|

시장보고서

상품코드

1693402

태국의 실란트 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Thailand Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

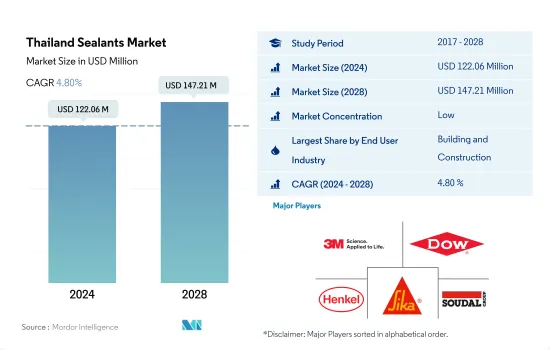

태국 실란트 시장 규모는 2024년에 1억 2,206만 달러로 평가되었고, 2028년에는 1억 4,721만 달러에 이를 것으로 예측되며, 예측 기간(2024-2028년)의 CAGR은 4.80%를 나타낼 전망입니다.

자동차산업과 첨단 의료 기기 수요 증가가 태국 실란트 소비를 끌어올릴 것으로 예측

- 건설 산업은 태국의 실란트 시장에서 주요 점유율을 차지하고 있으며, 건축 및 건설에 있어서의 실란트의 다양한 용도에 의해 다른 최종사용자 산업이 그 뒤를 잇고 있습니다. 건설 섹터는 2021년에 4,391억 3,000만 바트로 국가의 GDP에 공헌해, 주택 건설에 대한 투자 증가에 의해 큰 성장을 기록할 가능성이 높아, 향후 수년간 실란트 수요를 끌어올릴 것으로 예측됩니다.

- 기타 최종 사용자 산업 부문은 태국 실란트 시장에서 금액과 수량으로 두 번째로 높은 점유율을 차지할 것으로 예상되고 있으며, 그 중 전자 및 전기 장비가 주요한 부분을 차지할 것으로 예상됩니다. 다양한 실란트가 전기 장비 제조에서 포팅 및 보호 용도로 사용됩니다. 센서나 케이블 등의 씰에 사용됩니다.

- 씰링재는 자동차 산업의 다양한 용도로 사용되고 있으며, 주로 엔진과 자동차의 개스킷에 사용되고 있습니다. 향후 수년간 실란트 수요를 낳을 가능성이 높습니다. 실링재는 의료기기 부품의 조립이나 씰 등의 의료용도에도 사용되고 있기 때문에 최종 사용자 산업 중에서도 태국의 실링재 시장에서 일정한 점유율을 차지하고 있습니다.

태국 실링재 시장 동향

공공 인프라 프로젝트에 대한 지출 증가는 건설 섹터 성장을 가속할 것입니다.

- 태국 건설산업은 예측기간 2022-2028년에 걸쳐 약 2.59%의 연평균 복합 성장률(CAGR)로 성장할 것으로 예측되고 있습니다. 주택 건설은 2014-2019년에 걸쳐 태국의 건설 산업에서 가장 큰 부문이며, 2019년에는 그 총액의 40% 이상을 차지했습니다. 건설 산업은 2023년까지 회복될 것으로 예상되며, 건설 지출 총액은 2021년에 4.5-5%, 2022-2023년에 5-5.5% 증가할 것으로 예측되고 있습니다.

- 특히 동부경제회랑(Eastern Economic Corridor)에서는 정부가 지원하는 프로젝트에 대한 투자가 민간투자(공업단지 등)의 클라우딩인을 촉구할 것으로 예측됩니다.

- 2021년에는 몇몇 주택 프로젝트가 착공되었고, 이 부문의 성장은 더욱 촉진되었습니다. 이 프로젝트에는 5억 700만 달러의 Skyrise Avenue Sukhumvit 64 Mixed-Use Development와 1억 1,700만 달러의 Arom Wongamat Condominium Tower 등이 포함됩니다. 이러한 프로젝트의 완성 예정은 2024-2025년경입니다. 이 나라에서는 인프라 정비가 진행되고 있으며, 예측 기간 중에 접착제 수요가 증가할 것으로 예측됩니다.

ASEAN 국가 중 자동차 생산 대수 전체의 50.1% 가까이를 차지하는 태국이 이 산업을 견인할 것으로 전망

- 태국 자동차 산업은 지난 50년간 경이로운 성장을 이루었습니다. 이 나라는 보다 부가가치가 높은 생산으로 S자 곡선을 그리는 차세대 자동차 산업을 지속적으로 추진하고 있으며, 자동차 산업 시책도 환경보호 시책과의 정합을 목표로 하고 있습니다. 태국은 ASEAN 지역에서 가장 큰 자동차 생산국입니다. 2020년 생산 대수는 142만 7,074대로 ASEAN 전체의 50.1%를 차지했습니다. 이에 인도네시아(69만150대, 약 24.2%), 말레이시아(48만5,186대, 약 17.0%)가 그 뒤를 이었습니다.

- 2019년 자동차 생산 대수는 약 201만 3,710대를 기록했지만, 2020년에는 142만 7,074대로 격감해, COVID-19의 유행에 의해 약 29%의 감소를 기록했습니다. 그 결과 2019-2021년에 걸친 자동차 생산 대수의 변동은 약 -16%였지만, 2020-2021년에 걸친 변동은 약 -1%를 기록했습니다.

- 태국은 세계 제11위, ASEAN에서는 제1위의 자동차 생산국이며, 밸류체인이 확립되어 있기 때문에 ASEAN의 EV센터가 될 준비가 되어 있습니다. 국내의 EV충전 인프라에 적극적으로 투자하고 있는 것으로, 장래 수요 증가에 대한 확신이 높아지고 있는 것을 나타냅니다.

태국 실란트 산업 개요

태국의 실란트 시장은 세분화되어 있으며 상위 5개사에서 22.73%를 차지하고 있습니다. 3M, Dow, Henkel AG & Co.KGaA, Sika AG, Soudal Holding NV 등입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 규제 프레임워크

- 태국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 항공우주

- 자동차

- 건축 및 건설

- 의료

- 기타

- 수지

- 아크릴

- 에폭시

- 폴리우레탄

- 실리콘

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- 3M

- Arkema Group

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Plic Firston(Thailand) Co., Ltd

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- Soudal Holding NV

- THE YOKOHAMA RUBBER CO., LTD.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 접착제 및 실란트 산업 개요

- 개요

- Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 성장 촉진요인, 억제요인, 기회

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Thailand Sealants Market size is estimated at 122.06 million USD in 2024, and is expected to reach 147.21 million USD by 2028, growing at a CAGR of 4.80% during the forecast period (2024-2028).

The emerging automotive industry and rising demand for advanced medical equipment are expected to boost the consumption of sealants in Thailand

- The construction industry holds a major share of the Thai sealants market, followed by other end-user industries due to the diverse applications of sealants in building and construction. Moreover, construction sealants are designed for longevity and ease of application on different substrates. The construction sector contributed THB 439.13 billion to the nation's GDP in 2021 and is likely to register significant growth owing to increasing investment in residential construction, which is expected to boost the demand for sealants in the upcoming years.

- The other end-user industries segment is anticipated to hold the second-highest share in value and volume in the Thai sealants market, of which electronics and electrical equipment will account for the major portion. Various sealants are used in electrical equipment manufacturing for potting and protecting applications. They are used for sealing sensors and cables, etc. The Thai electronics industry is likely to grow over the coming years, owing to the presence of major manufacturers in the country. This will foster the production capacity and demand for sealants in the other end-user industries segment.

- Sealants are used in diverse applications in the automotive industry, mostly for engines and car gaskets, and exhibit extensive bonding to various substrates. Thailand has been a major hub for automakers over the last few years due to well-organized production facilities and the presence of leading companies, which is likely to create demand for sealants over the coming years. Sealants are also used for healthcare applications, such as assembling and sealing medical device parts, thus, accounting for a decent share of the Thai sealants market among end-user industries.

Thailand Sealants Market Trends

Increasing spending on public infrastructure projects is likely to facilitate the growth of construction sector

- The Thai construction industry is projected to record a CAGR of about 2.59% during the forecast period 2022-2028. Thailand is one of Southeast Asia's most exciting hubs for contractors, with a huge construction sector to invest in. With increasing public works, such as the construction of transit lines and subway infrastructure, the demand for residential construction has been consistently growing. Residential construction was the largest segment in the Thai construction industry between 2014 and 2019, accounting for more than 40% of its total value in 2019. The construction industry is expected to recover by 2023, with total construction spending having been forecast to rise by 4.5-5% in 2021 and then by 5-5.5% in 2022-2023.

- The major driver in the country for increasing construction will be public-sector spending on infrastructure megaprojects, especially in the Eastern Economic Corridor, where investment in government-backed projects will encourage crowding-in of private-sector investment (e.g., industrial estates). There will also be new opportunities in neighbouring countries as their governments improve national infrastructure in response to continued economic growth and urbanization.

- The segment's growth was further propelled in 2021 as a few residential projects started construction. The projects include the Skyrise Avenue Sukhumvit 64 Mixed-Use Development of USD 507 million and the Arom Wongamat Condominium Tower of USD 117 million, among others. The timelines for completing these projects range from around 2024 to 2025. The growing infrastructure development in the country is expected to generate demand for adhesives over the forecast period.

Nearly 50.1% share of the overall automotive production among the ASEAN countries is likely to drive the industry in Thailand

- The Thai automobile sector has grown tremendously over the last 50 years. The country is constantly advancing its next-generation automotive industry to follow the S-Curve promotion with better value-added production, and it also aims for the automotive industrial policy to be aligned with the environmental protection policy. Thailand is the largest auto producer in the ASEAN region. In 2020, production totaled 1,427,074 units, accounting for 50.1% of total ASEAN production. This was followed by Indonesia (690,150 units, or approximately 24.2%) and Malaysia (485,186 units, or approximately 17.0%).

- In 2019, the country recorded about 20.13,710 units of vehicles produced, which drastically reduced to 14,27,074 units in 2020, accounting for a decline of about 29% owing to the COVID-19 pandemic. As a result, the variation in automotive production between 2019 and 2021 amounted to about -16%, whereas between 2020 and 2021, the variation was recorded at about -1%.

- Thailand, ranked as the 11th largest automotive producer in the world and the first in ASEAN, is poised to become ASEAN's EV center, owing to its well-established value chain, which provides the industry with top-notch quality products at a competitive price. Thailand's EV stock has been steadily increasing in response to local demand. More importantly, several well-known Thai corporations have been actively investing in EV charging infrastructure around the country, indicating rising confidence in future demand increases. Efforts by governmental and private sector institutions to increase EV infrastructure, such as charging stations, suggest that Thailand's EV ecosystem is developing rapidly.

Thailand Sealants Industry Overview

The Thailand Sealants Market is fragmented, with the top five companies occupying 22.73%. The major players in this market are 3M, Dow, Henkel AG & Co. KGaA, Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Dow

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Plic Firston (Thailand) Co., Ltd

- 6.4.7 Shin-Etsu Chemical Co., Ltd.

- 6.4.8 Sika AG

- 6.4.9 Soudal Holding N.V.

- 6.4.10 THE YOKOHAMA RUBBER CO., LTD.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록