|

시장보고서

상품코드

1687266

액티브 지오펜싱 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Active Geofencing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

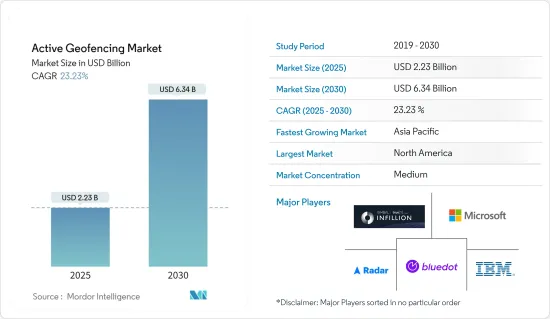

세계의 액티브 지오펜싱 시장 규모는 2025년 22억 3,000만 달러로 추정되며 예측 기간 중(2025-2030년) CAGR 23.23%로 확대되어, 2030년에는 63억 4,000만 달러에 달할 것으로 예측됩니다.

액티브 지오펜싱은 공간 데이터의 보다 효과적인 이용, 실시간 위치 정보 기술의 향상, 소비자에 의한 위치 정보 용도의 세계 채용 증가에 의해 성장하고 있습니다.

주요 하이라이트

- 지오펜싱은 GPS, PFID, WiFI, 모바일 데이터 등의 기술을 이용하고, 디바이스가 지오펜스로 알려진 지리적 영역의 가상 경계를 벗어나면 사전 프로그래밍된 액션을 트리거할 수 있도록 하는 용도과 소프트웨어로 각 최종 사용자가 이용하는 위치 기반 서비스입니다.

- 공간 데이터와 실시간 위치 정보 기술의 이용이 늘어남에 따라 사람들과 기업이 어떻게 세계와 관련되어 엄청난 절약을 할 수 있는지가 바뀌어 왔습니다.

- 기술적 유연성과 기능으로 액티브 지오펜싱의 진보는 증가하고 있습니다.

- 위치 추적에 대한 우려와 규제 증가는 액티브 지오펜싱 기술을 위협할 수 있습니다.

- COVID-19 바이러스는 의료, 산업 및 기타 여러 부문에서 액티브 지오펜스의 사용을 증가 시켰습니다.

액티브 지오펜싱 시장 동향

소매 부문이 크게 성장하는지 확인

- 액티브 지오펜싱을 통해 소매업체는 판매 거점의 정의된 반경 내에 있는 잠재 고객을 파악하고 개인화된 통지와 특정 오퍼를 전송할 수 있습니다.

- 소매 기업은 자사의 서비스나 제품에 참여할 가능성이 가장 높은 소비자를 대상으로 할 수 있기 때문에 지오펜싱 데이터를 이용한 광고 캠페인은 투자 수익률이 높아지는 경향이 있습니다.

- 향후 액티브 지오펜싱은 증강현실(AR), 고객, 첨단 기술과 결합되어 보다 디지털 방식으로 개인화된 쇼핑 경험을 기대할 수 있습니다. 고객은 보다 디지털 퍼스트로 퍼스널라이즈 된 쇼핑 체험을 경험할 것으로 기대됩니다.

- 쇼핑의 미래를 형성하는 동향에 관한 최근 조사에서는 2025년까지 미국 소비자의 약 3분의 1이 온라인으로 상품을 구입할 때 AR 기술을 사용하게 될 것으로 예측했습니다.

북미가 시장의 주요 점유율을 차지할 전망

- 북미에서는 의료, 수송, 물류, 금융 서비스 부문, 보안 등 다양한 엔드포인트에서 액티브 지오펜싱에 대한 투자와 혁신이 이루어지고 있습니다.

- 게다가 이 지역은 액티브 지오펜싱을 사용할 수 있는 BFSI 섹터, 소매, 운송, 물류 부문의 기업이 지배적입니다.

- 게다가 디지털 기술의 폭넓은 전개와, 모든 기업에 있어서의 비즈니스 인텔리전스 툴에 수요 증가에 의해 다양한 지오펜스 솔루션을 취하는 자동화 툴의 채용이 증가하고 있습니다.

- 그러나 많은 지역 소매업체들은 고객 충성도를 강화하기 위해 디지털 오퍼와 프로모션을 통해 액티브 지오펜싱을 적용하기 시작했습니다. 소매업체는 또한 고객이 특정 상점을 방문하기 전후에 어디에서 왔는지 더 잘 이해할 수 있습니다.

액티브 지오펜싱 산업 개요

액티브 지오펜싱 시장은 Bluedot Innovation Pty Ltd, Infillion Inc.(GIMBLE), IBM Corporation, Microsoft Corporation, Radar Labs Inc. 등과 같은 유명한 공급업체를 위해 반고체화되었습니다. 주요 기업은 시장 점유율을 높이고 조사된 시장에서의 수익성을 높이기 위해 인수 및 파트너십 등 다양한 전략에 참여하고 있습니다.

- 2023년 7월 Radar는 Cordial과의 제휴를 발표했으며 온프레미스 앱 모드, 상점 지도 및 로케이터, 주소 자동 완성 등의 위치 기반 경험을 통해 참여와 수익을 늘리고 있습니다. JOANN과 같은 브랜드는 Radar의 위치 정보 인프라와 Cordial 마케팅 및 데이터 플랫폼의 조합을 통해 고도로 개인화된 컨텍스트와 관련된 경험을 실시간으로 고객에게 제공합니다.

- 2023년 6월 Autodesk는 지리 정보 시스템(GIS) 소프트웨어의 세계 산업 리더인 Esri와의 전략적 제휴를 발표했습니다. ArcGIS GeoBIM을 통해 Autodesk BIM Collaborate Pro와 ArcGIS Online이 통합되어 설계 모델과 로케이션 인텔리전스의 전체적인 뷰가 실현됨으로써, 리스크의 저감, 프로젝트 콜라보레이션의 향상, 이해 관계자와의 커뮤니케이션의 개선이 가능하게 됩니다.

- M3는 2022년 9월 지오펜싱과 비콘 기술로 구성된 독자적인 노무관리 소프트웨어 'M3 labor'의 대폭적인 진화를 발표했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 분석

- 시장에 대한 COVID-19의 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 공간 데이터의 이용 증가와 실시간 위치 정보 기술의 향상

- 위치 정보 용도의 소비자 침투

- 시장 성장 억제요인

- 위치 정보 추적에 대한 소비자의 안전 및 안심 의식 고조

제6장 시장 세분화

- 조직 규모별

- 소규모 및 중견기업

- 대규모 기업

- 최종 사용자 산업별

- 은행, 금융서비스 및 보험

- 소매

- 방위, 정부, 군사

- 의료

- 제조업

- 운송 및 물류

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Bluedot Innovation Pty Ltd

- Infillion Inc.(GIMBLE)

- IBM Corporation

- Microsoft Corporation

- Radar Labs Inc.

- Google LLC

- Samsung Electronics Co.

- Verve Inc.

- Apple Inc.

- LocationSmart

- SZ DJI Technology Co.

- ESRI

제8장 투자 분석

제9장 시장의 미래

JHS 25.05.02The Active Geofencing Market size is estimated at USD 2.23 billion in 2025, and is expected to reach USD 6.34 billion by 2030, at a CAGR of 23.23% during the forecast period (2025-2030).

Active geofencing is growing due to more effective use of Spatial Data, improving Real Time Location Technologies, and increased adoption worldwide for location-bassed applications by consumers.

Key Highlights

- Geofencing is a location-based service used by each end user, for which an application or software uses technologies such as GPS, PFID, WiFI, and mobile data to enable them to trigger preprogrammed actions when the device leaves virtual boundaries of geographical zones known as geofences.

- How people and businesses interact with the world and make huge savings has changed due to the increased use of spatial data and real-time location technologies. All kinds of devices and systems are connected to the Internet, such as phones, Smart buildings, car navigation systems, industries, or fleets of autonomous vehicles. Technology that provides real-time location data is required to maintain the system's proper functioning on a daily basis.

- With technological flexibility and capabilities, advancement in Active Geofencing is increasing. The market's growth is driven by trends such as digital marketing and clustering, autonomous cars, increased adoption of Bring Your Own Device, etc. The market studied, therefore, is expected to remain robust and will have a significant growth contribution from players in the market.

- Increasing concerns and regulations regarding location tracking can threaten active geofencing technologies. Moreover, active geofencing solutions are being held back due to the lack of regulatory bodies dealing with privacy and data collection in various regions.

- The COVID-19 virus increased the use of Active Geofences in several sectors, such as healthcare, industry, and many others. For example, an application had to be submitted by individual companies to identify staff at their premises and communicate with them directly and immediately. Active geofencing has facilitated secure, timely communication during an emergency.

Active Geofencing Market Trends

Retail Segment to Witness Significant Growth

- An active geofence enables retailers to determine potential customers within a defined radius of any point of sale, sending them personalised notifications and specific offers that they can use in order to make their purchases. In addition, as digitisation continues to spread across all retail sectors, demand for effective geofencing is growing rapidly in the retail sector.

- In view of the fact that retailers can target consumers who are most likely to take part in their services or products, advertising campaigns using geofenced data tend to deliver higher return on investment. This leads to higher profits for retail organisations.

- Moreover, In the future, active geofencing will be combined with augmented reality (AR), customers and advanced technologies andexpect a more digital-first, personalized shopping experience. As more mobile devices become wearables, customers are expected to experience a more digital first and personalised shopping experience. In the coming forecast period, this will lead to a higher uptake of active geofencing in retail.

- Recent research on trends which are shaping the future of shopping, predicts that by 2025, about one third of consumers in the United States will be using AR technologies when purchasing products online. AR technologies enable virtual product viewing when shopping online. The study showed that while in countries like Saudi Arabia and United Arab Emirates, the expected use of AR was as high as 45 percent, in Europe, this share was much lower.

North America is Expected to Hold the Major Share of the Market

- In North America, active geofencing investments and innovation have been made at various endpoints, such as healthcare, transport, logistics, financial services sector, security, and many others. Market forces push for integrating spatial information and real-time location technologies in this region.

- Further, this region is dominated by companies in the BFSI sector, retail and transport, and logistics sectors capable of using active geofencing. In addition, North America has one of the most developed economies in the world in the form of the United States and Canada. As a result of the strong communication and Internet infrastructure in the region, it is also leading the market.

- In addition, the adoption of automated tools that take different geofence solutions has increased due to the wide deployment of digital technologies and the growing demand for business intelligence tools in all kinds of enterprises.

- However, many regional retailers are increasingly applying active geofencing through digital offers and promotions to strengthen customer loyalty. Retailers can also better understand where their customers are coming from before and after they visit one particular shop.

Active Geofencing Industry Overview

The active geofencing market is semi-consolidated due to prominent vendors like Bluedot Innovation Pty Ltd, Infillion Inc. (GIMBLE), IBM Corporation, Microsoft Corporation, Radar Labs Inc., etc. The key players are involved in various strategies, such as acquisitions and partnerships, to improve their market share and enhance their profitability in the market studied.

- In July 2023, Radar announced our partnership with Cordial, Increasing engagement and revenue through location-based experiences like on-premise app modes, store maps and locators, and address autocomplete. In real time, brands such as JOANN deliver highly personalised, contextually relevant experiences to their customers through the combination of Radar's industry location infrastructure with Cordial's marketing and data platform.

- In June 2023, Autodesk has announced the strategic partnership with Esri, one of the global industry leader in Geographic Information System (GIS) software, Where the Autodesk BIM Collaborate Pro and Esri's ArcGIS Online integrate through ArcGIS GeoBIM for a holistic view of design models and location intelligence to reduce risk, provide better project collaboration, and improve communication with stakeholders.

- In September 2022, M3 announced significant advancements to its proprietary Labour Management software, M3 labor, consisting of geofencing and beacon technologies. With this new functionality, users of the M3 Labour service can create an area radius where staff can punch in and out at work. These new features are intended to ensure that hotel staff clock in and out when and where they should while preventing them from doing so elsewhere, thereby avoiding the possibility of false and erroneous punching.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Use of Spatial Data and Improved Real-time Location Technology

- 5.1.2 Higher Adoption of Location-based Application among Consumers

- 5.2 Market Restraints

- 5.2.1 Rising Awareness Regarding Safety and Security among Consumers of Location Tracking

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small-Scale and Medium-Scale Businesses

- 6.1.2 Large-Scale Businesses

- 6.2 By End-user Industry

- 6.2.1 Banking, Financial Services, and Insurance

- 6.2.2 Retail

- 6.2.3 Defense, Government, and Military

- 6.2.4 Healthcare

- 6.2.5 Industrial Manufacturing

- 6.2.6 Transportation and Logistics

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bluedot Innovation Pty Ltd

- 7.1.2 Infillion Inc. (GIMBLE)

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Radar Labs Inc.

- 7.1.6 Google LLC

- 7.1.7 Samsung Electronics Co.

- 7.1.8 Verve Inc.

- 7.1.9 Apple Inc.

- 7.1.10 LocationSmart

- 7.1.11 SZ DJI Technology Co.

- 7.1.12 ESRI