|

시장보고서

상품코드

1685744

세계의 프로그래머블 로직 컨트롤러(PLC) 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Programmable Logic Controller (PLC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

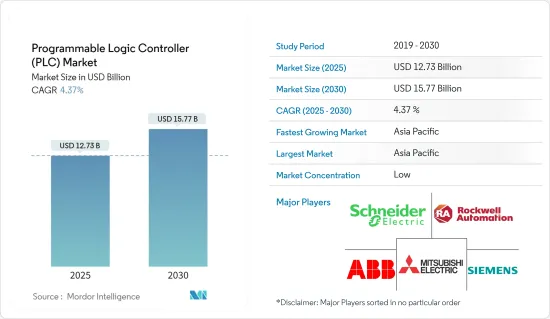

세계의 프로그래머블 로직 컨트롤러 시장 규모는 2025년 127억 3,000만 달러로 추정되며, 예측 기간(2025-2030년)중 CAGR 4.37%로 확대되어, 2030년에는 157억 7,000만 달러에 달할 것으로 예측됩니다.

이 시장은 생산 목표를 달성하고 제품 품질을 향상시키기 위한 자동화에 대한 수요가 증가함에 따라 현저한 성장을 이루고 있습니다.

주요 하이라이트

- 조사된 시장 산업 생산량과 컴퓨터 및 소프트웨어에 대한 투자에 크게 영향을 받습니다.

- 로봇은 PLC의 주요 사용자 중 하나이기 때문에 시장은 산업용 로봇의 세계 설치 대수 증가로 큰 혜택을 받을 것으로 예상됩니다. 국제 로봇 연맹(IFR)에 따르면, 미국의 제조 기업은 자동화에 다액의 투자를 실시했습니다.

- 시장의 또 다른 큰 동향은 HMI나 SCADA 등의 산업용 제어 장치에 PLC를 통합하는 등, 통합 솔루션이나 디바이스의 채용이 확대되고 있는 것입니다.

- PLC, 모션 컨트롤, HMI 프로그래밍을 단일 환경으로 통합하는 것은 예측 기간 동안 진행될 것으로 예상되는 동향입니다.

- 제품 커스터마이징에 대한 수요 증가와 이산 산업에서 일괄 처리에서 연속 처리로의 전환은 PLC 시장에 큰 어려움을 가져왔습니다. PLC는 여전히 많은 용도에서 필수 불가결하지만, 이러한 진화하는 환경에서의 다이나믹, 리얼타임, 대규모 프로세스의 처리에는 한계가 있기 때문에 산업계는 보다 뛰어난 적응성, 확장성, 효율성을 제공하는 대체품을 요구하고 있습니다.

- 경제 성장, 특히 제조업과 산업부문에서는 다양한 유형의 PLC에 대한 수요가 크게 늘어나고 있습니다.

프로그래머블 로직 컨트롤러(PLC) 시장 동향

자동차 산업이 가장 급성장하는 최종 사용자

- PLC는 조립 라인, 페인트, 용접 등 다양한 자동차 제조 용도에서 사용할 수 있습니다. 인공지능(AI)과 사물인터넷(IoT)을 PLC와 통합함으로써 스마트 공장으로의 길을 열 수 있습니다.

- 자동차 산업은 제품 용도의 관점에서 많은 PLC 용도을 발견하고 있으며, 가장 많은 것은 중형 PLC입니다. 머신 비전, 협동 로봇, 인공지능, IoT 커넥티드카의 인지 컴퓨팅 등의 신기술에 의해 더욱 확대될 것으로 예상됩니다.

- 예를 들어, 2023년 10월, Hyundai는 미국 최초의 전기자동차 공장의 건설을 계획해, 2025년 생산을 목표로 하고 있습니다. 이것은 시장에서의 자동차 제조 확대를 지원해, 공장 자동화용 PLC 시스템 수요를 낳을 것으로 예상됩니다.

- 여러 자동화 제어 포인트를 관리하는 제조업체는 가시성과 보안을 높이기 위해 중앙 집중식 관리를 선택합니다.

- 예를 들어, 2024년 5월, Ford Motors는 공장 제어를 중앙 집중화하기 위해 Siemens 자동화 시스템을 도입할 계획을 발표했습니다. 인터넷 테크놀로지(IT) 워크플로우를 오퍼레이션 테크놀로지(OT) 환경에 통합하는 것으로, 이 시스템은 오퍼레이션을 합리화해, PLC 솔루션의 기술적 진보를 강조해, 시장 채용율을 높여가고 있습니다.

- 전기자동차(EV)의 대폭적인 성장이 시장 수요를 밀어 올리고 있습니다.

- 이 때문에 자동차 제조에 PLC를 도입하는 것으로, 다운타임을 최소한으로 억제하면서 생산성과 품질을 향상시키는 등의 장점을 얻을 수 있습니다.

큰 성장을 기록하는 아시아태평양

- 중국은 특히 제조업, 자동차, 일렉트로닉스, 화학에 있어서 산업 자동화를 추진하고 있으며, PLC의 채용은 매우 중요합니다. 이 때문에 효율 개선, 휴먼 에러 감소, 생산 라인의 유연성 향상을 목적으로 한 PLC 시스템에 대한 투자가 증가하고 있습니다.

- 중국은 최근 선진제조업 추진의 일환으로 여러 산업정책을 발표했습니다.

- 국제 로봇 연맹(IFR)에 따르면, 산업용 로봇에 대한 거액의 투자에 의해 중국은 로봇 밀도로 처음으로 미국을 제치고 세계 최대가 되었습니다.

- 중국은 현재 전 세계에 설치된 산업용 로봇(IFR)의 거의 4분의 1을 차지하고 있으며, 국내에서 가장 빠르게 성장하고 있는 수직 시장은 다양한 수직 분야에서의 로봇 용도을 촉진할 것으로 기대되고 있습니다. 또한 우한대학 품질개발전략연구소는 2025년까지 중국의 노동인구의 약 5%가 기계와 로봇으로 대체될 것으로 예측했습니다.

- 인도의 제조업 부문은 ‘Make in India’와 같은 이니셔티브에 힘입어 생산성, 품질, 경쟁력을 강화하기 위해 자동화의 도입이 진행되고 있습니다.

- IBEF에 따르면 인도의 전기자동차(EV) 시장은 2025년까지 70억 9,000만 달러(50,000크로르 루피)에 이를 것으로 추정됩니다. CEEW Centre for Energy Finance의 조사에서는 2030년까지 인도에서 전기차에 2,060억 달러의 비즈니스 기회가 있다고 인식되고 있습니다.

- 일본은 산업 자동화에 있어서 중요한 기업이며, 자동차, 일렉트로닉스, 제조업 등의 업계에서는 스마트 팩토리 솔루션의 채용이 진행되고 있습니다. PLC는 생산 공정 자동화, 효율의 향상, 조업 비용의 삭감에 있어서 매우 중요합니다.

프로그래머블 로직 컨트롤러(PLC) 산업 개요

경쟁은 브랜드 아이덴티티, 강력한 경쟁 전략, 투명성 정도 등 시장에 영향을 미치는 요인에 따라 결정됩니다.

이 시장은 제품 기술의 향상에 많은 투자를 해 온 옛부터 정평이 있는 기업으로 구성되어 있습니다. 신규 기업은 높은 수준의 광고가 필요합니다. 그러나 업계의 주요 기업에게는, 이것은 매우 쉬운 일입니다.

ABB Ltd., Rockwell Automation Inc., Honeywell International Inc., Mitsubishi Electric Corporation 등 기존 벤더의 존재는 시장의 대부분을 차지하고 유통 채널에 대한 액세스도 크기 때문에 신규 진입에 높은 장벽이 되고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 거시 경제 동향이 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 자동화 시스템의 채용 증가

- PLC 프로그래밍의 사용 편의성과 친숙함이 성장을 지원

- 시장 성장 억제요인

- 이산형 산업에서 제품 맞춤화 수요와 배치 처리에서 연속 처리로의 단계적 이동

- 안전성과 고급 제어 기능을 강화한 분산형 제어 시스템(DCS)의 채용 증가

제6장 시장 세분화

- 유형별

- 하드웨어와 소프트웨어

- 대형 PLC

- 나노 PLC

- 소형 PLC

- 중형 PLC

- 기타 유형

- 서비스별

- 하드웨어와 소프트웨어

- 최종 사용자 산업별

- 식품, 담배, 식품 및 음료

- 자동차

- 화학제품 및 석유화학제품

- 에너지 및 유틸리티

- 펄프 및 제지

- 석유 및 가스

- 상하수도치료

- 제약

- 기타 최종 사용자 산업

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 아시아

- 중국

- 인도

- 일본

- 호주 및 뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- ABB Ltd

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Rockwell Automation Inc.

- Siemens AG

- Honeywell International Inc.

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Emerson Electric Co.

- Hitachi Ltd

- Toshiba International Corporation

제8장 투자 분석

제9장 시장의 미래

JHS 25.04.21The Programmable Logic Controller Market size is estimated at USD 12.73 billion in 2025, and is expected to reach USD 15.77 billion by 2030, at a CAGR of 4.37% during the forecast period (2025-2030).

The market is experiencing significant growth due to the increasing demand for automation to meet production goals and enhance product quality. The need for higher production volumes without compromising quality standards also drives this demand, as PLCs enable precise control over manufacturing parameters, ensuring consistent output and adherence to quality benchmarks.

Key Highlights

- The market studied is significantly influenced by industrial output and investments in computers and software. PLC systems have traditionally served as the foundation of process and discrete factory automation. The increasing adoption of Industry 4.0 across various industrial sectors has further driven market growth. A notable growth indicator for PLCs in discrete manufacturing is the increased deployment of robots in the automotive manufacturing, electrical, and electronics industries.

- With robots being one of the key users of PLCs, the market is expected to benefit significantly from the growth of global industrial robot installations. Industrial robots have witnessed a huge demand in recent years due to the rising adoption of smart factory systems. According to the International Robotics Federation (IFR), manufacturing companies in the United States have invested heavily in automation. The number of total industrial robots installed increased by 12% and reached 44,303 units in 2023.

- Another major trend in the market is the growing adoption of integrated solutions and devices, such as embedding PLCs with industrial controls such as HMIs or SCADA. These integrations improve efficacy and visibility in factory operations while reducing the workload on central controllers.

- The integration of PLC, motion control, and HMI programming into a single environment is a trend expected to advance over the forecast period. The demand for combining HMI processors and PLCs into the same rack, with a monitor included in the package or offered as an external option, is projected to increase significantly.

- The growing demand for product customization and the shift from batch to continuous processing in discrete industries are creating significant challenges for the PLC market. Factors such as greater flexibility, integration with advanced technologies, scalability, and cost pressures are pushing manufacturers to explore more advanced automation solutions like DCS, SCADA, industrial PCs, and cloud-based systems. While PLCs remain essential in many applications, their limitations in handling dynamic, real-time, and large-scale processes in these evolving environments drive industries to seek alternatives that offer better adaptability, scalability, and efficiency.

- Economic growth, particularly in the manufacturing and industrial sectors, is significantly driving demand for various types of PLCs. As economies expand and industries modernize, the demand for automation solutions is increasing, enabling these industries to enhance efficiency, productivity, and competitiveness.

Programmable Logic Controller (PLC) Market Trends

Automotive Industry to be the Fastest Growing End User

- PLCs can be used in various automotive manufacturing applications, including assembly lines, painting, and welding. They control the movement of materials and parts on the production line, ensuring efficient operations, which shows the potential demand for PLC systems in line with the growth of Automotive manufacturing worldwide. The potential for PLC in automotive manufacturing expands as technology evolves. Integrating Artificial Intelligence (AI) and the Internet of Things (IoT) with PLC paves the way for smart factories. These factories can monitor and optimize production in real-time, heightening efficiency. For instance, machines equipped with sensors can gather performance data and make necessary adjustments to enhance production.

- The automobile industry finds many PLC applications from the product application view, and the most significant amount is medium-sized PLC. Some forms of the PLC are mostly at the electric car's former disposal in the application. Moreover, the PLC market in the automotive industry is anticipated to expand further with new technologies such as machine vision, collaborative robotics, artificial intelligence for driverless/autonomous automobiles, cognitive computing in IoT-connected cars, and more. Furthermore, many automakers are expanding their Electric Vehicle factory in the studied region, further driving the market, which would support the demand for smart factories and create a growth opportunity for the market vendors.

- For instance, in October 2023, Hyundai planned to build its first US electric vehicle plant, with production on track for 2025. This would support the expansion of automobile manufacturing in the market and create a demand for PLC systems due to their applications in plant automation.

- Manufacturers managing multiple automation control points increasingly opt for centralized management to boost visibility and security. This trend would drive the demand for advanced PLC solutions in the market.

- For example, in May 2024, Ford Motors announced its plan to implement an automated system from Siemens to centralize its factory control. This innovative solution merges the capabilities of a hardware Programmable Logic Controller (PLC), a traditional Human Machine Interface, and an edge device into a unified, software-driven platform. By integrating Internet Technology (IT) workflows into Operational Technology (OT) environments, the system streamlines operations and underscores the technological strides in PLC solutions, bolstering their market adoption rate.

- Significant Growth in Electric Vehicles (EVs) To Boost the Market Demand. PLCs are essential for controlling the various robotic systems, conveyors, and machines that perform welding, painting, material handling, and assembly in EV production facilities. According to IEA, in 2023, China experienced the most electric car sales throughout the Asia-Pacific region, with over eight million electric cars sold.

- Therefore, deploying PLCs in automotive manufacturing results in benefits such as enhancing productivity and quality while minimizing downtime. Manufacturers can boost production rates through process automation while decreasing error probabilities, supporting the growth of the studied market in the future.

Asia-Pacific to Register Major Growth

- China's push for industrial automation, especially in manufacturing, automotive, electronics, and chemicals, is crucial for adopting PLC. The Chinese government has launched initiatives, such as Made in China 2025, to modernize its manufacturing sector through automation and smart technologies. This has increased investments in PLC systems to improve efficiency, reduce human error, and enhance production line flexibility. In 2023, the sales volume of automated mobile robots (AMR) and automated guided vehicles (AGV) amounted to 140 thousand units.

- China recently released multiple industrial policies as part of its advanced manufacturing drive. The guidelines support the country's objective of becoming a high-tech superpower during the next quarter-century. For instance, the Chinese government has been pushing for the industrial use of next-generation wireless technology amid a steady stream of directives focused on transforming the country's manufacturing.

- According to the International Federation of Robotics (IFR), China's massive investment in industrial robotics has put the nation in the top ranking in terms of robot density, surpassing the United States for the first time. The ratio of operational industrial robots to workers in manufacturing reached 322 units per 10,000 employees. The nation leads in annual robot installations and has consistently boasted the most significant operational stock of robots for several years.

- The fastest-growing vertical markets in the country are expected to facilitate robotics applications across different verticals, as China now accounts for almost a quarter of all the industrial robots installed globally (IFR). Also, the Wuhan University Institute of Quality Development Strategy predicts that by 2025, machinery and robotics will replace nearly 5% of China's workforce. Such investments are expected to drive the PLC market during the forecast period.

- India's manufacturing sector, driven by initiatives like "Make in India," is increasingly adopting automation to enhance productivity, quality, and competitiveness. Industries such as automotive, electronics, textiles, and food and beverages are investing in PLC-based automation systems to streamline operations and reduce human intervention, which leads to increased demand for PLCs.

- According to IBEF, India's electric vehicle (EV) market is estimated to reach USD 7.09 billion (INR 50,000 crore) by 2025. A study by the CEEW Centre for Energy Finance recognized a USD 206 billion opportunity for electric vehicles in India by 2030. This will necessitate a USD 180 billion investment in vehicle manufacturing and charging infrastructure.

- Japan is a significant player in industrial automation, with industries like automotive, electronics, and manufacturing increasingly adopting smart factory solutions. PLCs are crucial in automating production processes, improving efficiency, and reducing operational costs. The push toward "Industry 4.0" and "Society 5.0" initiatives encourages greater adoption of PLCs to enable smart manufacturing systems.

Programmable Logic Controller (PLC) Industry Overview

Competition depends on factors affecting the market, such as brand identity, powerful competitive strategy, and degree of transparency. The market studied has a highly sustainable competitive advantage through innovation, as buyers seek more efficient solutions to optimize the process.

The market consists of long-standing established players who have significantly invested in improving product technology. Some vendors include ABB Ltd, Siemens AG, and Emerson Electric Co.. The new players entering the market require a high level of advertising. However, this is quite simple for the key players in the industry. The companies can sustain themselves through powerful competitive strategies like technological collaborations, extensive R&D investments, and acquisitions.

The presence of established vendors, such as ABB Ltd, Rockwell Automation Inc., Honeywell International Inc., and Mitsubishi Electric Corporation, pose high barriers to the entry of new players since these players occupy the majority of the market and have greater access to the distribution channels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Automation Systems

- 5.1.2 Ease of Use and Familiarity with PLC Programming to Sustain Growth

- 5.2 Market Restraints

- 5.2.1 Demand for Customization of Products and Gradual Shift from Batch to Continuous Processing in the Discrete Industries

- 5.2.2 Increase in Adoption of Distributed Control Systems (DCS), with Enhanced Safety and Advanced Control Capabilities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware and Software

- 6.1.1.1 Large PLC

- 6.1.1.2 Nano PLC

- 6.1.1.3 Small PLC

- 6.1.1.4 Medium PLC

- 6.1.1.5 Other Types

- 6.1.2 Services

- 6.1.1 Hardware and Software

- 6.2 By End-user Industry

- 6.2.1 Food, Tobacco, and Beverage

- 6.2.2 Automotive

- 6.2.3 Chemical and Petrochemical

- 6.2.4 Energy and Utilities

- 6.2.5 Pulp and Paper

- 6.2.6 Oil and Gas

- 6.2.7 Water and Wastewater Treatment

- 6.2.8 Pharmaceutical

- 6.2.9 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Schneider Electric SE

- 7.1.4 Rockwell Automation Inc.

- 7.1.5 Siemens AG

- 7.1.6 Honeywell International Inc.

- 7.1.7 Omron Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Emerson Electric Co.

- 7.1.11 Hitachi Ltd

- 7.1.12 Toshiba International Corporation