|

시장보고서

상품코드

1690773

인도의 전기자전거 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)India E-bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

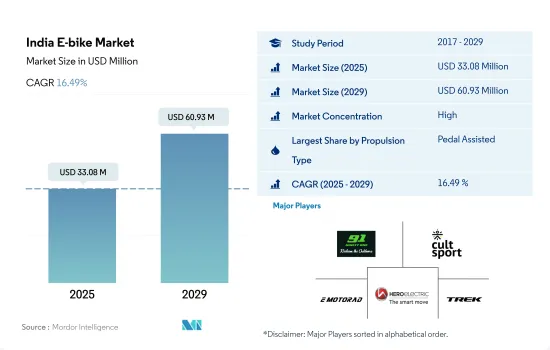

인도의 전기자전거 시장 규모는 2025년 3,308만 달러로 예측되고, 2029년에는 6,093만 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2029년) CAGR 16.49%로 성장할 것으로 예측됩니다.

추진 부문 시장 개요

- 전기자전거는 인도에서 최고의 이동 수단이 될 가능성을 가지고 있습니다. 또한 자동차의 편의성과 주행시의 흥분이 혼합되어 있어 뛰어난 이동 수단이며, 특히 레크리에이션 활동에 유용합니다. 스피드 페델렉은 가까운 미래에 단거리를 달리는 가장 실용적인 페달 어시스트 자전거가 될 것으로 기대됩니다. 인도의 힘과 속도가 앞으로 몇년안에 개발되면 사람들은 스피드 페델렉의 범주에 끌릴 수 있습니다. 마찬가지로, 수동으로 페달을 밟지 않고 모터에 직접 동력을 전달하는 스로틀 어시스트식 전기자전거의 인기가 높아지고 있는 것도, 이 부문의 확대에 기여하고 있을 가능성이 있습니다.

- 전기자전거는 대기 중으로 이산화탄소 배출량이 적기 때문에 기존의 이륜차보다 친환경적인 선택입니다. 자동차 공해를 줄이기 위해 인도 정부가 수행하는 많은 노력이 시장 성장을 뒷받침하고 있습니다. 전기자전거의 인기가 높아짐에 따라 소유 비용과 유지 보수 비용을 줄이면이 분야에 이익이 있습니다. 충전 인프라 개발과 인도 자동차 부문의 확대는 최종 고객에게 매력적인 개발 기회를 제공합니다.

- 온라인 및 오프라인 상점을 통한 전기자전거의 가용성 증가는 전국적인 전기자전거 판매를 촉진하고 있습니다. 인도에서 활동하는 주요 시장 조직은 제품의 품질을 높이기 위해 R&D 프로젝트에 대규모 투자를 하고 있습니다. 또한 배터리 기술 개선, 경량 소재 조합, 광고 캠페인 투자 등에 주력하여 전반적인 매출을 늘리고 있습니다. 이러한 노력의 결과로 시장 확대가 예상되고 앞으로 몇 년동안 인도에서 전기자전거의 성장을 가속할 수 있습니다.

인도의 전기자전거 시장 동향

인도의 전기자전거 보급률은 낮은 수준에서 시작하지만, 일관된 상승을 나타내며 시장의 잠재성이 높아지고 있음을 나타냅니다.

- 인도에서는 최근 몇년 간 전기자전거의 보급이 진행되고 있습니다. 또한 자전거가 건강에 가져오는 혜택에 대한 사람들의 의식이 높아지고, 인도에서의 러시시 교통 체증 증가, 전기자전거 도입을 지원하는 정부의 대처 확대 등이 전국의 전기자전거 보급에 기여하고 있습니다. 또, 연료비와 유지비의 저하에 의해 인도인의 전기자전거의 보급률은 2018년보다 2019년이 0.10%로 가속했습니다.

- COVID 사례의 확산과 파도의 성장은 자전거 사업에 긍정적인 영향을 미쳤습니다. 사회적 거리를 유지하기 위해 대중 교통이나 대여 교통을 이용하지 않는 등의 요인이 소비자의 통근 방법을 바꾸고 사무실이나 인근 장소에 매일 통근하는 다른 방법보다 편리하고 가격 친화적인 옵션 중 하나이기 때문에 전기자전거에 대한 투자를 더욱 촉구했습니다. 이러한 요인에 의해 2022년에는 전국에서 2021년 대비 0.60% 보급률이 가속되었습니다.

- 전기자전거의 보급은 상업 운전의 재개와 무역 장벽의 봉쇄 해제에 의해 증가했습니다. 무역제한이 해제된 결과, 이 나라의 수출입 활동이 개선되었습니다. 전기자전거의 보급률은 2022년의 0.60%에서 2029년에는 5.00%로 상승할 것으로 예상됩니다. 이것은 연료 절약과 시간 절약 등 전기자전거의 특징과 이점에 고객이 매력을 느낀 결과입니다.

인도에서는 매일 5-15km의 거리를 통근하는 인구 비율이 꾸준히 증가하고 있어 이동거리가 진화하고 있음을 보여줍니다.

- 각 도시의 사람들은 자전거 문화를 받아들이고 있으며, 인도의 자전거 수요는 지난 몇 년동안 증가하고 있습니다. 그러나 5-15km의 통근 및 통학거리는 다른 교통수단과 비교하면 아직 상대적으로 적고 대부분의 사람들이 이륜차나 대중교통기관 등 다양한 교통수단으로의 이동을 선호하고 있습니다. 2019년에는 5-15km 이내의 인근으로 자전거 통근을 선택한 사람은 인구의 5% 미만이었습니다. 그러나 2020년에는 많은 사람들이 운동을 시작하거나 닫는 동안 필수품을 사기 위해 가까운 마켓플레이스로 이동하기 위해 자전거를 사용하게 되었기 때문에 5-15km 이내의 이동이 증가했습니다. 이러한 요인으로 인해 2020년 인도의 자전거 수요는 2019년보다 증가했습니다.

- 유행은 인도의 자전거 시장에 중요하고 유익한 영향을 미쳤습니다. 더 많은 인도인이 대중교통을 사용하지 않고 도보와 자전거로 인근 장소로 이동했습니다. 또한 선진적인 기능을 갖춘 배터리 수명이 긴 전기자전거의 도입은 사람들이 운동이나 주말 레크리에이션 활동에 자전거를 선택하도록 촉구했으며, 2021년 인도에서 5-15km의 거리를 이동하는 통근자 수는 2020년보다 더 증가했습니다.

- 사람들은 인근 통근에 자전거를 이용하는 거주를 착용했습니다. 현재, 많은 사람들이 현지 시장 등 다양한 장소에 가기 위해, 반경 5-15km의 범위를 자전거로 매일 이동하고 있습니다. 건강상의 이점, 이산화탄소를 배출하지 않는 통근 방법, 교통 정체를 피함으로써 시간 절약 등의 이유로 자전거 통근을 선택하는 사람이 늘고 있습니다. 이러한 요인으로 인해 예측 기간 동안 인도에서는 5-15km의 통근 거리가 증가할 것으로 예상됩니다.

인도의 전기자전거 산업 개요

인도의 전기자전거 시장은 상당히 통합되어 있으며 상위 5개사에서 82.78%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다: Alphavector(India) Pvt Ltd, Cultsport, EMotorad, Hero Cycles Limited, TREK BICYCLE INDIA PRIVATE LIMITED(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 자전거 판매 대수

- 1인당 GDP

- 인플레이션율

- 전자 자전거의 보급률

- 1일 이동 거리가 5-15킬로인 인구/통근자의 비율

- 렌터사이클

- 전기자전거 배터리 가격

- 배터리 화학제품의 가격표

- 슈퍼 로컬 배송

- 자전거 전용 차로

- 트레커 수

- 배터리 충전 능력

- 교통 정체 지수

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 추진 유형

- 페달 어시스트

- 스피드 페데렉

- 스로틀 어시스트

- 용도 유형

- 화물 및 유틸리티

- 도시

- 트레킹

- 배터리 유형

- 납 배터리

- 리튬 이온 배터리

- 기타

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Alphavector(India) Pvt Ltd

- Being Human

- Cultsport

- EMotorad

- Hero Cycles Limited

- Motovolt

- Nibe E-motor Limited

- SJ Electric Vehicles Pvt. Ltd(Polarity Smart Bikes)

- Stryder

- TREK BICYCLE INDIA PRIVATE LIMITED

- Tru E Bikes Pvt. Ltd

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The India E-bike Market size is estimated at 33.08 million USD in 2025, and is expected to reach 60.93 million USD by 2029, growing at a CAGR of 16.49% during the forecast period (2025-2029).

PROPULSION SEGMENT MARKET OVERVIEW

- E-bikes have the potential to become India's best means of mobility. They are also an excellent means of transportation since they mix the convenience of a car with the excitement of riding, making them especially useful for recreational activities. Speed pedelec is expected to soon become the most practical pedal-assist bicycle alternative for shorter distances. As India's power and speed capabilities develop over the next years, people may gravitate toward the speed pedelec category. Similarly, the increasing popularity of throttle-assisted e-bikes, which transmit power directly to the motor without the need for manual pedaling, could be attributed to the segment's expansion.

