|

시장보고서

상품코드

1690085

조선 - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Shipbuilding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

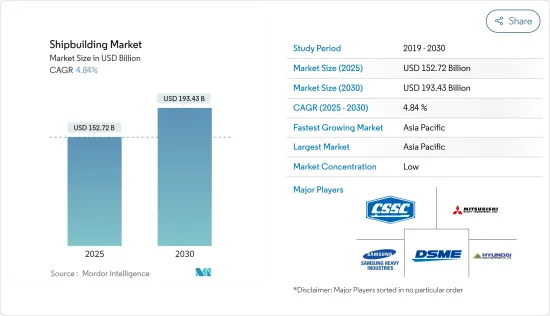

조선 시장 규모는 2025년 1,527억 2,000만 달러에 이르고 예측 기간 중(2025-2030년) CAGR은 4.84%를 나타내 2030년에는 1,934억 3,000만 달러에 달할 것으로 예상됩니다.

장기적으로는 해상무역 증가와 경제 성장, 에너지소비 증가, 친환경선박과 해운서비스에 대한 수요, 조선에 있어서의 로봇기술의 등장 등으로 조선 시장은 예측기간 동안 성장할 것으로 예상됩니다.

조선 시장은 엄격한 국면을 맞이하고 있지만, 주요시장은 여전히 시장을 성장방향으로 향하게 하려고 노력하고 있습니다.

최근 조선산업에서는 3D 프린팅 기술의 도입이 큰 흐름이 되고 있습니다.

또한 동아시아 지역이 조선을 지배하고 있으며 중국, 일본, 한국이 각각 1위와 2위를 차지하고 있습니다.

조선 시장 동향

각국 간의 무역과 해군 활동 증가가 시장을 견인

무역의 성장은 지난 수십 년의 세계 경제의 특징 중 하나이며 해상 운송은 세계 무역의 핵심입니다. 해상 무역은 주로 조선 시장에 영향을 미칩니다. 해상 운송은 세계 각국의 경제 개척의 촉매가 되고 있습니다. 세계 화물의 거의 90%는 해상 운송입니다. 그 결과, 각국은 선박에 크게 의존해, 그것이 조선 시장을 한층 더 가속시키고 있습니다.

중국, 일본, 한국은 조선활동의 약 85%를 차지하고 있습니다. 2022년 6월 대체 연료 사용 가능 선박의 70%는 한국이, 26%는 중국이, 58%는 유럽이, 17%는 일본이 발주했습니다.

해상 운송 수요는 해마다 증가하고 있으며, 이에 따라 수출입의 수도 세계적으로 증가하고 있습니다.

2022년 1월 1일 시점의 선박 보유국 톱 3에는 재화 중량 톤수와 상업 가치 모두 중국과 일본이라는 아시아 2개국이 포함되어 있었습니다.

캐나다 정부는 해군용 선박의 계약을 도입하고 있으며, 이것이 이 나라에서의 방위함선 수요를 창출할 가능성이 있습니다. 조선(핼리팩스)과 시스판의 밴쿠버 조선소(밴쿠버)와 캐나다 해군용 전투함정과 비전투함정, 캐나다 해안경비대용 비전투함정 건조에 관한 장기전략계약을 체결했습니다.

이와 관련하여 2023년 1월, 어빙 조선과 연방 정부는 캐나다 해안 경비대를 대상으로 북극·해상 순찰함 2척을 추가 건조하는 16억 달러의 계약에 합의했습니다.

이러한 사례가 조선 산업의 성장을 뒷받침하고 있습니다.

아시아태평양이 시장을 독점할 전망

조선부문은 제조업을 운영하는 국가들의 GDP에 크게 기여하고 있습니다.

중국, 일본, 한국이 조선활동의 약 85%를 차지하고 있습니다. 중국은 26%, 유럽은 58%, 일본은 17%를 주문했습니다.

인도 조선 산업은 Atmanirbhar Bharat의 사명을 강화할 가능성을 지니고 있습니다. 그것은 철강, 알루미늄, 전기 기계 설비 등 대부분의 다른 산업과 직접적, 간접적으로 광범위한 연결이 있으며, 경제 인프라와 서비스 부문에 의존하기 때문입니다. 2023년 8월 인도 JNPA에서 처리한 총 물동량은 734만 톤으로 2022년 8월의 639만 톤보다 14.75% 증가했습니다.

상업 가치 측면에서 함대 소유와 등록의 순위는 톤수보다 불안정합니다.

베트남 산업무역성은 아시아 지역 내 항로공급망 문제를 완화하고 무역업체의 부담을 경감하는 것을 목적으로 한 몇 가지 조치를 제안했습니다.

또한 국내에서는 군함 개발에 관한 다양한 움직임이 있습니다.

- 2023년 5월 Mitsubishi Heavy Industries(MHI) Group의 Mitsubishi Shipbuilding과 이마바리 조선과 Japan Marine United Corporation의 선박 설계·판매 합작회사인 Nihon Shipyard(도쿄)는 외항액화 CO2(LCO2) 운반선 개발을 위한 공동 연구를 개시했습니다.

따라서 위의 요인은이 지역의 조선 시장의 성장을 가져옵니다.

조선 산업 개요

조선 시장은 세분화되어 있으며, 여러 기업이 시장에서 큰 점유율을 차지하고 있습니다.

- 2023년 1월, 신흥 기업인 TvastaManufacturing Solutions는 콜카타 조선소의 Garden Reach Shipbuilders and Engineers를 위해 콜카타 최초의 3D 프린팅 구조물을 건조했습니다.

이러한 5년간 시장 개척이 시장을 견인할 것으로 기대됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 각국간의 무역활동의 활성화가 시장을 견인

- 시장 성장 억제요인

- 운송·재고 비용의 변동

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자/소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형

- 선박

- 컨테이너

- 여객선

- 기타

- 최종 사용자

- 운송 회사

- 군사

- 기타

- 지역

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 기타

- 브라질

- 멕시코

- 아랍에미리트(UAE)

- 기타 국가

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- China State Shipbuilding Corporation

- Mitsubishi Heavy Industries Ltd

- Samsung Heavy Industries

- Daewoo Shipbuilding Marine Engineering Co. Ltd

- Hyundai Heavy Industries Co. Ltd

- Sumitomo Heavy Industries

- Hanjin Heavy Industries and Construction Co.

- Yangzijiang Shipbuilding Ltd

- United Shipbuilding Corporation

- STX Group

제7장 시장 기회와 앞으로의 동향

KTH 25.05.09The Shipbuilding Market size is estimated at USD 152.72 billion in 2025, and is expected to reach USD 193.43 billion by 2030, at a CAGR of 4.84% during the forecast period (2025-2030).

Over the long term, the shipbuilding market is expected to grow over the forecast period due to increasing seaborne trade and economic growth, rising energy consumption, the demand for eco-friendly ships and shipping services, and the advent of robotics in shipbuilding.

Though the shipbuilding market is facing a tough time, the major markets are still working and trying to turn the market toward a growth direction. In Korea, the government is taking various initiatives to support the shipbuilding industry, as the companies in the nation receive a greater number of orders.

In recent years, the shipbuilding industry saw a significant trend toward the adoption of 3D printing technologies. Every industry related to manufacturing and engineering, including shipbuilding, is embracing 3D printing, also known as additive manufacturing. Companies in the shipbuilding industry are working together with other market participants to embrace cutting-edge manufacturing technologies, such as 3D printing, to improve their manufacturing capacities.

Further, the East Asian region dominates shipbuilding, with China, Japan, and South Korea ranking first and second, respectively. In 2022, China received more than half of all shipbuilding orders, establishing it as a global shipbuilding powerhouse. Southeast Asia is similarly concentrated in ship destruction, with Bangladesh, India, and Pakistan accounting for nearly 90% of global ship scrapping activities.

Shipbuilding Market Trends

Increasing Trade and Naval Activities Between Countries to Drive the Market

Trade growth is one of the hallmarks of the global economy in recent decades, and maritime transport is the backbone of global trade. Maritime trades primarily influence the shipbuilding market. With the extended supply chains and opened new markets, maritime transport is a catalyst for the economic development of nations worldwide. Almost 90% of global freight is seaborne. As a result, countries heavily rely on ships, which further accelerates the shipbuilding market.

China, Japan, and South Korea represented approximately 85% of the shipbuilding activity. China, the Republic of Korea, and Japan continue to dominate maritime ship supply, accounting for 94% of the market in 2022. Shipbuilding increased by 15.5% in China and 8.3% in the Republic of Korea over the past year but declined by 16.4% in Japan. In June 2022, the Republic of Korea ordered 70% of the alternative fuel-capable ships, China ordered 26%, Europe ordered 58%, and Japan ordered 17%. South Korea accounted for 64% of gas carriers and 42% of oil tankers, and Japan accounted for 45% of chemical tankers. Cargos are the most preferred marine vessels used for trading activities.

There is an increase in demand for maritime transport over the years, which caused a subsequent rise in the number of imports and exports across the world. With globalization taking root in the heart of many economies, there are growing possibilities of internationally trading goods, providing a superior range of available products at different price points.

The top three ship-owning countries in terms of both dead-weight tonnage and commercial value as of 1 January 2022 included two Asian countries, namely China and Japan. China had the second-highest increase in tonnage (13%) among the top 25 ship-owning countries in the 12 months to 1 January 2022.

The Canadian government is introducing contracts for ships for the navy, which may generate the demand for defense ships in the country. To support the government's plans to build a large vessel fleet, the government signed a long-term strategic agreement with two Canadian shipyards, namely, Irving Shipbuilding Inc. (Halifax) and Seaspan's Vancouver Shipyards Co. Ltd (Vancouver), for the construction of combat and non-combat naval vessels for the Royal Canadian Navy and non-combat vessels for the Canadian Coast Guard.

