|

시장보고서

상품코드

1640513

산소 가스 센서 시장 전망 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Oxygen Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

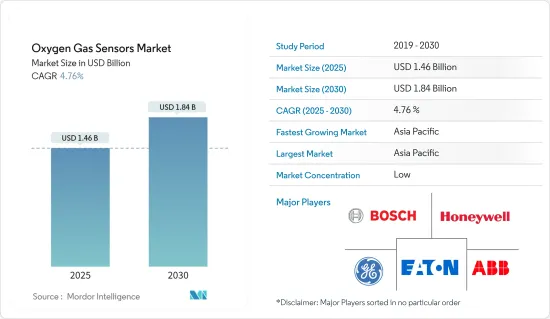

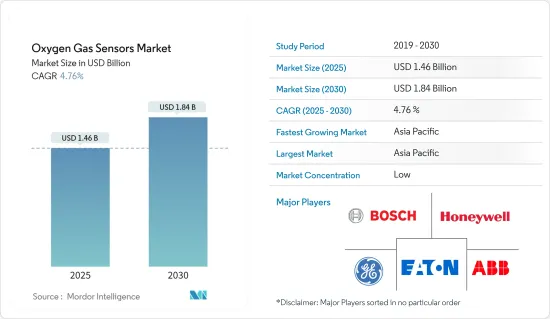

산소 가스 센서 시장 규모는 2025년에 14억 6,000만 달러로 추정되며, 예측 기간(2025-2030년)의 연평균 성장율(CAGR)은 4.76%로, 2030년에는 18억 4,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 광산, 석유 생산 시설, 화학 공장과 같은 산업 안전 환경에서는 산소 농도나 분압을 안정적으로 측정하고 비정상적인 상태를 경고하는 기능이 매우 중요합니다. 이는 시장 성장을 견인하는 데 도움이 됩니다.

- 시장의 성장은 의료, 자동차 및 산업 분야를 포함한 다양한 응용 분야에서 산소 가스 센서에 대한 수요가 증가했기 때문일 수 있습니다. 또한 감지 기술의 급속한 기술 발전과 함께 산소 센서의 응용 분야가 증가하고 있습니다. 또한 안전과 보안에 대한 인식이 높아지는 것도 이 시장의 성장을 견인하고 있습니다.

- 또한 환경 문제도 산소 가스 센서의 성장을 촉진하는 데 중요한 역할을 합니다. 용존 산소는 하구 및 근해 연안 해역에서 조개류, 어류 및 기타 수생 생물의 균형 잡힌 개체군 유지에 필수적인 요건이라고 알려져 있습니다. 수중 용존 산소를 측정하기 위한 다양한 프로젝트가 시행되어 왔고 앞으로도 시행될 예정입니다. 또한 암모니아, 오존, 염소는 모두 폐수 처리 및 정수장의 오염 제거 단계에서 사용되는 독성 가스입니다. 이러한 요인들은 산소 가스 센서에 대한 수요를 증가시킬 것입니다.

- 또한 자동차의 공기와연료 비율 조정부터 산업 공정 제어에 이르기까지 산소 수준을 정확하게 파악하는 것이 필수적이므로 산소 센서에 대한 수요가 점점 더 증가하고 있습니다. 예를 들어, 2022년 8월 Premier Auto Trade는 산소 및 공기 연료 비율 센서 제품군을 대폭 확장한다고 발표했습니다. 이제 일본, 한국, 미국, 유럽 제조업체에 걸쳐 800개 이상의 가솔린, LPG, 디젤 차량용 다이렉트 핏 산소 센서가 PAT 제품군에 포함됩니다. 이는 호주와 뉴질랜드에서 1,400만 대 이상의 차량에 적용되어 호주 애프터마켓에서 가장 광범위한 제품군입니다.

- 예를 들어, 2022년 8월 마하라슈트라주의 한 스타트업은 수소 가스 감지 기술의 토착화를 위해 정부로부터 3290만 루피(미화 0.4만 달러)의 지원을 받았습니다. 멀티 나노 센스 테크놀로지스는 수소 감지 및 분석 기술의 토착 개발을 위해 DST 산하 기술 개발 위원회와 양해각서(MoU)를 체결했습니다.

- 또한 병원 및 기타 의료 시설에서 낮은 수준의 산소를 측정할 수 있는 정밀한 장치에 대한 필요성이 증가함에 따라 이러한 산소 가스 센서의 의료 응용 분야가 빠르게 성장할 것으로 예상됩니다. 이러한 장치는 저산소 또는 무산소 손상을 입은 환자나 심폐정지 환자를 모니터링하는 데 활용됩니다. 또한 천식이나 만성폐쇄성폐질환(COPD)과 같은 호흡기 질환 환자를 위한 비침습적 인공호흡 시술에도 사용됩니다.

- 각 회사는 최근 시장 경쟁을 유지하기 위해 신제품을 투입하고 있습니다. 또한 Crowcon Detection Instruments Ltd는 Gasman 휴대용 가스 감지기에 장수명 산소 센서를 출시했습니다. 이 새로운 센서는 수명이 연장되어 총소유비용이 절감되고 납이 전혀 포함되어 있지 않아 조직이 임박한 유해물질 제한(RoHS) 규정 변경을 준수하고 환경에 대한 피해를 줄일 수 있도록 도와줍니다.

산소 가스 센서 시장 동향

자동차 부문이 큰 시장 수요를 차지

- 산소 가스 센서는 자동차 실린더로 유입되는 산소의 양을 정확하게 측정하기 위해 주로 자동차 배기 장치에 사용됩니다. 이 기기는 가솔린, 디젤, 가스 엔진의 배기가스 배출을 관리하는 데 사용됩니다. 자동차 차량의 증가와 정부의 엄격한 배기가스 규제는 향후 차량용 산소 가스 센서 판매를 촉진할 것으로 예상됩니다.

- 또한, 구형 차량에 대한 차량용 산소 가스 센서의 개조가 증가함에 따라 향후 몇 년 동안 이해 관계자들에게 상당한 기회를 제공할 것으로 예상됩니다. 2022년 8월, 인도 정부는 뭄바이에서 인도 최초의 2층 전기 버스를 출시했습니다. 인도 정부는 도시 교통 개혁을 강조하며 탄소 배출량이 적고 승객 밀도가 높은 통합 전기자동차(EV) 모빌리티 생태계를 조성하기 위해 노력하고 있습니다.

- 차량용 산소 가스 센서용 코팅 소재의 급속한 발전은 전 세계 차량용 산소 센서 시장에 새로운 패러다임을 가져올 것으로 예상됩니다. 현재 대부분의 업체들은 산소 센서에 고온 소성 세라믹(HTCC) 그린 테이프를 사용하여 강도가 높고 수명이 긴 차량용 센서를 제작하고 있습니다.

- 또한 보쉬는 2022년 8월 사우스캐롤라이나주 앤더슨에 연료전지 스택 생산을 위해 2억 달러 이상을 투자한다고 발표했습니다. 연료전지는 수소를 사용하여 전기 에너지를 생성하는 방식으로 작동합니다. 수소 이온이 연료전지 판을 통과하면서 산소와 결합하여 전기를 생성합니다. 유일한 부산물은 물뿐이므로 차량은 지역 탄소 배출을 전혀 하지 않고 운행할 수 있습니다.

- 또한 이 산업은 국내 및 국제 당국의 엄격한 정책과 규제가 적용되기 때문에 이러한 시스템을 의무적으로 사용해야 합니다. 산업계는 정부와 관련 당국이 정한 배출 기준을 충족하기 위해 산소 센서에 의존하고 있습니다. 예를 들어, 대부분의 가솔린 차량에는 미국 환경보호청의 엄격한 배기가스 배출 규제를 준수하기 위해 촉매 변환기가 장착되어 있습니다.

가장 빠른 성장률을 기록할 아시아태평양 지역

- 이 지역의 자동차 부문은 자동차 생산량 증가로 산소 센서 탑재의 중요한 원동력이 될 것으로 예상됩니다. India Brand Equity Foundation(IBEF)에 따르면 인도의 승용차 시장은 2027년까지 548억 4,000만 달러에 달할 것으로 예상됩니다. 인도의 자동차 산업은 2016-2026년 사이에 자동차 수출을 5배로 늘리는 것을 목표로 하고 있습니다. 또한 2022년도 인도의 자동차 수출 총액은 561만 7,246대였습니다.

- 또한, 2022년 3월 중국 상하이자동차가 소유한 MG 모터스는 전기자동차(EV) 확장을 포함한 미래 수요를 충당하기 위해 인도에서 3억 5,000만-5억 달러의 사모펀드를 조성할 계획이라고 발표했습니다. 또한, 이륜차 EV 제조업체인 Rays Power Infra의 다각화된 비즈니스 벤처인 HOP Electric Mobility는 향후 2년 동안 전기 자동차 제조 능력을 확장하기 위해 100억 루피(1,324만 달러)를 투자할 계획입니다. 이 지역의 자동차 사용 증가는 결과적으로 산소 가스 센서 시장을 주도하고 있습니다.

- 또한 인도 정부는 자동차 부문에 대한 외국인 투자를 장려하고 있으며 자동 경로를 통해 100% 외국인 직접 투자를 허용하고 있습니다. 또한, 2022년 2월에는 현지 자동차 제조를 늘리고 신규 투자를 유치하기 위한 정부 계획의 일환으로 타타 모터스, 스즈키 모터 구자라트, 마힌드라 앤 마힌드라, 현대, 기아 인도 법인 등 자동차 제조업체들이 PLI를 받았습니다. 20개 자동차 회사는 약 45,000루피(미화 59억 5,000만 달러)의 투자를 제안했습니다. 자동차 부문의 정부 정책과 노력은 향후 연구된 시장 수요를 더욱 촉진할 수 있습니다.

- 이 지역의 산업 제조업은 또한 개발도상국의 경제 발전과 “중국 제조” 및 “인도 제조”와 같은 정부 이니셔티브로 인해 증가 할 것으로 예상됩니다. 산업 부문의 성장은 산업 부문에서 산소 센서의 광범위한 응용으로 인해 산소 센서 시장을 활성화 할 것으로 예상됩니다.

- 화학 및 석유화학 부문은 산소 센서의 응용 분야가 많습니다. 이 지역은 세계에서 가장 광범위한 탐사가 이루어지는 곳 중 하나입니다. 예를 들어, IBEF에 따르면 2022-2023년 연합 예산에 따라 정부는 화학 및 석유화학 부서에 INR 209크로레(2,743만 달러)를 배정했습니다. 또한 2025년까지 인도 화학 및 석유화학 부문에 8억 루피(미화 1,738억 달러)가 투자될 것으로 예상됩니다.

산소 가스 센서 산업 개요

산소 가스 센서 시장은 다수의 진출기업이 존재하고 상대적으로 낮은 진입 장벽으로 인해 상당히 세분화되어 있는 것이 특징입니다. ABB, Honeywell, Eaton, GE 등 주요 시장 진출 기업들은 시장 점유율 확대를 위해 전략적 파트너십과 제품 개척에 지속적으로 노력하고 있습니다.

2023년 3월 LogiDataTech는 가스 혼합물의 산소 농도를 정밀하게 측정할 수 있도록 설계된 최첨단 솔루션인 MF420-O-Zr 산소 센서를 출시했습니다. 이 센서는 두 개의 이산화지르코늄 조각을 사용하여 밀폐된 챔버를 만드는 동적 공정을 채택하여 전체 범위에서 정확한 선형 측정이 가능합니다. 또한 산소 센서에는 사용 중 성능을 모니터링하고 잠재적인 하드웨어 또는 센서 문제에 대한 경고를 제공하는 진단 기능이 내장되어 있습니다. 따라서 별도의 산소 센서가 필요하지 않습니다.

2022년 5월, Angst Pfister Sensors and Power는 금속, 세라믹, 폴리머 적층 제조 공정을 위해 특별히 설계된 혁신적인 산소 센서를 공개했습니다. 수명이 긴 이 디지털 산소 센서와 적층 제조용 센서 모듈은 높은 ppm 신호 분해능을 제공하며 대부분의 다른 가스로 인한 간섭의 영향을 받지 않습니다.

2022년 3월, Sea-Bird Scientific은 GO-BGC 프로그램의 일환으로 나비스 플로트의 표준 센서가 될 SBS 83 광학 산소 센서의 출시를 발표했습니다. GO-BGC 프로그램은 전 세계 해양의 상태를 모니터링하기 위한 화학 및 생물학적 센서 네트워크를 구축하는 것을 목표로 합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인과 시장 성장 억제요인의 채택

- 시장 성장 촉진요인

- 직장에서의 안전 확보를 위한 정부 규제

- 시장 성장 억제요인

- 중소기업에서 산소 센서의 용도와 사용에 대한 인식 부족

- 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형별

- 전위차

- 암페로 메트릭

- 저항식

- 기타

- 기술별

- 적외선

- 촉매식

- 기타

- 최종 사용자 산업별

- 화학제품 및 석유화학제품

- 자동차

- 의료 생명 과학

- 공업

- 상하수도

- 스마트 빌딩

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 아시아

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 라틴아메리카

- 브라질

- 아르헨티나

- 멕시코

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Robert Bosch GmbH

- ABB Limited

- Honeywell International Corporation

- Eaton Corporation

- General Electric Company

- Figaro Engineering Inc.

- Advanced Micro Instruments Inc.

- Yokogawa Electric Corporation

- City Technology Limited

- Delphi Automotive PLC

- Hamilton Company

- Sensore Electronic GmbH

- Aeroqual Limited

- AlphaSense Inc.

- Control Instruments Corporation

- Fujikura Limited

- Membrapor AG

- Mettler-Toledo International Inc.

- Francisco Albero SAU

- Maxtec LLC

제7장 투자 분석

제8장 시장의 미래

HBR 25.02.13The Oxygen Gas Sensors Market size is estimated at USD 1.46 billion in 2025, and is expected to reach USD 1.84 billion by 2030, at a CAGR of 4.76% during the forecast period (2025-2030).

Key Highlights

- The ability to reliably measure oxygen concentration or partial pressure and warn about abnormal conditions is critical in industrial safety environments, such as mines, oil production facilities, and chemical plants. This helps in driving the growth of the market.

- The growth in the market can be attributed to the rising demand for oxygen gas sensors in a range of applications, including medical, automotive, and industrial sectors. Also, the increasing number of applications for oxygen sensors, coupled with rapid technological advancements in sensing technologies. Furthermore, the increasing awareness regarding safety and security is also driving the growth of this market.

- Moreover, environmental concerns play a crucial role in driving the growth of oxygen gas sensors. It is known that dissolved oxygen is a critical requirement for the maintenance of balanced populations of shellfish, fish, and other aquatic organisms in both estuarine and nearshore coastal waters. Various projects have been and are expected to be implemented to measure the dissolved oxygen in the water. Furthermore, ammonia, ozone, and chlorine are all toxic gases used in the decontamination stage of wastewater treatment and water purification plants. Such factors will boost the demand for oxygen gas sensors.

- Furthermore, applications ranging from adjusting the air-fuel ratio in automobiles to controlling industrial processes increasingly demand oxygen sensors, as ascertaining oxygen levels accurately is essential. For instance, in August 2022, Premier Auto Trade announced a significant expansion to its Oxygen and Air Fuel Ratio Sensors range. The PAT range now includes over 800 Direct Fit Oxygen Sensors for petrol, LPG, and diesel vehicles with a spread across Japanese, Korean, USA, and European manufacturers. This covers over 14 million vehicle applications in Australia and New Zealand, making it the most extensive range in the Australian Aftermarket.

- For instance, in August 2022, a Maharashtra Startup Got INR 32.9 million (USD 0.40 million) support from the Government for Indigenous Development of Hydrogen Gas Detecting Technology. Multi Nano Sense Technologies signed a memorandum of understanding (MoU) Technology Development Board under DST for the indigenous development of hydrogen sensing and analysis technology.

- Also, the medical application of these oxygen gas sensors is expected to experience rapid growth due to a rising need for precise devices that can measure low levels of oxygen in hospitals and other healthcare facilities. These devices are utilized for monitoring patients who have hypoxic or anoxic injuries, as well as those experiencing cardiopulmonary arrest. Additionally, they are also employed in non-invasive ventilation procedures for patients with respiratory disorders like asthma or chronic obstructive pulmonary disease (COPD).

- Companies are rolling out new products lately to remain competitive in the market. Further, Crowcon Detection Instruments Ltd launched a long-life oxygen sensor in its Gasman portable gas detector. The new sensor has an extended lifespan, which reduces the total cost of ownership and is also completely free of lead, helping organizations to comply with imminent changes to the restriction of hazardous substances (RoHS) regulations and reducing harm to the environment.

Oxygen Gas Sensors Market Trends

Automotive Sector to Occupy a Significant Market Demand

- Oxygen gas sensors are majorly employed in automobile exhausts to measure the amount of oxygen entering the car cylinders accurately. This instrument is used to manage the released emissions of petrol, diesel, and gas engines. The growing fleet of automotive vehicles, combined with tight government emission control regulations, is expected to stimulate automotive oxygen gas sensor sales in the future.

- Furthermore, the growing retrofitting of automotive oxygen gas sensors for vintage vehicles is expected to provide considerable opportunities for stakeholders in the coming years. In August 2022, the Indian government launched India's first double-decker electric bus in Mumbai. It is working to create an integrated electric vehicle (EV) mobility ecosystem with a low carbon footprint and high passenger density, emphasizing urban transportation reform.

- Rapid advancements in coating materials for automotive oxygen gas sensors are expected to usher in new paradigms in the worldwide automotive oxygen sensor market. Most players now use high-temperature co-fired ceramic (HTCC) green tapes with oxygen sensors to create high-strength and long-lasting vehicle sensors.

- Furthermore, in August 2022, Bosch announced a more than USD 200 million investment to produce fuel cell stacks in Anderson, S.C. A fuel cell operates by using hydrogen to generate electrical energy. As the hydrogen ions pass over the fuel cell plates, they combine with oxygen to create electricity. The only by-product is water, allowing the vehicle to run with zero local carbon emissions.

- Moreover, the industry is governed by strict policies and regulations employed by both national and international authorities, making it mandatory to utilize these systems. The industry depends on oxygen sensors to meet the emission standards governments and concerned authorities set. For instance, most gasoline-powered vehicles are equipped with catalytic converters to comply with the US Environmental Protection Agency's stricter regulation of exhaust emissions.

Asia-Pacific to Mark the Fastest Growth Rate

- The automotive sector in this region is expected to be the significant driver for incorporating oxygen sensors due to the increasing automobile production. According to the India Brand Equity Foundation (IBEF), the Indian passenger car market is predicted to reach a value of USD 54.84 billion by 2027. Indian automotive industry is targeting to increase the export of vehicles by five times during 2016-2026. Furthermore, in FY 2022, total automobile exports from India stood at 5,617,246.

- In addition, in March 2022, MG Motors, owned by China's SAIC Motor Corp, announced plans to raise USD 350-500 million in private equity in India to fund its future needs, including electric vehicle (EV) expansion. In addition, Two-wheeler EV maker HOP Electric Mobility, a diversified business venture of Rays Power Infra, is looking at investing INR 100 crore (USD 13.24 million) over the next two years to extend manufacturing capacity for Electric Vehicles. The increased usage of automobiles in the region consequently drives the market for oxygen gas sensors.

- Furthermore, the government of India encourages foreign investment in the automobile sector and has allowed 100% FDI under the automatic route. Furthermore, in February 2022, carmakers, including Tata Motors Ltd, Suzuki Motor Gujarat, Mahindra and Mahindra, Hyundai, and Kia India Pvt. Ltd received PLI as part of the government's plan to increase local vehicle manufacturing and attract new investment. The 20 automobile companies proposed an investment of around INR 45,000 crore (USD 5.95 billion). Government policies and initiatives in the automotive sector may further drive the studied market demand in the future.

- The region's industrial manufacturing is also set to increase due to developing economies and government initiatives like "Make in China" and "Make in India." The growth of the industrial sector is expected to boost the oxygen sensors market due to its wide applications in the industrial sector.

- The chemical and petrochemical sectors have many applications for oxygen sensors. The region is home to one of the most extensive explorations in the world. For instance, According to IBEF, under the Union Budget 2022-2023, the government allotted INR 209 crores (USD 27.43 million) to the Department of Chemicals and Petrochemicals. Furthermore, an investment of INR 8 lakh crore (USD 107.38 billion) is estimated in the Indian chemicals and petrochemicals sector by 2025.

Oxygen Gas Sensors Industry Overview

The oxygen gas sensors market is characterized by significant fragmentation due to the presence of numerous players and relatively low entry barriers. Key industry participants, including ABB, Honeywell, Eaton, and GE, continuously engage in strategic partnerships and product development initiatives to expand their market share.

In March 2023, LogiDataTech introduced the MF420-O-Zr oxygen sensor, a cutting-edge solution designed for precise measurement of oxygen concentration in gas mixtures. This sensor employs a dynamic process that utilizes two zirconium dioxide slices to create a sealed chamber, enabling accurate linear measurement across the entire range. Additionally, the oxygen sensor features a built-in diagnostic function that monitors its performance during use and provides alerts about potential hardware or sensor issues. Consequently, there is no need for an extra oxygen sensor.

In May 2022, Angst+Pfister Sensors and Power unveiled an innovative oxygen sensor designed specifically for metal, ceramic, and polymer Additive Manufacturing procedures. These long-life digital oxygen sensors and sensor modules for Additive Manufacturing offer high ppm signal resolution and are not affected by interference from most other gases.

In March 2022, Sea-Bird Scientific announced the launch of the SBS 83 Optical Oxygen Sensor, which is set to become the standard sensor for Navis floats as part of the GO-BGC program. The GO-BGC program aims to create a network of chemical and biological sensors to monitor the health of the global oceans.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Government Regulations to Ensure Safety in Work Places

- 4.4 Market Restraints

- 4.4.1 Lack of Awareness of Applications and Usage of Oxygen Sensors in SMEs

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Potentiometric

- 5.1.2 Amperometric

- 5.1.3 Resistive

- 5.1.4 Other Types

- 5.2 By Technology

- 5.2.1 Infrared

- 5.2.2 Catalytic

- 5.2.3 Other Technologies

- 5.3 By End-User Industry

- 5.3.1 Chemical and Petrochemical

- 5.3.2 Automotive

- 5.3.3 Medical and Life Sciences

- 5.3.4 Industrial

- 5.3.5 Water and Wastewater

- 5.3.6 Smart Buildings

- 5.3.7 Other End-User Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.3 Asia

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia and New Zealand

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Mexico

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Robert Bosch GmbH

- 6.1.2 ABB Limited

- 6.1.3 Honeywell International Corporation

- 6.1.4 Eaton Corporation

- 6.1.5 General Electric Company

- 6.1.6 Figaro Engineering Inc.

- 6.1.7 Advanced Micro Instruments Inc.

- 6.1.8 Yokogawa Electric Corporation

- 6.1.9 City Technology Limited

- 6.1.10 Delphi Automotive PLC

- 6.1.11 Hamilton Company

- 6.1.12 Sensore Electronic GmbH

- 6.1.13 Aeroqual Limited

- 6.1.14 AlphaSense Inc.

- 6.1.15 Control Instruments Corporation

- 6.1.16 Fujikura Limited

- 6.1.17 Membrapor AG

- 6.1.18 Mettler-Toledo International Inc.

- 6.1.19 Francisco Albero SAU

- 6.1.20 Maxtec LLC