- E-bikes are an eco-friendly option than traditional two-wheelers because they emit less carbon into the atmosphere. Many initiatives taken by the Indian government to decrease automotive pollution are boosting the growth of the market. The rising popularity of e-bikes is benefiting the sector due to lower ownership and maintenance costs. Advancements in charging infrastructure and India's expanding car sector provide end customers with attractive development opportunities.

- The increased availability of e-bikes through online and offline outlets is driving e-bike sales across the country. Key market organizations operating in India are investing extensively in R&D projects to increase product quality. They also focus on refining battery technology, combining lightweight materials, and investing in advertising campaigns to increase overall sales. As a result of these initiatives, the market is projected to expand, which may fuel the growth of electric bicycles in India in the next few years.

India E-bike Market Trends

India's E-Bike adoption rates, though starting from a low base, show a consistent increase, indicating a growing market potential.

- The use of e-bikes has become increasingly popular in India over the past few years. Additionally, growing public awareness of the health benefits of cycling, increasing traffic congestion in India during rush hours, and expanding government initiatives to support e-bike adoption are all contributing to the country's e-bike adoption. Also, fuel expenditures and lower maintenance costs sped up the adoption rate of e-bikes among Indians to 0.10% in 2019 over 2018.

- The spreading of COVID cases and growth in the wave affected the bicycle business positively. Factors such as not using public or rented transportation to maintain social distancing have changed the commuting methods of the consumer, further encouraging people to invest in e-bikes, as it is one of the convenient and price-friendly options over other modes of commuting daily to offices and nearby places. Such factors accelerated the adoption rate by 0.60% in 2022 over 2021 across the country.

- E-bike adoption has increased with the return of commercial operations and the lifting of trade barriers of lockdown. The country's import and export activities have improved as a result of the removal of trade restrictions. The adoption rate for e-bikes is anticipated to increase to 5.00% in 2029 from 0.60% in 2022 as a result of customer attraction to e-bikes due to their features and advantages, such as fuel saving and time-saving.

India shows a steady increase in the percentage of population commuting 5-15 km daily, indicating evolving travel distances.

- People in various cities have embraced the bicycle culture, and the demand for bicycles in India has increased over the past few years. However, commuter travel of 5-15 kilometers is still relatively low compared to other modes of transportation, as most people prefer to travel via various modes such as two-wheelers and public transportation. Less than 5% of the population chose to commute via bicycles to nearby places within 5-15 kilometers in 2019. However, in 2020, traveling between 5 and 15 kilometers increased as many people started exercising and using bicycles to travel to nearby marketplaces for buying essentials during the lockdown. Such factors increased the demand for bicycles in India in 2020 over 2019.

- The pandemic had a significant and beneficial impact on the Indian bicycle market. More Indians walked or cycled instead of using public transportation to nearby places. The introduction of e-bikes with advanced features and longer battery lives also encouraged people to choose bicycles for exercising and recreational weekend activities, which further increased the number of commuters traveling 5-15 kilometers in India in 2021 over 2020.

- People developed the habit of using bicycles to commute to nearby places. Currently, many people travel daily by bicycle within a radius of 5-15 kilometers to get to various places such as local markets. Due to the increased health advantages, carbon-free commutes, and time savings from avoiding traffic bottlenecks, more people are choosing to commute by bicycle. These factors are expected to increase commuter travel between 5 and 15 kilometers in India during the forecast period.

India E-bike Industry Overview

The India E-bike Market is fairly consolidated, with the top five companies occupying 82.78%. The major players in this market are Alphavector (India) Pvt Ltd, Cultsport, EMotorad, Hero Cycles Limited and TREK BICYCLE INDIA PRIVATE LIMITED (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Number Of Trekkers

- 4.12 Battery Charging Capacity

- 4.13 Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Application Type

- 5.2.1 Cargo/Utility

- 5.2.2 City/Urban

- 5.2.3 Trekking

- 5.3 Battery Type

- 5.3.1 Lead Acid Battery

- 5.3.2 Lithium-ion Battery

- 5.3.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Alphavector (India) Pvt Ltd

- 6.4.2 Being Human

- 6.4.3 Cultsport

- 6.4.4 EMotorad

- 6.4.5 Hero Cycles Limited

- 6.4.6 Motovolt

- 6.4.7 Nibe E-motor Limited

- 6.4.8 SJ Electric Vehicles Pvt. Ltd (Polarity Smart Bikes)

- 6.4.9 Stryder

- 6.4.10 TREK BICYCLE INDIA PRIVATE LIMITED

- 6.4.11 Tru E Bikes Pvt. Ltd

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms