|

시장보고서

상품코드

1689739

동남아시아의 배터리 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Southeast Asia Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

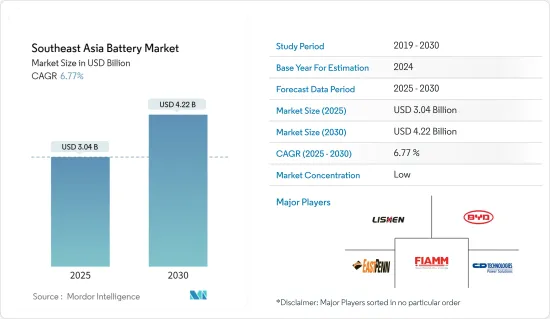

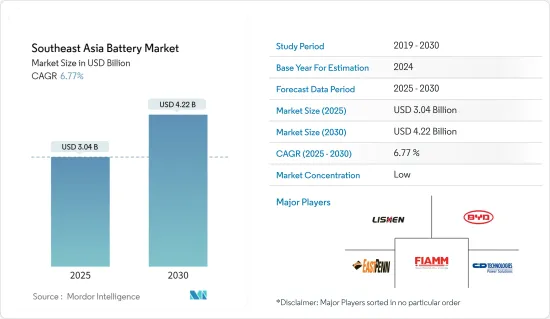

동남아시아의 배터리 시장 규모는 2025년에 30억 4,000만 달러, 2030년에는 42억 2,000만 달러에 달할 것으로 예측되고 있습니다. 예측기간(2025-2030년)의 CAGR은 6.77%를 나타낼 전망입니다.

2020년에는 COVID-19가 시장에 부정적인 영향을 미쳤지만, 팬데믹 이전의 수준에 도달했습니다.

주요 하이라이트

- 중기적으로는 자동차 부문 수요 증가, 리튬 이온 배터리 가격 하락, 동남아시아 데이터센터 허브 구축 등의 요인이 예측 기간 동안 시장을 견인할 것으로 전망됩니다.

- 자동차, 데이터센터, 통신 분야에서 배터리 수요가 증가하고 있음에도 불구하고, 대부분의 국가는 다른 에너지 저장 수단에 의존하기 때문에 배터리 에너지 저장 분야는 급성장할 것으로 예상됩니다. 이것은 예측 기간 동안 에너지 저장 분야에서 배터리 시장의 성장을 억제할 가능성이 높습니다.

- 또한, 재생가능 에너지를 각국의 송전망에 통합할 계획은 예측 기간 동안 리튬이온 배터리 제조업체 및 공급업체에게 큰 비즈니스 기회를 제공할 것으로 예상됩니다.

- 태국은 자동차, 데이터센터 및 기타 최종 사용자 부문 수요 증가로 인해 예측 기간 동안 시장을 독점할 것으로 예상됩니다.

동남아시아 배터리 시장 동향

자동차 분야가 시장을 독점할 것으로 예측

- 이전에는 내연 기관차(ICE)만 사용되었습니다. 내연 기관차에는 납 축배터리가 사용되고 있어 대폭적인 대체품 없이 계속될 가능성이 있습니다.

- 그러나 현재 환경에 대한 우려가 커짐에 따라 기술은 전기자동차로 이동하고 있습니다. EV에서는 에너지 밀도가 높고 자기 방전이 적고 유지 보수가 거의 필요없는 리튬 이온 배터리가 주로 사용됩니다.

- 리튬 이온 배터리 시스템은 플러그인 하이브리드 자동차 및 전기자동차를 추진합니다. 고에너지 밀도, 급속 충전 능력 및 높은 방전 전력으로 리튬 이온 배터리는 자동차 주행 거리 및 충전 시간에 대한 OEM 요구 사항을 충족하는 유일한 사용 가능한 기술입니다. 납 기반 트랙션 배터리는 비에너지가 낮고 무게가 크기 때문에 풀 하이브리드 전기자동차 및 전기자동차에 사용하기에는 경쟁하지 않습니다.

- 또한 리튬 이온 배터리의 가격이 급격히 하락했기 때문에 그 가치는 2013년 668달러/kWh에서 2021년 123달러/kWh로 81.5% 감소했습니다. 이 동향은 앞으로도 계속될 것으로 보이며, 이 지역의 폭넓은 경제층이 EV를 저렴한 가격으로 구입할 수 있게 됩니다.

- 하이브리드 자동차에서는 여러 배터리 기술이 다양한 조합으로 이러한 기능을 제공할 수 있지만, 니켈 수소와 리튬 이온 배터리는 고속 충전 능력, 좋은 방전 성능, 수명 내구성으로 고전압에서 선호됩니다.

- 일부 지역 정부는 배출량 감소 계획을 수립하고 있으며 예측 기간 동안 전기자동차(EV)의 지역 점유율이 높아질 것으로 예상됩니다.

- 따라서 위의 요인으로 인해 예측 기간 동안 자동차 부문은 동남아 배터리 시장을 독점할 것으로 예상됩니다.

태국이 시장을 독점할 전망

- 태국은 시장의 대부분의 점유율을 차지합니다. 자동차, 데이터센터, 통신 부문 수요 증가로 인해 이러한 추세는 예측 기간 동안 계속될 것으로 예상됩니다.

- 태국은 자동차 부문에 큰 투자 잠재력을 제공합니다. 이 나라는 동남아시아 국가 연합 중에서도 유수의 자동차 생산 거점입니다. 이 나라는 자동차 부품 조립업체에서 50년 이상 자동차 제조 및 수출의 톱 허브로 발전했습니다.

- 또한 이 나라는 EV 부문, 특히 플러그인 하이브리드 전기자동차(PHEV)와 하이브리드 전기자동차(HEV)에서 높은 성장이 예상됩니다. 2022년 9월 BYD는 방콕의 라용에 해외 최초의 전기승용차 공장을 건설할 계획을 발표했습니다.

- 국가전기자동차정책위원회(NEVPC) 로드맵에서 태국은 2025년까지 10만대에서 30만대, 궁극적으로 2026년까지 40만대에서 75만대를 추가할 것으로 예상됩니다.

- 게다가 2022년 4월, 태국 정부는 전기자동차(EV)의 동력원이 되는 아연 이온 배터리의 제조에 자금을 제공하기로 합의했습니다. 태국은 천연 자원인 아연을 활용하는 가치 있는 EV용 배터리 공장을 현지 개발합니다.

- 게다가 태국은 ICT 섹터의 성장에 있어서 큰 진보를 이루고, 기술의 세계에서는 2개의 다음의 존재였던 것이, 급속하게 지역의 리더의 하나로 뛰어들었습니다. 지난 10년간 태국의 디지털 점유율은 점점 가속화되고 있으며, 노동력 교육과 기술 구축으로 큰 성과를 거두고 있습니다.

- 정부는 태국 4.0 프로그램에 따라 비즈니스 모듈을 계획했습니다. 이 프로그램은 클라우드 컴퓨팅, 인터랙티브 미디어, 빅데이터, 사물인터넷 등 신기술의 이용을 촉진하는 프로그램입니다. 따라서 이 나라에서는 데이터센터 수요가 높고 예측기간 동안 데이터센터의 배터리 수요가 증가할 것으로 예상됩니다.

- 따라서 위의 요인으로 인해 태국은 예측 기간 동안 동남아시아 배터리 시장을 독점할 것으로 예상됩니다.

동남아시아 배터리 산업 개요

동남아 배터리 시장은 Tianjin Lishen Battery Joint-Stock, FIAMM Energy Technology SpA, BYD, C&D Technologies Inc., East Penn Manufacturing Co.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2028년까지 시장 규모 및 수요 예측

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 배터리 유형별

- 납축배터리

- 리튬 이온 배터리

- 기타 배터리 유형

- 최종 사용자별

- 자동차

- 데이터센터

- 통신

- 에너지 저장

- 기타 최종 사용자

- 지역별

- 인도네시아

- 말레이시아

- 필리핀

- 싱가포르

- 태국

- 베트남

- 미얀마

- 기타 동남아시아 지역

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- BYD Co. Ltd.

- C&D Technologies Inc.

- East Penn Manufacturing Co. Inc.

- Tianjin Lishen Battery Joint-Stock Co. Ltd.

- Exide Industries Ltd.

- FIAMM Energy Technology SpA

- GS Yuasa Corporation

- LG Chem Ltd.

- Panasonic Corporation

- Saft Groupe SA

- Samsung SDI Co. Ltd.

- Clarios

- Tesla Inc.

- Leoch International Technology Limited

제7장 시장 기회와 앞으로의 동향

SHW 25.04.07The Southeast Asia Battery Market size is estimated at USD 3.04 billion in 2025, and is expected to reach USD 4.22 billion by 2030, at a CAGR of 6.77% during the forecast period (2025-2030).

Though COVID-19 negatively impacted the market in 2020, it has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as growing demand from the automotive sector, declining lithium-ion battery prices, and plans to make Southeast Asia a data center hub are expected to drive the market during the forecast period.

- Despite the growing demand for batteries in the automotive, data centers, and telecommunications sectors, the battery energy storage segment is expected to witness stagnant growth, as most countries depend on other energy storage alternatives. This, in turn, is likely to restrain the growth of the battery market in the energy storage segment during the forecast period.

- Moreover, plans to integrate renewable energy with the national grids in respective countries are expected to create significant opportunities for lithium-ion battery manufacturers and suppliers during the forecast period.

- Thailand is expected to dominate the market during the forecast period due to the increasing demand from the automotive, data center, and other end-user sectors.

Southeast Asia Battery Market Trends

Automotive Sector is Expected to Dominate the Market

- Vehicles with internal combustion engines (ICE) were the only types used earlier. ICE vehicles have been using lead-acid batteries, which may continue with no significant replacement available.

- However, nowadays, technology has been shifting toward electric vehicles due to rising concerns about the environment. In EVs, mostly lithium-ion batteries are used, as they provide high energy density, have low self-discharge, and require little maintenance.

- Lithium-ion battery systems propel plug-in hybrid and electric vehicles. Due to their high energy density, fast recharge capability, and high discharge power, lithium-ion batteries are the only available technology that meets the OEM requirements for vehicles' driving range and charging time. Lead-based traction batteries are not competitive for use in full-hybrid electric cars or electric vehicles because of their lower specific energy and higher weight.

- Moreover, the exponential decline in lithium-ion batteries' prices reduced their value by 81.5% from USD 668/kWh in 2013 to USD 123/kWh in 2021. The trend is likely to continue in the future, making EVs affordable to a broader range of economic groups in the region.

- For hybrid vehicles, several battery technologies can provide these functions in different combinations, with nickel-metal hydride and lithium-ion batteries preferred at higher voltages due to their fast recharge capability, good discharge performance, and lifetime endurance.

- Several regional governments developed plans to reduce emissions, which are expected to increase the region's share of electric vehicles (EV) during the forecast period.

- Therefore, owing to the abovementioned factors, the automotive sector is expected to dominate the Southeast Asian battery market during the forecast period.

Thailand is Expected to Dominate the Market

- Thailand accounts for the majority share of the market. This trend is expected to continue during the forecast period, owing to the increasing demand from the automotive, data center, and telecom sectors.

- Thailand provides great investment potential for the automotive sector. The country has a leading automotive production base in the Association of Southeast Asian Nations. The country has developed from an assembler of auto components into a top automotive manufacturing and export hub in over 50 years.

- Moreover, the country is expected to witness high growth in the EV segment, particularly in plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs). In September 2022, BYD Co. announced plans to build its first overseas electric passenger car plant in Rayong, Bangkok.

- Under the National Electric Vehicle Policy Committee (NEVPC) roadmap, Thailand is expected to add between 100,000 and 300,000 vehicles by 2025 and finally between 400,000 and 750,000 vehicles by 2026.

- Further, in April 2022, the Thai government agreed to fund the manufacturing of zinc-ion batteries to power electric vehicles (EVs). Thailand will develop a local EV battery plant worth using zinc as a natural resource.

- Furthermore, Thailand has made great progress in growing its ICT sector, moving quickly from being a secondary player in the world of technology to one of the regional leaders. Over the past decade, the digital share in Thailand has been closing at an ever-increasing speed, with the country making significant gains in labor force education and skills building.

- The government planned its business module under Thailand's 4.0 Program. This program helps increase the use of new technologies such as cloud computing, interactive media, big data, and the internet of things. Hence, the country is expected to have a high demand for data centers, which is expected to increase the demand for batteries in its data centers during the forecast period.

- Therefore, owing to the abovementioned factors, Thailand is expected to dominate the Southeast Asian battery market during the forecast period.

Southeast Asia Battery Industry Overview

The Southeast Asian battery market is partially fragmented due to the presence of key players, including (in no particular order) Tianjin Lishen Battery Joint-Stock Co. Ltd., FIAMM Energy Technology SpA, BYD Co. Ltd., C&D Technologies Inc., and East Penn Manufacturing Co. Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Battery Type

- 5.1.1 Lead-acid Battery

- 5.1.2 Lithium-ion Battery

- 5.1.3 Other Battery Types

- 5.2 By End-User

- 5.2.1 Automotive

- 5.2.2 Data Centers

- 5.2.3 Telecommunication

- 5.2.4 Energy Storage

- 5.2.5 Other End-Users

- 5.3 By Geography

- 5.3.1 Indonesia

- 5.3.2 Malaysia

- 5.3.3 Philippines

- 5.3.4 Singapore

- 5.3.5 Thailand

- 5.3.6 Vietnam

- 5.3.7 Myanmar

- 5.3.8 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd.

- 6.3.2 C&D Technologies Inc.

- 6.3.3 East Penn Manufacturing Co. Inc.

- 6.3.4 Tianjin Lishen Battery Joint-Stock Co. Ltd.

- 6.3.5 Exide Industries Ltd.

- 6.3.6 FIAMM Energy Technology SpA

- 6.3.7 GS Yuasa Corporation

- 6.3.8 LG Chem Ltd.

- 6.3.9 Panasonic Corporation

- 6.3.10 Saft Groupe SA

- 6.3.11 Samsung SDI Co. Ltd.

- 6.3.12 Clarios

- 6.3.13 Tesla Inc.

- 6.3.14 Leoch International Technology Limited