|

시장보고서

상품코드

1640415

데이터센터 냉각 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2031년)Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

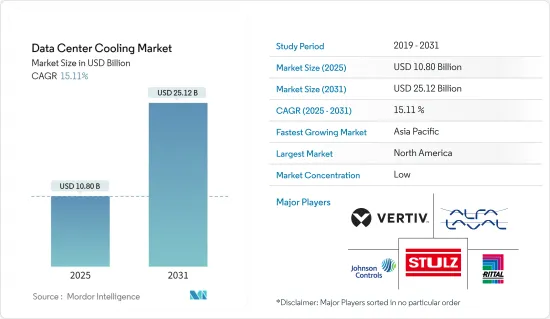

데이터센터 냉각 시장 규모는 2025년에 108억 달러로 추정되며, 예측 기간(2025-2031년)의 CAGR은 15.11%로, 2031년에는 251억 2,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- AI 및 미디어 용도의 계산 요구가 높기 때문에 데이터센터의 도입이 세계적으로 진행되고 있습니다. 이러한 데이터센터는 많은 양의 전력을 소비하고 많은 양의 열을 발생시키기 때문에 다양한 효율적인 냉각 시스템에 대한 필요성이 더욱 커지고 있습니다.

- 데이터센터 냉각 시장은 디지털화의 진전으로 컴퓨터 성능을 향상시키고 더 많은 집적 소형 칩이 필요하기 때문에 상당한 성장이 예상됩니다. 데이터센터 설계 및 냉각의 필요성은 주로 AI 워크로드를 위한 강력한 컴퓨터 하드웨어의 영향을 받습니다. 제조업체는 인공지능과 고성능 컴퓨팅 워크로드의 성능을 최적화하기 위해 대형 실리콘 칩을 도입했습니다. 인공지능과 고성능 컴퓨팅 환경에서 강력한 GPU를 사용하면 데이터센터 냉각 기술의 필요성이 뒷받침됩니다.

- OTT와 스트리밍 서비스의 이용 확대가 데이터 증가로 이어져 시장 개척을 촉진하고 있습니다. 또한 Disney Hotstar, Hulu, Netflix와 같은 온라인 스트리밍 서비스의 데이터 증가가 데이터센터 냉각 시스템 수요를 촉진할 것으로 예상됩니다.

- 시장 기업은 세계 사업의 전개와 서비스 제공의 확대에 주력함으로써 소비자 기반의 증강에 임하고 있습니다. 예를 들어, 2024년 3월, 지능형 전력 관리 회사인 Eaton은 머신러닝, 에지 컴퓨팅 및 AI 증가 요건을 신속하게 충족하려는 조직을 위한 혁신적인 모듈형 데이터센터 솔루션의 북미 출시를 선언했습니다. Eaton의 SmartRack 모듈형 데이터센터는 주로 IT 랙과 냉각 및 서비스 인클로저를 결합하여 최대 150kW의 장비 부하가 있는 중요한 IT 장비를 위한 성능 최적화된 데이터센터 솔루션을 구축합니다.

- 이 시장의 성장은 다양한 적응성에 대한 요구가 증가하고 세계 전력 부족에 의해 저해 될 것으로 예상됩니다. 또한, 시대 지연 인프라와 최적화되지 않은 레이아웃과 같은 비효율적인 냉각 시스템 설계의 사용은 에너지 효율 저하 및 운영 비용 증가로 이어지고, 에너지 가격 상승은 냉각 비용을 엄청나게 만들 수 있기 때문에 예측 기간 동안 시장 성장을 억제하는 요인 중 하나가 되었습니다.

데이터센터 냉각 시장 동향

IT 및 통신 부문이 가장 높은 성장을 이룰 전망

- 정보 기술에 의해 생성되는 데이터의 급격한 증가는 효율적인 데이터센터를 필요로 하며 첨단 냉각 솔루션에 대한 수요가 증가하고 있습니다. 증가하는 워크로드와 스토리지 수요를 수용하기 위해 데이터센터가 확장됨에 따라 발생하는 열은 심각한 우려가 되고 효과적인 냉각 솔루션에 대한 수요를 창출하고 있습니다.

- 클라우드 스토리지 채택은 해마다 증가하고 있습니다. 보다 효율적인 작업 프로세스를 제공하기 위해 Microsoft, AWS, Google과 같은 클라우드 스토리지 제공업체는 클라우드에 저장할 용량을 확장하고 있습니다. 이 회사들은 하이퍼스케일 트랜잭션에 투자하고 있습니다. 그 결과 SaaS(Software-as-a-Service)의 확대로 클라우드 스토리지 제공업체의 용량 증대가 가능해지고 데이터센터 냉각 시스템 수요가 확대될 것으로 예상됩니다.

- 침지 냉각에는 단상 또는 2상 솔루션이 있습니다. 단상 침지 냉각을 사용하면 서버를 밀폐 섀시에 보관하고 랙 장착형 또는 독립형 형식으로 설계를 구성할 수 있습니다. 한편, 2상 침지 냉각은 서버를 액체에 담그지만 냉각 과정 중에 액체가 변합니다. 액체가 따뜻해지고 결로되면 물 회로와 열교환기가 열을 빼앗습니다. 2P 액침 냉각에서는 서버를 수납한 금속 유지 탱크 내의 유전 냉각액이, 안전한 냉각 시스템으로 비등 및 응축해, 열전달 효율이 비약적으로 향상합니다.

- 2023년 5월 KT Cloud는 스위스의 액냉 솔루션 제공업체인 Immersion 4사와 KT Cloud의 데이터센터에 차세대 액침 냉각 기술을 도입하는 계약을 체결했습니다. 침지 냉각은 전기가 흐르지 않는 유전체 용액에 정보 통신 기술 장비를 담그어 열을 제거합니다. 이렇게 하면 공기 냉각 시스템에서 발생할 수 있는 데이터센터의 서버 룸 온도 불균형과 팬 소음이 제거됩니다.

아시아태평양이 현저한 성장을 이룰 전망

- 아시아태평양은 주로 네트워크 인프라의 급속한 개발로 예측 기간 동안 가장 빠른 성장률을 나타낼 것으로 예상됩니다. 이 지역에서는 데이터 생성에 대한 수요가 증가하고 있으며, 특히 인도나 중국과 같은 국가에서는 정부 정책에 따라 에너지 효율적인 인프라 정비가 진행되고 있습니다. 또한 AI를 활용한 냉각관리나 액냉시스템 등 기술의 진보가 상황을 바꾸어 이 지역에서의 추가 채용을 촉진하고 있습니다.

- 중국과 일본은 IoT, ML, AI 등의 영역에서 지속적인 혁신과 개발을 바탕으로 시장 성장 기회를 크게 홍보할 것으로 예상되는 가장 중요한 국가 중 하나입니다. 게다가 이들 국가에서는 데이터센터의 수가 급속히 증가하고 있으며, 지역 전반에 걸쳐 친환경적인 인프라를 추진하는 정부 정책은 이러한 데이터센터 내에서 보다 뛰어난 보다 효과적인 냉각 솔루션의 필요성을 촉진하고 있습니다.

- 예를 들어 2024년 4월 아시아에서 고성능 데이터센터를 운영 및 개발하는 GDS와 아시아태평양의 부동산 시장 및 기타 진입 장벽이 높은 세계 시장에 특화된 프라이빗 에퀴티 펀드 운용회사인 Gaw Capital Partners는 일본 도쿄에 40메가와트(MW)의 데이터센터 캠퍼스를 건설하는 전략적 파트너십을 체결했습니다.

- 아시아태평양의 데이터센터 냉각 시장은 주로 데이터 소비와 클라우드 서비스의 급격한 성장에 의해 활성화되고 있습니다. 기업이 디지털 인프라를 확장함에 따라 최적의 작동 온도를 유지하기 위한 효율적인 냉각 시스템에 대한 수요가 증가하고 있습니다. 또한 에너지 효율과 환경 지속가능성에 대한 엄격한 규제가 혁신적인 냉각 기술의 채택을 뒷받침하고 있습니다. 신흥국은 IT 인프라에 엄청난 투자를 하고 있으며, 신뢰성과 확장성이 높은 냉각 솔루션에 대한 요구가 시장 성장을 더욱 강화하고 있습니다.

- 2023년 12월 호주 클라우드 서비스 제공업체인 ResetData는 선구적인 액체 냉각 데이터센터 및 서버 기술 테스트 및 시뮬레이션 실험실을 개설했습니다. 이것은 액체 냉각 환경에서 워크로드를 시도할 수 있는 아시아태평양의 최초 시설 중 하나였습니다. 이 단계를 통해 현지 기업은 AI나 머신러닝 등의 가혹한 용도에 필수적인 보다 생태적이고 고성능인 IaaS(Infrastructure-as-a-Service)를 이용할 수 있게 되었습니다.

