|

시장보고서

상품코드

1850139

유아 영양 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Infant Nutrition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

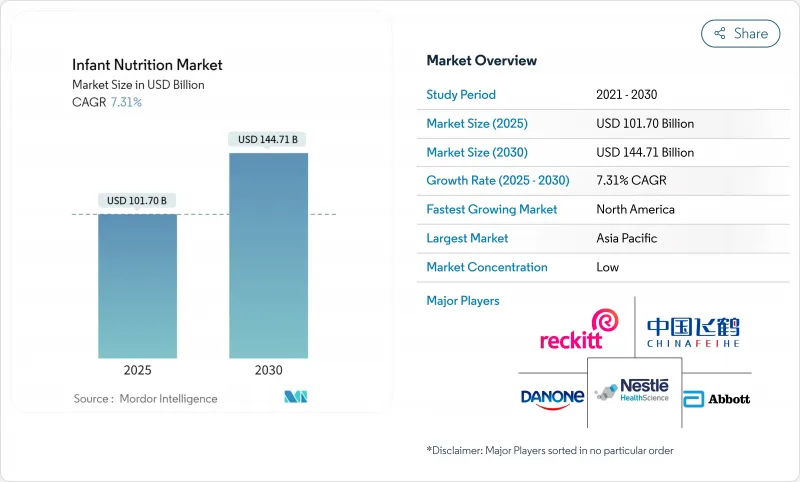

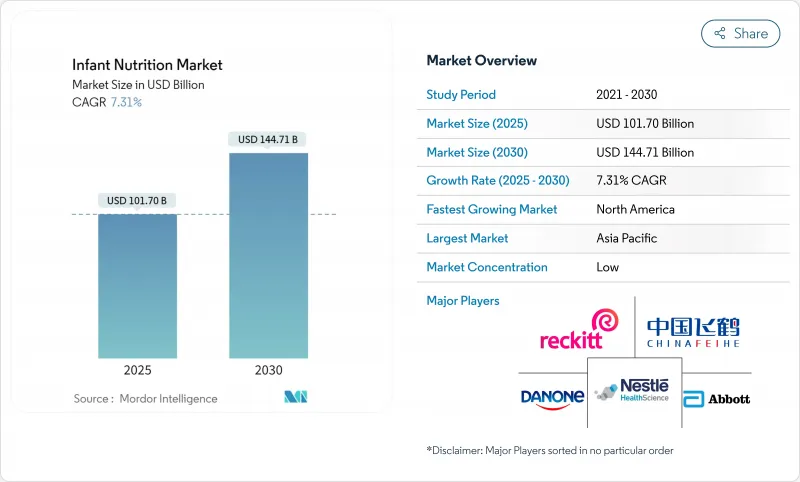

유아 영양 시장 규모는 2025년 1,017억 달러, 2030년에는 1,447억 1,000만 달러에 이르고, CAGR은 7.31%를 나타낼 전망입니다.

성장은 공동 작업 가구의 확대, 인간 우유 올리고당(HMOs)의 규제 승인, 모유의 복잡성을 재현하는 기술에 달려 있습니다. 과학적으로 검증된 인지 및 면역상의 이점과 가격 감도를 교환하는 부모가 있기 때문에 프리미엄 제품의 흡수는 계속 견고합니다. 새로운 정밀 발효 원료, 소비자 직접 판매(D2C) 계약, 전자상거래 물류는 소비자에게 도달 범위를 높이는 동시에 2022년공급 부족 후 공급망의 탄력성을 강화합니다. 아시아태평양 구매력과 중동 및 아프리카 인구동태 추풍이 지역 수요를 강화하는 한편 괴사성 장염(NEC)과 관련된 소송이 제조업체를 보다 안전하고 투명성이 높은 제제로 향하게 합니다.

세계 유아 영양 시장 동향과 통찰

워킹맘 및 맞벌이 가구의 증가

주요 경제국의 어머니의 취업률이 70%를 넘으면 모유 육아 기간이 단축되어 프리미엄 우유에 대한 의존도가 높아집니다. 2021년 전국 예방접종조사(Child Review)에 따르면 유급휴가가 있는 주에서는 모유 육아율이 5.36% 높지만, 어머니가 일로 복귀함에 따라 분유 사용률은 상승합니다. 바쁜 부모님들은 건강 앱에 수유 로그를 통합한 구독 서비스와 연결된 병 워머를 받아 편안함과 영양 밀도에 대한 비용을 기꺼이 지불할 의향이 있음을 보여줍니다.

유아의 건강과 프리미엄화에 대한 지출 증가

부모는 이제 조기 영양을 평생의 인지적 이익과 동일시하고 있어 초프리미엄 상품의 제공을 높이고 있습니다. 네슬레의 2024년 NAN Sinergity는 고가격대의 6유형의 HMO와 비피더스균을 도입했습니다. 2025년 영국 시장 경쟁청 분석은 저가 브랜드로 연간 500 파운드를 절약할 가능성을 제시했지만 프리미엄 라인은 인식된 건강에 대한 보상이 비용을 능가하기 때문에 확대를 계속하고 있습니다.

엄격한 안전 규정 및 리콜 위험

2023년 공급 부족으로 FDA는 생산 중단 5일 이내의 신고를 의무화하고, 컴플라이언스 비용을 증대시키고, 고급 품질 시스템을 가진 기존 기업을 우대하고 있습니다. 중국 국가시장 감독관리총국은 2023년 검사로 99.85%의 합격률을 달성했지만 감시 강화로 소규모 생산자는 배제되어 다국적 기업에 생산량이 집중되고 있습니다.

부문 분석

스페셜리티 포뮬러의 2030년까지의 CAGR은 9.8%를, 유아용 조제 분유의 우위성과는 대조적이지만, 보다 완만한 궤도를 그립니다. 부모가 미숙아, 우유 알레르기 또는 신진 대사 장애를 겨냥한 솔루션을 추구함에 따라 특수 제품의 유아 영양 시장 규모는 2030년까지 280억 달러 이상에 달할 것으로 예측됩니다. HMO와 락토페린을 포함한 면역특이적 블렌드는 신생아실로부터의 지지를 확보하고 프리미엄 포지셔닝을 강화합니다. 팔로우 온 포뮬러 및 글로잉 업 포뮬러는 유아기부터 유아기에 이르는 유아에 첨부하여 브랜드 평생 가치를 확대합니다. 한편, 조리된 베이비 푸드와 핑거 스낵도 같은 프리미엄화의 물결을 타고, 유기농 표시를 사용해 부모의 충성도를 획득합니다.

전문 기업은 규제 승리를 활용합니다. HMO와 프로바이오틱스 B. infantis를 결합한 네슬레 헬스사이언스의 우유 단백질 알레르기 대책 제품은 2025년 소아과에서 널리 채택되었습니다. 이 출시는 지적 재산에 뒷받침되는 성분이 얼마나 지속적인 차별화를 창출하는지를 보여줍니다. 소아과 의사와의 치료 영양 학적 제휴는 또한 전문 라인을 가격 기반 소매 경쟁에서 격리하여보다 광범위한 유아 영양 시장 내에서 두 자리 성장을 지속합니다.

2024년 유아 영양 시장 규모의 78.4%는 분말이 차지하고 있는데, 이는 비용 효율과 실온에서의 안정성이 이유입니다. 그러나 Ready-to-Feed의 CAGR 8.9%는 도시 지역의 공동 작업 부모가 받아들일 수 있는 편의성을 보여줍니다. RTF는 계량 실수를 없애고 오염 위험을 낮춥니다. 농축액은 경제성과 준비 시간의 단축을 양립하는 소비자를 위한 과도적인 선택입니다.

Gentle-UHT 살균 등의 기술 개량으로 영양소의 열화 없이 보존 가능한 RTF가 가능하게 되었습니다. 미국에서 9,200만 달러의 시설의 절반을 건설 중인 락타 로직스는 2025년 신생아 집중 치료실을 위한 기증자 우유 기반 RTF의 개발을 계획하고 있습니다. 제조 비용이 떨어지고 신흥 시장에서 콜드체인 적용 범위가 확대됨에 따라 RTF의 견인력이 가속화되고 10년후까지 유아 영양 시장 점유율을 높일 것으로 보입니다.

