|

시장보고서

상품코드

1548920

초광대역(UWB) 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Ultra-Wideband - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

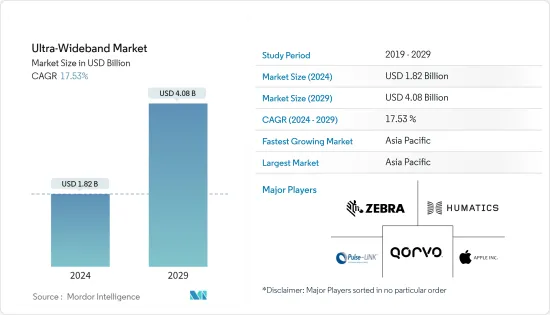

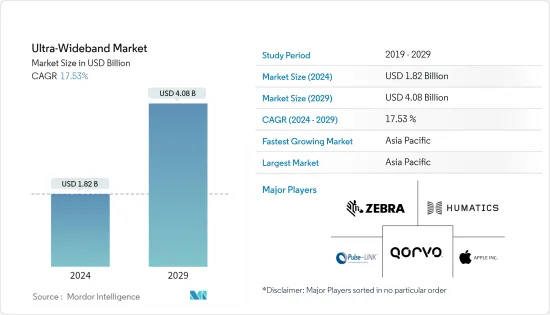

세계의 초광대역(UWB) 시장 규모는 2024년에 18억 2,000만 달러로 추정되며, 2029년에는 40억 8,000만 달러에 달하며, 예측 기간 중(2024-2029년) CAGR 17.53%로 성장할 것으로 예측됩니다.

주요 하이라이트

- 산업 인프라 및 스마트홈 증가에 따른 도시화 및 디지털화 전략 채택 증가, 반도체 툴의 조작성을 향상시키는 기술 발전, 세계 헬스케어 및 소매 분야의 디지털화 진전 등도 시장 성장을 가속하는 요인으로 꼽힙니다.

- 스마트 시티와 스마트홈의 성장과 함께 디지털 보안 분야에서 UWB 기술의 적용이 증가하고 있으며, 출입 통제 시스템의 보안을 강화하는 초광대역 기술을 포함하여 시장 성장을 가속할 것으로 예상됩니다. 출입 통제 시스템은 정확한 거리 측정 능력을 활용하여 안전한 구역에 대한 접근을 제한하고 허가된 개인만 출입할 수 있도록 허용할 수 있습니다. 이는 지능형 보안 솔루션에 대한 세계 수요 증가와 함께 향후 시장 성장 기회를 시사합니다.

- 그러나 Wi-Fi와 블루투스는 전통적으로 커넥티드 기기에 구현된 표준 무선통신 프로토콜이며, 다양한 용도에서 여전히 큰 지지를 받고 있으므로 UWB 기술에 대한 수요 증가는 제한적입니다. 블루투스 기술은 다른 무선통신 프로토콜에 비해 가격이 저렴하므로 가전제품에서 여전히 널리 사용되고 있으며, UWB 기술에 대한 수요 증가는 제한적일 것으로 예상됩니다.

- OEM 제조업체들이 전자기기에 초광대역(UWB) 기반 칩과 부품을 사용하게 되면 향후 시장 성장을 지원할 수 있을 것으로 보입니다. 예를 들어 2023년 10월 Samsung Electronics는 갤럭시 스마트태그2를 발표했습니다. 이 제품은 귀중품을 추적할 수 있고 UWB 지원 스마트폰과 통합하여 위치를 관리할 수 있습니다.

- UWB를 지원하는 갤럭시 제품에는 갤럭시 노트20 울트라, 갤럭시 S21, 갤럭시 S21 울트라, 갤럭시 S22, 갤럭시 S22 울트라, 갤럭시 S23, 갤럭시 S23 울트라, 갤럭시 Z 폴드2, Z 폴드3, Z 폴드4, Z 폴드5 등이 포함됩니다. Z Fold2, Z Fold3, Z Fold4, Z Fold5 등이 있으며, 이는 스마트폰 및 커넥티드 디바이스 시장에서 UWB 기술에 대한 수요가 증가하고 있음을 보여주며 시장 성장을 촉진할 것으로 보입니다.

초광대역(UWB) 시장 동향

가장 큰 최종사용자 산업은 가전제품

- 초광대역(UWB) 기술은 최근 수년간 가전제품에 큰 응용을 보이고 있습니다. 초광대역 기술은 다양한 하이엔드 스마트폰(애플, 삼성, 구글 픽셀), 일부 고급 노트북(레노버), 스피커(홈팟 미니) 웨어러블 기기에 주로 도입되고 있으며, 다양한 스마트홈 용도에서 빠르게 적용되고 있습니다.

- UWB 기술은 지난 수년간 스마트폰의 채택이 크게 증가했으며, 애플 스마트폰은 공간 인식을 위해 아이폰 11에 UWB 칩(U1)을 탑재하여 2019년 9월에 아이폰 11 프로가 다른 U1 탑재 애플 기기의 위치를 정확하게 파악할 수 있도록 했습니다. 했습니다. 이후 애플은 아이폰 12, 아이폰 13, 아이폰 14, 아이폰 15와 같은 플래그십 제품에 UWB 기술을 도입했습니다. 또한 Apple Watch Series 6, Series 7, Series 8, Series 9와 같은 웨어러블 제품에도 UWB 기술을 적용했습니다.

- 스마트홈을 보다 친숙하고 직관적으로 만드는 것도 UWB의 새로운 용도 중 하나입니다. 스마트홈 기기에 UWB 기술을 접목하면 선풍기나 조명을 켜고, 선호하는 플레이리스트를 재생하고, 온도를 조절하는 등 사용자의 특정 동작에 자동으로 반응할 수 있습니다. 따라서 향후 수년간 가전제품에서 초광대역(UWB)에 대한 수요가 증가할 것으로 예상됩니다.

- 스마트폰은 중국, 인도, 미국 등 국가의 높은 스마트폰 보급률로 인해 출하량 기준으로 가장 높은 점유율을 차지할 것으로 분석되며, GSMA에 따르면 2023년 전 세계 스마트폰 보급률은 69%에 달하고, 전년도 2022년보다 상승할 것으로 예상됩니다. 이 정보는 전 세계 스마트폰 계약 수 약 67억 대, 총 인구 약 74억 명에서 도출된 정보입니다.

아시아태평양이 큰 성장을 이룰 것입니다.

- 스마트폰에서 UWB 기술을 사용할 수 있게 되면서 많은 자동차 OEM들이 차세대 자동차에 UWB 기술을 채택하여 운전자에게 안전한 차량 액세스를 제공하면서 아시아태평양의 초광대역(UWB) 시장 성장에 박차를 가하고 있습니다.

- 아시아태평양에서 커넥티드카와 전기자동차의 성장은 시장 성장을 가속할 것으로 예상됩니다. 예를 들어 국제에너지기구(IEA)에 따르면 2023년 중국이 아시아태평양에서 가장 많은 전기자동차를 판매할 것으로 예상되며, 판매량은 800만 대를 넘어설 것으로 예상됩니다. 반면 인도는 2023년 약 8만 2,000대의 전기자동차가 판매될 것으로 예상됩니다.

- 2024년 2월, 무선 시스템온칩(SoC) 공급업체인 중국 심천 자이언트 마이크로일렉트로닉스(Shenzhen Giant Microelectronics Company Limited)는 MWC2024에서 거리측정, 위치측정 및 무선 연결 용도를 위한 업계 최고의 GT1500 UWB SoC를 발표했습니다. GT1500은 공간 제약이 있는 웨어러블 및 IoT 제품 용도에 적합합니다.

- 제조업과 자동차 분야의 IoT 채택은 IoT 기기에서 UWB 기술에 대한 요구가 증가함에 따라 시장에 기회를 가져다주고 있습니다. 제조업과 자동차 산업은 강력한 제조거점, 자동차의 급속한 성장, 예측 기간 중 기존 인프라로 인해 주요 견인차 역할을 할 가능성이 높습니다.

초광대역(UWB) 산업 개요

초광대역(UWB) 시장은 국제 및 국내 시장에서 활동하는 다양한 주요 벤더의 존재로 인해 경쟁이 치열하고 복잡해지고 있습니다. 시장은 적당히 집중되어 있으며, 주요 업체들은 제품 포트폴리오를 확장하고 지역적 범위를 넓히기 위해 합병, 인수, 제품 혁신과 같은 전략을 채택하고 있습니다. 시장의 중요 기업으로는 Qorvo Inc., Humatics Corporation, Pulse-Link Inc., Apple Inc., Zebra Technologies Corporation 등을 들 수 있습니다.

- 2024년 2월 - 테슬라는 애플의 초광대역(UWB) 기술을 도입한 운영체제 2024.2.3 버전을 발표했습니다. 이 업데이트는 전화 키의 기능을 대폭 강화하여 테슬라 소유자가 기존에 차량에 액세스하는 데 사용되었던 안전성이 떨어지고 정확도가 낮은 블루투스 연결을 우회할 수 있도록 합니다.

- 2023년 11월 - NXP 반도체가 Trimension NCJ29D6를 발표했습니다. 이 차량용 단일 칩 UWB(Ultra-Wideband) 제품군은 안전하고 정밀한 실시간 포지셔닝과 단거리 레이더를 통합했습니다. 보안 차량 출입, 어린이 존재 감지, 침입 경고, 제스처 인식 등 다양한 용도를 하나의 시스템에서 지원하도록 설계되었습니다. 자동차 제조업체들은 이미 이 장비를 탑재하고 있으며, 2025년형 차량에 도입될 것으로 예상됩니다.

기타 혜택 :

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 강도

- 거시경제 요인이 시장에 미치는 영향의 평가

제5장 시장 역학

- 시장 성장 촉진요인

- RTLS 용도의 수요 확대

- 산업용 사물인터넷(IIoT)의 채택 증가

- 시장 성장 억제요인

- 대체 제품과의 경쟁

제6장 시장 세분화

- 용도별

- RTLS

- 영상 처리

- 통신

- 최종사용자 업계별

- 헬스케어

- 자동차·운송

- 제조

- 가전

- UWB 대응 디바이스의 세계 출하대수 : 주요 용도별

- UWB 대응 스마트폰 디바이스의 지표 점유율 : 지역별

- UWB 스마트폰의 지표 점유율 : 아시아태평양의 국가별

- 스마트폰, IoT, 웨어러블에서의 주요 용도 인사이트

- 가전에 대한 UWB 채택에 대한 규제 변경의 영향

- 스마트폰 기업의 주요 UWB 공급업체

- 소매

- 기타 최종사용자 업계별

- 지역별

- 북미

- 유럽

- 아시아태평양

- 호주·뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 개요

- Qorvo Inc.

- Humatics Corporation

- Pulse-Link Inc.

- Apple Inc.

- Zebra Technologies Corporation

- NXP Semiconductors NV

- Texas Instruments Incorporated

- Johanson Technology Inc.

- Alereon Inc.

- Fractus SA

제8장 투자 분석

제9장 시장의 미래

KSA 24.09.20The Ultra-Wideband Market size is estimated at USD 1.82 billion in 2024, and is expected to reach USD 4.08 billion by 2029, growing at a CAGR of 17.53% during the forecast period (2024-2029).

Key Highlights

- Increasing urbanization and digitalization strategy adoptions in line with the growing industrial infrastructure and smart homes, technological advancements to improve the operation of semiconductor tools, and increasing digitization in healthcare and retail sectors worldwide are other factors driving the market's growth.

- With the growth of smart cities and homes, the increasing applications of UWB technology in the digital security segments are expected to boost the market's growth, including Ultra-wideband technology enhancing security in access control systems. Access control systems can restrict access to secure areas by utilizing their precise ranging capabilities, allowing only authorized individuals entry. This shows the market's future growth opportunity with the increasing demand for intelligent security solutions worldwide.

- However, Wi-Fi and Bluetooth are the standard wireless communications protocols traditionally implemented in connected devices. They are still gaining significant traction in various applications, thus limiting the growth in demand for UWB technology. Bluetooth technology is still widely used in consumer electronic products, owing to its low price among other wireless communication protocols.

- OEMs' increasing usage of Ultra-wideband-based chips and components in electronic devices will support market growth in the future. For instance, in October 2023, Samsung Electronics announced the Galaxy SmartTag2, enabling users to track valuables better and can be integrated with UWB-enabled smartphones for managing the locations.

- Galaxy products that support UWB include Galaxy Note20 Ultra, Galaxy S21+, Galaxy S21 Ultra, Galaxy S22+, Galaxy S22 Ultra, Galaxy S23+, Galaxy S23 Ultra, Galaxy Z Fold2, Z Fold3, Z Fold4, and Z Fold5, which shows the increasing demand for the UWB technology in the smartphones and connected devices in the market, which would fuel the market's growth.

Ultra Wideband (UWB) Market Trends

Consumer Electronics to be the Largest End-user Industry

- With its capability of providing high data rate wireless communications, ultra-wideband (UWB) technology has found significant applications in consumer electronic products in the past few years. The ultra-wideband technology is largely being deployed in various high-end smartphones (Apple, Samsung, and Google Pixel), some premium laptops (Lenovo), speakers (Homepod Mini) wearable devices, and its uses are rapidly increasing in various smart home applications, thus providing vast potential for the growth of the UWB market in the consumer electronics segment in coming years.

- UWB technology has gained significant smartphone adoption over the past few years, with Apple smartphone launching UWB chips (U1) in its iPhone 11 for spatial awareness, allowing iPhone 11 Pro to locate other U1-equipped Apple devices in September 2019 precisely. Since then, the company has deployed UWB technology in its flagship products, such as iPhone 12, iPhone 13, iPhone 14 and iPhone 15. The company also uses UWB technology in wearables such as the Apple Watch Series 6, Series 7, Series 8, and Series 9.

- Making smart homes more accessible and intuitive is another emerging UWB application. Embedding UWB technology within smart home devices allows them to automatically respond to specific user movements, such as turning on a fan or a light, playing a preferred playlist, or adjusting the temperature. Thus, this drives the demand for ultra-wideband in consumer electronics in the coming years.

- Smartphones are analyzed to hold the highest share shipment-wise owing to the high smartphone penetration in countries such as China, India, the United States, etc. According to GSMA, in 2023, the worldwide smartphone adoption rate reached 69%, increasing from the previous year in 2022. This information is derived from approximately 6.7 billion smartphone subscriptions globally and a total population of roughly 7.4 billion.

Asia-Pacific to Register Major Growth

- The increasing availability of UWB technology in smartphones and the growing adoption by many car OEMs in their next generation of vehicles to provide drivers with secure car access are fueling ultra-wideband market growth in Asia-Pacific.

- The growth of connected cars and EVs in the Asia-Pacific is expected to drive the market's growth. For instance, according to the International Energy Agency, in 2023, China experienced the most electric car sales throughout Asia-Pacific, with over 8 million electric cars sold. Comparatively, approximately 82 thousand electric cars were sold in India in 2023.

- In February 2024, China's Shenzhen Giant Microelectronics Company Limited, which supplies wireless system-on-chip (SoC), introduced an industry-leading GT1500 UWB SoC for ranging, positioning, and wireless connectivity applications at MWC 2024. GT1500 is ideally suited for space-constrained wearable and IoT product applications.

- The adoption of IoT in the manufacturing and automobile sectors is creating an opportunity for the market due to the increasing requirement for UWB technologies in IoT devices. The manufacturing and automotive sectors are likely to be primary drivers due to a strong manufacturing base, rapid automotive growth, and existing infrastructure over the forecast period.

Ultra Wideband (UWB) Industry Overview

The market for Ultra-Wideband is fragemented and exceptionally competitive, mainly due to the presence of various critical vendors in the market operating in both international and domestic markets. The market is moderately concentrated, with the significant players adopting strategies such as mergers, acquisitions, and product innovation to widen their product portfolio and extend their geographic reach. Some vital players in the market are Qorvo Inc., Humatics Corporation, Pulse~Link Inc., Apple Inc., and Zebra Technologies Corporation, among others.

- February 2024 - Tesla introduced a significant update to its operating system, version 2024.2.3, incorporating Apple's Ultra Wideband (UWB) technology. This update substantially enhances the functionality of the phone key, allowing Tesla owners to bypass the less secure and less accurate Bluetooth connections previously used for vehicle access.

- November 2023 - NXP Semiconductors introduced the Trimension NCJ29D6. This automotive single-chip Ultra-Wideband (UWB) family integrates advanced, secure, and precise real-time localization with short-range radar. It is engineered to support a variety of applications within a single system, including secure car access, child presence detection, intrusion alerts, and gesture recognition. Automotive OEMs are already incorporating these devices, with deployment expected in vehicles for the 2025 model year.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of the Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for RTLS applications

- 5.1.2 Increased Adoption of the Industrial Internet of Things (IIoT)

- 5.2 Market Restraints

- 5.2.1 Competition from the Substitute Products

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 RTLS

- 6.1.2 Imaging

- 6.1.3 Communication

- 6.2 By End-user Vertical

- 6.2.1 Healthcare

- 6.2.2 Automotive and Transportation

- 6.2.3 Manufacturing

- 6.2.4 Consumer Electronics

- 6.2.4.1 Global UWB-enabled Device Shipments by Major Application

- 6.2.4.2 Indicative Share of UWB-enabled Smartphone Devices by Region

- 6.2.4.3 Indicative Share of UWB Smartphones - Asia-Pacific Country Level

- 6.2.4.4 Key Applications Insights in Smartphone, IoT, and Wearables

- 6.2.4.5 Impact of Regulatory Changes on the Adoption of UWB in Consumer Devices

- 6.2.4.6 Major UWB Suppliers for Smartphone Companies

- 6.2.5 Retail

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qorvo Inc.

- 7.1.2 Humatics Corporation

- 7.1.3 Pulse~Link Inc.

- 7.1.4 Apple Inc.

- 7.1.5 Zebra Technologies Corporation

- 7.1.6 NXP Semiconductors NV

- 7.1.7 Texas Instruments Incorporated

- 7.1.8 Johanson Technology Inc.

- 7.1.9 Alereon Inc.

- 7.1.10 Fractus SA