|

시장보고서

상품코드

1640421

내비게이션 시스템 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Navigation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

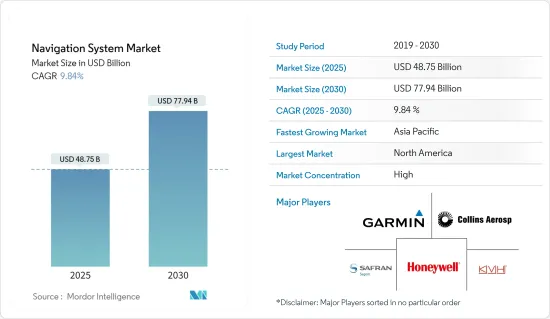

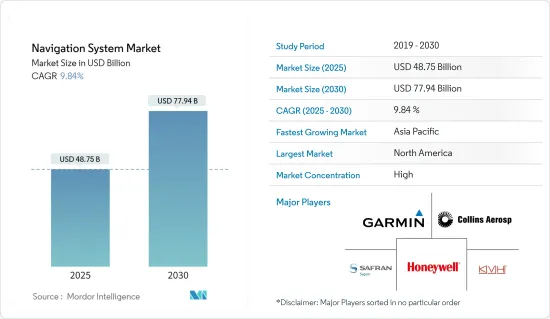

내비게이션 시스템 시장 규모는 2025년 487억 5,000만 달러, 2030년 779억 4,000만 달러로 추계되며, 예측기간(2025-2030년)의 CAGR은 9.84%에 달할 것으로 예측됩니다.

주요 하이라이트

- 자동차에서 자율형 로봇까지 다양한 용도로 실시간 정보에 대한 수요가 높아지는 가운데, 내비게이션 시스템은 세계적으로 점점 널리 채용되고 있습니다. 기술이 발전함에 따라 이러한 시스템은 변화를 일으켜 여러 서비스와 내비게이션 기능을 제공하며 내비게이션 기술을 중심으로 상당한 서비스 에코시스템이 형성되고 있습니다.

- 내비게이션 시스템은 차량의 위치와 방향을 식별하는 것 외에도 다양한 용도를 가지고 있습니다. 날씨 경보 파악, 소포 및 화물 추적, 교통 흐름 개선 등에 도움이 됩니다. 또한, 이러한 시스템은 스마트 공간을 홍보하기 위해 여러 고급 애플리케이션에서 사용됩니다.

- 다양한 GPS 시스템은 광업, 항공, 측량, 농업, 해양, 군사 애플리케이션에서 사용을 찾을 수 있습니다. 증가한 세계 무역과 해상 교통은 최근 시장의 성장을 돕고 있습니다. 또한 세계 각국의 정부는 다양한 산업 분야의 내비게이션 시스템에 엄청난 투자를 하고 있습니다.

- 예를 들어, 인도 우주 연구 기관(ISRO)과 인도 공항청(AAI)은 공동으로 위성 기반 보강 시스템(SBAS)으로 GAGAN 프로젝트를 실시했습니다.

- 마찬가지로 많은 자동차 관련 기업들이 내비게이션 시스템에 새로운 기술 혁신을 가져다 주는 데 주력하고 있습니다. 예를 들어, 2023년 2월 Mercedes Benz Google은 자동차 기술 혁신을 개선하고 업계의 차세대 디지털 럭셔리 자동차 경험을 창조하기 위한 장기 전략적 파트너십을 발표했습니다. 이 제휴를 통해 Mercedes Benz는 Google 지도 플랫폼의 새로운 자동차 데이터 및 내비게이션 기능을 기반으로 브랜드의 내비게이션 경험을 개발하는 최초의 자동차 제조업체입니다.

- 최근 COVID-19의 대유행은 세계 내비게이션 시스템 비즈니스에 심각한 영향을 미쳤습니다. 전 세계의 새로운 프로젝트가 중단되었습니다. 근로자가 집에서 지냈기 때문에 세계 공장이 최신 내비게이션 시스템 통합에 어려움을 겪었으며 전 세계 공급망이 혼란스러워졌습니다. COVID-19가 이 시장에 미친 영향은 일시적인 것으로, 생산과 공급 체인이 정지한 것이었습니다. 상황이 개선됨에 따라 내비게이션 시스템의 생산, 공급망, 수요가 꾸준히 확대되었습니다.

- 항공 산업의 높은 확장과 방위비는 예측 기간 동안 내비게이션 시스템 시장의 성장을 가속할 것으로 예상됩니다. 그러나 비용이 많이 드는 설치 비용과 안전 규정이 업계의 성장을 방해하고 있습니다. 그러나 이러한 장애를 극복하기 위해서는 새로운 기술 혁신의 도입에 주력해야합니다.

내비게이션 시스템 시장 동향

방어가 시장 성장을 뒷받침

- 내비게이션 시스템의 중요한 용도 중 하나는 방어 산업입니다. 내비게이션 시스템을 통해 사용자는 간섭원을 감지하고 위치를 확인하고 특성화할 수 있습니다. 군사 부대는 지상 내비게이션, 공중 모니터링 및 해상 내비게이션에 위성 내비게이션을 사용합니다.

- 내비게이션은 군사 임무에서 부대, 적의 부대, 적의 시설과 장비의 위치를 정확하게 파악하는 데 도움이 됩니다. 정확성, 신뢰성, 포지셔닝 정확도, 적시 측정은 방어 분야에서 시장 도입의 성장을 가속하는 주요 요인의 일부입니다.

- 많은 기업들이 다양한 최종 사용자의 요구를 충족시키기 위해 광범위한 제품을 제공합니다. 예를 들어 Collins Aerospace는 2022년 6월 밀리터리 코드(M-코드) 수신기 기술과 호환되는 최초의 국제 시장을 위한 비ITAR 차량 내비게이션 시스템인 NavHub-200M을 발표했습니다. NavHub-200M은 세계 포지셔닝 시스템(GPS)에 대한 기존 및 새로운 위협(스푸핑 및 재밍 등)에 대한 전반적인 내성을 향상시키면서 확실한 포지셔닝, 내비게이션 및 타이밍(APNT) 기능을 제공합니다.

- 마찬가지로 2023년 3월 Safran은 GEONYXTM-M과 VersaSync를 결합한 내비게이션과 탄력적 타이밍 통합 솔루션인 신제품 NAVKITE를 발표했습니다. 이 새로운 제품은 GeonixTM-M 내비게이션 시스템과 GNSS*/GPS 신호를 분석하고 완전성을 검증하는 VersaSynctime과 주파수 서버를 결합한 완전 자동화 시스템입니다.

- 각국 정부의 안보에 대한 관심이 높아짐에 따라 내비게이션 시스템은 방위 분야에 필수적입니다. 예를 들어, 영국은 위성 내비게이션 시스템을 시작하기 위해 움직이고 있습니다. 런던의 보수당 정부는 최근 갈릴레오 위성 시스템의 대체 시스템을 설계 및 개발하기 위한 피지빌리티 테스트에 착수하기 위해 9,200만 파운드(약 1억 1,530만 달러)를 확보했다고 발표했습니다.

- 게다가 2022년 9월, Raytheon Company Ltd.는 전장에서 병사에게 중요한 상황 인식과 상황을 제공하는 기술의 갱신판을 개발하기 위해 미국 육군의 내비게이션을 위해 5억 8,300만 달러의 계약을 획득했다고 발표했습니다. 이 기술은 브래들리 전투차, 팔라딘 포, 에이브람스 전차 등 다양한 장갑 플랫폼과 스트라이커와 함비 등의 경량 옵션에 탑재될 예정입니다.

북미가 큰 점유율을 차지할 전망

- 세계 내비게이션 시스템 시장에서는 북미가 큰 점유율을 차지하고 있습니다. 북미가 시장을 선도하는 주된 이유는 이 지역의 기술의 조기 도입과 고급 내비게이션 시스템에 대한 막대한 투자입니다. 또한 다양한 자동화 기술에 대한 지출이 증가하고 지역 전체에서 스마트 인프라를 구축하는 것이 시장 성장을 더욱 끌어올릴 것으로 예상됩니다.

- 시장을 견인하는 주요 요인은 셀룰러 네트워크 인프라의 보급률 증가와 자동 차량 위치 정보(AVL), 추적 시스템 등의 용도을 위한 기술의 통합입니다. 그러나 인지도 부족, GNSS 기술의 높은 비용, 신호 연결성 등의 요인이 시장 성장을 방해하고 있습니다.

- 내비게이션 시스템은 주로 방어 분야에서 사용됩니다. 추적 및 포지셔닝은 방위 산업에서 사용되는 내비게이션 시스템의 주요 응용 분야입니다. 국방 산업 지출의 대부분은 북미에서 파생되었으며 미국이 가장 기여하고 있습니다.

- 2023년 1월, L3Harris는 미국 공군에 대한 Navigation Technology Satellite-3의 납품과 우주선의 납품을 발표했습니다. NTS-3는 공군연구소가 자금을 제공하는 실험으로 지구의 정지궤도에서 위치, 항법, 타이밍(PNT) 신호를 전송합니다. 그 목적은 미군을 위한 차세대 PNT 기술을 입증하고 GPS를 대체하는 기술을 제공하는 것입니다.

- 미국은 중국, 사우디아라비아, 인도, 프랑스, 러시아, 영국, 독일 등의 국가들에 비해 국방비를 가장 많이 지출하고 있습니다.

- 게다가 북미 내비게이션 시스템 시장은 자율주행차와 승용차의 생산량이 증가함에 따라 높은 성장을 이룰 것으로 보입니다. 승용차에는 대시보드 또는 대시보드에 설치된 내비게이션 시스템이 장착되어 있습니다. 이러한 정품 내비게이션 시스템은 스마트폰 내비게이션보다 정확하고 기능이 풍부하며 통합성이 우수합니다.

- 또한, 정확성에 대한 요구가 증가함에 따라 자동차 내비게이션 기술은 실시간 배송 시스템을 제공하는 용도을 통합하여 공급망을 추적하고 예측하는 데 도움이 됩니다. 또한 카셰어링 서비스가 내비게이션 기반 기술에 크게 의존하기 때문에 Ola, Uber 및 Grab이 시장 성장을 이끌 것으로 예상됩니다.

내비게이션 시스템 업계 개요

내비게이션 시스템 시장의 경쟁 기업간 경쟁 관계는 Garmin Ltd., Honeywell International Inc., Collins Aerospace Inc. R&D에 대한 대규모 투자를 통해 제품을 지속적으로 혁신하는 그들의 능력은 다른 기업에 대한 경쟁 우위를 달성하는 데 도움이 됩니다.

- 2023년 2월, Raytheon Company Ltd.는 일본 해상 자위대(JMSDF)에 F-35 JPALS를 제공하는 계약을 860만 달러로 획득했다고 발표했습니다. JPALS는 소프트웨어 기반 차이 전지구 포지셔닝 시스템 항법 및 정밀 착륙 시스템입니다. 이 계약은 미국 해군이 수주했습니다. JPALS는 F-35 전투기와 통합되어 전천후 하에서 해상에서의 함정의 조작, 접근, 착함이 가능합니다.

- 2022년 1월 ASECNA(아프리카 및 마다가스카르 항공항법 안전청)의 대처로 아프리카 국가들이 위성이용보강시스템(SBAS)의 일부에 합류했습니다. SBAS는 정확하고 견고한 세계 위성 포지셔닝 시스템(GNSS)으로, 지역별 지상 내비게이션 보조 장치 및 공항 착륙 시스템을 필요로 하지 않습니다. ASECNA가 주도하는 아프리카 항공은 자체 SBAS 시스템을 개발하여 항공사 및 항공 이해관계자를 지원할 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 경쟁 기업간 경쟁 관계

- 대체품의 위협

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 자동차 산업에서의 내비게이션 시스템의 도입 증가

- 시장 성장 억제요인

- 신흥 국가의 높은 시스템 비용과 지원 인프라의 부족

제6장 시장 세분화

- 용도별

- 방어

- 항공

- 해사

- 자동차

- 기타 용도

- 유형별

- 위성 내비게이션 시스템

- 외과 수술용 내비게이션 시스템

- 관성 내비게이션 시스템

- 기타 유형

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Garmin Ltd

- Honeywell International Inc.

- Collins Aerospace Inc.

- Safran Electronics & Defense Inc.

- KVH Industries Inc.

- Raytheon Company Ltd

- SBG Systems SAS

- Advanced Navigation Inc.

- Trimble Navigation Ltd

- Lord Sensing Systems Inc.

- L3Harris Technologies Inc.

- Northrop Grumman Corporation

- Esterline Technologies Corporation

- Moog Inc.

제8장 투자 분석

제9장 시장의 미래

JHS 25.02.18The Navigation System Market size is estimated at USD 48.75 billion in 2025, and is expected to reach USD 77.94 billion by 2030, at a CAGR of 9.84% during the forecast period (2025-2030).

Key Highlights

- With the increasing demand for real-time information in various applications ranging from automotive to autonomous robots, navigation systems are increasingly widely adopted globally. With technological advancement, these systems have transformed and offered multiple services and navigation facilities, creating a considerable service ecosystem around navigation technologies.

- Besides determining the location or direction of vehicles, they have many different uses. They help to know the weather alerts, track parcels, and shipments, improve the traffic flow, etc. Also, these systems are used in several advanced applications to facilitate smart spaces.

- Various GPS systems find use in mining, aviation, surveying, agriculture, maritime, and military applications. Increased global trade and maritime traffic have aided the market's growth in recent years. Moreover, governments worldwide havesignificantly investeds in navigation systems across various industry verticals.

- For instance, in collaboration, the Indian Space Research Organization (ISRO) and the Airports Authority of India (AAI) implemented the GAGAN project as a Satellite-Based Augmentation System (SBAS), which is anticipated to benefit numerous stakeholders operating in Indian airspace.

- Similarly, many automotive players focus on bringing new technological innovations to navigation systems. For instance, in February 2023, Mercedes Benz and Google announced a long-term strategic partnership to improve auto innovation and create the industry's next-generation digital luxury car experiences. Through this partnership, Mercedes-Benz will be the first automaker to develop its own branded navigation experience based on the new in-vehicle data and navigation capabilities of the Google Maps platform.

- The recent COVID-19 pandemic severely impacted the global navigation system business. New projects all around the world had come to a halt. As workers stayed home, worldwide factories struggled to integrate modern navigation systems, disrupting global supply chains. COVID-19's impact on this market was only temporary because only the production and supply chain was halted. Production, supply networks, and demand for navigation systems steadily expanded as the situation improved.

- The aviation industry's high expansion and defense spending is expected to fuel the navigation system market growth during the projected period. However, expensive installation costs and safety regulations are impeding industry growth. Nonetheless, overcoming such impediments will focus on introducing new technological innovations.

Navigation Systems Market Trends

Defense is Boosting the Market Growth

- One of the significant applications of navigation systems is the defense industry. Navigation systems allow users to detect, locate, and characterize interference sources. Military forces use satellite navigation for ground navigation, aerial monitoring, and maritime navigation.

- Navigation helps military missions accurately position their units, the enemy's forces, and the locations of the enemy's facilities or installations. Accuracy, reliability, precision in positioning, and timely measurements are some of the major factors driving the growth of market adoption in the defense sector.

- Many companies provide a wide range of products to cater to the needs of various end-users. For instance, in June 2022, Collins Aerospace introduced NavHub-200M, the first non-ITAR vehicular navigation system for the international market compatible with Military Code (M-Code) receiver technology. NavHub-200M provides Assured Positioning, Navigation, and Timing (APNT) capabilities while improving overall resistance to existing and emerging threats to Global Positioning Systems (GPS), such as spoofing and jamming.

- Similarly, in March 2023, Safran announced to offer a new product, NAVKITE, an integrated navigation and resilient timing solution combining a GEONYXTM-M and a VersaSync. This new product is a fully automated system based on a combination of the GeonyxTM-M navigation system and the VersaSynctime and frequency server that analyzes GNSS*/GPS signals and verifies their integrity.

- Owing to the increasing security concerns by the government of various countries, a navigation system has become an indispensable part of the defense sector. For instance, Britain is moving toward launching its satellite navigation system. The Conservative government of London recently announced that it has set aside GBP 92 million (~USD 115.3 million) to undertake a feasibility test for designing and developing an alternative to the Galileo Satellite System.

- Moreover, in September 2022, Raytheon Company Ltd. announced that it had been awarded a USD 583 million contract for US Army navigation to develop an updated version of a technology that provides soldiers with critical situational awareness and context on the battlefield. The technology will be mounted into various armored platforms, including Bradley Fighting Vehicles, Paladin artillery, and Abrams tanks, as well as lighter options, such as Strykers and Humvees.

North America Expected to Hold Significant Share

- The North American region holds the majority share in the global navigation system market. The primary reason for North America to be the market leader can be the early adoption of technology in the region and immense investment into advanced navigation systems. Also, increased spending on various automation technologies and building a smart infrastructure throughout the region is further expected to boost market growth.

- The key factors driving the market are the increasing penetration of cellular network infrastructure and the integration of technologies for applications, such as Automatic Vehicle Location (AVL), tracking systems, etc. However, factors such as lack of awareness, high cost of GNSS technology, and signal connectivity hinder the market's growth.

- The navigation system is mostly used in the defense sector. Tracking and positioning is a navigation system's primary application area used in the defense industry. Most of the defense industry's spending comes from the North American region, with the United States contributing the most.

- In January 2023, L3Harris announced to delivery of the Navigation Technology Satellite-3 to the U.S. Air Force and the spacecraft. NTS-3 is an Air Force Research Laboratory-funded experiment that will transmit Positioning, Navigation, and Timing (PNT) signals from Earth's geostationary orbit. The goal is to demonstrate next-generation PNT technology for the U.S. military and provide an alternative to GPS.

- The United States is the largest spender on national defense compared to countries like China, Saudi Arabia, India, France, Russia, the United Kingdom, Germany, etc.

- Moreover, the navigation system market in North America will witness high growth owing to the rising production of autonomous and passenger vehicles. Passenger vehicles are equipped with dashboards or dashboard-mounted navigation systems. These factory-installed navigation systems are more accurate, have more features, and have better integration than smartphone navigation.

- Furthermore, with the growing need for accuracy, automotive navigation technology is helping supply chain tracking and forecasting by incorporating applications that provide real-time delivery systems. Moreover, Ola, Uber, and Grab are expected to drive market growth as car-sharing services rely heavily on navigation-based technology.

Navigation Systems Industry Overview

The competitive rivalry in the navigation systems market is high owing to some key players like Garmin Ltd, Honeywell International Inc., Collins Aerospace Inc., Safran Electronics & Defense Inc., and many more. Their ability to continually innovate their products through significant research and development investments has helped them achieve a competitive advantage over other players.

- In February 2023, Raytheon Company Ltd. announced that it had won USD 8.6 million contract to provide F-35 JPALS for Japan Maritime Self-Defense Force (JMSDF). JPALS is a software-based differential Global Positioning System navigation and precision landing system. The contract was awarded by U.S. Navy. JPALS is integrated with the F-35 fighter, capable of operating, approaching, and landing on naval vessels at sea in all weather conditions.

- In January 2022, African countries joined part of the satellite-based augmentation system (SBAS) because of ASECNA (Agency for Aerial Navigation Safety in Africa and Madagascar) efforts. SBAS is a precise and robust Global Navigation Satellite System (GNSS) system that eliminates the need for regional ground-based navigation aids and airport landing systems. Africa Aviation, led by ASECNA, can develop its own SBAS system to assist the airlines or aviation stakeholders.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Implementation of Navigation Systems in the Automobile Industry

- 5.2 Market Restraints

- 5.2.1 High System Cost and Lack of Supporting Infrastructure in Developing Countries

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Defense

- 6.1.2 Aviation

- 6.1.3 Maritime

- 6.1.4 Automotive

- 6.1.5 Other Applications

- 6.2 By Type

- 6.2.1 Satellite Navigation Systems

- 6.2.2 Surgical Navigation Systems

- 6.2.3 Inertial Navigation Systems

- 6.2.4 Other Types

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Garmin Ltd

- 7.1.2 Honeywell International Inc.

- 7.1.3 Collins Aerospace Inc.

- 7.1.4 Safran Electronics & Defense Inc.

- 7.1.5 KVH Industries Inc.

- 7.1.6 Raytheon Company Ltd

- 7.1.7 SBG Systems SAS

- 7.1.8 Advanced Navigation Inc.

- 7.1.9 Trimble Navigation Ltd

- 7.1.10 Lord Sensing Systems Inc.

- 7.1.11 L3Harris Technologies Inc.

- 7.1.12 Northrop Grumman Corporation

- 7.1.13 Esterline Technologies Corporation

- 7.1.14 Moog Inc.