|

시장보고서

상품코드

1910876

호흡기 질환 검사 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Global Respiratory Disease Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

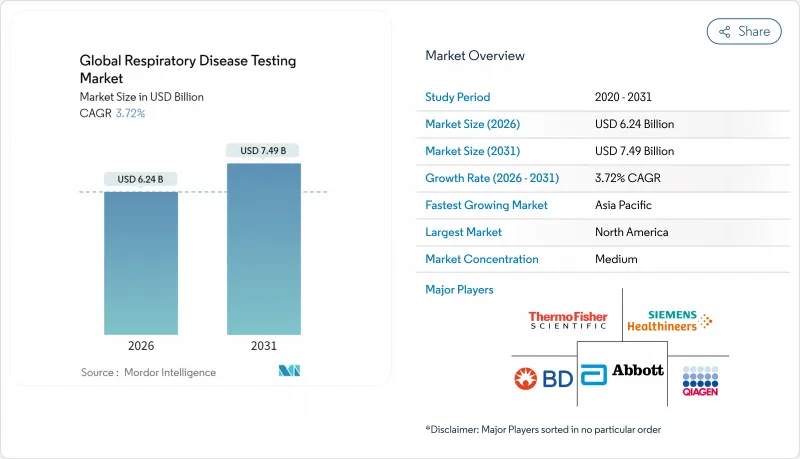

호흡기 질환 검사 시장은 2025년 60억 2,000만 달러에서 2026년 62억 4,000만 달러로 성장해 2026년부터 2031년에 걸쳐 CAGR 3.72%를 나타낼 전망입니다. 2031년까지 74억 9,000만 달러에 달할 것으로 예측됩니다.

팬데믹에 의한 급증기에서 안정적인 확대기로의 전환은 만성 질환 관리 프로그램의 정착, 다중분자진단법의 보급 확대, 의료 현장 전체의 디지털 통합 강화에 지지되고 있습니다. 포스트 COVID 감시 체제에 의해 검사량은 고수준을 유지하는 한편, 기업의 건강 증진 시책이 산업 보건 분야에서 새로운 수요를 창출하고 있습니다. AI 탑재 디지털 청진은 위양성률의 저감과 임상 판단의 신속화에 의해 스크리닝의 경제성을 향상시키고, 재택치료의 이용 확대는 시설 혼잡을 완화하는 분산형 검사 모델을 촉진하고 있습니다. 주요 공급업체는 진화하는 공중보건 우선순위를 충족하기 위해 검사 메뉴를 확대하고 클라우드 기반 워크플로우 솔루션에 계속 투자하고 있습니다. Trudell Medical에 의한 Vyaire의 호흡기 진단 사업 인수로 대표되는 업계 재편은 통합 호흡기 솔루션으로의 전환을 시사합니다.

세계의 호흡기 질환 검사 시장 동향과 인사이트

증가하는 만성 호흡기 질환의 부담

COPD는 세계 3억 명 이상에 영향을 미치고 있으며, 급성 악화와 입원을 억제하기 위한 조기 발견을 중시한 체계적인 스크리닝 프로그램이 추진되고 있습니다. 의료시스템은 적시에 모니터링을 통한 비용 절감 효과를 인식하고 있으며, 이는 1차 케어에서 루틴의 폐기능검사(스파이로메트리) 및 분자검사의 도입을 촉진하고 있습니다. AI를 활용한 COPD 식별 툴은 지역 진료소에서의 진단 감도를 향상시켜, 고령화 사회에 있어서 리스크층별화나 개입 전략의 개별화를 지원하고 있습니다. 종단 호흡기 데이터에 대한 수요는 집단 건강 관리 플랫폼과 원활하게 통합되어 진단을 임시 조치가 아닌 예방 의료의 기초로 자리 매김하고 있습니다.

재택형·POC 진단기기의 급속한 보급

FDA 승인의 NuvoAir 장치 등 환자 조작형 스파이로미터의 규제 인가에 의해 기존 진료소 이외에서의 신뢰성이 높은 폐기능 평가가 가능하게 되었습니다. 포인트 오브 케어 PCR 시스템은 40분 미만으로 병상에서 병원체 검출을 실현하여 외래 시설에서의 치료 및 치료를 효율화합니다. 의료 과소 지역에서는 휴대용 기기가 액세스 격차를 해소하고 소개 지연을 삭감합니다. 호흡기 질환이 환자에 가까운 환경에서 관리됨에 따라 보험자 측도 응급 부문 이용의 저감이라는 혜택을 받습니다. 재택 모니터링은 원격 의료 대시보드를 통한 의료 종사자의 감독을 지원하고 치료 준수를 강화함과 동시에 심각한 악화를 경감하는 조기 개입을 촉진합니다.

폐 진단 장비의 고액 자본 비용

고급 스파이로메트리 및 프레티스모그래피 시스템의 구매 비용은 10만 달러를 넘는 경우가 많으며, 연간 보수 계약이 총 소유 비용의 15-20%를 추가하기 때문에 소규모 의료기관은 도입을 망설입니다. 시설에서는 기기의 수명을 최적의 성능을 넘어 연장 사용하기 때문에 정밀도가 저하되어 지역 격차가 확대하고 있습니다. 임대 모델은 초기 비용을 줄이지만 장기 지출이 증가하고 예산 제약이있는 클리닉의 이익률을 압박합니다.

부문 분석

2025년 장비는 호흡기 질환 검사 시장의 41.72%를 차지했습니다. 이는 스파이로메트리, PCR 및 이미징 워크플로우에서 하드웨어 플랫폼이 여전히 필수적이기 때문입니다. 소프트웨어 및 서비스는 클라우드 분석, AI 해석, 원격 디바이스 관리에 대한 수요 증가를 반영하여 2031년까지 연평균 복합 성장률(CAGR) 4.05%를 나타낼 것으로 예측됩니다. 분석 및 키트는 분자 패널이 확대됨에 따라 지속적인 수익원이 되며 소모품은 교체 사이클을 통해 기준선 수량을 유지합니다. 소프트웨어 및 서비스 분야의 호흡기 질환 검사 시장 규모는 검사기관이 기기를 전자 차트나 집단 대시보드에 접속하는 움직임에 따라 꾸준히 확대될 전망입니다. Roche의 navify 플랫폼은 통합 정보 시스템이 검사 처리 능력을 최적화하고 품질 지표를 지원하는 좋은 예입니다.

둘째, 호흡기 질환 검사 시장은 진단 데이터를 실용적인 지식으로 변환하는 소프트웨어의 혜택을 받고 있습니다. 클라우드 인터페이스를 통해 호흡기 전문의는 실시간 폐 기능 검사 결과를 확인하고 폐 기능 저하의 자동 경고를 수신할 수 있습니다. 서비스 계약에는 현재 예지보전이 포함되어 있어 가동시간 확보와 자산 수명 연장을 실현하고 있습니다. 원격 의료 보급이 진행됨에 따라 보안 API는 환자 가정에서 임상 팀으로의 데이터 흐름을 가능하게하고 원격 의료 상환 모델을 지원합니다.

분자진단은 뛰어난 감도와 빠른 결과 제공으로 2025년 호흡기 질환 검사 시장의 46.85%를 차지했습니다. 임상의가 단일 검체에 의한 다중 병원체 동정을 선호하는 경향으로부터, 증후군 멀티플렉스 패널은 2031년까지 연평균 복합 성장률(CAGR) 4.82%를 나타낼 것으로 전망됩니다. 증후군 패널의 호흡기 질환 검사 시장 규모는 긴급 진료 및 소아과 진료소에서 포인트 오브 케어 검사의 채용 확대에 따라 기세를 늘리고 있습니다. 면역측정법/혈청학 검사는 감시 목적으로 지속적으로 이용되고, 이미징은 폐의 병변을 시각화함으로써 병원체 검출을 보완합니다. 폐기능검사는 만성질환의 경과관찰에 전략적 중요성을 가지고 있으며, 신흥 호기분석기술은 '기타' 범주로 분류되어 향후 경쟁환경의 변화를 시사하고 있습니다.

종합적인 패널은 경험적 항생제 사용을 줄이고 격리 판단을 가속화합니다. 검사실에서는 시약 재고 통합으로 표적당 비용을 절감. 또한 디지털 PCR 라인은 면역 결핍 환자의 검출 한계를 확대하여 임상 적 유용성을 높입니다. 업계의 혁신자들은 현재 나노포어 시퀀싱과 AI 해석을 결합한 카트리지 불필요 포맷을 모색하고 있으며, 미래의 경쟁은 '검체에서 답변까지'의 범용성으로 이행하고 있습니다.

지역별 분석

북미는 2025년 수익의 41.67%를 차지하며 종합적인 보험 적용 범위, 견고한 R&D 생태계, AI 강화 진단의 조기 도입을 반영했습니다. 인플루엔자 및 RSV 패널을 위한 연방 조달 이니셔티브가 기초가 되는 검사량을 지원하고, 고용주 주도의 건강 증진 프로그램이 직업 검사의 보급 범위를 확대하고 있습니다. 학계와 산업계의 연계에 의해 신규 검정의 검증이 가속화되는 한편, CMS의 인센티브는 신속 분자진단을 항균제 적정 사용 프로토콜에 통합하는 병원을 우대하고 있습니다.

유럽은 확립된 국민 모두 보험 제도와 엄격한 품질 기준에 의해 꾸준한 확대를 나타내고 있습니다. 독일에서는 산업안전프로그램에서 폐기능검사기기 수요가 견인되고 영국에서는 NHS 디지털 경로를 통한 재택 스파이로메트리 도입이 가속화되고 있습니다. 프랑스는 도시 오염 지역에서 소아 호흡기 선별에 주력하고 있습니다. GDPR(EU 개인정보보호규정)은 엄격한 클라우드 스토리지 규칙을 부과하며 공급업체는 개인 데이터를 로컬로 유지하는 에지 처리 기능을 통합해야 합니다.

아시아태평양은 5.18%라는 가장 빠른 CAGR을 나타내고 있으며, 중국의 '건강 중국 2030' 목표와 인도의 '아유슈만 바랏' 디지털 헬스 미션이 견인하고 있습니다. 대기오염에 의한 COPD 유병률 증가가 스크리닝 수요를 증가시켜, 관민 제휴에 의한 이동식 진단차의 지방 전개가 진행됩니다. 일본에서는 간병 시설용 AI 청진의 확대로 인력 부족을 완화해, 호주에서는 계절성 인플루엔자 대책에 다중 PCR 패널을 도입. 정부의 국내 제조 지원책은 공급업체의 진입 장벽을 낮추고 분자 카트리지의 현지 생산을 촉진합니다.

남미에서는 브라질이 COVID-19 후 호흡기 질환 감시 시스템에 투자해 진전. 콜롬비아는 도시의 혼잡한 병원의 부담 경감을 향해, 재택 케어용 스파이로메트리를 시험 도입했습니다. 아르헨티나는 중요 진단 시약의 수입 관세를 면제하고 거시 경제의 역풍에도 불구하고 보급을 촉진.

중동 및 아프리카에서는 석유 수입을 활용한 의료 인프라 개선이 진행되고 있습니다. 사우디아라비아에서는 1차 의료시설에 클라우드 접속형 포인트 오브 케어 PCR을 도입하고, 아랍에미리트(UAE)에서는 외국인 노동자 검진을 위한 AI 구동형 폐음 해석 기술의 연구를 진행하고 있습니다. 남아프리카에서는 결핵 대책 프로그램에 다중 패널을 통합하여 중복 감염 환자의 감별 진단을 확대하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 서포트(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 증가하는 만성 호흡기 질환의 부담

- 재택형 및 POC 진단 기기의 급속한 보급

- 다중 분자진단의 기술적 도약

- COVID-19 후의 감시 프로그램에 의한 검사량의 유지

- AI 탑재 디지털 청진에 의한 스크리닝 비용 대 효과 향상

- 기업 건강 관리의 의무화에 의한 직업성 폐 검사의 확대

- 시장 성장 억제요인

- 폐 진단 기기의 고액의 자본 비용

- 신규검사에 대한 복잡한 상환환경

- 훈련을 받은 호흡기 기술자의 부족

- 클라우드 접속 디바이스에 관한 데이터 프라이버시의 우려

- 가치/공급망 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces

- 경쟁 기업 간 경쟁 관계

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

제5장 시장 규모와 성장 예측

- 제품 유형별

- 기기

- 분석 및 키트

- 소모품 및 액세서리

- 소프트웨어 및 서비스

- 검사 유형별

- 분자 진단

- 면역분석법 및 혈청학

- 영상 기반 검사

- 폐기능 검사(폐활량측정, 폐활량계)

- 기타

- 질환 유형별

- 천식

- 만성 폐쇄성 폐질환(COPD)

- 감염성 질환(인플루엔자, RSV, COVID-19, 결핵)

- 폐암

- 간질성 폐질환

- 기타

- 최종 사용자별

- 병원 및 클리닉

- 진단 실험실

- 의사 진료실

- 재택치료 환경

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Abbott Laboratories

- Becton, Dickinson and Company

- Siemens Healthineers AG

- Qiagen NV

- BioMerieux SA

- DiaSorin SpA

- Hologic, Inc.

- Illumina, Inc.

- Revvity, Inc.

- Seegene Inc.

- Bio-Rad Laboratories Inc.

- Eurofins Scientific SE

- Oxford Nanopore Technologies plc

- Tecan Group Ltd

- Grifols, SA

- Vyaire Medical, Inc.

- GE HealthCare Technologies Inc.

제7장 시장 기회와 향후 전망

KTH 26.01.26The respiratory disease testing market is expected to grow from USD 6.02 billion in 2025 to USD 6.24 billion in 2026 and is forecast to reach USD 7.49 billion by 2031 at 3.72% CAGR over 2026-2031.

The transition from pandemic-driven spikes to a steady expansion is anchored in chronic disease management programs, broader adoption of multiplex molecular diagnostics, and stronger digital integration across care settings. Post-COVID surveillance maintains elevated test volumes, while corporate wellness initiatives create fresh demand in occupational health environments. AI-enabled digital auscultation improves screening economics by reducing false positives and accelerating clinical decision-making, and growing home-care utilization fosters decentralized testing models that lower facility congestion. Major suppliers continue to invest in assay menu expansions and cloud-based workflow solutions that keep pace with evolving public health priorities. Consolidation, exemplified by Trudell Medical's acquisition of Vyaire's respiratory diagnostics business, signals an industry shift toward integrated respiratory solutions.

Global Respiratory Disease Testing Market Trends and Insights

Rising chronic respiratory disease burden

COPD affects more than 300 million people worldwide, prompting systematic screening programs that emphasize early detection to curb acute exacerbations and hospitalizations. Health systems recognize the cost savings generated by timely monitoring, which has driven routine spirometry and molecular testing adoption within primary care. AI-assisted COPD identification tools now improve diagnostic sensitivity in community clinics, helping clinicians stratify risk in aging populations and tailor intervention strategies. The demand for longitudinal respiratory data integrates seamlessly with population health platforms, positioning diagnostics as a preventive-care staple rather than an episodic measure.

Rapid uptake of home-based & POC diagnostic devices

Regulatory clearance of patient-operated spirometers, such as the FDA-approved NuvoAir device, enables reliable lung-function evaluation outside traditional clinics. Point-of-care PCR systems deliver bedside pathogen detection in under 40 minutes, streamlining triage and treatment at ambulatory sites. For underserved regions, portable instruments close access gaps and cut referral delays. Payers also benefit from lower emergency department utilization once respiratory conditions are managed closer to the patient. Home monitoring supports clinician oversight via telehealth dashboards, reinforcing adherence and triggering early interventions that mitigate severe flare-ups.

High capital cost of pulmonary diagnostic instruments

Purchasing advanced spirometry or plethysmography systems often exceeds USD 100,000, and annual service contracts add 15-20% to total ownership costs, deterring smaller providers. Facilities prolong equipment lifecycles beyond optimal performance, compromising accuracy and widening geographic disparities. Leasing models alleviate upfront spending but increase long-term outlays, compressing margins for budget-constrained clinics.

Other drivers and restraints analyzed in the detailed report include:

- Technological leaps in multiplex molecular diagnostics

- Post-COVID surveillance programs sustaining test volumes

- Complex reimbursement landscape for new tests

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Instruments captured 41.72% of the respiratory disease testing market in 2025 because hardware platforms remain essential for spirometry, PCR, and imaging workflows. Software & services are projected to grow at 4.05% CAGR through 2031, reflecting escalating demand for cloud analytics, AI interpretation, and remote device management. Assays & kits fuel recurring revenue as molecular panels widen, and consumables sustain baseline volume through replacement cycles. The respiratory disease testing market size for software & services is set to expand steadily as laboratories connect instruments to electronic medical records and population dashboards. Roche's navify platform illustrates how integrated informatics optimize throughput and support quality metrics.

Second, the respiratory disease testing market benefits from software that transforms diagnostic data into actionable insights. Cloud interfaces allow pulmonologists to view real-time spirometry results and receive automated alerts for declining lung function. Service contracts now bundle predictive maintenance, ensuring uptime and prolonging asset life. As telehealth normalization grows, secure APIs enable data flow from patient homes to clinical teams, underpinning remote care reimbursement models.

Molecular diagnostics delivered 46.85% respiratory disease testing market share in 2025 due to superior sensitivity and rapid turnaround. Syndromic multiplex panels should grow 4.82% CAGR through 2031 as clinicians favor single-swab identification of multiple pathogens. The respiratory disease testing market size for syndromic panels gains momentum as point-of-care adoption rises in urgent care and pediatric offices. Immunoassay/serology persists for surveillance, while imaging complements pathogen detection by visualizing lung sequelae. Pulmonary function tests hold strategic importance in chronic disease follow-up, and emerging breath-analysis technologies populate the "others" category, hinting at future competitive disruption.

Comprehensive panels reduce empirical antibiotic use and shorten isolation decisions. Laboratories leverage consolidated reagent inventories, lowering cost per target. Moreover, digital PCR lines extend detection limits for immunocompromised patients, expanding clinical utility. Industry innovators now explore cartridge-free formats that pair nanopore sequencing with AI analytics, tilting future competition toward sample-to-answer versatility.

The Respiratory Disease Testing Market Report is Segmented by Product Type (Instruments, Assays & Kits, and More), Test Type (Molecular Diagnostics, Immunoassay/Serology, and More), Disease Type (Asthma, COPD, Infectious Diseases, and More), End User (Hospitals & Clinics, Diagnostic Laboratories, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 41.67% of 2025 revenue, reflecting comprehensive insurance coverage, robust R&D ecosystems, and early adoption of AI-enhanced diagnostics. Federal procurement initiatives for influenza and RSV panels underpin baseline volumes, and employer-sponsored wellness programs expand occupational testing footprints. Academic-industry collaborations accelerate validation of novel assays, while CMS incentives favor hospitals that integrate rapid molecular diagnostics into antimicrobial stewardship protocols.

Europe exhibits steady expansion thanks to established universal healthcare and stringent quality standards. Germany drives demand for pulmonary function equipment in industrial safety programs, while the United Kingdom accelerates home-spirometry deployment through NHS digital pathways. France focuses on pediatric respiratory screening in urban pollution zones. GDPR imposes strict cloud-storage rules, compelling vendors to embed edge-processing capabilities that keep personal data local.

Asia-Pacific posts the fastest 5.18% CAGR, propelled by China's Healthy China 2030 targets and India's Ayushman Bharat digital health mission. Air-pollution-induced COPD prevalence intensifies screening volumes, and public-private partnerships finance mobile diagnostic vans in rural districts. Japan scales AI-auscultation in elder-care facilities to mitigate workforce shortages, while Australia adopts multiplex PCR panels to counter seasonal influenza surges. Government subsidies for indigenous manufacturing lower barriers for domestic suppliers, stimulating local production of molecular cartridges.

South America advances through Brazil's investments in respiratory surveillance after COVID-19. Colombia pilots home-care spirometry to decentralize congested urban hospitals. Argentina offers import duty relief on critical diagnostic reagents, nurturing adoption despite macroeconomic headwinds.

The Middle East & Africa leverage oil-financed healthcare infrastructure improvements. Saudi Arabia deploys cloud-connected point-of-care PCR across primary clinics, and the United Arab Emirates explores AI-driven lung sound analytics for expatriate worker screenings. South Africa integrates multiplex panels into tuberculosis programs, broadening differential diagnosis for co-infected patients.

- Roche

- Thermo Fisher Scientific

- Danaher

- Abbott Laboratories

- Beckton Dickinson

- Siemens Healthineers

- QIAGEN

- bioMerieux

- DiaSorin

- Hologic

- Illumina

- Revvity, Inc.

- Seegene

- Bio-Rad Laboratories

- Eurofins

- Oxford Nanopore Technologies plc

- Tecan Group

- Grifols

- Vyaire Medical

- GE HealthCare Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising chronic respiratory disease burden

- 4.2.2 Rapid uptake of home-based & POC diagnostic devices

- 4.2.3 Technological leaps in multiplex molecular diagnostics

- 4.2.4 Post-COVID surveillance programs sustaining test volumes

- 4.2.5 AI-enabled digital auscultation improving screening economics

- 4.2.6 Corporate wellness mandates expanding occupational lung testing

- 4.3 Market Restraints

- 4.3.1 High capital cost of pulmonary diagnostic instruments

- 4.3.2 Complex reimbursement landscape for new tests

- 4.3.3 Shortage of trained respiratory technologists

- 4.3.4 Data-privacy concerns over cloud-connected devices

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.2 Threat of New Entrants

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Bargaining Power of Suppliers

- 4.7.5 Threat of Substitutes

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Instruments

- 5.1.2 Assays & Kits

- 5.1.3 Consumables & Accessories

- 5.1.4 Software & Services

- 5.2 By Test Type

- 5.2.1 Molecular Diagnostics

- 5.2.2 Immunoassay / Serology

- 5.2.3 Imaging-based Tests

- 5.2.4 Pulmonary Function (Spirometry, Plethysmography)

- 5.2.5 Others

- 5.3 By Disease Type

- 5.3.1 Asthma

- 5.3.2 Chronic Obstructive Pulmonary Disease (COPD)

- 5.3.3 Infectious Diseases (Flu, RSV, COVID-19, TB)

- 5.3.4 Lung Cancer

- 5.3.5 Interstitial Lung Diseases

- 5.3.6 Others

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Diagnostic Laboratories

- 5.4.3 Physician Offices

- 5.4.4 Home-care Settings

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 F. Hoffmann-La Roche Ltd

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Danaher Corporation

- 6.3.4 Abbott Laboratories

- 6.3.5 Becton, Dickinson and Company

- 6.3.6 Siemens Healthineers AG

- 6.3.7 Qiagen N.V.

- 6.3.8 BioMerieux SA

- 6.3.9 DiaSorin S.p.A.

- 6.3.10 Hologic, Inc.

- 6.3.11 Illumina, Inc.

- 6.3.12 Revvity, Inc.

- 6.3.13 Seegene Inc.

- 6.3.14 Bio-Rad Laboratories Inc.

- 6.3.15 Eurofins Scientific SE

- 6.3.16 Oxford Nanopore Technologies plc

- 6.3.17 Tecan Group Ltd

- 6.3.18 Grifols, S.A.

- 6.3.19 Vyaire Medical, Inc.

- 6.3.20 GE HealthCare Technologies Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment