|

시장보고서

상품코드

1687832

MEMS 센서 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)MEMS Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

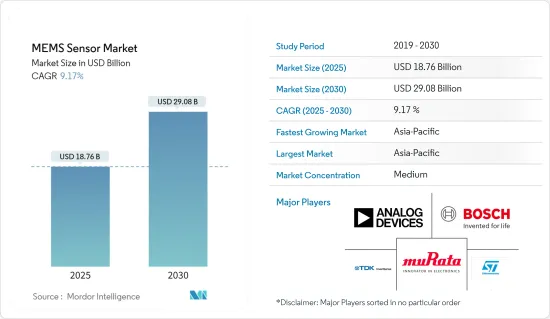

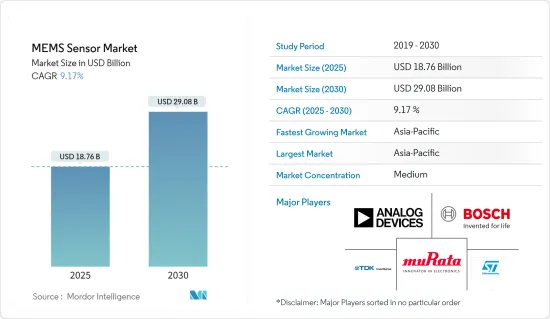

MEMS 센서 시장 규모는 2025년에 187억 6,000만 달러로 추계되며, 예측 기간(2025-2030년)의 CAGR은 9.17%로, 2030년에는 290억 8,000만 달러에 달할 것으로 예측됩니다.

반도체 분야에서 IoT의 인기 상승, 스마트 가전 및 웨어러블 기기에 대한 수요 증가, 산업 및 주거용 자동화 도입 강화 등이 시장 성장에 영향을 미치는 주요 요인으로 꼽힙니다.

주요 하이라이트

- MEMS 센서는 정확성, 신뢰성, 전자 장비의 소형화 등 여러 가지 장점을 가지고 있습니다. 그 결과, MEMS 센서는 지난 수년간 큰 호응을 얻고 있으며, IoT 커넥티드 디바이스 및 웨어러블 디바이스와 같은 소형화된 소비자 디바이스는 MEMS 센서의 새로운 용도로 떠오르고 있습니다.

- IFR의 예측에 따르면 향후 수년간 전 세계 공장에서 가동되는 산업용 로봇은 51만 8,000대에 달할 것으로 예상되며, 전 세계에서 보급이 크게 확대될 것으로 예측됩니다. 산업용 로봇 시장의 플러스 성장 궤도는 같은 기간 중 MEMS 센서 수요를 견인할 것으로 예측됩니다.

- 또한 가처분 소득 증가, 5G의 등장, 통신 인프라의 발전 등의 요인으로 인해 스마트폰에 대한 수요가 급증하고 있습니다. 예를 들어 에릭슨에 따르면 향후 수년간 전 세계 스마트폰 가입 건수는 76억 9,000만 건에 달할 것으로 예측됩니다.

- 또한 압력 센서는 생물의학, 차량용 전자제품, 소형 가전, 웨어러블 및 피트니스 전자제품 등 다양한 용도에서 사용되므로 가장 빠른 성장률을 나타낼 것으로 예측됩니다. 마이크, 초음파 MEMS 센서, 환경 센서, 마이크로볼로미터 등 기타 MEMS 센서도 시장 조사에서 큰 비중을 차지할 것으로 예측됩니다.

- 미국에 본사를 둔 반도체 테스트 핸들러 업체인 보스턴 세미 이큅먼트(BSE)는 최근 자동차 관련 고객으로부터 MEMS 고전력 및 압력 IC 테스트 용도를 위해 구성된 여러 대의 제우스 중력 테스트 핸들러를 반복 주문 받았다고 밝혔습니다. Zeus 핸들러는 MEMS 압력 감지 테스트 셀을 위한 유연한 범위를 가지고 있으며, IGBT, MOSFET, 게이트 드라이버, GaN, SiC 파워 반도체를 테스트하기 위한 생산용 핸들러에서 높은 전압 레벨을 제공합니다.