In this regard, in January 2023, Irving Shipbuilding and the federal government agreed to a USD 1.6 billion contract to build two additional Arctic and offshore patrol ships for the Canadian Coast Guard.

Such instances are aiding the growth of the shipbuilding industry.

Asia-Pacific is Expected to Dominate the Market

The shipbuilding sector is one of the major contributors to the GDP of the countries in the manufacturing sector. India currently includes 28 shipyards, six of which are run by the Central Public Sector, two by state governments, and 20 by private companies. The Federation of Indian Export Organizations (FIEO) is also advocating for shipbuilding industry reforms.

China, Japan, and South Korea represented approximately 85% of the shipbuilding activity. China, the Republic of Korea, and Japan continue to dominate maritime ship supply, accounting for 94% of the market in 2022. In June 2022, the Republic of Korea ordered 70% of the alternative fuel-capable ships, China ordered 26%, Europe ordered 58%, and Japan ordered 17%. South Korea accounted for 64% of gas carriers and 42% of oil tankers, and Japan accounted for 45% of chemical tankers. Cargos are the most preferred marine vessels used for trading activities.

The shipbuilding industry in India holds the potential to strengthen the mission of an Atmanirbhar Bharat. It is due to its extensive direct and indirect links with most other leading industries such as steel, aluminum, electrical machinery and equipment, and so on, as well as its reliance on infrastructure and services sectors of the economy. The total traffic handled at JNPA in India during August 2023 is 7.34 million tonnes, which is 14.75% higher than 6.39 million tonnes in August 2022. August's traffic includes 6.64 million tonnes of container traffic and 0.69 million tonnes of bulk cargo as against 5.81 million tonnes of container traffic and 0.59 million tonnes of bulk traffic in the corresponding month of 2022.

In terms of commercial value, the ranking of fleet ownership and registration is more volatile than in terms of tonnage. China increased its share the most by 1.1% points, followed by Switzerland, Hong Kong, China, and the Republic of Korea, all of which contain a higher proportion of container ships in their fleets.

The Ministry of Industry and Trade in Vietnam proposed several measures aimed at easing supply chain issues along intra-Asian routes and reducing the burden on traders. These included tax breaks to encourage foreign investment in new ships and private-sector investment in critical infrastructure upgrades, as well as fleet renewal and the development of a coastal fleet management program.

Further, there are various developments in the country concerning the development of warships in the country. For instance,

- In May 2023, Mitsubishi Shipbuilding, a part of Mitsubishi Heavy Industries (MHI) Group and Nihon Shipyard Co., Ltd., a Tokyo-based joint venture for ship design and sales between Imabari Shipbuilding Co., Ltd., and Japan Marine United Corporation, started joint study for the development of an ocean-going liquified CO2 (LCO2) carrier. Nihon Shipyard is pursuing this project to complete the construction of the vessel from 2027 onwards.

Thus, the factors above are responsible for the growth of the Shipbuilding market in the region.

Shipbuilding Industry Overview

The shipbuilding market is fragmented, with several players accounting for significant amounts of shares in the market. Some of the prominent companies in the market are Mitsubishi Heavy Industries, Hyundai Heavy Industries, China State Ship Building Corporation, DSME, and others. Companies are investing heavily in research and development for the innovation of new and advanced products. For instance:

- In January 2023, A start-up, TvastaManufacturing Solutions, built Kolkota's first 3D printed structure for Garden Reach Shipbuilders and Engineers at the Kolkata shipyard. Tvasta Manufacturing Solutions, which specializes in 3D printing construction, built the structure as a technology demonstrator for GRSE.

Such developments over the five years are expected to drive the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Trade Activities Between Countries to Drive the Market

- 4.2 Market Restraints

- 4.2.1 Fluctuation in Transportation and Inventory Cost May Hamper the Growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD)

- 5.1 Type

- 5.1.1 Vessel

- 5.1.2 Container

- 5.1.3 Passenger

- 5.1.4 Other Types

- 5.2 End User

- 5.2.1 Transport Companies

- 5.2.2 Military

- 5.2.3 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 United Arab Emirates

- 5.3.4.4 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 China State Shipbuilding Corporation

- 6.2.2 Mitsubishi Heavy Industries Ltd

- 6.2.3 Samsung Heavy Industries

- 6.2.4 Daewoo Shipbuilding Marine Engineering Co. Ltd

- 6.2.5 Hyundai Heavy Industries Co. Ltd

- 6.2.6 Sumitomo Heavy Industries

- 6.2.7 Hanjin Heavy Industries and Construction Co.

- 6.2.8 Yangzijiang Shipbuilding Ltd

- 6.2.9 United Shipbuilding Corporation

- 6.2.10 STX Group