|

시장보고서

상품코드

1686666

자동 자재 관리(AMH) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Automated Material Handling (AMH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

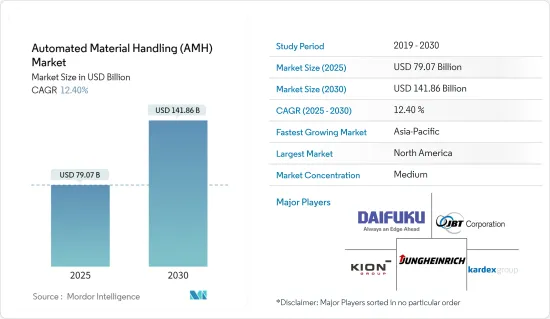

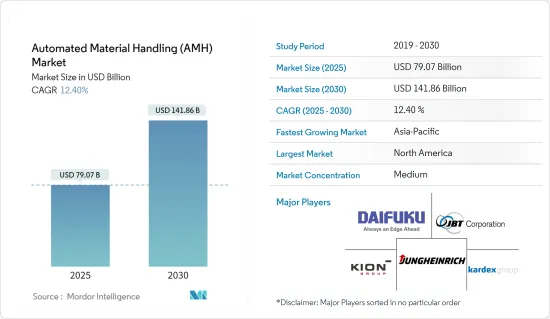

자동 자재 관리(AMH) 시장 규모는 2025년에 790억 7,000만 달러로 추정되고, 2030년에는 1,418억 6,000만 달러에 달할 것으로 예측되며, 예측 기간 중(2025-2030년) CAGR은 12.4%를 나타낼 전망입니다.

주요 하이라이트

- 기술 발전, 인건비 상승 및 안전 문제, 제조 및 창고 운영의 효율성 향상, 글로벌 제조업의 상당한 회복, 산업 자동화에 대한 수요 증가, 제조 단위 및 창고 시설에서 로봇에 대한 수요 증가, 신흥 시장의 성장은 자동화 자재 관리 시장을 이끄는 주요 요인입니다. 또한 이 시장은 예측 기간 동안 주문 맞춤화 및 개인화가 증가함에 따라 공급망 운영의 디지털화 확대로 인해 혜택을 받을 것입니다.

- 자동 자재 관리(AMH) 시스템은 제조 시설, 창고, 소매점, 공항 및 물류 센터를 포함한 다양한 환경에서 자재 이동을 간소화합니다. 이러한 시스템은 같은 구역 내, 부서 간, 심지어 서로 다른 건물 간에도 자재를 원활하게 이동할 수 있도록 지원합니다. AMH 시스템은 제조 실행 시스템(MES)에 의해 지정된 경로에 의존합니다.

- 지난 70년 동안 자재 관리은 상당한 변화를 겪으며 업계의 지형을 재편해 왔습니다. 기계와 로봇이 수작업을 대체하면서 여러 분야에서 성장을 촉진했습니다. 특히 자동차 산업은 10배의 괄목할 만한 성장을 기록하며 눈에 띄는 모습을 보이고 있습니다. 캐나다의 4차 산업혁명과 첨단 제조업의 발전은 다양한 기후에서도 제품 설계, 배송, 유지보수를 혁신적으로 변화시키고 있습니다. 로봇 공학 및 자동화부터 적층 제조(3D 프린팅)에 이르기까지 이러한 기술은 이커머스, 자동차, 농업, 제약 등 다양한 분야에서 폭넓게 활용되고 있습니다. 캐나다의 혁신가들은 국내 시장뿐만 아니라 치열한 경쟁이 벌어지는 글로벌 무대에서 정교한 고부가가치 제품을 만드는 데 앞장서고 있습니다.

- 1953년 최초의 AGV가 등장했지만, 생산 및 창고 회사 전반에 걸쳐 광범위한 도입이 여러 요인에 의해 저해되어 왔으며, 가장 큰 문제는 비용이었습니다. 일반적인 가이드 차량의 가격은 6만 달러에서 10만 달러 사이이며, 내비게이션 보조 장치 및 센서와 같은 고급 기능을 갖춘 시스템은 훨씬 더 비쌀 수 있습니다. 이러한 높은 초기 비용과 유지보수 문제는 시장의 성장을 저해하고 있습니다.

- 코로나19 팬데믹은 여러 부문의 자동화 도입에 큰 영향을 미쳤으며, 운영 규범을 재편하고 사회적 거리두기 및 비대면 운영과 같은 과제를 도입했습니다. 조직은 급증하는 수요와 인력 감소에 직면하여 강화된 안전 프로토콜을 구현해야 했습니다. 2020년 이후 코로나19는 미국 근로자들에게 영향을 미쳤고, 기업들은 새로운 안전 조치를 신속히 도입해야 했습니다.

자동 자재 관리(AMH) 시장 동향

인더스트리 4.0 투자는 시장 성장을 크게 견인

- 인더스트리 4.0 투자가 시장 성장을 크게 견인합니다. 이 시장은 인더스트리 4.0 및 IOT 기술을 채택하는 국가들의 발전으로 인해 주도되고 있습니다. 인더스트리 4.0은 로봇 공학의 사용을 통해 자재 관리 방식을 혁신하고 있습니다. 창고와 유통 시설에서 로봇 공학은 점점 더 널리 보급되고 있습니다. 예를 들어, 국제로봇연맹은 미국 제조업체들이 자동화에 집중 투자하여 2023년에 산업용 로봇 설치가 12% 증가하여 총 44,303대에 달할 것이라고 보고했습니다. 로봇은 주문 피킹 및 포장, 트럭 적재 및 하역, 창고 바닥 청소 등 다양한 업무에 활용될 수 있습니다. 로봇 공학을 통해 작업장의 정확성과 생산성을 모두 향상시킬 수 있습니다. 또한 로봇은 필요한 수작업의 양을 줄여 비용을 절감할 수 있습니다.

- 또한 로봇 공학, 자동화, 적층 제조(3D 프린팅)와 같은 기술은 전자상거래, 자동차, 농업, 제약 등 캐나다 산업에서 광범위하게 활용되고 있습니다. 캐나다의 혁신가들은 국내 및 경쟁이 치열한 글로벌 시장을 위해 기술적으로 복잡하고 부가가치가 높은 포괄적인 제품을 생산하고 있으며, 향상된 사례를 공유하고 첨단 자동화 기술의 미래를 형성하는 협업의 토대를 마련하고 있습니다.

- 독일은 또한 자율성, 상호운용성, 지속가능성이라는 세 가지 전략적 행동 분야에서 인더스트리 4.0을 위한 2030 비전에 집중하고 있습니다. 이 2030 비전에서 인더스트리 4.0 플랫폼의 이해관계자들은 디지털 생태계를 형성하기 위한 총체적인 접근 방식을 제시합니다. 목표는 사회적 시장 경제의 요구에 따른 미래 데이터 경제의 틀을 만들고, 개방형 생태계와 다양성을 강조하며, 자동화 시장에 대한 독일 산업 기반의 특정 상황과 확립된 강점을 바탕으로 모든 시장 이해관계자 간의 경쟁을 지원하는 것입니다.

- 또한, 인수 프로그램에 대한 정부의 강력한 지원으로 중국은 인더스트리 4.0으로 나아갈 수 있었습니다. 예를 들어, 중국에 본사를 둔 산업용 로봇 제조업체인 시아순은 중국 과학원 소속으로 정부와 더욱 긴밀한 관계를 맺고 있습니다. 중국에서 다양한 기업이 산업용 제어 시스템을 채택하는 것은 주목할 만한 추세입니다. 첨단 시스템을 통해 공장에서 생산이 용이해졌습니다.

- 연구 대상 시장에 영향을 미치는 중요한 트렌드는 스마트 제조 관행에 대한 초점입니다. IBEF의 데이터에 따르면 인도 정부는 2025년까지 제조업 생산 기여도를 국내총생산(GDP)의 16%에서 25%로 높이겠다는 야심찬 목표를 세웠습니다. 스마트 첨단 제조 및 신속 혁신 허브(SAMARTH)의 우디옥 바랏 4.0는 인도 제조 업계에서 인더스트리 4.0에 대한 인식을 제고하고 이해 관계자들이 자동화 자재 처리와 관련된 문제를 해결할 수 있도록 지원하는 것을 목표로 합니다.

아시아태평양이 가장 급성장하는 시장이 될 전망

- 중국은 아시아태평양 AMH 시장의 성장에 두드러진 기여를 해왔습니다. 하고 있습니다. PPP 기준으로 측정한 중국은 지난 10년 동안 세계 최대 경제대국이자 세계 최대 수출국이자 무역국이 되었습니다. 중국은 현재 제조 및 건설 주도 경제에서 소비자 주도 경제로 전환하고 있습니다.

- 중국국가통계국에 따르면 2023년 중국 소비재시장 소매총매출은 약 41조 8,605억 위안(5조 7,863억 1,000만 달러)이었습니다. 는 9억 1,500만 명을 넘어서 급증하고 있으며, 중국의 전자상거래 사업의 보급을 가능하게 하고 있습니다.

- 일본은 주로 제조업 국가입니다. 일본의 제조업은 명목 GDP에서 차지하는 비중이 20%에 가까운 반면, 다른 선진국의 경우 10%에 불과합니다.

- 업계의 기여와 'Make in India' 캠페인으로 강화된 정부의 인프라 투자는 자동화된 자재 관리(AMH) 시스템에 대한 수요를 촉진할 것으로 예상됩니다. 제조업 부문이 인도 GDP의 17%를 차지하고 2,730만 명 이상의 직원을 고용하고 있다는 점을 감안하면 인도 경제에서 제조업의 중요성은 부인할 수 없습니다. 인도 정부는 2025년까지 경제 생산량의 25%를 제조업에서 창출한다는 비전을 가지고 다양한 노력과 정책을 시행하고 있습니다

- 한국은 4차 산업혁명을 채택했습니다. 한국에서는 스마트 팩토리가 가장 중요한 분야 중 하나가 될 것입니다. 한국의 민간 및 공공 부문 모두 국내 스마트 팩토리 수를 늘리기 위해 노력하고 있습니다. 2023년까지 전국에 최신 디지털 및 분석 기술을 갖춘 최첨단 공장을 3만 개 구축한다는 야심찬 목표를 세우고 있습니다. 또한 한국의 생산가능인구 감소에 대응하기 위해 2030년까지 20개의 스마트 산업단지를 조성할 계획입니다. 이 계획의 일환으로 4차 산업혁명의 특징인 디지털화 및 자동화의 빠른 속도에 발맞춰 2030년까지 2,000개의 AI 기반 스마트 공장을 신설하는 것이 목표입니다

자동 자재 관리(AMH) 산업 개요

자동 자재 관리(AMH) 시장은 반통합과 높은 경쟁이 특징입니다. 시장의 주요 업체들은 치열한 경쟁에서 살아남기 위해 주로 제품 출시, R&D에 대한 상당한 투자, 파트너십 형성 또는 인수와 같은 전략에 의존하고 있습니다.

- 2024년 5월, 린데 자재 관리 장비의 유명한 제조업체인 KION 북미(KION NA)와 Fox Robotics는 전략적 비독점적 파트너십을 체결했습니다. 이 제휴의 일환으로 KION NA는 사우스캐롤라이나주 서머빌에 있는 최신예의 시설에서 FoxBot의 자율형 트레일러 로더/언로더(ATL)의 제조와 조립을 실시할 예정입니다.

- 2023년 11월, 자재 관리의 선구자인 도요타 자재 관리(TMH)은 최첨단 전동 지게차 3 모델을 발표했습니다. 이러한 추가 모델은 이미 광범위한 자재 관리 솔루션을 제공하는 TMH의 제품군을 더욱 강화합니다. 이 세 가지 모델에는 사이드 엔트리 엔드 라이더, 센터 라이더 스태커, 산업용 견인 트랙터가 포함됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 경쟁 기업간 경쟁 관계

- 대체품의 위협

- COVID-19 팬데믹 시장에 대한 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 시장 성장을 돕는 점진적인 기술 발전

- 자동화 및 자재 관리에 대한 수요를 주도하는 인더스트리 4.0 투자

- 전자상거래 부문의 급성장

- 시장의 과제

- 높은 초기 장비 비용

- 숙련 노동자의 부족

제6장 시장 세분화

- 제품 유형별

- 하드웨어

- 소프트웨어

- 서비스

- 기기 유형별

- 이동 로봇

- 무인 운반차(AGV)

- 자율 이동 로봇(AMR)

- 자동 보관 및 검색 시스템

- 고정 통로

- 회전식

- 수직 리프트 모듈

- 자동 컨베이어

- 벨트

- 롤러

- 팔레트

- 오버헤드

- 팔레타이저

- 기존

- 로봇

- 분류 시스템

- 이동 로봇

- 최종 사용자별

- 공항

- 자동차

- 식음료

- 소매, 창고, 유통 센터 및 물류 센터

- 일반 제조

- 의약품

- 우편 및 소포

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 프랑스

- 이탈리아

- 스페인

- 아시아

- 중국

- 일본

- 인도

- 호주 및 뉴질랜드

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Daifuku Co. Ltd

- Kardex Group

- KION Group AG

- JBT Corporation

- Jungheinrich AG

- TGW Logistics Group GmbH

- SSI Schaefer AG

- KNAPP AG

- Mecalux SA

- System Logistics SpA

- Viastore Systems GmbH

- BEUMER Group GmbH & Co. KG

- Interroll Holding AG

- WITRON Logistik

- Siemens AG

- KUKA AG

- Honeywell Intelligrated Inc.(Honeywell International Inc.)

- Murata Machinery Ltd

- Toyota Industries Corporation

- Visionnav Robotics

- Dearborn Mid-West Company

제8장 투자 분석

제9장 시장의 미래

HBR 25.05.02The Automated Material Handling Market size is estimated at USD 79.07 billion in 2025, and is expected to reach USD 141.86 billion by 2030, at a CAGR of 12.4% during the forecast period (2025-2030).

Key Highlights

- Technological advancements, rising labor costs and safety concerns, improved efficiency in manufacturing and warehouse operations, a significant recovery in global manufacturing, increasing demand for automation in industries, growing need for robots in manufacturing units and warehousing facilities, and the growth of emerging markets are key factors driving the automated material handling market. Additionally, the market will benefit from the expanding digitization of supply chain operations, further supported by increasing order customization and personalization during the forecast period.

- Automated Material Handling (AMH) systems streamline the movement of materials across various settings, including manufacturing facilities, warehouses, retail outlets, airports, and logistics centers. These systems facilitate the seamless transfer of materials, whether within the same area, across departments, or even between distinct buildings. AMH systems rely on routes designated by the manufacturing execution system (MES). These systems employ various technologies, including optical character recognition (OCR), barcodes, RFID, ultra-wideband indoor tracking, and near-field communication.

- Over the past seven decades, material handling has undergone significant transformations, reshaping the industry's landscape. Machines and robots have largely supplanted manual labor, catalyzing growth across sectors. Notably, the automotive industry stands out, boasting a remarkable tenfold expansion. Canada's advancements in Industry 4.0 and cutting-edge manufacturing are revolutionizing product design, delivery, and maintenance, even in diverse climates. From robotics and automation to additive manufacturing (3D printing), these technologies find broad utility in sectors spanning e-commerce, automotive, agriculture, and pharmaceuticals. Canadian innovators are spearheading the creation of sophisticated, high-value products, not only for domestic markets but also for a fiercely competitive global arena. Their initiatives not only elevate local practices but also set the stage for collaborative ventures that will define the trajectory of advanced automation technologies.

- While the first AGV debuted in 1953, widespread adoption across production and warehousing firms has been hindered by various factors, with cost being a primary concern. A typical guided vehicle is priced between USD 60,000 and 100,000, but systems with advanced features like navigation aids and sensors can be considerably pricier. These high upfront costs, coupled with maintenance challenges, are dampening the market's growth. Leading firms are striving to control costs without compromising on innovation or R&D investments.

- The COVID-19 pandemic has significantly impacted the adoption of automation across sectors, reshaping operational norms and introducing challenges such as social distancing and contactless operations. Organizations faced surging demands and reduced workforces, prompting the implementation of enhanced safety protocols. Since 2020, the outbreak affected the US workers, compelling companies to adopt new safety measures swiftly. While some industries, like food production, experienced shutdowns due to the virus's severity, many others adapted by incorporating stringent health measures to sustain operations.

Automated Material Handling (AMH) Market Trends

Industry 4.0 Investments Significantly Drive the Market's Growth

- The market is driven by the developments occurring due to countries adopting Industry 4.0 and IOT technologies. Through the use of robotics, industry 4.0 is revolutionizing how material handling is done. In warehouses and distribution facilities, robotics is becoming more and more prevalent. For instance, the International Federation of Robotics reported that US manufacturers heavily invested in automation, leading to a 12% increase in industrial robot installations, totaling 44,303 units in 2023. In addition to picking and packaging orders, loading and unloading trucks, and even cleaning the warehouse floor, they can also be employed for these activities. Workplace accuracy and productivity can both be enhanced by robotics. Robots can also enable company save money by lowering the quantity of necessary manual work.

- For instance, as warehouses are huge, associates must walk considerable distances to locate SKUs and deliver orders to the packing and shipping regions. Every year, an average warehouse wastes 6.9 weeks on unnecessary walking and other movements, equating to 265 million hours of work at the cost of USD 4.3 billion. During each stage of the selection process, collaborative robots also minimize the need for extended walks between functional areas. The rise in material handling equipment orders will significantly drive the studied market.

- Moreover, robotics, automation, and technologies like additive manufacturing (3D printing) have a wide range of applications in Canadian industries such as e-commerce, automotive, agriculture, and pharmaceuticals. Canadian innovators are producing a comprehensive range of technologically complex, increased-value products for domestic and competitive global markets, sharing enhanced practices and laying the groundwork for collaborations that shape the future of advanced automation technologies.

- Germany is also focused on the 2030 vision for Industry 4.0 in three strategic fields of action: autonomy, interoperability, and sustainability. In this 2030 vision, the stakeholders of the platform Industry 4.0 present a holistic approach to shaping the digital ecosystem. The goal is to create a framework for a future data economy that is by the demands of a social market economy, emphasizing open ecosystems, diversity, and supporting competition between all market stakeholders based on the specific situation and established strengths of the German industry base for the automation market.

- Furthermore, the government's strong support in the acquisition program has enabled China to move toward Industry 4.0. For instance, Siasun, a China-based industrial robot maker, is affiliated with the Chinese Academy of Sciences, which is further linked to the government. The country's adoption of industrial control systems by various companies is a notable trend. The advanced systems allow ease of production in factories. This also points to the gradual shift of companies from depending on manual labor to advanced technology-based systems that will enable the facility's automation.

- A significant trend impacting the market studied is the focus on smart manufacturing practices. According to the data from IBEF, the Government of India set an ambitious target of increasing manufacturing output contribution to 25% of the gross domestic product (GDP) by 2025 from 16%. The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims to enhance awareness about Industry 4.0 within the Indian manufacturing industry and enable stakeholders to address challenges related to automation material handling.

Asia-Pacific is Expected to be the Fastest Growing Market

- China has been a prominent contributor to the growth of the Asia-Pacific AMH market. The increasing demand for AMH products across industries, such as manufacturing, automotive, and e-commerce, boosts the market's growth. China has a vast population and pursues an industrial policy. Measured on the PPP basis, the country became the largest global economy and the largest global exporter and trader during the current decade. The country is currently transitioning from a manufacturing and construction-led economy to a consumer-led economy.

- According to China's National Bureau of Statistics, total retail sales in China's consumer products market were around CNY 41,860.5 billion (USD 5786.31 billion) in 2023. The number of Chinese online buyers has risen rapidly from under 34 million in 2006 to over 915 million in 2023, enabling China's e-commerce business to proliferate. Hence, with growing e-commerce, the demand for material-handling equipment will likely rise in the forecasted years.

- Japan is predominantly a manufacturing nation. Its manufacturing industry contributes close to 20% to the nominal GDP, whereas it is close to 10% for other developed countries. According to the IMF, the country's manufacturing sector has achieved significant industrial productivity gains over the services sector, owing to the increased adoption of ICT. The automotive and electronics sectors are the most productive manufacturing sectors in the country.

- The government's heightened infrastructure investments, bolstered by industry contributions and the 'Make in India' campaign, are set to propel the demand for automated material handling (AMH) systems. Given that the manufacturing sector accounts for 17% of India's GDP and employs over 27.3 million individuals, its significance in the nation's economic landscape is undeniable. With a vision to derive 25% of the economy's output from manufacturing by 2025, the Indian government is rolling out various initiatives and policies. Consequently, manufacturers are gearing up to embrace Industry 4.0 and other digital innovations to meet this ambitious goal.

- South Korea adopted the 4th Industrial Revolution. In Korea, smart factories will be one of the most important fields. Both the private and public sectors in Korea have committed to ramping up the number of domestic smart factories. Their target is ambitious: they aim to have 30,000 such cutting-edge factories equipped with the latest digital and analytical technologies up and running across the nation by 2023. Furthermore, in a bid to counteract Korea's shrinking working-age population, there are plans to establish 20 smart industrial zones by 2030. As part of this initiative, the goal is to set up 2,000 new AI-powered smart factories by 2030, aligning with the rapid pace of digitalization and automation characteristic of the fourth industrial revolution.

Automated Material Handling (AMH) Industry Overview

The automated material handling (AMH) market is characterized by semi-consolidation and high competitiveness. Key players in the market primarily rely on strategies like product launches, significant investments in R&D, and forming partnerships or making acquisitions to navigate the fierce competition.

- In May 2024, KION North America (KION NA), a prominent manufacturer of Linde Material Handling equipment, and Fox Robotics entered into a strategic non-exclusive partnership. As part of this collaboration, KION NA is expected to manufacture and assemble FoxBot autonomous trailer loader/unloaders (ATLs) at its state-of-the-art facilities in Summerville, South Carolina.

- In November 2023, Toyota Material Handling (TMH), a pioneer in material handling, unveiled three cutting-edge electric forklift models. These additions bolster TMH's already extensive range of material handling solutions. The trio includes a Side-Entry End Rider, a Center Rider Stacker, and an Industrial Tow Tractor. These models promise heightened efficiency, versatility, and top-tier performance, all while emphasizing operator comfort.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Incremental Technological Advancements aiding the Market's Growth

- 5.1.2 Industry 4.0 Investments driving the Demand for Automation and Material Handling

- 5.1.3 Rapid Growth of the E-commerce Sector

- 5.2 Market Challenges

- 5.2.1 High Initial Equipment Costs

- 5.2.2 Unavailability for Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Equipment Type

- 6.2.1 Mobile Robots

- 6.2.1.1 Automated Guided Vehicle (AGV)

- 6.2.1.2 Autonomous Mobile Robot (AMR)

- 6.2.2 Automated Storage and Retrieval System

- 6.2.2.1 Fixed Aisle

- 6.2.2.2 Carousel

- 6.2.2.3 Vertical Lift Module

- 6.2.3 Automated Conveyor

- 6.2.3.1 Belt

- 6.2.3.2 Roller

- 6.2.3.3 Pallet

- 6.2.3.4 Overhead

- 6.2.4 Palletizer

- 6.2.4.1 Conventional

- 6.2.4.2 Robotic

- 6.2.5 Sortation System

- 6.2.1 Mobile Robots

- 6.3 By End User

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food And Beverages

- 6.3.4 Retail/Warehousing/Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 France

- 6.4.2.3 Italy

- 6.4.2.4 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daifuku Co. Ltd

- 7.1.2 Kardex Group

- 7.1.3 KION Group AG

- 7.1.4 JBT Corporation

- 7.1.5 Jungheinrich AG

- 7.1.6 TGW Logistics Group GmbH

- 7.1.7 SSI Schaefer AG

- 7.1.8 KNAPP AG

- 7.1.9 Mecalux SA

- 7.1.10 System Logistics SpA

- 7.1.11 Viastore Systems GmbH

- 7.1.12 BEUMER Group GmbH & Co. KG

- 7.1.13 Interroll Holding AG

- 7.1.14 WITRON Logistik

- 7.1.15 Siemens AG

- 7.1.16 KUKA AG

- 7.1.17 Honeywell Intelligrated Inc. (Honeywell International Inc.)

- 7.1.18 Murata Machinery Ltd

- 7.1.19 Toyota Industries Corporation

- 7.1.20 Visionnav Robotics

- 7.1.21 Dearborn Mid-West Company