|

시장보고서

상품코드

1444356

동물 헬스케어 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Veterinary Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

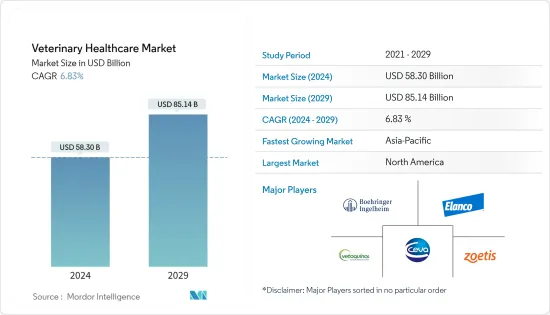

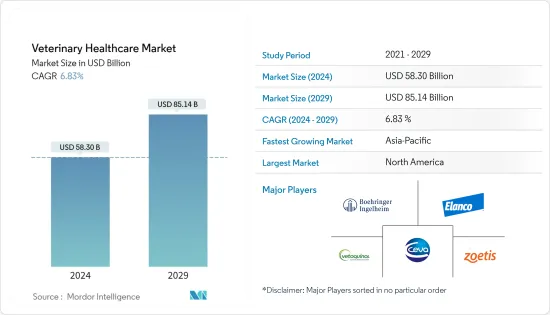

동물 헬스케어(Veterinary Healthcare) 시장 규모는 2024년에 583억 달러로 추정되며, 2029년까지 851억 4,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년) 동안 6.83%의 CAGR로 성장할 전망입니다.

제조 현장의 일시적 폐쇄, 수출 금지, COVID-19 치료를 위한 치료제 수요 증가로 인해 여러 국가에서 동물용 의약품의 공급 차질과 부족이 관찰되었습니다. 각국 정부는 의약품 공급을 완화하기 위한 조치를 취하고 있습니다. 예를 들어, 2020년 유럽의약품청(European Medicines Agency)은 동물용 의약품을 담당하는 기업을 대상으로 규제 프레임워크 적응에 관한 지침을 발표했는데, 주로 팬데믹 기간 동안 직면한 문제를 해결하기 위한 것이었습니다. 또한, 2020년 7월 미국 질병통제예방센터는 COVID-19 팬데믹 기간 동안 반려동물 치료를 위한 구체적인 가이드라인을 수의사 전문가에게 권고했습니다. 따라서 팬데믹이 연구 대상 시장에 상당한 영향을 미친 것으로 관찰되었습니다. 그러나 시장은 동물 헬스케어 제품 및 서비스에 대한 수요 측면에서 전염병 이전 단계에 도달했습니다. 시장은 단기간에 상당한 성장을 보일 것으로 예상됩니다.

이 시장은 주로 동물 질환 치료와 관련된 신제품의 승인에 의해 주도되고 있습니다. 예를 들어, 2022년 6월, DechraVeterinary은 개와 고양이를 위한 베트라덴트 액상 수분 첨가제를 발표하고 수의구강보건위원회(VOHC)로부터 치석 관리에 도움이 되는 제품으로 승인받았다고 발표했습니다. 이 인증은 안전성과 효능을 충분히 입증한 후 반려견에 대해 부여되었습니다. 또한, 2021년 10월에는 가축, 양식 및 반려동물을 위한 혁신적인 사료 첨가제를 공급하는 BASF Animal Nutrition과 BASF SE의 전액 출자 자회사인 trinamiXGmbH가 협력하여 사료 업계에 trinamiX의 모바일 근적외선(NIR) 분광 솔루션을 도입했습니다. 이번 출시로 전체 가치 사슬에 걸쳐 고객에게 동물 사료 및 성분에 대한 빠르고 신뢰할 수 있는 현장 분석을 제공하는 휴대용 NIR 솔루션이 제공됩니다. 이러한 동물용 제품 출시로 인해 연구 대상 시장은 향후 몇 년 동안 건전한 성장을 보일 것으로 예상됩니다.

많은 기업들이 전 세계적인 성장을 견인할 수 있는 제품을 자주 출시하는 데 주력하고 있습니다. 예를 들어, 2022년 6월 R-BiopharmAG는 AusDiagnostics를 인수했습니다. 이 인수를 통해 알바이오팜은 분자생물학 멀티플렉스 진단, 추출 시약, 동물과 인간을 위한 실험실 자동화 장비로 제품 포트폴리오를 확장했습니다. 또한 2022년 1월에는 수의사들이 암 진단 및 치료의 어려움을 더 잘 해결할 수 있도록 참조 실험실 검사 및 서비스 메뉴를 확장했습니다. 이번 확장에는 차세대 DNA 시퀀싱 기술을 활용하여 개 암을 진단하는 액체 생검 검사가 포함됩니다. 따라서 동물 헬스케어 시장은 앞서 언급한 요인으로 인해 예측 기간 동안 상당한 성장을 보일 것으로 예상됩니다.

그러나 진단 영상 장비 및 동물 의약품의 높은 비용과 높은 수의학 서비스 가격은 예측 기간 동안 시장의 성장을 제한 할 것으로 예상됩니다.

동물 헬스케어 시장 동향

백신 부문은 예측 기간 동안 큰 점유율을 유지할 것으로 예상

백신은 바이러스, 박테리아 및 기타 질병을 일으키는 미생물을 죽이거나 수정하여 질병을 일으키지 않도록 구성되어 면역력을 높입니다. 이러한 병원체에서 유래된 유전자 변형 성분을 포함하는 새로운 첨단 백신이 생산되었습니다. Merck Animal Health와 같은 기업들은 공중 보건, 수의학, 기생충학 전문가를 특집한 가상 이벤트를 2022년 3월에 주최해, 매개 감염(VBD)의 위협 관리에 대한 견해를 공유했습니다. One Health의 접근법은 추적성, 적절한 백신 접종 정책, 지속적인 모니터링 및 치료를 통해 VBD의 출현과 만연을 예방하는 데 독자적으로 적합합니다.

게다가 시장 관계자는 시장에서 존재감을 높이기 위해 세계에서 새로운 백신을 개발하고 출시하고 있습니다. 예를 들어, 2021년 3월에 러시아에서 COVID-19에 대한 세계 최초의 동물 백신이 등록되어 'Carnivac-Cov'로 명명되었으며, Rosselkhoznadzor(연방 수의사 식물 검역 감시청) 부문에서 개발되었습니다. Carnivac-Cov의 임상시험이 시작되었습니다. 2021년 10월에는 개, 고양이 및 기타 동물이 참여했습니다.

2021년 7월, Zoetis는 약 70개의 동물원과 수십 개의 온실, 보호구, 학술시설, 27개 주에 있는 기관 및 정부기관에 서식하는 100종 이상의 포유류의 건강과 행복을 지키기 위해 11,000 회분 이상의 실험용 신형 COVID-19 바이러스 감염증 백신을 기증했습니다.

또한, 2022년 6월 인도에서는 농업 및 농민 연합부 장관인 슈리 나렌드라 싱 토마르가 ICAR-국립 말 연구 센터에서 개발한 동물 백신과 기타 진단 키트를 출시했습니다. 말용 Ancovax 백신은 동물용 불활화 SARS-CoV-2 델타(COVID-19) 백신입니다. Ancovax로 유도된 면역은 SARS-CoV-2의 델타 변종과 오미크론 변종을 모두 중화시킵니다. 이 백신은 비활성화된 SARS-CoV-2(델타) 항원과 알하이드로겔라스를 보조제로 함유하고 있습니다. 따라서 동물 백신의 이러한 새로운 출시로 인해이 부문은 향후 몇 년 동안 전 세계적으로 상당한 성장을 목격 할 것으로 예상됩니다.

북미는 예측 기간 동안 최대 시장 점유율을 유지할 것으로 예상

북미는 세계에서 가장 발전한 지역 중 하나입니다. 현재 동물 헬스케어 시장에서 주요 점유율을 차지하고 있으며 예측 기간 동안에도 비슷한 경향을 따를 것으로 예상됩니다. 북미 국가에서는 반려동물의 보급률이 높고 다양한 조직의 노력이 증가하고 있기 때문에 조사 대상 시장은 강력한 성장을 나타낼 것으로 예상됩니다.

예를 들어, 2025년까지 미국 보호소에서 개와 고양이의 도살을 종식시키기 위해 노력하는 동물 복지 단체인 베스트 프렌즈 애니멀 소사이어티는 미국 전역의 600개 이상의 보호소 및 구조 파트너와 협력하여 6개월 만에 세 번째 전국적인 입양 캠페인을 통해 사람들이 다음 반려동물을 사지 않고 입양을 선택하도록 장려한다고 발표했습니다. 이를 통해 미국 내 반려동물 입양이 증가하고 있습니다. 베스트프렌즈 동물협회는 노킬 운동의 선구자로서 보호소에서 죽는 동물의 수를 연간 약 1,700만 마리에서 약 355,000마리로 줄이는 데 기여했습니다. 베스트 프렌즈 동물 협회는 또한 2021년 미국 내 보호소에서 약 355,000마리의 개와 고양이가 소유주가 없는 동물로 인해 죽임을 당했다고 보고했습니다. 이러한 이니셔티브를 통해 동물 의료 시장은 크게 성장하고 있습니다.

마찬가지로, 2022년 8월, 캘리포니아주 동물복지기금연합회(CAWFC)는 주내 사람들과 그 반려동물에 가능한 한 큰 영향을 미치고 반려동물에 적절한 식단, 의약품, 진단제를 제공하기 위해 에, 19의 단체에 30만 달러의 보조금을 수여했습니다. 동물 복지에 대한 이러한 엄청난 자금은 시장 성장에 크게 기여하는 수의학에 대한 관심 증가를 보여줍니다.

게다가, 2022년 5월에 'Pet Keen'이 발표한 데이터에 의하면, 2021년에는 캐나다의 세대의 38% 근처가 고양이를 기르고 있어, 2021년에는 35%가 개를 기르고 있었습니다. 또한 위의 출처는 캐나다 반려동물 주인의 지출액이 증가하고 있다고 추정합니다. 반려동물에 대한 돈은 이전보다 늘고 있으며, 주인의 17%는 반려동물의 헬스케어에 매년 500달러 이상을 지출해도 상관없습니다고 생각하고 있습니다. 반려동물 주인들 사이에서 반려동물의 건강관리에 대한 의식이 높아짐에 따라 동물별 건강 관리에 이용할 수 있는 제품과 서비스에 대한 수요가 높아질 것으로 예상됩니다. 그러면 조사 대상 시장의 성장이 촉진됩니다.

동물 헬스케어 산업 개요

대기업은 지역의 확대, 합병·인수, 공동 조사의 대처 등, 경쟁력을 높이기 위해서 몇개의 사업 전략을 강구해 왔습니다. 조사 대상 시장의 주요 기업으로는 Elanco Animal Health Incorporated, Boehringer Ingelheim International GmbH, Vetoquinol SA, Zoetis Inc., IDEXX Laboratories 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사 전제 조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진 요인

- 동물 헬스케어의 혁신으로 이어지는 첨단 기술

- 세계에서 정부나 동물복지단체에 의한 대처가 증가

- 새로운 인수 공통 감염증의 리스크를 안면서 생산성을 향상

- 시장 성장 억제 요인

- 위조 의약품의 사용

- 동물실험과 수의학 서비스 비용 증가

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 제품별

- 치료

- 백신

- 기생충 구제제

- 항감염증약

- 의료용 사료 첨가물

- 기타 치료법

- 진단

- 면역진단검사

- 분자진단학

- 화상 진단

- 임상 화학

- 기타 진단

- 치료

- 동물 유형별

- 개와 고양이

- 말

- 반추동물

- 돼지

- 가금

- 기타 동물 유형

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 프랑스

- 독일

- 영국

- 이탈리아

- 스페인

- 기타 유럽

- 아시아 태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아 태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Norbrook

- Boehringer Ingelheim International GmbH

- Ceva Animal Health LLC

- Elanco Animal Health

- Idexx Laboratories

- Innovative Diagnostics(IDVet)

- INDICAL Bioscience GmbH

- Merck &Co. Inc.

- Phibro Animal Health

- Randox Laboratories Ltd

- Thermo Fisher Scientific

- Vetoquinol

- Virbac SA

- Zoetis Inc.

제7장 시장 기회 및 향후 동향

LYJ 24.03.15The Veterinary Healthcare Market size is estimated at USD 58.30 billion in 2024, and is expected to reach USD 85.14 billion by 2029, growing at a CAGR of 6.83% during the forecast period (2024-2029).

Supply disruptions and shortages of veterinary medicines were observed in several countries, primarily due to the temporary lockdowns of manufacturing sites, export bans, and increased demand for therapy for the treatment of COVID-19. Governments are taking measures to mitigate the supply of medicines. For instance, in 2020, the European Medicines Agency issued guidance for companies responsible for veterinary medicines concerning adaptations to the regulatory framework, primarily to address the challenges faced during this pandemic. Also, the Centers for Disease Control and Prevention, in July 2020, recommended specific guidelines to veterinary professionals for treating companion animals during the COVID-19 pandemic. Hence, it is observed that the pandemic had a significant impact on the market studied. However, the market has reached pre-pandemic in terms of demand for veterinary health products and services. The market is expected to witness significant growth in a short period.

The market is primarily driven by the approval of new products related to treating animal disorders. For instance, in June 2022, DechraVeterinary Products announced that it is VETRADENT Liquid Water Additive for dogs and cats and received the seal of acceptance to help control tartar from the Veterinary Oral Health Council (VOHC). The seal has been granted for dogs after adequately demonstrating safety and efficacy. Also, in October 2021, BASF Animal Nutrition, a supplier of innovative feed additives for livestock, aquaculture, and companion animals, and trinamiXGmbH, a wholly owned subsidiary of BASF SE, joined forces to introduce trinamiX' Mobile Near Infrared (NIR) Spectroscopy Solution to the feed industry. With this launch, the portable NIR solution provides customers across the entire value chain with a fast and reliable on-site analysis of animal feed and ingredients. With the launch of such veterinary products, the market studied is expected to witness healthy growth in the coming years.

Many companies focus on frequent product launches that may drive worldwide growth. For instance, in June 2022, R-BiopharmAG acquired AusDiagnostics. With the acquisition, R-Biopharmexpanded its product portfolio with molecular biology multiplex diagnostics, extraction reagents, and laboratory automation equipment for animals and humans. In addition, in January 2022, IDEXX Laboratories, Inc. expanded its reference laboratory menu of tests and services that will enable veterinarians to meet better the challenges of diagnosing and treating cancer. The expansion includes a liquid biopsy test that utilizes next-generation DNA sequencing technology to diagnose canine cancers. Hence, the market for veterinary healthcare is expected to witness substantial growth over the forecast period due to the aforementioned factors.

However, the high cost of diagnostic imaging equipment and veterinary medicines and the high price of veterinary services is anticipated to restrain the market's growth over the forecast period.

Veterinary Healthcare Market Trends

Vaccine Segment Expected to Hold the Significant Share Over the Forecast Period

Vaccines are comprised of viruses, bacteria, or other disease-causing organisms that have been killed or altered so that they cannot cause any disease, thus, boosting immunity. New advanced vaccines have been manufactured containing genetically engineered components derived from those disease agents. Companies like Merck Animal Health hosted a virtual event in March 2022 featuring public health, veterinary medicine, and parasitology experts, who will share their perspectives on managing the threat of vector-borne diseases (VBDs). The One Health approach is uniquely suited to help prevent the emergence and spread of VBDs through traceability, appropriate vaccination policies, and ongoing monitoring and treatment.

Additionally, market players are developing and launching new vaccines globally to enhance their market presence. For instance, in March 2021, the world's first animal vaccine against the novel coronavirus was registered in Russia, named Carnivac-Cov, developed by a unit of Rosselkhoznadzor(Federal Service for Veterinary and Phytosanitary Surveillance. The clinical trials of Carnivac-Cov were started in October 2021 and involved dogs, cats, and other animals.

In July 2021, Zoetis donated more than 11,000 doses of its experimental COVID-19 vaccine to help protect the health and well-being of more than 100 mammalian species living in nearly 70 zoos, as well as more than a dozen conservatories, sanctuaries, academic institutions, and government organizations located in 27 states.

Additionally, in June 2022, in India, the Union Minister of Agriculture & farmers, farmers Shri Narendra Singh Tomar, launched animal vaccines and other diagnostic kits developed by the ICAR-National Research Centre on Equines. The AncovaxVaccine on Equines is an inactivated SARS-CoV-2 Delta (COVID-19) Vaccine for Animals. The immunity induced by Ancovaxneutralizes both Delta and Omicron Variants of SARS-CoV-2. The vaccine contains inactivated SARS-CoV-2 (Delta) antigen with Alhydrogelas as an adjuvant. Therefore, owing to such new launches in veterinary vaccines, the segment is believed to witness substantial growth across the globe in the coming years.

North America Expected to Hold the Largest Market Share over the Forecast Period

North America is one of the most developed regions in the world. It currently holds the major share of the veterinary healthcare market, and it is expected to follow the same trend over the forecast period. With the increasing initiatives by various organizations in North American countries coupled with the high adoption of pets, the market studied is expected to show strong growth.

For instance, in September 2022, Best Friends Animal Society, an animal welfare organization working to end the killing of cats and dogs in America's shelters by 2025, announced that it is teaming up with more than 600 shelter and rescue partners across the United States for its third nationwide adoption campaign in six months to encourage people to choose to adopt, not buy, their next pet. Thus, increasing pet adoption in the United States. Best Friends Animal Society is a pioneer in the no-kill movement and has helped reduce the number of animals killed in shelters from an estimated 17 million per year to around 355,000. Best Friend's Animal Society also reported that in 2021, around 355,000 dogs and cats were killed in shelters in the United States as these animals were not owned. With such initiatives, the veterinary healthcare market is growing significantly.

Similarly, in August 2022, California Animal Welfare Funders Collaborative (CAWFC) awarded USD 300,000 in grants to 19 organizations to make the largest possible impact on people and their pets across the state, to provide the pets with proper food, medicines, and diagnostics as required. Such high funding for animal welfare indicates the rising focus on veterinary health which is contributing largely to the market growth.

In addition, the data published by 'Pet Keen' in May 2022 shows that nearly 38% of Canadian households owned a cat, while 35% owned a dog in 2021. Also, the source mentioned above estimated that pet owners in Canada are spending more money on their pets than before, and 17% of owners are willing to spend more than USD 500 every year for their pet healthcare. This awareness about pet healthcare among pet owners is expected to create demand for products and services available for per-animal healthcare. Thereby driving the studied market growth.

Veterinary Healthcare Industry Overview

Major companies have undertaken several business strategies to gain a competitive edge, such as regional expansion, mergers and acquisitions, and collaborative research initiatives. Some of the key players in the market studied are Elanco Animal Health Incorporated, Boehringer Ingelheim International GmbH, Vetoquinol SA, Zoetis Inc., and IDEXX Laboratories, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Advanced Technologies Leading to Innovations in Animal Healthcare

- 4.2.2 Increasing Initiatives by Governments and Animal Welfare Associations Globally

- 4.2.3 Increasing Productivity at the Risk of Emerging Zoonosis

- 4.3 Market Restraints

- 4.3.1 Use of Counterfeit Medicines

- 4.3.2 Increasing Cost of Animal Testing and Veterinary Services

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Therapeutics

- 5.1.1.1 Vaccines

- 5.1.1.2 Parasiticides

- 5.1.1.3 Anti-infectives

- 5.1.1.4 Medical Feed Additives

- 5.1.1.5 Other Therapeutics

- 5.1.2 Diagnostics

- 5.1.2.1 Immunodiagnostic Tests

- 5.1.2.2 Molecular Diagnostics

- 5.1.2.3 Diagnostic Imaging

- 5.1.2.4 Clinical Chemistry

- 5.1.2.5 Other Diagnostics

- 5.1.1 Therapeutics

- 5.2 By Animal Type

- 5.2.1 Dogs and Cats

- 5.2.2 Horses

- 5.2.3 Ruminants

- 5.2.4 Swine

- 5.2.5 Poultry

- 5.2.6 Other Animal Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 France

- 5.3.2.2 Germany

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Norbrook

- 6.1.2 Boehringer Ingelheim International GmbH

- 6.1.3 Ceva Animal Health LLC

- 6.1.4 Elanco Animal Health

- 6.1.5 Idexx Laboratories

- 6.1.6 Innovative Diagnostics (IDVet)

- 6.1.7 INDICAL Bioscience GmbH

- 6.1.8 Merck & Co. Inc.

- 6.1.9 Phibro Animal Health

- 6.1.10 Randox Laboratories Ltd

- 6.1.11 Thermo Fisher Scientific

- 6.1.12 Vetoquinol

- 6.1.13 Virbac SA

- 6.1.14 Zoetis Inc.