지역 분석

아시아태평양은 2024년 유아 영양 시장 점유율의 44.3%를 차지하며 중국인 출생 수가 감소했음에도 불구하고 주도권을 유지하고 있습니다. 제조업체는 수량 축소를 보충하기 위해, 프리미엄 SKU와 국경 간 전자상거래로 전환하고 있습니다. 인도의 규제 당국은 2025년에 위험이 높은 식품의 라이선싱을 엄격화하고, 엄격한 문서화에 대응할 수 있는 대기업 기존 기업을 우대합니다. 동남아시아 경제는 도시화와 가처분소득 상승에 힘입어 판매량 증가에 기여하고 있습니다. APAC 국가에서는 소득과 규제 프레임워크이 다양하기 때문에 기업은 세계 안전 기준을 유지하면서 풍미, 포장 크기, 성분 목록을 현지화해야 합니다.

중동 및 아프리카는 CAGR로 가장 빠른 7.4%를 기록했으며 인구 역학 확대와 건강 관리 인프라 개선에 힘입었습니다. 걸프 협력 회의 제국에서는 모유 육아의 의향이 높은 것, 독점률은 낮고, 부유한 국외 거주자의 사이에 분유에 의한 보완의 여지가 남아 있습니다. 사하라 이남의 아프리카 국가에서는 영양 실조 지향의 강화 블렌드가 지지를 모으고 있지만, 저렴한 가격이 장벽이 되고 있습니다. 이 지역에서의 성공의 열쇠는 보통 1회분씩 가방에 들어간 분유를 유통시키는 것과 농촌에 침투시키기 위해 관민 제휴를 맺는 것입니다.

북미와 유럽은 여전히 혁신적인 핫스팟이며, 성장은 수량보다 프리미엄화에 달려 있습니다. 미국 시장은 신규 성분에 관한 규제의 명확화로부터 혜택을 받았으며, 애봇사는 2025년 1분기에 소아용 영양제로 14.2%의 성장을 달성했습니다. 그러나 소송위험은 보험료와 리콜비용을 급등시킵니다. 유럽 소비자는 유기농 인증과 탄소 중립 인증을 선호합니다. 보다 신속한 EFSA의 신규 식품 승인은 HMO의 신속한 전개에 박차를 가하고, 현지 계약 제조업자는 소규모 프리미엄 브랜드에 서비스를 제공하기 위해 생산 능력을 확대합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 워킹맘 및 맞벌이 가구의 증가

- 영유아의 건강 지출 증가와 고급화 경향

- 유기농과 클린 라벨의 영양 식품 수요 급증

- HMO와 락토페린의 규제 승인

- D2C 구독과 스마트 피딩 에코시스템

- 중국의 2023년 포뮬러 등록 규칙에서의 현지화

- 시장 성장 억제요인

- 엄격한 안전규제와 리콜 리스크

- 소비자 신뢰를 약화시키는 오염 스캔들

- 성숙 경제에서 출생률 저하

- NEC와 알레르기에 관한 소송

- 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력/소비자

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 유아용 조제분유

- 이유식

- 형태별

- 분말

- 액체 농축물

- RTF(Ready-to-Feed)

- 성분별

- 우유 베이스

- 염소 우유 베이스

- 식물 유래 및 가수분해 단백질

- 기능성 첨가제(HMO, DHA/ARA, 락토페린, 프로바이오틱스)

- 유통 채널별

- 하이퍼마켓 및 슈퍼마켓

- 약국 및 드럭스토어

- 편의점과 백화점

- 전자상거래와 D2C 구독

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Abbott Laboratories

- Nestle SA

- Danone SA

- Reckitt Benckiser Group Plc(Mead Johnson)

- Royal FrieslandCampina NV

- Bellamy's Organic

- The Kraft Heinz Company

- Perrigo Company Plc

- Synutra International Inc.

- A2 Milk Company Ltd.

- Hero Group

- Arla Foods amba

- Fonterra Co-operative Group Ltd.

- Ausnutria Dairy Corporation Ltd.

- Inner Mongolia Yili Industrial Group

- China Feihe Ltd.

- Beingmate Baby & Child Food Co.

- HIPP GmbH & Co. Vertrieb KG

- Dana Dairy Group Ltd.

- Baby Gourmet Foods Inc.

제7장 시장 기회와 장래의 전망

SHW 25.11.17The infant nutrition market size stands at USD 101.70 billion in 2025 and is forecast to reach USD 144.71 billion by 2030, advancing at a 7.31% CAGR.

Growth rests on dual-income household expansion, regulatory approval of human milk oligosaccharides (HMOs), and technology that reproduces breast-milk complexity. Premium product uptake remains robust as parents trade price sensitivity for scientifically validated cognitive and immune benefits. Emerging precision-fermentation ingredients, direct-to-consumer (D2C) subscriptions, and e-commerce logistics enhance consumer reach while tightening supply-chain resilience after the 2022 shortage. Asia-Pacific's purchasing power and Middle East & Africa's demographic tailwinds strengthen regional demand, whereas litigation linked to necrotizing enterocolitis (NEC) pushes manufacturers toward safer, more transparent formulations.

Global Infant Nutrition Market Trends and Insights

Rise in Working Mothers & Dual-Income Households

Employment rates above 70% among mothers in leading economies shorten breastfeeding periods and increase reliance on premium formula. A 2021 National Immunization Survey-Child review showed states with paid family leave achieving 5.36% higher exclusive breastfeeding, yet formula usage still rose as mothers returned to work. Busy parents accept subscription services and connected bottle warmers that integrate feeding logs into health apps, revealing a willingness to pay for ease of mind as well as nutrient density.

Higher Spending on Infant Health & Premiumization

Parents now equate early nutrition with lifelong cognitive benefit, elevating super-premium offerings. Nestle's 2024 NAN Sinergity introduced six HMOs plus Bifidobacterium infantis at higher price points. Although a 2025 UK Competition and Markets Authority analysis suggested potential annual savings of GBP 500 from lower-priced brands, premium lines keep expanding because perceived health returns override cost.

Stringent Safety Regulations & Recall Risk

Following the 2023 shortage, the FDA now mandates a five-day notification for production disruptions, increasing compliance costs and favoring incumbents with sophisticated quality systems. China's State Administration for Market Regulation achieved a 99.85% pass rate in 2023 inspections, yet heightened scrutiny eliminates smaller producers, concentrating volume within multinationals.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Demand for Organic & Clean-Label Nutrition

- Regulatory Green-Lights for HMOs & Lactoferrin

- Contamination Scandals Eroding Consumer Trust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Specialty formulas post a 9.8% CAGR through 2030, contrasting with Infant Formula's dominant yet flatter trajectory. The infant nutrition market size for specialty products is projected to exceed USD 28 billion by 2030 as parents seek targeted solutions for prematurity, cow's-milk allergy, or metabolic disorders. Immune-specific blends containing HMOs and lactoferrin secure endorsement from neonatal units, reinforcing premium positioning. Follow-on and Growing-up Formulas widen brand lifetime value by accompanying toddlers into early childhood. Meanwhile, prepared baby foods and finger snacks ride the same premiumization wave, using organic labeling to capture parental loyalty.

Specialty players leverage regulatory wins; Nestle Health Science's cow's-milk protein allergy solution combining HMOs and probiotic B. infantis gained wide paediatric adoption in 2025. These launches illustrate how intellectual-property-backed ingredients create durable differentiation. Therapeutic nutrition tie-ins with paediatricians also insulate specialty lines from price-based retail competition, sustaining double-digit growth inside the broader infant nutrition market.

Powder dominated 78.4% of the infant nutrition market size in 2024 due to cost efficiency and room-temperature stability. Yet Ready-to-Feed's 8.9% CAGR signals a convenience premium that dual-income urban parents embrace. RTF eliminates measuring errors and lowers contamination risk, which is vital amid heightened safety concerns. Liquid Concentrate supplies a transitional option for consumers balancing economy with reduced preparation time.

Technology improvements, such as Gentle-UHT pasteurization, permit shelf-stable RTF without nutrient degradation. LactaLogics, halfway through a USD 92 million US facility, plans a 2025 roll-out of donor-milk-based RTF aimed at neonatal intensive-care units. As manufacturing costs drop and cold-chain coverage expands in emerging markets, RTF traction will accelerate, raising its share inside the infant nutrition market by the end of the decade.

The Infant Nutrition Market is Segmented by Product (Infant Formula and Baby Food), Form (Powder, Liquid Concentrate, and More), Ingredient Cow-Milk Based, Goat-Milk Based, and More), Distribution Channel (Hypermarkets & Supermarkets, Pharmacy & Drug Stores, E-Commerce, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 44.3% of the infant nutrition market share in 2024 and sustains leadership despite declining Chinese births. Manufacturers shift toward premium SKUs and cross-border e-commerce to offset volume contraction. India's regulator tightened licensing for high-risk foods in 2025, favoring large incumbents capable of meeting stringent documentation. Southeast Asian economies contribute incremental volume, buoyed by urbanisation and rising disposable incomes. The diversity of incomes and regulatory frameworks across APAC obliges companies to localise flavors, pack sizes, and ingredient lists while maintaining global safety standards.

Middle East and Africa recorded the fastest 7.4% CAGR, fueled by demographic expansion and improving healthcare infrastructure. Gulf Cooperation Council countries show high breastfeeding intent yet low exclusivity rates, leaving space for formula supplementation among affluent expatriate populations. Across Sub-Saharan Africa, malnutrition-oriented fortified blends gain traction, though affordability remains a barrier. Regional success typically hinges on distributing single-serve powder sachets and forging public-private alliances to penetrate rural areas.

North America and Europe remain innovative hotspots where growth depends on premiumization rather than volume. The US market benefits from regulatory clarity on novel ingredients, enabling Abbott to post 14.2% pediatric nutrition growth in Q1 2025. Litigious risk, however, escalates insurance and recall costs. European consumers prioritize organic certification and carbon-neutral credentials. Faster EFSA novel-food approvals spur rapid HMO rollouts, with local contract manufacturers scaling capacity to serve smaller premium brands.

- Abbott Laboratories

- Nestle S.A.

- Danone

- Reckitt Benckiser Group Plc (Mead Johnson)

- Royal FrieslandCampina N.V.

- Bellamy's Organic

- The Kraft Heinz Company

- Perrigo Company

- Synutra International

- A2 Milk Company Ltd.

- Hero Group

- Arla Foods amba

- Fonterra Co-operative Group Ltd.

- Ausnutria Dairy Corporation Ltd.

- Inner Mongolia Yili Industrial Group

- China Feihe Ltd.

- Beingmate Baby & Child Food Co.

- HIPP GmbH & Co. Vertrieb KG

- Dana Dairy Group Ltd.

- Baby Gourmet Foods

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise In Working Mothers & Dual-Income Households

- 4.2.2 Higher Spending On Infant Health & Premiumisation

- 4.2.3 Surge In Demand For Organic & Clean-Label Nutrition

- 4.2.4 Regulatory Green-Lights For HMOs & Lactoferrin

- 4.2.5 D2C Subscription & Smart-Feeding Ecosystems

- 4.2.6 Localization Amid China's 2023 Formula Registration Rules

- 4.3 Market Restraints

- 4.3.1 Stringent Safety Regulations & Recall Risk

- 4.3.2 Contamination Scandals Eroding Consumer Trust

- 4.3.3 Falling Birth Rates In Mature Economies

- 4.3.4 Litigation Over NEC & Allergy Claims

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Infant Formula

- 5.1.2 Baby Food

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid Concentrate

- 5.2.3 Ready-to-Feed (RTF)

- 5.3 By Ingredient

- 5.3.1 Cow-milk based

- 5.3.2 Goat-milk based

- 5.3.3 Plant-based & Hydrolyzed Protein

- 5.3.4 Functional Additives (HMOs, DHA/ARA, Lactoferrin, Probiotics)

- 5.4 By Distribution Channel

- 5.4.1 Hypermarkets & Supermarkets

- 5.4.2 Pharmacy & Drug Stores

- 5.4.3 Convenience & Departmental Stores

- 5.4.4 E-commerce & D2C Subscriptions

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Nestle S.A.

- 6.3.3 Danone S.A.

- 6.3.4 Reckitt Benckiser Group Plc (Mead Johnson)

- 6.3.5 Royal FrieslandCampina N.V.

- 6.3.6 Bellamy's Organic

- 6.3.7 The Kraft Heinz Company

- 6.3.8 Perrigo Company Plc

- 6.3.9 Synutra International Inc.

- 6.3.10 A2 Milk Company Ltd.

- 6.3.11 Hero Group

- 6.3.12 Arla Foods amba

- 6.3.13 Fonterra Co-operative Group Ltd.

- 6.3.14 Ausnutria Dairy Corporation Ltd.

- 6.3.15 Inner Mongolia Yili Industrial Group

- 6.3.16 China Feihe Ltd.

- 6.3.17 Beingmate Baby & Child Food Co.

- 6.3.18 HIPP GmbH & Co. Vertrieb KG

- 6.3.19 Dana Dairy Group Ltd.

- 6.3.20 Baby Gourmet Foods Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment