|

시장보고서

상품코드

1693382

스페인의 접착제 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Spain Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

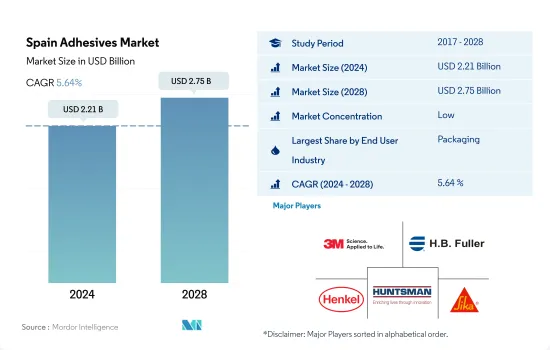

스페인의 접착제 시장 규모는 2024년에 22억 1,000만 달러로 추정되고, 2028년에는 27억 5,000만 달러에 이를것으로 예측되며, 예측 기간중(2024-2028년)에 CAGR 5.64%로 성장할 것으로 예측됩니다.

스페인에서 접착제 소비를 촉진할 것으로 예상되는 새로운 연질 포장 동향

- 접착제는 산업 전반에 걸쳐 사용되는 다양한 기질을 접착하고 결합하는 데 중요한 역할을 합니다.

- 2021년의 접착제 소비량은 다양한 최종 사용자 산업의 포장 용도의 성장으로 41만 1,363톤 이상 증가했습니다. 2020년 카톤보드 생산량은 여러 가지 어려움에도 불구하고 32만 1,600톤에 달했습니다. 또한 스페인의 식품 포장재 생산량은 2022년까지 0.3%의 비율로 상당한 성장을 보일 것으로 예상됩니다. 포장 육류 및 해산물, 가공 과일 및 채소에 대한 수요 증가, 토마토 페이스트 및 퓨레용 액체 상자의 광범위한 사용과 같은 요인으로 인해 향후 몇 년 동안 연질 포장용 접착제 소비가 촉진될 것으로 예상됩니다. 수성 접착제는 이러한 용도에 필요한 저렴한 비용과 높은 접착 강도로 인해 업계에서 많이 소비되고 있습니다.

- 현재 진행 중인 여러 인프라 프로젝트가 인도에서 접착제에 대한 수요를 증가시켰습니다. 2019년 아마존 웹 서비스(AWS)는 스페인에 새로운 인프라 리전을 개설하여 유럽에서 일곱 번째 리전을 만들었습니다. 또한 주택 건설은 예측 기간 후반부에 걸쳐 크게 성장할 것으로 예상됩니다. 스페인 국립통계연구소(INE)에 따르면 2019-2025년의 순 가구 건설은 연평균 약 13만 5,000가구씩 증가할 것으로 예상됩니다. 이는 스페인의 접착제 시장에 영향을 미칠 것으로 예상됩니다.

스페인의 접착제 시장 동향

플라스틱 재활용성 향상과 식음료 산업의 수요 증가로 포장 산업을 주도하는 플라스틱 포장재

- 포장은 제품의 안전과 수명을 보호하고 향상시키기 위한 디자인과 기술 측면에서 가장 빠르게 성장하는 산업 중 하나입니다. 스페인의 포장 산업은 최근 몇 년간 식음료 산업의 급속한 성장에 힘입어 크게 성장했습니다. 농식품 산업은 스페인에서 가장 유망한 분야이자 유럽에서 4번째로 큰 농식품 시장으로, 3만 개 이상의 기업이 종사하고 있습니다.

- COVID-19 팬데믹으로 인해 전국적인 봉쇄령과 제조 시설의 일시적인 폐쇄로 인해 공급망과 수출입에 차질이 생기는 등 여러 가지 문제가 발생했습니다. 그 결과 2020년 국내 포장재 생산량은 전년 대비 6% 감소하여 시장에 큰 영향을 미쳤습니다. 포장재 생산은 주로 종이와 판지가 주도하고 있으며, 2021년 생산된 포장재의 거의 52%를 차지합니다.

- 스페인의 포장 산업 성장은 국내 신선 식품 수요 증가와 맞물려 있습니다. 팬데믹 이후 공중 보건 문제에 대한 관심 증가와 전국적으로 부상하는 전자상거래 활동은 식품 가공 산업의 성장을 촉진하고 향후 몇 년 동안 포장에 대한 수요를 더욱 촉진할 것으로 보입니다.

전기차 수요 증가와 자동차 수요 부양을 위한 240억 유로 규모의 공공 및 민간 e-모빌리티 투자에 대한 정부의 투자 확대

- 스페인은 독일에 이어 유럽 2위의 자동차 생산국입니다. 스페인 자동차 공급업체는 2019년 358억 2,200만 유로 상당의 제품을 생산했으며, 그 중 60%가 유럽 내외로 수출되었습니다.

- 이 나라의 자동차 생산은 지난 몇 년 동안 거의 일정합니다. 2019년, 이 나라의 생산 대수는 약 2,822만 2,355대로, 2018년 대비 0.1%의 미세한 성장률을 기록했습니다. 2020년 자동차 생산 대수는 약 226만 8,185대였습니다. 2020년 자동차 생산 대수는 COVID-19 팬데믹으로 공급망이 중단되면서 2020년 자동차 생산량은 18.6% 감소했습니다.

- 2021년 1-3분기 자동차 생산 대수는 2020년 1-3분기 대비 4% 증가하여 159만 2,277대에 달했습니다. 이 나라의 자동차 산업은 예측 기간 동안 적당한 수요를 보일 것으로 보입니다. 그러나 2021년 동국의 자동차 생산 대수는 약 209만 8,133대로 2020년부터 8% 감소했습니다. 반도체 칩 부족과 공급망 제한은 국내 자동차 생산에 부정적인 영향을 미쳤습니다.

- 최근 자동차 생산 부족이 악화되고 있으며 2022년에는 생산량이 18% 증가하면서 강한 반등이 예상됩니다. 스페인의 전기자동차 시장은 공급업체들이 e-모빌리티로 전환하는 것을 지원하는 차세대 EU 펀드의 혜택을 받을 수 있을 것입니다. 또한 스페인 정부는 향후 3년간 240억 유로에 달하는 공공 및 민간 e-모빌리티 투자를 발표했습니다.

스페인의 접착제 산업 개요

스페인의 접착제 시장은 세분화되어 있으며 상위 5개 기업에서 9.10%를 차지합니다. 이 시장의 주요 업체는 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, 헌츠맨 인터내셔널 LLC, 시카 AG(알파벳순) 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 신발 및 가죽

- 포장

- 목공 및 목공예

- 규제 프레임워크

- 스페인

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 항공우주

- 자동차

- 건축 및 건설

- 신발 및 가죽

- 의료

- 포장

- 목공 및 목공예

- 기타

- 기술

- 핫멜트

- 반응성

- 용매

- UV 경화형 접착제

- 수성

- 수지

- 아크릴계

- 시아노아크릴레이트

- 에폭시

- 폴리우레탄

- 실리콘

- VAE 및 EVA

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- 3M

- AC Marca

- AVERY DENNISON CORPORATION

- Beardow Adams

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- MAPEI SpA

- Sika AG

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 접착제 및 실란트 산업 개요

- 개요

- Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 성장 촉진요인, 억제요인, 기회

- 출처 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Spain Adhesives Market size is estimated at 2.21 billion USD in 2024, and is expected to reach 2.75 billion USD by 2028, growing at a CAGR of 5.64% during the forecast period (2024-2028).

Emerging trend of flexible packaging expected to boost the consumption of adhesives in Spain

- Adhesives play an important role in bonding and joining various substrates that are used across industries. These adhesives help manufacturers lower the weight of their components and assemblies and form joints quickly, easily, and accurately. As a result of the COVID-19 outbreak in 2020, consumption fell by 8.91% compared to 2019.

- Adhesive consumption increased by more than 411,363 ton in 2021 due to the growth of packaging applications among various end-user industries. In 2020, carton board production reached 321.6 thousand ton despite several challenges. Moreover, Spanish food packaging volume is expected to witness considerable growth at a rate of 0.3% through 2022. Factors such as rising demand for packaged meat and seafood, processed fruits and vegetables, and widespread usage of liquid cartons for tomato pastes and purees are expected to foster adhesives consumption in flexible packaging over the coming years. Waterborne adhesives are highly consumed in the industry because of their cheaper cost and high bonding strength which is required in these applications. It is seen that nearly 201 thousand tons of water-borne adhesives are consumed in the packaging industry of the country during 2021.

- Several ongoing infrastructure projects have boosted the demand for adhesives in the country. In 2019, Amazon Web Services (AWS) launched a new infrastructure region in Spain, making it its seventh region in Europe. Moreover, residential construction is expected to grow significantly over the later parts of the forecast period. According to Spain's National Statistics Institute (INE), net household construction is anticipated to increase at an average pace of around 135,000 units annually from 2019 to 2025. This is expected to influence the market for adhesives in Spain.

Spain Adhesives Market Trends

With the advancement in plastic recyclability and demand from the food and beverage industry, plastic packaging to lead the packaging industry

- Packaging is one of the fastest-growing industries in terms of design and technology for protecting and enhancing products' safety and longevity. The Spanish packaging industry has been majorly driven by the rapid growth of the food and beverages industry in recent years. The agri-food industry is the most promising sector in Spain and the fourth-largest agri-food market in Europe, with over 30,000 companies. Owing to the high-level promotion of country brands, Spain has positioned itself as a major exporter of food and drinks worldwide.

- Due to the COVID-19 pandemic, the country-wide lockdowns and temporary shutdown of manufacturing facilities caused several issues, including disruptions in supply chains and imports and exports. As a result, the country's packaging production declined by 6% in 2020 compared to the previous year, significantly affecting the market. Packaging production is majorly driven by paper and paperboard in the country, which accounts for nearly 52% of the packaging produced in 2021. However, with the advancement of plastic recyclability, the plastic production segment is likely to register the fastest growth of around 4.27% CAGR during the forecast period.

- The growth of the packaging industry in Spain is in line with the growing demand for fresh food domestically. The growing interest in public health issues post-pandemic, along with the emerging e-commerce activities across the nation, is likely to boost the growth of the food processing industry and further drive the demand for packaging over the coming years.

Increasing EVs demand and government investment of public and private e-mobility investments worth EUR 24 billion to boost the automotive demand

- Spain is the second-largest automobile producer in Europe, after Germany. Spanish automotive suppliers produced EUR 35,822 million worth of products in 2019, of which 60% were exported inside and outside the European region.

- Automobile production in the country has been almost constant in the past few years. In 2019, the country produced about 28,22,355 units, registering a meager growth rate of 0.1% over 2018. The country produced about 22,68,185 units of vehicles in 2020. Automotive vehicle production contracted by 18.6% in 2020 as the COVID-19 pandemic halted the supply chain.

- In the first three quarters of 2021, automotive production increased by 4% over Q1-Q3 of 2020 and reached 1,592,277 vehicles. The country's automotive industry is likely to witness moderate demand during the forecast period. However, in 2021, the country produced about 2,098,133 vehicles, which was a decline of 8% from 2020. The semiconductor chip shortage and supply chain restrictions negatively affected the production of automotive vehicle units in the country.

- The automotive production shortfalls have recently worsened, and a strong rebound is expected in 2022, with output increasing by 18%. The Spanish electric vehicles market should benefit from the Next Generation EU fund, which supports suppliers in their shift toward e-mobility. Additionally, the Spanish government has announced public and private e-mobility investments worth EUR 24 billion over the coming three years.

Spain Adhesives Industry Overview

The Spain Adhesives Market is fragmented, with the top five companies occupying 9.10%. The major players in this market are 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Spain

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Cyanoacrylate

- 5.3.3 Epoxy

- 5.3.4 Polyurethane

- 5.3.5 Silicone

- 5.3.6 VAE/EVA

- 5.3.7 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 AC Marca

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 Beardow Adams

- 6.4.5 Dow

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Huntsman International LLC

- 6.4.9 MAPEI S.p.A.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록