|

시장보고서

상품코드

1693650

영국의 전기자동차 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)UK Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

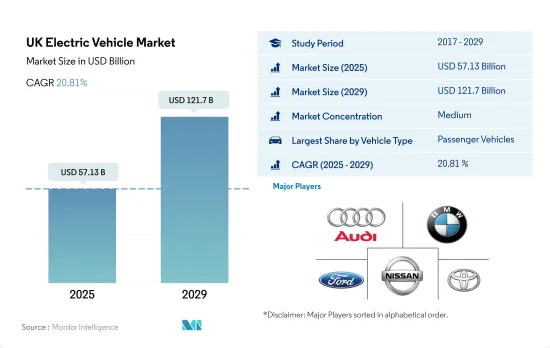

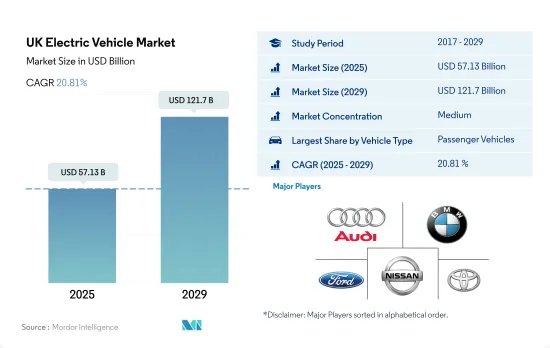

영국의 전기자동차(EV) 시장 규모는 2025년에 571억 3,000만 달러로 추정되고, 2029년에는 1,217억 달러에 이를것으로 예측되며, 예측 기간(2025-2029년)의 CAGR은 20.81%를 보일 것으로 예측됩니다.

영국 정부의 포괄적인 규제와 인센티브는 전기자동차 산업의 성장을 크게 가속화하여 소비자 채택과 제조업체 혁신을 모두 촉진했습니다.

- 영국의 전기차 산업은 탄소 배출을 줄이고 지속 가능한 교통수단을 장려하기 위한 정부의 규제와 인센티브에 힘입어 빠르게 성장하고 있습니다. 영국 정부는 2050년까지 순배출량 제로를 달성한다는 광범위한 전략 하에 2030년까지 휘발유 및 디젤 자동차 신차 판매 금지와 같은 야심찬 목표를 설정했습니다. 이러한 전환을 지원하기 위해 정부는 전기자동차 보조금, 가정용 및 공공 충전 인프라 보조금 등 다양한 인센티브를 시행하고 있습니다.

- 또한, 정부는 전기차 보급에 필수적인 인프라를 확충하는 데 주력하고 있으며, 이는 전기차의 광범위한 보급에 매우 중요합니다. 여기에는 급속 충전소의 수를 대폭 늘리는 것을 목표로 전국에 걸쳐 충전 네트워크에 대한 상당한 투자가 포함됩니다. 전기차 주차 요금 감면, 런던과 같은 도시 지역의 혼잡 통행료 면제 등의 정책은 전기자동차의 매력을 더욱 높이고 있습니다. 정부의 의지는 가정용 충전기 설치에 자금을 지원하는 전기차 홈 충전 제도(EVHS)와 같은 프로젝트를 지원하여 전기차 소유의 실용성을 높이는 데에도 분명하게 드러납니다.

- 제조업체들은 전기 전용 생산 라인을 구축하고 현지 전기차 및 배터리 제조에 투자함으로써 지원 규제 프레임워크에 부응하고 있으며, 이는 영국 전기차 산업의 탄탄한 미래 궤적을 보여줍니다.

영국의 전기자동차 시장 동향

영국 정부의 정책과 인센티브가 전기차 판매의 급증을 이끌고 있습니다.

- 영국 정부의 정책과 인센티브 제도가 영국 내 전기 승용차 시장을 견인하고 있습니다. 예를 들어, 2022년 3월 정부는 2035년까지 디젤 및 가솔린 자동차와 같은 화석 연료 차량을 단계적으로 퇴출하고, 모든 새로운 무공해 차량으로 대체할 계획을 발표했습니다.

- 영국 정부는 내연기관 차량보다 전기자동차의 채택률을 높이기 위해 다양한 정책을 시행하고 있습니다. 2023년 영국 정부는 전기차를 선택하는 소비자에게 제공되는 리베이트와 보조금을 발표했습니다. 보조금은 구매 차량의 종류에 따라 다르며, 전기자동차의 경우 최대 2,500파운드까지 지급됩니다.

- 영국 전기차 산업의 인프라 개발과 같은 긍정적인 변화와 발전으로 영국 내 전기차 판매량이 증가하고 있습니다. 영국 정부는 2030년까지 30만 개의 공공 충전소를 설치하여 충전 인프라를 개선하고 강화하기 위해 19억 6,000만 달러를 투자할 계획입니다.

영국의 전기자동차 산업 개요

영국의 전기자동차 시장은 적당히 통합되어 있으며 상위 5개 기업이 57.42%를 점유하고 있습니다. 이 시장의 주요 업체는 Audi AG, Bayerische Motoren Werke AG, Ford Motor Company, Nissan Motor Co., Toyota Motor Corporation(알파벳 순 정렬)입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 GDP

- 차량 구매를 위한 소비자 지출(CVP)

- 인플레이션율

- 자동차 대출 금리

- 공유 차량 서비스

- 전기화의 영향

- EV 충전소

- 배터리 팩 가격

- Xev 신모델 발표

- 중고차 판매

- 연료 가격

- OEM 생산 통계

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 차량 부문

- 상용차

- 버스

- 대형 상용 트럭

- 경상용 픽업 트럭

- 경상용 밴

- 중형 상용 트럭

- 승용차

- 이륜차

- 상용차

- 연료 카테고리

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Audi AG

- Bayerische Motoren Werke AG

- Ford Motor Company

- Hyundai Motor Coportaion

- Jaguar Land Rover Limited

- Kia Corporation

- Mercedes-Benz

- Nissan Motor Co. Ltd.

- Toyota Motor Corporation

- Volvo Car AB

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 출처 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The UK Electric Vehicle Market size is estimated at 57.13 billion USD in 2025, and is expected to reach 121.7 billion USD by 2029, growing at a CAGR of 20.81% during the forecast period (2025-2029).

The UK government's comprehensive regulations and incentives have significantly accelerated the growth of the electric vehicle industry, fostering both consumer adoption and manufacturer innovation

- The UK EV industry has experienced rapid growth, significantly propelled by government regulations and incentives aimed at reducing carbon emissions and promoting sustainable transport. The British government has set ambitious targets, such as the ban on new petrol and diesel cars by 2030, under its broader strategy to achieve net-zero emissions by 2050. To support this transition, the government has implemented various incentives, including grants for electric cars and subsidies for home and public charging infrastructure. These policies have not only eased the financial burden on consumers but have also encouraged manufacturers to increase their offerings of electric models.

- Furthermore, the government has focused on expanding the necessary infrastructure to support electric vehicles, which is crucial for widespread adoption. This includes substantial investments in charging networks across the nation, with aims to significantly increase the number of fast-charging stations. Policies such as reduced parking fees for EVs and exemptions from congestion charges in urban areas like London have further boosted the attractiveness of electric vehicles. The government's commitment is evident in its backing of projects like the Electric Vehicle Homecharge Scheme (EVHS), which provides funding for home charger installations, enhancing the practicality of owning an EV.

- Manufacturers are responding to the supportive regulatory framework by committing to electric-only production lines and investing in local manufacturing of EVs and batteries, indicating a robust future trajectory for the UK's electric vehicle industry.

UK Electric Vehicle Market Trends

Policies and incentives of the UK Government are driving the surge in electric vehicle sales

- Policies and incentive schemes by the UK government are driving the electric passenger car market in the country. For instance, in March 2022, the government announced plans to phase out fossil fuel-powered vehicles such as diesel and petrol cars, which will be replaced by all new zero-emission vehicles by 2035. Such factors are giving people second thoughts and shifting them to opt for electric cars. As a result, the demand for electric passenger cars increased by 18.40% in 2022 over 2021, also impacting the demand for battery packs positively.

- The government of the UK is implementing various practices to increase the adoption rate of electric vehicles over ICE vehicles. In 2023, the UK government announced the rebates and subsidies offered to consumers opting for electric vehicles. The subsidy amount varies depending on the type of vehicle being purchased, with a maximum of up to 2500 pounds on an electric car. Such offers are encouraging consumers to invest in EVs, which is expected to accelerate the sales of electric cars during the 2024-2030 period.

- Development and positive changes, such as infrastructure development in the UK electric vehicle industry, are increasing the sales of electric vehicles in the country. The UK government is committed to investing USD 1.96 billion to enhance and improve the charging infrastructure by deploying 300,000 public charge points by 2030. This will also contribute to the government's aim to increase the electrification of vehicles in the country during the 2024-2030 period.

UK Electric Vehicle Industry Overview

The UK Electric Vehicle Market is moderately consolidated, with the top five companies occupying 57.42%. The major players in this market are Audi AG, Bayerische Motoren Werke AG, Ford Motor Company, Nissan Motor Co. Ltd. and Toyota Motor Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.2 Passenger Vehicles

- 5.1.3 Two-Wheelers

- 5.1.1 Commercial Vehicles

- 5.2 Fuel Category

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Audi AG

- 6.4.2 Bayerische Motoren Werke AG

- 6.4.3 Ford Motor Company

- 6.4.4 Hyundai Motor Company

- 6.4.5 Jaguar Land Rover Limited

- 6.4.6 Kia Corporation

- 6.4.7 Mercedes-Benz

- 6.4.8 Nissan Motor Co. Ltd.

- 6.4.9 Toyota Motor Corporation

- 6.4.10 Volvo Car AB

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms