|

시장보고서

상품코드

1685844

가스 센서 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

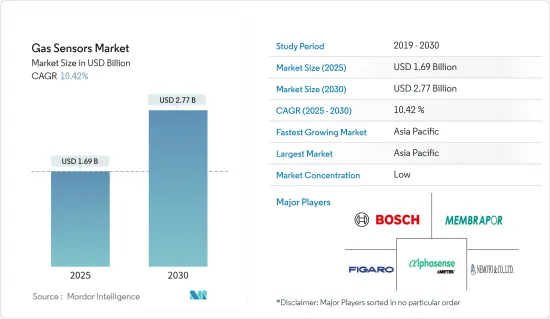

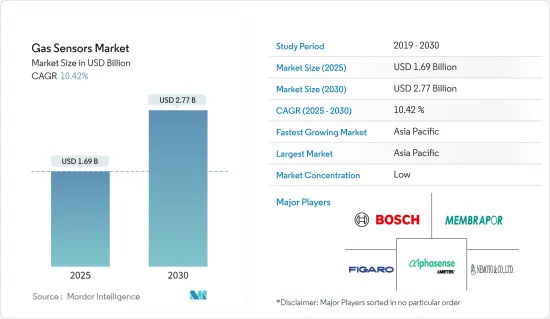

가스센서 시장 규모는 2025년에 16억9,000만 달러, 2030년에는 27억7,000만 달러에 달할 것으로 예측되며, 예측기간(2025-2030년)의 CAGR은 10.42%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 스마트 시티에서 가스 센서는 기상 관측소, 공공 구역, 빌딩 자동화 시스템의 공기 품질 검사 등 환경 모니터링에 적용됩니다. 이러한 광범위한 채용은 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다.

- 또한 난방, 환기 및 에어컨(HVAC) 시스템은 건물에 필수적이며 환경을 모니터링하고 가스 농도를 조정합니다. 이 두 가지 기능은 큰 수요를 불러 일으키고 시장 성장을 더욱 강화하고 있습니다.

- 가스 감지는 세계 석유 및 가스 부문에서 가장 중요합니다. 이 산업의 해양 드릴링 및 탐사 활동은 위험 가스, 가연성 가스 및 독성 가스를 발생시킵니다. 소량이면 양성의 가스도 있지만, 고농도가 되면 산소를 빼앗아 질식 등의 심각한 리스크로 이어집니다. 석유 생산량 증가가 예측되는 가운데 가스 센서 수요도 증가하고 있습니다. 이러한 센서는 장비, 파이프라인, 저장 탱크에서 가스 누출을 신속하게 파악하는 데 매우 중요합니다.

- 유독가스 및 위험가스와 관련된 직장에서의 위험에 대한 의식의 고조가 특히 석유 및 가스, 화학, 석유화학, 금속, 광업 등의 분야에서 가스센서의 채용을 뒷받침하고 있습니다. 잠재적인 위험을 감안할 때, 화학 산업에서는 가스 농도가 안전 한계를 초과할 경우 긴급 시스템을 작동시키기 위해 가스 센서에 의존하는 경우가 많습니다.

- 가스 센서의 제조 비용은 주로 기술의 진보에 따라 상승하고 있습니다. 많은 센서들은 현재 미세전기기계(MEMS)와 나노테크와 같은 최첨단 기술을 통합하고 있지만, 이들은 성능을 향상시키면서 제조 공정을 복잡화시키고 비용을 상승시키고 있습니다. 이러한 첨단 센서 기술 개발에는 연구 개발에 많은 투자가 필요하며 비용 구조가 더욱 악화됩니다. 기존 제조업체는 이러한 변화에 적응하고 있지만, 신규 참가 제조업체나 중견 제조업체는 큰 장애물에 직면하고 있습니다.

- 가스 센서 시장은 러시아와 우크라이나 분쟁과 이어지는 경기 감속으로 현저한 혼란에 직면했습니다. 인플레이션과 금리 상승은 개인 소비를 억제하고 가스 센서 수요를 퇴각시켰습니다. 미국과 중국의 무역 마찰은 세계 공급망의 혼란을 악화시켰습니다. 특히 미국이 중국으로의 반도체 제조장치 수출을 엄격히 규제함으로써 중국의 가전과 자동차 부문의 생산을 방해했습니다.

가스 센서 시장 동향

일산화탄소(CO) 부문이 큰 시장 점유율을 차지

- 일산화탄소(CO)는 중독을 일으킬 수 있으며, 예측할 수 없는 이환율과 사망률의 주요 원인이 되기 때문에 큰 위협이 되고 있습니다. 이러한 이유로 이 위험한 가스를 감지하기 위한 최적의 재료와 기술을 파악하는 것이 매우 중요합니다. 금속 산화물 반도체(MOS) 센서는 특히 마이크로 또는 나노 박막 형태로 응용 분야에서 주목을 받고 있습니다.

- 일산화탄소는 본질적으로 독성이지만 산업 및 야금 작업에서 중요한 가연성과 환경 친화적인 에너지 원으로 사용됩니다. 일산화탄소는 산화 환원 반응에서 매우 중요한 역할을 하며, 금속의 정제를 돕습니다. 특히 일산화탄소는 가연성이 높고 폭발하기 쉽습니다. 잠재적 위험을 고려하면 일산화탄소 센서의 채택은 증가하는 경향이 있습니다. 이러한 추세는 특히 근로자의 안전을 중시하는 정부의 규제가 점점 더 엄격해짐에 따라 더욱 강화되고 있습니다.

- 일산화탄소 검지기는 무색, 무취, 무미의 이 가스를 검지하는 능력에 의해 다양한 산업에서 불가결한 것이 되고 있습니다. 이러한 센서는 일산화탄소 중독을 피하는 데 매우 중요합니다. 일산화탄소 중독은 방치하면 의식 상실, 발작 또는 죽음과 같은 심각한 결과를 초래할 수 있습니다. 미국에서만 이 조용한 살인범이 연간 20,000 명 이상이 응급 외래를 받도록 했으며, 많은 국가에서 가장 흔한 치명적인 중독이 되었습니다.

- 일산화탄소(CO)는 신체의 장기와 조직에 산소 공급을 억제하여 건강에 해를 끼칠 수 있습니다. 심장병을 앓고 있는 사람은 CO 농도가 낮아도 위험이 높아져 흉통, 운동능력 저하 등의 증상을 경험하고 반복적으로 노출되면 심혈관계의 합병증을 일으킬 수 있습니다. 도로를 달리는 자동차 증가로 인해 대량의 CO가 발생하기 때문에 환경 속의 가스를 분석 및 검출하는 가스 센서에 대한 큰 수요가 발생하고 있습니다. CO(일산화탄소)가스 센서는 가정과 자동차에서 산업 환경에 이르기까지 다양한 환경에서 일산화탄소를 식별하기 위해 설계된 가스 감지 장비의 중요한 구성 요소입니다.

- 환경보호청에 따르면 미국에서는 2023년 산불에 의한 것을 제외하고 약 4,230만 톤의 일산화탄소(CO)가 배출됩니다. 이러한 CO 배출량 증가는 부문 성장의 새로운 시장 기회를 창출합니다.

아시아태평양이 큰 성장을 이룰 전망

- 이산화탄소에 이어 메탄은 지구온난화에 큰 영향을 미치는 온실가스입니다. 중국은 화석연료활동에 의한 메탄 배출량이 톱 클래스이며, 메탄 배출량의 억제를 강요받고 있습니다.

- 생태환경부(Ministry of Ecology and Environment)에 의해 최근 발표된 중국의 메탄계획에서는 그 대처가 개략되어 있음에도 불구하고 메탄 배출량의 억제가 강요되고 있습니다. 메탄 배출의 억제에는 불충분한 데이터 수집, 세제상의 규제 기준, 지속적인 기술적 및 경영적 장애물 등이 있습니다.

- 지정학적 갈등으로 인한 에너지 가격 상승으로 수소와 같은 대체 에너지원에 대한 관심이 높아지고 있습니다. 수소는 산업 및 주거용 1차 에너지원이 될 수 있습니다. 의료 산업은 카푸노그래피와 호기 분석기 등의 기기에 가스 센서가 탑재되어 견조하게 추이할 것으로 예측됩니다.

- 가스 센서는 수소 누출을 감지하고 수소의 안전한 제조, 저장 및 사용을 보장하기 위해 매우 중요합니다. 일본은 깨끗한 에너지원으로서 수소에 상당액의 투자를 실시하고 있어 자동차나 발전용의 수소 연료전지의 개발에 임하고 있습니다. 가스 센서는 수소 누출을 감지하고 수소의 안전한 생산, 저장 및 사용을 보장하기 위해 매우 중요합니다.

- 예를 들어, 일본에서 가장 유명한 발전 회사인 JERA는 2035년까지 암모니아와 수소 연료 공급에 60억 달러 이상을 투자할 의향입니다. 이 회사가 가장 주력하는 것은 블루 수소와 그린 수소입니다. 블루 수소는 천연가스로부터 제조되어 이산화탄소를 배출하지만 이를 회수 및 저장함으로써 온실가스에 대한 영향을 최소화합니다. 한편, 녹색수소는 물의 전기분해를 이용한 태양에너지와 풍력에너지의 재생가능한 자원으로부터 제조됩니다.

가스 센서 산업 개요

가스 센서 시장은 많은 업체들이 존재하기 때문에 세분화됩니다. 다양한 유형의 가스 센서를 제공하는 기업은 기술적 제품 차별화를 도모하고 있습니다. 따라서 시장 점유율을 얻기 위해 경쟁사와의 가격 경쟁 전략을 채택하고 있습니다. 주요 기업으로는 Membrapor AG, AlphaSense Inc., Nemoto & Co.Ltd, Figaro Engineering Inc., Robert Bosch GmbH 등이 있습니다.

2023년 10월-Figaro Engineering은 독일 노이스에 Figaro 유럽 사무소를 개소한다고 발표했습니다. 이 전략적 움직임은 고객과 현지 리셀러에게 전담 기술 지원을 제공함으로써 유럽에서 Figaro의 존재감을 높이는 것을 목표로 합니다. 이 사무소는 마케팅 활동의 선두에 가까워질 것으로 예상되며 유럽 시장에서 발판을 확장하는 Figaro의 약속을 강조합니다.

2023년 10월 - MEMBRAPOR AG는 NO2/CA-2 센서를 강화하여 그 감도를 거의 2배로 높였습니다. 이 개선으로 ppb 범위의 저농도를 검출할 수 있게 되었습니다. 이 센서는 전기 화학 NO2 센서에서 일반적인 O3 교차 감도를 효과적으로 완화시키는 확립된 촉매 O3 필터를 갖추고 있습니다. NO2/CA-20 센서를 도입하여 측정 능력을 최대 20ppm의 범위로 확장했습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 정부 규제에 대응하기 위한 자동차용 가스 센서 수요 증가

- 주요 산업에 있어서의 노동 재해에 대한 의식의 고조

- 시장의 과제

- 비용 상승과 제품 차별화의 부족

제6장 시장 세분화

- 유형별

- 산소

- 일산화탄소(CO)

- 이산화탄소(CO2)

- 질소 산화물

- 탄화수소

- 기타 유형

- 기술별

- 전기화학식

- 광이온화 검출기(PID)

- 고체, 금속 산화물 반도체

- 촉매식

- 적외선

- 반도체

- 용도별

- 의료

- 빌딩 자동화

- 산업

- 음식

- 자동차

- 수송 및 물류

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 아시아

- 중국

- 일본

- 인도

- 호주 및 뉴질랜드

- 라틴아메리카

- 브라질

- 아르헨티나

- 멕시코

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Figaro Engineering Inc.

- Membrapor AG

- AlphaSense Inc.

- Nemoto & Co. Ltd

- Robert Bosch GmbH

- Delphi Technologies

- SGX Sensortech Ltd(Amphenol Corporation)

- Zhengzhou Winsen Electronics Technology Co., Ltd.

- Niterra Co. Ltd.(NGK-NTK)

- Senseair(Asahi Kesai)

- Drgerwerk AG & Co. KGaA

제8장 투자 분석

제9장 시장 기회와 미래 성장

SHW 25.04.01The Gas Sensors Market size is estimated at USD 1.69 billion in 2025, and is expected to reach USD 2.77 billion by 2030, at a CAGR of 10.42% during the forecast period (2025-2030).

Key Highlights

- In smart cities, gas sensors find applications in environmental monitoring, including air quality checks at weather stations, public areas, and within building automation systems. This widespread adoption is expected to drive the market's growth through the forecast period.

- Additionally, heating, ventilation, and air conditioning (HVAC) systems are integral to buildings, monitoring environments and regulating gas concentrations. This dual functionality has spurred significant demand, further fueling market growth.

- Gas detection is paramount in the global oil and gas sector. This industry's offshore drilling and exploration activities produce a spectrum of hazardous, flammable, and toxic gases. While some gases are benign in small quantities, they can deplete oxygen in high concentrations, leading to severe risks like suffocation. As oil production is projected to rise, so is the demand for gas sensors. These sensors are crucial for swiftly identifying gas leaks from equipment, pipelines, and storage tanks.

- Increasing awareness of workplace hazards related to toxic and hazardous gases is propelling the adoption of gas sensors, especially in sectors like oil and gas, chemicals, petrochemicals, metals, and mining. Given the potential risks, chemical industries often rely on gas sensors to trigger emergency systems when gas concentrations exceed safe limits.

- Production costs for gas sensors have increased, primarily due to technological advancements. Many sensors now incorporate cutting-edge technologies like microelectromechanical systems (MEMS) or nanotech, which, while enhancing performance, also complicate the fabrication process, thereby increasing costs. Developing these advanced sensor technologies necessitates substantial investments in research and development, further adding to the cost structure. While established players have adapted to these changes, newcomers and mid-tier manufacturers face significant hurdles.

- The gas sensors market faced notable disruptions due to the Russia-Ukraine conflict and subsequent economic slowdown. Rising inflation and interest rates curtailed consumer spending, dampening the demand for gas sensors. The trade tensions between the United States and China exacerbated global supply chain disruptions. Notably, the United States' stringent controls on semiconductor manufacturing equipment exports to China have hampered production in China's consumer electronics and automotive sectors.

Gas Sensors Market Trends

Carbon Monoxide (CO) Segment to Hold Significant Market Share

- Carbon monoxide (CO) poses a significant threat as it can cause intoxication, a leading factor in unpredictable morbidity and mortality, which is often linked to inhalation injuries from combustion. This underscores the critical need to identify optimal materials and technologies for detecting this hazardous gas. Metal oxide semiconductor (MOS) sensors have garnered attention, especially for their application in micro- or nano-thin film formats.

- While carbon monoxide is inherently toxic, it serves as a crucial, combustible, and eco-friendly energy source in industrial and metallurgical operations. It plays a pivotal role in redox reactions, aiding in metal purification. Notably, carbon monoxide is both highly flammable and prone to explosions. Given the potential dangers, the adoption of carbon monoxide sensors is on the rise. This trend is further propelled by increasingly stringent government regulations, particularly those emphasizing worker safety.

- Carbon monoxide detectors are indispensable in various industries, primarily for their ability to detect this colorless, odorless, and tasteless gas, which is otherwise imperceptible to human senses. Such sensors are pivotal in averting carbon monoxide poisoning, a condition that, when left unchecked, can lead to severe consequences, including loss of consciousness, seizures, or even death. In the United States alone, this silent killer prompts over 20,000 emergency room visits annually and stands as the most common fatal poisoning in many nations.

- Carbon monoxide (CO) can harm health by impeding oxygen delivery to the body's organs and tissues. Individuals with heart disease face heightened risks even at lower CO levels, experiencing symptoms like chest pain, reduced exercise capacity, and potentially additional cardiovascular complications with repeated exposure. The growing number of vehicles on the road generates a huge amount of CO, which creates a significant demand for gas sensors to analyze and detect gases in the environment. CO (Carbon Monoxide) gas sensors are crucial components in gas detection equipment, designed to identify carbon monoxide in various settings, from homes and automotive to industrial environments.

- According to the Environmental Protection Agency, the United States saw emissions of around 42.3 million tons of carbon monoxide (CO) in 2023, excluding those from wildfires. Such increased CO emissions create new market opportunities for segment growth.

Asia-Pacific Expected to Witness Major Growth

- After CO2, methane is the second most impactful greenhouse gas, significantly contributing to global warming. China is one of the top methane emitters from fossil fuel activities, and the nation is under pressure to rein in its methane output.

- Despite efforts outlined in China's recent methane plan issued by the Ministry of Ecology and Environment. These include inadequate data collection, tax regulatory standards, and ongoing technical and managerial hurdles in controlling methane emissions.

- The increase in energy prices due to geopolitical conflicts has caused a growing interest in alternative energy sources like Hydrogen. Hydrogen can potentially be a primary energy source for industrial and residential uses. The medical industry is projected to stay steady, with gas sensors in devices like capnography and breath analyzers.

- Gas sensors are crucial for detecting hydrogen leaks and ensuring Hydrogen's safe production, storage, and utilization. Japan invests heavily in Hydrogen as a clean energy source, with initiatives to develop hydrogen fuel cells for vehicles and power generation. Gas sensors are crucial for detecting hydrogen leaks, ensuring the safe production, storage, and utilization

- For instance, Japan's most prominent power generation company, JERA, intends to invest over USD 6 billion in ammonia and hydrogen fuel supplies by 2035. The company's primary focus will be on blue and green Hydrogen. Blue Hydrogen is generated from natural gas, which produces carbon emissions that are then captured and stored to minimize its greenhouse gas impact. In contrast, green Hydrogen is produced through water electrolysis-powered solar and wind energy renewable resources.

Gas Sensors Industry Overview

The gas sensors market is fragmented because of the presence of many players. The companies offering various types of gas sensors have technological product differentiation. Hence, they are adopting competitive pricing strategies to gain market share. Some of the key players include Membrapor AG, AlphaSense Inc., Nemoto & Co. Ltd, Figaro Engineering Inc., and Robert Bosch GmbH

October 2023-Figaro Engineering announced the opening of the Figaro Europe Office in Neuss, Germany. This strategic move aimed to bolster Figaro's presence in Europe by offering dedicated technical support to customers and local distributors. The office was expected to spearhead targeted marketing initiatives, underscoring Figaro's commitment to expanding its foothold in the European market.

October 2023 - MEMBRAPOR AG enhanced its NO2/CA-2 sensor, boosting its sensitivity to nearly double its capability. This advancement enabled the sensor to detect lower concentrations in the ppb range. The sensor features its established catalytic O3 filter, effectively mitigating the common O3 cross-sensitivity in electrochemical NO2 sensors. It introduced the NO2/CA-20 sensor, extending its measurement capabilities to ranges of up to 20 ppm.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Gas Sensors in Automobiles for Compliance with Governmental Regulations

- 5.1.2 Growing Awareness on Occupational Hazards across Major Industries

- 5.2 Market Challenges

- 5.2.1 Rising Costs and Lack of Product Differentiation

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Oxygen

- 6.1.2 Carbon Monoxide (CO)

- 6.1.3 Carbon Dioxide (CO2)

- 6.1.4 Nitrogen Oxide

- 6.1.5 Hydrocarbon

- 6.1.6 Other Types

- 6.2 By Technology

- 6.2.1 Electrochemical

- 6.2.2 Photoionization Detectors (PID)

- 6.2.3 Solid State/Metal Oxide Semiconductor

- 6.2.4 Catalytic

- 6.2.5 Infrared

- 6.2.6 Semiconductor

- 6.3 By Application

- 6.3.1 Medical

- 6.3.2 Building Automation

- 6.3.3 Industrial

- 6.3.4 Food and Beverages

- 6.3.5 Automotive

- 6.3.6 Transportation and Logistics

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Figaro Engineering Inc.

- 7.1.2 Membrapor AG

- 7.1.3 AlphaSense Inc.

- 7.1.4 Nemoto & Co. Ltd

- 7.1.5 Robert Bosch GmbH

- 7.1.6 Delphi Technologies

- 7.1.7 SGX Sensortech Ltd (Amphenol Corporation)

- 7.1.8 Zhengzhou Winsen Electronics Technology Co., Ltd.

- 7.1.9 Niterra Co. Ltd. (NGK-NTK)

- 7.1.10 Senseair (Asahi Kesai)

- 7.1.11 Drgerwerk AG & Co. KGaA