|

시장보고서

상품코드

1692484

동남아시아의 디지털 옥외 광고(DooH) 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)South East Asia Digital Out-of-Home (DooH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

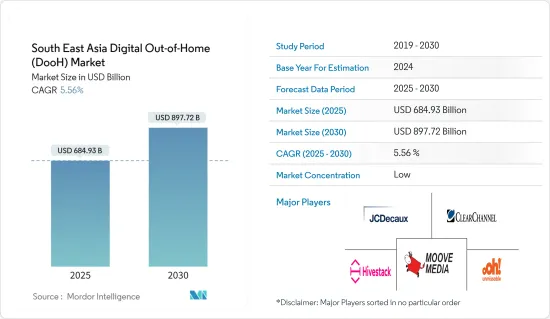

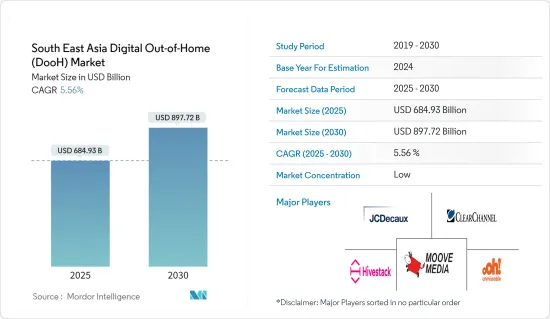

동남아시아의 디지털 옥외 광고(DooH) 시장 규모는 2025년에 6,849억 3,000만 달러로 추정되며, 예측기간(2025-2030년)의 CAGR은 5.56%로, 2030년에는 8,977억 2,000만 달러에 달할 것으로 예측됩니다.

디지털 옥외 광고는 디지털 사이니지 기술을 활용한 옥외 광고입니다. 이 기술은 AI와 애널리틱스를 이용하여 마케터가 적절한 메시지를 적절한 시기에 적절한 사람들에게 전달할 수 있도록 지원합니다.

주요 하이라이트

- 오프라인 광고 비즈니스에서는 지오펜싱이나 비콘 등의 신기술이 서서히 채용되어 지금까지 불가능했던 추적이나 커스터마이즈가 가능해지고 있습니다.

- 디지털 옥외 광고는 관리가 쉽고, 변경이 빠르고, 저렴하며, 시장을 타겟팅할 수 있는 등 여러 이유로 적절한 장소에서 이용되고 있습니다. 광고주나 마케팅 담당자는 디지털 옥외 광고를 사용해 복수의 정보를 장치의 네트워크로 전송하고 이러한 장치에 원격으로 연결하여 컨텐츠를 업데이트 할 수 있습니다.

- DooH는 이 지역의 판매자가 보다 신속하게 디스플레이나 커뮤니케이션을 변경할 수 있게 하고, 보다 저렴한 비용으로, 보다 효과적으로 잠재적인 구매자에게 정보를 전달할 수 있게 합니다. 또한, 기존의 광고보다 관리가 간단합니다.

- 스마트 시티 프로젝트에서는 다양한 유형의 디지털 디스플레이를 사용하여 도시를 원활하게 운영하고 있으며, 모든 디지털 디스플레이는 광고 수익을 얻기 위해 사용할 수 있습니다. 소형 대화형 키오스크 화면에서 대형 디지털 빌보드에 이르기까지 시스템은 인상을주는 데 필요한 컴퓨팅 성능, 고품질 그래픽, 연결성, 중요한 정보를 공개하는 데 필요한 분석을 제공합니다.

- 게다가 이 지역은 솔루션 공급자에게 개발과 성장을 위한 유리한 기회를 제공하는 세계 기업에 의한 사업 확대를 목격하고 있습니다.

- 정확한 DooH 노출수를 계산하는 것은 불가능하기 때문에 DooH를 통한 사용자 참여를 정량화하는 것은 어렵습니다. 트래픽을 예측할 수는 있지만, 정확한 카운트는 아니며, 이미 광고를 본 사람의 성별이나 연령을 특정하기 위한 얼굴 인식의 통합도 포함되어 있지 않기 때문에 도입이 보다 복잡해져, 시장의 성장을 방해하고 있습니다.

- 팬데믹에 의해 뉴스패브리셔의 트래픽이 증가해, 디지털 재고의 가치가 높아졌다고는 해도, COVID-19 컨텐츠에 있어서의 브랜드의 안전성에 대한 우려로부터, 프로그래매틱 CPM은 하락했습니다.

동남아시아 디지털 옥외 광고(DooH) 시장 동향

빌보드가 크게 성장

- 싱가포르에는 빌보드가 집중되어 있기 때문에 디지털 옥외 광고를 획득하는 기업은 브랜드의 인지도와 지명도를 높이는 큰 기회를 얻을 것으로 보입니다. 이 업계에서는 DooH에 의한 상호작용(예를 들어, 인터랙티브 디스플레이나 QR코드에 의한 옵트인이 가능한 광고 등)의 측정에 있어서도 진보를 이루고 있기 때문에 동국에 있어서의 디지털 옥외 광고에의 대규모 투자를 통해, 기업은 캠페인의 유효성을 평가하기 위한 데이터를 손에 넣을 수 있습니다.

- 싱가포르에서는 DooH 빌보드는 쇼핑센터, 식료품점, 주유소, 펍, 레스토랑, 무료 Wi-Fi를 갖춘 LCD 공공 고지 키오스크, 병원, 진료소, 진료소, 콘도미니엄, 주택개발, 오피스 타워, 영화관, 스포츠 스타디움, 엔터테인먼트 시설, 주요 거리, 사람의 왕래가 많은 장소 중의 하나에 표시하거나 붙일 수 있습니다.

- DooH 빌보드 광고는 최대 수의 청중에게 도달하기 위한 광고 플랫폼으로서의 독특한 제공을 위해 옥외 광고 매체의 최초로 가장 효과적인 형식입니다.

- 게다가 3D나 모바일 빌보드의 진화 등 최근의 혁신도 이용 사례를 대폭 확대하고 새로운 광고 방법을 지원할 뿐만 아니라 기업이 혁신적인 방법으로 고객 경험을 강화하는 데 도움이 되기 때문에 조사한 시장의 성장에 영향을 줄 것으로 예상됩니다.

- 인도네시아의 DooH 산업은 디지털화로의 전환이 급속히 진행되고 있습니다.

- 빌보드는 필리핀의 DooH 시장에서 큰 점유율을 차지하고 있습니다.

- 베트남에서는 다양한 도시에 전통적인 빌보드가 많이 설치되어 있습니다.

- 2023년 12월 Location Media Xchange(LMX)와 DOmedia는 파트너십을 맺고 세계에서 가장 널리 사용되는 지역 OOO 광고 마켓플레이스인 BillboardsIn.com을 통해 15,000개 이상의 OOH 광고 자산을 온라인으로 구입할 수 있도록 했습니다.

큰 성장을 이루는 말레이시아

- 말레이시아의 OOH 광고 시장은 광고주와 마케팅 담당자의 관심이 높아지고 있는 것 외에도 OOH 광고가 광고주에게 가장 비용 효율적인 미디어 채널 중 하나가 되고 있는 한편, 현실의 환경과는 대조적이고 크기도 크기 때문에 소비자에게 큰 임팩트를 주는 등 수많은 이점이 있기 때문에 앞으로 수년간 크게 성장할 것으로 예상되고 있습니다.

- 게다가 광고의 보다 혁신적인 미디어에 대한 수요는 전국의 광고주와 브랜드 소유자들 사이에서 높아지고 있으며, OOH 시장의 성장에 긍정적인 영향을 미치고 있습니다.

- 예를 들어, 2023년 12월, Vistar Media와 Big Tree는 말레이시아 전역의 광고주에게 다양한 프리미엄 디지털 스크린을 제공하는 파트너십을 발표했습니다. Big Tree는 말레이시아 아웃 오브 홈(OOH) 광고 솔루션 제공 업체입니다.

- 마찬가지로, 2022년 1월, Hivestack은 말레이시아에서 본격적인 사업 시작을 발표했습니다.

- 게다가 디지털 디스플레이의 성장은 말레이시아의 OOH 시장에 유망한 장래를 가져오고 있습니다.

- 말레이시아의 DooH는 과거 2년간 큰 성장을 이루고 있으며, 디지털화 및 자동화의 동향, 전국적인 빌보드나 디스플레이의 디지털화의 진전, 부동산, 소매, 자동차 등의 상업 분야에서의 수요의 성장 등의 요인에 의해 예측 기간 중에도 큰 성장이 전망되고 있습니다.

- 국내 광고 수요는 DooH 캠페인의 높은 기대율과 다른 많은 유형의 광고에 비해 저비용 등 많은 이점이 원동력이 되고 있습니다.

