|

시장보고서

상품코드

1685888

산업용 전분 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Industrial Starches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

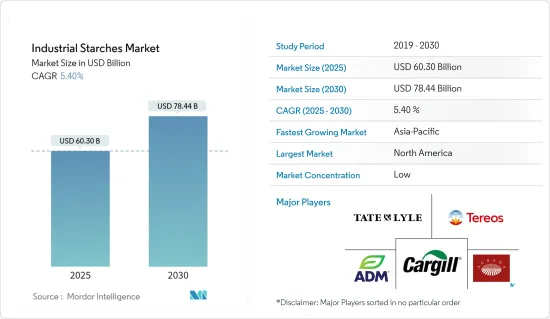

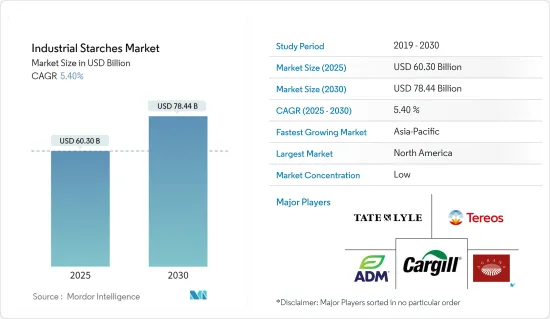

산업용 전분 시장 규모는 2025년에 603억 달러로 추정되고, 2030년에는 784억 4,000만 달러에 달할 것으로 예측되며, 예측기간 중(2025-2030년) CAGR은 5.4%를 보일 전망입니다.

전분은 농산물 원료에서 추출한 탄수화물로, 다양한 일상 식품 및 비식품에 사용됩니다. 산업용 전분은 옥수수, 감자, 밀 등 다양한 원료에서 추출됩니다. 세계 경제가 점차 개선되고 가공식품 및 편의식품의 섭취가 증가함에 따라 이러한 식품에 많이 사용되는 산업용 전분 시장이 수요가 증가하여 전체 시장을 견인하고 있습니다.

식품 산업의 급속한 발전과 함께 개량 전분에 대한 수요도 증가하고 있습니다. 개량 전분은 베이커리, 스낵, 음료 및 영양 식품과 같은 다양한 식품에 많은 기능적 이점을 제공합니다. 현재 시장에는 천연 전분, 개량 전분, 맥아 덱스트린, 전분 기반 당 등의 형태로 연구된 다양한 전분이 시판되고 있습니다. 이러한 전분은 주로 음료 및 제과 산업, 제약 및 발효 산업 등에서 응용 분야가 확대되면서 시장을 주도하고 있습니다.

산업용 전분 시장 동향

산업용 전분의 주요 공급원 중 하나인 옥수수

옥수수에서 추출한 전분은 질감 특성으로 인해 특히 유제품 및 음료와 같은 산업에서 증점제로서 수요가 높습니다. 또한 이 성분은 밀에서 추출한 전분은 추출 과정에서 미량의 글루텐이 남을 가능성이 있기 때문에 글루텐 프리 제품 개발에서도 우위를 점하고 있습니다. 클린 라벨 식재료와 제품의 트렌드는 전 세계 식음료 산업에 큰 영향을 미치고 있습니다. 또한 식품 가공 산업의 급속한 확장은 원료 제조업체가 증가하는 수요를 충족하기 위한 전략적 조치를 채택할 수 있는 중요한 기회를 제공합니다. 비식품 분야에서는 제지 산업에서 옥수수 전분을 필러 및 사이징 재료로 활용하고 있습니다. 또한 섬유, 세탁, 파운드리, 공기 부양 및 접착제 산업에서도 응용 분야를 찾을 수 있습니다. 다양한 산업에서 옥수수 전분의 광범위한 응용 분야가 시장 성장을 주도하고 있습니다.

북미가 산업용 전분 시장에서 주요 점유율을 차지

모든 재료를 활용하는 식품 산업이 고도로 발달한 북미는 지역별 산업용 전분 시장에서 선두 자리를 차지하고 있습니다. 전 세계적으로 미국은 2021-2022년 옥수수 생산량이 3억 8,394만 톤에 달하는 최대 옥수수 생산국으로 전분 생산을 비롯한 다양한 응용 분야에 활용되고 있습니다. 이 시장은 글루텐 프리 식품 소비에 크게 기울어져 있으며, 글루텐 프리 성분의 제품 라벨링에 관한 엄격한 규제를 시행하는 미국 정부의 지원을 받고 있습니다. 따라서 미국 내 대부분의 변형 식품 전분은 글루텐 프리이며 옥수수, 왁스 옥수수, 감자에서 추출합니다. 따라서 밀에서 추출한 전분은 시장에서 차지하는 비중이 낮습니다. 캐나다의 산업용 전분 시장은 건강하고 깨끗한 식재료에 대한 소비자 수요 증가로 인해 빠르게 성장하고 있습니다. 특히 은은한 풍미를 지닌 밝은 색상의 응용 제품이 캐나다에서 토종 전분에 대한 수요를 주도하고 있습니다. 현지 제조업체들은 가공식품에 토종 전분을 사용하여 제품의 매력을 유지하고 있습니다.

산업용 전분 산업 개요

산업용 전분 시장은 매우 세분화되어 있으며 많은 현지, 지역 및 국제 업체들이 시장 점유율을 놓고 경쟁하고 있습니다. 시장의 주요 기업으로는 Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle PLC, Tereos Group 등이 있습니다. 각 회사는 비즈니스 강화를 위해 확장, 신제품 출시, 혁신을 위한 주요 전략을 채택합니다. 현지 업체들과 새로운 계약 및 파트너십을 맺는 전략은 해외에서 입지를 넓히고 산업 요구 사항에 따라 신제품을 출시하고 이러한 소규모 지역 기업의 전문성을 활용하는 데 도움이 되었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자, 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형별

- 천연

- 전분 유도체 및 감미료

- 원료별

- 옥수수

- 밀

- 카사바

- 감자

- 기타

- 용도별

- 식품

- 사료

- 제지 산업

- 제약 산업

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 스페인

- 영국

- 독일

- 러시아

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 채택된 전략

- 시장 점유율 분석

- 기업 프로파일

- Cargill Incorporated

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate & Lyle PLC

- Agrana Beteiligungs AG

- Kent Nutrition Group Inc.(Grain Processing Corp.)

- The Tereos Group

- Cooperatie Koninklijke Cosun UA

- Altia PLC

- Angel Starch and Food Pvt. Ltd

- Manildra Group

- Japan Corn Starch Co. Ltd

제7장 시장 기회와 앞으로의 동향

제8장 면책사항

HBR 25.04.04The Industrial Starches Market size is estimated at USD 60.30 billion in 2025, and is expected to reach USD 78.44 billion by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

Starch is a carbohydrate extracted from agricultural raw materials, which finds applications in many everyday food and non-food products. Industrial starches are derived from various sources, including corn, potato, wheat, and other sources. With the global economy gradually improving and resulting in an increased intake of processed and convenience foods, the market for industrial starch, which finds substantial usage in these food applications, is finding increased demand, thereby driving the overall market.

The demand for modified starches is increasing in parallel with the rapid development of the food industry. Modified starches offer many functional benefits to various foods, such as bakeries, snacks, beverages, and nutritional foods. Currently, a wide range of starches are available in the market, studied in the form of native starches, modified starches, malt dextrin, starch-based sugars, and others. These starches have expanding applications, primarily in the beverage and confectionery industries and the pharmaceutical and fermentation industries, among others, driving the market.

Industrial Starch Market Trends

Corn as one of the Prominent Source of Industrial Starch

Starch derived from corn is in high demand because of its textural properties, especially as a thickening agent in industries such as dairy and beverages. The ingredient also gains an edge in the development of gluten-free products, which is a challenge for starch sourced from wheat, considering the potential remains of traces during extraction. The trend of clean-label ingredients and products is drastically impacting the global food and beverage industry. Moreover, the rapid expansion of the food processing industry offers a significant opportunity for ingredient manufacturers to adopt strategic measures to cater to the growing demand. When it comes to non-food applications, the paper industry utilizes corn starch as a filler and sizing material. It also finds applications in the textile, laundry, foundry, air flotation, and adhesive industries. The wide applications of corn starch in various industries drive market growth.

North America Holds a Major Share in the Industrial Starches Market

With a highly developed food industry utilizing all ingredients, North America occupies the pole position in the Industrial Starches Market by region. Globally, the United States is the largest producer of corn, with a production of 383.94 million metric tons in 2021-2022, which is utilized in various application areas, including starch production. The market is significantly inclined toward the consumption of gluten-free food, supported by the country's government with its stringent regulations regarding product labeling of gluten-free ingredients. Thus, most modified food starches in the United States are gluten-free and derived from corn, waxy maize, and potatoes. Consequently, the wheat-sourced starches amount to a lower share of the market. The Canadian industrial starches market is growing rapidly, owing to rising consumer demand for healthy and cleaner ingredients. Light-colored applications with subtle flavors especially drive the demand for native starches in the country. Local manufacturers are using it in processed food products, aiding in maintaining the product's appeal.

Industrial Starch Industry Overview

The industrial starch market is highly fragmented, with many local, regional, and international players competing for market share. Some of the major players in the market are Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle PLC, and The Tereos Group. Companies adopt major strategies for expansion, new product launches, and innovations to strengthen their business. The strategy of forming new agreements and partnerships with local players helped the companies increase their footprint in foreign countries and release new products according to the industrial requirements preferences and leverage the expertise of these small regional companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Native

- 5.1.2 Starch Derivatives & Sweeteners

- 5.2 By Source

- 5.2.1 Corn

- 5.2.2 Wheat

- 5.2.3 Cassava

- 5.2.4 Potato

- 5.2.5 Other Sources

- 5.3 By Application

- 5.3.1 Food

- 5.3.2 Feed

- 5.3.3 Paper Industry

- 5.3.4 Pharmaceutical Industry

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 Russia

- 5.4.2.5 France

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Cargill Incorporated

- 6.3.2 Archer Daniels Midland Company

- 6.3.3 Ingredion Incorporated

- 6.3.4 Tate & Lyle PLC

- 6.3.5 Agrana Beteiligungs AG

- 6.3.6 Kent Nutrition Group Inc. (Grain Processing Corp.)

- 6.3.7 The Tereos Group

- 6.3.8 Cooperatie Koninklijke Cosun UA

- 6.3.9 Altia PLC

- 6.3.10 Angel Starch and Food Pvt. Ltd

- 6.3.11 Manildra Group

- 6.3.12 Japan Corn Starch Co. Ltd