|

시장보고서

상품코드

1640592

펨토셀 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Femtocells - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

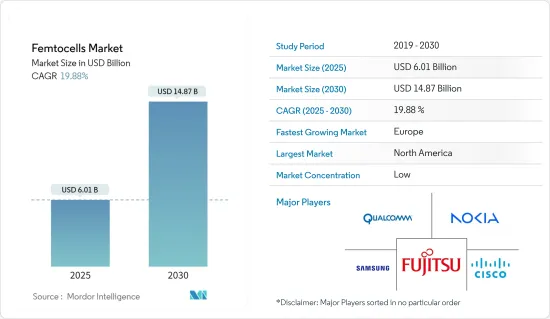

펨토셀 시장 규모는 2025년에 60억 1,000만 달러로 추정됩니다. 예측 기간(2025-2030년)의 CAGR은 19.88%로, 2030년에는 148억 7,000만 달러에 달할 것으로 예상되고 있습니다.

펨토셀은 모바일 장치에 무선 연결을 제공하는 셀룰러 기지국입니다. 펨토셀은 모바일 신호가 약한 지역에서 사용됩니다. 이 액세스 포인트는 음성 및 데이터 서비스에 대한 액세스를 용이하게 하여 확장 가능한 배포, 매크로셀 기술과의 호환성, 전송 전력 감소, 장치 이식성, 모바일 배터리 수명 연장으로 이어지는 커버리지를 개선할 수 있습니다.

주요 하이라이트

- 펨토셀 기술의 발전과 펨토셀 디바이스의 저가격화로 인해 펨토셀 시장이 성장하고 있습니다. 주택 분야에서의 펨토셀 채용 증가와 기업 분야 수요 증가가 시장을 확대하고 있습니다.

- 펨토셀 시장의 주요 촉진요인은 전력 소비의 한계입니다. 펨토셀의 전송 전력은 매크로셀 네트워크에 비해 상대적으로 작기 때문에 펨토셀의 전력 소비가 적습니다. 펨토셀의 전력 소비는 7W 미만이며 각 범위에서 여러 연결을 지원합니다.

- 부가가치 서비스를 이용하기 위한 스마트폰 용도의 성장은 펨토셀 시장의 성장을 가속하고 있습니다. 휴대폰, 노트북 및 기타 장치의 비용 절감은 시장 수요를 증가하고 있습니다.

- COVID-19의 유행은 펨토셀 기술이 대용량 인터넷 트래픽 수요에 대응하는 비즈니스를 지원하기 때문에 펨토셀 시장 확대에 긍정적인 영향을 미칩니다. 대부분의 인터넷 및 데이터 서비스 제공업체는 COVID-19 유통과 관련된 지난 1년간 세계 인터넷 트래픽 증가와 제조업, 전자상거래, 운송 및 물류 등 다양한 산업에 걸친 산업 자동화의 도입을 알고 있으며, 사물 인터넷 연결을 위한 펨토셀 수요가 증가할 것으로 예상됩니다.

펨토셀 시장 동향

상당한 성장이 예상되는 상용 부문

- 모바일 트래픽 증가와 멀티 테넌트 빌딩, 호텔 및 사무실 타워에서의 네트워크 강화의 필요성은 상업 부문에서 펨토셀 성장의 원동력이되었습니다. 펨토셀은 저렴하고 유연성이 뛰어난 등의 장점이 있으며, 시장 성장을 더욱 강화하고 있습니다.

- IoT의 등장은 비즈니스 모델, 밸류체인, 산업 구성을 재구성함으로써 산업을 변화시키고 있습니다. 올해 6월 에릭슨 모바일 보고서에 따르면 브로드밴드 IoT(4G/5G)는 지난해 전셀러 IoT 디바이스의 최대 점유율을 연결한 기술이었습니다.

- Industry 4.0 도입 증가와 BYOD를 추진하는 기업 등 다양한 요인들이 시장 성장을 가속하고 있습니다. 시장 성장 촉진요인에는 혁신적인 도시 개념이 포함되어 있으며 공급업체는 스마트 시티와 같은 용도에 특화된 제품 개발을 촉구합니다.

- 예를 들어 NXP Semiconductor는 최근 고대역폭, 저전력 베이스밴드 용도을 대상으로 하는 펨토셀 솔루션을 발표했습니다. 이 솔루션은 LTE 및 WCDMA(HSPA)에 최적화되어 있으며 혁신적인 도시 개발을 위해 최적화된 비용과 전력을 제공합니다.

- 펨토셀 기술을 통해 통신 사업자는 고정 모바일 대체와 같은 이점을 누릴 수 있으며 ARPU 증가를 촉진할 수 있습니다. 펨토셀 기술은 실내 환경이나 교외와 같은 원격지에서의 수준을 향상시킵니다.

현저한 성장이 기대되는 유럽

- 유럽에서는 영국이 기술과 서비스의 전면 주자였으며 GDP 성장률은 1.6%를 기록했습니다. 소비자 지출의 침체와 브렉시트 협상의 결과로 인한 정치적, 경제적 불확실성으로 인해 경기는 소폭 유지될 것으로 예상됩니다.

- 영국 부문은 Verizon과 같은 시장 리더의 존재로 인해 견고한 기술과 인프라에 의해 지원됩니다. 또한 모바일과 광대역 모두의 치열한 경쟁이 특징입니다. 이것이 이 나라의 휴대폰 보급률이 유럽 평균을 넘어서 비교적 낮은 소비자 가격에 지지되는 이유 중 하나입니다.

- 스마트폰의 보급이 진행되고(약 80%), 이러한 모바일 기기의 기능이 진보해, 지역 전체에 4G 기술이 침투한 것으로, 데이터 이용이 견조하게 추이하고 있습니다. 앞으로 몇 년간 영국 가정의 거의 50%가 스마트 홈이 될 것으로 예상됩니다. 이 추세는 펨토셀 채용에 큰 잠재력이 있음을 보여줍니다.

- 영국 부문의 성장은 주택 및 상업 부문의 무선 네트워크에 대한 견조한 수요, 모바일 기기의 견조한 데이터 이용, 스마트 홈 채용 증가로 인한 것으로 예상됩니다.

펨토셀 산업 개요

펨토셀 시장은 단편화되었습니다. 시장 선수들은 많은 혁신을 가져오고 다양한 합병과 인수를 받고 있습니다. 이 시장에서 사업을 전개하는 시장 기업은 비용 효율적이고 일관성 있고 확장 가능한 장비를 제공함으로써 경쟁 우위를 확보할 수 있습니다.

- 2023년 6월 - 산업개발국(IDB) 및 대만정보산업원(III)과 제휴한 일련의 업계 주요 기업은 COMNEXT Tokyo 2023에서 혁신적인 산업 및 기업용 5G 연결 솔루션을 전시했습니다. 전시회에서는 LITE-ON Technology Corp.를 비롯하여 대만과 일본의 차세대 통신 업계 동향에 대해 논의가 이루어졌습니다. LITEON RAN 솔루션은 종합적인 5G/O-RAN SA 호환 제품 포트폴리오를 제공합니다. LITEON FlexFi AIO & Femtocell은 n78/n79의 서브 6G 밴드를 지원하며 유연하고 고성능이며 비용 효율적인 아키텍처를 채택하고 있습니다.

- 2022년 11월 - 시스코는 스페인에 차세대 반도체 디바이스 설계 센터를 개설할 계획을 밝혔습니다. 시스코는 신뢰할 수 있고 확장 가능하고 지속 가능한 세계 반도체 공급망을 실현하는 세계 전략의 일환으로 차세대 반도체 장치를 만들고 프로토타입하는 엔지니어링 디자인 센터를 설립할 계획입니다. 이것은 마이크로 일렉트로닉스 및 반도체의 회복과 경제적 변화를 위한 스페인 전략 프로젝트의 틀 안에서 이루어집니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인과 시장 성장 억제요인의 소개

- 시장 성장 촉진요인

- 4G와 5G의 연속성에서 펨토셀의 역할 증대

- 이기종 네트워크에 대한 수요

- 시장 성장 억제요인

- 각 업계의 전문 기술자 부족

- 업계 밸류체인 분석

- 업계의 매력 - Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 기술 스냅샷

제6장 시장 세분화

- 용도별

- 상업

- 주거

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Nokia Corporation

- Samsung Electronics

- Cisco

- Qualcomm

- Airvana Inc.

- CommScope Inc.

- Fujitsu Ltd.

- ZTE Corporation

- Netgear Inc.

제8장 투자 분석

제9장 시장 기회와 앞으로의 동향

KTH 25.02.19The Femtocells Market size is estimated at USD 6.01 billion in 2025, and is expected to reach USD 14.87 billion by 2030, at a CAGR of 19.88% during the forecast period (2025-2030).

Femtocells are cellular base stations providing wireless connectivity for mobile devices. Femtocells are used in areas with weak mobile signal. The access points facilitate feasible access to voice and data services, enabling a scalable deployment, compatibility with the macrocellular technology, reduced transmission power, device portability, and improved coverage that results in prolonged mobile battery life.

Key Highlights

- Femtocells market is growing due to advancements in femtocell technology and the low cost of femtocell devices. Increased adoption of femtocells in the residential segment and increasing demand from the enterprise segment augment the market.

- The primary driving factor for the femtocells market is limited power consumption. Femtocells consume less power as the transmission power of femtocells is comparatively less than macrocell networks. A femtocell consumes less than 7 W and support several connections in each range.

- Growth in the applications of smartphones for availing value-added services is propelling the growth of the femtocell market. Reductions in the cost of mobile phones, laptops, and other devices have increased the demand for the market.

- The COVID-19 pandemic has had a positive impact on the femtocell market's expansion as femtocell technologies assist businesses in meeting the high-capacity internet traffic demand. Most internet and data service providers noticed increased worldwide internet traffic over the past year related to the COVID-19 pandemic and the adoption of industrial automation across various industry verticals, including manufacturing, e-commerce, and transit and logistics, which is expected to increase demand for femtocells for Internet of Things connectivity.

Femtocell Market Trends

Commercial Segment Expected to Witness Significant Growth

- The increased mobile traffic and the need for more networks in multitenant buildings, hotels, or office towers are drivers of the growth of femtocell in the commercial segment. Benefits such as it can be cheaper and more flexible are further bolstering the market growth.

- The advent of IoT is transforming industries by reshaping business models, value chains, and industry configurations. Femtocells offers indoor coverage and satisfies the needs of smart devices, ensuring affordable connectivity throughout enterprises. according to Ericsson Mobility Report in June this year, broadband IoT (4G/5G) was the technology that connected the largest share of all cellular IoT devices last year.

- Rising Industry 4.0 adoption as well as business organizations promoting BYOD, various factors have been augmenting the market's growth. Significant market drivers include innovative city initiatives, encouraging vendors to develop products specific to applications such as smart cities.

- For instance, NXP Semiconductor recently introduced a femtocell solution that targets high-bandwidth, low-power baseband applications. The solution is optimized for LTE and WCDMA (HSPA+), offering optimized cost and power for innovative city development.

- Femtocell technology enables carriers to enjoy benefits, such as fixed mobile substitution, driving incremental ARPU. Femtocell technology raises the bar in indoor environments and remote areas, such as the suburbs.

Europe Expected to Witness Significant Growth

- In Europe, the United Kingdom is a front-runner in technology and services and recorded GDP growth of 1.6%. The economy is expected to be modest, owing to the subdued consumer expenditure and the political and economic uncertainty of the outcomes of Brexit negotiations.

- The UK segment is buoyed by the presence of robust technologies and infrastructure, owing to the presence of market leaders like Verizon. It is characterized by intense competition in the mobile and broadband sectors. This is one of the reasons why mobile penetration in the country is higher than the European average, supported by relatively low consumer prices.

- With the increasing smartphone penetration (which is around 80%), advancements in the capabilities of these mobile devices and the penetration of the 4G technology across the region have led to robust data usage. In the next few yaers, nearly 50% of UK households are expected to be smart homes. This trend indicates that there exists a significant potential for the adoption of femtocells.

- The growth of the UK segment is anticipated to be driven by the robust demand for wireless networks in the residential and commercial sectors, robust data usage on mobile devices, and the increasing adoption of smart homes.

Femtocell Industry Overview

The femtocells market is fragmented. The players in the market are bringing many innovations, and there are various mergers and acquisitions. The market players operating in this market can achieve a competitive advantage by providing cost-efficient, consistent, and scalable equipment.

- June 2023 - A series of industry-leading companies in partnership with the Industry Development Bureau (IDB) and the Institute for Information Industry (III), Taiwan, showcased their innovative industrial and enterprise 5G connectivity solutions at COMNEXT Tokyo 2023. The exhibition included LITE-ON Technology Corp., among others and a discussing regarding the next generation communication industry trends in Taiwan and Japan. LITEON RAN solution provides a comprehensive 5G/O-RAN SA compliant product portfolio. LITEON FlexFi AIO & Femtocell support sub-6G bands across n78/n79, using a flexible, high performance, and cost-effective architecture.

- November 2022 - Cisco revealed plans to open a next-generation semiconductor device design center in Spain. Cisco plans to establish an engineering design center to create and prototype next-generation semiconductor devices as part of its global strategy to enable a dependable, scalable, and sustainable global semiconductor supply chain. This will be done within the framework of the Spanish strategic project for the Recovery and Economic Transformation of Microelectronics and Semiconductors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Role of Femtocells in the Continuity of 4G and 5G

- 4.3.2 Demand for Heterogeneous Networks

- 4.4 Market Restraints

- 4.4.1 Lack of Skilled Professional Across Industries

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Commercial

- 6.1.2 Residential

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 Samsung Electronics

- 7.1.3 Cisco

- 7.1.4 Qualcomm

- 7.1.5 Airvana Inc.

- 7.1.6 CommScope Inc.

- 7.1.7 Fujitsu Ltd.

- 7.1.8 ZTE Corporation

- 7.1.9 Netgear Inc.