에 걸쳐, 모두 원활한 운영을 목적으로 하고 있습니다.

- 전자상거래와 옴니채널이 보급됨에 따라 기존 소매업은 실제 매장을 재구성하고 있습니다. 이러한 소매 기업은, 점포내에서의 독특한 체험을 우선하기 때문에, 환경 제어를 최적화해, 고객의 쾌적성을 높이고, 테크놀로지를 심리스하게 통합하는 고도의 시설 관리가 필요합니다.

- 또한 싱가포르 도시 재개발청(Urban Redevelopment Authority Singapore)의 보고서에 따르면 2023년 3분기 현재 950만 5,000평방미터의 호텔 룸이 건설 준비 중이며, 이어서 단일 사용자 공장 공간, 사무실 공간 및 기타가 되고 있습니다. 이는 싱가포르의 새로운 상업 및 주택 분야의 성장을 나타내고 있으며, 시설 관리 서비스에 대한 수요가 높아지고 있습니다. 이러한 서비스에는 유지보수, 경비, 청소, 에너지 관리 등이 포함되어 시설의 원활한 운영을 보장합니다. 이러한 수요에 의해, 기업은 서비스 제공의 강화, 기술 혁신, 테크놀로지 주도의 솔루션의 채용을 진행시키고 있습니다.

- 게다가 싱가포르 그린 플랜 2030과 같은 이니셔티브는 정부의 지속가능성에 대한 헌신을 강조하고 있습니다. 그 결과, 기업은 점점 더 친환경적인 관행을 채택하게 되었습니다. 이 시프트는, 시설 관리 회사에 의한 에너지 효율이 높은 그린 빌딩 솔루션에 대한 수요를 증폭해, 광범위한 시설 관리 시장 속에서 이러한 분야의 성장을 뒷받침하고 있습니다.

- 2024년 5월, 미국의 스낵 과자 및 음료회사인 몬델리즈 인터내셔널은 싱가포르에 지역 비스킷 구운 과자 랩과 혁신 키친을 개설했습니다. '전략적 지역 허브'로 자리매김하는 이 랩은 이 회사가 설립한 싱가포르 테크니컬 센터를 보완하는 것입니다.

싱가포르 시설 관리 산업 개요

싱가포르의 시설 관리 시장은 단편화되어 있으며, 다양한 규모의 기업이 존재하고 있습니다. 이 시장은 조직이 현재의 둔화를 상쇄하기 위해 전략적인 투자를 계속하고 있기 때문에 많은 제휴, 합병, 인수가 발생할 것으로 예상됩니다. 이 지역의 고객은 사업 운영을 용이하게 하기 위해 FM 서비스를 채택하고 있습니다. 이 시장은, ISSA/S, CBRE Group Inc., CBM Pte Ltd, ENGIE Services Singapore(Engie SA), Sodexo Singapore Pte. Ltd.등의 주요 솔루션 서비스 프로바이더로 구성되어 있습니다.

FM 벤더는 전문 지식을 활용한 강력한 경쟁 전략을 도입하고 있으며, 광고 선전비에도 많은 예산을 투자하고 있습니다.

시장의 주요 벤더는 소비자를 매료시키는 통합 솔루션을 제공하는 데 더욱 주력하고 있습니다. FM 벤더는 자사의 서비스에 테크놀로지를 도입해 서비스 포트폴리오에 강점을 더하고 있습니다.

시장의 소규모 벤더와 신규 참가 벤더는 대기업 벤더보다 비용 및 베네핏을 유지하는 것에 주력해, 국내에서의 경쟁을 더욱 격화시킬 것으로 예측됩니다. 국내에서는 공공부문에 비해 민간부문에 치중하는 비중이 커질 것으로 보입니다.

품질인증, 서비스 내용, 비용, 기술력, 기술은 신규 계약을 획득하기 위한 중요한 요소입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 상업용 부동산 부문의 성장

- 오피스 입주율의 상승

- FM 업계에서 볼 수 있는 주요 지속가능성 동향

- 그린 프랙티스 및 안전 의식 중시

- 스마트 빌딩 동향 증가

- 싱가포르 그린빌딩협의회에 의한 그린빌딩의 대두 및 실천

- 업계의 매력-Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 거시 경제 지표가 업계에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 비중핵 업무의 아웃소싱 중시 고조

- 인프라 개발 투자 증가

- 시장 성장 억제요인

- 복수의 로컬 벤더에 의한 시장의 단편화

- 규제 및 법 개정

- PESTEL 분석

- 시장 진입을 위한 규제 상황 및 법적 틀

제6장 시장 세분화

- 서비스 유형별

- 하드 서비스

- 에셋 매니지먼트

- MEP 및 HVAC 서비스

- 소방 시스템 및 안전

- 기타 하드 FM 서비스

- 소프트 서비스

- 사무실 지원 및 보안

- 청소 서비스

- 케이터링 서비스

- 기타 소프트 FM 서비스

- 하드 서비스

- 서비스 유형별

- 인하우스

- 아웃소싱

- 싱글 FM

- 번들 FM

- 통합형 FM

- 최종 사용자 산업별

- 상업, 소매 및 레스토랑

- 제조업 및 공업

- 정부, 인프라 및 공공단체

- 시설

- 기타 최종 사용자 산업

제7장 경쟁 구도

- 기업 프로파일

- ISS A/S

- CBRE Group Inc.

- CBM Pte. Ltd

- ENGIE Services Singapore(ENGIE SA)

- Sodexo Singapore Pte. Ltd(Sodexo Group)

- Abacus Property Management Pte. Ltd

- ACMS Facilities Management Pte. Ltd

- Certis CISCO Security Pte. Ltd(Temasek Holdings(Private)Limited)

- Compass Group PLC

- Cushman & Wakefield PLC

- Exceltec Property Management Pte. Ltd

- Jones Lang LaSalle Incorporated(JLL Incorporated)

- OCS Group International Limited

- Savills Singapore(Savills)

- Serco Group PLC

- United Tech Engineering Pte. Ltd

- UTiZ Facilities Management Services(UTiZ Global Ventures Pvt Ltd)

- Vinci Facilities Limited

제8장 벤더 포지셔닝 분석

제9장 투자 분석

제10장 투자 분석 시장의 미래

AJY 25.05.14The Singapore Facility Management Market size is estimated at USD 3.65 billion in 2025, and is expected to reach USD 4.25 billion by 2030, at a CAGR of 3.1% during the forecast period (2025-2030).

Singapore's prime position as a global transportation and logistics hub underscores its commitment to top-notch infrastructure and facilities management. As a pivotal gateway to Southeast Asia, Singapore has seen substantial investments in upgrading and maintaining its facilities. The Singaporean government has been instrumental in pushing the envelope on facilities management through agencies like the Building and Construction Authority (BCA) and the Housing and Development Board (HDB). They've rolled out stringent regulations and offered guidance to champion sustainable and efficient practices.

Key Highlights

- Smart buildings epitomize the convergence of technology and real estate, prioritizing human experience. These structures leverage digital systems to boost efficiency, sustainability, and user satisfaction. In a smart building, management systems integrate into a single digital platform. This unified approach empowers asset owners to oversee building performance, prolong the structure's lifespan, and foster enhanced interactions among tenants. At the heart of a thriving smart building are its predictive capabilities, driven by artificial intelligence.

- Many service providers operating in Singapore have prioritized expanding their presence over the last decade in order to profit from the increasing need for facility management, particularly with the existing trend favoring the outsourcing of non-core activities.

- The Singaporean facility management market faces significant challenges due to its fragmented nature, characterized by the presence of numerous small to mid-sized local vendors. These vendors often specialize in specific sectors or services such as cleaning, security, or maintenance, which limits their ability to offer integrated, full-scale solutions. Unlike larger multinational players, these local vendors lack the resources and expertise that are critical for modern facility management practices. As a result, their operational efficiency and service offerings remain suboptimal, leading to limited scalability.

- In addition to this, considering the opportunities, the country has seen a surge in the number of possibilities to utilize facility management and corporate real estate in innovative ways. Also, the rising demand for IFM and outsourcing of non-core operations from emerging verticals and renewed emphasis on workplace optimization and productivity are further augmenting the growth of the market.

- The surge in infrastructure development investments can positively impact the Singaporean facility management services market. As new infrastructure projects are built, there is a rising demand for effective facility management to maintain, handle, and operate these facilities efficiently. This, in turn, can lead to the growth of facility management services as more organizations and government entities seek these services to ensure their assets' proper upkeep and functionality.

Singapore Facility Management Market Trends

Asset Management is Expected to be the Fastest Growing Segment

- Asset management within the market involves systematically maintaining, operating, and optimizing physical assets such as building structures, electrical systems, and plumbing to ensure their functionality, safety, and efficiency throughout their life cycle. It focuses on extending asset lifespan, ensuring operational efficiency, and managing the life cycle of these assets through preventive maintenance, inspections, and timely repairs.

- Asset management is driving the growth of the Singaporean facility management market, which is supported by increasing building development and the demand for advanced infrastructure management.

- Singapore's push toward becoming a smart city and its focus on sustainability and energy efficiency create opportunities for hard facility services, particularly in asset management. According to the World Population Review, Singapore ranked as one of the top smart cities with a motion index score of 79.52 in 2024.

- In August 2024, AtkinsRealis Group Inc., an engineering services and nuclear company, was awarded the project management services contract by Singapore GP Pte. Ltd (SGP) for the Formula 1 Singapore Grand Prix, a key motor racing event, which is part of the International Automobile Federation's (FIA) series of the Formula One World Championship. AtkinsRealis will provide cost management and construction management services involving over 50 contracts and 4,000 personnel to support the facilities' building, operation, and dismantling as part of its two-year contract. The mandate also includes health and safety, sustainability advisory, and digital and facilities management support to ensure the project is delivered to the highest quality and efficiency standards.

- Singapore is witnessing an uptick in large-scale construction projects, boosting the demand for facility management services. For instance, the development of the Punggol Digital District represents a major smart and sustainable initiative. It will feature a campus for the Singapore Institute of Technology and serve as a hub for cybersecurity and other digital industries. Another significant project is the expansion of Changi Airport, with the upcoming Terminal 5 expected to be completed by the mid-2030s, with construction ramping up in the 2024-2025 period.

The Commercial, Retail, and Restaurants Segment Holds Major Share

- As a global business hub, Singapore draws in multinational corporations, driving the demand for professional facility management services in its commercial spaces. With companies emphasizing boosting workplace efficiency more, facility management providers offer integrated services. These range from space optimization and energy management to advanced smart building technologies, all aimed at ensuring smooth operations.

- As e-commerce and omnichannel shopping gain traction, traditional retailers reimagine their physical stores. These retailers prioritize distinctive in-store experiences, necessitating sophisticated facility management to optimize environmental control, enhance customer comfort, and seamlessly integrate technology.

- Further, according to the report by Urban Redevelopment Authority Singapore, as of the third quarter of 2023, 9,505 thousand square meters of hotel rooms were in the pipeline, followed by single-user factory space, office space, and others. This represents the growth in the country's new commercial and residential sector, which has increased the demand for facility management services. These services encompass maintenance, security, cleaning, and energy management, ensuring that facilities operate smoothly. This demand encourages companies to enhance their service offerings, innovate, and adopt technology-driven solutions.

- Moreover, initiatives like the Singapore Green Plan 2030 underscore the government's commitment to sustainability. As a result, businesses are increasingly adopting eco-friendly practices. This shift amplifies the demand for energy-efficient and green building solutions from facility management companies, bolstering the growth of these sectors within the broader facility management market.

- In May 2024, Mondelez International, a US snacks and drinks company, inaugurated its Regional Biscuit and Baked Snacks Lab and Innovation Kitchen in Singapore. Positioned as a "strategic regional hub," this lab will complement the company's established Singapore Technical Centre.

Singapore Facility Management Industry Overview

The Singapore facility management market is fragmented, with the presence of diverse firms of different sizes. This market is anticipated to encounter a number of partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns that they are experiencing. Clients in this region are employing FM services to increase the ease of their business operations. The market comprises key solutions and service providers, such as ISS A/S, CBRE Group Inc., CBM Pte Ltd, ENGIE Services Singapore (Engie SA), and Sodexo Singapore Pte. Ltd. (Sodexo Group).

The FM vendors are incorporating a powerful competitive strategy by leveraging their expertise. In addition, they are spending a significant amount on advertising.

Major vendors in the market are further focusing on offering integrated solutions to attract consumers. FM vendors are incorporating technologies into their services, adding strength to their service portfolio.

Smaller and new vendors in the market are expected to focus on maintaining cost-benefit over major vendors, further intensifying the competition in the country. A significant share of the focus will be directed toward the private sector compared to the public sector in the country.

Quality certification, service offerings, costs, technical capabilities, and technology are important factors for attracting new contracts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.1.1 Growth in the Commercial Real Estate Sector

- 4.1.2 Rise in Occupancy of Offices

- 4.1.3 Key Sustainability Trends Observed within the FM industry

- 4.1.4 Strong Emphasis on Green Practices and Safety Awareness

- 4.1.5 Growing Trend of Smart Buildings

- 4.1.6 Rise of Green Buildings and Practices Outlined by the Singapore Green Building Council

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Indicators on The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Outsourcing of Non-core Operations

- 5.1.2 Increasing Investments in Infrastructure Development

- 5.2 Market Restraints

- 5.2.1 Fragmented Market with Several Local Vendors

- 5.2.2 Regulatory & Legal Changes

- 5.3 PESTEL Analysis

- 5.4 Regulatory Landscape and Legislative Framework for a Market Entrant

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Hard Services

- 6.1.1.1 Asset Management

- 6.1.1.2 MEP and HVAC Services

- 6.1.1.3 Fire Systems and Safety

- 6.1.1.4 Other Hard FM Services

- 6.1.2 Soft Services

- 6.1.2.1 Office Support and Security

- 6.1.2.2 Cleaning Services

- 6.1.2.3 Catering Services

- 6.1.2.4 Other Soft FM Services

- 6.1.1 Hard Services

- 6.2 By Offering Type

- 6.2.1 In-house

- 6.2.2 Outsourced

- 6.2.2.1 Single FM

- 6.2.2.2 Bundled FM

- 6.2.2.3 Integrated FM

- 6.3 By End-user Industry

- 6.3.1 Commercial, Retail and Restaurants

- 6.3.2 Manufacturing and Industrial

- 6.3.3 Government, Infrastructure, and Public Entities

- 6.3.4 Institutional

- 6.3.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ISS A/S

- 7.1.2 CBRE Group Inc.

- 7.1.3 CBM Pte. Ltd

- 7.1.4 ENGIE Services Singapore (ENGIE SA)

- 7.1.5 Sodexo Singapore Pte. Ltd (Sodexo Group)

- 7.1.6 Abacus Property Management Pte. Ltd

- 7.1.7 ACMS Facilities Management Pte. Ltd

- 7.1.8 Certis CISCO Security Pte. Ltd (Temasek Holdings (Private) Limited)

- 7.1.9 Compass Group PLC

- 7.1.10 Cushman & Wakefield PLC

- 7.1.11 Exceltec Property Management Pte. Ltd

- 7.1.12 Jones Lang LaSalle Incorporated (JLL Incorporated)

- 7.1.13 OCS Group International Limited

- 7.1.14 Savills Singapore (Savills)

- 7.1.15 Serco Group PLC

- 7.1.16 United Tech Engineering Pte. Ltd

- 7.1.17 UTiZ Facilities Management Services (UTiZ Global Ventures Pvt Ltd)

- 7.1.18 Vinci Facilities Limited