|

시장보고서

상품코드

1851165

점적 관개 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Drip Irrigation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

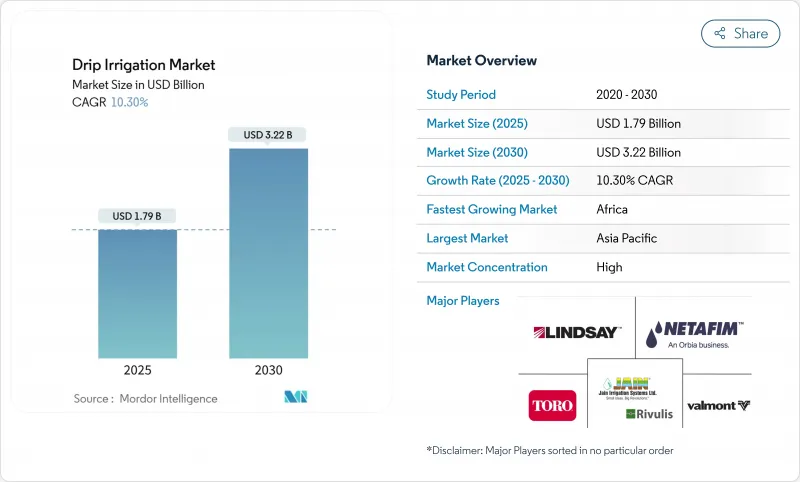

점적 관개 시장은 2025년 17억 9,000만 달러로 추정되고, 2030년에는 32억 2,000만 달러로 확대될 전망이며, CAGR 10.3%로 성장할 것으로 예측됩니다.

시장 확대의 주요 요인은 물 부족에 대한 우려 증가, 온실 재배의 개척, 물 효율이 높은 관개 시스템을 의무화하는 정부 규제의 시행 등입니다. 전략적 합병에 의한 산업 재편은 기술력을 강화하고 디지털 농업 플랫폼과의 통합은 센서 기술, 클라우드 분석, 노지 재배 및 보호 재배 환경에서 압력 보상 이미터를 통합합니다. 제조 기업은 소규모 농업 경영에서의 채용을 촉진하기 위해 종합적인 자금 조달과 농학 서비스 패키지를 도입하고 있습니다. 시장 세분화는 유럽에서 상당한 성장 기회, 아시아태평양에서 상당한 시장 존재, 중동 및 아프리카에서 유리한 규제 프레임워크를 보여 주며, 지하 관개 시스템과 스마트 컨트롤러가 제품 부문 확대를 지배하고 있습니다.

세계의 점적 관개 시장 동향 및 인사이트

물 부족의 위협

물 부족은 점적 관개 시장 성장의 주요 요인이며, 뿌리 관개 시스템은 오버헤드 스프링클러에 비해 물 소비량을 최대 50% 절감합니다. 대수층 수준의 감소와 지방 자치 단체의 급수 제한으로 인해 농업 생산자는 유출과 증발을 최소화하는 정밀 관개 방법을 채택해야 합니다. 설문 조사는 가뭄 기간 동안 물 분배 감소와 점적 관개 채택 증가 사이에 직접적인 관계가 있음을 보여줍니다. 이 기술은 절수뿐만 아니라 잡초 성장 감소 및 엽면병 발생률 감소와 같은 기타 혜택을 제공하고 수익성을 향상시키고 시장의 지속적인 확대를 지원합니다.

정부의 유리한 정책 및 보조금

공적 조성 프로그램은 전체 시장의 점적 관개 도입률에 영향을 미칩니다. 스페인에서는 150만 헥타르 관개망의 현대화로 국지적 시스템이 관개 총 면적의 48.23%로 증가했습니다. 인도, 이스라엘, 걸프 지역의 비용 공유 보조금은 초기 투자와 투자 회수 기간을 단축하고 있습니다. 발렌시아의 조사에 따르면 소규모 협동 조합에서는 유지 보수 비용이 보조금을 초과할 수 있으며 장비와 지속적인 유지 보수 비용을 모두 다루는 종합적인 프로그램의 중요성이 부각되었습니다. 수도요금 인상과 정책적 인센티브의 조합은 점적 관개 시장의 성장을 계속 추진하고 있습니다.

고액의 초기 설비 투자

점적 관개 시장에서는 특히 소규모 농가들이 많은 크레딧 접근이 제한되어 있는 지역에서는 높은 초기 비용이 여전히 큰 장벽이 되고 있습니다. 25,000루피(300달러)의 토양 수분 프로브와 같은 필수 장비의 비용은 대부분의 영세 농가의 자금 능력을 초과합니다. 다자간 은행은 페이어스 유글로우 론 및 장비 임대 프로그램과 같은 유연한 대출 옵션을 도입하고 있지만 도입률은 지역에 따라 다릅니다. 게다가 물 부족에 대한 우려가 높아지고 있음에도 불구하고 보조금 및 정액제의 물 가격 설정은 점적 관개 시스템에 투자하는 경제적 인센티브를 낮추고 있습니다.

부문 분석

2024년 점적 관개 시장의 62.0%는 지표 설치형이며, 그 이유는 간단한 설치, 효율적인 유지보수, 굴착 요건의 저감에 있습니다. 농업 경영자는 피벗 시스템을 효율적으로 변환하기 위해 표면 라인을 도입하여 전문 장비없이 즉시 절수 효과를 창출합니다. 상업 농장은 작물의 최적 온도 제어를 유지하기 위해 표면 드립 시스템을 잎 표면 미스트와 통합하여 여러 작물과 토양 조성에 해당하는 시스템의 다양성을 보장합니다.

서브 서페이스 시스템은 현재 시장 규모는 작고, 2030년까지 CAGR 11.8%로 성장이 예측되고 있습니다. 이러한 장비는 관개 인프라를 기계적 손상으로부터 보호하면서, 특히 건조 지역에서는 물의 증발을 최소화합니다. 워싱턴 대학이 실시한 조사에 따르면 지하 15cm에 설치된 이미터는 표면 유출을 크게 감소시킵니다. 물 비용 상승 및 규제 요건의 강화가 결합되어 지하 시스템의 경제성이 강화되고 점적 관개 시장에서의 전략적 중요성이 확립되고 있습니다.

이미터는 2024년 매출의 28.5%를 차지했으며, 이는 균일한 수류를 공급하는 중요한 역할을 반영합니다. 정밀 성형 및 압력 보정 기술의 향상은 연장된 측선에 걸쳐 일관된 토출 속도를 유지하는 데 도움이 되며, 필요한 압력 헤드를 줄이고 펌프 당 현장 커버 범위를 넓힐 수 있습니다.

클라우드에 연결된 컨트롤러, 수분 센서, 관개 밸브와 같은 스마트 관개 컴포넌트는 CAGR 14.6%로 성장하고 있습니다. EPA의 데이터에 따르면 스마트 컨트롤러는 계획 관개를 20-43% 줄이고 통합 토양 센서 시스템은 가뭄 시 물 소비량을 최대 72% 줄일 수 있습니다. 하드웨어 비용 절감과 스마트폰 인터페이스 개선은 보급을 촉진합니다. 농업 경영자가 수율과 자원 이용을 연계함에 따라 데이터 중심 인사이트가 컨트롤러의 채택을 가속화하고 시장 세분화 시장에서 디지털 분야의 점유율을 확대합니다.

지역 분석

아시아태평양은 2024년 매출의 34.9%를 차지했으며, 인도와 중국의 지하수 고갈에 대한 노력이 견인하고 있습니다. Jain Irrigation은 위성 이미지와 현장 원격 측정을 결합한 농학 자문 팀을 사용하여 52개 작물 850만 에이커를 관리합니다. 정부 보조금과 무이자 대출을 통해 농부는 디지털 감시 기능을 갖춘 통합 점적 관개 시스템을 도입하고 있습니다. 투입 비용의 상승과 농촌에서 도시로의 이동이 도입률을 가속화하고, 아시아태평양의 점적 관개 시장에서 지배적 지위가 강화됩니다.

아프리카는 2030년까지 연평균 복합 성장률(CAGR) 예측에서 가장 빠른 12.1%를 기록할 전망입니다. 다자간 개발 프로그램은 소규모 농부를 위한 태양광 발전 관개 시스템을 지원하고 제한된 전력 인프라를 지원합니다. 케냐와 모로코의 MIT GEAR Lab 이니셔티브는 작동 압력 감소, 배터리 효율 개선, 모래 토양 조건 하에서 양수 비용 절감을 위해 시스템을 최적화합니다. 케냐, 에티오피아, 모로코의 수출용 화초 및 야채 생산자는 유럽의 추적성 요구 사항을 충족하기 위해 클라우드 기반 모니터링 시스템을 도입하여 지역 시장 성장을 이끌고 있습니다.

유럽 시장은 농가의 고령화와 함께 엄격한 물에 관한 지침을 반영합니다. 유럽 시장의 성장은 절수 규제와 농업 인구 역학의 변화를 반영합니다. 스페인에서는 100,000헥타르의 근대화를 위한 차세대 EU 자금이 할당되는 반면, 농업 인구의 고령화라는 과제에도 임하고 있습니다. 제조업체 각 회사는 간소화된 인터페이스와 원격 업데이트 기능을 갖춘 사용하기 쉬운 컨트롤러를 개발합니다. 물가격 개혁은 운영 비용을 증가시켜 전통적인 농부들에게 점적 관개 시스템의 채용을 촉진하고 안정적인 시장 수요를 유지합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 물 부족의 위협

- 정부로부터 유리한 정책 및 보조금

- 고부가가치 온실 야채의 종합 감귤 수요

- 피벗 관개에서 점적 관개로 전환하여 노동 비용 절감

- 기후 변화의 영향에 적응하는 지중해의 포도밭

- 종래의 홍수 관개에서 마이크로 관개 시스템으로 이행하는 대규모 농장

- 시장 성장 억제요인

- 높은 초기 설비 투자

- 복잡한 셋업에 의한 점적 관개의 손해

- 신흥 시장에서 애프터 서비스망의 미정비

- 수도 요금의 불확실성 및 ROI의 억제

- 규제 전망

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력 및 소비자

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 세분화

- 신청별

- 서피스 점적 관개

- 서브 서페이스 점적 관개

- 컴포넌트별

- 이미터 및 드리퍼

- 드립 튜브 및 라인

- 필터

- 압력 펌프

- 밸브 및 피팅

- 컨트롤러 및 센서

- 액세서리(스테이크, 조이너, 플러그)

- 작물 유형별

- 밭 작물

- 야채 작물

- 과수원 작물

- 포도밭

- 기타 작물(상업용 및 관상용 식물)

- 최종 사용자별

- 상업 농장

- 온실 및 나사리

- 주택용 정원 및 정세

- 스포츠 필드 및 골프 코스

- 판매 채널별

- 직접 판매

- 딜러 및 판매점

- 온라인 소매

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 칠레

- 기타 남미

- 중동 및 아프리카

- 이스라엘

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 남아프리카

- 이집트

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 가장 채용된 전략

- 시장 점유율 분석

- 기업 프로파일

- Jain Irrigation Systems Ltd.(Rivulis Irrigation Ltd.)

- The Toro Company

- Netafim Limited(An Orbia Business)

- Rain Bird Corporation

- Valmont Industries, Inc.

- Chinadrip Irrigation Equipment Co. Ltd

- Antelco Pty Ltd

- Sistema Azud

- Metzer Group(Adam Partners)

- DripWorks Inc.

- Mahindra EPC Irrigation Ltd

- Irritec SpA

- Hunter Industries Inc.

제7장 시장 기회 및 향후 전망

AJY 25.11.12The drip irrigation market is projected to increase from USD 1.79 billion in 2025 to USD 3.22 billion by 2030, registering a CAGR of 10.3%.

The market expansion is primarily attributed to intensifying water scarcity concerns, greenhouse farming development, and the implementation of government regulations mandating water-efficient irrigation systems. Industry consolidation through strategic mergers has enhanced technological capabilities, while integration with digital farming platforms incorporates sensor technology, cloud analytics, and pressure-compensating emitters in both open-field and protected cultivation environments. Manufacturing companies are implementing comprehensive financing and agronomic service packages to facilitate adoption among small-scale agricultural operations. The market demonstrates substantial growth opportunities in Europe, considerable market presence in Asia-Pacific, and favorable regulatory frameworks in the Middle East and Africa, with subsurface irrigation systems and smart controllers dominating product segment expansion.

Global Drip Irrigation Market Trends and Insights

Threat of Water Scarcity

Water stress is the primary driver of drip irrigation market growth, as root-zone delivery systems reduce water consumption by up to 50% compared to overhead sprinklers. Declining aquifer levels and municipal water restrictions are pushing agricultural producers to adopt precision irrigation methods that minimize runoff and evaporation. Research demonstrates a direct relationship between reduced water allocations during drought periods and increased drip irrigation adoption. The technology provides additional benefits beyond water conservation, including decreased weed growth and lower foliar disease incidence, which improve profitability and support continued market expansion.

Favorable Policies and Subsidies from the Government

Public funding programs influence drip irrigation adoption rates across markets. Spain's modernization of 1.5 million hectares of irrigation networks increased localized systems to 48.23% of the total irrigated area. Cost-share grants in India, Israel, and the Gulf regions reduce initial investments and payback periods. Research from Valencia indicates that maintenance costs can exceed subsidy benefits for small cooperatives, highlighting the importance of comprehensive programs covering both equipment and ongoing maintenance expenses. The combination of increasing water tariffs and policy incentives continues to drive growth in the drip irrigation market.

High Initial Capital Investments

High initial costs remain a significant barrier in the drip irrigation market, particularly in regions with small farm holdings and limited credit access. The cost of essential equipment, such as a soil-moisture probe at INR 25,000 (USD 300), exceeds the financial capacity of most smallholder farmers. Although multilateral banks have introduced flexible financing options like pay-as-you-grow loans and equipment leasing programs, adoption rates vary across regions. Additionally, subsidized or flat-rate water pricing reduces the financial incentive to invest in drip irrigation systems, despite increasing water scarcity concerns.

Other drivers and restraints analyzed in the detailed report include:

- Integrated Fertigation Demand for High-Value Greenhouse Vegetables

- Labor Cost Reduction Through Pivot-to-Drip Irrigation Conversion

- Damages in Drip Irrigation Due to the Complex Set-up

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surface installations comprised 62.0% of the drip irrigation market in 2024, attributed to their straightforward installation, efficient maintenance, and reduced excavation requirements. Agricultural operators implement surface lines to convert pivot systems effectively, generating immediate water conservation benefits without specialized equipment. Commercial farms integrate surface drip systems with foliar misters to maintain optimal crop temperature control, ensuring system versatility across multiple crops and soil compositions.

Subsurface systems, despite their current smaller market presence, are projected to achieve a CAGR of 11.8% through 2030. These installations minimize water evaporation, particularly in arid regions, while protecting irrigation infrastructure from mechanical damage. Research conducted by Washington universities indicates that emitters positioned 15 cm below ground substantially reduce surface runoff. The combination of escalating water costs and enhanced regulatory requirements strengthens the economic viability of subsurface systems, establishing their strategic importance in the drip irrigation market.

Emitters accounted for 28.5% of revenue in 2024, reflecting their essential role in delivering uniform water flow. Improvements in precision molding and pressure compensation technology help maintain consistent discharge rates across extended lateral lines, reducing pressure head requirements and enabling broader field coverage per pump.

Smart irrigation components, including cloud-connected controllers, moisture sensors, and irrigation valves, are growing at a 14.6% CAGR. Smart controllers reduce scheduled irrigation by 20-43%, while integrated soil-sensor systems can decrease water consumption by up to 72% during drought conditions, according to EPA data. Reduced hardware costs and improved smartphone interfaces facilitate adoption. As agricultural operators correlate yields with resource utilization, the resulting data-driven insights accelerate controller adoption, increasing the digital segment's share of the drip irrigation market.

The Drip Irrigation Market Report is Segmented by Application (Surface Drip Irrigation and More), by Component (Emitters / Drippers, and More), by End-User (Commercial Farms, and More), by Crop Type (Field Crops, and More), by Sales Channel (Direct Sales, and More), and by Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific accounts for 34.9% of 2024 revenue, driven by India and China's initiatives to address groundwater depletion. Jain Irrigation manages 8.5 million acres across 52 crops, using agronomic advisory teams that combine satellite imagery with in-field telemetry. Government subsidies and zero-interest loans encourage farmers to adopt integrated drip-fertigation systems with digital monitoring capabilities. Increasing input costs and rural-urban migration accelerate adoption rates, strengthening Asia-Pacific's dominant position in the drip irrigation market.

Africa posts the fastest 12.1% CAGR forecast through 2030. Multilateral development programs support solar-powered irrigation systems for small-scale farmers, addressing limited power infrastructure. MIT's GEAR Lab initiatives in Kenya and Morocco optimize systems for reduced operating pressure, improving battery efficiency, and reducing water pumping costs in sandy soil conditions. The region's export-oriented floriculture and vegetable producers in Kenya, Ethiopia, and Morocco implement cloud-based monitoring systems to meet European traceability requirements, driving regional market growth.

Europe's market reflects stringent water directives alongside aging farmer demographics. Europe's market growth reflects water conservation regulations and demographic shifts in farming. Spain allocates Next Generation EU funding to modernize 100,000 hectares, while addressing challenges of an aging farming population, with 59% of Spanish farmers over 55 and only 18% having formal ICT training. Manufacturers develop user-friendly controllers with simplified interfaces and remote update capabilities. Water pricing reforms increase operational costs, encouraging traditional farmers to adopt drip irrigation systems, and maintaining steady market demand.

- Jain Irrigation Systems Ltd. (Rivulis Irrigation Ltd.)

- The Toro Company

- Netafim Limited (An Orbia Business)

- Rain Bird Corporation

- Valmont Industries, Inc.

- Chinadrip Irrigation Equipment Co. Ltd

- Antelco Pty Ltd

- Sistema Azud

- Metzer Group (Adam Partners)

- DripWorks Inc.

- Mahindra EPC Irrigation Ltd

- Irritec SpA

- Hunter Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Threat of Water Scarcity

- 4.2.2 Favorable Policies and Subsidies from the Government

- 4.2.3 Integrated Fertigation Demand for High-Value Greenhouse Vegetables

- 4.2.4 Labor Cost Reduction Through Pivot-to-Drip Irrigation Conversion

- 4.2.5 Mediterranean Vineyards Adapt to Climate Change Impacts

- 4.2.6 Large-Scale Farms Shifting from Traditional Flood Irrigation to Micro-Irrigation Systems

- 4.3 Market Restraints

- 4.3.1 High Initial Capital Investments

- 4.3.2 Damages in Drip Irrigation Due to the Complex Set-up

- 4.3.3 Underdeveloped After-Sales Service Networks in Emerging Markets

- 4.3.4 Water-Tariff Uncertainties and Curtailing ROI

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Surface Drip Irrigation

- 5.1.2 Subsurface Drip Irrigation

- 5.2 By Component

- 5.2.1 Emitters / Drippers

- 5.2.2 Drip Tubes and Lines

- 5.2.3 Filters

- 5.2.4 Pressure Pumps

- 5.2.5 Valves and Fittings

- 5.2.6 Controllers and Sensors

- 5.2.7 Accessories (Stake, Joiners, and Plugs)

- 5.3 Crop Types

- 5.3.1 Field Crops

- 5.3.2 Vegetable Crops

- 5.3.3 Orchard Crops

- 5.3.4 Vineyards

- 5.3.5 Other Crops (Commercial and Ornamental Plants)

- 5.4 By End-User

- 5.4.1 Commercial Farms

- 5.4.2 Greenhouses and Nurseries

- 5.4.3 Residential Gardens and Landscapes

- 5.4.4 Sports Fields and Golf Courses

- 5.5 By Sales Channel

- 5.5.1 Direct Sales

- 5.5.2 Dealer and Distributor

- 5.5.3 Online Retail

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Spain

- 5.6.2.6 Italy

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of the Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Israel

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Turkey

- 5.6.5.5 South Africa

- 5.6.5.6 Egypt

- 5.6.5.7 Rest of the Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Jain Irrigation Systems Ltd. (Rivulis Irrigation Ltd.)

- 6.3.2 The Toro Company

- 6.3.3 Netafim Limited (An Orbia Business)

- 6.3.4 Rain Bird Corporation

- 6.3.5 Valmont Industries, Inc.

- 6.3.6 Chinadrip Irrigation Equipment Co. Ltd

- 6.3.7 Antelco Pty Ltd

- 6.3.8 Sistema Azud

- 6.3.9 Metzer Group (Adam Partners)

- 6.3.10 DripWorks Inc.

- 6.3.11 Mahindra EPC Irrigation Ltd

- 6.3.12 Irritec SpA

- 6.3.13 Hunter Industries Inc.