|

시장보고서

상품코드

1692095

북미의 분석기기 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)North America Analytical Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

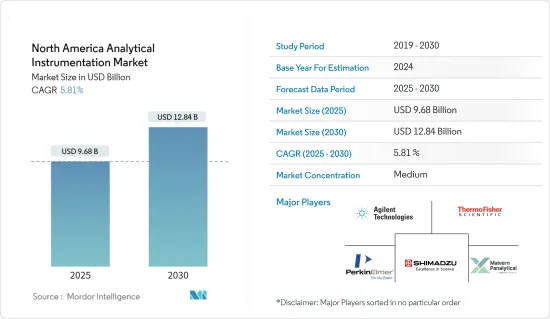

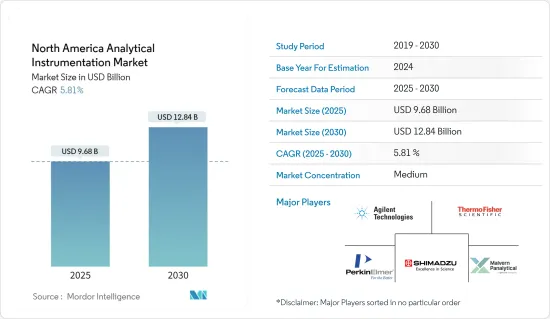

북미의 분석기기 시장 규모는 2025년에 96억 8,000만 달러로 추정되고, 2030년에는 128억 4,000만 달러에 달할 것으로 예측되며, 예측기간(2025-2030년)의 CAGR은 5.81%를 나타낼 전망입니다.

제품 품질에 대한 우려의 증가, R&D 투자 증가, 엄격한 정부 규제는 북미의 분석기기 시장의 성장을 이끄는 주요 요인 중 일부입니다. 특히 신흥 지역에서 고객 인식이 높아지고 여러 부문에서 분석기기에 대한 수요가 증가함에 따라 예측 기간 동안 시장의 성장이 더욱 확대될 것으로 예상됩니다.

주요 하이라이트

- 지난 몇 년 동안 연구 대상 시장의 성장은 주로 환경 테스트 및 오염 제어를 위한 정부 이니셔티브, 특히 개발도상국, 북미 제약 R&D 투자 증가, 의약품 안전에 대한 엄격한 규제, 원유 및 셰일 가스 생산 확대, 식품 품질에 대한 관심 증가, 질량 분석기의 기술 발전과 같은 요인에 의해 주도되었습니다.

- 또한 휴대폰, 전기자동차, 에너지 시스템 및 기타 시스템/장치용 배터리를 개발하는 기업들은 보다 효율적이고 깨끗하며 안전한 에너지원을 만들기 위해 테스트, 저장 잠재력 및 출력을 향상시키는 분석기기에 의존하고 있습니다. 기업들은 전자 현미경 기술을 사용하여 원자 단위의 구조를 이해하고 분광학 도구를 사용하여 결함 및 비효율을 유발하는 재료의 중요한 변화를 발견합니다.

- 그러나 분석기기의 높은 비용은 연구 시장의 성장을 제한하고 있습니다. 또한 기기 비용과 함께 인력, 유지 보수 및 실험실 비용과 같은 다양한 기타 비용이 관련되어 시장 성장을 억제합니다.

- 시장 공급업체들은 주로 전 세계의 규제 대상 분야에서 운영되는 산업을 지원하기 위해 점점 더 분석을 타깃으로 삼고 있습니다. 제약과 같은 산업에서 비즈니스 성장에 필수적인 공동 작업의 도입이 점점 더 증가하고 있습니다.

북미의 분석기기 시장 동향

생명 과학 부문이 상당한 시장 점유율을 차지할 전망

- 생명 과학은 분석기기 산업에서 가장 큰 비중을 차지하며 전체 산업의 4분의 1을 차지합니다.

- 차세대 시퀀싱(NGS)에 대한 수요가 지속적으로 증가하면서 시퀀싱 부문에 영향을 미치고 핵산 샘플 준비 부문의 강력한 수요를 견인하고 있습니다. 이러한 성장은 유전체학 기술이 기초 연구를 넘어 생물의학 영역으로 확대됨에 따라 공공 및 민간 부문에서 뚜렷하게 나타났습니다. 이러한 엄청난 성장은 제약 회사가 의약품 안전에 대한 엄격한 규정을 준수하는 데 도움이 되므로 분석 계측 솔루션에 대한 상당한 수요를 창출할 것으로 예상됩니다.

- 지리적으로 생명과학 기기에 대한 수요가 가장 높은 국가는 중국으로, 중국의 정밀 의학 노력에 힘입어 생명과학 기기에 대한 수요가 가장 높습니다. 그다음으로 가장 큰 생명과학 시장인 미국이 그 뒤를 잇고 있습니다.

- 또한 제약 바이오시밀러, 식물 의약품 및 재생 의학에 대한 수요가 크게 증가하면서 업계에서 분석 계측 솔루션을 채택하는 데 도움이 될 것으로 예상됩니다.

- Agilent Technologies와 같은 회사는 미국의 의료 및 연구 실험실용 분석기기 제조업체 중 하나로서 연구 및 실험을 수행하고 정확한 진단을 내리기 위한 분석기기 및 소모품을 제공함으로써 이 시장에 기여하고 있습니다.

- 시장은 신제품 개발, 합병 및 협업과 같은 몇 가지 전략적 발전을 목격하고 있으며, 이는 해당 부문에서 분석 도구 채택이 증가했음을 시사합니다. 바이오 제약 연구소는 Thermo Scientific Orbitrap Exploris MX 질량 분석기를 통해 다중 속성 분석법(MAM)을 구현하고, 온전한 단일 클론 항체 분석을 수행하고, 올리고뉴클레오티드 질량 분석을 수행하고, 펩타이드 매핑을 수행할 수 있습니다.

시장 성장을 주도하는 정밀 의약품 개발

- 개인 맞춤형 의약품과 치료법을 개발하기 위한 정밀 의학의 등장은 실험실 분석기기 시장의 성장을 이끄는 가장 중요한 요인 중 하나입니다. 정밀 의학에 대한 접근성이 높아지면 새로운 표적 치료법의 출시를 앞당기기 위해 임상시험에 더 많은 사람들이 참여해야 합니다. 이를 위해서는 임상시험에서 다양한 기능을 수행할 수 있는 분석기기가 필요합니다.

- 이러한 임상 연구 영역의 요구로 인해 FDA는 Lynparza, Blincyto와 같이 개인의 특정 특성에 맞춘 다양한 약물을 승인했습니다. 이러한 발전은 분석기기 시장에 대한 수요를 증가시킬 것으로 예상됩니다.

- 이 시장의 공급업체들은 주로 파트너십과 협업을 통해 정밀 의학 산업에서 제품을 확장하는 데 주력하고 있습니다. 예를 들어, 2021년 7월 Sciex는 제노 트랩과 전자 활성화 해리(EAD) 단편화를 모두 포함하는 질량 액체 크로마토그래피-질량 분석/질량 분석(LC-MS/MS) 기기인 ZenoTOF 7600 시스템을 출시했습니다.

북미의 분석기기 산업 개요

북미의 분석기기 시장의 경쟁 정도는 예측 기간 동안 적당히 높을 것으로 예상됩니다. 시장의 주요 공급 업체는 다양한 고객 요구 사항을 충족하는보다 심층적 인 제품 포트폴리오를 확보하는 반면, 소규모 공급 업체는 맞춤형 및 고객 별 주문을 제공하는 틈새 부문에서 운영됩니다. 주요 기업은 Agilent Technologies Inc., Malvern Panalytical Ltd(Spectris Company), PerkinElmer Inc., Thermo Fisher Scientific, Shimadzu Corporation 등입니다.

- 2021년 11월 : Agilent Technologies은 나노입자 용출 시험용 NanoDisSystem의 도입을 발표했습니다. Agilent 계측기와 소프트웨어를 결합하여 고객이 애플리케이션을 통해 21 CFR Part 11 및 기타 규정을 준수할 수 있도록 지원하는 새로운 NanoDisSystem은 자동화 및 감사가 가능한 전용 워크플로우를 제공합니다.

- 2021년 10월 : Bruker는 대형 샘플 Dimension IconIR나노급 적외선 분광 및 화학 이미징 시스템을 출시했다고 발표했습니다. 이 플랫폼은 10nm 미만의 화학 이미징을 통해 새로운 화학 및 재료 특성 매핑 표준을 확립하기 위해 Dimension Icon AFM과 nanoIR 광열 AFM-IR 기술을 결합합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 경쟁 기업간 경쟁 관계

- 대체품의 위협

- 시장 성장 촉진요인

- 정밀 의약품 개발

- 시장 성장 억제요인

- 높은 초기 비용

- COVID-19의 업계에 대한 영향 평가

제5장 시장 세분화

- 제품 유형별

- 크로마토그래피

- 분자 분석 분광법

- 원소 분석 분광법

- 질량 분석기

- 분석 현미경

- 기타 제품 유형

- 최종 사용자 산업별

- 생명 과학

- 화학 및 석유 화학

- 재료 과학

- 식품 검사

- 석유 및 가스

- 연구 및 연구기관

- 기타 최종 사용자

제6장 경쟁 구도

- 기업 프로파일

- Agilent Technologies Inc.

- Bruker Corporation

- Perkinelmer Inc.

- Thermo Fisher Scientific Inc.

- Shimadzu Corporation

- Malvern Panalytical Ltd(Spectris Plc)

- Mettler Toledo International

- Waters Corporation

- Bio-Rad Laboratories Inc.

제7장 투자 분석과 전망

- 투자분석

- 장래의 전망

The North America Analytical Instrumentation Market size is estimated at USD 9.68 billion in 2025, and is expected to reach USD 12.84 billion by 2030, at a CAGR of 5.81% during the forecast period (2025-2030).

The rising concerns regarding product quality, increasing investments in R&D, and stringent government regulations are some major factors driving the growth of the North American analytical instrumentation market. The rising customer awareness, especially in emerging regions, and the need for analytical instruments across multiple sectors, are further expected to augment the market's growth over the forecast period.

Key Highlights

- In the past few years, the growth in the market studied was primarily driven by factors such as government initiatives for environmental testing and pollution control and especially in developing countries, increasing investments in North America's pharmaceutical R&D, stringent regulations on drug safety, expansion of crude and shale gas production, increasing focus on the quality of food products, and technological advancements in mass spectrometers.

- Further, companies developing batteries for mobile phones, electric vehicles, energy systems, and other systems/devices depend on analytical instruments to enhance testing, storage potential, and output to create more efficient, cleaner, and safer energy sources. Companies use electron microscopy technologies to understand structures that level down at the atomic scale, along with spectroscopy tools to discover critical changes in materials that cause defects and inefficiency.

- However, the high cost of analytical instruments restrains the growth of the studied market. Furthermore, along with the cost of instruments, various other costs are associated, such as staffing, maintenance, and laboratory expenses, thereby restraining the market's growth. Moreover, the advancement in features and functionalities, technological advancements, and innovative systems are adding to the cost of analytical instruments.

- The market vendors are increasingly targeting analytics, mainly to support industries operating in regulated sectors across the world. To target applications in industries such as pharmaceuticals, collaborative work is increasingly witnessing adoption, which is critical for business growth.

- The recent COVID-19 outbreak resulted in significant demand in the market studied. The need for accelerated research has significantly increased during the COVID-19 outbreak, and the public expects unprecedented progress from the scientific community.

North America Analytical Instrumentation Market Trends

Life Sciences Segment Expected to Hold Significant Market Share

- Life sciences account for the largest share in the analytical instrument industry, representing a quarter of the entire industry. Life sciences comprise more than 13 individual technology segments, encompassing a wide range of applications using analytical tools such as spectrometry, atomic spectroscopy, and molecular spectroscopy. This provides significant opportunities to grow both general instrument applications and niche research systems.

- Demand for Next Generation Sequencing (NGS) continues to flourish, impacting the sequencing segment and driving strong demand in the nucleic acid sample preparation segment. This growth was evident in the public and private sectors, as genomics technology went beyond basic research to reach the biomedical domain. Such tremendous growth is expected to create a significant demand for analytical instrumentation solutions, as it helps pharmaceutical companies comply with stringent regulations on drug safety.

- Geographically, China has the highest demand for life science instruments, majorly propelled by the country's precision medicine initiative. It is followed by the United States, which is the largest life science market. Owing to the impact of COVID-19 on the economy, the demand for analytical tools is rapidly shifting to the clinical and pharmaceutical segments.

- Also, a significant rise in demand for pharmaceutical biosimilars, phytopharmaceuticals, and regenerative medicine, is expected to aid in the adoption of analytical instrumentation solutions in the industry.

- The companies such as Agilent Technologies are just one of the leading manufacturers of analytical instruments for healthcare and research laboratories in the United States that contributes to this market by offering analytical instruments and supplies to conduct research and experiments and make accurate diagnoses.

- The market is witnessing several strategic developments such as new product developments, mergers, and collaboration that suggest the increase in the adoption of analytical tools in the segment. For instance, in November 2021, Thermo Fisher Scientific launched its new mass spectrometry (MS) instruments, workflows, and software. The Thermo Scientific Orbitrap Exploris MX mass detector allows biopharmaceutical laboratories to implement the multi-attribute method (MAM), perform intact monoclonal antibody analysis, conduct oligonucleotide mass determination, and carry out peptide mapping.

Development of Precision Medicines to Drive the Market Growth

- The emergence of precision medicine to develop personalized medicines and therapies is one of the most important factors driving the laboratory analytical instruments market's growth.

- Increased access to precision medicine requires more widespread participation in clinical trials to accelerate the availability of new targeted therapies. This requires the analytical instrument to perform various functions in clinical trials.

- Owing to such needs in the clinical research domain, the FDA approved various drugs, such as Lynparza and Blincyto, that are tailored to specific characteristics of an individual. Such developments are expected to boost the demand for the analytical instruments market.

- Vendors in the market are focusing on expanding their offerings in the precision medicine industry, primarily through partnerships and collaborations. For instance, in July 2021, Sciex launched the ZenoTOF 7600 System, a mass liquid chromatography-mass spectrometry/mass spectrometry (LC-MS/MS) instrument that includes both Zeno trap and electron activated dissociation (EAD) fragmentation.

North America Analytical Instrumentation Industry Overview

The degree of competition in the North America Analytical Instrumentation Market is anticipated to be moderately high over the forecast period. The major vendors in the market garner more in-depth product portfolios, catering to different customer requirements, whereas smaller vendors operate in niche segments providing customizations and customer-specific orders. Key players include Agilent Technologies Inc., Malvern Panalytical Ltd (Spectris Company), PerkinElmer Inc., Thermo Fisher Scientific, and Shimadzu Corporation.

- November 2021 - Agilent Technologies announced the introduction of the NanoDisSystem for nanoparticle dissolution testing. Combining Agilent instrumentation and software to enable customers to meet 21 CFR Part 11 and other regulations through its application, the new NanoDisSystem delivers a dedicated workflow that is automatable and auditable.

- October 2021 - Bruker Corporation announced the launch of its large sample Dimension IconIRnanoscale infrared spectroscopy and chemical imaging systems. The platform combines Dimension Icon AFM and nanoIR photothermal AFM-IR technology to establish new chemical and material property mapping standards with sub-10nm chemical imaging resolution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Market Drivers

- 4.4.1 Development of Precision Medicines

- 4.5 Market Restraints

- 4.5.1 High Initial Cost

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Chromatography

- 5.1.2 Molecular Analysis Spectroscopy

- 5.1.3 Elemental Analysis Spectroscopy

- 5.1.4 Mass Spectroscopy

- 5.1.5 Analytical Microscopes

- 5.1.6 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Life Sciences

- 5.2.2 Chemical and Petrochemical

- 5.2.3 Material Sciences

- 5.2.4 Food Testing

- 5.2.5 Oil and Gas

- 5.2.6 Research and Academia

- 5.2.7 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Agilent Technologies Inc.

- 6.1.2 Bruker Corporation

- 6.1.3 Perkinelmer Inc.

- 6.1.4 Thermo Fisher Scientific Inc.

- 6.1.5 Shimadzu Corporation

- 6.1.6 Malvern Panalytical Ltd (Spectris Plc)

- 6.1.7 Mettler Toledo International

- 6.1.8 Waters Corporation

- 6.1.9 Bio-Rad Laboratories Inc.

7 INVESTMENT ANALYSIS AND FUTURE OUTLOOK

- 7.1 Investment Analysis

- 7.2 Future Outlook