|

시장보고서

상품코드

1548909

솔리드 스테이트 릴레이 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2024-2029년)Solid-state Relay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

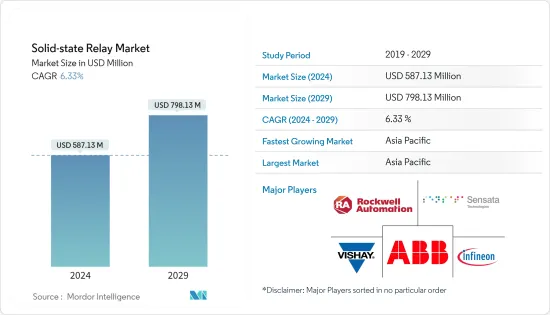

솔리드 스테이트 릴레이(SSR) 시장 규모는 2024년에 5억 8,713만 달러로 추정되며, 2029년에는 7억 9,813만 달러에 이를 것으로 예측되며, 예측 기간 중(2024-2029년) CAGR은 6.33%로 성장할 전망입니다.

솔리드 스테이트 릴레이(SSR)와 전기기계식 릴레이(EMR)는 공통 기능을 갖지만 구현과 성능은 크게 다릅니다. SSR은 EMR의 기계적 동등한 역할을 하며 이동식 부품 없이 전기 부하를 관리할 수 있습니다. 기계적 NO 접점에 의존하는 EMR과 달리 SSR은 TRIAC, SCR, 스위칭 트랜지스터와 같은 구성 요소를 활용하여 AC 및 DC 전류를 모두 처리합니다.

중요한 차이점 중 하나는 SSR에서 저전압 입력과 부하 스위칭 출력이 전기적으로 절연되어 있다는 것입니다. 한편, EMR은 접점 수명이 유한하고, 치수가 커지고, 스위칭 속도가 느려지는 것이 특징이며, 특히 대형의 파워 릴레이나 컨택터에 현저하지만, 이것은 SSR에는 없는 제한 입니다.

태양광과 풍력과 같은 깨끗하고 재생 가능한 에너지원으로의 세계 변화는 효율적인 전력 변환과 제어 시스템의 필요성을 만들어 냈습니다. 태양광 인버터, 풍력 터빈, 에너지 저장 시스템의 도입이 증가하고 있으며, 재생 가능 에너지 분야에서 전력 반도체 수요를 견인할 것으로 예상됩니다. SSR은 태양광 인버터에서 중요하며 태양에너지를 효율적으로 전력으로 변환할 수 있습니다.

스마트 가전, HVAC 시스템, 노트북, 스마트폰 등의 전자기기의 보급이 진행되어 전력 소비가 증가하고 있습니다. 게다가 기술이 발전함에 따라 LED 조명은 소비자들 사이에서 인기 조명으로 떠오르고 있습니다. LED 램프의 판매 급증은 솔리드 스테이트 릴레이에 큰 시장 전망을 열고 있습니다. 이러한 릴레이는 스마트 조명 시스템에서 매우 중요한 역할을 하며, LED 조명의 효율적인 제어와 디밍을 가능하게 하고, 결국 전력 사용을 억제합니다.

SSR의 초기 비용은 EMR보다 높으며 장기적으로 SSR은 비용 효율적입니다. 이것은 주로 EMR은 유지 보수 비용이 높고 전력 소비가 많고 수명이 짧기 때문입니다.

종합적인 서비스 수명, 점검 및 유지 보수 비용, 불안정한 릴레이 및 고장난 릴레이로 인한 비효율성과 같은 추가 비용을 고려하면 솔리드 스테이트 릴레이를 사용하는 평균 비용은 전자기 릴레이를 사용하는 평균 비용보다 훨씬 큽니다. 낮습니다. 또한, 일부 용도에서는 접점 진동을 방지하고 기계식 릴레이의 확실한 접점을 확보하기 위해 추가 비용이 필요합니다.

경제 성장, 인플레이션, 정부 지출, 세계 무역, 지정 역학과 같은 세계 동향은 다양한 국가의 제조 생태계에 영향을 미칩니다. 러시아와 우크라이나의 분쟁과 미국과 중국의 긴장과 같은 사건으로 인한 공급망의 혼란은 제조업에 큰 영향을 미쳤습니다. 예를 들어, 중국의 전자기기 제조업의 부가가치 성장률은 2023년에 3.4%에 달하고, 동기간 최고를 기록했다고 중국 국가 통계국은 보고하고 있습니다. 이 성장은 2019년과 2020년에 떨어지고 2021년에 회복되었습니다.

솔리드 스테이트 릴레이 시장 동향

자동차 및 운송 분야가 가장 빠르게 성장하는 용도

- 솔리드 스테이트 릴레이는 배전 및 모터 제어 기능을 갖춘 자동차 시스템에 채택되었습니다. 방향 지시기, 와이퍼, 냉각 팬과 같은 부품에 안정적인 스위칭을 제공합니다. 이 릴레이는 고전류를 지원하며 고속 스위칭이 가능하므로 자동차 용도에 적합합니다.

- 솔리드 스테이트 릴레이는 전기자동차의 파워 일렉트로닉스 시스템에서 중요한 역할을 합니다. 이 릴레이는 배터리 관리 시스템, 모터 제어 유닛 및 충전 시스템에 사용됩니다. 이 릴레이는 전기자동차의 고전압 및 고전류 회로의 효율적이고 신뢰성있는 스위칭을 가능하게합니다.

- 전기자동차 시장, 특히 파워트레인의 성장으로 솔리드 스테이트 릴레이 수요가 더욱 증가할 것으로 예상됩니다. 자동차 산업의 전자 부품은 안전성이 중요하며 극단적인 전압 및 환경 조건에 노출됩니다. 이 때문에 제조업체 각사는 차재용 솔리드 스테이트 릴레이의 새로운 제품 라인을 개발할 필요가 있습니다.

- SSR의 성장을 가속하는 요인으로는 자동차 생산 증가와 전기자동차 수요 증가가 있습니다. 또한 IoT의 도입과 자율주행차, 커넥티드카, 저배출가스차의 생산에 관한 유리한 정부기준 등 몇 가지 기술적 진보가 예측기간 중 솔리드 스테이트 릴레이 시장 성장을 더욱 추진하고 있습니다.

- 예를 들어, 2024년 5월 NOVOSENSE는 산업용 등급과 자동차용 등급 모두에서 사용할 수 있는 용량 절연형 솔리드 스테이트 릴레이의 신제품 NSI7258 시리즈를 출시했습니다. 고전압 측정 및 절연 모니터링을 위해 특별히 설계된 NSI7258은 업계를 선도하는 내전압 성능과 EMI 성능을 제공하며 산업용 BMS, PV, 에너지 저장, 충전 말뚝, 신 에너지 차량용 BMS 및 OBC 등 고전압 시스템의 안정성과 안정성 향상에 기여합니다.

- IEA의 'Global EV Outlook 2024'에 따르면 2024년 미국 전기차 판매 대수는 전년 대비 20% 증가했으며 2023년 대비 약 50만대 증가할 것으로 예측되고 있습니다. 최근 동향과 CO2 목표 강화가 2025년까지만 예정되어 있다는 점을 감안하면 유럽의 전기차 판매량 증가는 3대 시장 중 가장 낮아질 것으로 예상됩니다. 2024년 판매량은 약 350만대에 달할 것으로 예측되며, 전년 대비 10% 미만의 완만한 성장이 되고 있습니다. 이러한 추세는 예측 기간 동안 솔리드 스테이트 릴레이에 대한 수요를 창출합니다.

아시아태평양이 현저한 성장을 이룰 전망

- 솔리드 스테이트 릴레이의 응용 분야는 최근 몇 년간 크게 확대되고 있습니다. 솔리드 스테이트 릴레이에는 움직이는 부품이 없으므로 소모가 적고 신뢰성과 수명이 향상됩니다. 이는 부품이 항상 진동이나 가혹한 조건에 노출되는 자동차 분야에서 특히 중요합니다. 솔리드 스테이트 릴레이는 전기 기계식 릴레이보다 스위칭 속도가 빠르며 ADAS, 배전 유닛, EV 배터리 관리 시스템 등 다양한 자동차 시스템의 성능을 향상시킵니다.

- 중국 시장 성장은 자동차 부문이 크게 견인하는 자세입니다. 자동차 제조에서의 솔리드 스테이트 릴레이 수요의 급증이 주로 이 급성장의 원동력이 되고 있습니다. 예를 들어 2024년 1월 중국자동차공업협회(China Association of Automobile Manufacturers)는 이 나라의 자동차산업이 연간 생산·판매 대수 3,000만대를 돌파한다는 중요한 성과를 달성했다고 발표하고, 이 분야의 성장 기회가 매우 큰 것을 강조했습니다.

- 게다가 중국은 2030년까지 자동차 총 판매 대수에 차지하는 전기자동차의 비율을 40%로 한다는 야심적인 목표에 힘입어 하이브리드 자동차·전기자동차 시장의 중요한 기업으로 대두했습니다.

- 성장하는 전기자동차(EV) 시장을 포함한 일본 자동차 산업은 솔리드 스테이트 릴레이를 크게 견인하고 있습니다. 이러한 릴레이는 높은 신뢰성과 효율성을 제공하며 배터리 관리 시스템, 배전 및 다양한 차량 제어 시스템에서 사용됩니다.

- 역사적으로 일본의 GDP의 89% 이상에 기여해 온 일본의 자동차 부문은 큰 전환기를 맞이하고 있습니다. 2050년까지 순 배출량 제로를 달성해 2030년까지 46% 삭감한다는 일본의 야심적인 목표에 힘입어 전기자동차(EV)의 인기가 높아지고 있습니다. 이와 함께 정부는 명확한 목표를 나타냅니다. 2030년까지 승용차 판매 대수의 20-30%를 EV와 플러그인 하이브리드차(PHEV)가 차지하고, 연료전지차(FCV)는 3%를 목표로 내걸고 있습니다.

- 인도에서는 스마트 시티와 현대적인 교통 시스템과 같은 인프라 정비가 급속히 진행되고 있으며 솔리드 스테이트 릴레이(SSR)에 대한 수요가 증가하고 있습니다. 이러한 프로젝트에서는 SSR의 신뢰성과 고전압 용도의 관리 능력이 필수적입니다. 예를 들어, 2024년 2월 인도 의회 위원회는 주도에서 반경 100km 이내의 2급 도시에 초점을 맞춘 정부의 주요 스마트 시티 임무의 후속 단계를 시작하는 것의 중요성을 강조 했습니다.

솔리드 스테이트 릴레이 산업 개요

솔리드 스테이트 릴레이 시장은 반고체화되고 있으며, Rockwell Automation Inc., ABB Ltd., Infineon Technologies AG, Sensata Technologies Inc., Vishay Intertechnology Inc.와 같은 대기업이 진출하고 있습니다. 시장 기업은 제품 라인업을 강화하고 지속 가능한 경쟁 우위를 얻기 위해 파트너십 및 인수와 같은 전략을 채택하고 있습니다.

2024년 6월 - Infineon Technologies는 자동차 탑재 전력 관리용으로 설계된 600V CoolMOS S7TA 슈퍼 접합 MOSFET을 발표했습니다. 이 혁신적인 제품은 현대 자동차의 안전과 효율성에 필수적인 다양한 중요한 용도을 위한 향상된 솔루션을 제공합니다. 이러한 용도에는 회로 차단기, 고전압 배터리 연결 스위치, DC 및 AC용 저주파 스위치, 고전압 전자 퓨즈와 같은 중요한 구성 요소가 포함됩니다.

2024년 3월 - Autonics는 서일본 지역을 타겟으로 한 새로운 영업소를 오사카에 개설했습니다. 이 이전은 고객 서비스와 액세스 개선을 목적으로 합니다. 오사카 오피스는 동일본의 도쿄 오피스를 보완하고 Autonics는 전국적인 시장 확대를 목표로 하고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- COVID-19의 영향과 기타 거시 경제 요인이 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 신재생에너지원에 대한 투자 증가

- 주택·산업 부문에 있어서의 절전 요구의 고조

- 시장 성장 억제요인

- 전기 기계식 릴레이와 비교한 솔리드 스테이트 릴레이의 고비용

제6장 시장 세분화

- 마운트별

- 패널 마운트

- PCB 마운트

- DIN 레일 마운트

- 출력별

- AC 솔리드 스테이트 릴레이

- DC 솔리드 스테이트 릴레이

- AC/DC 출력 릴레이

- 용도별

- 에너지 및 인프라

- 산업용 OEM

- 빌딩 시설

- 음식

- 자동차 및 운송

- 산업 자동화

- 헬스케어

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 프랑스

- 영국

- 아시아

- 중국

- 일본

- 인도

- 호주 및 뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Rockwell Automation Inc.

- ABB Ltd

- Infineon Technologies AG

- Sensata Technologies Inc.

- Vishay Intertechnology Inc.

- Omron Corporation

- Fujitsu Limited

- Broadcom Inc.

- Omega Engineering Inc.

- TE Connectivity Ltd

- Celduc Relais.

- Littelfuse

- Schneider Electric SE

- Autonics Corporation

- Toshiba Corporation

제8장 시장 기회와 앞으로의 동향

JHS 24.09.12The Solid-state Relay Market size is estimated at USD 587.13 million in 2024, and is expected to reach USD 798.13 million by 2029, growing at a CAGR of 6.33% during the forecast period (2024-2029).

Solid State Relays (SSRs) and electromechanical relays (EMRs) share a common functionality, but their implementation and performance diverge significantly. SSRs, acting as the mechanical counterparts of EMRs, can manage electrical loads sans moving parts. Unlike EMRs that rely on mechanical NO contacts, SSRs leverage components like TRIACs, SCRs, or switching transistors to handle both AC and DC currents.

One key distinction lies in the electrical isolation of the low voltage input from the load-switching output in SSRs, a feature absent in EMRs. EMRs, on the other hand, are characterized by a finite contact life, bulkier dimensions, and slower switching speeds, particularly evident in larger power relays and contactors-limitations not shared by SSRs.

The global shift toward clean and renewable energy sources, such as solar and wind, has created a need for efficient power conversion and control systems. The increasing deployment of solar inverters, wind turbines, and energy storage systems is anticipated to drive the demand for power semiconductors in the renewable energy sector. SSRs are crucial in solar inverters, allowing efficient solar energy conversion into electricity.

The rising uptake of smart home appliances, HVAC systems, and electronic devices, including laptops and smartphones, is driving up power consumption. In addition, with technological advancements, LED lighting has emerged as a favorite lighting among consumers. The surge in LED lamp sales is opening substantial market prospects for solid-state relays. These relays play a pivotal role in smart lighting systems, enabling efficient control and dimming of LED lights, ultimately curbing power usage.

The upfront cost of SSR surpasses that of EMR, and SSR proves more cost-effective in the long term. This is primarily because EMR entails higher maintenance costs, consumes more power, and boasts a shorter lifespan.

Considering additional costs, such as comprehensive service life, inspection and maintenance expenses, and inefficiencies due to unstable or faulty relays, the average cost of using solid-state relays is significantly lower than that of electromagnetic relays. Furthermore, some applications require extra costs to prevent contact vibration and ensure reliable contact in mechanical relays.

Macroeconomic trends like economic growth, inflation, government spending, global trade, and geopolitical dynamics influence various countries' manufacturing ecosystems. Disruptions in supply chains, triggered by events such as the Russia-Ukraine conflict and tensions between the US and China, have significantly impacted the manufacturing sector. For example, the electronics manufacturing industry in China saw a 3.4% growth in value added in 2023, marking the highest point in the given period, as China's National Bureau of Statistics reported. This growth had dipped in 2019 and 2020, only to rebound in 2021.

Solid-state Relay Market Trends

Automotive and Transportation Segment to be the Fastest Growing Application

- Solid-state relays are employed in automotive systems for power distribution and motor control functions. They provide reliable switching for components like turn signals, windshield wipers, and cooling fans. These relays can handle high currents and offer fast switching, making them suitable for automotive applications.

- Solid-state relays play a crucial role in the power electronics systems of electric vehicles. They are used on battery management systems, motor control units, and charging systems. These relays enable efficient and reliable switching of high-voltage and high-current circuits in EVs.

- The growth in the electric vehicle markets, especially power trains, is further expected to increase the demand for solid-state relays. Electronic components in the automotive industry are critical for safety and are subjected to extreme voltages and environmental conditions. This has driven the manufacturers to develop a new line of solid-state relays for automotive applications.

- The factors driving the growth of the SSRs include increased vehicle production and rising demand for electric vehicles. In addition, several technological advancements, such as the implementation of IoT and favorable government standards for the production of autonomous, connected, and low-emission vehicles, are further fueling the market's growth of solid-state relays during the forecast period.

- For instance, in May 2024, NOVOSENSE announced the launch of its new NSI7258 series of capacitive isolation-based solid-state relays, available in both industrial and automotive grades. Designed specifically for high-voltage measurement and insulation monitoring, NSI7258 provides industry-leading voltage withstand capability and EMI performance to help improve the reliability and stability of high-voltage systems such as industrial BMS, PV, energy storage, charging piles, and BMS and OBCs for new energy vehicles.

- According to IEA's Global EV Outlook 2024, in 2024, electric car sales in the United States are projected to rise by 20% compared to the previous year, translating to almost half a million more sales relative to 2023. Based on recent trends and considering that tightening CO2 targets are due to come in only in 2025, the growth in electric car sales in Europe is expected to be the lowest of the three largest markets. Sales are projected to reach around 3.5 million units in 2024, reflecting modest growth of less than 10% compared to the previous year. Such trends are creating a demand for solid-state relays over the forecast period.

Asia Pacific Expected to Witness Significant Growth

- The application field for solid-state relays has significantly broadened recently. Solid-state relays have no moving parts, reducing wear and tear and increasing reliability and longevity. This is particularly important in the automotive sector, where components are subjected to constant vibrations and harsh conditions. Solid-state relays offer faster switching speeds than electromechanical relays, improving the performance of various automotive systems, including ADAS, power distribution units, and battery management systems in EVs.

- China's market growth is poised to be significantly driven by the automotive sector. The surging demand for solid-state relays within automotive manufacturing primarily fuels this surge. For instance, in January 2024, the China Association of Automobile Manufacturers announced a significant achievement for the country's auto industry: production and sales have surpassed 30 million units annually, highlighting the immense growth opportunities in the sector.

- In addition, China emerged as a significant player in the hybrid and electric vehicle market, propelled by its ambitious target: achieving a 40% share of electric vehicles in total car sales by 2030.

- Japan's automotive industry, including the growing electric vehicle (EV) market, is a significant driver of solid-state relays. These relays offer high reliability and efficiency and are used in battery management systems, power distribution, and various vehicle control systems.

- Japan's automotive sector, which historically contributes to over 89% of the nation's GDP, is undergoing a significant shift. Driven by Japan's ambitious targets of achieving net-zero emissions by 2050 and a 46% reduction by 2030, electric vehicles (EVs) are gaining traction. In line with this, the national government has outlined clear targets: aiming for EVs and plug-in hybrid electric vehicles (PHEVs) to constitute 20-30% of passenger car sales by 2030, with fuel cell vehicles (FCVs) targeted at 3%.

- India's rapid infrastructure development, including smart cities and modern transportation systems, boosts the demand for solid-state relays (SSRs). The SSR's reliability and ability to manage high-voltage applications are essential in these projects. For instance, in February 2024, the Indian parliamentary committee underscored the importance of initiating the subsequent phase of the government's primary Smart Cities Mission, focusing on tier-2 cities within a 100-kilometer radius of state capitals.

Solid-state Relay Industry Overview

The solid state relay market is semi-consolidated, with major players like Rockwell Automation Inc., ABB Ltd, Infineon Technologies AG, Sensata Technologies Inc., and Vishay Intertechnology Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantages.

June 2024 - Infineon Technologies unveiled the 600 V CoolMOS S7TA superjunction MOSFET designed for automotive power management. This innovative product offers an enhanced solution for various important applications crucial to the safety and efficiency of contemporary vehicles. These applications encompass vital components like circuit breakers, high-voltage battery disconnect switches, low-frequency switches for DC and AC, and high-voltage electronic fuses.

March 2024 - Autonics opened a new sales office in Osaka, Japan, targeting the western Japan region. This move aims to improve customer service and accessibility. With the Osaka office complementing the Tokyo office in eastern Japan, Autonics seeks nationwide market expansion.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Investment in Renewable Energy Sources

- 5.1.2 Elevated Requirement of Power Savings in the Residential and Industrial Sectors

- 5.2 Market Restraints

- 5.2.1 High Cost of the Solid-state Relay Compared to Electromechanical Relay

6 MARKET SEGMENTATION

- 6.1 By Mounting

- 6.1.1 Panel Mount

- 6.1.2 PCB Mount

- 6.1.3 DIN Rail Mount

- 6.2 By Output

- 6.2.1 AC Solid State Relay

- 6.2.2 DC Solid State Relay

- 6.2.3 AC/DC Output Relay

- 6.3 By Application

- 6.3.1 Energy and Infrastructure

- 6.3.2 Industrial OEM

- 6.3.3 Building Equipment

- 6.3.4 Food and Beverages

- 6.3.5 Automotive and Transportation

- 6.3.6 Industrial Automation

- 6.3.7 Healthcare

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 France

- 6.4.2.3 United Kingdom

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 ABB Ltd

- 7.1.3 Infineon Technologies AG

- 7.1.4 Sensata Technologies Inc.

- 7.1.5 Vishay Intertechnology Inc.

- 7.1.6 Omron Corporation

- 7.1.7 Fujitsu Limited

- 7.1.8 Broadcom Inc.

- 7.1.9 Omega Engineering Inc.

- 7.1.10 TE Connectivity Ltd

- 7.1.11 Celduc Relais.

- 7.1.12 Littelfuse

- 7.1.13 Schneider Electric SE

- 7.1.14 Autonics Corporation

- 7.1.15 Toshiba Corporation