|

시장보고서

상품코드

1693647

상용차 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

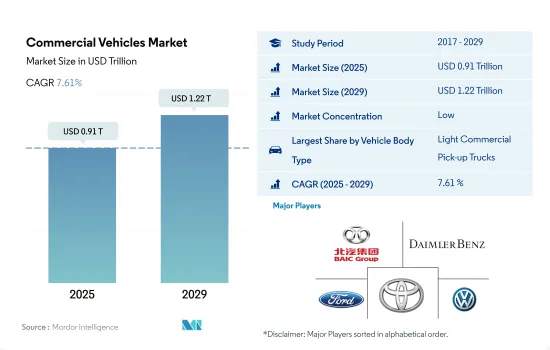

세계의 상용차 시장 규모는 2025년 9,100억 달러로 추정되고, 2029년에는 1조 2,200억 달러에 이르고, 예측 기간 중(2025-2029년) CAGR 7.61%로 성장할 것으로 예측됩니다.

- 신흥 경제권에서 산업 부문의 성장과 상업 물류 활동의 활성화가 상용차 수요의 주요 촉진요인이 되고 있습니다. 이 수요 급증의 주요 요인은, 건설 산업과 전자상거래 산업의 확대이며 효율적인 자재 수송의 필요성이 높아지고 있습니다.

- COVID-19의 유행에 의해 대부분의 국제 국경이 폐쇄되었기 때문에 상용차 제조 산업은 2021년에 공급 체인의 장기적인 혼란에 직면해, 시장 성장의 방해가 되었습니다.

- 상용차에 대한 수요 증가에 의해 트럭 제조업체는 수요의 고조와 배기가스 규제에 대응하기 위해, 선진적인 신형 트럭을 도입하고 있습니다. E-Commerce는 최근, 세계의 소매의 틀에 있어서 불가결한 요소가 되고 있습니다.

운송 부문의 이산화탄소 배출에 대한 우려 증가는 앞으로 수년간 전기 상용차의 보급을 촉진할 것으로 예측됩니다.

- 2021년, 세계의 상용차 생산 대수는 회복해, 2020년의 300만대의 감소에 이어 약 2,320만대에 달했습니다. 소형 상용차는 일반적으로 중량 3.5톤 이하로 분류됩니다. 2021년에는 1,090만대의 상용차가 생산됩니다.

- 2019-2020년까지 13% 떨어진 세계의 상용차 생산 대수는 2021년에는 회복했습니다.

- 운수부문의 이산화탄소 배출에 대한 우려가 높아지는 가운데 상용차산업은 대체연료원을 우선하고 있습니다. 중국, 인도, 프랑스, 영국은 2040년까지 가솔린차와 디젤차의 생산을 정지할 계획을 발표하고 있습니다. 이 시프트에 의해 향후 몇년간은 전기 상용차의 보급이 촉진될 것으로 예측됩니다.

세계 상용차 시장 동향

세계 수요 증가와 정부 지원이 전기차 시장 성장을 뒷받침

- 전기자동차(EV)는 에너지 효율을 높이고 온실가스와 공해의 배출을 삭감할 가능성에 힘입어 자동차 산업에 있어서 필수적인 요소가 되고 있습니다. 특히 EV의 세계 판매 대수는 2021년에 비해 2022년에는 10.82% 증가하고 견조한 성장을 보였습니다.

- 런던 경시청 소방국과 같은 선도적인 제조업체와 조직은 전동 이동성 전략을 적극적으로 추진하고 있습니다. 2025년까지 차량은 제로 배출화, 2030년까지 밴 40%를 전동화, 2040년까지 완전 전동화를 달성한다는 목표를 내걸고 있습니다.

- 아시아태평양과 유럽은 배터리기술과 차량전화의 진보에 견인되어 전기자동차 생산을 지배하는 태세를 갖추고 있습니다. Kia는 2025년까지 승용차, SUV, MPV 등 다양한 부문에 걸친 11개의 EV 모델을 세계에 투입한다는 야심적인 계획을 내걸고 있습니다.

상용차 산업 개요

상용차 시장은 세분화되어 있으며 상위 5개사에서 30%를 차지하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 아프리카

- 아시아태평양

- 유럽

- 중동

- 북미

- 남미

- 1인당 GDP

- 아프리카

- 아시아태평양

- 유럽

- 중동

- 북미

- 남미

- 자동차 구입을 위한 소비 지출(cvp)

- 아프리카

- 아시아태평양

- 유럽

- 중동

- 북미

- 남미

- 인플레이션율

- 아프리카

- 아시아태평양

- 유럽

- 중동

- 북미

- 남미

- 자동차 대출 금리

- 전화의 영향

- EV 충전소

- 배터리 팩 가격

- 아프리카

- 아시아태평양

- 유럽

- 중동

- 북미

- 남미

- Xev 신모델 발표

- 물류 성능 지수

- 아프리카

- 아시아태평양

- 유럽

- 중동

- 북미

- 남미

- 연료 가격

- 제조업체별 생산 통계

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 차종

- 상용차

- 대형 상용 트럭

- 소형 상용 픽업 트럭

- 소형 상용 밴

- 중형 상용 트럭

- 상용차

- 추진 유형

- 하이브리드와 전기자동차

- 연료 카테고리별

- BEV

- FCEV

- HEV

- PHEV

- 내연기관

- 연료 카테고리별

- 천연가스

- 디젤

- 가솔린

- LPG

- 하이브리드와 전기자동차

- 지역별

- 아프리카

- 아시아태평양

- 호주

- 중국

- 인도

- 인도네시아

- 일본

- 말레이시아

- 한국

- 태국

- 기타 아시아태평양

- 유럽

- 체코 공화국

- 중동

- 북미

- 캐나다

- 남미

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- BAIC Motor Corporation Ltd.

- BYD Auto Co. Ltd.

- Daimler AG(Mercedes-Benz AG)

- Dongfeng Motor Corporation

- Ford Motor Company

- General Motors Company

- Groupe Renault

- Mahindra & Mahindra Limited

- Nissan Motor Co. Ltd.

- Rivian Automotive Inc.

- Saic General Motors Corporation Limited

- Scania AB

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen AG

- Volvo Group

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Commercial Vehicles Market size is estimated at 0.91 trillion USD in 2025, and is expected to reach 1.22 trillion USD by 2029, growing at a CAGR of 7.61% during the forecast period (2025-2029).

- The industrial sector's growth in emerging economies and the rise in commercial logistics activities are key drivers of the demand for commercial vehicles. This demand surge is primarily fueled by the expanding construction and e-commerce industries, which are driving the need for efficient material transportation. Following a dip of three million units in 2020, the production of commercial vehicles rebounded, reaching approximately 23.2 million units in 2021, marking a steady recovery.

- With most international borders closed due to the COVID-19 pandemic, the commercial vehicle manufacturing industry faced prolonged disruptions in its supply chain in 2021, hampering market growth. The pandemic's impact on the transportation sector was profound, presenting significant hurdles for both the freight and manufacturing industries in ensuring smooth movement of goods.

- Due to increased demand for commercial vehicles, truck manufacturers have been introducing new advanced trucks to meet the rising demand and emission standards. Commercial vehicle leasing and the rental industry are also growing due to the increasing demand for operational efficiencies and the realization of economies of scale by businesses across multiple industries. E-commerce has become an essential component of the global retail framework in recent years. Over 2 billion people purchased goods or services online in 2020, and global e-commerce sales surpassed USD 4.2 trillion in the same year. The overall commercial vehicle market is expected to grow significantly in the future.

The rising concerns over carbon emissions from the transportation sector are expected to drive the penetration of electric commercial vehicles in the coming years

- In 2021, global commercial vehicle manufacturing rebounded, reaching approximately 23.2 million units, following a decline of 3 million units in 2020. Light commercial vehicles, typically weighing under 3.5 tons, are classified as such. Broadly, commercial vehicles refer to motor vehicles designed for transporting goods and people. North America took the lead in production, manufacturing 10.9 million commercial vehicles in 2021. Asia and Oceania emerged as the top producers of heavy trucks, with an estimated output of nearly 3.3 million units in 2021. A notable growth driver for this sector is the increasing demand for clean energy in the automotive industry.

- After a 13% dip from 2019 to 2020, global commercial vehicle output rebounded in 2021. The global commercial vehicles market faced significant disruptions during the pandemic, with manufacturing facilities shutting down due to national lockdowns that extended into 2020. Although the demand and output recovered in 2021, the market faced a setback due to a global chip shortage, leading to production cutbacks.

- Amid the rising concerns over carbon emissions from the transportation sector, the commercial fleet industry is prioritizing alternative fuel sources. Governments worldwide are taking the lead in implementing regulations to promote electric vehicle adoption. China, India, France, and the United Kingdom have announced plans to halt gasoline and diesel vehicle production by 2040. This shift is expected to drive the penetration of electric commercial vehicles in the coming years.

Global Commercial Vehicles Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Commercial Vehicles Industry Overview

The Commercial Vehicles Market is fragmented, with the top five companies occupying 30%. The major players in this market are BAIC Motor Corporation Ltd., Daimler AG (Mercedes-Benz AG), Ford Motor Company, Toyota Motor Corporation and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.8.1 Africa

- 4.8.2 Asia-Pacific

- 4.8.3 Europe

- 4.8.4 Middle East

- 4.8.5 North America

- 4.8.6 South America

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.10.1 Africa

- 4.10.2 Asia-Pacific

- 4.10.3 Europe

- 4.10.4 Middle East

- 4.10.5 North America

- 4.10.6 South America

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Heavy-duty Commercial Trucks

- 5.1.1.2 Light Commercial Pick-up Trucks

- 5.1.1.3 Light Commercial Vans

- 5.1.1.4 Medium-duty Commercial Trucks

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

- 5.3 Region

- 5.3.1 Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 Australia

- 5.3.2.2 China

- 5.3.2.3 India

- 5.3.2.4 Indonesia

- 5.3.2.5 Japan

- 5.3.2.6 Malaysia

- 5.3.2.7 South Korea

- 5.3.2.8 Thailand

- 5.3.2.9 Rest-of-APAC

- 5.3.3 Europe

- 5.3.3.1 Czech Republic

- 5.3.4 Middle East

- 5.3.5 North America

- 5.3.5.1 Canada

- 5.3.6 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BAIC Motor Corporation Ltd.

- 6.4.2 BYD Auto Co. Ltd.

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Dongfeng Motor Corporation

- 6.4.5 Ford Motor Company

- 6.4.6 General Motors Company

- 6.4.7 Groupe Renault

- 6.4.8 Mahindra & Mahindra Limited

- 6.4.9 Nissan Motor Co. Ltd.

- 6.4.10 Rivian Automotive Inc.

- 6.4.11 Saic General Motors Corporation Limited

- 6.4.12 Scania AB

- 6.4.13 Tata Motors Limited

- 6.4.14 Toyota Motor Corporation

- 6.4.15 Volkswagen AG

- 6.4.16 Volvo Group

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록