- 또한 시장 성장의 과제로는 인터페이스 설계 고려에 따른 MEMS 센서의 구현 비용 상승, MEMS 제조 공정의 표준화 미비 등을 들 수 있으며, MEMS의 표준화가 기존 반도체 공정 및 모델 환경보다 더 진전되지 않은 것은 틀림없습니다. 그러나 표준화 절차는 향후 몇년안에 실현될 것이며, 향후 수년간은 이러한 문제들이 점차적으로 영향을 덜 받게 될 것입니다.

- COVID-19 팬데믹으로 인해 일부 MEMS 센서에 대한 수요가 크게 증가했습니다. 예를 들어 비접촉식으로 사람의 체온을 모니터링해야 하는 상황에서 온도총과 열화상 카메라에 사용되는 써모파일과 마이크로볼로미터에 대한 수요가 증가했습니다. 또한 COVID-19 검출을 위한 실시간 중합효소연쇄반응(PCR) 진단 테스트와 DNA 염기서열 분석을 위한 마이크로유체공학이 시장에서 큰 관심을 받고 있습니다.

- 또한 병원 중환자실(ICU)을 위한 인공호흡기 압력계와 유량계가 성장했습니다. 따라서 팬데믹은 견고한 의료 인프라를 갖추는 것의 중요성을 부각시켰으며, 이후 산업의 발전은 예측 기간 중 시장 수요를 촉진할 것으로 예측됩니다.

MEMS 센서 시장 동향

자동차 분야가 시장 성장을 촉진할 것으로 전망

- MEMS 센서는 자동차 산업과 지능형 자동차에 사용되고 있으며, MEMS 센서의 개발은 자동차 산업에 집중될 것으로 예측됩니다. 엔진 E(ABS), 전자식 안정화 프로그램(ESP), 전자제어 서스펜션(ECS), 전동식 핸드 브레이크(EPB), 경사로 밀림 방지 장비(HAS), 타이어 공기압 모니터링(EPMS), 자동차 엔진 안정화, 각도 측정, 심박수 감지, 적응형 센서 각도 측정, 심박수 감지, 적응형 내비게이션 시스템 등에 널리 사용되고 있습니다.

- 세계보건기구(WHO)에 따르면 매년 135만 명 이상이 교통사고로 사망하고 있으며, MEMS 센서는 자동차의 안전 기능 향상에 중요한 역할을 하고 있으며, 시장 성장의 촉매제 역할을 하고 있습니다. 시장 성장의 촉매제 역할을 하고 있습니다.

- 오므론은 로봇 암용 FH-SMD 비전 센서 시리즈를 새롭게 출시했습니다. 이를 로봇에 탑재함으로써 기존 로봇에서는 어려웠던 3 사이즈의 랜덤(벌크) 자동차 부품을 인식하고, 생산성을 향상시켜 공간 절약, 검사, 픽앤플레이스(Pick and Place)를 실현합니다.

- 예를 들어 타타모터스는 2022년 4월 승용차 사업에 향후 5년간 24,000억 루피(30억 8,000만 달러)를 융자하는 프로젝트를 발표했습니다. 또한 2022년 3월에는 중국 상하이자동차 산하 MG모터스가 전기자동차 확장을 포함한 향후 필요 자금을 충당하기 위해 인도에서 3억 5,000만-5억 달러의 비공개 투자를 확대할 계획을 발표했습니다. 이러한 자동차의 개발은 조사 대상 시장의 성장을 더욱 촉진할 것으로 보입니다.

- 또한 신에너지 자동차, 무인자동차 등 새로운 지능형 자동차 시장 개발으로 MEMS 센서는 향후 자동차 센서 시장에서 더 큰 점유율을 차지할 것으로 예측됩니다. 최근 인벤센스는 CES에서 혁신적인 MEMS 센서 기술의 방대한 포트폴리오를 발표했습니다. 예를 들어 IMU IAM-20685 고성능 차량용 6축 모션 트래킹 센서 플랫폼(ADAS 및 자율주행 시스템용), TCE-11101(가정용, 산업용, 차량용, 헬스케어 및 기타 용도에서 CO2를 직접적이고 정확하게 감지할 수 있는 초소형 초저전력 MEMS 플랫폼) 등이 발표되었습니다. 초저전력 MEMS 플랫폼) 등이 발표되었습니다.

아시아태평양이 큰 시장 점유율을 차지할 것으로 예상

- 시스코에 따르면 아시아태평양은 인도, 일본, 중국 등의 경제 성장과 함께 가전 및 자동차 분야의 성장으로 인해 MEMS 센서의 가장 광범위한 시장이 될 것으로 예상되며, 올해 아시아태평양에서 약 3억 1,100만대, 북미에서 약 4억 3,900만대의 웨어러블 디바이스가 판매될 것으로 예측됩니다. 웨어러블 디바이스가 판매될 것으로 예측됩니다. 이는 이 지역의 MEMS 센서에 대한 수요를 더욱 증가시키고 있습니다.

- 중국은 자동차 시장과 소비자 시장의 상승, 스마트폰, 태블릿, 드론, 기타 마이크로 시스템 및 반도체 지원 제품의 수출로 인해 최근 수년간 MEMS 센서의 사용량이 크게 증가했습니다. 가속도계, 자이로스코프, 압력 센서, 무선 주파수(RF) 필터 등 여러 MEMS 센서가 제품 조립을 위해 중국으로 수입되고 있습니다.

- 또한 중국 정부는 자동차 부품 부문을 포함한 자동차 산업을 주요 산업 중 하나로 간주하고 있습니다. 중국 정부는 향후 몇년안에 중국의 자동차 생산량이 3,500만 대에 달할 것으로 예상하고 있습니다. 따라서 자동차 산업은 중국에서 MEMS 센서의 중요한 용도 중 하나가 될 것으로 예측됩니다.

- 인도 브랜드 주식 재단(IBEF)에 따르면 인도의 가전 및 가전제품(ACE) 시장은 CAGR 9%를 기록하여 올해 3조 1,500억 루피(약 483억 7,000만 달러)를 달성했습니다. 정부는 이 제품을 촉진하기 위해 몇 가지 구상을 취하고 있으며, 그 중에는 국내 전자 제품 제조를 촉진하고 전체 밸류체인을 수출하여 향후 수년간 약 4,000억 달러의 매출을 달성하는 것을 목표로 하는 '전자제품에 관한 국가 정책 2019'가 포함되어 있습니다. 포함되어 있습니다. 이러한 지역 정부의 구상은 조사 대상 시장을 강화할 것으로 추정됩니다.

- 인도의 자동차 산업은 경제적으로나 인구통계학적으로 성장하기 좋은 위치에 있으며, 국내의 관심과 수출 잠재력을 높이고 있습니다. 인도 정부는 Make in India 구상의 일환으로 자동차 제조를 이 구상의 주요 동력으로 삼고자 합니다. 이 제도는 2016-26년 자동차 미션 계획(AMP)에서 강조한 바와 같이 향후 수년간 승용차 시장을 940만 대까지 증가시킬 준비가 되어 있습니다. 이러한 요인으로 인해 이 지역의 자동차 부문에서 MEMS 센서의 채택이 증가할 것으로 예측됩니다.

- 또한 일본에 본사를 둔 민베아미쯔미 주식회사는 최근 자회사인 미쯔미전기가 오므론 주식회사와 오므론의 MEMS 제품 개발 기능인 오므론 노즈 사업소의 반도체 및 MEMS 제조 공장을 미쯔미를 통해 인수하기로 합의했다고 발표했습니다. 센서 사업을 인수함으로써 미쓰미의 가장 중요한 사업 중 하나인 센서 사업을 강화합니다.

MEMS 센서 산업 개요

MEMS 센서 시장은 비교적 경쟁이 치열하며, 다수의 중요한 기업으로 구성되어 있습니다. 시장 점유율 측면에서 STMicroelectronics NV, Invensense Inc. (TDK Corp), Bosch Sensortec GmbH (Robert Bosch GmbH), Analog Devices Inc., Murata Manufacturing Co. Ltd가 큰 점유율을 차지하고 있습니다. 또한 이들 기업은 시장 점유율과 수익성을 높이기 위해 지속적으로 제품을 혁신하고 있습니다.

- 2022년 4월: 보쉬 센서텍은 최초의 정전식 기압 센서 BMP581을 출시했습니다. 이 에너지 효율적인 기압 센서는 고정밀 고도 추적 IC로 실내 현지화, 바닥 감지, 내비게이션 용도를 위한 정확한 위치 정보를 제공할 수 있습니다. 이 센서는 I2C, I3C, SPI 디지털 시리얼 인터페이스 등 다양한 통신 인터페이스를 지원합니다. 소형, 저전력 소비로 스마트 웨어러블, 히어러블, IoT 용도에 적합합니다.

- 2022년 1월: TDK는 SoundWire 기능이 탑재된 최신 MEMS 마이크로폰을 발표했습니다. 새로운 T5828 MEMS(마이크로 전기 기계 시스템) 마이크는 MIPI SoundWire 프로토콜을 준수하며, 68dBA SNR(신호 대 잡음비)과 상시 켜짐 초저전력 소비 모드의 음향 활동 감지 소자를 탑재하고 있습니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 강도

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 자동차 산업에서 안전성에 대한 관심의 증가

- 자동화와 인더스트리 4.0의 출현

- 시장이 해결해야 할 과제

- 복수 인터페이스 설계의 복잡성에 의한 MEMS 센서의 총비용 상승

- MEMS 표준화된 제조 프로세스의 결여

제6장 시장 세분화

- 유형별

- 압력 센서

- 관성 센서

- 기타 유형

- 최종사용자 산업별

- 자동차

- 헬스케어

- 가전

- 산업용

- 항공우주·방위

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 세계의 기타 지역

- 북미

제7장 경쟁 구도

- 기업 개요

- STMicroelectronics NV

- InvenSense Inc.(TDK Corp.)

- Bosch Sensortec GmbH(Robert Bosch GmbH)

- Analog Devices Inc.

- Murata Manufacturing Co. Ltd

- Kionix Inc.(ROHM Co Ltd)

- Infineon Technologies AG

- Freescale Semiconductors Ltd(NXP Semiconductors NV)

- Panasonic Corporation

- Omron Corporation

- First Sensor AG(TE Connectivity)

제8장 투자 분석

제9장 시장의 미래

KSA 25.05.14The MEMS Sensor Market size is estimated at USD 18.76 billion in 2025, and is expected to reach USD 29.08 billion by 2030, at a CAGR of 9.17% during the forecast period (2025-2030).

The rising popularity of IoT in semiconductors, the growing need for smart consumer electronics and wearable devices, and the enhanced adoption of automation in industries and residences are some significant factors influencing the growth of the studied market.

Key Highlights

- MEMS sensors deliver multiple advantages, such as accuracy, reliability, and the prospect of making smaller electronic devices. As a result, they have gained considerable traction in the past few years. Miniaturized consumer devices, such as IoT-connected devices and wearables, are emerging applications of MEMS sensors in the market.

- According to the IFR forecasts, global adoption is expected to increase significantly to 518,000 industrial robots operational across factories all around the globe in the next few years. The positive growth trajectory of the industrial robots market is expected to drive the demand for MEMS sensors during the same period.

- Moreover, the demand for smartphones has been witnessing an upsurge owing to several factors increasing disposable income, the advent of 5G, and the development of telecom infrastructure. For instance, according to Ericsson, worldwide smartphone subscriptions are expected to reach 7,690 million in the next few years.

- Furthermore, pressure sensors are anticipated to witness the fastest growth rate as they are used in numerous application areas, such as biomedicine, automotive electronics, small home appliances, and wearable and fitness electronics. Other MEMS sensors, such as microphones and ultrasonic MEMS sensors, environmental sensors, and microbolometers, are expected to hold a significant share of the market studied.

- The US-based Boston Semi Equipment (BSE), a semiconductor test handler company, recently received repeat orders from automotive customers for multiple Zeus gravity test handlers configured for MEMS high-power and pressure IC testing applications. Zeus handlers have a flexible range for MEMS pressure sensing test cells and offer high voltage levels in a production handler for testing IGBT, MOSFET, gate drivers, GaN, and SiC power semiconductors.

- In addition, the factors challenging the market's growth include the increase in the cost of MEMS sensors implementation due to interface design considerations and the lack of a standardized fabrication process of MEMS. The standardization in MEMS is undoubtedly less advanced than it is for conventional semiconductor processes and model environments. However, the standard procedure is bound to happen in the next few years, making the impact of the challenge gradually low in the next few years.

- Due to the COVID-19 pandemic, certain types of MEMS sensors significantly spiked in demand. For instance, the demand for thermopiles and microbolometers used in temperature guns and thermal cameras increased because of the need for contactless monitoring of people's temperatures. Moreover, real-time polymerase chain reaction (PCR) diagnostic tests for detecting COVID-19 and microfluidics for DNA sequencing gained substantial market relevance.

- Furthermore, pressure and flowmeters in ventilators grew because of hospital intensive care units (ICUs). Therefore, the pandemic highlighted the criticality of having a robust healthcare infrastructure, and the industry's subsequent developments are expected to propel market demand over the forecast period.

MEMS Sensor Market Trends

Automotive Sector Expected to Drive the Market Growth

- MEMS sensors are used in the automobile industry and intelligent automobiles. MEMS sensor development is expected to focus on the automotive industry. It is widely used in engine e(ABS), electronic stability program (ESP), electronic control suspension (ECS), electric hand brake (EPB), slope starter auxiliary (HAS), tire pressure monitoring (EPMS), car engine stabilization, angle measure, and heartbeat detection, as well as adaptive navigation systems.

- The increasing demand for safety and security in automobiles is one of the main factors that play a vital role in the market's growth. According to the WHO, more than 1.35 million people yearly are killed in road accidents. MEMS sensors play a critical role in improving the safety features of vehicles and act as a catalyst for the market's growth.

- OMRON has newly released the FH-SMD Vision Sensor series for robot arms, which can be used for fast detection for humans and flexibility for auto-selection of the compartment. These can be mounted on a robot to recognize random (bulk) automotive parts in three sizes that are hard to use with conventional robots and improve productivity, thereby saving space, inspection, and pick and place.

- For instance, in April 2022, Tata Motors announced projects to finance INR 24,000 crores (USD 3.08 billion) in its passenger motorcar business over the next five years. Furthermore, in March 2022, MG Motors, owned by China's SAIC Motor Corp., declared plans to expand USD 350-500 million in confidential equity in India to fund its future requirements, including EV expansion. Such developments in automobiles will further drive the studied market growth.

- Furthermore, with the development of new intelligent vehicles, such as new energy vehicles and driverless vehicles, MEMS sensors may occupy a more significant share of the automotive sensor market in the future. Recently, InvenSense presented its vast portfolio of innovative MEMS sensor technologies at CES. For instance, it released the IMU IAM-20685 high-performance automotive 6-Axis MotionTracking sensor platform for ADAS and autonomous systems and TCE-11101, a miniaturized ultra-low-power MEMS platform for direct and accurate detection of CO2 in home, industrial, automotive, healthcare, and other applications.

Asia-Pacific Expected to Hold Significant Market Share

- Asia-Pacific is anticipated to be the most extensive market for MEMS sensors due to economies, such as India, Japan, and China, along with the increasing growth of the consumer electronics and automobile segments. According to Cisco, this year, around 311 million and 439 million wearable device units are expected to be sold in Asia-Pacific and North America, respectively. This is further driving the demand for MEMS sensors in the region.

- China has witnessed a significant increase in the usage of MEMS sensors in the past couple of years due to the rise in its automotive and consumer markets and the export of smartphones, tablets, drones, and other microsystem and semiconductor-enabled products. Multiple MEMS sensors, such as accelerometers, gyroscopes, pressure sensors, and radio frequency (RF) filters, have been imported into China for product assembly.

- Moreover, the Chinese administration also views its automotive industry, including the auto parts sector, as one of the major industries. The Central Government expects China's automobile output to reach 35 million units in the next few years. This is posed to make the automotive sector one of the prominent uses of MEMS sensors in China.

- According to the India Brand Equity Foundation (IBEF), the Indian appliances and consumer electronics (ACE) market has registered a CAGR of 9% to achieve INR 3.15 trillion (USD 48.37 billion) this year. The government has taken several initiatives to propel this product, including the National Policy on Electronics 2019, which aims to promote domestic electronic manufacturing and export a complete value chain to achieve a turnover of approximately USD 400 billion in the next few years. Such regional government initiatives are estimated to bolster the studied market.

- The Indian automotive industry is well-positioned for growth economically and demographically, serving domestic interest and export possibilities, which will rise shortly. As a part of the Make in India scheme, the Government of India aims to make automobile fabricating the main driver for the initiative. The system is poised to make the passenger vehicles market rise to 9.4 million units in the next few years, as underlined in the 2016-26 Auto Mission Plan (AMP). This factor is expected to raise the adoption of MEMS sensors in the region's automotive sector.

- Furthermore, Minbea Mitsumi Inc., based in Japan, recently announced that Mitsumi Electric Co. Ltd, a company subsidiary, has reached an agreement with Omron Corporation to acquire the semiconductor and MEMS Manufacturing plant as the MEMS product development function at OMRON's Yasu facility through MITSUMI. Acquiring the MEMS sensor business will strengthen Mitsumi's sensor business, which is one of its most important.

MEMS Sensor Industry Overview

The MEMS sensors market is relatively competitive and consists of numerous significant players. In terms of market share, a few crucial players, such as STMicroelectronics NV, Invensense Inc. (TDK Corp), Bosch Sensortec GmbH (Robert Bosch GmbH), Analog Devices Inc., and Murata Manufacturing Co. Ltd, currently hold a significant market share. Additionally, these companies continuously innovate their products to increase their market share and profitability.

- April 2022: Bosch Sensortec released its first capacitive barometric pressure sensor, the BMP581. The energy-efficient barometric is a highly accurate altitude-tracking IC that can provide precise location information for indoor localization, floor detection, and navigation applications. The sensor supports multiple communication interfaces, including I2C, I3C, and SPI digital serial interfaces. Its small size and low power consumption create it ideal for smart wearables, hearables, and IoT applications.

- January 2022: TDK introduced the most recent MEMS microphone with SoundWire functionality. The new T5828 MEMS (micro-electromechanical system) microphone complies with the MIPI SoundWire protocol. It includes 68dBA SNR (signal-to-noise ratio) and acoustic activity detect elements with always-on ultra-low power mode.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Safety Concerns in the Automotive Industry

- 5.1.2 Emergence of Automation and Industry 4.0

- 5.2 Market Challenges

- 5.2.1 Increase in Overall Cost of MEMS Sensors due to Multiple Interface Design Complexity

- 5.2.2 Lack of Standardized Fabrication Process for MEMS

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure Sensors

- 6.1.2 Inertial Sensors

- 6.1.3 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Consumer Electronics

- 6.2.4 Industrial

- 6.2.5 Aerospace and Defense

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of the Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics NV

- 7.1.2 InvenSense Inc. (TDK Corp.)

- 7.1.3 Bosch Sensortec GmbH (Robert Bosch GmbH)

- 7.1.4 Analog Devices Inc.

- 7.1.5 Murata Manufacturing Co. Ltd

- 7.1.6 Kionix Inc. (ROHM Co Ltd)

- 7.1.7 Infineon Technologies AG

- 7.1.8 Freescale Semiconductors Ltd (NXP Semiconductors NV)

- 7.1.9 Panasonic Corporation

- 7.1.10 Omron Corporation

- 7.1.11 First Sensor AG (TE Connectivity)