|

시장보고서

상품코드

1437991

임상 진단 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Clinical Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

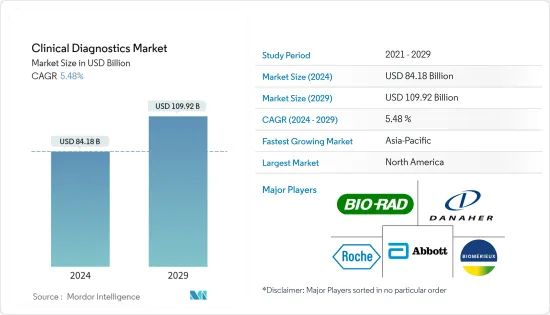

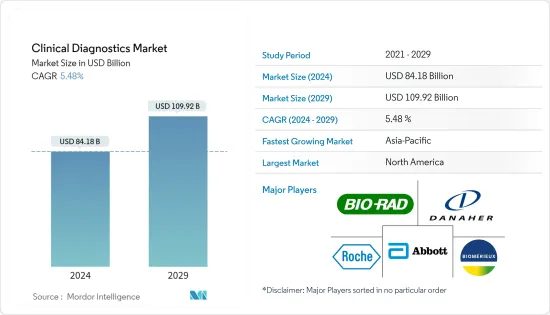

임상 진단(Clinical Diagnostics) 시장 규모는 2024년 841억 8,000만 달러로 추정되며, 2029년까지 1,099억 2,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년) 동안 5.48%의 CAGR로 추이하며 성장할 전망입니다.

COVID-19 팬데믹으로 인해 실험실 검사가 증가했고, COVID-19 의심 사례에 발맞춰 수요가 더욱 빠르게 증가했습니다. Atlantic Monthly Group에 따르면 전 세계적으로 COVID-19 검사는 2020년 9월 760,441건에서 2020년 10월에는 964,792건으로 크게 증가했습니다. 이처럼 지속적인 환자 증가와 정부의 자금 지원으로 인한 검사 건수 증가가 COVID-19 테스트 키트 수요를 확대하고 전체 시장 성장을 기하급수적으로 이끈 요인으로 작용했습니다. 또한, COVID-19 바이러스의 변종 출현으로 인해 팬데믹 이후에도 임상 진단에 대한 수요는 일정하게 유지될 것으로 예상되어 향후 5년간 시장 성장에 기여할 것으로 전망됩니다.

이 시장은 감염성 및 만성 질환의 발생률 증가와 자동화 플랫폼의 채택 증가로 인해 성장할 것으로 예상됩니다. 2022년 2월 세계보건기구의 보고서에 따르면 매년 약 40만 명의 0-19세 어린이와 청소년이 암에 걸리고 있습니다. 같은 자료에 따르면 가장 흔한 소아암 유형에는 백혈병, 뇌암, 림프종, 신경모세포종 및 윌름스 종양과 같은 고형 종양이 포함된다고 언급했습니다. 2020년 12월 국제 암 연구 기관(IARC)이 발표한 보고서에 따르면 전 세계 암 부담이 1930만 건으로 증가했으며, 전 세계적으로 암 유병률이 높아짐에 따라 효과적인 임상 진단에 대한 수요가 증가하여 시장 성장에 기여하고 있습니다. 또한 감염성 질환의 증가도 임상 진단 시장 성장에 기여할 것으로 예상됩니다. 예를 들어, 2021년 11월 세계보건기구가 발표한 보고서에 따르면 전 세계적으로 1.0만 명 이상의 성병 감염자가 발생하고 있으며 대부분 무증상인 것으로 나타났습니다. 또한 매년 성병 감염 4건 중 1건은 임질, 클라미디아, 트리코모나스증, 매독으로 추정되는 3억 7,400만 건의 새로운 감염이 발생한다고 보고했습니다.

만성 질환의 증가로 인해 의료 시스템에 대한 수요도 증가하고 있습니다. 따라서 임상 진단은 만성 질환 상태에서 유익한 것으로 입증되었으며 질병 예방, 발견 및 관리에 유용한 것으로 밝혀졌습니다. 따라서 만성 질환의 발병률 증가는 전체 시장을 더욱 촉진할 것으로 예상됩니다.

임상 진단 시장 동향

지질 패널 검사 부문은 예측 기간 동안 좋은 성장을 기록할 것으로 예상

지질 패널은 신체에서 에너지 원으로 사용되는 지질, 지방 및 지방 물질을 측정하는 혈액 검사입니다. 지질 패널에는 총 콜레스테롤, HDL 콜레스테롤, 트리글리세리드, LDL 콜레스테롤, 콜레스테롤/HDL 비율 및 비 HDL 콜레스테롤 검사가 포함됩니다.