동남아시아 디지털 옥외 광고(DooH) 산업 개요

동남아시아의 디지털 옥외 광고(DooH) 시장은 단편화되어 있으며, 소수의 대기업이 존재하고 있습니다.

2024년 4월 태국을 비롯한 동남아 시장에서 아웃 오브 홈(OOH) 미디어 서비스를 제공하는 Plan B Media는 태국과 싱가포르의 디지털 옥외 광고(DooH) 광고를 강화하기 위해 프로그래매틱 솔루션 제공업체의 선두주자인 Vistar Media사와 제휴했습니다. 이 제휴는 이 지역의 DooH 광고 업계에 원활한 프로그래매틱 솔루션을 가져오는 것을 목적으로 하고 있습니다.

2023년 10월 세계 유수의 독립형 프로그래매틱 DooH 애드테크 기업인 Hivestack사는 엘리베이터 스크린을 전문으로 하는 현지 미디어 오너인 UpMedia사와 제휴해 태국에서의 프레즌스를 확대했습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 상정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 시장 성장 촉진요인

- 스마트 시티 프로젝트에 대한 지출 증가로 디지털 광고로의 전환 진행

- 상업 부문에서 높은 수요

- 시장의 과제

- 광고 효과의 측정, 비용, 시장의 세분화에 관한 운용상의 과제

- 동남아시아의 DooH 시장 진입이 기대되는 세계의 주요 단서

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 생태계 분석

- COVID-19가 DooH 시장에 미치는 영향

제5장 동남아시아의 디지털 옥외 광고(DooH) 시장 상황

- 말레이시아 DooH 시장 상황

- 말레이시아 OOH 시장

- 말레이시아 DooH 시장

- 용도별 세분화

- 싱가포르 DooH 시장 상황

- 싱가포르 OoH 시장

- 싱가포르 DooH 시장

- 용도별 세분화

- 태국 DooH 시장 상황

- 태국 OOH 시장

- 태국 DooH 시장

- 용도별 세분화

- 인도네시아 DooH 시장 상황

- 인도네시아 OOH 시장

- 인도네시아 DooH 시장

- 용도별 부문

- 필리핀 DooH 시장 상황

- 필리핀 OOH 시장

- 필리핀 DooH 시장

- 용도별 세분화

- 베트남 DooH 시장 상황

- 베트남 OOH 시장

- 베트남 DooH 시장

- 용도별 세분화

제6장 경쟁 구도

- 기업 프로파일

- JCDecaux Singapore Pte Ltd

- Clear Channel Singapore Pte Ltd

- Ooh!Media Digital PTY Limited

- Hivestack Inc.

- Moove Media Pte Ltd

- SPHMBO(Singapore Press Holding Ltd)

- Vistar Media

- Talon outdoor limited

- Mediatech Services Pte Ltd

- Daktronics Inc.

- Neosys Documail(S)Pte Ltd

- TAC Media Sdb Bhd

- Moving Walls

- Pi Interactive(Brandlah)

제7장 향후의 DooH 시장 전망

JHS 25.05.07The South East Asia Digital Out-of-Home Market size is estimated at USD 684.93 billion in 2025, and is expected to reach USD 897.72 billion by 2030, at a CAGR of 5.56% during the forecast period (2025-2030).

DooH advertising is out-of-home advertising that is powered by digital signage technologies. These technologies use AI and analytics to help marketers get the right message to the right people at the right time.

Key Highlights

- The offline advertising business is slowly adopting new technologies, like geofencing and beacons, which make tracking and customization possible in ways that weren't possible before. This is helping the market grow significantly.

- DooH is being used in the right places for many reasons, such as how easy it is to manage, how quickly it can be changed, how cheap it is, how well it can target a market, and more. Advertisers and marketers can use DooH to send multiple pieces of information to a network of devices and connect to these devices remotely to update their content. Government restrictions on offline shopping due to the COVID-19 pandemic caused a big loss for the DooH advertising business.

- DooH allows sellers in the region to modify the displays and communications more rapidly and allows the information to reach potential buyers at a lower cost and with better effectiveness. Additionally, it is simpler to manage than conventional advertisements. Digital signs provide up-to-the-minute details on products and accessibility, interactive information, and visually appealing images and videos.

- Smart city projects use different kinds of digital displays to make sure the city runs smoothly, and every digital display can be used to make money from ads. Digital signage technology assists in capitalizing on these prospects. From small interactive kiosk screens to large-format digital billboards, systems deliver the computing performance, high-quality graphics, and connectivity needed to make an impression and the analytics needed to disclose critical information.

- Furthermore, the region has been witnessing expansions from global companies, as they offer lucrative opportunities to the solution providers for development and growth. For instance, during the InfoComm Asia 2023 event, Samsung partnered with regional companies to showcase the latest professional audio-visual technology for businesses returning to the office, as well as customers seeking engaging interactions with companies.

- User engagement with DooH is difficult to quantify because counting exact DooH impressions is impossible. While vendors can predict traffic near a specific outdoor ad using smartphone location data, it may not be an exact count, and it does not include the integration of face recognition to establish people's gender and age who have already seen the advertisements, which makes the implementation more complex and hinders the market's growth.

- Even though the pandemic helped news publishers get more traffic and increase the value of their digital inventory, programmatic CPM fell because of concerns about brand safety in COVID-19 content.

South East Asia Digital Out-of-Home (DooH) Market Trends

Billboards to Witness Significant Growth

- Due to Singapore's sizable billboard concentration, companies that acquire DooH advertising would have considerable opportunities to increase their brand awareness and visibility. The industry has also made strides in measuring the interactions brought about by DooH (for instance, through interactive displays and ads that allow opt-ins through QR codes), so the businesses will have data to back their assessments of the efficacy of their campaigns through significant investments in the digital billboard advertising in the country.

- In Singapore, DooH billboards can be displayed or mounted on any of the following: shopping centers, grocers, petrol stations, pubs, and restaurants; LCD public announcement kiosks with free Wi-Fi; hospitals, clinics, and doctor's offices; condominiums, housing developments, and office towers; movie theaters, sports stadiums, and entertainment venues; major thoroughfares; and areas where there is a lot of foot activity.

- Billboard advertising in DooH is the first and most effective form of outdoor advertising medium because of its unique offerings as an advertising platform to reach the maximum number of audiences. Thailand consists of two major cities, which creates a significant opportunity for market growth in the country because digital billboards can be mounted on roadside poles to drive audiences' attention.

- Furthermore, recent innovations such as the evolution of 3D and mobile billboards are also expected to influence the growth of the market studied, as they significantly expand the use cases and support the new way of advertising, as well as help businesses enhance the customer experience in an innovative way.

- The DooH industry in Indonesia is witnessing a rapid transition toward digitalization. Digital billboards have become much more widespread in and outside of Indonesia. Combined with modern advertising technology, these dynamic displays have the same high reach as traditional billboards but with the added benefit of providing deeper analytics capabilities.

- Billboards hold a significant share of the DooH market in the Philippines. A billboard is an effective form of advertising, giving maximum exposure to the brand's products and services to a high volume of people at various locations.

- Vietnam has significant traditional billboards installed across various cities. According to Shojiki Advertising JSC, a well-known advertising firm, there are 17,135 large-sized outdoor billboards in Vietnam, most of which are located in the four major cities of Ho Chi Minh, Hanoi, Da Nang, and Can Tho.

- In December 2023, Location Media Xchange (LMX) and DOmedia formed a partnership to provide more than 15,000 OOH (out-of-home) advertising assets for purchase online through BillboardsIn.com, the most widely used local OOH ad marketplace in the world. Advertisers can now plan and purchase local ad campaigns across Singapore, Malaysia, Indonesia, Thailand, the Philippines, Vietnam, and India.

Malaysia to Witness Major Growth

- The Malaysian ooH market is expected to grow significantly in the coming years due to increased interest from advertisers and marketers, as well as the numerous benefits, such as the fact that ooH advertising remains one of the most cost-effective media channels for advertisers while also having a significant impact on consumers due to their contrast and size to the real-world environment.

- Additionally, demand for more innovative media in advertising is increasing among advertisers and brand owners around the country, thus positively impacting the ooH market's growth. Furthermore, in today's competitive market, the increasing focus of organizations in the country drives the demand for ooH solutions to create impactful ooH campaigns to increase their visibility and drive business growth.

- For instance, in December 2023, Vistar Media and Big Tree announced a partnership to bring a variety of premium digital screens to advertisers throughout Malaysia. Vistar Media is a global provider of programmatic technology for digital out-of-home (DooH), while Big Tree is a Malaysian out-of-home (ooH) advertising solutions provider. Through their collaboration, Vistar can effortlessly connect advertisers from around the world to Big Tree's network of 30 digital venues, which include outdoor billboards, retail shopping malls, and transit train stations.

- Similarly, in January 2022, Hivestack announced the launch of full operations in Malaysia. Several agencies, brands, and omnichannel demand-side platforms (DSPs) in Malaysia can access the Hivestack platform to plan, activate, and measure programmatic DOOH campaigns via private marketplace (PMP) and open exchange deals.

- Further, the growth in digital displays offers a promising future for the ooH market in the country. This has resulted in significant growth in the digital ooH segment in the past few years compared to the static ooH segment in the country. However, with technological advances, the static ooH segment is expected to hold a significant share in the coming years.

- The Malaysian DooH has been witnessing significant growth in the past two years and is expected to grow at a significant rate over the forecast period due to factors such as the digitization and automation trend, the increasing digitization of ooH billboards and displays across the country, and growth in demand from commercial sectors such as real estate, retail, and automotive.

- The demand for advertising in the country is driven by the many benefits of DooH campaigns, such as their high rate of recall and low cost compared to many other types of advertising. The improvements and new ideas that DooH market vendors have come up with have led to better personalization, better targeting, and more accurate measurement, which has helped the market grow quickly in the country.

South East Asia Digital Out-of-Home (DooH) Industry Overview

The Southeast Asian digital out-of-home (DooH) market is fragmented, with the presence of a few major companies. The companies continuously invest in strategic partnerships and product developments to gain market share.

April 2024: Plan B Media, a prominent provider of out-of-home (OOH) media services in Thailand and other Southeast Asian markets, partnered with Vistar Media, a leading programmatic solutions provider, to enhance the digital out-of-home (DOOH) advertising landscape in Thailand and Singapore. The collaboration aims to bring seamless programmatic solutions to the region's DooH advertising industry.

October 2023: Hivestack, the world's leading independent programmatic DooH ad tech company, expanded its presence in Thailand by partnering with UpMedia, a local media owner that specializes in elevator screens.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects

- 4.2.2 High Demand from Commercial Segment

- 4.3 Market Challenges

- 4.3.1 Operational Challenges Related to Measurement of Advertising Effectiveness, Cost and Market Fragmentation

- 4.4 Key Global Cues Expected to Find their Way into the SEA DooH Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Ecosystem Analysis

- 4.7 Impact of COVID-19 on the DooH Market

5 SOUTH EAST ASIA DooH MARKET LANDSCAPE

- 5.1 Malaysia DooH Market Landscape

- 5.1.1 Malaysia OoH Market

- 5.1.2 Malaysia DooH Market

- 5.1.3 Segmentation by Application

- 5.2 Singapore DooH Market Landscape

- 5.2.1 Singapore OoH Market

- 5.2.2 Singapore DooH Market

- 5.2.3 Segmentation by Application

- 5.3 Thailand DooH Market Landscape

- 5.3.1 Thailand OoH Market

- 5.3.2 Thailand DooH Market

- 5.3.3 Segmentation by Application

- 5.4 Indonesia DooH Market Landscape

- 5.4.1 Indonesia OoH Market

- 5.4.2 Indonesia DooH Market

- 5.4.3 Segmentation by Application

- 5.5 Philippines DooH Market Landscape

- 5.5.1 Philippines OoH Market

- 5.5.2 Philippines DooH Market

- 5.5.3 Segmentation by Application

- 5.6 Vietnam DooH Market Landscape

- 5.6.1 Vietnam OoH Market

- 5.6.2 Vietnam DooH Market

- 5.6.3 Segmentation by Application

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 JCDecaux Singapore Pte Ltd

- 6.1.2 Clear Channel Singapore Pte Ltd

- 6.1.3 Ooh!Media Digital PTY Limited

- 6.1.4 Hivestack Inc.

- 6.1.5 Moove Media Pte Ltd

- 6.1.6 SPHMBO (Singapore Press Holding Ltd)

- 6.1.7 Vistar Media

- 6.1.8 Talon outdoor limited

- 6.1.9 Mediatech Services Pte Ltd

- 6.1.10 Daktronics Inc.

- 6.1.11 Neosys Documail (S) Pte Ltd

- 6.1.12 TAC Media Sdb Bhd

- 6.1.13 Moving Walls

- 6.1.14 Pi Interactive (Brandlah)