|

시장보고서

상품코드

1522877

어댑티브 크루즈 컨트롤(ACC) 및 사각지대 감지(BSD) 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2024-2029년)Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

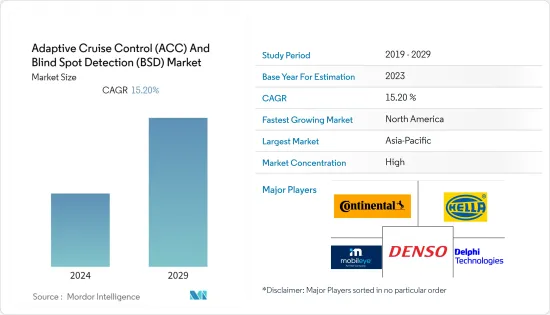

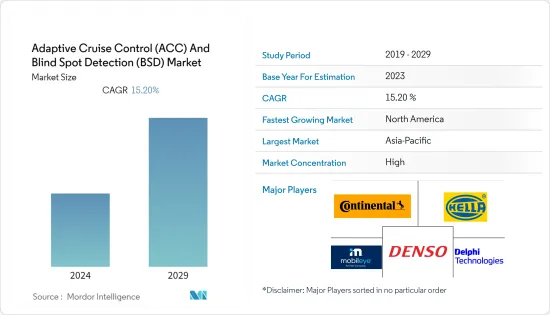

어댑티브 크루즈 컨트롤 및 사각지대 감지 시장 규모는 2024년에 35억 8,000만 달러로 추정되고, 2029년에는 72억 7,000만 달러에 달할 것으로 예측되며, 예측 기간 중(2024-2029년) CAGR은 15.20%로 성장할 전망입니다.

어댑티브 크루즈 컨트롤 및 사각지대 감지 시장은 최근 몇 년동안 급격히 급성장하고 있습니다. 자동차의 안전성에 대한 의식의 고조가, 어댑티브 크루즈 컨트롤 및 사각지대 감지 등 선진 안전 시스템의 개발에 필수적인 요인의 하나가 되고 있습니다.

게다가 세계의 고급차 판매량 증가도 ACC 및 BSD 시장을 견인하고 있습니다. 2023년에는 2022년 15만 7,000대에 대해 18만 3,000대 이상의 고급차가 세계에서 판매되었습니다. 이는 16% 이상의 상당한 급증을 보여줍니다.

또한 엄격한 안전규제가 제정되고 소비자들 사이에서 자동차 안전에 대한 관심이 높아지고 있다는 점도 ACC 및 BSD 시장을 뒷받침하고 있습니다. 세계보건기구(WHO)에 따르면 교통사고로 인해 연간 135만 명 가까이 사망하고 있습니다. 이러한 사고의 원인의 대부분은 운전자가 특정 상황을 판단하지 못하고 올바른 판단을 내릴 수 없기 때문입니다. 교통사고로 인한 사망자를 줄이기 위한 정부의 이니셔티브로 신차에 안전시스템의 탑재가 증가하고 있습니다.

조사 대상 시장의 90% 이상은 OEM 제조업체가 차지하고 있으며, 사각지대 감지 시스템의 애프터마켓은 한정적이고 미조직입니다. 시장의 성장 기회에 주목한 대기업은 소비자 수요에 부응하기 위해 이러한 기능을 자동차에 탑재하는 움직임을 강화하고 있습니다.

이러한 모든 요인들이 함께 예측 기간 동안 ACC 및 BSD 시장의 잠재적인 성장을 보여줍니다.

어댑티브 크루즈 컨트롤 및 사각지대 감지 시장 동향

승용차 부문이 가장 큰 차종 부문

어댑티브 크루즈 컨트롤 및 사각지대 감지 시장 규모는 차종별로 승용차 부문이 가장 큽니다. 최근의 승용차에서는 안전의 중시나 운전 체험의 향상에 대한 소비자의 요구의 높아짐에 따라, ADAS(선진 운전 지원 시스템)의 통합이 널리 행해지고 있습니다.

승용차 제조업체는 안전과 편의성을 모두 향상시키는 최첨단 기능을 제공합니다. ACC 시스템은 고속도로 주행에 적합하므로 승용차를 사용하는 매일 통근자와 장거리 여행자에게 특히 매력적입니다. 승용차에서의 ACC의 주류 채용은 센서 기술의 진보, 저렴한 가격, 반자동 운전 기능으로의 이동에 의해 촉진되고 있습니다.

마찬가지로 사각지대 감지 기능도 특히 교통량이 많은 도시 환경에서는 중요한 안전 기능이 되고 있습니다. 승용차 부문은 자동차 시장에서 가장 큰 대수를 차지하며 차선 변경 및 합류 동작의 발생률이 높습니다. BSD는 사각에 있는 차량을 감지하는 센서를 사용하여 촉진요인의 시야 제한을 해결하고 승용차 사용 시 일반적인 시나리오인 차선 변경 시 사고 위험을 줄입니다.

또한 첨단 안전 기능을 탑재한 차량을 우선적으로 평가하는 규제 이니셔티브와 안전 등급이 승용차에서 ACC 및 BSD의 보급에 기여하고 있습니다. 북미에서는 미국 교통 안전국(NHTSA)의 주요 프로그램인 미국 신차 평가 프로그램(US NCAP)이 이러한 안전 시스템의 탑재에 중점을 두고 구매자의 안전 관련 우려를 경감시키기 위해 도입되었습니다.

자동차 제조업체 각 회사는 이러한 기술을 승용차 모델에 통합하여 고객의 폭넓은 고객층에 대한 소구력을 높이고 있습니다. 시장 기업은 자동차의 자율 주행 기능과 관련된 여러 유효한 특허를 등록합니다. 2022년에는 도요타가 1,823건으로 가장 많았고, 백도, 혼다가 이에 뒤따랐습니다.

승용차와는 별도로 상용차, 특히 대형 트럭도 고급 운전 지원 시스템과 충돌 회피 시스템에 대한 수요가 증가하고 있습니다. 상용차는 승용차보다 차체가 길고 차폭이 넓기 때문에 사각이 커집니다. 따라서 안전성을 높이고 사각을 없애기 위해 각 기업은 상용차 제조업체와 협의하면서 이러한 차량에 적합한 사각지대 감지 시스템을 개발하고 있습니다.

차량의 안전성에 대한 우려 증가 및 사각과 관련된 사고 증가는 예측 기간 동안 ACC 및 BSD 시스템 시장을 견인하는 요인 중 하나입니다.

아시아태평양과 북미가 시장을 견인

아시아태평양은 BSD 및 ACC의 양산업 성장에 크게 기여하며 가장 급성장하고 있는 지역 시장이 될 것으로 예측되며, 북미가 이에 이어집니다. 이러한 지역의 성장을 견인하고 있는 것은 고급차를 중심으로 한 자동차 판매 증가, 자동차 1대당의 안전 장비 증가라고 하는 요인입니다.

인도나 한국 등 신흥국 시장의 발전이 현저한 나라의 존재와, 이 지역의 자동차에 부과되는 안전 규제가, 아시아태평양의 운전 지원 시스템 시장에 큰 영향을 주고 있습니다. 이러한 규정은 유럽과 북미와 마찬가지로 엄격합니다.

- Bharat New Car Assessment Program(통칭 Bharat NCAP)은 세계에서 10번째 NCAP로 인도 정부에 의해 설립되었습니다. 이 프로그램은 2023년 10월에 시작되었습니다. 이 프로그램은 인도에서 판매되는 자동차의 안전 성능을 평가하고 안전 기능과 성능에 따라 별 평가를 제공하는 것을 목표로 합니다. 바랏 NCAP은 테스트한 자동차에 1에서 5까지의 별 등급을 부여하고 1이 최저 평가가 됩니다. 이러한 평가에는 성인 탑승자 보호(AOP), 소아 탑승자 보호(COP), 안전 지원 기술의 장착이 포함됩니다.

게다가 인도, 태국, 인도네시아의 사회경제 상황 개선은 럭셔리 승용차 부문에 대한 수요를 창출하고 있으며, 이들 국가에서 ACC 및 BSD에 대한 수요를 증가시키고 있습니다.

또한 홍보 요인의 안전 시스템에 대한 인식이 높아짐에 따라 아시아태평양 국가에서 ADAS가 장착된 자동차 시장이 확대되고 있습니다. 정부 규정에 따라 자동차 제조업체는 고급 ADAS 모듈이 장착된 차량을 설계해야 합니다. 또한, 이 지역에서 자율주행 차량의 진화는 Tier 1 제조업체가 최신 기술과 사용자 친화적인 시스템을 갖춘 ADAS를 설계하고 제공할 수 있는 기회를 창출하고 있습니다.

이 모든 신흥국 시장의 개척이 아시아태평양의 어댑티브 크루즈 컨트롤 및 사각지대 감지 시장을 견인할 것으로 예상됩니다.

어댑티브 크루즈 컨트롤(ACC) 및 사각지대 감지(BSD) 산업 개요

어댑티브 크루즈 컨트롤 및 사각지대 감지 시장은 상당히 통합되어 있습니다. Continental AG, Hella KGaA Hueck & Co., Mobileye, Denso Corporation, Delphi Automotive PLC 등의 기업이 시장의 주요 기업입니다.

자동차의 안전기능에 대한 기준이 증가함에 따라 시장의 주요 ACC 및 BSD 제조업체는 연구개발 활동에 대한 투자를 시작하고 있습니다. 예를 들면

*2023년 7월, 미쓰비시 자동차 공업은 태국 방콕에서 1톤 픽업 트럭 '트라이턴'의 디자인을 일신하여 첫 공개했습니다. 트럭 회사는 2024년 초 12년 만에 일본에서 발매할 예정입니다. 어댑티브 크루즈 컨트롤(ACC)을 비롯한 새로운 안전 장비와 커넥티드카 기술을 활용한 긴급시 서포트 등을 채용하여 안전성과 쾌적성이 대폭 향상되었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 자동차의 안전성에 대한 소비자 관심의 고조가 시장 견인

- 시장 성장 억제요인

- ACC 및 BSD의 높은 초기 도입 비용이 과제

- 업계의 매력-Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화(금액 단위)

- 유형별

- 어댑티브 크루즈 컨트롤(ACC)

- 사각지대 감지(BSD)

- 차량 유형별

- 승용차

- 상용차

- 판매 채널별

- OEM

- 애프터마켓

- 비술별

- 적외선

- 레이더

- 이미지

- 기타 기술

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 세계 기타 지역

- 브라질

- 아르헨티나

- 기타 국가

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Continental AG

- Delphi Technologies PLC

- DENSO Corp

- Autoliv Inc.

- Magna International

- WABCO Vehicle Control Services

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Bendix Commercial Vehicle Systems LLC(Knorr-Bremse AG)

- Mobileye

- Mando-Hella Electronics Corp.

제7장 시장 기회 및 향후 동향

- 자동차에서 ADAS 기능의 이용 확대가 충분한 성장 기회를 가져온다

제8장 수량 기준 시장 규모 및 예측

제9장 ACC 및 BSD 기술의 기술적 진보 분석

제10장 지역 및 국가 수준에서의 자동차 안전성과 ADAS 기능의 탑재에 관한 규제에 관한 인사이트

AJY 24.08.08The Adaptive Cruise Control And Blind Spot Detection Market size is estimated at USD 3.58 billion in 2024, and is expected to reach USD 7.27 billion by 2029, growing at a CAGR of 15.20% during the forecast period (2024-2029).

The market for adaptive cruise control and blind spot detection has witnessed a significant surge in recent years. The growing awareness about vehicle safety has been one of the vital factors in the development of advanced safety systems, such as adaptive cruise control and blind-spot detection.

Additionally, the increase in the sales of luxury vehicles worldwide is also driving the market for ACC and BSD. In 2023, over 183 thousand units of luxury cars were sold worldwide, compared to 157 thousand units in 2022. This indicated a significant surge of over 16%.

Further, the enactment of stringent safety regulations and increasing vehicle safety concerns among consumers have also propelled the market for ACC and BSD. According to the World Health Organization, nearly 1.35 million people die annually due to road accidents. The cause of these accidents is mostly attributed to the driver's inability to judge certain conditions and make the right decisions. The efforts of governments to reduce fatalities due to road accidents have led to increased installation of safety systems in new vehicles.

More than 90% of the market studied is captured by OEMs, with a limited and unorganized aftermarket for the blind spot detection system. Eyeing the growth opportunities present in the market, the leading players are increasingly incorporating these features in their vehicles to cater to consumer demand.

All these factors combined indicate potential growth for the ACC and BSD market during the forecast period.

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) Market Trends

Passenger Car Segment is The Largest Vehicle Type Segment

The passenger car segment is the largest market segment for adaptive cruise control (ACC) and blind spot detection (BSD) among vehicle types. There has been a widespread integration of advanced driver assistance systems (ADAS) in modern passenger cars, driven by a growing emphasis on safety and the increasing consumer demand for enhanced driving experiences.

Passenger car manufacturers are largely offering cutting-edge features that enhance both safety and convenience. ACC systems are well-suited for highway driving, making them particularly attractive for daily commuters and long-distance travelers using passenger cars. The mainstream adoption of ACC in passenger cars is fuelled by advancements in sensor technologies, affordability, and a shift toward semi-autonomous driving features.

Similarly, blind spot detection has also become a crucial safety feature, especially in urban environments with dense traffic. The passenger car segment, being the largest volume contributor in the automotive market, experiences a higher incidence of lane changes and merging movements. BSD addresses the limitations of driver visibility by using sensors to detect vehicles in blind spots, reducing the risk of accidents during lane changes-a common scenario in passenger car usage.

Furthermore, regulatory initiatives and safety ratings that prioritize vehicles equipped with advanced safety features contribute to the prevalence of ACC and BSD in passenger cars. In North America, the United States New Car Assessment Program (US NCAP), a flagship program of the country's National High Traffic Safety Administration (NHTSA), focused on the incorporation of these safety systems, was introduced to reduce the safety-related concerns of buyers.

Automakers are integrating these technologies into their passenger car models, making them more appealing to a broader customer base. Market players have multiple active patents registered to their name related to autonomous features in their vehicles. In 2022, Toyota had the most number of active patents, amounting to 1,823, followed by Baidu and Honda Motors.

Apart from passenger cars, commercial vehicles, particularly large trucks, are also seeing an increase in demand for sophisticated driver assistance systems and collision avoidance systems. Commercial vehicles are longer and broader than passenger vehicles, resulting in substantially greater blind areas. Thus, to enhance safety and eliminate blind spots, companies, in consultation with commercial vehicle manufacturers, are developing blind spot detection systems that are suitable for these vehicles.

The rising vehicle safety concerns and a growing number of blind spot-related accidents are some of the factors that will drive the market for ACC and BSD systems during the forecast period.

Asia-Pacific and North America Driving the Market

Asia-Pacific is projected to be the fastest-growing regional market, contributing significantly to the growth of both the BSD and ACC industries, followed by North America. The growth in these regions is driven by factors such as increasing vehicle sales, particularly of luxury cars, and an increase in safety installations per vehicle.

The presence of fast-developing countries, like India and South Korea, and the safety regulations imposed on vehicles in the region have influenced the Asia-Pacific market for driving assistance systems significantly. These regulations are as stringent as those of Europe and North America.

- The Bharat New Car Assessment Program, commonly known as Bharat NCAP, is the 10th NCAP in the world and has been set up by the Government of India. The program commenced in October 2023. The program aims to evaluate the safety performance of cars sold in India and assign star ratings based on their safety features and performance. Bharat NCAP will assign star ratings ranging from 1 to 5 for cars tested, with 1 being the lowest rating. These ratings cover Adult Occupant Protection (AOP), Child Occupant Protection (COP), and Fitment of Safety Assist Technologies.

Additionally, the improvement in socioeconomic conditions in India, Thailand, and Indonesia has also created a demand for the premium passenger cars segment, thereby increasing the demand for ACC and BSD in these countries.

Further, the rising awareness of driver safety systems is enhancing the market for ADAS-equipped vehicles in Asia-Pacific countries. Government regulations are compelling car manufacturers to design their vehicles with advanced ADAS modules. Moreover, the evolution of autonomous cars in this region is creating the opportunity for tier-1 manufacturers to design and deliver ADAS with the latest technologies and user-friendly systems.

All these developments combined are expected to drive the market for adaptive cruise control (ACC) and blind spot detection (BSD) in Asia-Pacific.

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) Industry Overview

The adaptive cruise control (ACC) and blind spot detection (BSD) market is fairly consolidated. Companies such as Continental AG, Hella KGaA Hueck & Co., Mobileye, Denso Corporation, and Delphi Automotive PLC are some of the major players in the market.

To meet the increasing standards for safety features in the vehicles, major ACC and BSD manufacturers in the market have started investing in R&D activities. For instance,

* In July 2023, Mitsubishi Motors Corporation premiered the completely redesigned Triton 1-ton pickup truck in Bangkok, Thailand. The truck company scheduled a launch in Japan in early 2024 for the first time in 12 years. Safety and comfort have been greatly improved in the vehicle with the adoption of Adaptive Cruise Control (ACC), among other new safety features and emergency support using connected car technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 The Increasing Concern of Consumers Toward Vehicle Safety is Driving the Market

- 4.2 Market Restraints

- 4.2.1 High Initial Installation Costs of ACC and BSD Act as a Major Challenge

- 4.3 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Value in USD Billion)

- 5.1 Type

- 5.1.1 Adaptive Cruise Control (ACC)

- 5.1.2 Blind Spot Detection (BSD)

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 Technology

- 5.4.1 Infrared

- 5.4.2 Radar

- 5.4.3 Image

- 5.4.4 Other Technologies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Delphi Technologies PLC

- 6.2.3 DENSO Corp

- 6.2.4 Autoliv Inc.

- 6.2.5 Magna International

- 6.2.6 WABCO Vehicle Control Services

- 6.2.7 Robert Bosch GmbH

- 6.2.8 ZF Friedrichshafen AG

- 6.2.9 Bendix Commercial Vehicle Systems LLC (Knorr-Bremse AG)

- 6.2.10 Mobileye

- 6.2.11 Mando-Hella Electronics Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of ADAS Features in Vehicles Presents Ample Growth Opportunities