|

시장보고서

상품코드

1693847

북미의 폴리아미드 시장(2024-2029년) : 시장 점유율 분석, 산업 동향, 성장 예측North America Polyamide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

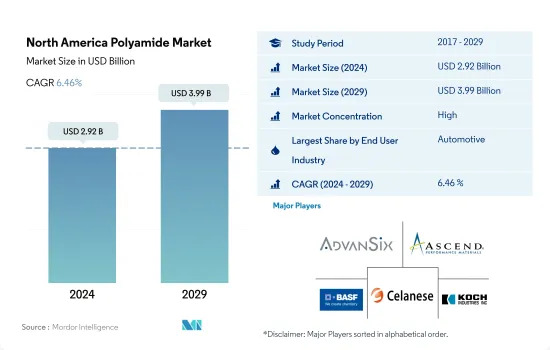

북미의 폴리아미드 시장 규모는 2024년에 29억 2,000만 달러를 달성하였고, 2029년에는 39억 9,000만 달러에 이를 전망이며 예측 기간(2024-2029년) 동안의 CAGR은 6.46%를 보일 것으로 예측됩니다.

멕시코의 자동차 산업과 전기 및 전자 산업 수요 증가가 시장 성장을 이끌 전망

- 폴리아미드는 고온이나 부식 환경에 견디는 고성능 플라스틱입니다. 비점착성으로 마찰이 적기 때문에 항공우주, 일렉트로닉스, 자동차, 통신 등 다양한 최종 사용자 산업의 용도로 적합합니다.

- 2022년 폴리아미드 소비량은 자동차 산업이 가장 큰 시장 점유율을 차지하였습니다. 북미에서 생산되는 부품의 75%는 관세가 부과되지 않으며 따라서 이 지역의 자동차와 폴리아미드 수요를 견인하고 있습니다.

- 전기 및 전자산업은 2022년 폴리아미드 소비량으로 2위 시장 점유율을 차지하였으며 예측 기간 동안 금액 기준으로 CAGR 8.87%를 기록해 가장 급성장하는 산업이 될 전망입니다.

- 기업이 재택 근무 모델을 채용하고 사람들이 홈 오피스를 구축하기 시작하면서 소비자는 노트북, 휴대전화, 스마트 디바이스 등의 소비자용 전자기기 제품으로 크게 이동했습니다.

- 첨단 재료의 사용, 유기 일렉트로닉스, 소형화, 5G, 인공지능(AI), 사물인터넷(IoT) 등의 동향은 스마트한 제조방법을 가능하게 할 것으로 예측됩니다.

미국은 자동차 산업과 포장 산업의 성장으로 이 지역에서 폴리아미드 수지의 최대 소비국이 될 전망입니다.

- 북미는 2022년 폴리아미드 수지의 세계 소비액의 15.6%를 차지하였습니다.

- 미국은 자동차 산업과 포장 산업의 성장으로 이 지역에서 폴리아미드 수지의 최대 소비국이 될 전망입니다. 자동차 산업과 전기 및 전자 산업의 성장은 예측 기간 중, 동국의 폴리아미드 수지 수요를 견인할 것으로 예측됩니다.

- 멕시코의 폴리아미드 수지 수요는 자동차 생산, 플라스틱 포장 생산, 전기 및 전자기기 생산에서 수익 증가에 따라 크게 증가하고 있습니다.

- 멕시코는 북미의 폴리아미드 시장에서 가장 급성장하고 있는 국가로, 예측 기간(2023-2029년) 동안의 CAGR은 금액 기준으로 8.39%를 보일 것으로 예측되고 있습니다. 2023년의 103억 6,000만 달러에서 2027년에는 162억 3,000만 달러에 이를 것으로 예상되고 있습니다. 미국의 전기 및 전자 산업의 성장은 장래에 동국의 폴리아미드 수지 수요를 견인할 것으로 예측되고 있습니다.

북미의 폴리아미드 시장 동향

기술 혁신의 강력한 성장으로 산업 전체의 성장을 가속할 전망

- 북미의 전기 및 전자기기 생산은 스마트 텔레비전, 냉장고, 에어컨 등의 소비자용 전자기기 제품 수요 증가와 함께, 기술의 진보에 의해 2017-2019년에 걸쳐 CAGR이 1.4%를 넘어섰습니다.

- 북미의 전자기기 매출은 COVID-19의 영향으로 인한 생산 시설의 조업 정지, 공급체인의 혼란, 기타 다양한 제약으로 인해 2020년에는 2019년 대비 약 9% 감소했습니다.

- 2021년에는 이 지역의 소비자용 전자기기의 매출액은 약 1,130억 달러에 이르렀으며, 2020년보다 4% 증가했습니다.

- 2027년에는 북미는 전기 및 전자기기 생산에서 제3위의 지역이 될 전망이며 세계 시장의 약 10.5%의 점유율을 차지할 것으로 예측되고 있습니다. 2023년 1,276억 달러에서 2027년에는 약 1,618억 달러 규모에 이를 것으로 예측되고 있습니다.

북미의 폴리아미드 산업 개요

북미의 폴리아미드 시장은 상당히 통합되어 있으며 상위 5개 기업에서 92.38%를 차지하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 전기 및 전자

- 포장

- 수출입 동향

- 폴리아미드(PA) 무역

- 가격 동향

- 재활용 개요

- 폴리아미드(PA)의 재활용 동향

- 규제 프레임워크

- 캐나다

- 멕시코

- 미국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 항공우주

- 자동차

- 건축 및 건설

- 전기 및 전자

- 공업 및 기계

- 포장

- 기타

- 세부 수지 유형

- 아라미드

- 폴리아미드(PA) 6

- 폴리아미드(PA) 66

- 폴리프탈아미드

- 국가명

- 캐나다

- 멕시코

- 미국

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- AdvanSix

- Arkema

- Ascend Performance Materials

- BASF SE

- Celanese Corporation

- Domo Chemicals

- DSM

- EMS-Chemie Holding AG

- Koch Industries, Inc.

- Polymeric Resources Corporation

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The North America Polyamide Market size is estimated at 2.92 billion USD in 2024, and is expected to reach 3.99 billion USD by 2029, growing at a CAGR of 6.46% during the forecast period (2024-2029).

Increasing demand from the automotive and electrical and electronics industries in Mexico may drive the market growth

- Polyamides are high-performance plastics that can withstand high temperatures and corrosive environments. Due to their non-adhesive and low friction properties, they are suitable for applications in various end-user industries like aerospace, electronics, automotive, and telecommunications.

- The automotive industry occupied the largest market share in terms of consumption of polyamides in 2022. This can be attributed to the United States-Mexico-Canada agreement, which enforces that 75% of the components manufactured in the United States, Mexico, or Canada will avail zero tariffs, subsequently driving the demand for vehicles and polyamides in the region. For instance, vehicle production reached 14.5 million units in 2022 compared to 14 million units in the previous year.

- The electrical and electronics industry occupied the second-largest market share in terms of consumption of polyamides in 2022, and it is expected to register a CAGR of 8.87% in terms of value during the forecast period, making it the fastest-growing industry.

- There was a significant shift of consumers toward consumer electronics items like laptops, mobiles, and smart devices, as companies began adopting work-from-home models and people began setting up home offices. This caused a surge in the demand for consumer electronics. For instance, the electrical and electronics industry generated a production revenue of USD 378 billion in 2022 compared to USD 371 million in 2021.

- Trends like using advanced materials, organic electronics, miniaturization, 5G, Artificial Intelligence (AI), and the Internet of Things (IoT) are expected to enable smart manufacturing practices. They are expected to work as growth drivers for the industry. The electrical and electronics production revenue is expected to reach USD 977 billion by 2029.

The United States is the largest consumer of polyamide resin in the region owing to its growing automotive and packaging industries

- North America accounted for 15.6% by value of the global consumption of polyamide resin in 2022. Polyamide is a key polymer in North America for various industries, including automotive, packaging, and electrical and electronics.

- The United States is the largest consumer of polyamide resin in the region, owing to its growing automotive and packaging industries. The automotive and electrical and electronics industries accounted for around 29.1% and 15.5%, respectively, by value of polyamide demand in the country in 2022. The rising automotive and electrical and electronics industries are projected to drive the demand for polyamide resin in the country during the forecast period. For instance, vehicle production in the country reached 9.6 million units in 2022 from 9.3 million units in 2021.

- Mexico's demand for polyamide resin is increasing significantly due to increased revenue from vehicle production, plastic packaging production, and electrical and electronics production. The country's demand for polyamide resin is expected to be driven by the growing automotive and electrical and electronics industries. For instance, vehicle production in the country is expected to reach 5.9 million units in 2029 from 4.0 million units in 2023.

- Mexico is expected to be the fastest-growing country in the North American polyamide market and is expected to register a CAGR of 8.39% by value during the forecast period (2023-2029). The country's consumer electronics market is also expanding at a rapid rate, and it is expected to reach USD 16.23 billion in 2027 from USD 10.36 billion in 2023. The growing US electrical and electronics industry is projected to drive the demand for polyamide resin in the country in the future.

North America Polyamide Market Trends

Strong growth of technological innovations to augment the overall growth of the industry

- Electrical and electronics production in North America witnessed a CAGR of over 1.4% between 2017 and 2019 owing to the advancement of technology, coupled with the increasing demand for consumer electronics products, such as smart TVs, refrigerators, air conditioners, and other products. The rapid pace of electronic technological innovation is driving the demand for newer and faster electronic products. As a result, it has also increased the electrical and electronics production in the region.

- Electronic device sales in North America fell by around 9% in 2020 compared to 2019, owing to the COVID-19 impact, because of the production facility shutdowns, supply chain disruptions, and various other constraints. As a result, revenue from electrical and electronics production in the region decreased by 4.7% in 2020 compared to the previous year.

- In 2021, the sales of consumer electronics in the region reached around USD 113 billion, 4% higher than in 2020. As a result, North America's electrical and electronics production grew by 13.8% in 2021 in terms of revenue compared to the previous year.

- By 2027, North America is projected to be the third-largest region for electrical and electronics production and account for a share of around 10.5% of the global market. The emergence of advanced technologies such as virtual reality, IoT solutions, and robotics into consumer electronic products to achieve efficiency and low cost has provided a significant advantage to the consumer electronics industry. The consumer electronics industry in the region is projected to reach a market volume of around USD 161.8 billion by 2027 from USD 127.6 billion in 2023. As a result, the demand for electrical and electronic products in the region is projected to increase.

North America Polyamide Industry Overview

The North America Polyamide Market is fairly consolidated, with the top five companies occupying 92.38%. The major players in this market are AdvanSix, Ascend Performance Materials, BASF SE, Celanese Corporation and Koch Industries, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Polyamide (PA) Trade

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 Canada

- 4.5.2 Mexico

- 4.5.3 United States

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Sub Resin Type

- 5.2.1 Aramid

- 5.2.2 Polyamide (PA) 6

- 5.2.3 Polyamide (PA) 66

- 5.2.4 Polyphthalamide

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 AdvanSix

- 6.4.2 Arkema

- 6.4.3 Ascend Performance Materials

- 6.4.4 BASF SE

- 6.4.5 Celanese Corporation

- 6.4.6 Domo Chemicals

- 6.4.7 DSM

- 6.4.8 EMS-Chemie Holding AG

- 6.4.9 Koch Industries, Inc.

- 6.4.10 Polymeric Resources Corporation

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록