|

시장보고서

상품코드

1851667

제트 연료 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Jet Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

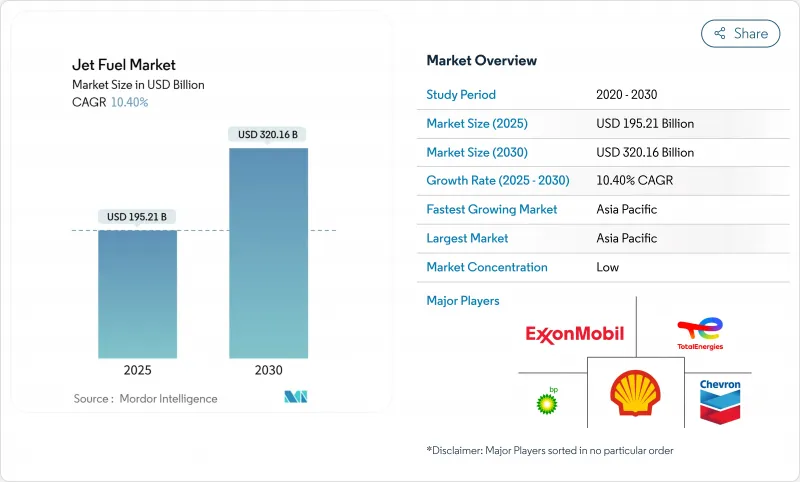

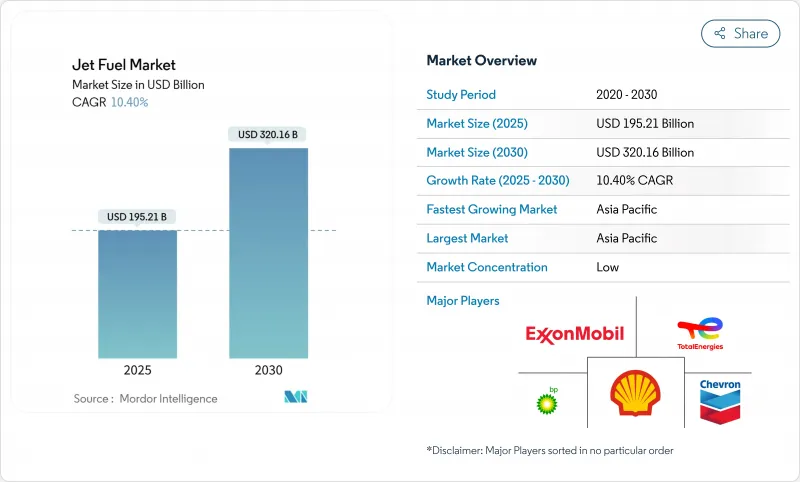

제트 연료 시장 규모는 2025년에 1,952억 1,000만 달러로 추정되고, 예측 기간(2025-2030년) 중 CAGR 10.40%로 성장할 전망이며, 2030년에는 3,201억 6,000만 달러에 이를 것으로 예측됩니다.

민간항공은 예상보다 빠른 속도로 회복되고 있으며, 아시아, 북미, 유럽의 여객 탑승률은 여행 수요가 오랜 시간 침체된 수요를 해소함에 따라 이미 2019년 벤치마크를 웃돌고 있습니다. 저가 항공사 확대, 전자상거래 주도 화물기 수요 지속, 중동의 메가허브 출현이 제트 연료 시장의 구조적 성장을 지원하고 있습니다. 동시에 지속가능한 항공연료(SAF)의 의무화는 원가 비용에도 불구하고 조달 이동을 가속화하고, 원료의 유연성과 정유소 구성은 주요 종합 공급업체에게 가격 우위를 가져왔습니다. 원유의 품질에 대한 지정학적 압력 및 유럽에서의 탄소 규제 강화는 추가적인 가격 변동을 가져오고, 항공사와 연료 공급 회사에 장기 인수 계약 및 혼합 인프라에 대한 투자를 촉구하는 동기가 되고 있습니다.

세계의 제트 연료 시장 동향 및 인사이트

팬데믹 후 로드 팩터 회복이 아시아 제트 연료 수요 상승

중국, 인도, 동남아시아의 주요 시장 국내선 수송량은 2023년 후반까지 2019년 수준을 웃돌아 국제선은 90% 가까이 회복하고 있습니다. 항공기 납품 지연에 직면한 항공사는 항공기 이용을 강화하고 차세대 제트기가 단위 소비량을 줄일 것을 약속했음에도 불구하고 항공기 1대당 연료 소비량을 역사적 기준을 웃도는 수준으로 밀어 올리고 있습니다. 싱가포르와 한국에서 정유소의 유지보수가 동시에 이루어졌기 때문에 스폿 시장의 수급이 핍박해, 유연한 저장 및 혼합 능력을 가지는 판매자가 보상되었습니다. 그 결과, 제트 A 사양의 상승이 지역의 물류에 부담을 주지만, 높은 케로신 수율로 설정된 정유소에 있어서는 프리미엄 가격 설정의 기회가 됩니다. 레저와 비즈니스 여행의 기세가 지속됨에 따라 탄소 규제로 인한 항공권 비용의 압력이 다가오고 있음에도 불구하고 수요 회복력은 당분간 확보됩니다.

아프리카 및 아세안에서 저렴한 항공사 확대

저가 항공사는 나이지리아, 케냐, 태국, 베트남의 2차 도시 쌍의 좌석 수를 늘리고 역내 노선도를 바꿉니다. 한때 약간의 연료 공급지였던 2차 공항은 현재 더 빈번한 턴어라운드를 다루었고, 이전에는 주요 공급망에서 벗어난 지역의 제트 연료 시장을 끌어올렸습니다. 라고스, 나이로비, 푸켓에서는 새로운 연료 농장에 대한 투자가 운영의 신뢰성을 뒷받침하고 항공사와 공급업체의 직접 계약은 기존 유통층을 우회하기 때문에 마진이 압축되고 판매량이 자극됩니다. 저비용 모델은 하루 사용률이 높다는 점을 강조하므로 급유 창구가 좁아지고 급수 마개 인프라가 있는 통합 공급업체는 서비스 프리미엄을 얻을 수 있습니다. 이러한 역학은 수율 압력이 항공사의 수익성에 도전하더라도 장기적인 수요를 견고하게 만듭니다.

EU-ETS Phase IV 항공권 과징금이 레저 항공편 억제

4단계에서는 2026년까지 무상 배출 프레임이 철폐되기 때문에 비용 전가가 진행되고 가격에 민감한 여행자가 철도 및 EU역 외 허브 공항으로 이동함으로써 2030년까지 레저 수요가 최대 5% 감소할 수 있습니다. 항공사는 탄소 가격이 변동하는 동안 컴플라이언스 비용 증가에 직면하고 일부 항공사는 서차지의 영향을 받기 어려운 북아프리카나 중동의 게이트웨이에 와이드 바디의 용량을 재배치해야 합니다. 운송량의 상당한 감소보다는 운송량의 재분배가 예측을 복잡하게 하고 있지만, 유럽의 제트 연료 상승을 전반적으로 억제하고 있습니다. 세계 제트 연료 시장은 아시아와 중동의 보상 성장으로 이 축소의 일부를 흡수하고 있지만, 유럽에서 큰 노출을 가진 공급업체는 정유소의 수율 계획을 검토해야 합니다.

부문 분석

제트 연료 A-1은 2024년 소비량의 72.5%를 차지했는데, 이는 민간 및 많은 군용 연료로 보편적인 사양임을 반영합니다. 양호한 응고점 및 인화점 특성은 기후를 불문하고 신뢰성을 지원하며 제트 연료 시장에서 중심적인 역할을 보장합니다. 제트 A는 여전히 북미 항공기에 집중하고 있으며, 제트 B와 TS-1은 극단적인 환경 및 지역 환경에서 틈새 요구 사항을 충족합니다.

SAF가 주도하는 '기타' 범주는 2030년까지 연평균 복합 성장률(CAGR)이 17.5%를 기록했으며, 이는 EU의 혼합 연료 요구 증가와 항공사의 자발적인 노력에 힘쓰고 있습니다. 총 에너지는 2030년까지 연간 150만 톤의 SAF를 공급할 계획이며, 이는 에어버스의 유럽 수요에서 약 절반에 해당합니다. 현재의 생산량은 세계 수요의 불과 0.53%에 불과해, 수급의 불균형을 확대하며, 가격 프리미엄을 높이고 있습니다. 1톤당 최대 1만 6,300유로의 규정 준수 위반에 대한 벌금은 조달의 긴급성을 높이고 초기 단계의 생산자에게 불균형한 수익 업사이드를 초래합니다. 이러한 배경에서 대체 등급 제트 연료 시장 규모는 절대량이 전통적인 켈로신에 비해 소폭임에도 불구하고 급상승할 것으로 예측됩니다.

제트 연료 시장 보고서는 연료 유형별(제트 A, 제트 A-1, 제트 B 등), 용도별(민간 항공, 방위 항공, 일반 항공), 유통 채널별(기내 공급, 고정 기지 운영자에게 벌크 공급), 지역별(북미, 아시아태평양, 유럽, 남미, 중동 및 아프리카)로 구분됩니다. 시장 규모와 예측은 금액(달러)으로 제공됩니다.

지역별 분석

아시아태평양은 2024년에 세계 소비의 36.0%를 차지하였고, 2030년까지 CAGR 11.5%로 성장할 전망입입니다. 중국 항공기 보유 수는 2043년까지 2배의 9,740기가 될 것으로 예측되며 이 지역 수요를 지지하고 있습니다. 동남아 항공사는 ASEAN의 오픈 스카이 정책에 도움을 받아 국내선 트래픽을 2019년 수준의 100%까지 회복시키고 국제선은 90% 이상의 회복을 기록하고 있습니다. 인도는 재량소득 상승과 IndiGo와 Air India에 의한 적극적인 용량 확대로 기세를 늘리며 남아시아 전역의 제트 연료 시장을 격화시킵니다.

북미는 효율성 향상이 용량 증가를 부분적으로 상쇄하여 완만한 성장을 보였습니다. FAA의 예측에 따르면 미국의 국제선 수송량은 2044년까지 매년 2.8% 증가할 전망이며, 장거리 노선 수익률은 프리미엄 클래스 회복에 도움이 됩니다. 캐나다는 밴쿠버와 토론토를 허브 공항으로 하는 태평양 횡단 화물 운송량에서 이익을 얻어 이 궤도를 반영합니다.

유럽은 복잡한 전망에 직면하고 있습니다. EUROCONTROL은 탄소 부과금에도 불구하고 2050년까지 비행이 52% 증가할 것으로 예측하고 있지만, SAF 혼합 의무화와 EU-ETS 서차지는 저소득층에서 단기적인 레저 여행을 침식합니다. 항공사는 이스탄불, 두바이, 도하를 경유하는 용량을 추가하여 익스포저를 희박화하고, 제트 연료 시장의 상승분을 중동의 허브로 이동시킴으로써 대응합니다.

중동은 메가 허브 전략과 걸프 항공사의 장거리 네트워크에서 이익을 얻고 있습니다. 에미레이트 항공의 과거 최고 이익 227억 AED는 왕성한 수요를 나타내고 있으며, 사우디아라비아의 2030년 관광 촉진책이 더욱 성장하고 있습니다. 에티오피아 항공의 멀티 허브 모델과 라고스와 나이로비의 공항 리노베이션은 대륙 내 연결성을 확보하며 분산형 연료 수요 노드를 추가했습니다.

라틴아메리카는 국내 교통과 전자상거래 물류로 회복되었습니다. 브라질 콩고냐스 공항과 콜롬비아 엘도라도 공항은 급수전 확장에 투자하고 있으며, 칠레의 JETSMART 모델은 저렴한 가격의 역동성을 더하고 있습니다. 이 지역은 절대량으로는 아시아보다 열등한 반면, 2자리대의 성장률로 세계 제트 연료 시장의 확대에 크게 공헌하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- Covid 후의 로드 팩터 회복이 아시아의 제트 A 수요 촉진

- 아프리카 및 아세안의 저렴한 항공사 확대

- 태평양 횡단 노선으로 와이드 바디 화물기의 수주 급증

- 중동의 메가 허브 생산 능력 증강이 팜 투자 뒷받침

- 미국과 NATO의 대규모 항공 연습이 JP-8 인수 뒷받침

- EU의 2% SAF 블렌드 의무화, 밀도 저하에 의한 풀 용적 증가

- 시장 성장 억제요인

- EU-ETS 4단계 항공권 과징금으로 레저 항공편 감소

- 저연비기로의 기재 갱신이 1 비행 당 연비 삭감

- SAF 프리미엄의 급등이 항공사의 헤지 및 연료 급등 압박

- 방향족 리치 원유 부족이 USGC 제트 수율 저하 초래

- 공급망 분석

- 규제 전망

- 기술의 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 연료 유형별

- 제트 A

- 제트 A-1

- 제트 B

- 기타(TS-1, 지속 가능한 항공 연료(SAF))

- 용도별

- 상용 항공

- 방위 항공

- 일반 항공

- 유통 채널별

- 기내(공항내)

- 고정 베이스 오퍼레이터(FBO)에 대한 벌크 공급

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 북유럽 국가

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 카타르

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(M&A, 파트너십, PPA)

- 시장 점유율 분석(주요 기업의 시장 순위 및 점유율)

- 기업 프로파일

- Shell PLC

- Exxon Mobil Corp

- BP PLC(Air BP)

- Chevron Corp

- TotalEnergies SE

- Qatar Jet Fuel Company(QJet)

- Gazprom Neft PJSC

- Bharat Petroleum Ltd

- Indian Oil Corporation

- China Petroleum & Chemical Corp(Sinopec)

- PetroChina Co Ltd

- Neste OYJ

- LanzaJet Inc.

- Gevo Inc.

- World Fuel Services Corp

- Phillips 66 Aviation

- Vitol Aviation

- PETRONAS Dagangan Berhad

- Petrobras Distribuidora SA

- OMV AG

- Eni SpA

- Saudi Aramco(SAF-focused JVs)

- Idemitsu Kosan Co.

- Rosneft PJSC

제7장 시장 기회 및 향후 전망

AJY 25.11.24The Jet Fuel Market size is estimated at USD 195.21 billion in 2025, and is expected to reach USD 320.16 billion by 2030, at a CAGR of 10.40% during the forecast period (2025-2030).

Commercial aviation has rebounded faster than anticipated, with passenger load factors in Asia, North America, and Europe already surpassing 2019 benchmarks as travel demand releases years of pent-up demand. Low-cost carrier expansion, sustained e-commerce-led freighter demand, and mega-hubs' emergence in the Middle East underpin structural growth for the jet fuel market. At the same time, sustainable aviation fuel (SAF) mandates are accelerating procurement shifts despite cost premiums, while feedstock flexibility and refinery configurations give large integrated suppliers a pricing edge. Geopolitical pressures on crude quality and more stringent carbon regulations in Europe create additional price volatility, incentivizing airlines and fuel providers to pursue long-term offtake agreements and investments in blending infrastructure.

Global Jet Fuel Market Trends and Insights

Post-Covid Load-Factor Rebound Lifting Asia Jet A Demand

Domestic traffic in China, India, and key Southeast Asian markets surpassed 2019 levels by late 2023, while international routes sit near 90% recovery. Airlines, facing delayed aircraft deliveries, intensify aircraft utilization, pushing per-aircraft fuel burn above historic norms even as new-generation jets promise lower unit consumption. Concurrent refinery maintenance in Singapore and South Korea adds spot-market tightness, rewarding sellers with flexible storage and blending capability. The resulting uplift spikes for Jet A specifications strain regional logistics yet create premium pricing opportunities for refineries configured for high kerosene yields. Sustained leisure and business travel momentum ensures near-term demand resilience despite looming ticket cost pressures from carbon regulation.

Expansion of Low-Cost Carriers Across Africa & ASEAN

Budget airlines are redrawing intra-regional route maps, elevating seat capacity on secondary city pairs in Nigeria, Kenya, Thailand, and Vietnam. Secondary airports, once marginal fuel nodes, now handle more frequent turnarounds that lift the jet fuel market in regions previously outside major supply chains. New fuel farm investments in Lagos, Nairobi, and Phuket underpin operational reliability, while direct airline-supplier contracts bypass legacy distribution layers, compressing margins yet stimulating volume. The low-cost model's emphasis on high daily utilization squeezes refueling windows, giving integrated suppliers with hydrant infrastructure a service premium. These dynamics solidify longer-term demand even if yield pressures challenge carrier profitability.

EU-ETS Phase-IV Ticket Surcharges Curtail Leisure Flying

Phase IV eliminates free allowances by 2026, driving cost pass-throughs that could trim leisure demand by up to 5% by 2030 as price-sensitive travelers shift to rail or non-EU hubs . Airlines face higher compliance expenditure amid volatile carbon prices, prompting some to redeploy wide-body capacity toward North African or Middle-East gateways where surcharge exposure is lower. Traffic redistribution rather than outright volume loss complicates forecasting but dampens European jet fuel uplift in aggregate. The global jet fuel market absorbs some of this contraction through compensatory growth in Asia and the Middle East, yet suppliers with heavy European exposure must recalibrate refinery yield planning.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Wide-Body Freighter Orders on Trans-Pacific Routes

- Mega-Hub Capacity Builds in Middle-East Fuel Farm Investments

- Fleet Renewal Toward Fuel-Efficient Aircraft Cuts Per-Flight Burn

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Jet A-1 retained 72.5% of 2024 consumption, reflecting its status as the universal specification for commercial and many military operations. Favorable freezing and flash-point properties support reliability across climates, assuring its central role in the jet fuel market. Jet A remains concentrated in North American fleets, while Jet B and TS-1 serve niche requirements in extreme or regional settings.

The "Others" category-led by SAF-records a 17.5% CAGR to 2030, propelled by the EU's escalating blend requirements and voluntary airline commitments. TotalEnergies plans to supply 1.5 million t of SAF annually by 2030, enough to cover roughly half of Airbus' European demand . Current output equals only 0.53% of global needs, magnifying supply-demand imbalance and elevating price premiums. Fines for non-compliance of up to EUR 16,300 per tonne intensify procurement urgency, providing disproportionate revenue upside for early-stage producers. In this context, the alternative grades' jet fuel market size is expected to climb sharply even as absolute volumes remain modest relative to conventional kerosene.

The Jet Fuel Market Report is Segmented Into Fuel Type (Jet A, Jet A-1, Jet B, and Others), Application (Commercial Aviation, Defense Aviation, and General Aviation), Distribution Channel (Into-Plane and Bulk Supply To Fixed-Base Operators), and Geography (North America, Asia-Pacific, Europe, South America, and Middle East and Africa). The Market Size and Forecast are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 36.0% of global consumption in 2024 and is on an 11.5% CAGR path to 2030. China's fleet is forecast to double to 9,740 aircraft by 2043, anchoring regional demand. Southeast Asian carriers, aided by ASEAN open-skies policies, have restored domestic traffic to 100% of 2019 levels, while international routes track above 90% recovery. India adds momentum through rising discretionary income and aggressive capacity expansions by IndiGo and Air India, intensifying the jet fuel market across South Asia.

North America shows modest growth as efficiency gains partially offset capacity additions. FAA projections indicate U.S. international traffic will rise 2.8% annually through 2044, with long-haul yields aided by a resilient premium-class segment. Canada mirrors this trajectory, reaping gains from trans-Pacific freighter volumes linked to Vancouver and Toronto hubs.

Europe faces a mixed outlook. EUROCONTROL expects flights to increase 52% by 2050 despite carbon levies, but SAF blend mandates and EU-ETS surcharges erode near-term leisure travel in lower-income segments. Carriers respond by adding capacity through Istanbul, Dubai, and Doha to dilute exposure, shifting some jet fuel market uplift to Middle-East hubs.

The Middle East benefits from mega-hub strategies and Gulf carriers' long-haul networks. Emirates' record AED 22.7 billion profit signals robust demand, while Saudi Arabia's 2030 tourism drive injects additional growth. Africa's jet fuel market accelerates off a small base; Ethiopian Airlines' multi-hub model and airport upgrades in Lagos and Nairobi unlock intra-continental connectivity, adding distributed fuel demand nodes.

Latin America rebounds on domestic traffic and e-commerce logistics. Brazil's Congonhas and Colombia's El Dorado airports are investing in hydrant expansions, while Chile's JETSMART models add low-cost dynamism. Although the region trails Asia in absolute volume, double-digit growth rates contribute meaningfully to global jet fuel market expansion.

- Shell PLC

- Exxon Mobil Corp

- BP PLC (Air BP)

- Chevron Corp

- TotalEnergies SE

- Qatar Jet Fuel Company (QJet)

- Gazprom Neft PJSC

- Bharat Petroleum Ltd

- Indian Oil Corporation

- China Petroleum & Chemical Corp (Sinopec)

- PetroChina Co Ltd

- Neste OYJ

- LanzaJet Inc.

- Gevo Inc.

- World Fuel Services Corp

- Phillips 66 Aviation

- Vitol Aviation

- PETRONAS Dagangan Berhad

- Petrobras Distribuidora SA

- OMV AG

- Eni SpA

- Saudi Aramco (SAF-focused JVs)

- Idemitsu Kosan Co.

- Rosneft PJSC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Covid Load-Factor Rebound Lifting Asia Jet A Demand

- 4.2.2 Expansion of Low-Cost Carriers Across Africa & ASEAN

- 4.2.3 Surge in Wide-Body Freighter Orders on Trans-Pacific Routes

- 4.2.4 Mega-Hub Capacity Builds in Middle-East Fuel Farm Investments

- 4.2.5 Large-Scale U.S. & NATO Air-Exercises Boosting JP-8 Offtake

- 4.2.6 EU 2 % SAF Blend Mandate Raising Pool Volumes via Density Loss

- 4.3 Market Restraints

- 4.3.1 EU-ETS Phase-IV Ticket Surcharges Curtail Leisure Flying

- 4.3.2 Fleet Renewal Toward Fuel-Efficient Aircraft Cuts Per-Flight Burn

- 4.3.3 High SAF Premium Squeezes Airline Hedging & Fuel Uplift

- 4.3.4 Aromatics-Rich Crude Shortage Lowering USGC Jet Yield

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Fuel Type

- 5.1.1 Jet A

- 5.1.2 Jet A-1

- 5.1.3 Jet B

- 5.1.4 Others [TS-1, Sustainable Aviation Fuel (SAF)]

- 5.2 By Application

- 5.2.1 Commercial Aviation

- 5.2.2 Defense Aviation

- 5.2.3 General Aviation

- 5.3 By Distribution Channel

- 5.3.1 Into-Plane (On-Airport)

- 5.3.2 Bulk Supply to Fixed-Base Operators (FBO)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Nordic Countries

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 ASEAN Countries

- 5.4.3.6 Australia

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Shell PLC

- 6.4.2 Exxon Mobil Corp

- 6.4.3 BP PLC (Air BP)

- 6.4.4 Chevron Corp

- 6.4.5 TotalEnergies SE

- 6.4.6 Qatar Jet Fuel Company (QJet)

- 6.4.7 Gazprom Neft PJSC

- 6.4.8 Bharat Petroleum Ltd

- 6.4.9 Indian Oil Corporation

- 6.4.10 China Petroleum & Chemical Corp (Sinopec)

- 6.4.11 PetroChina Co Ltd

- 6.4.12 Neste OYJ

- 6.4.13 LanzaJet Inc.

- 6.4.14 Gevo Inc.

- 6.4.15 World Fuel Services Corp

- 6.4.16 Phillips 66 Aviation

- 6.4.17 Vitol Aviation

- 6.4.18 PETRONAS Dagangan Berhad

- 6.4.19 Petrobras Distribuidora SA

- 6.4.20 OMV AG

- 6.4.21 Eni SpA

- 6.4.22 Saudi Aramco (SAF-focused JVs)

- 6.4.23 Idemitsu Kosan Co.

- 6.4.24 Rosneft PJSC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment