|

시장보고서

상품코드

1850270

면역치료제 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Immunotherapy Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

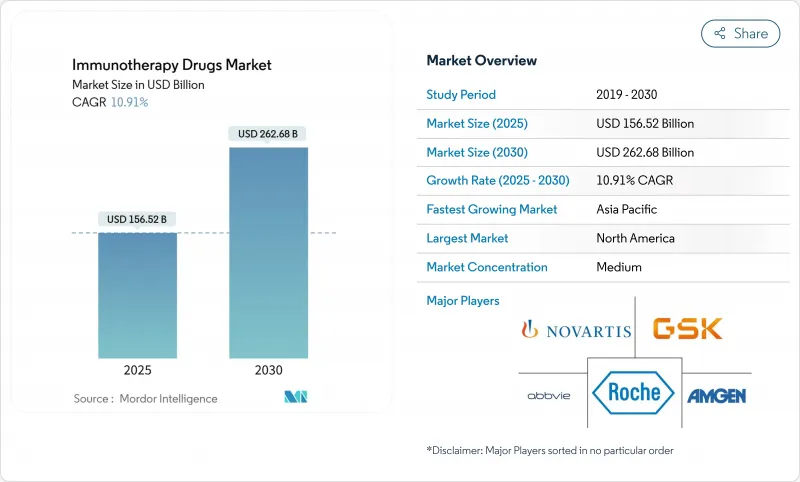

세계 면역치료제 시장의 매출은 2025년에 1,565억 2,000만 달러로 추정되고, 2030년에는 2,626억 8,000만 달러로 증가할 전망이며, CAGR 10.91%로 성장할 전망입니다.

급증의 배경은 체크포인트 억제제의 침투, T 세포 공학의 급속한 성숙, 발견 사이클을 단축하는 인공지능 플랫폼의 일상적인 사용을 포함합니다. 고형암에서는 단일클론항체와 정밀 바이오마커를 조합한 멀티모달 요법이 계속해서 퍼스트 라인 프로토콜의 주류를 차지하고, 흑색종이나 폐암에서는 특주의 네오 안티겐 백신이 조기 임상시험에서 매우 중요한 시험으로 이행하고 있습니다. 규제 당국에 의한 병용 요법의 심사가 간소화되고, 결과 기반 결제 시험은 의료 시스템의 초기 비용 부담을 경감시킵니다. 아시아태평양의 제조 규모를 확대하면 복용량당 비용이 줄어들고, 실시간 파마코비질런스 네트워크는 부작용 추적을 개선하며 복잡한 생물학적 제제의 지리적 접근을 확대합니다.

세계의 면역치료제 시장 동향 및 인사이트

면역 체크포인트 억제제의 폭발적인 파이프라인

2024년에 tislelizumab-jsgr과 cosibelimab-ipdl이 승인됨에 따라 PD-1, PD-L1, CTLA-4 프로그램은 현재 종양 진단 및 희소암 설정에 축발을 두었으며, 종종 이중 또는 삼중 요법의 일부로 사용되는 것으로 확인되었습니다. LAG-3, TIGIT, TIM-3 후보를 포함한 후기 임상시험은 지금까지 저항성이었던 집단에 대한 접근을 제안하고 적응 시험 설계는 개발 기간을 단축합니다. 니볼루맙+이피리무맙과 같은 병용 요법은 흑색종에서 보다 높은 완전주효율을 확보하고, 단제요법에 비해 생존에 명백한 이점을 가져오는 시너지 프로토콜에 대해 규제 당국이 획기적 치료제 지정을 계속 주고 있는 이유를 명확히 하고 있습니다.

단일클론항체의 우위성 확대

이중특이적 항체, 삼중특이성 항체, 항체 약물 복합체(ADC) 포맷 등 공학적 개선이 반복되어 항체에 의한 수익의 77.55%의 지배가 유지되고 있습니다. Teclistamab은 후기 다발성 골수종에서 63%의 전주 효율을 보여주며, 화이자의 AI 가이드와 함께 ADC 공동 연구는 리드 최적화 창을 수개월에서 며칠로 단축합니다. CD3 Engaged Bispecific은 현재 CAR-T 전달 메커니즘에서 도달할 수 없는 고형 종양 항원에 대한 T 세포의 세포 독성을 리디렉션합니다.

높은 치료비 및 상환 장애물

CAR-T의 가격은 37만 3,000달러에서 425만 달러로 지불자 예산에 부담을 줍니다. 이에 반해 CMS는 기본 지불액의 17% 증가를 제안하고, 비응답자에게 환불을 하는 결과 기반 계약을 시험적으로 도입하고 있습니다. 메디케이드의 CGT 액세스 모델은 상환을 실세계의 내구성 지표에 연결하는 것이지만, 신흥국에서는 미충족 요구가 높음에도 불구하고 비싼 생물 제제를 구입하는 데 어려움을 겪고 있습니다.

부문 분석

면역치료제 시장은 계속해서 단일클론항체가 지배적이지만 T세포요법은 2030년까지 연평균 복합 성장률(CAGR) 18.25%로 가장 빠른 성장이 전망되는 기둥입니다. T세포요법에 할당된 면역치료제 시장 규모는 2025년 152억 달러에서 2030년 353억 달러로 확대될 것으로 예상되며, 재발 다발성 골수종과 침공성 림프종에 대한 T세포요법의 변혁적인 영향을 강조하고 있습니다. FDA가 승인한 이데카부타젠 비클루셀과 틸타카부타젠 오토류셀은 70% 이상의 최소 잔존 병변음성률을 나타내며, 듀얼 타겟 CAR 구조는 종양 항원의 커버리지를 넓힙니다. 체크포인트 억제제는 병용 승인에 의해 안정적인 점유율을 획득하고, mRNA 암 백신의 파이프라인은 획기적인 치료제 지정을 배경으로 가속화하고 있습니다. LOAd703과 같은 종양 용해성 바이러스는 아테졸리주맙과 병용하여 44%의 연주 효율을 나타내며, Anktiva와 같은 IL-15 슈퍼작용제는 림프구 감소성 질환에서 승인을 얻었으며, 보다 광범위한 면역치료제 시장에서 사이토카인 기반 제품의 이점을 보였습니다.

일반 화학의 발전은 ADC의 페이로드 탐색을 압축하여 독성을 병행시키지 않고 효능을 향상시킵니다. 따라서 면역치료제 시장은 단일 생물 제제에서 종양 용해 플랫폼과 표적 사이토 카인을 세포 치료와 종합 용해 플랫폼과 결합한 통합 다제 병용 요법으로 전환합니다. 생산 자동화는 자기 세포 구조의 정맥에서 정맥까지의 시간을 단축하므로 비용 곡선이 감소하면 생물학적 제형이 미래의 면역치료제 시장 점유율에서 더 큰 슬라이스를 보장할 수 있습니다.

지역 분석

북미는 2025년까지 48.72%의 매출 점유율을 유지해 성숙한 상환의 틀, 밀집한 혁신 클러스터, 결과 기반 계약의 조기 도입이 그 기반이 되고 있습니다. 이 지역의 기존 바이오 의약품 기업은 AI 벤처 기업과 제조 전문가를 인수하여 배치 불량률을 저하시키면서 플랫폼 관리를 강화합니다. 전략적 온쇼어링은 공급망이 지정학적 충격에 노출되기 어려워지며, 이 지역 시장 경쟁력을 장기적으로 강화합니다.

아시아태평양의 CAGR은 14.22%로 세계 최고 속도를 기록해 규제의 조화, 인건비의 저하, 정부의 지원에 의한 생산 능력 확대가 그 원동력이 되고 있습니다. 중국 최초의 국산 IL-4Ra 길항제인 스타포키바트의 승인은 현지 규제 당국의 고도화를 반영하여 구미 벤치마크에 비해 출시까지의 기간이 단축되었습니다. 일본과 한국은 조건부 조기 승인의 길을 세련시키고 인도의 바이오 제조 회랑은 비용 효율적인 제조 프레임을 요구하는 구미의 스폰서를 유치해 세계 면역치료제 시장의 지역 점유율을 총체적으로 끌어올리고 있습니다.

유럽은 세포 치료 및 유전자 치료의 심사를 표준화하는 선진치료제 규제 하에서 한자리대 중반의 꾸준한 성장을 나타내고 있습니다. 바이오시밀러 경쟁은 단일클론항체 가격을 완화시키지만 접근은 확대되고 시장 전체의 가치는 유지됩니다. 디지털 헬스 이니셔티브는 레지스트리와 파마코비질런스 포털을 연결하여 승인 후 모니터링을 간소화하고 면역치료의 안전성 프로파일에 대한 사회적 신뢰를 강화합니다.

중동 및 아프리카에서는 사우디아라비아의 Cancer BioShield 플랫폼 등 지역의 유전적 배경에 맞는 면역 회복 요법을 제공하는 주요 프로젝트가 기세를 늘리고 있습니다. 지역 정부 펀드와의 다국적 파트너십은 인근 신흥 시장의 허브 역할을 하는 정밀 종양학 센터에 자금을 제공합니다. 라틴아메리카에서는 바로 사용할 수 있는 제제의 라이선스 공여와 리스크 공유 상환의 도입에 주력하고 위암 등 부담이 큰 암 치료 도입이 서서히 진행되고 있습니다. 이러한 진전으로 면역치료제 시장의 세계 확산이 확대되고 일부 성숙지역에 대한 의존도는 감소하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 면역관문억제제의 폭발적인 파이프라인

- 단일클론항체의 우위성 확대

- 암과 만성질환의 발생률 상승

- 바이오마커 주도의 정밀의료 도입

- 이중 특이성 항체와 ADC가 새로운 적응증 개척

- AI를 활용한 인실리코 발견이 연구 개발 가속

- 시장 성장 억제요인

- 고액의 치료비 및 상환의 장애물

- 바이오 의약품 공급망 제조의 복잡성

- 면역 관련 부작용 관리 부담

- 바이오시밀러의 경쟁에 의한 가격 저하

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 약제 유형별

- 단일클론항체

- 체크포인트 억제제

- 암 백신

- 인터페론α/β

- 인터루킨

- 종양 용해성 바이러스 요법

- T세포요법(CAR-T, TCR, TIL)

- 사이토 카인 및 면역 조절제

- 기타 약물의 유형

- 치료 영역별

- 암

- 자가면역 질환 및 염증성 질환

- 감염증

- 기타 치료 영역

- 최종 사용자별

- 병원 및 클리닉

- 연구실 및 학술기관

- 제약 및 바이오테크놀러지 기업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb

- F. Hoffmann-La Roche AG

- GSK PLC

- Johnson & Johnson

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Bayer AG

- Sanofi

- Boehringer Ingelheim

- Gilead Sciences Inc.

- UbiVac

- Regeneron Pharmaceuticals

- Eli Lilly & Co.

- Seagen Inc.

- BeiGene Ltd.

제7장 시장 기회 및 향후 전망

AJY 25.11.07Global immunotherapy drugs market revenues reach USD 156.52 billion in 2025 and are set to climb to USD 262.68 billion by 2030, locking in a 10.91% CAGR.

The surge originates from deeper checkpoint-inhibitor penetration, rapid maturation of T-cell engineering, and the routine use of artificial-intelligence platforms that shorten discovery cycles. Multi-modal regimens that merge monoclonal antibodies with precision biomarkers continue to dominate first-line protocols in solid tumors, while bespoke neoantigen vaccines graduate from early trials into pivotal studies in melanoma and lung cancer. Regulatory agencies simplify combination-therapy reviews, and outcomes-based payment pilots reduce upfront cost exposure for health systems. Manufacturing scale-ups in Asia-Pacific lower per-dose costs, and real-time pharmacovigilance networks improve adverse-event tracking, supporting broader geographic access for complex biologics.

Global Immunotherapy Drugs Market Trends and Insights

Explosive Pipeline of Immune-Checkpoint Inhibitors

Approvals of tislelizumab-jsgr and cosibelimab-ipdl in 2024 confirmed that PD-1, PD-L1, and CTLA-4 programs now pivot toward tumor-agnostic and rare-cancer settings, often as part of doublet or triplet regimens. Late-phase trials involving LAG-3, TIGIT, and TIM-3 candidates signal access to previously resistant populations, while adaptive trial designs shrink development timelines. Combination strategies such as nivolumab + ipilimumab secure higher complete-response rates in melanoma, underlining why regulators continue to grant breakthrough designations for synergistic protocols that deliver clear survival advantages over monotherapies.

Expanding Dominance of Monoclonal Antibodies

Iterative engineering upgrades-bispecific, trispecific, and antibody-drug conjugate (ADC) formats-preserve the 77.55% revenue grip held by antibodies. Teclistamab delivers a 63% overall response rate in late-line multiple myeloma, and Pfizer's AI-guided ADC collaboration compresses lead-optimization windows from months to days. CD3-engaging bispecifics redirect T-cell cytotoxicity against solid-tumor antigens that remain out of reach for current CAR-T delivery mechanisms.

High Treatment Costs & Reimbursement Hurdles

CAR-T price tags ranging from USD 373,000 to USD 4.25 million strain payer budgets; in response, CMS proposes a 17% base-payment increase and pilots outcomes-based contracts that refund non-responders. Medicaid's CGT Access Model ties reimbursement to real-world durability metrics, yet emerging economies still struggle to afford premium biologics despite high unmet needs.

Other drivers and restraints analyzed in the detailed report include:

- Rising Incidence of Cancer & Chronic Diseases

- Biomarker-Driven Precision-Medicine Adoption

- Manufacturing Complexity of Biologics Supply Chains

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The immunotherapy drugs market continues to be dominated by monoclonal antibodies, yet T-cell therapies represent the fastest-rising pillar with an 18.25% CAGR through 2030. The immunotherapy drugs market size allocated to T-cell therapies is forecast to expand from USD 15.2 billion in 2025 to USD 35.3 billion by 2030, underscoring their transformative impact on relapsed multiple myeloma and aggressive lymphomas. FDA approvals of idecabtagene vicleucel and ciltacabtagene autoleucel produce minimal-residual-disease negativity rates above 70%, while dual-target CAR constructs broaden tumor-antigen coverage. Checkpoint inhibitors gather steady share via combination approvals, and the pipeline for mRNA cancer vaccines accelerates on the back of breakthrough-therapy designations. Oncolytic viruses such as LOAd703 post 44% response rates when paired with atezolizumab, while IL-15 super-agonists like Anktiva secure approvals for lymphopenic settings, signaling gains for cytokine-based products within the broader immunotherapy drugs market.

Progress in generative chemistry compresses ADC payload discovery, raising potency without parallel toxicity. The immunotherapy drugs market thus transitions from standalone biologics to integrated, multimodal regimens that pair cell therapies with oncolytic platforms and targeted cytokines. Manufacturing automation reduces vein-to-vein time for autologous constructs, suggesting that living products will secure larger slices of future immunotherapy drugs market share once cost curves decline.

The Immunotherapy Drugs Market is Segmented by Drug Type (Monoclonal Antibodies, Cancer Vaccines, Interferons Alpha and Beta, Interleukins, and More), Therapy Area (Cancer, Autoimmune and Inflammatory Diseases, Infectious Diseases, and More), End-User (Hospitals & Clinics, Research Laboratories, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America keeps a 48.72% revenue stake through 2025, anchored by a mature reimbursement framework, dense innovation clusters, and early adoption of outcomes-based contracting. The region's biopharma incumbents acquire AI start-ups and manufacturing specialists, consolidating platform control while reducing batch-failure rates. Strategic onshoring incentives lower supply-chain exposure to geopolitical shocks, strengthening long-term competitiveness for the regional immunotherapy drugs market.

Asia-Pacific records a 14.22% CAGR, the fastest worldwide, powered by regulatory harmonization, lower labor costs, and government-backed capacity expansions. China's approval of Stapokibart, the first domestic IL-4Ra antagonist, reflects higher local regulatory sophistication and shortens launch lags versus Western benchmarks. Japan and South Korea refine conditional early-approval pathways, and India's biomanufacturing corridors lure Western sponsors seeking cost-effective production slots, collectively lifting regional share in the global immunotherapy drugs market.

Europe demonstrates steady mid-single-digit growth under the Advanced Therapy Medicinal Products regulation that standardizes cell- and gene-therapy review. Biosimilar competition tempers monoclonal-antibody pricing but widens access, keeping overall market value intact. Targeted digital-health initiatives link registries with pharmacovigilance portals, streamlining post-approval monitoring and reinforcing public confidence in immunotherapy safety profiles.

The Middle East and Africa gain momentum from flagship projects such as Saudi Arabia's Cancer BioShield platform, which delivers immune-restorative regimens tailored to local genetic backgrounds. Multinational partnerships with regional sovereign funds finance precision oncology centers that function as hubs for nearby emerging markets. Latin America focuses on licensing ready-to-fill formulations and implementing risk-sharing reimbursement, gradually lifting therapy uptake in high-burden cancers like gastric carcinoma. Together, these advancements broaden the global footprint of the immunotherapy drugs market and reduce dependency on a handful of mature territories.

- Abbvie

- Amgen

- AstraZeneca

- Bristol-Myers Squibb

- Roche

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Bayer

- Sanofi

- Boehringer Ingelheim

- Gilead Sciences

- UbiVac

- Regeneron Pharmaceuticals

- Eli Lilly and Company

- Seagen

- BeiGene Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive Pipeline of Immune-Checkpoint Inhibitors

- 4.2.2 Expanding Dominance of Monoclonal Antibodies

- 4.2.3 Rising Incidence of Cancer & Chronic Diseases

- 4.2.4 Biomarker-Driven Precision-Medicine Adoption

- 4.2.5 Bispecific Antibodies & Adcs Unlocking New Indications

- 4.2.6 AI-Enabled In-Silico Discovery Accelerating R&D

- 4.3 Market Restraints

- 4.3.1 High Treatment Costs & Reimbursement Hurdles

- 4.3.2 Manufacturing Complexity Of Biologics Supply Chains

- 4.3.3 Immune-Related Adverse-Event Management Burden

- 4.3.4 Price Erosion From Biosimilar Competition

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Type

- 5.1.1 Monoclonal Antibodies

- 5.1.2 Checkpoint Inhibitors

- 5.1.3 Cancer Vaccines

- 5.1.4 Interferons Alpha/Beta

- 5.1.5 Interleukins

- 5.1.6 Oncolytic Viral Therapies

- 5.1.7 T-Cell Therapies (CAR-T, TCR, TIL)

- 5.1.8 Cytokines & Immunomodulators

- 5.1.9 Other Drug Types

- 5.2 By Therapy Area

- 5.2.1 Cancer

- 5.2.2 Autoimmune & Inflammatory Diseases

- 5.2.3 Infectious Diseases

- 5.2.4 Other Therapy Areas

- 5.3 By End-User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Research Laboratories & Academic Institutes

- 5.3.3 Pharmaceutical & Biotechnology Companies

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AbbVie Inc.

- 6.3.2 Amgen Inc.

- 6.3.3 AstraZeneca PLC

- 6.3.4 Bristol-Myers Squibb

- 6.3.5 F. Hoffmann-La Roche AG

- 6.3.6 GSK PLC

- 6.3.7 Johnson & Johnson

- 6.3.8 Merck & Co. Inc.

- 6.3.9 Novartis AG

- 6.3.10 Pfizer Inc.

- 6.3.11 Bayer AG

- 6.3.12 Sanofi

- 6.3.13 Boehringer Ingelheim

- 6.3.14 Gilead Sciences Inc.

- 6.3.15 UbiVac

- 6.3.16 Regeneron Pharmaceuticals

- 6.3.17 Eli Lilly & Co.

- 6.3.18 Seagen Inc.

- 6.3.19 BeiGene Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment