|

시장보고서

상품코드

1693831

남미의 불소수지 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)South America Fluoropolymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

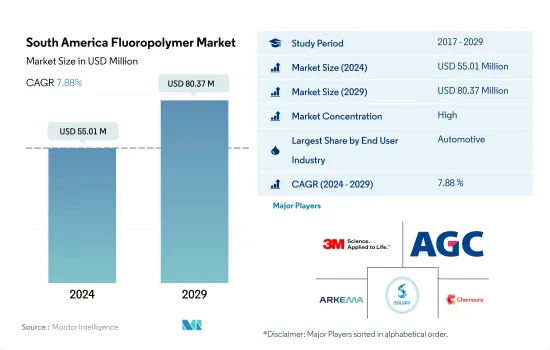

남미의 불소수지 시장 규모는 2024년에 5,501만 달러에 달했고, 2029년에는 8,037만 달러에 이르고, 예측 기간(2024-2029년)의 CAGR은 7.88%를 나타낼 것으로 예상됩니다.

아르헨티나 자동차 산업이 불소수지 시장을 독점

- 불소수지는 범용성과 강인성에 따라 다양한 최종 사용자 산업에서 용도를 발견하고 있습니다.

- 2017-2019년 기간 불소수지 수요는 안정적인 성장을 보였으며 이는 주로 이 지역의 전기 및 전자제품 증가에 견인되었습니다. 자동차산업과 산업기계산업 수요가 최악의 타격을 받아 2019년 매출액의 32.66%와 28.41%가 감소했습니다.

- 불소수지의 용도가 증가하고 있는 것은 고온이나 저온, 엄격한 부식 환경에 견딜 수 있는 능력이 있기 때문에 대부분의 화학제품이 불소수지 수요 증가를 견인할 것으로 예측됩니다. 중에서 아르헨티나의 자동차 산업이 가장 높은 성장을 이룰 것으로 예상되며 예측 기간 중 수량 기준 CAGR은 10.65%를 나타낼 것으로 전망됩니다. 불소수지에 대한 지역 수요는 예측 기간 동안 수량 및 가치 측면에서 각각 6.21%와 7.95%의 연평균 성장률 (CAGR)을 나타낼 것으로 예상됩니다.

아르헨티나는 자동차 산업의 급성장에 힘입어 고성장을 보여

- 남미는 불소수지 소비량으로는 세계 제4위로, 2022년의 점유율은 수량 기준으로 불과 1.43%를 나타냈습니다.

- 예측 기간 동안 불소수지 수요는 안정적인 성장이 예상되며 CAGR 6.19%를 나타낼 전망입니다.

- 2020년에는 팬데믹(세계적 대유행)시의 조업·무역 제한에 기인하는 노동자 부족이나 원료 부족 등 다양한 억제요인이 다양한 최종 사용자 산업에 심각한 영향을 미치고, 이 지역의 불소수지 수요에 이나스의 영향을 주었습니다. 그 중에서도 브라질의 불소수지 수요가 가장 큰 영향을 받았습니다.

- 2021년에는 규제가 완화되어 불소수지 수요는 팬데믹 전 수준을 웃돌았습니다. 이 성장의 주인은 아르헨티나 등에서의 자동차 생산의 급성장입니다. 전반적으로 남미의 불소 중합체 수요는 예측 기간 동안 매출 측면에서 7.93%의 연평균 성장률을 기록하면서 증가할 것으로 예상됩니다.

남미의 불소수지 시장 동향

기술 혁신의 급속한 속도가 산업 성장을 뒷받침

- 남미에서는 2017년 브라질이 이 지역의 전기 및 전자 제품 생산 수익의 40% 가까운 주요 점유율을 차지했습니다. - 텔레비전, 스마트 냉장고, 스마트 에어컨, 기타 전기 및 전자 제품 등의 소비자용 전자 기기 제품에 대한 수요를 증가시켰습니다.

- 2020년 팬데믹에 의한 리모트 워크와 홈 엔터테인먼트용 소비자용 전자기기 제품 수요 증가에 따라 이 지역의 전기 및 전자제품의 생산은 전년 대비 매출액 성장률 1.1%로 증가했습니다. 고급품에 대한 수요 증가, 기술의 진보, 생활 수준의 향상은 전기 및 전자 기기 시장의 성장을 가속하는 주요인의 하나입니다.

- 전자기술 혁신의 급속한 페이스는 보다 새롭고 고속의 전기 및 전자제품에 대한 일관된 수요를 촉진하고 있습니다. a, Sony, Philips, Sharp, Apple, Lenovo 등 다국적 기업의 진출도 전기 및 전자기기 시장에 긍정적인 영향을 주고 있습니다.

남미의 불소수지 산업 개요

남미의 불소수지 시장은 상당히 통합되어 있으며 상위 5개사에서 79.37%를 차지하고 있습니다. 이 시장의 주요 기업은 3M, AGC Inc., Arkema, Solvay, The Chemours Company 등입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 전기 및 전자

- 포장

- 수출입 동향

- 불소수지 무역

- 규제 프레임워크

- 아르헨티나

- 브라질

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 항공우주

- 자동차

- 건축 및 건설

- 전기 및 전자

- 산업 및 기계

- 기타

- 하위 수지 유형

- 에틸렌테트라플루오로에틸렌(ETFE)

- 플루오르화 에틸렌-프로필렌(FEP)

- 폴리테트라플루오로에틸렌(PTFE)

- 폴리비닐플루오라이드(PVF)

- 폴리비닐리덴 플루오라이드(PVDF)

- 기타 하위 수지

- 국가명

- 아르헨티나

- 브라질

- 기타 남미

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- 3M

- AGC Inc.

- Arkema

- Dongyue Group

- Gujarat Fluorochemicals Limited(GFL)

- Solvay

- The Chemours Company

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The South America Fluoropolymer Market size is estimated at 55.01 million USD in 2024, and is expected to reach 80.37 million USD by 2029, growing at a CAGR of 7.88% during the forecast period (2024-2029).

The automotive industry in Argentina to dominate the market for fluoropolymers

- Fluoropolymers find applications in a range of end-user industries due to their versatile and tough nature. In 2022, the increase in industrial applications made fluoropolymers an increasingly commercial material. Common fluoropolymer applications are cookware, wires, semiconductors, medical devices, roofing materials, and waterproof films.

- During the 2017-19 period, the demand for fluoropolymers witnessed steady growth, which was majorly driven by the increase in electrical and electronics products in the region. In 2020, due to various operational, travel, and trade restrictions, because of the pandemic, the demand for fluoropolymers witnessed a Y-o-Y decline of 17.88%. Among all end-user industries, the demand from the automotive and industrial machinery industries took the worst hit, declining by 32.66% and 28.41% of their 2019 revenue. As the restrictions eased, the demand for fluoropolymers increased to pre-pandemic levels. This growth was majorly driven by Argentina.

- The increasing applications of fluoropolymers are due to their ability to resist high and low temperatures and severe corrosive environments, and most chemicals are expected to drive the growth in the demand for fluoropolymers. Among all end users in South America, the automotive industry in Argentina is expected to witness the highest growth, with a CAGR of 10.65% in volume terms during the forecast period. The regional demand for fluoropolymers is expected to register CAGRs of 6.21% and 7.95% in volume and value terms, respectively, during the forecast period.

Argentina to exhibit high growth, aided by fast-paced automobile industry

- South America ranks fourth in the consumption of fluoropolymers globally, and it occupied a share of just 1.43%, by volume, in 2022. In South America, fluoropolymers find a range of applications in the electrical and electronics, automotive, and healthcare device manufacturing industries.

- During the forecast period, the demand for fluoropolymers is expected to witness steady growth, registering a CAGR of 6.19%, mainly driven by the rapid growth in the electrical and electronics industry in countries like Argentina. Among all sub-resin types in all countries in the region, the demand for fluorinated ethylene-propylene (FEP) in Argentina witnesses the highest growth. In volume terms, its demand is expected to record a CAGR of 8.40% during the forecast period.

- In 2020, various restraining factors like worker unavailability and raw material shortages, which resulted from operational and trade restrictions during the pandemic, severely affected various end-user industries, negatively affecting the region's fluoropolymer demand. Among all countries, Brazil's fluoropolymer demand received the biggest impact. In 2020, the country's Y-o-Y demand volume declined by 13.20%, whereas the regional Y-o-Y decline was 10.18%.

- In 2021, as the restrictions eased, fluoropolymer demand outgrew its pre-pandemic levels. This growth was majorly driven by the rapid growth in automotive production in countries like Argentina. This growth trend is expected to continue throughout the forecast period, with Argentina witnessing the highest growth in fluoropolymer demand among all countries. Overall, fluoropolymer demand from South America is expected to grow, recording a CAGR of 7.93% in revenue terms during the forecast period.

South America Fluoropolymer Market Trends

Rapid pace of technological innovations to boost the industry growth

- In South America, Brazil held the major share of nearly 40% of the region's electrical and electronics production revenue in 2017. In 2017, Brazilian electronics products had a penetration of nearly 20% in the e-commerce sector. The advancement of technology in the region increased the demand for consumer electronics products, such as smart TVs, smart refrigerators, smart air conditioners, and other electrical and electronic products. South American electrical and electronics production revenue witnessed a CAGR of over 6.16% between 2017 and 2019.

- In 2020, with the rise in demand for consumer electronics for remote working and home entertainment due to the pandemic, the production of electrical and electronic products in the region increased at a growth rate of 1.1% by revenue compared to the previous year. Rising disposable income, increased demand for luxury products, technological advancements, and improvement in living standards are some of the major factors driving the electrical and electronics market's growth. As a result, in the region, electrical and electronics production also increased at a rate of 14.9% by revenue in 2021.

- The rapid pace of electronic technological innovation is driving consistent demand for newer and faster electrical and electronic products. As a result, it has also increased the demand for the production of electrical and electronics in the region. The penetration of multinational companies, like LG, Samsung, Microsoft, Panasonic, Dell, Intel, Toshiba, Sony, Philips, Sharp, Apple, and Lenovo, also positively affects the electrical and electronics market. All such factors are expected to fuel the production revenue of electrical and electronics in the region during the forecast period at a rate of around 7%.

South America Fluoropolymer Industry Overview

The South America Fluoropolymer Market is fairly consolidated, with the top five companies occupying 79.37%. The major players in this market are 3M, AGC Inc., Arkema, Solvay and The Chemours Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Fluoropolymer Trade

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Other End-user Industries

- 5.2 Sub Resin Type

- 5.2.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.3 Polytetrafluoroethylene (PTFE)

- 5.2.4 Polyvinylfluoride (PVF)

- 5.2.5 Polyvinylidene Fluoride (PVDF)

- 5.2.6 Other Sub Resin Types

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 Dongyue Group

- 6.4.5 Gujarat Fluorochemicals Limited (GFL)

- 6.4.6 Solvay

- 6.4.7 The Chemours Company

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록