|

시장보고서

상품코드

1687824

가스 센서, 검출기 및 분석장치 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Gas Sensor, Detector And Analyzer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

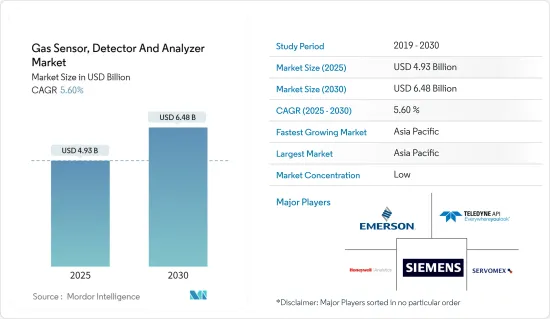

세계의 가스 센서, 검출기 및 분석장치 시장 규모는 2025년 49억 3,000만 달러로 추정되며, 예측기간 중(2025-2030년) CAGR 5.6%로, 2030년에는 64억 8,000만 달러에 달할 것으로 예측됩니다.

가스 센서는 그 근처의 구성 가스의 농도를 측정할 수 있는 화학 센서입니다. 이 센서는 매체의 정확한 가스량을 정량화하는 다양한 기술을 포함합니다. 가스 감지기는 다른 기술을 통해 공기 중의 특정 가스의 농도를 측정하고 표시합니다. 가스 감지기는 환경에서 감지할 수 있는 가스의 유형을 특징으로 합니다. 가스 분석장치는 직장의 안전성을 충분히 유지하기 위해 다수의 최종 사용자 산업에서 사용되는 안전장치에 응용되고 있습니다.

주요 하이라이트

- 가스 분석장치의 세계 수요는 셰일 가스와 꽉 오일의 발견 증가에 의해 밀어 올랐습니다. 가스 분석장치의 사용은 정부의 법률과 노동안전보건규칙의 시행에 의해 여러 산업현장에서도 강제되고 있습니다. 가스 누출과 배기 가스의 위험성에 대한 사회적 의식 증가도 가스 분석장치의 채용 확대에 기여하고 있습니다. 제조업체는 가스 분석장치를 휴대폰 및 기타 무선 장비와 통합하여 실시간 모니터링, 원격 조작 및 데이터 백업을 제공합니다.

- 가스 누출 및 기타 의도하지 않은 오염은 폭발적인 결과, 신체적 위험, 화재 위험을 초래할 수 있습니다. 폐쇄 공간에서는 많은 위험한 가스가 산소를 대체하여 주변 작업자를 질식 사멸시킬 수 있습니다. 이러한 결과는 직원의 안전, 장비 및 재산의 안전을 위협합니다.

- 휴대용 가스 감지 도구는 설치 및 이동 중 사용자의 호흡 영역을 모니터링하여 작업자의 안전을 보호합니다. 이러한 장비는 가스 위험이 있을 수 있는 많은 상황에서 매우 중요합니다. 모든 사람의 안전을 보장하기 위해서는 산소, 가연물 및 독성 가스의 공기 모니터링이 필수적입니다. 핸드헬드 가스 검지기에는 사이렌이 내장되어 있어 폐쇄 공간 등의 용도 내에서 잠재적으로 위험한 상황을 작업원에게 알립니다. 알람이 작동하면 크고 보기 쉬운 LCD가 위험한 가스 및 가스 농도를 확인합니다.

- 가스 센서와 검출기의 제조 비용은 최근 기술 혁신으로 꾸준히 상승하고 있습니다. 시장의 기존 기업은 이러한 변화에 대응하고 있지만, 신규 참가 기업과 중견 제조업체는 상당한 과제에 직면하고 있습니다.

- COVID-19의 발생에 따라 조사 대상 시장의 다수의 최종 사용자 산업이 조업 축소, 일시적인 공장 폐쇄 등의 영향을 받고 있습니다. 예를 들어 신재생에너지 산업에서는 세계 공급 체인이 큰 우려재료가 되고 있어 생산이 대폭 감속하고 있어 새로운 측정 시스템과 센서에 대한 지출이 감소하고 있습니다. 천연가스처리에서는 황화수소(H2S)와 이산화탄소(CO2)의 검출과 감시가 중요하며 가스분석장치에 대한 수요가 커지고 있습니다.

가스 센서, 검출기, 분석장치 시장 동향

석유 및 가스산업 부문이 큰 시장 점유율을 차지할 전망

- 석유 및 가스산업에서는 가압 파이프라인을 부식과 누출로부터 보호하고 다운타임을 최소화하는 것이 중요한 책무가 되고 있습니다. NACE(National Association of Corrosion Engineers)의 조사에 따르면 석유 및 가스 생산산업에서 부식의 연간 총 비용은 약 13억 7,200만 달러입니다.

- 가스 샘플에서 산소의 존재는 가압 파이프라인 시스템에서 누출을 결정합니다. 지속적이고 발견되지 않은 누출은 파이프라인의 작동 유량 효율에 영향을 주면서 상황을 악화시킬 수 있습니다. 또한, 황화수소(H2S)와 이산화탄소(CO2)와 같은 가스가 파이프라인 시스템에 존재하면 산소와 반응하여 결합하여 파이프라인의 벽을 내부에서 열화시키는 부식성의 파괴적인 혼합물을 형성할 수 있습니다.

- 이러한 비싼 비용을 줄이는 것은 업계에서 예방 조치를 위해 가스 분석장치를 채택하는 원동력 중 하나입니다. 가스 분석장치는 이러한 가스의 존재를 효과적으로 감지하여 파이프라인 시스템의 수명을 연장하기 위해 누출을 모니터링하는 데 도움이 됩니다. 석유 및 가스 산업은 TDL 기술(파장 가변 다이오드 레이저)로 이행하고 있으며, 고분해능의 TDL 기술에 의해 정밀도가 높은 검출의 신뢰성을 가능하게 해, 종래의 분석장치와의 일반적인 간섭을 회피하고 있습니다.

- 국제에너지기구(IEA)의 2022년 6월 발표에 따르면 세계 순정능력은 2022년에 100만b/d 확대하고, 2023년에는 추가로 160만b/d 확대할 것으로 예상됐습니다. 정유소 가스 분석장치는 원유 정제 중에 발생하는 가스의 특성화에 일반적으로 사용되기 때문에 이러한 동향은 시장 수요를 더욱 증가시킬 것으로 예상됩니다.

- IEA에 따르면 2021년 세계 천연가스 공급량은 추정 4.1% 증가했으며, 이는 COVID-19 팬데믹 이후 시장 회복도 원인이 되고 있습니다. 천연가스처리에서는 황화수소(H2S)와 이산화탄소(CO2)의 검출과 감시가 중요하며 가스 분석장치에 대한 수요가 커지고 있습니다.

- 이 업계에서는 생산 확대를 위한 거대한 투자를 수반하는 진행 중인 프로젝트와 향후 프로젝트가 많이 있습니다. 예를 들어 West Path Delivery 2023 프로젝트는 기존 25,000km NGTL 시스템에 약 40km의 새로운 천연 가스 파이프라인을 추가하여 캐나다 전역과 미국 시장에 가스를 출하할 예정입니다. 이러한 프로젝트는 예측 기간 동안 계속될 것으로 예상되며 가스 분석장치 수요를 뒷받침합니다.

아시아태평양이 큰 시장 점유율을 차지할 전망

- 석유 및 가스, 철강, 전력, 화학, 석유화학의 새로운 플랜트에 대한 투자 증가, 국제적인 안전기준 및 관행의 채용 증가가 시장 성장에 영향을 미칠 것으로 예상됩니다. 아시아태평양은 최근 석유 및 가스 생산 능력 증가를 기록한 유일한 지역입니다. 이 지역에서는 약 4곳의 정유소가 신설되어 세계 원유 생산량에 일량 75만 배럴 근처가 추가되었습니다.

- 이 지역의 산업 개발은 석유 및 가스 산업의 공정 모니터링, 안전성 향상, 효율화, 품질 향상 등의 용도로 가스 분석장치의 성장을 이끌고 있습니다. 따라서 이 지역의 정유소는 가스분석장치를 공장에 도입하고 있습니다.

- 예측 기간 동안 아시아태평양은 세계 가스 센서 시장의 급성장 지역 중 하나가 될 것으로 예상됩니다. 이 배경에는 정부의 엄격한 규제 증가와 환경 의식 향상 캠페인의 지속이 포함됩니다. 또한 IBEF의 National Infrastructure Pipeline 2019-25에 따르면 예상 자본 지출 총액 130조 루피(1조 4,000억 달러) 중 에너지 부문 프로젝트가 가장 높은 점유율(24%)을 차지하고 있습니다.

- 또한 이 지역에서는 최근 정부의 엄격한 규제가 큰 성장을 보이고 있습니다. 게다가 스마트시티 프로젝트에 대한 정부 투자의 급증은 스마트 센서 디바이스의 큰 잠재력을 창출하고 이 지역의 가스 센서 시장의 성장을 가속할 가능성이 높습니다.

- 아시아태평양의 여러 국가에서 급속한 산업화는 가스 감지기 시장의 성장을 가속하는 주요 요인 중 하나입니다. 연기, 연무, 유독가스 배출은 화력발전소, 탄광, 해면철, 철강, 합금철, 석유, 화학약품 등의 오염도가 높은 산업에 의해 발생합니다. 가스 감지기는 가연성 가스, 인화성 가스, 독성 가스를 감지하고 안전한 산업 운영을 보장하기 위해 일반적으로 사용됩니다.

가스 센서, 검출기, 분석장치 산업 개요

가스 센서, 검출기, 분석장치 시장은 세계에 많은 기업이 존재하기 때문에 단편화되고 있습니다. 현재 일부 유명 기업은 검출기를 중심으로 한 용도의 제품을 개발하고 있습니다. 분석장치 부문은 임상 검사, 환경 배출 제어, 폭발물 검출, 농업 저장, 선적, 직장 위험 모니터링 등 광범위한 분야에서 적용됩니다. 시장 기업들은 제품 제공을 강화하고 지속 가능한 경쟁 우위를 얻기 위해 파트너십, 합병, 확대, 혁신, 투자, 인수 등의 전략을 채택하고 있습니다.

- 2022년 12월 - Servomex Group Limited(Spectris PLC)는 한국에 새로운 서비스 센터를 개설하고 아시아 시장으로 서비스를 확대했습니다. 서비스 센터는 용인에서 공식적으로 선보이며, 반도체 산업, 석유 및 가스, 발전, 철강 산업의 산업 공정 및 배출 고객은 귀중한 조언과 지원에 액세스할 수 있습니다.

- 2022년 8월 - Emerson은 공장이 지속가능성 목표를 달성하는 데 도움이 되는 가스 분석 솔루션 센터를 스코틀랜드에 개설할 것이라고 발표했습니다. 이 센터에서는 60가지 이상의 가스 성분을 측정할 수 있는 10가지 이상의 감지 기술을 활용할 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 업계 밸류체인 분석

- COVID-19가 업계에 미치는 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 노동재해에 관한 안전의식의 고조

- 핸드헬드 기기의 보급

- 시장 성장 억제요인

- 고비용과 제품차별화의 부족

제6장 시장 세분화

- 가스분석장치

- 기술

- 전기화학식

- 상자성

- 지르코니아

- 비파괴 IR

- 최종 사용자 산업

- 석유 및 가스

- 화학제품 및 석유화학제품

- 상하수도

- 제약

- 기타 최종 사용자 산업

- 지역

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 기술

- 가스 센서

- 유형

- 독성

- 전기화학

- 반도체

- 광이온화

- 가연성

- 촉매

- 적외선

- 최종 사용자 산업

- 석유 및 가스

- 화학제품 및 석유화학제품

- 상하수도

- 금속 및 광업

- 유틸리티

- 기타 최종 사용자 산업

- 지역

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 유형

- 가스 검출기

- 통신 유형

- 유선

- 무선

- 검출기 유형

- 고정식

- 휴대용

- 최종 사용자 산업

- 석유 및 가스

- 화학제품 및 석유화학제품

- 상하수도

- 금속 및 광업

- 유틸리티

- 기타 최종 사용자 산업

- 지역

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 통신 유형

제7장 경쟁 구도

- 기업 프로파일

- Emerson Electric Company

- Teledyne API

- Siemens AG

- Servomex Group Limited(Spectris PLC)

- Honeywell Analytics Inc.

- Draegerwerk AG & Co KGaA

- Industrial Scientific Corporation

- MSA Safety Incorporated

- Crowncon Detection Instruments Limited

- Yokogawa Electric Corporation

- Control Instruments Corporation

- Membrapor AG

- Senseir AB

- Eaton Corporation PLC

- GfG Gas Detection UK Ltd

- Figaro Engineering Inc.

- Robert Bosch GmbH

- Thermofisher Scientific Inc.

- Detector Electronics Corporation

- Alphasense Limited

- California Analytical Instruments

- Testo SE & Co. KGaA

- Trolex Ltd

- Bacharach Inc.

- MKS Instruments Inc.

- RKI Instruments Inc.

- Horiba Ltd

- SGX Sensortech Limited(Amphenol Limited)

- Afriso-Euro-Index GmbH

- General Electric Company

- NGK Spark Plugs USA Inc.

- Delphi Technologies(BorgWarner Inc.)

- Denso Corporation

- 벤더의 시장 점유율 분석

제8장 투자 분석

제9장 시장 기회와 미래 성장

JHS 25.04.01The Gas Sensor, Detector And Analyzer Market size is estimated at USD 4.93 billion in 2025, and is expected to reach USD 6.48 billion by 2030, at a CAGR of 5.6% during the forecast period (2025-2030).

Gas sensors are chemical sensors that can measure the concentration of a constituent gas in its vicinity. These sensors embrace different techniques for quantifying a medium's exact amount of gas. A gas detector measures and indicates the concentration of certain gases in the air via other technologies. These are characterized by the type of gases they can detect in the environment. Gas analyzers find applications across safety instruments used in multiple end-user industries to maintain adequate safety in the workplace.

Key Highlights

- The global demand for gas analyzers has been boosted by an increase in shale gas and tight oil discoveries since these resources are utilized to stop corrosion in the infrastructure of natural gas pipelines. The use of gas analyzers has also been enforced in several industrial settings by government law and the enforcement of occupational health and safety rules. The growing public consciousness of the dangers of gas leaks and emissions contributed to the increased adoption of gas analyzers. Manufacturers are integrating gas analyzers with mobile phones and other wireless devices to offer real-time monitoring, remote control, and data backup.

- Gas leaks and other unintentional contamination can result in explosive consequences, physical harm, and fire risk. In confined spaces, numerous hazardous gases can even asphyxiate workers in the vicinity by displacing oxygen, which results in death. These outcomes jeopardize employee safety and the safety of equipment and property.

- Handheld gas detection tools keep personnel safe by monitoring a user's breathing zone while stationary and moving. These devices are critical in many situations where gas risks may exist. It is essential to monitor the air for oxygen, combustibles, and poisonous gases to ensure the safety of all people. Handheld gas detectors include built-in sirens that alert workers to potentially hazardous situations within an application, such as a confined space. When an alert is triggered, a large, easy-to-read LCD verifies the concentration of dangerous gas or gases.

- The production costs for gas sensors and detectors have steadily risen due to recent technological changes. While the market incumbents have been able to adapt to these changes, new entrants and mid-range manufacturers face considerable challenges.

- With the onset of COVID-19, multiple end-user industries in the market studied have been affected by reduced operations, temporary factory closures, etc. For instance, in the renewable energy industry, significant concerns revolve around global supply chains, which are considerably slowing down production, thus, aiming at reduced spending for new measurement systems and sensors. The detection and monitoring of hydrogen sulfide (H2S) and carbon dioxide (CO2) is pertinent in natural gas processing, creating significant demand for gas analyzers.

Gas Sensor, Detector, and Analyzer Market Trends

Oil and Gas Industry Segment is Expected to Hold Significant Market Share

- In the oil and gas industry, protecting a pressurized pipeline from corrosion and leaks and minimizing downtime are a few of the crucial responsibilities of the industry. As per a NACE (National Association of Corrosion Engineers) study, the total annual cost of corrosion in the oil and gas production industry is around USD 1.372 billion.

- The presence of oxygen in the gas sample determines a leak in the pressurized pipeline system. The continuous and undetected leak may worsen the situation while impacting on operational flow efficiency of the pipeline. Moreover, the presence of gases, such as hydrogen sulfide (H2S) and carbon dioxide (CO2), in the pipeline system reacting with oxygen can combine and form a corrosive and destructive mixture that can deteriorate the pipeline wall inside out.

- Mitigating such expensive costs is one of the drivers for adopting gas analyzers for preventive actions in the industry. Gas analyzer helps monitor leaks to extend the life of pipeline systems by effectively detecting the presence of such gases. The oil and gas industry is moving toward the TDL technique (tunable diode laser), which enables the reliability of detecting with precision because of its high-resolution TDL technique and avoids common interferences with traditional analyzers.

- As per the International Energy Agency's (IEA) June 2022, net global refining capacity is expected to expand by 1.0 million b/d in 2022 and by an additional 1.6 million b/d in 2023. With refinery gas analyzers commonly used to characterize gases produced during crude oil refining, such trends are expected to increase the market demand further.

- According to IEA, global natural gas supply increased by an estimated 4.1% globally in 2021, partly supported by the market recovery post the COVID-19 pandemic. The detection and monitoring of hydrogen sulfide (H2S) and carbon dioxide (CO2) is pertinent in natural gas processing, creating significant demand for gas analyzers.

- There are many ongoing and upcoming projects in the industry, with massive investments toward expanding production. For instance, the West Path Delivery 2023 project is expected to add about 40 km of new natural gas pipeline to the existing 25,000-km NGTL system, which ships gas across Canada and to the U.S. markets. Such projects are expected to continue during the forecast period, which will fuel the demand for gas analyzers.

Asia Pacific is Expected to Hold Significant Market Share

- Increased investments in new plants in oil and gas, steel, power, chemical, and petrochemicals and the rising adoption of international safety standards and practices are expected to influence market growth. Asia Pacific is the only region to register an oil and gas capacity growth in recent years. About four new refineries were added in the area, which has added nearly 750,000 barrels per day to global crude oil production.

- The development of industries in the region is driving the growth of gas analyzers, owing to their use in the oil and gas industry, such as monitoring processes, increased safety, enhanced efficiency, and quality. Hence, the refineries in the region are deploying gas analyzers in the plants.

- During the forecast period, Asia Pacific is anticipated to be one of the fastest-growing global gas sensors market regions. This is due to a rise in strict governmental regulations and ongoing environmental awareness campaigns. Further, according to IBEF, as per the National Infrastructure Pipeline 2019-25, energy sector projects accounted for the highest share (24%) out of the total expected capital expenditure of INR 111 lakh crore (USD 1.4 trillion).

- Also, the strict government regulations have recently shown significant growth in this region. Moreover, the surge in the government's investments in smart city projects creates a significant potential for smart sensor devices, likely to impel regional Gas Sensors Market growth.

- Rapid industrialization across the different countries in the Asia Pacific region is one of the primary factors driving the growth of the gas detectors market. Smoke, fumes, and toxic gas emissions occur due to highly polluting industries such as thermal power plants, coal mines, sponge iron, steel and ferroalloys, petroleum, and chemicals. Gas detectors are commonly used to detect combustible, flammable, and toxic gases and ensure safe industrial operations.

Gas Sensor, Detector, and Analyzer Industry Overview

The gas analyzer, sensor, and detector market is fragmented due to the presence of many players worldwide. Currently, some prominent companies are developing products with applications centering on the detector. The analyzer segment has applications across clinical assaying, environmental emission control, explosive detection, agricultural storage, shipping, and workplace hazard monitoring. Players in the market are adopting strategies such as partnerships, mergers, expansion, innovation, investment, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022 - Servomex Group Limited (Spectris PLC) extended its offerings to the Asian market by opening a new service center in Korea. As the service center is officially unveiled at Yongin, customers from the semiconductor industry, as well as the industrial process and emissions for oil and gas, power generation, and steel industry, can access invaluable advice and assistance.

- August 2022 - Emerson has announced opening a gas analysis solutions center in Scotland to help plants meet sustainability goals. The center has access to more than ten different sensing technologies that can measure more than 60 other gas components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Safety Awareness Regarding Occupational Hazards

- 5.1.2 Proliferation of Handheld Devices

- 5.2 Market Restraints

- 5.2.1 High Costs and Lack of Product Differentiation

6 MARKET SEGMENTATION

- 6.1 Gas Analyzers

- 6.1.1 Technology

- 6.1.1.1 Electrochemical

- 6.1.1.2 Paramagnetic

- 6.1.1.3 Zirconia

- 6.1.1.4 Non-disruptive IR

- 6.1.2 End-user Industry

- 6.1.2.1 Oil and Gas

- 6.1.2.2 Chemicals and Petrochemicals

- 6.1.2.3 Water and Wastewater

- 6.1.2.4 Pharmaceuticals

- 6.1.2.5 Other End-user Industries

- 6.1.3 Geography

- 6.1.3.1 North America

- 6.1.3.2 Europe

- 6.1.3.3 Asia-Pacific

- 6.1.3.4 Latin America

- 6.1.3.5 Middle-East and Africa

- 6.1.1 Technology

- 6.2 Gas Sensor

- 6.2.1 Type

- 6.2.1.1 Toxic

- 6.2.1.1.1 Electrochemical

- 6.2.1.1.2 Semiconductor

- 6.2.1.1.3 Photoionization

- 6.2.1.2 Combustible

- 6.2.1.2.1 Catalytic

- 6.2.1.2.2 Infrared

- 6.2.2 End-user Industry

- 6.2.2.1 Oil and Gas

- 6.2.2.2 Chemicals and Petrochemicals

- 6.2.2.3 Water and Wastewater

- 6.2.2.4 Metal and Mining

- 6.2.2.5 Utilities

- 6.2.2.6 Other End-user Industries

- 6.2.3 Geography

- 6.2.3.1 North America

- 6.2.3.2 Europe

- 6.2.3.3 Asia-Pacific

- 6.2.3.4 Latin America

- 6.2.3.5 Middle-East and Africa

- 6.2.1 Type

- 6.3 Gas Detectors

- 6.3.1 Communication Type

- 6.3.1.1 Wired

- 6.3.1.2 Wireless

- 6.3.2 Type of Detector

- 6.3.2.1 Fixed

- 6.3.2.2 Portable

- 6.3.3 End-user Industry

- 6.3.3.1 Oil and Gas

- 6.3.3.2 Chemicals and Petrochemicals

- 6.3.3.3 Water and Wastewater

- 6.3.3.4 Metal and Mining

- 6.3.3.5 Utilities

- 6.3.3.6 Other End-user Industries

- 6.3.4 Geography

- 6.3.4.1 North America

- 6.3.4.2 Europe

- 6.3.4.3 Asia-Pacific

- 6.3.4.4 Latin America

- 6.3.4.5 Middle-East and Africa

- 6.3.1 Communication Type

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Company

- 7.1.2 Teledyne API

- 7.1.3 Siemens AG

- 7.1.4 Servomex Group Limited (Spectris PLC)

- 7.1.5 Honeywell Analytics Inc.

- 7.1.6 Draegerwerk AG & Co KGaA

- 7.1.7 Industrial Scientific Corporation

- 7.1.8 MSA Safety Incorporated

- 7.1.9 Crowncon Detection Instruments Limited

- 7.1.10 Yokogawa Electric Corporation

- 7.1.11 Control Instruments Corporation

- 7.1.12 Membrapor AG

- 7.1.13 Senseir AB

- 7.1.14 Eaton Corporation PLC

- 7.1.15 GfG Gas Detection UK Ltd

- 7.1.16 Figaro Engineering Inc.

- 7.1.17 Robert Bosch GmbH

- 7.1.18 Thermofisher Scientific Inc.

- 7.1.19 Detector Electronics Corporation

- 7.1.20 Alphasense Limited

- 7.1.21 California Analytical Instruments

- 7.1.22 Testo SE & Co. KGaA

- 7.1.23 Trolex Ltd

- 7.1.24 Bacharach Inc.

- 7.1.25 MKS Instruments Inc.

- 7.1.26 RKI Instruments Inc.

- 7.1.27 Horiba Ltd

- 7.1.28 SGX Sensortech Limited (Amphenol Limited)

- 7.1.29 Afriso-Euro-Index GmbH

- 7.1.30 General Electric Company

- 7.1.31 NGK Spark Plugs USA Inc.

- 7.1.32 Delphi Technologies (BorgWarner Inc.)

- 7.1.33 Denso Corporation

- 7.2 Vendor Market Share Analysis