지질 패널은 혈중 특정 지질의 수치를 측정하여 심혈관 질환의 위험을 평가하며, 심장 질환 발병 위험이 높은 대상자를 선별하는 데 사용됩니다. 영국심장재단은 2022년 1월 전 세계적으로 가장 흔한 심장 질환은 관상동맥(허혈성) 심장 질환(전 세계 유병률 2억 명 추정), 말초 동맥(혈관) 질환(1억 1천만 명), 뇌졸중(1억 명), 심방세동(6천만 명)이라고 보고했습니다. 이러한 전 세계적인 유병률이 시장 성장을 촉진하고 있습니다. 또한 2021년 9월에 업데이트된 미국 질병통제예방센터(CDC) 보고서에 따르면 미국 내 40세 이상 인구 중 약 650만 명이 말초동맥질환을 앓고 있는 것으로 나타났습니다. 또한 2021년 9월에 발표된 MDPI 저널 연구 기사에서는 말초동맥질환(PAD)의 전 세계 유병률이 3%-12%로 추정되며, 미국과 유럽에서 약 2,700만 명에게 영향을 미치는 것으로 보고했습니다. 또한 같은 자료에 따르면 유럽에서는 45세에서 55세 사이의 말초동맥질환 유병률이 약 17.8%로 추정된다고 합니다. 따라서 말초 혈관 질환의 높은 부담을 보여주는 이러한 연구는 시장 성장을 촉진 할 것으로 예상됩니다. 따라서 심혈관 질환의 유병률과 발병률이 증가함에 따라 초기 단계에서 지질 프로필 검사에 대한 요구가 증가하여 지질 패널 부문가 주도하고 있습니다.

또한 지질 패널 테스트를위한 제품 출시가 증가하는 것도 예측 기간 동안 연구 된 부문의 성장에 기여할 것으로 예상됩니다. 예를 들어, 2022년 10월 Boston Heart Diagnostics는 LipoMap의 가용성을 발표했습니다. 33 개의 지질, 지단백질 및 아포지 단백질 검사로 구성된이 패널은 고해상도 600MHz 핵 자기 공명을 통해 수행되며 시중에서 판매되는 지질 대사에 대한 가장 포괄적인 평가 중 하나입니다.

주요 기업은 잠재적인 기회를 활용하기 위해 새로운 제품의 개발과 출시에 주력하고 있습니다. 따라서 이 부문은 앞서 언급한 요인에 따라 예측 기간 동안 성장할 것으로 추정됩니다.

예측기간 중 북미가 임상진단시장을 독점할 것으로 예상

북미의 임상 진단 시장은 주로 노인 인구의 증가, 실험실 검사의 가치에 대한 환자 인식의 증가, 감염성 및 만성 질환 환자의 유병률 증가에 의해 주도되고 있습니다.

예를 들어, 2022년 미국암학회에서 발표한 데이터에 따르면 2022년 미국에서 총 190만 건의 새로운 암 사례가 발생할 것으로 예상됩니다. 또한 2021년 3월 미국 질병통제예방센터는 2021년 미국 성인의 15%인 7명 중 1명 이상이 만성 신장 질환을 앓고 있을 것으로 추정된다고 발표했습니다. 이러한 만성 질환의 유병률은 시장 성장을 견인할 것으로 예상됩니다.

또한 임상 진단의 성장을 지원하기위한 자금 지원 활동이 증가함에 따라이 지역의 시장 성장에 기여할 것으로 예상됩니다. 예를 들어, 2020년 9월 미국 국립보건원은 진단의 신속 가속화(RADx) 이니셔티브의 일환으로 새로운 COVID-19 검사 기술에 대한 제조 지원을 확대하기 위해 MatMaCorp, Maxim Biomedical Inc., MicroGEM International 등 9개 기업에 1억 2,430만 달러의 자금을 지원할 계획이라고 발표했습니다.

이로 인해 효율적인 관리를 통한 더 나은 치료에 대한 수요가 높아져 북미 시장을 더욱 견인하고 있습니다. 따라서 전염성 및 만성 질환의 유병률 증가와 실험실 테스트의 가치에 대한 인식이 높아짐에 따라 북미 시장 성장이 가속화될 것으로 예상됩니다.

임상 진단 산업 개요

시장은 경쟁이 치열하며 세계 및 현지 기업로 구성됩니다. 경쟁 구도은 시장 점유율을 유지하고 잘 알려진 여러 회사의 국제 기업과 지역 기업 분석을 포함합니다. 시장의 주요 주요 기업으로는 Abbott Laboratories, Bio-Rad Laboratories Inc., Danaher Corporation, Becton, Dickinson and Company, Qiagen 및 Roche Diagnostics가 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사 전제 조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진 요인

- 증대하는 감염증 및 만성질환의 부담

- 자동화 플랫폼의 채택 증가

- 시장 성장 억제 요인

- 하이엔드의 분자진단을 저렴한 가격으로 제공

- 상환 시나리오와 관련된 제한

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 기업 간 경쟁 정도

제5장 시장 세분화(금액 기반 시장 규모)

- 검사별

- 지질 패널

- 간 패널

- 신장 패널

- 전혈구 계산

- 전해질 시험

- 감염증 검사

- 기타 검사

- 제품별

- 기기

- 시약

- 기타 제품

- 최종 사용자별

- 병원 검사실

- 진단 실험실

- 포인트 오브 케어 검사

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아 태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아 태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Abbott Laboratories

- Becton, Dickinson and Company

- BioMerieux

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- Siemens AG

- Hologic Inc.

- Qiagen NV

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific

- Quest Diagnostics Inc.

- Sysmex Corporation

- Sonic Healthcare Ltd

- Charles River Laboratories

제7장 시장 기회 및 향후 동향

LYJThe Clinical Diagnostics Market size is estimated at USD 84.18 billion in 2024, and is expected to reach USD 109.92 billion by 2029, growing at a CAGR of 5.48% during the forecast period (2024-2029).

Owing to the COVID-19 pandemic, there had been an increase in lab testing, which saw demand grow even more rapidly to keep pace with the suspected cases of COVID-19. According to the Atlantic Monthly Group, there was a tremendous increase globally in COVID-19 tests, rising from 760,441 tests in September 2020 to 964,792 tests by October 2020. Thus, the rising number of tests owing to the constant upsurge in patients and funding by governments were the factors responsible to escalate the demand for COVID-19 test kits and drove the overall market growth exponentially. In addition, the demand for clinical diagnostics is expected to remain constant during the post-pandemic period due to the emergence of a mutant strain of the COVID-19 virus, thereby contributing to the growth of the market over the five years.

The market is expected to grow due to the increasing incidence of infectious as well as chronic diseases and the increasing adoption of automated platforms. According to the World Health Organization report in February 2022, each year, approximately 400,000 children and adolescents of 0-19 years old develop cancer. The same source also mentioned that the most common types of childhood cancers include leukemias, brain cancers, lymphomas, and solid tumors, such as neuroblastomas and Wilms tumors. The report Published by International Agency for Research on Cancer (IARC) in December 2020 that the global cancer burden has risen to 19.3 million cases. and thus, due to the high prevalence of cancer around the world, the demand for effective clinical diagnostics, thereby contributing to the growth of the market. Also, the rising infectious diseases are expected to contribute to the growth of the clinical diagnostics market. For instance, the report published by the World Health Organization in November 2021, reported that more than 1.0 million sexually transmitted infections are acquired globally and most of them are asymptomatic. It also reported that every year there are an estimated 374.0 million new infections with 1 out of 4 sexually transmitted infections: gonorrhea, chlamydia, trichomoniasis, and syphilis.

Owing to the increase in chronic diseases, the demand for healthcare systems is also increasing. Clinical diagnostics have, thus, proven to be beneficial in chronic disease conditions and are found to be valuable for disease prevention, detection, and management. Thus, the increasing incidence of chronic diseases is expected to propel the overall market further.

Clinical Diagnostics Market Trends

Lipid Panel Tests Segment is Expected to Register Good Growth in the Forecast Period

The lipid panel is a blood test that measures the lipids, fats, and fatty substances used as a source of energy by the body. The lipid panel includes tests for total cholesterol, HDL cholesterol, triglycerides, LDL cholesterol, cholesterol/HDL ratio, and non-HDL cholesterol.

A lipid panel measures the level of specific lipids in the blood to assess the risk of cardiovascular disease and is used in screening populations to identify subjects with a high risk of developing a cardiac event. The British Heart Foundation reported in January 2022 that the most common heart conditions affected globally were coronary (ischemic) heart disease (global prevalence estimated at 200 million), peripheral arterial (vascular) disease (110 million), stroke (100 million), and atrial fibrillation (60 million). Such a large prevalence globally is fueling the growth of the market. Furthermore, the Centers for Disease Control and Prevention (CDC) article updated in September 2021 reported that approximately 6.5 million people aged 40 and older in the United States have peripheral arterial disease. Additionally, the MDPI Journal research article published in September 2021 reported that the worldwide prevalence of peripheral arterial disease (PAD) is estimated to be 3%-12%, affecting nearly 27 million people in America and Europe. The same source also reported that in Europe, the prevalence of PAD is estimated at around 17.8% between the ages of 45 and 55. Thus, these studies showing the high burden of peripheral vascular diseases are expected to boost the growth of the market. Hence, with an increase in the prevalence and incidence rate of cardiovascular diseases, there is an increase in the requirement for lipid profile testing at an early stage, which is driving the lipid panel segment.

Also, the increasing number of product launches for lipid panel tests is also expected to contribute to the growth of the studied segment over the forecast period. For instance, in October 2022, Boston Heart Diagnostics announced the availability of LipoMap. This panel of 33 lipid, lipoprotein, and apolipoprotein tests is performed via high-resolution 600 MHz nuclear magnetic resonance and is one of the most comprehensive assessments of lipid metabolism commercially available.

Key companies are focusing on novel product developments and launches to leverage potential opportunities. Hence, the segment is estimated to grow over the forecast period due to the aforementioned factors.

North America is Expected to Dominate the Clinical Diagnostics Market Over the Forecast Period

The market for clinical diagnostics in North America is majorly driven by the increasing geriatric population, rising patient awareness about the value of laboratory tests, and the rising prevalence of infectious and chronic disease patients.

For instance, the data published by the American Cancer Society in 2022 mentioned that a total 1.9 million new cancer cases are expected to occur in the United States in 2022. Also, the Centers for Disease Control and Prevention in March 2021 published that more than 1 in 7, which is 15% of the United States adults are estimated to have chronic Kidney disease in 2021. such prevalence of chronic diseases is expected to drive the growth of the market.

Also, the rising funding activities to support the growth of clinical diagnostics are expected to contribute to the growth of the market in this region. For instance, in September 2020, the National Institutes of Health, US, announced its plan to give funding of USD 129.3 million to nine companies, including MatMaCorp, Maxim Biomedical Inc., MicroGEM International, etc., to scale-up manufacturing support for a new set of COVID-19 testing technologies as part of its Rapid Acceleration of Diagnostics (RADx) initiative.

This has led to a higher demand for better treatment with efficient management, further driving the market in the North America. Hence, the increasing prevalence of infectious and chronic diseases and the growing awareness of the value of laboratory tests are expected to fuel the market growth in the country.

Clinical Diagnostics Industry Overview

The market is highly competitive and consists of global and local players. The competitive landscape includes an analysis of a few international as well as local companies that hold market shares and are well known. The major key players in the market include Abbott Laboratories, Bio-Rad Laboratories Inc., Danaher Corporation, Becton, Dickinson and Company, Qiagen, and Roche Diagnostics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Infectious and Chronic Diseases

- 4.2.2 Increasing Adoption of Automated Platforms

- 4.3 Market Restraints

- 4.3.1 Affordability for High-end Molecular Diagnostics

- 4.3.2 Limitations Associated with Reimbursement Scenario

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Test

- 5.1.1 Lipid Panel

- 5.1.2 Liver Panel

- 5.1.3 Renal Panel

- 5.1.4 Complete Blood Count

- 5.1.5 Electrolyte Testing

- 5.1.6 Infectious Disease Testing

- 5.1.7 Other Tests

- 5.2 By Product

- 5.2.1 Instruments

- 5.2.2 Reagents

- 5.2.3 Other Products

- 5.3 By End User

- 5.3.1 Hospital Laboratory

- 5.3.2 Diagnostic Laboratory

- 5.3.3 Point-of-care Testing

- 5.3.4 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories

- 6.1.2 Becton, Dickinson and Company

- 6.1.3 BioMerieux

- 6.1.4 Bio-Rad Laboratories Inc.

- 6.1.5 Danaher Corporation

- 6.1.6 Siemens AG

- 6.1.7 Hologic Inc.

- 6.1.8 Qiagen NV

- 6.1.9 F. Hoffmann-La Roche AG

- 6.1.10 Thermo Fisher Scientific

- 6.1.11 Quest Diagnostics Inc.

- 6.1.12 Sysmex Corporation

- 6.1.13 Sonic Healthcare Ltd

- 6.1.14 Charles River Laboratories