|

시장보고서

상품코드

1690807

베트남의 종이 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Vietnam Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

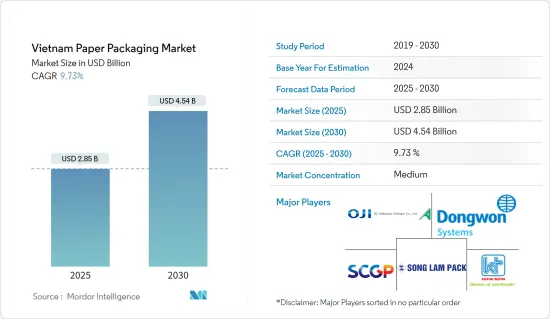

베트남의 종이포장 시장 규모는 2025년에 28억 5,000만 달러로 추정되고, 2030년에는 45억 4,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2030년) CAGR은 9.73%를 나타낼 전망입니다.

베트남의 종이 포장 시장은 예측 기간 동안 크게 확대될 것으로 예상되며, 여러 기업이 향후 몇 년 동안 매출 성장을 예상하고 있습니다. 베트남의 안정적인 경제 상황과 높은 도시화율은 종이 포장 형식의 사용을 촉진할 것으로 예상됩니다.

주요 하이라이트

- 베트남은 전 세계의 다양한 산업을 위해 생산할 준비가 되어 있고 국내 구매력이 빠르게 증가하고 있는 국가입니다. 이는 포장 산업의 성장을 반영하며 베트남의 경제 상황과도 일치합니다.

- 다양한 국가의 포장 제품 제조업체가 있습니다. 많은 제조업체가 베트남을 중심으로 동남아시아 투자에 관심을 갖고 있습니다. 태국 제조업체들은 이 산업에 투자할 기회가 있을 것으로 예상하고 있습니다.

- 베트남은 동남아시아에서 포장 식품, 병 음료, 화장품 시장이 꾸준히 성장하고 있어 종이 포장에 대한 수요가 상당합니다. 또한 퍼스널 케어, 헬스케어, 홈케어, 소매업 등의 산업이 성장함에 따라 종이 포장의 적용도 증가하고 있습니다.

- 마찬가지로 자유무역협정은 베트남의 포장 및 포장지를 세금 인센티브 시장에 수출할 수 있는 기회를 제공하기도 했습니다. 일부 응용 분야에서 미니 플루트 골판지 상자를 활용하면 시리얼 상자 및 테이크아웃 식품 포장과 같은 시장에서 골판지 상자의 입지를 넓힐 수 있습니다.

- 조직화된 식품 가공 부문은 또한 전국의 농업과 제조업을 연결하는 의미 있는 연결고리 역할을 하며 GDP에 기여하고 국가 경제에 크게 이바지하고 있습니다. 식음료 산업은 예측 기간 동안 베트남에서 종이 포장재에 대한 수요를 증가시킬 것으로 예상됩니다.

- 베트남에는 베트남의 제지 생산 수요를 충족하기에 충분한 산림 자원이 없습니다. 베트남에서 제지 생산을 위한 대부분의 원자재를 수입하고 있으며, 이는 비용을 증가시키고 글로벌 시장에서 베트남의 경쟁력에 영향을 미칩니다.

베트남의 종이 포장 시장 동향

골판지 상자 부문이 현저한 성장을 이룰 전망

- 베트남은 향후 5년 동안 전자상거래 매출에서 연간 두 자릿수 성장률을 목표로 하고 있습니다. 베트남 정부의 전자상거래 발전 전략에 관한 데이터에 따르면 2025년까지 베트남 인구 9,600만 명 중 절반 이상이 온라인 쇼핑을 할 것으로 예상됩니다. 이러한 전망은 전자 상거래 부문에서 골판지 상자에 대한 수요 증가로 이어질 것입니다.

- 베트남의 전자 산업은 베트남에서 가장 빠르게 성장하고 있는 중요한 산업 중 하나입니다. 다국적 기업들이 이 산업을 지배하고 있으며, 지난 10년 동안 베트남의 무역량을 증가시키고 GDP에 기여했습니다.

- 전자 제품에는 깨지기 쉬운 다양한 제품이 포함되며 추가적인 배송 관리가 필요합니다. 따라서 이러한 제품의 골판지 포장에는 보호 기능이 필요합니다. 전자 산업이 확장됨에 따라 운송 중 전자 제품을 보호하기 위한 포장재에 대한 수요도 함께 증가하고 있습니다. 골판지 상자는 보호 기능과 깨지기 쉬운 물품을 완충하는 기능으로 인해 이러한 목적에 적합합니다.

- 베트남의 미용산업에서는 여드름, 넓은 모공, 눈 밑 다크닝 등 스킨케어 고민을 해결하기 위한 K-뷰티 및 멀티스텝 클렌징과 같은 트렌드가 증가하고 있습니다. 베트남의 스킨케어 쇼핑객 대부분은 여전히 1단계 스킨케어 루틴을 선호하지만, 최근 2단계 및 3단계 루틴이 인기를 얻으면서 그 매력은 점점 사라지고 있습니다.

- 다단계 스킨케어 루틴은 여러 제품을 사용하는 경우가 많으며, 각 제품은 특정 용도로 사용됩니다. 골판지 상자는 이러한 다양한 제품을 체계적이고 시각적으로 매력적인 방식으로 수용하도록 맞춤 제작할 수 있습니다. 골판지 상자 안에 맞춤형 인서트, 칸막이 및 구획을 사용하면 다양한 스킨케어 제품을 구분하여 보관하는 동시에 전체적인 프레젠테이션을 향상시킬 수 있습니다.

상당한 시장 점유율을 차지할 식음료 산업

- 지난 몇 년 동안 식음료 포장 산업은 전자상거래의 발전과 앱 기반 배달 비즈니스의 급속한 확산으로 인해 성장세를 보였습니다. 베트남이 참여한 자유무역협정은 또 다른 성장의 촉매제가 되었습니다.

- 식품 포장 산업의 성장으로 베트남에서 종이 포장에 대한 수요가 증가했습니다. 또한 종이로 만든 친환경 제품이 일회용 플라스틱 제품을 대체할 수 있는 식품 포장 산업의 성장 잠재력이 있는 것으로 추정됩니다.

- 식품 가공 및 포장 솔루션 회사인 테트라팩에 따르면 베트남의 액체 식품 시장은 지난 3년 동안 연평균 6%의 높은 성장률을 기록했습니다.

- 소득이 높아지고 영양에 대한 인식이 개선되면서 베트남 사람들의 유제품 구매는 지속적으로 증가하고 있습니다.

- 베트남은 주류, 특히 맥주에 대한 수익성이 높은 시장이지만, 건강한 청량음료에 대한 수요가 증가하면서 역동적인 변화가 일어났습니다. 또한 자연스럽게 차, 과일 또는 채소 주스와 같은 건강 음료가 인기를 얻고 있습니다.

- 베트남 통계청에 따르면 베트남의 식음료 소비액은 2023년 470억 달러로 2018년 260억 달러에 비해 크게 증가할 것으로 예상됩니다. 소매점, 슈퍼마켓, 레스토랑, 카페, 음식 배달 서비스의 확장은 식음료 소비의 성장과 함께 동반되는 경우가 많습니다.

베트남의 종이 포장 산업 개요

베트남 종이 포장 시장은 반통합 시장입니다. 주요 시장 진출기업으로는 Song Lam Trading & Packaging Production, SCG Vietnam(SCG Packaging), Hanh Packaging, Oji Interpack Vietnam, Khang Thanh 등이 있습니다.

- 2023년 12월 : SCGP는 베트남의 주요 고객층을 국내 및 다국적 기업으로 확보하고 있는 프리미엄 오프셋 접이식 상자 포장 제조업체인 Starprint Vietnam JSC의 지분 70%를 인수했습니다. 이번 인수를 통해 SCGP의 포장 솔루션 역량이 강화되어 ASEAN의 확대되는 고객 기반에 서비스를 제공할 수 있게 되었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 역학

- 시장 성장 촉진요인

- 전자상거래 부문에서 수요 증가

- 최대 아웃소싱 거점 중 하나인 베트남은 FMCG나 일렉트로닉스 등 주요 산업으로부터 시장 수요에 공헌할 전망

- 플라스틱 포장에 대한 엄격한 규제에 의해 벤더는 종이 베이스의 대체품으로의 전환을 촉진

- 시장의 과제

- 종이 생산 능력 저하와 해외 가공 원료 공급 감소

제6장 현재의 무역 시나리오-수출입 분석

- 종이 및 판지

- 헌지

제7장 베트남 국가별 분석

- 주요 거시경제지표 분석

- 규제 상황과 법적 상황

- 경제 성장에 기여하는 주요산업

- 외자계 기업이 베트남에 진출하기 위한 주요 조건

제8장 베트남의 종이 포장 산업 전망

제9장 시장 세분화

- 유형별

- 판지 보드

- 골판지 원지

- 제품 유형별

- 접이식 판지

- 골판지 상자

- 최종 사용자 산업

- 음식

- 의료

- 퍼스널케어

- 공업용

제10장 경쟁 구도

- 기업 프로파일

- Song Lam Trading & Packaging Production Co. Ltd

- Minh Viet Packaging One Member Co. Ltd(동원시스템스)

- Tetra Pak International SA

- Oji Interpack Vietnam Co. Ltd

- Khang Thanh Co. Ltd

- Hanh Packaging Co. Ltd

- SCG Vietnam Co. Ltd(SCG Packaging)

- Binh Minh Pat Co. Ltd

- Bien Hoa Packaging Joint Stock Company(Rengo Co. Ltd)

- HC Packaging Vn Company Limited

- Starprint Vietnam Jsc

- Viet Thang Package Co. Ltd

- Doanket Commercial And Packaging Production Company Limited

제11장 시장의 미래

HBR 25.05.09The Vietnam Paper Packaging Market size is estimated at USD 2.85 billion in 2025, and is expected to reach USD 4.54 billion by 2030, at a CAGR of 9.73% during the forecast period (2025-2030).

The paper packaging market in Vietnam is expected to expand significantly during the forecast period, with several companies expecting sales growth in the coming years. The country's stable economic situation and high urbanization rate are expected to drive the use of paper packaging formats.

Key Highlights

- Vietnam is a country that is ready to produce for various industries worldwide and has a rapidly increasing domestic purchasing power. This reflects the growth of the packaging industry and is in line with the country's economic conditions.

- There are manufacturers of packaging products from different nations. Many are interested in investing in Southeast Asia, with Vietnam as the destination. Thai manufacturers foresee the opportunity to invest in this industry. For instance, ProPak Vietnam 2023 attracted 400 exhibitors from more than 30 countries and territories, including the United States, United Kingdom, France, Germany, Italy, Denmark, Poland, the Netherlands, Australia, Austria, Belgium, Japan, South Korea, Singapore, mainland China, and Taiwan. It showcased advanced packaging, processing, pharmaceutical technologies, cold chain logistics, warehousing, coding, marking, labeling, and testing equipment.

- Vietnam is a consistently growing market for packaged foods, bottled beverages, and cosmetics in Southeast Asia, so the demand for paper packaging is significant. In addition, the application of paper packaging has been increasing due to growing industries, such as personal care, healthcare, homecare, and retail.

- Similarly, free trade agreements have also offered opportunities to export Vietnam's packaging and packaging paper to tax-incentive markets. Utilizing mini-flute corrugated boxes in some applications has allowed corrugated boxes to expand their presence in markets, like cereal boxes and carryout food packaging.

- The organized food processing sector has also been a meaningful link between the agriculture and manufacturing businesses across the country, contributing to the GDP and significantly adding to the national economy. The food and beverage industry is anticipated to boost the demand for paper packaging in the country during the forecast period.

- Vietnam does not have sufficient forest resources to meet the country's paper production needs. Most raw materials for paper production in Vietnam are imported, which increases costs and affects the country's competitiveness in the global market.

Vietnam Paper Packaging Market Trends

The Corrugated Boxes Segment to Witness Significant Growth

- Vietnam is aiming for a double-digit annual growth rate in the turnover of e-commerce over the next five years. According to the Vietnamese government's data on e-commerce development strategy, over half of Vietnam's 96 million people are set to shop online by 2025. Such projections would lead to higher demand for corrugated boxes in the e-commerce sector.

- The country's electronics industry is one of Vietnam's fastest-growing and crucial industries. Multinational organizations dominate it, have increased the country's trade volume, and contributed to its GDP in the past decade.

- Electronic products include a wide range of fragile products and require extra shipping care. Thus, the corrugated packaging of these goods requires a protective feature. As the electronics industry expands, there is a parallel increase in the demand for packaging materials to protect electronic products during transit. Corrugated boxes are well-suited for this purpose due to their protective features and ability to cushion fragile items.

- Trends like K-beauty and multi-step cleansing to address skincare concerns, such as acne, large pores, and dark under eyes, are increasing in the Vietnamese beauty industry. Most skincare shoppers in Vietnam still prefer a one-step skincare routine, although it recently lost its appeal while two-step and three-step routines have gained popularity.

- Multi-step skincare routines often involve using several products, each serving a specific purpose. Corrugated boxes can be customized to accommodate these various products in an organized and visually appealing manner. Custom inserts, dividers, and compartments within corrugated boxes can help keep different skincare items separate while also enhancing the overall presentation.

The Food and Beverages Industry to Hold Significant Market Share

- Over the past few years, the food and beverage packaging industry witnessed gains from the development of e-commerce and the rapid spread of app-based delivery businesses. The free trade agreements that Vietnam participated in were another catalyst for growth.

- The growth in the food packaging industry resulted in the increased demand for paper packaging in the country. It is also estimated that eco-friendly products made from paper have the potential for growth in the food packaging industry to replace disposable plastic products.

- According to Tetra Pak, a food processing and packaging solutions company, the liquid food market in Vietnam registered a healthy 6% compound annual growth rate over the last three years. It is projected to grow similarly during the next three years, compared to the 4% yearly growth in Asia-Pacific and 3% globally.

- With higher income and better nutrition awareness, Vietnamese people have sustainably increased their purchase of dairy products. All the dairy supply chain stakeholders have been actively changing and innovating. Distribution channels have also been improved, especially with the thriving of e-commerce.

- Although Vietnam is a lucrative market for alcoholic beverages, especially beer, a dynamic shift occurred, showing a growing demand for healthy soft drinks. Moreover, naturally, healthy beverages, such as tea and fruit or vegetable juices, have been gaining popularity.

- According to the General Statistics Office of Vietnam, the consumption of food and beverages in Vietnam was USD 47 billion in 2023, compared to 2018, which was USD 26 billion. The expansion of retail outlets, supermarkets, restaurants, cafes, and food delivery services often accompanies the growth in food and beverage consumption. These establishments rely heavily on paper packaging solutions to package and present their products to customers. As the food and beverage sector expands, so does the demand for paper packaging products.

Vietnam Paper Packaging Industry Overview

The Vietnamese paper packaging market is semi-consolidated. Some major market players include Song Lam Trading & Packaging Production, SCG Vietnam Co. Ltd (SCG Packaging), Hanh Packaging Co. Ltd, Oji Interpack Vietnam Co. Ltd, and Khang Thanh Co. Ltd.

- December 2023 - SCGP acquired a 70% stake in Starprint Vietnam JSC, a leading premium offset folding carton packaging manufacturer in Vietnam with key customer bases as domestic and multinational profiles. This acquisition will enhance SCGP's packaging solutions capabilities to serve an enlarging customer base in ASEAN.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from the E-commerce Sector

- 5.1.2 Vietnam as One of the Largest Outsourcing Hubs Expected to Aid the Market Demand From Key Verticals, Such as FMCG and Electronics

- 5.1.3 Stringent Regulations on Plastic Packaging to Prompt Vendors to Switch to Paper-based Alternatives

- 5.2 Market Challenges

- 5.2.1 Low Paper Production Capacity and Decline in Foreign Processed Material Supply

6 CURRENT TRADE SCENARIO - EXIM ANALYSIS

- 6.1 Paper And Paperboard

- 6.2 Recovered Paper

7 VIETNAM COUNTRY ANALYSIS

- 7.1 Analysis of Key Macro-economic Indicators

- 7.2 Regulatory and Legal Landscape

- 7.3 Major Industries Contributing to the Economic Growth

- 7.4 Key Imperatives for Foreign Companies to Establish Presence in Vietnam

8 VIETNAM PACKAGING INDUSTRY OUTLOOK

9 MARKET SEGMENTATION

- 9.1 By Types

- 9.1.1 Carton Board

- 9.1.2 Containerboard

- 9.2 By Product Types

- 9.2.1 Folding Cartons

- 9.2.2 Corrugated Boxes

- 9.3 End-user Industry

- 9.3.1 Food and Beverage

- 9.3.2 Healthcare

- 9.3.3 Personal Care and Household Care

- 9.3.4 Industrial

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Song Lam Trading & Packaging Production Co. Ltd

- 10.1.2 Minh Viet Packaging One Member Co. Ltd (Dongwon Systems)

- 10.1.3 Tetra Pak International SA

- 10.1.4 Oji Interpack Vietnam Co. Ltd

- 10.1.5 Khang Thanh Co. Ltd

- 10.1.6 Hanh Packaging Co. Ltd

- 10.1.7 SCG Vietnam Co. Ltd (SCG Packaging)

- 10.1.8 Binh Minh Pat Co. Ltd

- 10.1.9 Bien Hoa Packaging Joint Stock Company (Rengo Co. Ltd)

- 10.1.10 HC Packaging Vn Company Limited

- 10.1.11 Starprint Vietnam Jsc

- 10.1.12 Viet Thang Package Co. Ltd

- 10.1.13 Doanket Commercial And Packaging Production Company Limited