데이터센터 냉각 산업 개요

데이터센터 냉각 시장은 주요 산업 기업 간의 통합도가 낮습니다. 주목할만한 시장 리더는 Stulz GmbH, Alfa Laval AB, Schneider Electric SE, Johnson Controls Inc., Vertiv Group Corp., Asetek A/S를 포함합니다. 대규모 시장 점유율을 자랑하는 이 업계의 선두 주자는 이 지역 전반에 걸쳐 고객 기반을 확대하기 위해 적극적으로 노력하고 있습니다. 그들의 성장 전략은 주로 시장 점유율과 전반적인 수익성을 높이는 것을 목표로 한 전략적 공동 작업에 달려 있습니다. 또한 Schneider Electric SE, Johnson Controls Inc., Mitsubishi Electric Europe BV와 같은 기업은 액체 및 공기 기반 냉각 제품을 제공합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 상정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 냉각에 관한 주요 비용의 고찰

- DC 냉각을 시야에 둔 DC 운용과 관련된 주요 비용 오버헤드의 분석

- 설계의 복잡성, PUE, 이점, 단점, 자연 기상 조건의 이용 범위 등의 주요 요인에 근거한 각 냉각 기술에 관련된 비용과 운용상의 고려 사항의 비교 연구

- 데이터센터 냉각의 주요 혁신과 발전

- 데이터센터에서 채용되고 있는 주된 에너지 효율화 수법

제5장 시장 역학

- 시장 성장 촉진요인

- 세계의 AI와 HPC 워크로드의 급속한 디지털화와 보급

- 그린 데이터센터의 출현

- 시장의 과제

- 비용, 적응 요건, 정전

- 세계 공급망의 혼란

- 시장 기회

- 디지털 경제의 성장과 주요 지역의 정부 지원 증가

- 업계 생태계 분석

제6장 세계 데이터센터의 현황 분석

- 데이터센터의 IT 부하 용량과 면적 실적 분석(2017-2030년 기간)

- 세계에서의 현재의 DC 핫스팟과 미래의 확장 전망의 분석

- 주요 지역의 주요 데이터센터 건설업자와 운영자의 분석

제7장 인도네시아 데이터센터 시장의 세분화

- 냉각 기술별

- 공냉

- 칠러 및 이코노마이저

- CRAH

- 냉각탑(직접 냉각, 간접 냉각, 2단계 냉각을 커버)

- 기타 공냉 기술

- 액체 베이스 냉각

- 액침 냉각

- 칩간 직접 냉각

- 리어 도어식 열교환기

- 공냉

- 유형별

- 하이퍼스케일러(소유 및 리스)

- 엔터프라이즈(온프레미스)

- 코로케이션

- 업계별

- IT 및 통신

- 소매 및 소비재

- 헬스케어

- 미디어 및 엔터테인먼트

- 연방정부기관

- 기타 최종 사용자 업계별

- 지역별

- 북미

- 유럽

- 아시아태평양

- 세계 기타 지역

제8장 경쟁 구도

- 기업 프로파일

- Vertiv Co.

- Stulz GmbH

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Alfa Laval Corporate AB

- Fujitsu General Limited

- Johnson Controls Inc.

- Hitachi Ltd

- CoolIT Systems Inc.

- Liquid Stack Inc.

- Asetek Inc. A/S

- Asperitas

- Chilldyne Inc.

- Fujitsu Ltd

- Mikros Technologies

- KAORI HEAT TREATMENT Co. Ltd

- Lenovo Group Limited

제9장 투자 분석

제10장 시장 기회와 앞으로의 동향

제11장 출판사에 대해서

JHS 25.02.18The Data Center Cooling Market size is estimated at USD 10.80 billion in 2025, and is expected to reach USD 25.12 billion by 2031, at a CAGR of 15.11% during the forecast period (2025-2031).

Key Highlights

- Due to the high computational needs of AI and media applications, data centers are being increasingly deployed worldwide. These data centers consume a massive amount of power, generating a significant amount of heat, further creating the need for various efficient cooling systems.

- The data center cooling market is expected to show substantial growth due to increased digitization, leading to greater computer performance and requiring a larger number of integrated small chips. The design of data centers and the need to cool them are mainly influenced by powerful computer hardware for AI workloads. Manufacturers are introducing large silicon chips to optimize the performance of artificial intelligence and high-performance computing workloads. The use of powerful GPUs in artificial intelligence and high-performance computing environments supports the need for data center cooling technologies.

- The increasing use of OTT and streaming services has led to a growth in data, fostering market development. Also, the increasing data from online streaming services such as Disney+ Hotstar, Hulu, and Netflix is expected to drive the demand for data center cooling systems.

- Market players are taking action to augment their consumer base by focusing on expanding their global footprint and service offerings. For instance, in March 2024, the intelligent power management company Eaton declared the North American launch of an innovative modular data center solution for organizations that are seeking to rapidly fulfill the increasing requirements for machine learning, edge computing, and AI. Eaton's SmartRack modular data centers primarily combine IT racks and cooling and service enclosures to build a performance-optimized data center solution for critical IT equipment with up to 150 kW of equipment load.

- The market's growth is expected to be hampered by the rising need for various adaptability requirements and power shortages worldwide. Also, the use of inefficient cooling system designs, such as outdated infrastructure or poorly optimized layouts, leading to energy inefficiencies and increased operational costs, and rising energy prices, which might make the cooling expenses prohibitive, are some of the factors that can restrain the market's growth during the forecast period.

Data Center Cooling Market Trends

The IT and Telecom Segment is Expected to Witness the Highest Growth

- The exponential growth of data generated by information technology significantly necessitates efficient data centers, driving demand for advanced cooling solutions. As data centers expand to accommodate increasing workloads and storage demands, the heat generated becomes a significant matter of concern, creating demand for effective cooling solutions.

- The adoption of cloud storage has been increasing over the years. To provide more efficient work processes, cloud storage providers such as Microsoft, AWS, and Google are expanding their capacity to store in the cloud. These companies make their investments in hyperscale transactions. As a result, the demand for data center cooling systems is expected to grow due to the expansion of Software-as-a-Service, enabling cloud storage providers to augment their capacity.

- Immersion cooling can be executed in a single-phase or two-phase solution. Single-phase immersion cooling encapsulates the server in a sealed chassis, and the design can be configured in a rackmount or standalone format. However, two-phase immersion cooling locations the server in the liquid, but the liquid transitions during the cooling process. As the fluid warms up and turns to condensation, the water circuit and heat exchanger withdraw the heat. In 2P immersion cooling, dielectric cooling fluid inside a metal holding tank contained with servers is boiled and condensed in a secured cooling system, exponentially growing heat transfer efficiency.

- In May 2023, KT Cloud signed a deal with Immersion 4, a Swiss provider of liquid cooling solutions, to install next-generation immersion cooling technology at KT Cloud data centers. Immersion cooling removes heat by immersing information and communications technology equipment in a dielectric solution where electricity does not flow. This eliminates the imbalance in server room temperatures and fan noise at data centers that can occur with an air-cooling system.

Asia-Pacific is Expected to Register Significant Growth

- Asia-Pacific is estimated to witness the fastest growth rate during the forecast period, mainly due to the rapid development of the network infrastructure. The demand for data generation is increasing in the region, and government policies are promoting more energy-efficient infrastructure, especially in countries like India and China. Also, advancements in technologies such as AI-driven cooling management and liquid cooling systems are reshaping the landscape, driving further adoption in the region.

- China and Japan are among the most important countries that are expected to fuel the market's growth opportunities, significantly based on their ongoing innovations and developments in domains like IoT, ML, and AI. Moreover, the rapidly growing number of data centers in these countries and the government policies to promote more environmentally sound infrastructure across the region are driving the need for better and more effective cooling solutions within these data centers.

- For instance, in April 2024, GDS, an operator and developer of high-performance data centers in Asia, and Gaw Capital Partners, a private equity fund management firm especially focusing on the real estate markets in Asia-Pacific and other high barrier-to-entry markets worldwide, signed a strategic partnership to build a 40 megawatts (MW) data center campus in Tokyo, Japan.

- The Asia-Pacific data center cooling market is primarily fueled by the exponential growth of data consumption and cloud services. As businesses expand their digital infrastructure, the demand for efficient cooling systems to maintain optimal operating temperatures increases. Additionally, stringent regulations regarding energy efficiency and environmental sustainability encourage the adoption of innovative cooling technologies. With emerging economies investing heavily in IT infrastructure, the need for reliable and scalable cooling solutions further fuels market growth.

- In December 2023, the Australian cloud service provider ResetData launched a test and simulation lab for its pioneering liquid-cooled data center server technology. This was one of the first facilities in Asia-Pacific capable of trialing workloads in a liquid-cooled environment. This step empowered local businesses to utilize a more ecological and high-performance Infrastructure-as-a-Service (IaaS) that is essential for strenuous applications like AI and machine learning.

Data Center Cooling Industry Overview

The data center cooling market exhibits a low level of consolidation among key industry players. Notable market leaders include Stulz GmbH, Alfa Laval AB, Schneider Electric SE, Johnson Controls Inc., Vertiv Group Corp., and Asetek A/S. These industry giants, boasting significant market shares, are actively engaged in expanding their customer base throughout the region. Their growth strategies primarily hinge on strategic collaborative efforts aimed at enhancing market share and overall profitability. Moreover, companies such as Schneider Electric SE, Johnson Controls Inc., and Mitsubishi Electric Europe BV offer both liquid and air-based cooling products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Key Cost Considerations for Cooling

- 4.2.1 Analysis of the Key Cost Overheads Related to DC Operations with an Eye on DC Cooling

- 4.2.2 Comparative Study of the Cost and Operational Considerations Related to Each Cooling Technology Based on Key Factors Such as Design Complexity, PUE, Advantages, Drawbacks, and Extent of Utilization of Natural Weather Conditions

- 4.2.3 Key Innovations and Developments in Data Center Cooling

- 4.2.4 Key Energy Efficiency Practices Adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Digitization and Adoption of AI and HPC Workload Around the Globe

- 5.1.2 Emergence of Green Data Centers

- 5.2 Market Challenges

- 5.2.1 Costs, Adaptability Requirements, and Power Outages

- 5.2.2 Supply Chain Disruption Globally

- 5.3 Market Opportunities

- 5.3.1 The Growth of the Digital Economy and Increasing Government's Support across Major Regions

- 5.4 Industry Ecosystem Analysis

6 ANALYSIS OF THE CURRENT DATA CENTER FOOTPRINT IN GLOBAL

- 6.1 Analysis of IT Load Capacity and Area Footprint of Data Centers (For the Period of 2017-2030)

- 6.2 Analysis of the Current DC Hotspots and Scope for Future Expansion Globally

- 6.3 Analysis of Major Data Center Contractors and Operators Across Major Regions

7 INDONESIA DATA CENTER MARKET SEGMENTATION

- 7.1 By Cooling Technology

- 7.1.1 Air-based Cooling

- 7.1.1.1 Chiller and Economizer

- 7.1.1.2 CRAH

- 7.1.1.3 Cooling Tower (Covers Direct, Indirect, and Two-stage Cooling)

- 7.1.1.4 Other Air-based Cooling Technologies

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-chip Cooling

- 7.1.2.3 Rear-door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By Type

- 7.2.1 Hyperscalers (Owned and Leased)

- 7.2.2 Enterprise (On-premise)

- 7.2.3 Colocation

- 7.3 By End-user Vertical

- 7.3.1 IT and Telecom

- 7.3.2 Retail and Consumer Goods

- 7.3.3 Healthcare

- 7.3.4 Media and Entertainment

- 7.3.5 Federal and Institutional Agencies

- 7.3.6 Other End-user Verticals

- 7.4 By Region

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia-Pacific

- 7.4.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Vertiv Co.

- 8.1.2 Stulz GmbH

- 8.1.3 Schneider Electric SE

- 8.1.4 Rittal GmbH & Co. KG

- 8.1.5 Alfa Laval Corporate AB

- 8.1.6 Fujitsu General Limited

- 8.1.7 Johnson Controls Inc.

- 8.1.8 Hitachi Ltd

- 8.1.9 CoolIT Systems Inc.

- 8.1.10 Liquid Stack Inc.

- 8.1.11 Asetek Inc. A/S

- 8.1.12 Asperitas

- 8.1.13 Chilldyne Inc.

- 8.1.14 Fujitsu Ltd

- 8.1.15 Mikros Technologies

- 8.1.16 KAORI HEAT TREATMENT Co. Ltd

- 8.1.17 Lenovo Group Limited