|

시장보고서

상품코드

1850059

스마트 마이닝 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Smart Mining - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

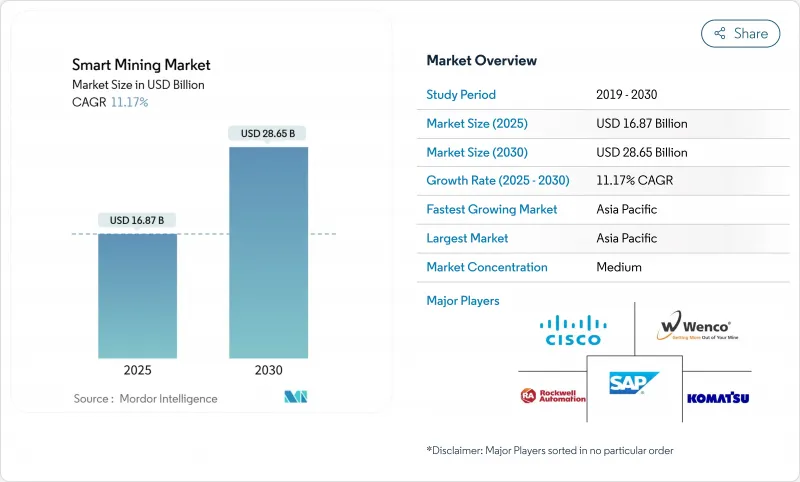

스마트 마이닝 시장 규모는 2025년에 168억 7,000만 달러로 추정되고, 2030년에는 286억 5,000만 달러에 달할 것으로 예측되며, CAGR 11.2%로 성장할 전망입니다.

급속한 디지털화는 광석 품위 저하, 보다 엄격한 안전 의무, 탈탄소화 목표에 직면하는 사업자를 위해 광산 계획, 차량 관리 및 광물 처리를 재구성하고 있습니다. 자율적인 운반, IoT를 활용한 예지보전, 프라이빗 5G 네트워크는 지속적인 생산성 향상과 운영 리스크의 저감을 실현합니다. 리튬, 니켈, 희토류 수요 증가로 회수율을 극대화하는 커넥티드 기기에 대한 투자가 강화됩니다. 세계 자동화 벤더와 틈새 광산 기술 전문가의 파트너십을 통해 갱내에서 항구까지의 데이터를 통합하는 통합 플랫폼을 구축할 수 있습니다.

세계의 스마트 마이닝 시장 동향 및 인사이트

중요 광물 수요 급증

국제에너지기구(IEA)는 2040년까지 리튬 수요가 40배 이상으로 증가할 것으로 예측했습니다. 광산업자는 보다 높은 수준의 광상을 찾기 위해 연결된 시추 장비 및 클라우드 기반 지질 모델에 의존하는 확장 프로젝트와 탐사 캠페인을 가속화하고 있습니다. 호주, 캐나다, 미국 정부는 안전한 공급망에서 채굴과 정광 생산을 자동화하는 비용을 낮추는 인센티브를 할당합니다. 디지털 트윈은 시약 용량과 에너지 투입량을 실시간으로 조정하고 회수율을 향상시키면서 비용을 절감하는 처리 플랜트를 시뮬레이션하는 데 도움이 됩니다. 구매자가 다년간 오프 테이크 계약을 체결하면 운영자는 스마트 장비의 도입을 재량 지출이 아닌 전략적 투자로 취급합니다.

자율 주행 운반 채용

고마츠의 FrontRunner 트럭은 출시 이래 20억 톤 이상의 자재를 운반해 철광석, 구리, 석탄 프로젝트에서 24시간 365일 안정적인 가동을 증명하고 있습니다. 캐터필러는 2024년 동안 랙스톤의 버지니아 주 채석장에서 이 기술을 중형 777 트랙으로 확장하여 메가핏 작업 이외에도 적용할 수 있음을 입증했습니다. 리오 틴토는 피르바라 광산으로 교통량이 많은 구역에서 인위적인 접촉을 없애고, 발레는 브루카츠에서 완전 자율주행 차량에 임해 안전성과 비용면에서의 이점을 검증했습니다. Wi-Fi에서 프라이빗 LTE나 5G로의 전환은 한때 깊은 갱내나 산악지대에서의 자율주행에 제한을 주었던 지연과 커버리지 갭을 해결합니다. 공급업체는 현재 차량 관리 소프트웨어와 차량 탑재 지각 센서를 번들로 제공하고 있으며 선진 지역과 개발 도상 지역 모두에서 채용을 가속화하고 있습니다.

높은 CAPEX 및 ROI 불확실성

종합적인 자동화 프로젝트에는 센서, 소프트웨어, 통신 및 변경 관리를 위한 다년간의 지출이 수반되며 중소기업은 자금을 벌이기 어렵습니다. 왕성한 배터리 및 메탈 수요에도 불구하고, 2024년의 투자 의욕은 약하고, 경영진이 경쟁하는 우선사항을 음미하고 있기 때문에 신중함이 엿보입니다. 이익은 종종 채굴, 가공, 물류 사일로에 걸쳐 있으며 순현재가치 계산을 복잡하게 만듭니다. 분석가들은 2030년까지 미네랄 수요를 충족하기 위해 5조 4,000억 달러가 필요하며, 전면 전개 전에 투자 회수를 증명하는 단계적 전개의 중요성이 높아질 것으로 추정하고 있습니다.

부문 분석

2024년 스마트 마이닝 시장에서 스마트 자산 관리는 31.5%의 점유율을 차지했습니다. 이 부문은 센서 퓨전, AI 진단 및 라이프사이클 대시보드를 활용하여 적당한 투자로 신속한 절약을 실현합니다. 많은 기업들은 윤활 감시 카트리지와 진동 노드를 운반 트럭, 분쇄기 및 파쇄기에 6개월의 파일럿 기간 내에 통합하여 보다 대규모 프로젝트에 대한 신뢰성을 높이고 있습니다. 자율적인 운반 및 시추는 2030년까지 연평균 복합 성장률(CAGR)이 11.5%로 가장 급성장하는 솔루션에 랭크되어 있으며, 기본 원격 측정이 도입되면 크루레스 오퍼레이션으로의 시프트를 시사하고 있습니다. 데이터 관리 및 분석 플랫폼은 플릿, 플랜트 및 환경 센서의 정보를 통합하여 부서 횡단 팀이 원시 데이터를 실용적인 인사이트로 전환하여 회수율을 높이고 배출량을 줄일 수 있습니다. 안전 및 보안 시스템은 지속적인 인력 추적 및 지오펜싱을 필요로 하는 규제 강화의 혜택을 받습니다. 모니터링 및 시각화 대시보드는 생산 KPI와 함께 예측 경고를 표시하여 폐쇄 루프 제어를 완성합니다. 블록체인 추적성에서 광석 분류 디지털 트윈에 이르기까지 다른 새로운 툴은 광산 특유의 페인 포인트에 대응하는 다양한 포트폴리오를 완성합니다.

스마트 자산 관리는 또한 대출자가 환경 조항과 비교하여 설비 효율의 향상을 검증할 수 있기 때문에 지속가능성에 연동한 대출의 입구로서도 기능합니다. 공장 관리자가 예기치 못한 가동 중단 시간을 구체적으로 줄이면 이사회 위원회는 자율 드릴 장비, 버킷 휠 굴삭기 및 원격 조작 LHD의 광범위한 도입을 승인합니다. 자율 운반 솔루션으로 인한 스마트 마이닝 시장 규모는 센서 비용 저하와 견고한 5G 커버리지로 견인되어 2025-2030년 4.7배로 확대될 것으로 예측됩니다. 조기 어댑터는 벤치마크의 사이클 타임 개선을 발표하고 경쟁사에게 업그레이드 프로그램에 대한 투자를 촉구합니다. 플랫폼 벤더는 가용성 보증을 중심으로 서비스 수준 계약을 재작성하고 기술 지출과 생산 실적을 일치시키는 성과 기반 가격 설정을 도입합니다.

시스템 통합은 2024년 서비스 수익의 58.0%를 창출했는데, 이는 광산 회사가 자체 플릿 관리 소프트웨어를 레거시 PLC, 히스토리언 데이터베이스, ERP 제품군과 연결하는 것을 고민하기 때문입니다. 주요 오토메이션 벤더는 아키텍처 감사, 광섬유 설계, 사이버 보안 강화 등을 현대화 위험을 줄이는 턴키 프로그램에 번들로 제공합니다. CAGR 12.2%를 보일 것으로 예측되는 관리 서비스는 기술 전문 지식을 위한 자본 스파이크보다 예측 가능한 운영 예산을 선호하는 기업에 호소합니다. 공급자는 원격 운영 센터를 운영하고, 센서의 건전성을 모니터링하고, 취약성을 패치하고, 분석 업데이트를 야간에 푸시함으로써 현장 직원의 부담을 줄일 수 있습니다. 센서 배치 검증, LIDAR 유닛 교정, 진동 및 먼지에 노출되는 엣지 컴퓨팅 인클로저 수리 등 엔지니어링 및 유지보수 서비스는 여전히 필수적입니다.

컨설팅 회사는 디지털 성숙도 평가를 주도하고, 동업 타사에 비해 현장을 벤치마크하며 신속한 성과를 우선시킵니다. 트레이닝 부서는 전기 기사와 기계공을 상태 모니터링 대시보드를 해독하는 데이터 기술자에게 스킬업시킵니다. 채굴기기, 기술 및 서비스(METS) 분야의 성장은 지난 10년간 두배로 늘어날 것으로 예상되고 있으며, 단발 하드웨어 판매에서 정기적인 서비스 계약으로의 축족을 명확히 하고 있습니다. 스마트 마이닝 매니지드 서비스 시장 규모는 구독 서비스가 세계적으로 확대됨에 따라 2030년까지 42억 달러를 초과할 전망입니다. 공급업체는 현재 부품 가용성과 소프트웨어 가동 시간을 보장함으로써 광산 소유자로부터 운영 리스크를 벗어나 장기적인 파트너십을 강화하고 있습니다.

스마트 마이닝 시장 보고서는 솔루션별(스마트 제어 시스템, 스마트 자산 관리 등), 서비스 유형별(시스템 통합, 컨설팅 서비스 등), 채굴 유형별(갱내 채굴, 노천 채굴), 기술별(IoT, 인공지능, 분석 등), 지역별로 분류되어 있습니다.

지역 분석

아시아태평양은 2024년 스마트 마이닝 시장에서 38.3%의 점유율을 유지하였고, 2030년까지 CAGR 12.0%로 성장할 것으로 예측됩니다. 중국은 리튬, 레어 어스, 흑연 처리에서 우위성을 활용해, 메이드 인 차이나 2025와 일대일로의 광물 수직 수송에 지지된 자율형 운반 및 AI 구동형 농축기에 대한 대액의 투자를 정당화하고 있습니다. 호주는 광대한 철광석과 금 매장량과 엄격한 안전 규정을 결합하여 수백 킬로미터 떨어진 차량을 관리하는 퍼스 원격 운영 센터의 조기 채용을 촉진합니다. 일본과 한국은 배터리용 금속공급망의 탄력성을 우선으로 채굴 용도에 파급하는 로봇 공학 연구에 자금을 제공합니다. ASEAN 국가들은 2023년 FDI에서 2,300억 달러를 확보했으며, 인도네시아와 필리핀은 첫날부터 디지털 인프라를 통합한 니켈과 구리 프로젝트에 자금을 모으고 있습니다.

북미는 기술 강대국으로서 지속적으로 센서, 애널리틱스, 산업용 AI 공급업체를 보유하고 있는 한편, 대규모 노천굴 구리, 금, 오일샌드 광산을 운영하고 있습니다. 캐나다의 크리티컬 미네랄 전략은 전기 운반 트럭과 예지 보전 시스템의 도입을 가속화하고 국가를 지속 가능한 광업의 리더로 자리매김합니다. 미국은 국내 리튬, 니켈, 희토류 프로젝트 확보에 주력하고 있으며, 네바다 주와 애리조나 주에서는 에너지부 보조금으로 시험적 자율 시추를 실시합니다. 멕시코는 소노라주와 사카테카스주에서 은과 리튬의 민간 LTE와 모듈식 처리 라인을 통합한 클러스터 개발을 확대. 북미의 스마트 마이닝 시장 규모는 연방 정부의 인센티브와 ESG 연동형 대출을 배경으로 2030년까지 63억 달러 이상에 달할 것으로 예측됩니다.

유럽은 책임있는 조달과 순환 경제의 원칙을 강조하며 배출량 감소와 추적성 향상을 위해 디지털 도입을 가속화하고 있습니다. 독일의 원재료 전략은 국내 칼리 채석장과 건축자재 채석장에 대한 블록 체인 기반 증명과 장비의 원격 모니터링을 추진하고 있습니다. 스칸디나비아에서는 철광석과 베이스 메탈 광산을 위한 수명 주기 배출량 프로파일을 향상시키는 풍부한 수력 발전을 지원하는 배터리 갱내 차량을 개척하고 있습니다. 남미에서는 자동차 제조업체가 안정 공급을 요구하는 가운데 칠레와 페루에서 구리의 그린 필드 투자가 부활합니다. 칠레는 2032년까지 657억 1,000만 달러의 광산 투자를 계획하고 있으며, 원격지의 아타카마에서는 민간 5G가 중요한 역할을 합니다. 중동 및 아프리카는 사우디아라비아의 '비전 2030'이 광업을 주요 경제의 기둥으로 정하고 남아프리카가 AI에 의한 루트 최적화를 통합한 백금 광산용 수소 운반 트럭을 시험적으로 도입하는 등 프론티어 지역으로 부상하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 자율주행차의 도입

- IoT-AI에 의한 예지보전

- 안전 중시의 감시 수요

- 프라이빗 5G 전개

- 지속가능성 관련 금융

- 중요 광물 수요 급증

- 시장 성장 억제요인

- 높은 CAPEX 및 ROI 불확실성

- 레거시 시스템 통합의 갭

- 사이버 보안 취약성

- 숙련된 디지털 인력의 부족

- 밸류체인 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 라이벌 관계의 격렬

- 대체품의 위협

- 거시 경제 동향이 시장에 미치는 영향 평가

- 투자분석

제5장 시장 규모 및 성장 예측

- 솔루션별

- 스마트 제어 시스템

- 스마트 자산 관리

- 안전 및 보안 시스템

- 데이터 관리 및 분석 소프트웨어

- 감시 및 시각화

- 자율주행 운반 및 드릴링

- 기타 솔루션

- 서비스 유형별

- 시스템 통합

- 컨설팅 서비스

- 엔지니어링 및 유지보수

- 매니지드 서비스

- 채굴 유형별

- 지하 채굴

- 노천 시추

- 기술별

- 사물인터넷(IoT)

- 인공지능 및 분석

- 로봇 공학 및 자동화

- 접속성(5G/LTE)

- 클라우드 및 엣지 컴퓨팅

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- ASEAN

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- ABB Ltd

- Caterpillar Inc.

- Cisco Systems Inc.

- Komatsu Ltd

- Epiroc AB

- Hexagon AB

- Sandvik AB

- Rockwell Automation Inc.

- SAP SE

- Trimble Inc.

- IBM Corporation

- Wenco International Mining Systems Ltd

- Symboticware Inc.

- MineExcellence

- Metso Outotec Oyj

- Siemens AG

- Hitachi Construction Machinery Co., Ltd.

- Honeywell International Inc.

- Schneider Electric SE

- Accenture plc

제7장 시장 기회 및 향후 전망

AJY 25.11.05The smart mining market size stands at USD 16.87 billion in 2025 and is forecast to advance to USD 28.65 billion by 2030, reflecting an 11.2% CAGR.

Rapid digitalization is reshaping mine planning, fleet management and mineral processing as operators confront declining ore grades, stricter safety mandates and decarbonization targets. Autonomous haulage, IoT-enabled predictive maintenance, and private 5G networks deliver continuous productivity gains while lowering operating risk. Growing demand for lithium, nickel and rare earths bolsters investment in connected equipment that maximizes recovery rates. Partnerships between global automation vendors and niche mining-tech specialists foster integrated platforms that unify data from pit to port.

Global Smart Mining Market Trends and Insights

Critical-mineral demand surge

Global electrification drives unprecedented demand for lithium, cobalt, and rare earth elements, with the International Energy Agency projecting lithium demand to rise more than fortyfold by 2040. Miners expedite expansion projects and exploration campaigns that depend on connected drilling rigs and cloud-based geological models to locate higher-grade deposits. Governments in Australia, Canada, and the United States allocate incentives that lower the cost of automating extraction and concentrate production within secure supply chains. Digital twins help simulate processing plants that adjust reagent dosage and energy input in real time, cutting costs while improving recovery. As buyers sign multi-year offtake agreements, operators treat smart-equipment roll-outs as strategic investments rather than discretionary spending.

Autonomous haulage adoption

Komatsu's FrontRunner trucks have moved more than 2 billion tons of material since launch, proving consistent 24/7 availability in iron ore, copper, and coal projects. Caterpillar extended the technology to mid-range 777 trucks at Luck Stone's Virginia quarry during 2024, demonstrating applicability beyond mega-pit operations. Rio Tinto eliminated human exposure to high-traffic zones at its Pilbara mines, while Vale committed to fully autonomous fleets at Brucutu, validating safety and cost benefits. Transition from Wi-Fi to private LTE or 5G resolves latency and coverage gaps that once limited autonomous haulage in deep pits or mountainous terrains. Suppliers now bundle fleet management software with on-board perception sensors, accelerating adoption across both developed and developing regions.

High CAPEX and ROI uncertainty

Total automation projects involve multi-year outlays for sensors, software, communications, and change management that smaller firms struggle to finance. Weak investment appetite in 2024, despite strong battery-metal demand, reveals caution as executives weigh competing priorities. Benefits often span mining, processing and logistics silos, complicating net-present-value calculations. Analysts estimate the sector needs USD 5.4 trillion by 2030 to satisfy mineral demand, magnifying the importance of phased roll-outs that prove payback before full-site deployment.

Other drivers and restraints analyzed in the detailed report include:

- IoT-AI predictive maintenance

- Private 5G roll-outs

- Legacy-system integration gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart asset management held a commanding 31.5% share of the smart mining market in 2024 as operators prioritized uptime and cost control before expanding to full autonomy. The segment leverages sensor fusion, AI diagnostics, and lifecycle dashboards that drive quick savings with moderate investment. Many firms integrate lubrication-monitoring cartridges and vibration nodes on haul trucks, mills, and crushers within six-month pilots, building confidence for larger projects. Autonomous haulage and drilling ranks as the fastest-growing solution with an 11.5% CAGR through 2030, signalling a shift toward crewless operations once foundational telemetry is in place. Data management and analytics platforms unify information from fleets, plants, and environmental sensors, allowing cross-functional teams to turn raw data into actionable insights that boost recovery rates and lower emissions. Safety and security systems benefit from tightening regulations that require continuous personnel tracking and geofencing. Monitoring and visualization dashboards complete closed-loop control by displaying predictive alerts alongside production KPIs. Other emerging tools, from blockchain traceability to ore-sorting digital twins, round out a diverse portfolio that addresses mine-specific pain points.

Smart asset management also acts as the entry point for sustainability-linked financing because lenders can verify equipment efficiency gains against environmental covenants. As plant managers witness tangible reductions in unplanned downtime, board committees approve wider deployment of autonomous drill rigs, bucket-wheel excavators, and remote-operated LHDs. The smart mining market size attributed to autonomous haulage solutions is forecast to expand 4.7 times between 2025 and 2030, driven by falling sensor costs and robust 5G coverage. Early adopters publicize benchmark cycle-time improvements, spurring competitors to invest in upgrade programs. Platform vendors rewrite service-level agreements around guaranteed availability, introducing outcome-based pricing that aligns technology spending with production results.

System integration generated 58.0% of service revenue in 2024 as miners grapple with connecting proprietary fleet-management software to legacy PLCs, historian databases, and ERP suites. Large automation vendors bundle architecture audits, fiber-optic design, and cybersecurity hardening into turnkey programs that de-risk modernization. Managed services, forecast to grow at a 12.2% CAGR, appeal to firms that prefer predictable operating budgets over capital spikes for technology expertise. Providers run remote operations centers that monitor sensor health, patch vulnerabilities, and push analytics updates overnight, lowering the burden on site staff. Engineering and maintenance services remain essential for validating sensor placement, calibrating LIDAR units, and repairing edge-compute enclosures exposed to vibration and dust.

Consulting firms lead digital-maturity assessments that benchmark sites against industry peers and prioritize quick wins. Training divisions upskill electricians and mechanics into data technicians who decode condition-monitoring dashboards. Growth of the mining equipment, technology, and services (METS) sector, expected to double this decade, underscores the pivot from one-off hardware sales to recurring service contracts. The smart mining market size of managed services is poised to exceed USD 4.2 billion by 2030 as subscription offerings scale globally. Vendors now guarantee parts availability and software uptime, transferring operational risk away from mine owners and reinforcing long-term partnerships.

The Smart Mining Market Report is Segmented by Solution (Smart Control Systems, Smart Asset Management, and More), Service Type (System Integration, Consulting Service, and More), Mining Type (Underground Mining and Surface (Open-Pit) Mining), Technology (Internet of Things (IoT), Artificial Intelligence and Analytics, and More), and Geography.

Geography Analysis

Asia-Pacific maintained a 38.3% share of the smart mining market in 2024 and is set to deliver a 12.0% CAGR to 2030. China leverages its dominance in lithium, rare earth and graphite processing to justify heavy investment in autonomous haulage and AI-driven concentrators, supported by Made in China 2025 and the Belt and Road mineral verticals. Australia combines vast iron ore and gold reserves with stringent safety regulation to foster early adoption of remote-operating centers in Perth that manage fleets hundreds of kilometers away. Japan and South Korea prioritize supply-chain resilience for battery metals and fund robotics research that spills into mining applications. ASEAN nations secured USD 230 billion in 2023 FDI, with Indonesia and the Philippines drawing capital for nickel and copper projects that embed digital infrastructure from day one.

North America remains a technology powerhouse, hosting suppliers of sensors, analytics and industrial AI while operating large-scale open-pit copper, gold and oil-sands mines. Canada's Critical Minerals Strategy accelerates deployment of electrified haul trucks and predictive maintenance systems, positioning the country as a sustainable mining leader. The United States focuses on securing domestic lithium, nickel and rare earth projects; Nevada and Arizona host pilot autonomous drills under Department of Energy grants. Mexico expands cluster developments in Sonora and Zacatecas that integrate private LTE and modular processing lines for silver and lithium. The smart mining market size for North America is expected to cross USD 6.3 billion by 2030 on the back of federal incentives and ESG-linked financing.

Europe emphasizes responsible sourcing and circular-economy principles, accelerating digital adoption to cut emissions and improve traceability. Germany's raw materials strategy promotes blockchain-based provenance and remote equipment monitoring for domestic potash and construction-material quarries. Scandinavia pioneers battery-electric underground fleets for iron ore and base-metal mines, backed by abundant hydropower that enhances lifecycle emissions profiles. South America witnesses a resurgence of greenfield copper investments in Chile and Peru as automakers seek stable supplies; Chile plans USD 65.71 billion in mining investment through 2032, with private 5G pivotal in remote Atacama sites. Middle East and Africa emerge as frontier regions, with Saudi Arabia's Vision 2030 designating mining a primary economic pillar and South Africa piloting hydrogen haulage trucks for platinum mines that integrate AI route optimization.

- ABB Ltd

- Caterpillar Inc.

- Cisco Systems Inc.

- Komatsu Ltd

- Epiroc AB

- Hexagon AB

- Sandvik AB

- Rockwell Automation Inc.

- SAP SE

- Trimble Inc.

- IBM Corporation

- Wenco International Mining Systems Ltd

- Symboticware Inc.

- MineExcellence

- Metso Outotec Oyj

- Siemens AG

- Hitachi Construction Machinery Co., Ltd.

- Honeywell International Inc.

- Schneider Electric SE

- Accenture plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Autonomous haulage adoption

- 4.2.2 IoT-AI predictive maintenance

- 4.2.3 Safety-driven monitoring demand

- 4.2.4 Private 5G roll-outs

- 4.2.5 Sustainability-linked financing

- 4.2.6 Critical-mineral demand surge

- 4.3 Market Restraints

- 4.3.1 High CAPEX and ROI uncertainty

- 4.3.2 Legacy-system integration gaps

- 4.3.3 Cyber-security vulnerabilities

- 4.3.4 Skilled digital-talent shortage

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Smart Control Systems

- 5.1.2 Smart Asset Management

- 5.1.3 Safety and Security Systems

- 5.1.4 Data Mgmt and Analytics Software

- 5.1.5 Monitoring and Visualization

- 5.1.6 Autonomous Haulage and Drilling

- 5.1.7 Other Solutions

- 5.2 By Service Type

- 5.2.1 System Integration

- 5.2.2 Consulting Services

- 5.2.3 Engineering and Maintenance

- 5.2.4 Managed Services

- 5.3 By Mining Type

- 5.3.1 Underground Mining

- 5.3.2 Surface (Open-Pit) Mining

- 5.4 By Technology

- 5.4.1 Internet of Things (IoT)

- 5.4.2 Artificial Intelligence and Analytics

- 5.4.3 Robotics and Automation

- 5.4.4 Connectivity (5G/LTE)

- 5.4.5 Cloud and Edge Computing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Australia and New Zealand

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ABB Ltd

- 6.4.2 Caterpillar Inc.

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Komatsu Ltd

- 6.4.5 Epiroc AB

- 6.4.6 Hexagon AB

- 6.4.7 Sandvik AB

- 6.4.8 Rockwell Automation Inc.

- 6.4.9 SAP SE

- 6.4.10 Trimble Inc.

- 6.4.11 IBM Corporation

- 6.4.12 Wenco International Mining Systems Ltd

- 6.4.13 Symboticware Inc.

- 6.4.14 MineExcellence

- 6.4.15 Metso Outotec Oyj

- 6.4.16 Siemens AG

- 6.4.17 Hitachi Construction Machinery Co., Ltd.

- 6.4.18 Honeywell International Inc.

- 6.4.19 Schneider Electric SE

- 6.4.20 Accenture plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment