|

시장보고서

상품코드

1689886

워크플로우 자동화 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Workflow Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

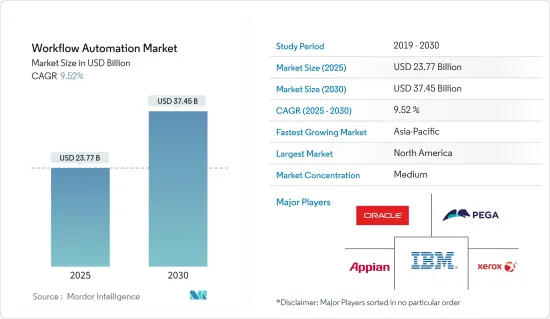

워크플로우 자동화 시장 규모는 2025년 237억 7,000만 달러에 달하고, 2030년에는 374억 5,000만 달러에 이를 것으로 예상되며, 예측 기간(2025-2030년)의 CAGR은 9.52%를 나타낼 것으로 전망됩니다.

워크플로우의 개념은 제조업과 사무실에서의 프로세스의 개념으로부터 발전한 것이며, 이러한 프로세스는 산업화의 시대부터 존재하고, 작업활동의 루틴적인 측면에 집중함으로써 효율을 급상승시키는 것을 추구 프로세스는 일반적으로 작업 활동을 명확하게 정의된 작업, 규칙, 절차로 분리하고 제조업 및 사무실 작업의 대부분을 규제합니다.

주요 하이라이트

- 정보기술의 도입으로 직장의 프로세스는 부분적으로 또는 전체적으로 정보시스템에 의해 자동화되어 컴퓨터 프로그램이 태스크를 실행하고 이전에는 인간이 실시하고 있던 규칙을 실시하게 되었습니다.에서 획득한 데이터와 특정 스테이지의 실행이 이루어지는 다양한 스테이지의 네트워크 위치에서 작업 티켓 생성과 함께 워크플로우 프로세스를 정의하는 것을 용이하게 합니다.

- 조직의 워크플로우 소프트웨어에 대한 수요 증가는 보다 정교하고 효율적인 소프트웨어 개발에 대한 급속한 투자로 이어지고 있다고 합니다. 시그나비오에 따르면 62%의 조직이 비즈니스의 최대 25%까지 모델링했지만, 모든 프로세스를 모델링한 조직은 2%에 불과했습니다. 또한 설문조사에 참여한 조직 중 13%는 지능형 자동화 솔루션을 대규모로 구현하고 있다고 답했으며, 23%는 구현 중, 37%는 시범적으로 자동화를 도입하고 있다고 답했습니다.

- 조직의 워크플로우 소프트웨어에 대한 수요 증가는 보다 정교하고 효율적인 소프트웨어 개발에 대한 급속한 투자로 이어지고 있습니다. 쿠프로세스 자동화에 이르기까지 인공지능과 관련 신기술의 채용이 증가하고 있습니다.

- 모든 새로운 기술의 도입과 달리 워크플로우 자동화는 인간 및 비인간 계정을 위한 사이버 공격의 위험을 초래할 수 있습니다. RPA 봇은 종종 민감한 데이터를 다루고 한 시스템에서 다른 시스템으로 데이터를 전송합니다.

- COVID-19의 발생으로 인해 공급망의 취약성이 드러났습니다. 나사 공급자는 미션 크리티컬 기업의 고객이 제공하는 서비스의 속도, 보안, 품질, 종합적인 효과를 실현하는 데 필요한 툴과 기술을 확실히 이용할 수 있게 되었습니다.

워크플로우 자동화 시장 동향

소프트웨어 부문이 상당한 성장을 기록할 것으로 예상

- IoT의 도입은 용도 및 비즈니스 모델의 출현, 디바이스 비용 절감으로 각 업계에서 급증하고 있습니다. 에 사용되는 툴이 큰 수요를 관찰하고 있습니다.워크플로우 자동화 소프트웨어에는 부가가치 기능을 포함한 여러가지 이점이 있어, 자동화의 범위를 넓히는 통합 기능을 제공합니다.

- 일부 기능은 소프트웨어를 구현하고 유지 관리하는 데 필요한 IT 지원을 줄이는 기능을 포함합니다. 비즈니스 사용자는 직관적 인 시각적 인터페이스를 통해 여러 기능에 편리하게 액세스할 수 있으며 자동화를 가속화하고 비즈니스 팀을 워크 플로우 최적화를위한 공동 창조 로 역할을 할 수 있습니다.로우 코드는 또한 IT 백로그에 압박을 줄입니다.

- 워크플로우 자동화 소프트웨어는 사용자 정의 가능한 양식과 같은 기능을 통해 프로세스를 표준화하고, 오류를 피하고, 중복 데이터 입력을 제거하여 요청 관리를 단순화하는 솔루션을 제공합니다. 포털은 사내외의 파트너와의 폼의 정리와 안전한 공유를 용이하게 합니다.

- 예를 들어, 2023년 10월, 비즈니스 소프트웨어용 로우코드 개발 플랫폼인 Retool Inc.는 Retool Workflows의 일반 제공을 발표했습니다. 이 매우 혁신적인 자동화 도구는 개발자가 코딩에 우선 순위를 부여하고 모니터링 및 유지 보수 도구와 함께 작업을 원활하게 자동화 할 수 있도록함으로써 개발자를 크게 지원하는 것을 목적으로 설계되었습니다. 정기적 인 작업, 사용자 정의 경고 및 정보 관리 작업의 효율적인 프로토 타이핑 및 구축을 가능하게하는 코딩 도구의 광범위한 배열을 제공하는 사용자 친화적이고 시각적으로 매력적인 인터페이스를 제공합니다.

예측기간 동안 아시아태평양이 가장 빠른 성장을 기록할 전망

- 중국 시장의 경쟁이 치열 해짐에 따라 일본의 다양한 산업이 디지털 혁신을 통해 워크 플로우를 개선하고 있습니다. Nissan은 효율성을 높이고 새로운 자동차 마케팅 프로세스를 가속화하기 위해 디지털 혁신 프로그램을 시작했습니다.

- 중국 유니콤의 지능형 네트워크 혁신 센터는 2021년 화웨이와 협력하여 화웨이의 AUTIN 시스템을 기반으로 AI 기반의 네트워크 관리 및 운영 플랫폼을 개발 및 배포했습니다. 베이스의 네트워크 관리·운용 플랫폼을 도입해, 데이터를 활용해 전국 네트워크의 운용, 계획, 관리를 간소화·자동화하는 것과 동시에, 5G 네트워크와 서비스를 전개하는 가운데 비용대효과, 고객 경험, 지속가능성을 향상시켰습니다.

- 자동화은 미래의 일 접근과 관련된 가장 중요한 부분 중 하나이며, 일본은 AI를 통해 혁신을 진행하고 있습니다.

- 인도의 경제개발에 있어서도 자동화는 큰 역할을 하고 있습니다.

- 기타 아시아태평양에서는 동남아시아와 호주가 뚜렷한 지역입니다. 갭을 메워야 합니다. 디지털화는 이 지역이 현지 기업에 있어서 세계적으로 경쟁력 있는 파트너십을 구축하는데 도움이 될 뿐만 아니라, 세계 전개의 가능성을 높여 기술과 지식의 이전을 성공시키는 것을 지원합니다.

워크플로우 자동화 산업 개요

워크플로우 자동화 시장은 세분화되고 경쟁이 치열합니다.

- 2023년 11월 세계 클라우드 플랫폼으로 재무, 조달 및 고객 서비스 기능을 위한 AI 주도형 프로세스 자동화 솔루션의 업계 리더인 Esker는 Teknion이 비즈니스 효율성을 높이기 위해 Esker의 현금 자동화 솔루션을 채택했다고 발표했습니다. Esker의 혁신적인 기술을 활용함으로써 테크니온은 세계 기지의 시스템과 ERP 워크플로우의 합리화를 목표로 하고 있습니다.

- 2023년 9월 세일즈포스는 Slack 플랫폼에 몇 가지 훌륭한 진화를 도입했습니다. 또한 Slack은 태스크, 승인, 정보를 정리하기 위한 리스트 기능 등, 워크플로우의 자동화에 가치 있는 추가를 실시했습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 경쟁 기업간 경쟁 관계

- 대체품의 위협

- 시장 성장 촉진요인

- 업계 전체의 IoT 도입 증가

- 비즈니스 프로세스 관리에서 RPA 도입 증가

- 시장 성장 억제요인

- 데이터 보안에 대한 우려

제5장 시장 세분화

- 배포별

- 온프레미스

- 클라우드

- 솔루션별

- 소프트웨어

- 서비스별

- 최종 사용자 산업별

- 은행

- 통신

- 소매

- 제조 및 물류

- 헬스케어 및 제약

- 에너지 및 유틸리티

- 기타 최종 사용자 산업

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 세계 기타 지역(라틴아메리카, 중동 및 아프리카)

- 북미

제6장 경쟁 구도

- 기업 프로파일

- IBM Corporation

- Oracle Corporation

- Xerox Corporation

- Pegasystems Inc.

- Appian Corporation

- Bizagi

- Software AG

- IPsoft Inc.

- Newgen Software Technologies Limited

- Nintex Global Limited

제7장 투자 분석

제8장 시장 동향과 장래 기회

KTH 25.05.09The Workflow Automation Market size is estimated at USD 23.77 billion in 2025, and is expected to reach USD 37.45 billion by 2030, at a CAGR of 9.52% during the forecast period (2025-2030).

The workflow concept has evolved from the notion of process in manufacturing and the office, and such processes have existed since the time of industrialization and are the outcome of a search to surge efficiency by concentrating on the routine aspects of work activities. They typically separate work activities into well-defined tasks, rules, roles, and procedures that regulate most of the manufacturing and office work. Initially, processes were carried out entirely by humans who manipulated physical objects.

Key Highlights

- With the introduction of information technology, processes in the workplace are partially or totally automated by information systems through computer programs performing tasks and enforcing rules that humans previously implemented. Workflow automation is developed to enhance productivity and quality by incorporating best practices in workflow processes involved in manufacturing as well as management. It facilitates defining workflow processes from the data fetched from the data sources and the network location of the various stages at which the execution of that particular stage is performed, along with the generation of job ticket. The system is able to move the job ticket automatically without any intervention of any external factor along with providing the user, a visual display of status of any job ticket at any point of time. The system is also adaptable to changes at a particular stage.

- The growing demand for workflow software from organizations is leading to rapid investment in the development of more sophisticated and efficient software. According to Signavio, 62% of the organizations have modeled up to 25% of their businesses, but a meager 2% have all their processes modeled. Moreover, 13% of the surveyed organizations say that they are implementing intelligent automation solutions at scale; 23% are implementing, and 37% are piloting automation.

- The increasing demand for workflow software by organizations is leading to rapid investment in the development of more sophisticated and efficient software. There is increasing adoption of artificial intelligence and related new technologies ranging from computer vision, cognitive automation, and machine learning to robotic process automation. This convergence of technologies produces automation capabilities that dramatically elevate business value and competitive advantages for customers.

- Unlike any new technology implementation, workflow automation can create risks for cyberattacks directed at both human and non-human accounts. As a result, process automation security is of critical importance. RPA bots often work on confidential data, transferring it from one system to another. If data is not protected, it can be leveraged, costing businesses millions.

- With the onset of COVID-19, the vulnerability of supply chains has been exposed. For most IT organizations, a fragile ecosystem includes providers of critical IT services. In addition, work-from-home mandates led the service providers to ensure that mission-critical enterprise customers have the necessary tools and technologies to enable the speed, security, quality, and overall efficacy of services provided.

Workflow Automation Market Trends

Software Segment is Expected to Register Significant Growth

- The adoption of IoT is surging among industries owing to the emergence of applications and business models and reduced device costs. With surging IoT connective, the tools used to automate workflows, including workflow automation software, workflow management software, workflow systems, or business process automation (BPA) are observing significant demand. The workflow automation software has various advantages, including value-adding features, and provides integration capabilities to increase the range of automation one can implement. Such adoption will bring more demand for the software segment across the workflow automation market.

- Some features include the capability of reducing the amount of IT support required to implement and maintain the software. Business users can conveniently access some features through an intuitive visual interface, making the automation faster and putting business teams in a co-creative role for optimizing workflows. Low code also relieves pressure on the IT backlog. For instance, Integrify is a low-code workflow automation platform that offers an easy-to-use builder, flexible customization, multiple pricing options, and dedicated customer support.

- Moreover, capturing and consolidating incoming data can be challenging for any team, and workflow automation software facilitates a solution with features such as customizable forms to simplify request management by standardizing processes, avoiding errors, and eliminating duplicate data entry. Portals make organizing and securely sharing forms with internal or external partners easy. Other features that play a crucial role in the workflow automation includes integrations, presence of templates and rules as well as conditional logic.

- For instance, In October 2023, Retool Inc., a low-code development platform for business software, announced the general availability of Retool Workflows. This highly innovative automation tool has been designed with the aim of greatly assisting developers by enabling them to prioritize coding and then seamlessly automate tasks alongside monitoring and maintenance tools. With Retool Workflows, developers are offered a user-friendly and visually appealing interface that provides an extensive array of coding tools, allowing for efficient prototyping and construction of periodic jobs, customized alerts, and information management tasks. Furthermore, this tool facilitates data extraction, transformation, and loading based on triggers.

Asia-Pacific Expected to Register the Fastest Growth During the Forecast Period

- With the increasing competition in the Chinese market, various industries in the country have been improving workflow through digital transformation. For instance, Dongfeng Nissan initiated its digital transformation program to improve efficiency and speed up the process of marketing a line of new vehicles. The company launched its digital transformation strategy for promoting the better use of data aimed to improve existing workflows, streamline internal business operations, and promote overall efficiency. As part of the program, the company implemented robotic process automation (RPA) software, UiPath, to automate repetitive digital tasks.

- China Unicom's Intelligent Network Innovation Center worked with Huawei in 2021 to develop and deploy an AI-powered network management and operations platform based on Huawei's AUTIN system. The company deployed an AI-based network management and operations platform to use data to simplify and automate national network operation, planning, and management while improving cost-effectiveness, customer experience, and sustainability as it rolled out 5G networks and services.

- Automation is one of the most crucial parts related to the future of work approach, and Japan is innovating through AI. According to the Nomura Research Institute, the AI sector in the country will see a massive stride by 2035. Automation companies such as Abeja, NEC, and others innovate to bring more production efficiency to push Japan's GDP.

- Automation has been playing a major role in India's economic development. The country is currently witnessing a transition in most sectors through the implementation of technology and innovation. The National Strategy for Artificial Intelligence (NSAI) highlighted that AI is predicted to accelerate India's annual growth rate by 1.3% by 2035.

- Southeast Asia and Australia are prominent regions in the Rest of Asia-Pacific. Southeast Asian companies are preparing employees for an AI-centered future and embracing new technologies. This would require enterprises to plug the skills gap through a proper upskilling strategy. Digitization would help the region to create globally competitive partnerships for local companies as well as improve the potential for global expansion and support a successful technology and knowledge transfer.

Workflow Automation Industry Overview

The Workflow Automation Market is fragemented and highly competitive. This market consists of several major players, such as IBM Corporation, Oracle Corporation, Pegasystems Inc., Xerox Corporation, and Appian Corporation. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

- November 2023: Esker, a global cloud platform and industry leader in AI-driven process automation solutions for Finance, Procurement, and Customer Service functions, announced Teknion has selected Esker's Accounts Payable automation solution to enhance its operational efficiencies. By leveraging Esker's innovative technology, Teknion aims to streamline its systems and ERP workflow across its global sites. Teknion specifically sought a solution incorporating automation and artificial intelligence to effectively combine information from multiple ERPs for their ongoing transformation of financial systems.

- September 2023: Salesforce has introduced some impressive advancements to its Slack platform. These include integrating Slack-native generative AI capabilities, a helpful lists function for structured workflow, and various enhancements to its automation platform. On the other hand, Slack has also made significant strides by launching its own Slack AI, which is powered by its own native LLM technology. Additionally, Slack has made valuable additions to its workflow automation, such as a lists feature for organized tasks, approvals, and information.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of IoT across industries

- 4.3.2 Rise in Implementation of RPA in Business Process Management

- 4.4 Market Restraints

- 4.4.1 Data Security Concerns

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Solution

- 5.2.1 Software

- 5.2.2 Service

- 5.3 By End-user Industry

- 5.3.1 Banking

- 5.3.2 Telecom

- 5.3.3 Retail

- 5.3.4 Manufacturing and Logistics

- 5.3.5 Healthcare and Pharmaceuticals

- 5.3.6 Energy and Utilities

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World (Latin America, Middle East and Africa)

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Oracle Corporation

- 6.1.3 Xerox Corporation

- 6.1.4 Pegasystems Inc.

- 6.1.5 Appian Corporation

- 6.1.6 Bizagi

- 6.1.7 Software AG

- 6.1.8 IPsoft Inc.

- 6.1.9 Newgen Software Technologies Limited

- 6.1.10 Nintex Global Limited