|

시장보고서

상품코드

1910926

유럽의 빌딩 자동화 시스템 시장 - 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)Europe Building Automation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

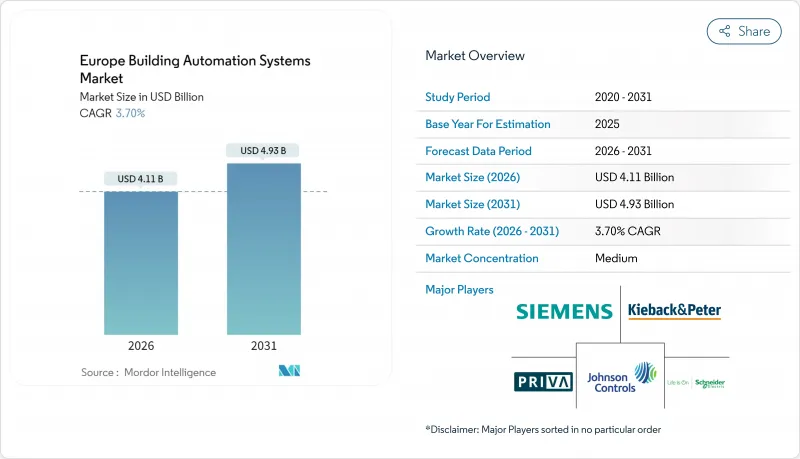

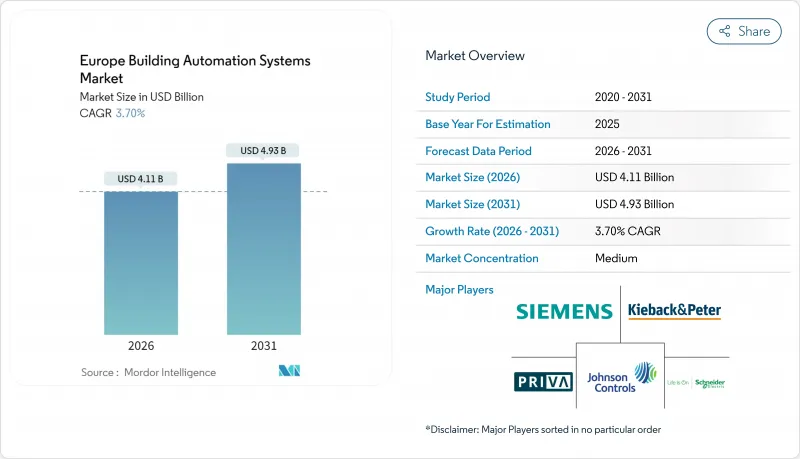

유럽의 빌딩 자동화 시스템 시장은 2025년 39억 6,000만 달러로 평가되었으며, 2026년 41억 1,000만 달러에서 2031년까지 49억 3,000만 달러에 이를 것으로 예상됩니다. 예측 기간(2026-2031년)의 CAGR은 3.70%를 나타낼 것으로 전망됩니다.

개정된 '건물의 에너지 성능 지령'에 따른 컴플라이언스 의무 강화, 전기 요금 상승, 기업의 넷 제로 목표가 투자 판단의 대부분을 이끌고 있습니다. 이 지역의 건축 스톡의 4분의 3이 1990년 이전에 건설되었기 때문에 개수 수요가 주류가 되고 있지만, 혁신은 클라우드 대응 분석, 무선 센서, AI 구동형 최적화에 집중하고 있습니다. 하드웨어가 수익의 기반이 되고 있는 반면 SaaS(서비스로서의 소프트웨어)는 지속적인 수입원을 제공하여 중규모 부동산 포트폴리오의 투자 회수 기간을 단축합니다. 경쟁은 중간 정도입니다. 핵심 컨트롤러와 현장 장치를 공급하는 세계 제조업체는 여러 회사입니다. 지속적인 노동력 부족과 사이버 보안 책임은 프로젝트 진행 속도에 대한 단기적인 브레이크 역할을 하지만 제품 표준화와 생태계 파트너십으로 인해 위험 인식이 점차 줄어들고 있습니다.

유럽의 빌딩 자동화 시스템 시장 동향 및 인사이트

EPBD 개정에서 BACS 의무화

2025년에 시행된 개정 에너지 성능 지령(EPBD)에 의해 난방 부하 290kW를 넘는 비주택 시설은 상호 운용 가능한 자동화·제어 시스템의 도입이 의무화됩니다. 독일과 프랑스에서는 더욱 엄격한 기준이 채용되어, 관공청·학교·의료시설에 있어서 입찰 활동이 가속하고 있습니다. BACnet 및 KNX와 같은 개방형 프로토콜 솔루션은 보조금 프로그램에서 우대 조치를 받았으며 건물 소유자는 계획된 리노베이션 시 자체 표준 네트워크를 대체하도록 촉구되었습니다. 적합 기한은 2027년경에 집중되어 엔지니어링 수요의 현저한 피크를 만들어 전문적인 연수 이니셔티브를 환기하고 있습니다. 시행의 엄격성은 회원국에 따라 다르지만, 전반적인 의무화로 인해 유럽의 빌딩 자동화 시스템 시장의 성장은 규제 일정에 통합됩니다. 현지 설치 파트너와 다국어 지원 시운전 소프트웨어를 갖춘 공급업체는 명백한 경쟁 우위를 확보했습니다.

무선 센서 가격 급락

멀티 테크놀로지 대응의 재실 검지·온도·조도 센서의 평균 판매 가격은 2023년부터 2025년에 걸쳐 약 30% 하락했습니다. 주요 요인은 동아시아의 200mm 웨이퍼 생산량 증가와 시스템 온칩(SoC) 아키텍처로의 전환입니다. 북유럽 부동산 소유자는 조기 도입자이며 장기간의 난방 시즌 동안 에너지 집약형 시설을 모니터링하기 위해 배터리 구동 센서를 활용하고 있습니다. 배선 공사 및 천장 코어 드릴링 비용 절감으로 소규모 프로젝트의 투자 회수 기간이 단축되어 고객 기반이 A급 오피스 타워 이외에도 확대되고 있습니다. 새로운 칩에 내장된 에지 처리 기능은 지연 감소, 오감지 스크리닝, 기밀성이 높은 건물 사용 데이터의 시설 내 유지를 실현하고 GDPR(EU 개인정보보호규정) 준수를 지원합니다. 부품 가격은 2021-2022년 공급 급박 시점에 변동이 없었지만, 특수 RF 마이크로컨트롤러의 간헐적인 부족으로 인티그레이터용 리드 타임이 소폭 상승하는 경우가 여전히 발생하고 있습니다.

분할된 기존 건축 스톡

파리, 로마, 바르셀로나 등의 역사적인 석조 건축에서는 코어 드릴링과 대규모 배관 공사가 제약되는 경우가 많아 센서 설치 및 배선 작업이 복잡해집니다. 라디에이터에서 가변 풍량 박스에 이르기까지 서로 다른 시대의 기계 설비가 혼재되어 있어 꼼꼼한 인터페이스 설계가 필요하고 설계 공수와 예비 예산이 증가합니다. 주인은 대규모 테넌트 교체 시까지 고급 자동화를 연기할 수 있으며 의사결정 주기가 기존 회계연도를 넘어 장기화합니다. 지역의 장인조합이 보존기준을 엄격하게 적용하기 때문에 침습적인 리노베이션은 제한됩니다. 그 결과, 인티그레이터는 무선식·전지 불필요한 액추에이터나 역사적 건조물 가이드라인에 준거한 가역 마운트 킷에 투자합니다만, 이러한 특수 부품은 가격 프리미엄이 있어 투자 회수 기간을 단축합니다.

부문 분석

하드웨어는 2025년 수익의 65.58%를 차지하며 신뢰할 수 있는 컨트롤러, 액추에이터 및 멀티스탠다드 게이트웨이가 유럽의 빌딩 자동화 시스템 시장 규모의 모든 기능 계층을 지원했습니다. 컨트롤러는 일상적으로 수천 개의 I/O 포인트를 관리하기 때문에 공급업체는 실시간 처리와 사이버 보안 강화의 고도화를 강요하고 있습니다. 병행하여 센서는 초저전력 무선 칩으로 이동하여 케이블 트레이가 부족한 1910년 이전 건물 내에서의 수리 가능성을 확대하고 있습니다.

클라우드 분석 서비스와 원격 펌웨어 업데이트가 SaaS 구독의 CAGR 6.02%를 나타낼 전망입니다. 건물 소유자는 자본 지출보다 운영 경비를 중시하고 AI 기반 최적화 기능을 계속 계약으로 구입하고 있습니다. 예측 가능한 과금 체계는 예산 계획을 용이하게 하고 지속적인 기능 확장을 촉진합니다. 건물의 HVAC 루프가 온라인화되면 조명, 보안 및 EV 충전기 모듈이 신속하게 추적됩니다. 공급업체는 에지 AI 추론 기능을 룸 컨트롤러에 통합하여 하이퍼스케일 데이터센터의 계산 부하를 줄이고 지역 데이터 주권법을 준수합니다.

2025년 시점에서 유럽 빌딩 자동화 시스템 시장의 44.92%를 상업시설이 차지했으며, 의무화된 에너지 감사와 경쟁 환경이 이를 뒷받침했습니다. 시설 관리자는 하이브리드 워크 환경에서의 입주자 유치를 위해, 열적 쾌적성과 실내 공기 품질 대시보드를 우선적으로 도입. 병원에서는 음압 제어를 위한 중요한 구역을 업그레이드하고 소매 업계에서는 식품 폐기 감축을 위해 AI 기반 냉장 감시 시스템을 도입하고 있습니다.

주택 수요는 스마트 미터 도입의 보조금이나 국가적인 전화 촉진책을 계기로, 2031년까지 연평균 복합 성장률(CAGR) 5.59%를 나타낼 전망입니다. 집합 주택에서는 광열비를 정확하게 배분하기 위해 집중 플랜트 제어를 도입하고, 단독 주택에서는 음성 조작 장면과 수요 반응 위젯이 주류가 됩니다. 단체당 도입 포인트는 적은 것, 가구 전체의 도입 규모는 소규모 상업시설에 필적하기 때문에 가전 제조업체는 종래의 BAS 공급자와의 제휴를 추진하고 있습니다.

유럽의 빌딩 자동화 시스템 보고서는 구성 요소(하드웨어 : 컨트롤러 및 필드 장치, SaaS 소프트웨어), 최종 사용자(주택, 상업, 산업), 빌딩 수명 주기(새로운 구축, 리노베이션), 통신 프로토콜(BACnet, KNX Classic 및 IoT, Modbus/LonWorks), 지역별로 분류됩니다. 시장 예측은 금액 기준(달러)으로 제공됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 서포트(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 에너지 성능 지령(EPBD) 개정에 있어서 BACS의 의무화

- 무선 센서 가격의 급격한 하락

- 기업의 넷 제로 목표

- 엣지 AI 분석에 의한 운영 비용 절감 효과

- 스마트홈 리노베이션 증가

- ESG 연동형 금융 인센티브

- 시장 성장 억제요인

- 분산된 기존 건축 스톡

- 사이버 보안 책임에 대한 우려

- 공급업체 고유의 프로토콜에 의한 락인

- 숙련 노동자의 부족

- 업계 밸류체인 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 구성 요소별

- 하드웨어

- 컨트롤러

- 현장 장치

- Software-as-a-Service(SaaS)

- 하드웨어

- 최종 사용자별

- 주택용

- 상업용

- 산업용

- 건물 수명 주기별

- 신축

- 리모델링

- 통신 프로토콜별

- BACnet

- KNX(클래식 및 IoT)

- Modbus/LonWorks

- 지역별

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 벨기에

- 스웨덴

- 핀란드

- 덴마크

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Siemens AG

- Johnson Controls International plc

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd

- Robert Bosch GmbH

- Trane Technologies plc

- Kieback and Peter GmbH and Co. KG

- Priva Holding BV

- Belimo Holding AG

- Fr. Sauter AG

- Lynxspring Inc.

- Delta Controls Inc.

- Legrand SA

- Distech Controls Inc.

- Regin AB

- Danfoss A/S

- Beckhoff Automation GmbH and Co. KG

- Somfy SA

- Crestron Electronics Inc.

제7장 시장 기회와 향후 전망

KTH 26.01.26The Europe Building Automation Systems market was valued at USD 3.96 billion in 2025 and estimated to grow from USD 4.11 billion in 2026 to reach USD 4.93 billion by 2031, at a CAGR of 3.70% during the forecast period (2026-2031).

Growing compliance obligations under the revised Energy Performance of Buildings Directive, rising electricity prices, and corporate net-zero targets guide most investment decisions. Retrofit opportunities dominate because three-quarters of the region's building stock predates 1990, yet innovation centers on cloud-enabled analytics, wireless sensors, and AI-driven optimization. Hardware remains the revenue anchor while Software-as-a-Service introduces recurring income streams and shortens payback periods for mid-sized property portfolios. Competition is moderate: a handful of global manufacturers supply core controllers and field devices, but hundreds of regional integrators shape delivery schedules, project costs, and user training outcomes. Persistent labour bottlenecks and cybersecurity liabilities act as near-term brakes on project velocity, although product standardization and ecosystem partnerships are gradually reducing risk perceptions.

Europe Building Automation Systems Market Trends and Insights

Mandatory BACS in EPBD revision

The 2025 enforcement of the revised Energy Performance of Buildings Directive obliges non-residential facilities above 290 kW heating load to deploy interoperable automation and control systems. Germany and France adopted even stricter thresholds, accelerating tender activity across public offices, schools, and healthcare sites. Open-protocol solutions such as BACnet and KNX receive preferential treatment in grant programs, prompting building owners to replace proprietary networks during planned renovations. Compliance deadlines cluster around 2027, creating pronounced peaks in engineering demand and sparking specialized training initiatives. Enforcement rigor differs by member state, yet the overall mandate locks Europe Building Automation Systems market growth into regulatory timetables. Vendors with local installation partners and multilingual commissioning software gain a visible competitive edge.

Rapid fall in wireless sensor prices

Average selling prices of multi-technology occupancy, temperature, and light sensors dropped by nearly 30% between 2023 and 2025, mainly because of higher 200 mm wafer output in East Asia and a transition to system-on-chip architectures. Nordic property owners were early adopters, using battery-powered sensors to monitor energy-intensive facilities during prolonged heating seasons. Reduced wiring and ceiling core-drilling costs shorten payback periods on small projects, broadening the customer base beyond A-grade office towers. Edge-processing features embedded inside new chips lower latency, screen false positives, and retain sensitive building usage data inside the premises, supporting GDPR compliance. Although component prices are now less volatile than during the 2021-2022 supply crunch, occasional shortages of specialized RF microcontrollers still trigger modest lead-time spikes for integrators.

Fragmented legacy building stock

Historic masonry structures in Paris, Rome, and Barcelona often prohibit core drilling or heavy conduit runs, complicating sensor placement and cabling. Mixed-era mechanical plant - from radiators to variable-air-volume boxes - requires meticulous interface mapping, elevating engineering hours and contingency budgets. Owners sometimes postpone deep automation until major tenancy turnovers, prolonging decision cycles beyond conventional fiscal years. Regional craft guilds enforce preservation norms, curbing invasive retrofits. Consequently, integrators invest in wireless, battery-free actuators and reversible mounting kits that comply with heritage guidelines, yet these specialized components carry price premiums that shrink return-on-investment windows.

Other drivers and restraints analyzed in the detailed report include:

- Corporate net-zero commitments

- Edge-AI analytics boosting OPEX savings

- Cyber-security liability concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware captured 65.58% of 2025 revenue as reliable controllers, actuators, and multi-standard gateways underpin every functional layer of the Europe Building Automation Systems market size. Controllers routinely manage thousands of I/O points, pushing suppliers to refine real-time processing and cyber-hardening. In parallel, sensors migrate to ultra-low-power wireless chips, broadening retrofit feasibility inside pre-1910 buildings where cable trays are scarce.

Cloud-hosted analytics and remote firmware updates explain the 6.02% CAGR in SaaS subscriptions. Building owners favour operating expenses over capital outlays, purchasing AI-based optimization features on rolling contracts. Predictable billing eases budget planning and encourages continuous scope expansion, once a building's HVAC loops are online, lighting, security, and EV-charger modules follow swiftly. Vendors integrate edge-AI inference capabilities into room controllers, shifting computation away from hyperscale data centers and satisfying regional data-sovereignty laws.

Commercial premises held 44.92% of Europe Building Automation Systems market share in 2025, spurred by mandatory energy audits and competitive tenant landscapes. Facility managers prioritize thermal comfort and indoor-air-quality dashboards to attract occupants in hybrid-work environments. Hospitals upgrade critical zones for negative pressure control, whereas the retail sector deploys AI-based refrigeration monitoring to reduce spoilage.

Residential demand grows at a 5.59% CAGR through 2031, catalysed by smart-meter rebates and national electrification incentives. Multi-family dwellings adopt centralized plant control to allocate utility costs precisely, while detached homes lean toward voice-activated scenes and utility-driven demand-response widgets. Despite fewer per-unit points, aggregate household volumes rival small commercial footprints, prompting consumer-electronics brands to forge alliances with traditional BAS suppliers.

The Europe Building Automation Systems Report is Segmented by Component (Hardware - Controllers and Field Devices, Software-As-A-Service), End User (Residential, Commercial, Industrial), Building Life-Cycle (New-Build, Retrofit), Communication Protocol (BACnet, KNX Classic and IoT, Modbus/LonWorks), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Siemens AG

- Johnson Controls International plc

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd

- Robert Bosch GmbH

- Trane Technologies plc

- Kieback and Peter GmbH and Co. KG

- Priva Holding B.V.

- Belimo Holding AG

- Fr. Sauter AG

- Lynxspring Inc.

- Delta Controls Inc.

- Legrand SA

- Distech Controls Inc.

- Regin AB

- Danfoss A/S

- Beckhoff Automation GmbH and Co. KG

- Somfy SA

- Crestron Electronics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory BACS in EPBD revision

- 4.2.2 Rapid fall in wireless sensor prices

- 4.2.3 Corporate net-zero commitments

- 4.2.4 Edge-AI analytics boosting OPEX savings

- 4.2.5 Increasing smart-home retrofits

- 4.2.6 ESG-linked financing incentives

- 4.3 Market Restraints

- 4.3.1 Fragmented legacy building stock

- 4.3.2 Cyber-security liability concerns

- 4.3.3 Vendor-specific protocol lock-in

- 4.3.4 Skilled-labour bottlenecks

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Controllers

- 5.1.1.2 Field Devices

- 5.1.2 Software-as-a-Service

- 5.1.1 Hardware

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 By Building Life-Cycle

- 5.3.1 New-build

- 5.3.2 Retrofit

- 5.4 By Communication Protocol

- 5.4.1 BACnet

- 5.4.2 KNX (Classic and IoT)

- 5.4.3 Modbus / LonWorks

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 Netherlands

- 5.5.7 Belgium

- 5.5.8 Sweden

- 5.5.9 Finland

- 5.5.10 Denmark

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Siemens AG

- 6.4.2 Johnson Controls International plc

- 6.4.3 Schneider Electric SE

- 6.4.4 Honeywell International Inc.

- 6.4.5 ABB Ltd

- 6.4.6 Robert Bosch GmbH

- 6.4.7 Trane Technologies plc

- 6.4.8 Kieback and Peter GmbH and Co. KG

- 6.4.9 Priva Holding B.V.

- 6.4.10 Belimo Holding AG

- 6.4.11 Fr. Sauter AG

- 6.4.12 Lynxspring Inc.

- 6.4.13 Delta Controls Inc.

- 6.4.14 Legrand SA

- 6.4.15 Distech Controls Inc.

- 6.4.16 Regin AB

- 6.4.17 Danfoss A/S

- 6.4.18 Beckhoff Automation GmbH and Co. KG

- 6.4.19 Somfy SA

- 6.4.20 Crestron Electronics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment