|

시장보고서

상품코드

1689945

3D 프린팅 필라멘트 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)3D Printing Filament - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

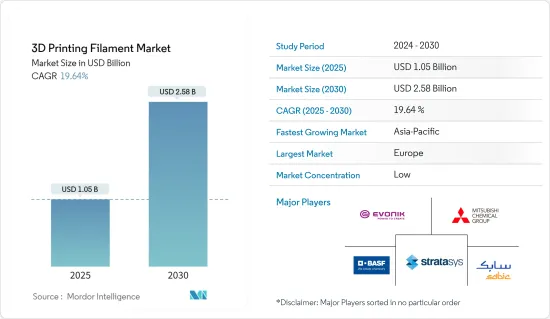

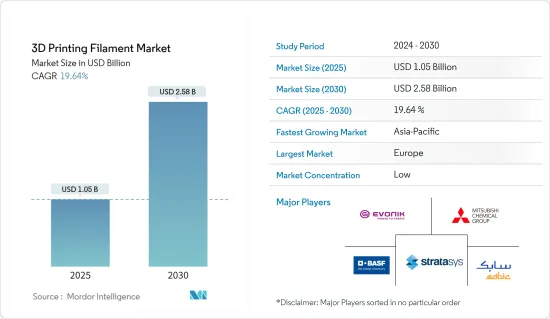

3D 프린팅 필라멘트 시장 규모는 2025년에 10억 5,000만 달러로 추정되고, 예측 기간 2025년부터 2030년까지 CAGR 19.64%로 성장할 전망이며, 2030년에는 25억 8,000만 달러에 달할 것으로 예측됩니다.

COVID-19의 발생은 세계 각지에서의 가동 중단, 제조 활동 및 공급망의 혼란, 생산 중단을 일으켰으며, 이들 모두가 2020년 시장에 부정적인 영향을 미쳤습니다. 그러나 2021-2022년에는 상황이 개선되기 시작했으며, 예측 기간 동안 시장은 전년 대비 성장할 것으로 예상됩니다.

주요 하이라이트

- 제조 용도에서의 3D 프린팅 필라멘트의 이용 확대는 3D 프린팅에 따른 매스커스터마이제이션과 함께 예측 기간 중 시장 성장을 견인할 것으로 보입니다.

- 반대로 3D 프린팅에 필요한 설비 투자액이 높으면 시장 성장을 방해할 수 있습니다.

- 의료 산업의 3D 프린팅 기술 혁신과 3D 프린팅 재료의 진보는 향후 연구될 시장의 성장 기회로 작용할 수 있습니다.

- 예측 기간 동안 유럽은 가장 큰 시장 점유율로 시장을 독점할 것으로 예상됩니다.

3D 프린팅 필라멘트 시장 동향

의료 및 치과 부문 수요 증가가 시장 성장을 가속할 가능성

- 의료 및 치과 산업은 3D 프린팅 필라멘트를 사용하는 주요 산업입니다. 3D 프린팅 필라멘트 용도 전체의 약 30-35%에 기여하고 있습니다.

- 다양한 필라멘트를 사용하는 3D 프린팅 기술을 통해 의료 및 치과 업계의 용도로 조직 및 오가노이드, 수술 기구, 환자별 수술 모델 및 맞춤형 보철물을 만들 수 있습니다. 이러한 3D 프린팅된 물체는 업계의 발전과 개발에 크게 기여하고 있습니다.

- 3D 프린팅에 의해 제조되는 의료기기로는 정형외과 및 두개골 임플란트, 수술 기구, 크라운 등의 치과 수복물, 외장 보철물 등이 있습니다.

- 2023년 3월, Invibio는 의료기기의 용융 필라멘트 적층 성형을 위해 특별히 설계된 필라멘트를 추가하여 임플란트 등급 PEEK-OPTIMA 폴리머의 선택을 확장했습니다.

- 2022년 8월, 3D 세라믹 프린팅 기업인 Lithoz는 제품 수주 증가로 상반기가 회사 역사상 가장 호조를 보였다고 보고했습니다. 이 회사는 다양한 의료, 치과 및 산업 분야를 위한 광범위한 세라믹 3D 프린터를 제공합니다.

- 위에서 언급한 요인들로부터 이 분야는 예측 기간 동안 빠르게 성장할 것으로 보입니다.

유럽이 시장을 독점

- 독일은 GDP에서 유럽 최대의 경제국입니다. 독일, 영국, 프랑스는 세계적으로 가장 빠르게 경제가 발전하고 있는 국가 중 하나입니다.

- 2023년 10월 현재 유럽 국내총생산(GDP)의 평균 약 11%가 의료에 지출되고 있으며, 국민 1인당 의료기술에 대한 지출은 약 312유로(337달러)입니다.

- MedTech Europe에 따르면 유럽에는 33,000개가 넘는 의료 기술 기업이 있습니다. 그 대부분은 독일에 있으며 이탈리아, 영국, 프랑스, 스위스가 이어집니다. 중소기업(SME)이 의료기술 산업의 약 95%를 차지하고 있습니다.

- 독일 항공우주 산업에는 전국에 2,300개 이상의 기업이 있으며, 그 중에서도 북독일에 기업이 집중하고 있습니다. 바이에른, 브레멘, 바덴-뷔르템베르크, 머크렌부르크-포-폰메른 주를 중심으로 항공기의 인테리어 부품 및 소재 생산 기지가 많습니다.

- 국제무역부에 따르면 영국의 일렉트로닉스 산업은 매년 160억 파운드(약 195억 3,000만 달러)의 현지 경제에 기여하고 있습니다. 이 나라는 현재 유럽에서 사용할 수 있는 전자 설계 산업의 40% 점유율을 차지하고 있습니다. 이 산업의 현재 전문 지식은 집적 회로(IC), RFID, 광전자 전자 부품에 집중되어 있습니다.

- 프랑스는 Airbus, Safran, Embraer, Daher-Socata와 같은 제조업체의 주요 제조 기지이기 때문에 항공기의 제조 및 조립 업무가 최근 증가하고 있습니다.

- 또한 Air & Cosmos-International에 따르면 프랑스는 2024년부터 2030년까지 4,130억 유로(4,471억 3,000만 달러)를 국방비에 지출할 것으로 예상됩니다. 이는 미래에 3D 프린팅을 위한 나라의 필라멘트 소비를 크게 높일 수 있습니다.

- 위의 모든 요인은 이 지역에서 3D 프린팅 필라멘트 수요를 높일 것으로 예상됩니다.

3D 프린팅 필라멘트 산업 개요

3D 프린팅 필라멘트 시장은 매우 세분화되어 있으며 소수의 대기업이 상당 부분을 차지하고 있습니다. 이 시장에서 사업을 전개하고 있는 주요 기업(순부동)으로는 Stratasys Ltd, SABIC, BASF SE, Evonik Industries AG, Mitsubishi Chemical Corporation 등이 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 제조 용도에서의 이용 확대

- 3D 프린팅에 의한 매스커스터마이제이션

- 성장 억제요인

- 3D 프린팅 공정에서 높은 설비 투자 요건

- 업계 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 유형별

- 금속

- 티타늄

- 스테인리스

- 기타 금속

- 플라스틱

- 폴리에틸렌테레프탈레이트(PET)

- 폴리유산(PLA)

- 아크릴로니트릴 부타디엔 스티렌(ABS)

- 나일론

- 기타 플라스틱

- 세라믹

- 기타 유형

- 금속

- 용도별

- 항공우주 및 방위

- 자동차

- 의료 및 치과

- 일렉트로닉스

- 기타 용도

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 베트남

- 인도네시아

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 노르딕

- 터키

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 나이지리아

- 카타르

- 이집트

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 시장 점유율(%)** 및 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- BASF SE

- Covestro Ag

- DOW

- DSM

- Evonik Industries Ag

- Keene Village Plastics

- Mitsubishi Chemical Corporation

- SABIC

- Solvay

- Shenzhen Esun Industrial Co. Ltd

- Stratasys

제7장 시장 기회 및 향후 동향

- 의료 업계의 3D 프린팅 혁신

- 3D 프린팅 재료의 진보

The 3D Printing Filament Market size is estimated at USD 1.05 billion in 2025, and is expected to reach USD 2.58 billion by 2030, at a CAGR of 19.64% during the forecast period (2025-2030).

The COVID-19 outbreak caused nationwide lockdowns across the world, disruption in manufacturing activities and supply chains, and production halts, all of which had a negative impact on the market in 2020. However, conditions began to improve in 2021-2022, and the market is expected to grow year-on-year during the forecast period.

Key Highlights

- The growing usage of 3D printing filaments in manufacturing applications, along with mass customization associated with 3D printing, is expected to drive the market growth during the forecast period.

- Conversely, high capital investment requirements in 3D printing may hinder the market's growth.

- 3D printing innovation in the medical industry and advancements in 3D printing materials may act as growth opportunities for the market studied in the future.

- Europe is expected to dominate the market with the largest market share during the forecast period.

3D Printing Filament Market Trends

Increased Demand from the Medical and Dental Segment May Facilitate Market Growth

- The medical and dental industry is the leading industry that uses 3D printing filaments. It contributes to around 30-35% of the total applications of 3D printing filaments.

- 3D printing technology using different filaments allowed the creation of tissues and organoids, surgical tools, patient-specific surgical models, and custom-made prosthetics as applications in the medical and dental industry. These 3D-printed objects significantly contribute to the advancement and development of the industry.

- Medical devices produced by 3D printing include orthopedic and cranial implants, surgical instruments, dental restorations such as crowns, and external prosthetics.

- In March 2023, Invibio broadened its selection of implantable-grade PEEK-OPTIMA polymers by adding a filament specifically designed for fused filament additive manufacturing of medical devices.

- In August 2022, Lithoz, a 3D ceramic printing company, reported the first half of the year as the most successful in its history due to the increased order of its products. The company offers a wide range of ceramic 3D printers for various medical, dental, and industrial applications.

- Owing to all the above-mentioned factors, this segment is expected to grow rapidly in the market studied over the forecast period.

Europe to Dominate the Market

- Germany is the largest economy in Europe in terms of GDP. Germany, the United Kingdom, and France are among the fastest-emerging economies globally.

- As of October 2023, an average of approximately 11% of Europe's gross domestic product (GDP) was spent on healthcare, and expenditure on medical technology per capita was around EUR 312 (USD 337).

- According to MedTech Europe, over 33,000 medical technology companies are present in Europe. Most of them are located in Germany, followed by Italy, the United Kingdom, France, and Switzerland. Small and medium-sized companies (SMEs) make up around 95% of the medical technology industry.

- The German aerospace industry includes more than 2,300 firms located across the country, with Northern Germany recording the highest concentration of firms. The country hosts many production bases for aircraft interior components and materials, largely in Bavaria, Bremen, Baden-Wurttemberg, and Mecklenburg-Vorpommern.

- According to the Department for International Trade, the electronics industry in the United Kingdom contributes GBP 16 billion (~USD 19.53 billion) each year to the local economy. The country currently holds 40% of the share in the available electronics design industry in Europe. Current expertise within the industry is focused on integrated circuits (ICs), RFIDs, optoelectronics, and electronic components.

- France has been witnessing an increase in aircraft manufacturing and assembly operations in recent times as it is a major manufacturing base for manufacturers such as Airbus, Safran, Embraer, and Daher-Socata.

- Moreover, according to Air & Cosmos-International, France is expected to spend EUR 413 billion (USD 447.13 billion) on defense between 2024 and 2030 under its latest military programming law (LPM). This can substantially boost the country's consumption of 3D printing filament in the future.

- All the factors mentioned above are expected to boost the demand for 3D printing filament in the region.

3D Printing Filament Industry Overview

The 3D printing filament market is highly fragmented, with a few major players dominating a significant portion. Some of the major companies (not in any particular order) operating in the market include Stratasys Ltd, SABIC, BASF SE, Evonik Industries AG, and Mitsubishi Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage in Manufacturing Applications

- 4.1.2 Mass Customization Associated with 3D Printing

- 4.2 Restraints

- 4.2.1 High Capital Investment Requirement in 3D Printing Process

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Metals

- 5.1.1.1 Titanium

- 5.1.1.2 Stainless Steel

- 5.1.1.3 Other Metals

- 5.1.2 Plastics

- 5.1.2.1 Polyethylene Terephthalate (PET)

- 5.1.2.2 Polylactic Acid (PLA)

- 5.1.2.3 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.2.4 Nylon

- 5.1.2.5 Other Plastics

- 5.1.3 Ceramics

- 5.1.4 Other Types

- 5.1.1 Metals

- 5.2 Application

- 5.2.1 Aerospace and Defense

- 5.2.2 Automotive

- 5.2.3 Medical and Dental

- 5.2.4 Electronics

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Vietnam

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Covestro Ag

- 6.4.3 DOW

- 6.4.4 DSM

- 6.4.5 Evonik Industries Ag

- 6.4.6 Keene Village Plastics

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 SABIC

- 6.4.9 Solvay

- 6.4.10 Shenzhen Esun Industrial Co. Ltd

- 6.4.11 Stratasys

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 3D Printing Innovation in the Medical Industry

- 7.2 Advancements in 3D Printing Materials